Marechale Capital Plc Trading Update

March 04 2021 - 9:25AM

UK Regulatory

TIDMMAC

04 March 2021

Marechale Capital plc

("Marechale" or the "Company")

Trading Update

Marechale Capital Plc (AIM: MAC) provides an update on its current trading.

Further to the announcement of 26 January 2021, Marechale recently completed a

strategic fundraising to put the Company in a better position to take advantage

of opportunities that are presented to Marechale in connection with its work

for corporate clients whereby Marechale takes shares, founder shares or long

term warrants in lieu of or in addition to cash fees. The Company sees

significant potential for growth within the technology, alternative and

renewable energy and leisure and hospitality sectors as the economy recovers

from the current pandemic and the Directors consider that a stronger balance

sheet will allow it greater scope to capitalise on and participate in client

financing opportunities on advantageous terms.

Recent transactions concluded by the Company include providing strategic advice

to a high growth energy business, which is planning a realisation event in the

short term, whereby the Company was able to receive a greater proportion of

shares and warrants as part of its advisory fees. In addition, Marechale is

now better positioned to invest in and support its corporate clients alongside

its investor relationships which it has recently done with a growing global

technology group which is on the cusp of its first commercial contract. In this

transaction, the Company received further shares in a new equity round, at a

premium valuation to previous rounds, together with increasing its warrant

position. Finally, the Company completed a short-term, high yielding loan note

funding round through its investor contacts, in which it was also able to

participate and receive warrants, for a UK hospitality brand with the potential

for high growth. The board believes these investments and other maturing

warrants and equity and founder equity investments in the Marechale corporate

finance portfolio have the potential to generate material value to

shareholders.

Marechale is an established corporate finance firm providing strategic, M&A and

advisory services helping to provide finance for earlier stage and growth

capital companies from its family office, private investor and private equity

relationships where it often co invests. The majority of the Company's recent

share placing funding has been invested in, or committed to, a number of these

completed and ongoing transactions, taking the form of equity at attractive

valuations and short-term, high yielding loans with warrants attached.

This announcement contains inside information for the purposes of Article 7 of

EU Regulation 596/2014 (which forms part of domestic UK law pursuant to the

European Union (Withdrawal) Act 2018).

For further information please contact:

Marechale Capital plc Tel: +44 (0)20 7628 5582

Mark Warde-Norbury / Patrick Booth-Clibborn

Cairn Financial Advisers LLP (Nomad) Tel: +44 (0)20 7213 0880

Jo Turner / Sandy Jamieson / Mark Rogers

Novum Securities Limited (Broker) Tel: +44 (0)20 7399 9427

Colin Rowbury

END

(END) Dow Jones Newswires

March 04, 2021 10:25 ET (15:25 GMT)

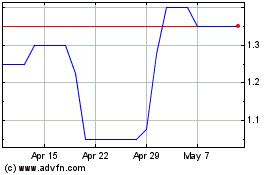

Marechale Capital (LSE:MAC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marechale Capital (LSE:MAC)

Historical Stock Chart

From Apr 2023 to Apr 2024