TIDMLXI

RNS Number : 1813P

LXI REIT PLC

16 February 2021

16 February 2021

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE MARKET ABUSE REGULATION (EC NO. 596/2014) AS IT

FORMS PART OF THE DOMESTIC LAW OF THE UNITED KINGDOM BY VIRTUE OF

THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMED) (THE "UK MARKET

ABUSE REGULATION")

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, DIRECTLY OR

INDIRECTLY, IN OR INTO THE UNITED STATES, AUSTRALIA, NEW ZEALAND,

CANADA, SINGAPORE, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR ANY

MEMBER STATE OF THE EEA (OTHER THAN ANY MEMBER STATE OF THE EEA

WHERE THE COMPANY'S SECURITIES MAY BE LEGALLY MARKETED), OR ANY

OTHER JURISDICTION WHERE SUCH DISTRIBUTION IS UNLAWFUL, OR TO ANY

NATIONAL, RESIDENT OR CITIZEN OF THE UNITED STATES, AUSTRALIA, NEW

ZEALAND, CANADA, SINGAPORE, THE REPUBLIC OF SOUTH AFRICA, JAPAN OR

ANY MEMBER STATE OF THE EEA

This announcement is an advertisement for the purposes of the

Prospectus Regulation Rules of the UK Financial Conduct Authority

("FCA") and does not constitute a prospectus. Investors must

subscribe for or purchase any shares referred to in this

announcement only on the basis of information contained in a

tripartite prospectus (comprising a summary, a registration

document and a securities note) expected to be published shortly by

LXi REIT plc (the "Prospectus") in its final form and not in

reliance on this announcement. The Prospectus will, when published,

be available, subject to certain access restrictions, on the

Company's website (www.lxireit.com/company-documents), at the

Company's registered office at 1st Floor Senator House, 85 Queen

Victoria Street, London EC4V 4AB, and at the National Storage

Mechanism via

https://data.fca.org.uk/#/nsm/nationalstoragemechanism. Approval of

the Prospectus by the FCA should not be understood as an

endorsement of the securities that are the subject of the

Prospectus. Potential investors are recommended to read the

Prospectus before making an investment decision in order to fully

understand the potential risks and rewards associated with a

decision to invest in the Company's securities. This announcement

does not constitute, and may not be construed as, an offer to sell

or an invitation or recommendation to purchase, sell or subscribe

for any securities or investments of any description, or a

recommendation regarding the issue or the provision of investment

advice by any party.

LXi REIT plc

(the "Company" or "LXi REIT")

Proposed Initial Placing, Open Offer, Offer for Subscription and

Intermediaries Offer and Notice of General Meeting

The board of Directors (the "Board") of LXi REIT (ticker: LXI),

the specialist inflation-protected long income REIT, today

announces the proposed issue of further ordinary shares ("New

Ordinary Shares") in the Company to raise gross proceeds of

approximately GBP75 million (the "Initial Issue") and a proposed

ongoing share issuance programme of New Ordinary Shares (the "Share

Issuance Programme"), the details of which will be set out in the

Prospectus, expected to be published by the Company later this week

(the "Proposals").

The Initial Issue will be by way of an initial placing, open

offer, offer for subscription and intermediaries offer for a target

issue of up to 60,164,539 New Ordinary Shares at an issue price of

124.50 pence per New Ordinary Share (the "Issue Price"). The Issue

Price represents a premium of 2.3 per cent. to the Estimated NAV

per Ordinary Share as at 31 December 2020 (unaudited) of 123.2

pence, reduced by the Q3 dividend of 1.44 pence per Ordinary Share,

and, a discount of 3.0 per cent. to the closing price per Ordinary

Share on 15 February 2021 of 128.4 pence per Ordinary Share (being

the last business day prior to this announcement).

Conditional on the passing of the shareholder resolutions to be

proposed at a general meeting of the Company expected to take place

on or around 10 March 2021 (the "Issue Resolutions") (the "General

Meeting"), the maximum number of New Ordinary Shares that may be

issued pursuant to the Initial Issue and the Share Issuance

Programme is 400,000,000.

The Company was launched as a closed-ended investment company in

February 2017. The Company has successfully deployed the GBP843

million of equity and debt capital raised both on and since its IPO

in February 2017 and, consequently, the Company has been

considering a further equity raise to fund further investments in

line with its investment policy and objective and with a view to

delivering further value for its shareholders.

Summary

-- Issue of up to 60,164,539 New Ordinary Shares pursuant to an

Initial Placing, Open Offer, Offer for Subscription and

Intermediaries Offer, targeting gross proceeds of approximately

GBP75 million

-- Shareholders who qualify for the Open Offer ("Qualifying

Shareholders") will be offered the opportunity to participate in

the Open Offer on the basis of 3 New Ordinary Shares for every 26

Existing Ordinary Shares (the "Open Offer Entitlement")

-- Qualifying Shareholders will also be offered the opportunity

to subscribe for New Ordinary Shares in addition to their Open

Offer Entitlement under an excess application facility (the "Excess

Application Facility")

-- The Board have reserved the right to increase the size of the

Initial Issue by reallocating New Ordinary Shares otherwise

available under the Share Issuance Programme to increase the size

of the Initial Placing, the Offer for Subscription and/or the

Intermediaries Offer. Any decision to increase the size of the

Initial Issue will only be made after careful consideration of the

size and availability of the Company's investment pipeline

-- The Issue Price is 124.50 pence per New Ordinary Share. This

represents a premium of 2.3 per cent. to the Estimated NAV per

Ordinary Share as at 31 December 2020 (unaudited) of 123.2 pence,

reduced by the Q3 dividend of 1.44 pence per Ordinary Share

-- The Issue Price represents a discount of 3.0 per cent. to the

closing price per Ordinary Share on 15 February 2021 of 128.4 pence

per Ordinary Share (being the last business day prior to this

announcement)

-- The Investment Advisor, on behalf of the Company, has

identified a significant pipeline of additional assets which meet

the Company's investment objective and policy, the vast majority of

which have been sourced off-market through the Investment Advisor's

extensive contacts and relationships

-- The pipeline assets, which total around GBP140 million

including expected costs, are diversified across a range of

defensive and structurally supported sub-sectors, including

foodstores, industrial, drive-thru coffee and garden centres. They

benefit from a long weighted average unexpired lease term to expiry

of 21 years and to first break of 20 years and a blended net

initial yield of 5.5 per cent. (net of acquisition costs). These

assets are diversified by location and leased to a range of

institutional-grade tenants with strong financial covenants, with

rental uplifts linked to inflation or a fixed growth rate and with

a good mix within the pipeline of built assets and forward funded

structures

-- Although there can be no assurance that any of these

properties will be purchased by the Company, the Investment Advisor

is confident that it will substantially invest or commit the net

proceeds resulting from the Initial Issue within three months

following Initial Admission

-- The Company has reported continuing robust rent collection,

despite the pandemic, and as announced on 11 February 2021, the

Company is now targeting an annual dividend of 6.0 pence per

Ordinary Share for the 12-month period commencing on 1 April 2021*

(which represents a 4.3 per cent. increase on the Company's

pre-Covid-19 dividend rate of 5.75 pence per Ordinary Share)

-- The results of the Initial Issue are expected to be announced

in early March 2021 and a full timetable will be published shortly

in the Prospectus

Commenting on today's announcement, Stephen Hubbard, Chairman of

LXi REIT plc, said:

"This Initial Issue will enable the Company to capitalise on its

GBP140 million pipeline of off market investment opportunities. The

properties are diversified across a range of defensive and

structurally supported sub-sectors and let to high-quality tenant

covenants. We expect these opportunities to deliver attractive

returns to our shareholders going forward."

Applications will be made to the Financial Conduct Authority and

the London Stock Exchange for all of the New Ordinary Shares to be

issued pursuant to the Initial Issue and the Share Issuance

Programme to be admitted to the premium listing segment of the

Official List and to trading on the premium segment of the Main

Market ("Admission"). It is expected that Admission in respect of

the Initial Issue ("Initial Admission") will become effective and

dealings in the New Ordinary Shares will commence in March

2021.

Terms not otherwise defined in this announcement have the

meanings that will be given to them in the Prospectus. This summary

should be read in conjunction with the full text of this

announcement and the Prospectus, when available.

Background to, and reasons for, the Initial Issue

The Company listed on the London Stock Exchange in 2017 with the

objective of delivering inflation-protected income, as well as

ongoing capital growth, by investing in a diversified portfolio of

UK property that benefits from long term index-linked leases with

institutional-grade tenants. The Company has successfully deployed

the GBP843 million of equity and debt capital raised on and since

its IPO in February 2017 and, consequently, has been considering a

further equity raise to fund an accretive pipeline. The Board is

therefore proposing to seek Shareholder approval at the General

Meeting to authorise the Directors to allot New Ordinary Shares

pursuant to the Initial Issue and the Share Issuance Programme to

fund further investments in line with its investment policy and

objective and with a view to delivering further value for its

Shareholders.

The Investment Advisor, on behalf of the Company, has identified

a significant pipeline of additional assets which meet the

Company's investment objective and policy, the vast majority of

which have been sourced off-market through the Investment Advisor's

extensive contacts and relationships.

The Investment Advisor has already commenced negotiations and

discussions concerning the acquisition of such assets on behalf of

the Company. Furthermore, the Investment Advisor, on behalf of the

Company, has entered into exclusivity agreements in relation to the

acquisition of a number of these assets.

These assets are diversified by location and leased to a range

of institutional-grade tenants with strong financial covenants,

with rental uplifts linked to inflation or a fixed growth rate and

with a good mix within the pipeline of built assets and forward

funded structures.

The assets, which total around GBP140 million including expected

costs, are diversified across a range of defensive and structurally

supported sub-sectors, including foodstores, industrial, drive-thru

coffee and garden centres. They benefit from a long weighted

average unexpired lease term to expiry of 21 years and to first

break of 20 years and a blended net initial yield of 5.5 per cent.

(net of acquisition costs) (versus a current portfolio valuation

yield of 5.0 per cent. as at 31 December 2020).

These acquisitions are subject to ongoing due diligence by the

Investment Advisor and the Company's other professional advisers.

The Company currently has no binding contractual obligations with

potential vendors and, although there can be no assurance that any

of these properties will be purchased by the Company, the

Investment Advisor is confident that it will substantially invest

or commit the net proceeds resulting from the Initial Issue within

three months following Initial Admission. The Company fully

invested the proceeds of its two previous capital raises within six

weeks of closing those raises.

Following completion of the Initial Issue, the Board believes

that it is in the Company's best interests that it has the

flexibility to issue further New Ordinary Shares during the 12

months following publication of the Prospectus in order to raise

additional capital for the purpose of investment in accordance with

the Company's investment policy and objective. Conditional on the

passing of the Issue Resolutions to be proposed at the General

Meeting, the Board will be authorised to issue up to 400,000,000

New Ordinary Shares (less the number of New Ordinary Shares issued

pursuant to the Initial Issue) pursuant to the Share Issuance

Programme. If approved, the Share Issuance Programme may be

implemented by way of a series of placings and, potentially, open

offers, offers for subscription and/or intermediaries offers. Any

such issues of New Ordinary Shares would be at the discretion of

the Directors.

Benefits of the Issue

The Board believes that the Initial Issue and the Share Issuance

Programme will have the following benefits for the Company:

-- The additional assets forming the pipeline identified by the

Investment Advisor, if acquired, are expected to further diversify

the Company's portfolio of properties in terms of tenant,

geographic and sector exposures at a net initial yield higher than

the current portfolio valuation yield.

-- The Initial Issue and the Share Issuance Programme are

expected to broaden the Company's investor base and enhance the

size and liquidity of the Company's share capital.

-- Growing the Company through the Initial Issue and the Share

Issuance Programme will spread the fixed operating costs over a

larger capital base, thereby reducing the Company's ongoing charges

ratio.

-- The Share Issuance Programme will give the Company the

flexibility to raise additional capital following completion of the

Initial Issue for the purpose of investment in accordance with the

investment policy and objective of the Company and with a view to

delivering further value for Shareholders.

Overview of the Initial Issue

Initial Issue

The Company is targeting an issue of approximately GBP75 million

(gross) through the issue of 60,164,539 New Ordinary Shares

pursuant to the Initial Issue at the Issue Price of 124.50 pence

per New Ordinary Share.

If the overall demand exceeds this target, the Directors have

reserved the right, following consultation with Peel Hunt and

Jefferies (the "Joint Bookrunners"), to increase the size of the

Initial Issue by reallocating New Ordinary Shares that would

otherwise be available under the Share Issuance Programme to

increase the size of the Initial Placing, the Offer for

Subscription and/or the Intermediaries Offer. Any decision to

increase the size of the Initial Issue will only be made after

careful consideration of the size and availability of the Company's

investment pipeline. The maximum number of New Ordinary Shares that

may be issued pursuant to the Initial Issue and the Share Issuance

Programme is 400,000,000.

The actual number of New Ordinary Shares to be issued pursuant

to the Initial Issue, and therefore the gross proceeds of the

Initial Issue (the "Gross Issue Proceeds"), is not known as at the

date of this announcement but will be notified by the Company via a

RIS prior to Initial Admission. The Directors intend to use the net

proceeds of the Initial Issue to acquire investments in accordance

with the Company's investment policy and objective, as will be more

fully set out in the Prospectus.

The New Ordinary Shares issued pursuant to the Initial Issue

will, following Initial Admission, rank pari passu in all respects

with the Existing Ordinary Shares and will carry the right to

receive all dividends and distributions declared, made or paid in

respect of the Ordinary Shares by reference to a record date after

Initial Admission. For the avoidance of doubt, the New Ordinary

Shares will not be eligible to receive the interim quarterly

dividend, in respect of the quarter ended 31 December 2020, of 1.44

pence per Ordinary Share, payable on 26 March 2021 to shareholders

on the register at 26 February 2021, as declared on 11 February

2021.

The Issue Price is calculated by reference to the Estimated NAV

per Ordinary Share as at 31 December 2020 (unaudited) of 123.2

pence, reduced by the dividend of 1.44 pence per Ordinary Share

announced on 11 February 2021 with a record date of 26 February

2021, in respect of the quarter ended 30 December 2020, and

increased to reflect the costs and expenses of the Initial Issue,

which are expected to be approximately 2 per cent. of the Gross

Issue Proceeds.

Initial Placing

Peel Hunt and Jefferies have each agreed to use their reasonable

endeavours to procure subscribers for New Ordinary Shares pursuant

to the Initial Placing. The terms and conditions which shall apply

to any subscription for New Ordinary Shares pursuant to the Initial

Placing will be set out in the Prospectus.

Open Offer

New Ordinary Shares are being offered to Qualifying Shareholders

by way of the Open Offer. The Open Offer will provide an

opportunity for Qualifying Shareholders to participate in the

Initial Issue by subscribing for their Open Offer Entitlements,

being 3 New Ordinary Shares for every 26 Existing Ordinary Shares

held and registered in their name at a record date to be specified

in the Prospectus.

If the Initial Issue proceeds, valid applications under the Open

Offer will be satisfied in full up to applicants' Open Offer

Entitlements. Any New Ordinary Shares not taken up under the Open

Offer will be made available under the Excess Application Facility,

the Initial Placing, the Offer for Subscription and the

Intermediaries Offer. Open Offer Entitlements will be rounded down

to the nearest whole number and any fractional entitlements to New

Ordinary Shares will be disregarded in calculating Open Offer

Entitlements. Fractions will be aggregated and made available to

Qualifying Shareholders under the Excess Application Facility.

Qualifying Shareholders who wish to subscribe for more New Ordinary

Shares than their Open Offer Entitlement could therefore make an

application under the Excess Application Facility, the Offer for

Subscription, the Intermediaries Offer or, if appropriate, the

Initial Placing. Shareholders should be aware that the Open Offer

is not a rights issue and Open Offer Entitlements cannot be

traded.

The full details of the timetable relating to the Open Offer

will be contained within the Prospectus, together with details of

how Shareholders can apply for New Ordinary Shares under the Open

Offer. Shareholders should not subscribe for or purchase any New

Ordinary Shares except on the basis of information set out in the

Prospectus.

Offer for Subscription

The Directors are also proposing to offer New Ordinary Shares

under the Offer for Subscription, subject to the terms and

conditions to be set out in the Prospectus. The Offer for

Subscription will be made available in the United Kingdom,

Guernsey, Jersey and the Isle of Man. Individual applications must

be for a minimum subscription of 1,000 New Ordinary Shares and then

in multiples of 1,000 New Ordinary Shares thereafter, although the

Board has discretion to accept applications below these minimum

amounts. Multiple subscriptions under the Offer for Subscription by

individual investors will not be accepted.

Intermediaries Offer

Prospective investors may also subscribe for New Ordinary Shares

pursuant to the Intermediaries Offer. Only the Intermediaries'

retail investor clients in the United Kingdom, Guernsey, Jersey and

the Isle of Man are eligible to participate in the Intermediaries

Offer. Investors may apply to any one of the Intermediaries to be

accepted as their client.

No New Ordinary Shares allocated under the Intermediaries Offer

will be registered in the name of any person whose registered

address is outside the United Kingdom, the Channel Islands or the

Isle of Man. A minimum application of 1,000 New Ordinary Shares per

Underlying Applicant will apply and thereafter an Underlying

Applicant may apply for any higher amount. Allocations to

Intermediaries will be determined solely by the Company (following

consultation with Peel Hunt, in its capacity as intermediaries

offer adviser, and Jefferies).

Scaling back and allocation

The Directors have reserved the right, following consultation

with the Joint Bookrunners, to increase the size of the Initial

Issue if overall demand exceeds 60,164,539 New Ordinary Shares by

reallocating New Ordinary Shares that would otherwise be available

under the Share Issuance Programme to increase the size of the

Initial Placing, the Offer for Subscription and/or the

Intermediaries Offer.

In the event that commitments under the Initial Issue exceed the

maximum number of New Ordinary Shares available (notwithstanding

any such reallocation), applications under the Initial Issue (other

than applications up to Qualifying Shareholders' full entitlement

under the Open Offer) will be scaled back at the Company's

discretion following consultation with the Joint Bookrunners. The

basis of allocation of New Ordinary Shares under the Initial Issue

will be:

(i) to each Qualifying Shareholder who applies, up to his full

entitlement under the Open Offer (New Ordinary Shares issued to

Qualifying Shareholders under the Open Offer are not subject to

scaling back to satisfy valid applications under the Initial

Placing, the Offer for Subscription, the Intermediaries Offer or

the Excess Application Facility); and

(ii) any New Ordinary Shares not taken up under the Open Offer

or otherwise available under the Initial Issue, to applicants under

the Initial Placing, the Offer for Subscription, the Intermediaries

Offer and the Excess Application Facility, with applications scaled

back at the discretion of the Company following consultation with

the Joint Bookrunners.

There will be no priority given to applications under the

Initial Placing, the Offer for Subscription, the Intermediaries

Offer or the Excess Application Facility pursuant to the Initial

Issue.

New Ordinary Shares and future dividends

The Directors have considered the potential impact of the

Initial Issue on the payment of dividends to existing holders of

Ordinary Shares and will take steps to ensure that it will not

result in any material dilution of the dividends attributable to

existing Shareholders. Holders of New Ordinary Shares will not be

entitled to receive any dividends declared with a record date prior

to the date of their issue.

On 11 February 2021, the Board declared an interim dividend of

1.44 pence per Ordinary Share in respect of the quarter ended 31

December 2020, payable on 26 March 2021 to Shareholders on the

register at 26 February 2021 (the "Q3 Dividend"). Accordingly,

holders of New Ordinary Shares issued pursuant to the Initial Issue

(or the Share Issuance Programme) will not be entitled to receive

the Q3 Dividend.

However, holders of the New Ordinary Shares issued pursuant to

the Initial Issue will be entitled to receive any dividend declared

in respect of the quarter ending 31 March 2021. On 11 February

2021, the Board confirmed that it continues to target an interim

dividend of 1.46 pence per Ordinary Share in respect of the quarter

ending 31 March 2021.

Throughout the pandemic, the Company has maintained a policy to

continue to pay dividends which are covered by net income. The

Board reported on 11 February 2021, that, following successive

quarters of strong rent collection and rental growth, the Company

is targeting an annual dividend of 6.0 pence per Ordinary Share for

the 12-month period commencing 1 April 2021* (the "Annual Dividend

Target").

The Annual Dividend Target assumes that rent collection levels

remain in line with forecasts and the resulting dividend will be

fully covered by net rental income. The Annual Dividend Target will

be payable in equal quarterly instalments of 1.50 pence per

Ordinary Share and represents a 4.3 per cent. increase on the

Company's pre-Covid-19 dividend rate of 5.75 pence per Ordinary

Share.

Share Issuance Programme

Following the Initial Issue, the Directors intend to implement

the Share Issuance Programme to enable the Company to raise

additional capital in the 12 months following publication of the

Prospectus for the purpose of investment in accordance with the

investment policy and objective of the Company and with a view to

delivering further value for Shareholders.

The Directors will seek authority at the General Meeting to

allot up to 400,000,000 million New Ordinary Shares pursuant to the

Initial Issue and the Share Issuance Programme. Assuming 60,164,539

New Ordinary Shares are issued pursuant to the Initial Issue (being

the target number of New Ordinary Shares to be issued thereunder),

the Directors will be authorised to issue a further 339,835,461 New

Ordinary Shares pursuant to the Share Issuance Programme

(conditional on the passing of the Issue Resolutions). However, the

number of New Ordinary Shares available under the Share Issuance

Programme is intended to be flexible and should not be taken as an

indication of the number of shares to be issued (which will depend

on investor demand, the wider investment market for long leased

property assets, and the Company's ability to source attractive

investment opportunities in this market).

Any New Ordinary Shares issued pursuant to the Share Issuance

Programme will, following the relevant Admission, rank pari passu

in all respects with the Ordinary Shares then in issue and will

carry the right to receive all dividends and distributions

declared, made or paid in respect of the Ordinary Shares by

reference to a record date after the relevant Admission.

The Share Issuance Programme may be implemented by a series of

placings, the terms and conditions of which will be set out in the

Prospectus, and/or by way of open offers, offers for subscription

and/or intermediaries offers, the terms of which will be published

at the time of such open offers, offers for subscription or

intermediaries offers (each a "Subsequent Issue"). Conditional on

the passing of the Issue Resolutions, the issue of New Ordinary

Shares pursuant to the Share Issuance Programme will be at the

discretion of the Directors.

The price at which New Ordinary Shares will be issued pursuant

to a Subsequent Issue under the Share Issuance Programme will be

determined by the Company and will be not less than the prevailing

Net Asset Value per Ordinary Share at the time of issue plus a

premium to cover the costs and expenses of such issue. Further

information on the Share Issuance Programme will be set out in the

Prospectus.

Considerations associated with the Proposals

Shareholders should have regard to the following when

considering the Proposals:

-- The past performance of the Company or of the Investment

Advisor is not necessarily indicative of likely future

performance.

-- All existing Shareholders not participating in the Initial

Issue will be diluted. Furthermore, Shareholders who choose not to,

or who are unable to, participate in any Subsequent Issue under the

Share Issuance Programme for an amount at least pro rata to their

existing holding will have their percentage holding diluted

following the relevant Admission. Assuming that 400,000,000 New

Ordinary Shares are issued pursuant to the Initial Issue and the

Share Issuance Programme (being the maximum number of New Ordinary

Shares that the Directors would be authorised to issue thereunder):

(i) Qualifying Shareholders who take up their full Open Offer

Entitlement under the Initial Issue (excluding any New Ordinary

Shares acquired through the Excess Application Facility) will

suffer a maximum dilution of approximately 36.9 per cent. to their

ownership and voting interests in the Company by virtue of the

issue of New Ordinary Shares pursuant to the Initial Issue and the

Share Issuance Programme; and (ii) Qualifying Shareholders who do

not take up any of their Open Offer Entitlement under the Initial

Issue and Shareholders who are not eligible to participate in the

Open Offer will suffer a maximum dilution of approximately 43.4 per

cent. to their ownership and voting interests in the Company by

virtue of the issue of New Ordinary Shares pursuant to the Initial

Issue and the Share Issuance Programme.

-- The Company has not entered into any legally binding

contractual arrangements to acquire any further properties from any

potential vendors. There can therefore be no assurance as to how

long it will take for the Company to invest the proceeds of the

Initial Issue. Even where the Company, acting on advice from the

Investment Advisor, has identified and approved the acquisition of

a property in line with its investment objective and investment

policy, it may encounter a number of delays before the property is

finally acquired. The past performance of the Investment Advisor in

terms of the speed of deployment of the GBP843 million of equity

and debt raised on and since the Company's IPO cannot be taken as

an indication of the speed of deployment of the net proceeds of the

Initial Issue.

Shareholders should read the Risk Factor section in the

Prospectus in full.

General Meeting

The Initial Issue and the Share Issuance Programme are

conditional on the approval by Shareholders of the Issue

Resolutions to be proposed at a General Meeting of the Company

which is expected to be convened on or around 10 March 2021.

The Company currently has authority to issue up to 52,142,601

Ordinary Shares on a non-pre-emptive basis. It is proposed that the

authorities sought at the General Meeting, if approved, will be in

addition to any existing authorities obtained by the Company.

In accordance with the Articles, all Shareholders present in

person or by proxy shall upon a show of hands have one vote and

upon a poll shall have one vote in respect of each Ordinary Share

held. In order to ensure that a quorum is present at the General

Meeting, it is necessary for two Shareholders entitled to vote to

be present, whether in person or by proxy (or, if a corporation, by

a representative).

All Shareholders are entitled to attend and vote at the General

Meeting. However, In light of the ongoing COVID-19 pandemic and the

measures imposed by the UK Government to combat the spread of the

virus, the General Meeting will be run as a closed meeting and

Shareholders will not be permitted to attend in person.

The formal notice convening the General Meeting will be set out

in the Circular, expected to be published shortly.

Company Overview

-- The Company's current portfolio:

o has a long weighted average unexpired lease term to first

break of 21 years, with 95 per cent. of its rental income being

index-linked or containing fixed uplifts;

o was acquired at an attractive average net initial yield of 5.8

per cent., which is 80 basis points above its current portfolio

valuation yield (as at 31 December 2020), through a mix of pre-let

forward fundings and built asset acquisitions;

o is 100 per cent. let or pre-let to over 50 institutional-grade

tenants across a range of robust sectors; and

o is leveraged at 30 per cent. LTV, with a weighted average of

13 years unexpired and a fixed average rate of 2.85 per cent. per

annum on the Company's term loans

-- The Company has delivered an average annual total NAV return

of 10 per cent. per annum since IPO

-- The Company has effected selective asset disposals generating

an average geared IRR of 23 per cent. per annum

FOR FURTHER INFORMATION, PLEASE CONTACT:

LXI REIT Advisors Limited Via Maitland/AMO

John White

Simon Lee

Freddie Brooks

Peel Hunt LLP (Sponsor, Joint Global Tel: 020 7418 8900

Co-ordinator, Joint Broker, Joint Bookrunner

and Intermediaries Offer Adviser)

Luke Simpson, Liz Yong, Tom Pocock

(IBD)

Alex Howe, Chris Bunstead (Sales)

Alistair Boyle (Intermediaries)

Al Rae, Sohail Akbar (Syndicate)

---------------------------------

J efferies International Limited and

Jefferies GmbH (Joint Global Co-ordinator,

Joint Broker and Joint Bookrunner)

Ed Matthews - ematthews1@jefferies.com

Tom Yeadon - tyeadon@jefferies.com 020 7029 8000

---------------------------------

Maitland/AMO (Communications Adviser) 07747 113 930

James Benjamin lxireit-maitland@maitland.co.uk

---------------------------------

The Company's LEI is: 2138008YZGXOKAXQVI45

NOTES:

LXI REIT plc invests in UK commercial property assets let, or

pre-let, on very long (typically 20 to 30 years to expiry or first

break), inflation-linked leases to a wide range of strong tenant

covenants across a diverse range of robust property sectors.

The Company may invest in fixed-price forward funded

developments, provided they are pre-let to an acceptable tenant and

full planning permission is in place. The Company will not

undertake any direct development activity nor assume direct

development risk.

The Company is targeting an annual dividend of 6.0 pence per

Ordinary Share for the 12-months commencing 1 April 2021*.

The Company, a real estate investment trust ("REIT")

incorporated in England and Wales, is listed on the premium listing

segment of the Official List of the Financial Conduct Authority and

was admitted to trading on the main market for listed securities of

the London Stock Exchange in February 2017.

The Company is a constituent of the FTSE 250, FTSE EPRA/NAREIT

and MSCI indices.

* These are guidance levels or targets only and not a profit

forecast. In setting this target the Board has applied

sensitivities to contracted rental income that reflect the possible

impact of the COVID-19 pandemic and assessed the effect of such

sensitivities on the net earnings and liquidity of the Group. The

target assumes that future rent collection is not materially lower

than that achieved so far throughout the pandemic and the Board

reserves the right to withdraw or amend guidance in the event that

rent collection materially worsens.

There can be no assurance that this target will be met and it

should not be taken as an indication of the Group's expected future

results which may be impacted by events or circumstances existing

or arising after the date that the Annual Dividend Target was

announced.

EXPECTED TIMETABLE

2021

Posting of the Circular and Notice Mid-February

of General Meeting

Prospectus published and Initial Mid-February

Issue opens

General Meeting Early-March

Initial Issue closes Early-March

Announcement of the results of the Early-March

Initial Issue

The above times and/or dates may be subject to change and, in

the event of such change, the revised times and/or dates will be

notified to Shareholders by an announcement through a Regulatory

Information Service.

All references to times in this announcement are to London

times.

About the AIFM and LXI REIT Advisors Limited

The Company has appointed Alvarium Fund Managers (UK) Limited as

its alternative investment fund manager (the "AIFM"). The Company

and the AIFM have appointed the Investment Advisor to provide

certain services in relation to the Company and its portfolio.

Alvarium Fund Managers (UK) Limited is 100 per cent. owned by

Alvarium Investments Limited. Alvarium was established in 2009 and

has grown to become a substantial, international multi-family

office and asset manager, supervising in excess of US$18 billion of

assets, for families, private individuals and institutions. It has

over 200 employees and 12 offices around the world.

The Investment Advisor has extensive expertise in the purchase

and forward funding of commercial property assets let or pre-let on

long, index-linked leases to institutional grade tenants with

strong financial covenants across a wide range of defensive and

robust sectors.

The Investment Advisor comprises property, legal and finance

professionals with significant experience in the real estate

sector, as described below. The team has capitalised and transacted

over GBP2 billion of commercial property assets with a particular

focus on accessing secure, long-let and index-linked UK commercial

real estate through forward funding and built asset structures.

The core management team of the Investment Advisor (whose

details are set out below) is supported by a team of other

accounting, asset management, compliance, marketing, public

relations, administrative and support staff. The key individuals

responsible for executing the Company's investment strategy at the

Investment Advisor are:

John White

John entered the commercial property market in 1987 and after

qualifying as a chartered surveyor at Allsops moved to the

investment team at Cushman & Wakefield. There he became a

partner and spent the next 18 years advising a range of

institutional investor clients on their UK acquisitions and

disposals across the full range of real estate sub-sectors

including retail (in and out of town), offices (London, Thames

Valley and regional cities), logistics, and alternatives. John

moved into private equity real estate in 2007 and co-founded Osprey

Equity Partners in 2011 and LXi REIT Advisors Limited in 2016.

Simon Lee

Simon trained and practised as a solicitor at City law firm,

Slaughter and May, from 1999 to 2006, following which he spent the

next 10 years in private equity real estate, co-founding Osprey

Equity Partners in 2011 and LXi REIT Advisors Limited in 2016.

Simon's role covers a wide range of areas, including formulating

investment strategies and products, raising equity and debt

finance, asset selection, and negotiating and implementing

transactions with vendors, purchasers, developers, investors,

lenders and joint venture partners.

Freddie Brooks

Freddie trained and qualified as a chartered accountant in BDO's

Real Estate and Construction team, gaining significant experience

in the sector, working with similar listed vehicles, private

property funds, developers and a number of the UK's top

contractors. Freddie is also a qualified chartered surveyor

(property finance and investment pathway) and a member of the RICS.

Freddie's role covers all historical and strategic financial

matters including annual and interim reporting, budgeting and

forecasting, treasury management and the monitoring of internal

controls. Freddie is also responsible for the Investment Advisor's

reporting to the Company's Board of Directors.

Directors of the Company

The Directors are as follows:

Stephen Hubbard, non-executive Chairman

Stephen Hubbard previously served as Executive Chairman of UK

CBRE Group, the world's largest property advisory firm. Before that

Stephen served as Co-Head of CBRE Capital Markets Europe. He joined

Richard Ellis in 1976 and served as Head of EMEA and UK Capital

Markets from 1998 to 2012. He is also a member of the Advisory

Board for Redevco which is a pan-European property holding company.

In July 2020, Stephen became the Chairman of Workspace Group plc,

having served as a non-executive director since July 2014.

Colin Smith OBE, non-executive Director

Colin Smith OBE served for ten years as Chairman of Poundland

Group Holdings, Europe's largest single price discount retailer.

Prior to this, he was Chief Executive and Finance Director of

Safeway Plc, the national supermarket retailer. Colin served as

Chairman of Hilton Food Group plc between 2016 and 2018, having

previously served as a non-executive director since 2010. He also

has experience in the not for profit sector, formerly serving as

Chairman of The Challenge Network, as a trustee of Save the

Children and as Chairman of the food industry sponsored Red Tractor

assurance scheme. Colin has been appointed as the Company's Senior

Independent Director.

Jeannette (Jan) Etherden, non-executive Director

Jan Etherden has over 35 years' experience in the investment

industry, as an analyst, fund manager, then a non-executive

director. Previously head of UK equities for Confederation Life/Sun

Life of Canada, she joined Newton in 1996 as a director

specialising in multi-asset segregated portfolios and also was

their Investment COO from 1999 to 2001. Subsequently she worked

with Olympus Capital Management as business development manager for

specialist hedge fund products. She is a director of Miton UK

MicroCap Trust plc and has previously served on the Boards of

Ruffer Investment Company Ltd and TwentyFour Income Fund Ltd.

John Cartwright, non-executive Director

John Cartwright was formerly Chief Executive of The Association

of Real Estate Funds (AREF) from 2009 to 2019. His responsibilities

as Chief Executive of AREF were to represent and promote the

interests of members, promote best practice in fund governance and

ensure the smooth running of the association. Prior to this, John

was with M&G Real Estate (formerly PRUPIM) for nearly 35 years

in a variety of roles; latterly as Head of Institutional and Retail

Funds and a member of PRUPIM's Board and Investment Committee. He

has more than 20 years' experience of managing pooled and

segregated accounts for both retail and institutional investors.

John is also a member of the Investment Committee of Lothbury

Property Trust.

Patricia Dimond, non-executive Director

Patricia Dimond has had an international career with over 30

years in consumer and financial markets. As an Executive or

Strategic Advisor, she has worked with FTSE 100, Private Equity and

owner managed companies. She is an investor in early stage

technology ventures, with an expertise in Fintech. Patricia is an

alumnae of McKinsey, 1994-1999 and a Chartered Financial Analyst

(CFA), 2006. She qualified, with Deloitte, as a Chartered

Accountant (CA) in 1985, and holds an MBA from IMD Switzerland,

1993. Patricia currently serves as a Non-Executive Director for the

English National Opera, where she is Senior Independent Director

(SID) and Chair of Audit and Risk, and, as a non-executive director

of Foresight VCT plc.

Disclaimer

This announcement is an advertisement and does not constitute a

prospectus and investors must subscribe for or purchase any shares

referred to in this announcement only on the basis of information

contained in the Prospectus expected to be published by the Company

shortly and not in reliance on this announcement. Copies of the

Prospectus may, subject to any applicable law, be obtained from the

registered office of the Company and at the National Storage

Mechanism at https://data.fca.org.uk/#/nsm/nationalstoragemechanism

and on the Company's website, www.lxireit.com/company-documents.

Neither the content of the Company's website, nor the content on

any website accessible from hyperlinks on its website for any other

website, is incorporated into, or forms part of, this announcement

nor, unless previously published by means of an RIS announcement,

should any such content be relied upon in reaching a decision as to

whether or not to acquire, continue to hold, or dispose of,

securities in the Company. This announcement does not constitute,

and may not be construed as, an offer to sell or an invitation to

purchase investments of any description or a recommendation

regarding the issue or the provision of investment advice by any

party. No information set out in this announcement is intended to

form the basis of any contract of sale, investment decision or any

decision to purchase shares in the Company. Approval of the

prospectus by the FCA should not be understood as an endorsement of

the securities that are the subject of the prospectus. Potential

investors are recommended to read the prospectus before making an

investment decision in order to fully understand the potential

risks and rewards associated with a decision to invest in the

Company's securities.

This is a financial promotion and is not intended to be

investment advice. The content of this announcement, which has been

prepared by and is the sole responsibility of the Company, has been

approved by Alvarium Fund Managers (UK) Limited, which is

authorised and regulated by the Financial Conduct Authority, solely

for the purposes of section 21(2)(b) of the Financial Services and

Markets Act 2000 (as amended).

This announcement is not for release, publication or

distribution, directly or indirectly, in or into the United States

(including its territories and possessions, any state of the United

States and the District of Columbia, collectively, the "United

States"). This announcement is not an offer of securities for sale

in or into the United States. The New Ordinary Shares have not

been, and will not be, registered under the US Securities Act 1933,

as amended (the "US Securities Act"), or with any securities

regulatory authority of any state or other jurisdiction of the

United States, and may not be offered or sold into or within the

United States, absent registration under, or except pursuant to an

exemption from the registration requirements of, the US Securities

Act, and in compliance with any applicable securities laws of any

state or other jurisdiction in the United States. No public

offering of securiteis is being made in the United States.

In addition the Company has not been and will not be registered

under the US Investment Company Act of 1940, as amended.

Further, this announcement is not for release, publication or

distribution into Australia, New Zealand, Canada, Singapore, the

Republic of South Africa, Japan or any member state of the EEA

(other than any member state of the EEA where the Company's

securities may be lawfully marketed) or any other jurisdiction

where such distribution is unlawful.

The distribution of this announcement may be restricted by law

in certain jurisdictions and persons into whose possession any

document or other information referred to herein comes should

inform themselves about and observe any such restriction. Any

failure to comply with these restrictions may constitute a

violation of the securities laws of any such jurisdiction. Each of

Peel Hunt LLP ("Peel Hunt"), Jefferies International Limited, both

of which are authorised and regulated in the United Kingdom by the

FCA, and Jefferies GmbH, registered in Germany and authorised and

regulated by the Bundesanstalt für Finanzdienstleistungsaufsicht

(together, Jefferies International Limited and Jefferies GmbH,

being "Jefferies"), is acting exclusively for the Company and for

no-one else and will not regard any other person (whether or not a

recipient of this announcement or the Prospectus) as its client in

relation to the Initial Issue, the Share Issuance Programme and the

other arrangements referred to in the Prospectus and will not be

responsible to anyone other than the Company for providing the

protections afforded to its clients, nor for providing advice in

connection with the Initial Issue, the Share Issuance Programme,

any Admission and the other arrangements referred to in this

announcement and in the Prospectus.

The value of shares and the income from them is not guaranteed

and can fall as well as rise due to stock market and currency

movements. When you sell your investment you may get back less than

you originally invested. Figures refer to past performance and past

performance is not a reliable indicator of future results. Returns

may increase or decrease as a result of currency fluctuations.

This announcement contains forward looking statements,

including, without limitation, statements including the words

"believes", "estimates", "anticipates", "expects", "intends",

"may", "will" or "should" or, in each case, their negative or other

variations or comparable terminology. Such forward looking

statements involve unknown risks, uncertainties and other factors

which may cause the actual results, financial condition,

performance or achievements of the Company, or industry results, to

be materially different from any future results, performance or

achievements expressed or implied by such forward-looking

statements.

These forward-looking statements speak only as at the date of

this announcement and cannot be relied upon as a guide to future

performance. The Company, the Investment Advisor, the AIFM, Peel

Hunt and Jefferies expressly disclaim any obligation or undertaking

to update or revise any forward-looking statements contained herein

to reflect actual results or any change in the assumptions,

conditions or circumstances on which any such statements are based

unless required to do so by the Financial Services and Markets Act

2000, the Prospectus Regulation Rules of the Financial Conduct

Authority, the UK Market Abuse Regulation or other applicable laws,

regulations or rules.

The information in this announcement is for background purposes

only and does not purport to be full or complete. None of Peel Hunt

or Jefferies, or any of their respective affiliates, accepts any

responsibility or liability whatsoever for, or makes any

representation or warranty, express or implied, as to this

announcement, including the truth, accuracy or completeness of the

information in this announcement (or whether any information has

been omitted from the announcement) or any other information

relating to the Company or associated companies, whether written,

oral or in a visual or electronic form, and howsoever transmitted

or made available or for any loss howsoever arising from any use of

the announcement or its contents or otherwise arising in connection

therewith. Peel Hunt and Jefferies, and their affiliates,

accordingly disclaim all and any liability whether arising in tort,

contract or otherwise which they might otherwise be found to have

in respect of this announcement or its contents or otherwise

arising in connection therewith.

In connection with the Initial Issue and/or any Subsequent

Issue, Peel Hunt and/or Jefferies, and any of their affiliates, may

take up a portion of the New Ordinary Shares as a principal

position and in that capacity may retain, purchase, sell, offer to

sell for their own accounts such New Ordinary Shares and other

securities of the Company or related investments in connection with

the Initial Issue, relevant Subsequent Issue or otherwise.

Accordingly, references in the Prospectus, once published, to the

New Ordinary Shares being issued, offered, subscribed, acquired,

placed or otherwise dealt in should be read as including any issue

or offer to, or subscription, acquisition, placing or dealing by,

Peel Hunt and any of its affiliates and/or Jefferies and any of its

affiliates acting in such capacity. In addition Peel Hunt and/or

Jefferies, and any of their affiliates may enter into financing

arrangements (including swaps or contracts for differences) with

investors in connection with which Peel Hunt and/or Jefferies, and

any of their affiliates may from time to time acquire, hold or

dispose of Ordinary Shares. Peel Hunt and Jefferies do not intend

to disclose the extent of any such investment or transactions

otherwise than in accordance with any legal or regulatory

obligations to do so.

Information to Distributors

Solely for the purposes of the product governance requirements

contained within: (a) the UK's implementation of EU Directive

2014/65/EU on markets in financial instruments, as amended ("UK

MiFID II"); and (b) the UK's implementation of Articles 9 and 10 of

Commission Delegated Directive (EU) 2017/593 supplementing UK MiFID

II, and in particular Chapter 3 of the Product Intervention and

Product Governance Sourcebook of the FCA (together, the "MiFID II

Product Governance Requirements"), and disclaiming all and any

liability whether arising in tort, contract or otherwise, which any

"manufacturer" (for the purposes of the MiFID II Product Governance

Requirements) may otherwise have with respect thereto, the New

Ordinary Shares have been subject to a product approval process,

which has determined that such securities are: (i) compatible with

an end target market of retail investors and investors who meet the

criteria of professional clients and eligible counterparties, each

as defined in UK MiFID II; and (ii) eligible for distribution

through all distribution channels as are permitted by UK MiFID II

(the "Target Market Assessment"). Notwithstanding the Target Market

Assessment, distributors (such term to have the same meaning as in

the MiFID II Product Governance Requirements) should note that: the

market price of the New Ordinary Shares may decline and investors

could lose all or part of their investment; the New Ordinary Shares

offer no guaranteed income and no capital protection; and an

investment in the New Ordinary Shares is compatible only with

investors who do not need a guaranteed income or capital

protection, who (either alone or in conjunction with an appropriate

financial or other adviser) are capable of evaluating the merits

and risks of such an investment and who have sufficient resources

to be able to bear any losses that may result therefrom. The Target

Market Assessment is without prejudice to the requirements of any

contractual, legal or regulatory selling restrictions in relation

to the Inital Issue and/or Share Issuance Programme. Furthermore,

it is noted that, notwithstanding the Target Market Assessment,

Peel Hunt and Jefferies will only procure investors (pursuant to

the Initial Issue and Share Issuance Programme) who meet the

criteria of professional clients and eligible counterparties. For

the avoidance of doubt, the Target Market Assessment does not

constitute: (a) an assessment of suitability or appropriateness for

the purposes of UK MiFID II; or (b) a recommendation to any

investor or group of investors to invest in, or purchase, or take

any other action whatsoever with respect to the New Ordinary

Shares. Each distributor is responsible for undertaking its own

target market assessment in respect of the New Ordinary Shares and

determining appropriate distribution channels.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEGPUUPPUPGPGA

(END) Dow Jones Newswires

February 16, 2021 02:00 ET (07:00 GMT)

Lxi Reit (LSE:LXI)

Historical Stock Chart

From Mar 2024 to Apr 2024

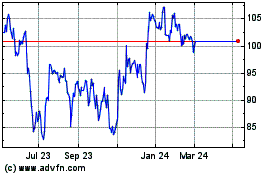

Lxi Reit (LSE:LXI)

Historical Stock Chart

From Apr 2023 to Apr 2024