TIDMMBH

RNS Number : 8753T

Michelmersh Brick Holdings PLC

30 March 2021

30 March 2021

Michelmersh Brick Holdings Plc

("MBH" or the "Group")

FINAL RESULTS

Resilient trading through Covid-19 interruption, dividend

payments resumed

Michelmersh Brick Holdings (AIM: MBH), the specialist brick

manufacturer, is pleased to report its audited final results for

the year ended 31 December 2020, representing a strong performance

and continued progress.

Financial Highlights

-- GBP52.0 million of revenue generated, in line with the prior

year despite Covid-19 shutdown and loss of output (2019: GBP53.5

million)

-- EBITDA of GBP12.3 million, down 10% (2019: GBP13.6 million)

-- Robust operating performance driving improved gross margin 41.3% (2019: 40.9%)

-- Strong cash generation building to a year end cash balance of

GBP12.2 million and a positive net cash position

-- Repayment of furlough monies drawn during shutdown

-- Final single payment dividend of 2.50 pence, being a 117%

increase year on year (2019: 1.15 pence)

Operational Highlights

-- Strong operational and financial performance during year which has continued into 2021

-- Comprehensive support for staff through shutdown and home working

-- Commencement of road construction at Telford for long-term

benefits of the brickworks and restoration

-- Launched sustainability steering committee

-- Completion of new Floren offices, welfare & technical testing building

-- Exercised option securing additional mineral reserves at Michelmersh

Commenting on the 2020 performance, Martin Warner, Chairman at

Michelmersh Brick Holdings, said:

" To almost equal 2019's revenue level and deliver such robust

earnings after operations were suspended for most of April is an

incredible achievement. The Group worked tirelessly to make its

plants Covid-19 safe and minimise the impact. With Michelmersh

being such an effective operator, production was able to return to

optimal levels within a few weeks of recommencing.

"Michelmersh is operating in a sector that is currently buoyant

and supported by government incentives. As such, it is well placed

to capitalise on the UK and Benelux markets with its strong brands,

well-invested operational structure and sound financial footing. We

are still conscious that Covid-19 continues to cause a level of

uncertainty, whilst the UK and Europe are both getting used to

post-Brexit conditions. However, the Group has had a good start to

2021 and I remain confident that the Company can look forward to

continued growth and prosperity with the longer-term market

fundamentals in our favour."

An online analyst briefing will be held at 9.30am today. To

attend please email michelmersh@yellowjerseypr.com .

Michelmersh Brick Holdings plc Tel: +44 (0)7384 259 407

Frank Hanna, Joint CEO

Stephen Morgan, Finance Director

Canaccord Genuity Limited (NOMAD Tel: +44 (0)20 7523 8000

and Broker)

Bobbie Hilliam

Georgina McCooke

Yellow Jersey PR Tel: +44 (0)7747 788 221

Charles Goodwin

Annabel Atkins

The information contained within this announcement is deemed to

constitute inside information as stipulated under the UK Market

Abuse Regulation. Upon the publication of this announcement, this

inside information is now considered to be in the public

domain.

About Michelmersh Brick Holdings PLC:

Michelmersh Brick Holdings PLC is a business with seven market

leading brands: Blockleys, Carlton, Charnwood, Freshfield Lane,

Michelmersh, Floren and Hathern Terra Cotta. These divisions

operate within a fully integrated business combining the

manufacture of clay bricks and pavers. The Group also includes a

landfill operator, New Acres Limited, and seeks to develop future

landfill and development opportunities on ancillary land

assets.

Established in 1997, the Company has grown through acquisition

and organic growth into a profitable and asset rich business,

producing over 120 million clay bricks and pavers per annum.

Michelmersh currently owns most of the UK's premium manufacturing

brick brands and is a leading specification brick and clay paving

manufacturer.

Michelmersh strives to be a well invested, long term,

sustainable, environmentally responsible business. Opportunity,

training and security for all employees, whilst meeting the needs

of stakeholders are at the forefront of everything we do. We aim to

lead the way in producing some of Britain's premium clay products

and enhancing our environment by adding value to the architectural

landscape for generations to come.

We are Michelmersh Brick Holdings PLC: we are "Britain's Brick

Specialist".

Please visit the Group's websites at: www.mbhplc.co.uk and

www.bimbricks.com

Chairman's Statement

Introduction:

It is extremely gratifying to be able to report that your

Company has successfully navigated a very challenging year,

delivered a very commendable result and retained a strong financial

position. After Covid-19 led to our manufacturing operations being

suspended for most of April 2020, the Group worked tirelessly to

get the business back up to speed in a safe manner. Whilst

construction site activity also slowed in early spring due to

Covid-19, by the beginning of May activity had picked up, which we

experienced with customer orders and sales returning quickly.

Throughout the pre- and post-Covid-19 interruption, the Board

has striven to uphold the Group's 'good corporate citizen'

principles and sought to balance the Group's responsibilities to

all stakeholders. The Group's financial resilience has allowed us

to support and reward our staff, maintain responsibilities to

customers and suppliers, return furlough monies drawn to HMRC and

re-instate the dividend stream to shareholders.

Financial Highlights

2020 2019 yoy

Turnover (GBPm) 52.0 53.5 - 2.8%

Gross margin 41.3% 40.9% + 0.4%

Operating profit (GBPm)-

underyling(1) 8.8 10.3 - 15.2%

Profit before tax (GBPm)

underyling(1) 8.0 9.6 - 16.5%

EBITDA(GBPm) underyling(1) 12.3 13.6 - 9.8%

Basic EPS (pence) underyling(1) 6.28 8.41 - 25.3%

Dividend per share (pence) 2.50 1.15 +117.4%

Net cash /(debt) (GBPm) 0.7 (6.3)

Net cash generated by

operations(GBPm) 12.9 16.6 - 22.5%

(1) Underlying excludes items regarded as exceptional and

amortisation of intangibles

The Group has for some time operated on the basis that

production output should be maximised and all product will be sold

to a customer. Covid-19 regulations caused operations to cease in

late March and production output was lost and, despite a strong

performance once this recommenced, the Directors consider that

output was negatively impacted by 6.5 million bricks. Despite the

Group being able to return to production swiftly, the customer

markets reopening lagged production output and this impacted

deliveries. This led to a small reduction in turnover during the

year.

Given the challenges, the Directors believe the overall

financial results of the Group are impressive with turnover and

volumes only 3% lower than the Group's strongest ever performance

in 2019. Increased costs eroded earnings as Covid-19 related

cleaning costs, continued IT development costs and unfavourable

currency rates had an impact. This led to earnings metrics being

below that achieved in 2019. However, the return to full capacity

and operational performance in the second half of the year gives me

confidence that the worst is over and the business is in a strong

and stable position moving forward.

Cash and Net Debt

The Group ended 2020 in a modest net cash position after opening

the year with net debt of GBP6.3 million. Cash preservation

measures were taken in the early part of the year in the face of

Covid-19 but strong trading put the Group on a solid financial

footing by the end of the year.

In the early stages of Covid-19, the financial backdrop held

uncertainties and the Board took certain measures to protect the

business - drawing down GBP3 million from existing bank facilities,

accepting government support through furlough payments and

deferring VAT payments, holding back capital projects, cancelling

the final dividend in respect of 2019 and stress testing the

business prospects. As trading recovered from early summer onwards,

uncertainties receded and cash reserves recovered, which enabled

the Group to reverse the measures taken by repaying furlough

payments, schedule the repayment of deferred VAT payment and

reinstate dividends. Moreover, the Group has made a voluntary

prepayment of GBP10 million of bank debt as well as GBP3.3 million

of scheduled repayments. The Group entered 2021 in a net cash

position including substantial cash balances which, along with

undrawn bank facilities, afford headroom against risk, the

opportunity to invest and to pay a progressive dividend.

Dividend

As mentioned above, the Board reluctantly withdrew the final

dividend in respect of 2019, but the business has now achieved the

stability and cash resources to recommence dividend payments. The

Board proposes a single dividend in respect of 2020 of 2.5 pence

per ordinary share to shareholders on the register on 4 June 2021

which will be paid on 14 July 2021. The Company will again offer

shareholders a scrip alternative to a cash dividend with a scrip

election date of 23 June.

The dividend exceeds previous levels as a proportion of earnings

in recognition of the withdrawal of the 2019 dividend.

Board and Employees

This year has seen an impressive response from the Group's staff

to significant challenges both as individuals and in demonstrating

significant and outstanding teamwork. Operational and financial

outcomes owe much to their skill and commitment and on behalf of

the shareholders and the Board, I would like to pass on my sincere

thanks.

The Board is also undergoing a period of change with the

addition of two new non-executive directors within the year. Paula

Hay-Plumb joined at the 2020 AGM and is already ensconced as Chair

of the Audit Committee and contributing to the effectiveness of the

Board. In November, Tony Morris was appointed bringing energy and

experience that will help the Group explore and develop commercial

opportunities. I welcome them to the business.

The role of Company Secretary has been transferred to a

professional third-party corporate entity, Prism Cosec, adding

front-line expertise and guidance to the Board.

We will, however, be losing two long established members of the

Board in 2021 as Bob Carlton-Porter and Stephen Morgan step away

from the Company at the forthcoming AGM, having served 17 and 11

years respectively. On a personal note, and on behalf of

shareholders, can I extend my thanks to them for their contribution

and support which have helped to make Michelmersh the Company it is

today through a period of remarkable growth. They will be hugely

missed and I wish them well.

The CFO role has been filled following a rigorous and

wide-ranging recruitment process. The new appointee, Ryan Mahoney,

will join us following our 2021 AGM in early June, bringing

significant financial and operational experience. His expertise

will help the business secure continued growth and we look forward

to working with him.

Ryan joins from Avon Rubber, the FTSE 250 defence engineering

and manufacturing group where he has been Deputy Chief Financial

Officer since April 2018. Prior to that, Ryan had been Group

Financial Controller for Unite Students, the FTSE 250 property

group, since November 2015, and before then held other senior

finance roles within the business. Prior to joining Unite, Ryan

worked for KPMG for 9 years in both audit and advisory roles. Ryan

is both a qualified accountant and a member of the ICAEW.

OUTLOOK

Michelmersh is operating in a sector that is currently buoyant

and supported by government incentives. As such, it is well placed

to capitalise on the UK and Benelux markets with its strong brands,

well-invested operational structure and sound financial footing. We

are still conscious that Covid-19 continues to cause a level of

uncertainty, whilst the UK and Europe are both getting used to

post-Brexit conditions. However, the Group has had a good start to

2021 and I remain confident that the Company can look forward to

continued growth and prosperity with the longer-term market

fundamentals in our favour.

Martin Warner

Chairman

30 March 2021

Chief Executives' Report

The first quarter of 2020 showed a promising start to the year

up until the Group's manufacturing activities were suspended due to

Covid-19. All factories undertook the process of a safe, phased

shut-down of kilns and manufacturing operations ceased as home

working continued where possible for administrative staff. During a

four-week shutdown, skeleton staff ensured on-site safety and

conducted critical maintenance duties, and health and safety teams

liaised with operational staff to develop Covid-19 secure safe

operating procedures ("SOPs") in preparation for the return to

work. The intention from operational teams was to return to a safe

workplace as soon as possible in order to protect the business and

the workforce's livelihood.

Return to work commenced towards the end of April on a phased

basis as new SOPs were implemented. At this stage, some operations

were expected to be scaled back with two sites not scheduled to

achieve full capacity until all restrictions were lifted. It was

not long, however, before development of systems and structures

allowed full capacity to be achieved at all plants.

The closure of operations meant that the Group lost output of

9.5 million units. Strenuous efforts were made to recover lost

units and by the end of December 2020, the Group's UK output was

only 6.5 million units behind the level of output achieved in the

whole of 2019. Following the return to operations in April 2020,

the business experienced minimal Covid-19 related absence for the

remainder of the period thanks in no small part to the commitment

of employees in following the SOPs. There was, however, a spike in

Covid-19 infections and isolations at the beginning of 2021

following the Christmas break, affecting a small number of

employees relatively severely. The absences have reduced

significantly in recent weeks and overall have not had a dramatic

effect on operations. The business continues to operate under the

established SOPs and deep-cleaning routines.

The impact of Covid-19 on deliveries to customers was greater

than on manufacturing output as elements of the market were slower

to re-open operations. At the low point, UK despatch volumes were

down by 14 million units, however there was pent-up demand in a

buoyant construction sector that was released through the second

half of the year. By the close of the year, units despatched were

only 7.4 million units less than in 2019, in itself a very

successful year.

The Group met the objectives set at the half year by converting

the strong order book into sales throughout H2, managing down our

debt and returning to a progressive dividend stream.

Energy costs in 2020 were relatively benign as world energy

markets were depressed. This compensated for some additional health

and safety and cleaning costs related to Covid-19. Despite lower

volumes in what is a business with heavy fixed costs, gross margins

were slightly ahead of the levels seen in 2019. The UK results also

benefitted from a strong rebound in performance from Carlton Brick

after disruptions in 2019 brought on by integration of new

investment in plant.

During the course of 2020, the Group completed the supply to

several inspiring schemes which achieved BREEAM "excellent"

sustainability ratings. Other notable projects included Hobb House

Court in London, Victoria House in Leeds, Clockworks in Manchester

and University College London Hospital to name but a few. The Group

strategy of ensuring a well-balanced forward order book continues

from previous years into 2021 and Q1 order intake remains

robust.

Despite the disruption from Covid-19 and with many staff

homeworking, the Group was able to build momentum through H2 on a

number of key initiatives. The Group's newly formed Sustainability

Steering Committee successfully implemented a Net Zero road map and

the IT department went live with the implementation of the new

Salesforce software. We are the first brick manufacturer to partner

the industry's Supply Chain Sustainability School. We also met our

Pledge 100 target of donating 100k bricks to key NVQ colleges

around the UK to help train our future bricklayers.

As we look around at the UK vernacular we see many examples of

brick applications, proudly standing after hundreds of years. We

know that our products are natural, thermally efficient, durable

and can be recycled, boasting huge longevity with a minimal

environmental footprint. In this context it is clear that the

overall carbon emissions spread through every year of the brick's

service life is extremely low. With a lifecycle at least two and

half times that of environmental product declarations (60 years),

zero in-use emissions due to no maintenance, brick is by far the

most sustainable, long term choice. As Britain's Brick Specialists,

we will continue to inspire beautiful, comfortable, safe and

sustainable architecture that will enhance our built environment

for generations to come.

Floren

Belgium has suffered the impact of Covid-19 more than most and

their recovery is likely to lag behind the UK. Despite this, Floren

has performed very well with output in the year similar to 2019.

Despite a slight reduction in turnover as markets were affected,

net contribution to the Group improved for the year after only

contributing 10 months post acquisition in 2019. The business has

undergone an extended winter shutdown in which new investment has

been made to improve efficiency and reduce risk of breakdown.

The vendors of Floren remained in place as general managers post

acquisition by Michelmersh in February 2019 and helped deliver two

years of above expected contribution. They have now moved on to new

ventures and we thank them for their contribution and wish them

well. After notifying us that they intended to leave the business,

a new general manager was recruited and has been in place since the

autumn and a new management team has been developed. We look

forward to continued progress from our Belgian business.

Staff development

During the year, the role of the intermediate management board

of Associate Directors was broadened with new members and a wider

remit. As the Group develops, this forum extends responsibilities,

rewards key individuals and strengthens the management structure of

the Group. This board includes expertise from a range of

disciplines that controls and directs day-to-day operations.

2020 was a year that saw companies across the world face

challenges that could never have been imagined or foreseen a year

before. The impact, not just on businesses, but on individuals and

their wellbeing, cannot be underestimated. As a company we felt it

was of paramount importance that our staff continued to feel safe

and supported throughout the pandemic. Following the reopening of

all our sites, and adhering to all government guidelines, we

engaged an external company to provide deep cleaning of all our

offices and public areas every week and have continued this

throughout the lockdown.

We organised a mental health and wellbeing awareness week for

all staff raising the importance of having recognised breaks and

stepping away from our work stations and taking time for ourselves.

During this week, regular emails and bulletins were sent out with

tips and advice on how to help improve our wellbeing and mental

health. All staff also had the option of completing an online

survey enabling them to provide feedback on how they felt the Group

could improve wellbeing within the workplace.

Our commitment to ensure our core values are upheld and adhered

to remains unwavering and we will continue to model this at all

levels to ensure all our staff are treated with integrity and

respect. Despite the unprecedented challenges faced as a Group last

year we believe we have shown that we live out our values and not

only support our staff practically but also recognise and

appreciate them and reward where possible. It was pleasing to note

that eight members of staff celebrated between 25-50 years' service

with the business during 2020.

We would also like to take this opportunity to thank both

Stephen Morgan and Bob Carlton-Porter for their commitment and hard

work over the years. Their input and dedication have been hugely

appreciated. We look forward to welcoming our new CFO Ryan Mahoney

to the Board and, with Stephen's assistance, we will ensure a

smooth transition as we progress with our strategic aims for H2 and

beyond 2021.

Land Assets

During the year, preparations were completed that enabled the

Group to commence construction of the road that bisects the quarry

at Telford. Contractors broke ground late in 2020 and are expected

to complete the project in summer 2021. The existing public road

prevents access to the remaining clay mineral on the site that

supports brick manufacturing for decades to come. A long-term,

detailed extraction and land remediation plan is in place that

delivers mineral to the brick manufacturing business and releases

land for alternative use.

In January 2021, the option agreement for mineral in land

adjacent to the Michelmersh brickworks at Romsey was exercised

securing minerals for at least 15 years brickmaking on the

site.

Plant and machinery

As with other aspects of the business, Covid-19 impacted our

approach in the year. Investment in plant was deferred initially in

order to preserve cash resources, and once operations recommenced

after the shutdown, concentration was directed towards recovery of

output and health and safety measures.

The business will now turn its attention to projects that

address our goals of expansion of capacity, reduction in labour and

energy input costs and de-risking processes. The recent budget

provides an incentive to invest surplus cash if the project returns

are attractive.

Charity

Our commitment to our Corporate and Social Responsibility (CSR)

is never seen as just a 'tick box' exercise. It is an area of our

business that we believe in strongly, as mirrored in our Company

core values. During 2020 we once again contributed to charities

across the country donating funds, food products, children's toys,

resources and a wealth of clay products to various charities and

institutions across the UK.

Due to the huge impact the pandemic has had on so many people

some of the charities we consistently donated money to were MIND's

emergency COVID crisis fund, NHS Sussex to help support the amazing

work of our NHS and The Trussell Trust which runs local foodbanks

across the UK.

At the end of 2020 we introduced a new initiative to be launched

in 2021 where staff can nominate two charities that will be

Michelmersh's key charities for the year and we will not only

donate funds but also look to raise the profile of the chosen

charities through our social media platforms .

Outlook

We remain well placed in a market that is both performing well

and has positive, longer-term fundamentals. Challenges over imports

and reduced UK manufacturing capacity suggest that demand for our

products will remain strong and the first quarter of 2021 has been

encouraging with a strong order intake and KPIs ahead of

expectations despite some poor weather.

A new range of challenges presents itself in 2021 alongside some

traditional ones. The manner in which the staff responded

positively in the face of Covid-19 gives us confidence that all

challenges will be met with the same ingenuity and commitment. We

remain resolute and excited about the prospects for the Group for

the remainder of 2021 and beyond.

Frank Hanna, Peter Sharp

Joint Chief Executives

30 March 2021

Consolidated Income Statement

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Revenue 52,044 53,523

Cost of sales (30,525) (31,618)

Gross profit 21,519 21,905

Administrative expenses (12,840) (11,754)

Amortisation of intangibles (1,170) (1,166)

(14,010) (12,920)

Other income 75 224

Exceptional item - Bargain purchase(1) - 2,422

- acquisition costs(2) - (566)

Operating profit 7,584 11,065

Finance costs (713) (698)

Profit before taxation 6,871 10,367

Taxation (1,938) (1,763)

Profit for the financial year 4,933 8,604

Basic earnings per share 5.27 p 9.41 p

Diluted earnings per share 4.95 p 9.19 p

Exceptional Items

(1) Bargain purchase; represents the excess of the fair value of

assets less liabilities acquired over the consideration payable for

the acquisition of Floren in February 2019.

(2) Costs relating to the acquisition of Floren.

Consolidated Statement of Comprehensive Income

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Profit for the financial year 4,933 8,604

Other comprehensive income/(expense)

Items which may subsequently be classified

to profit and loss

Currency movements 66 67

Items which will not subsequently be

classified to profit and loss

Revaluation surplus of property, plant

and equipment 1,571 801

Revaluation deficit of property, plant

and equipment (3,710) (10)

Deferred tax on movement 280 (134)

(1,793) 724

Total comprehensive income for the year 3,140 9,328

Consolidated Balance Sheet

As at 31 December 2020

2020 2019

GBP'000 GBP'000

Assets

Non-current assets

Intangible assets 21,420 22,590

Property, plant and equipment 60,948 65,348

---------------------------------------- ---------- ----------

82,368 87,938

Current assets

Inventories 10,046 9,761

Trade and other receivables 11,189 8,567

Cash and cash equivalents 12,243 15,140

---------------------------------------- ---------- ----------

Total current assets 33,478 33,468

---------------------------------------- ---------- ----------

Total assets 115,846 121,406

Liabilities

Current liabilities

Trade and other payables 12,049 9,889

Lease liabilities 530 542

Interest bearing borrowings 986 3,414

Corporation tax payable 240 882

Total current liabilities 13,805 14,727

---------------------------------------- ---------- ----------

Non-current liabilities

Interest bearing borrowings 10,487 18,036

Lease liabilities 240 673

Deferred tax liabilities 11,663 11,866

---------------------------------------- ---------- ----------

22,390 30,575

--------------------------------------- ---------- ----------

Total liabilities 36,195 45,303

Net assets 79,651 76,103

---------------------------------------- ---------- ----------

Equity attributable to equity holders

Share capital 18,789 18,498

Share premium account 15,827 15,545

Other reserves 21,581 23,192

Retained earnings 23,454 18,868

---------------------------------------- ---------- ----------

Total equity 79,651 76,103

---------------------------------------- ---------- ----------

Consolidated Statement of changes in equity

For the year ended 31 December 2020

Share Other Share premium Retained Total

Capital reserves earnings

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1 January 2019 17,297 21,788 11,643 13,066 63,794

Profit for the year - - - 8,604 8,604

Revaluation deficit - (10) - - (10)

Revaluation surplus - 801 - - 801

Deferred taxation

on revaluation - (134) - - (134)

Currency difference - - - 67 67

---------------------- --------- ---------- -------------- ---------- --------

Total comprehensive

income - 657 - 8,671 9,328

Share based payment - 765 - - 765

Shares issued during

the year 1,201 - 3,902 - 5,103

Transfer to retained

earnings - (18) - 18 -

Dividend paid - - - (2,887) (2,887)

---------------------- --------- ---------- -------------- ---------- --------

At 31 December 2019 18,498 23,192 15,545 18,868 76,103

Profit for the year - - - 4,933 4,933

Revaluation deficit - (3,710) - - (3,710)

Revaluation surplus - 1,571 - - 1,571

Deferred taxation

on revaluation - 280 - - 280

Currency difference - 66 - - 66

---------------------- --------- ---------- -------------- ---------- --------

Total comprehensive

income - (1,793) - 4,933 3,140

Transfer between

reserves - 67 - (67) -

Share based payment - 1,099 - - 1,099

Shares issued during

the year 44 - 86 - 129

Released on maturity

of options 200 (983) - 783 -

Dividend paid 47 - 196 (1,064) (821)

---------------------- --------- ---------- -------------- ---------- --------

At 31 December 2020 18,789 21,581 15,827 23,454 79,651

---------------------- --------- ---------- -------------- ---------- --------

Consolidated Statement of cash flows

For the year ended 31 December 2020

2020 2019

GBP'000 GBP'000

Cash flows from operating activities

Profit before taxation 6,871 10,368

Loss/ (profit) on disposal of fixed assets 119 247

Finance expense 713 698

Depreciation 3,544 3,313

Amortisation 1,170 1,165

Bargain purchase - (2,422)

Share based payment charge 899 765

--------------------------------------------- --------- --------

Cash flow from operations before changes

in working capital 13,316 14,134

(Increase) / decrease in inventories (234) 822

(Increase) / decrease in receivables (2,422) 37

Increase in payables 2,223 1,629

--------------------------------------------- --------- --------

Net cash generated by operations 12,883 16,622

Taxation paid (2,501) (2,105)

Net cash generated by operating activities 10,382 14,517

--------------------------------------------- --------- --------

Cash flows from investing activities

Purchase of subsidiary undertaking net

of cash acquired - (6,202)

Purchase of property, plant and equipment (1,241) (2,412)

Net cash used in investing activities (1,241) (8,614)

--------------------------------------------- --------- --------

Cash flows from financing activities

Proceeds of loan drawdown 3,000 5,100

Adjustment in respect of IFRS16 (656) (646)

Repayment of interest bearing liabilities (12,977) (1,990)

Interest paid (713) (698)

Proceeds of share issue 129 4,704

Dividend paid (821) (2,488)

--------------------------------------------- --------- --------

Net cash (used in)/generated by financing

activities (12,038) 3,982

--------------------------------------------- --------- --------

Net (decrease)/increase/ in cash and

cash equivalents (2,897) 9,885

Cash and cash equivalents at the beginning

of the year 15,140 5,255

--------------------------------------------- --------- --------

Cash and cash equivalents at the end

of the year 12,243 15,140

--------------------------------------------- --------- --------

Cash and cash equivalents comprise:

Cash at bank and in hand 12,243 15,140

Bank overdraft - -

-------------------------------------------- --------- --------

12,243 15,140

-------------------------------------------- --------- --------

NOTES TO THE FINANCIAL STATEMENTS

1. ACCOUNTING POLICIES

The consolidated financial statements have been prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 . There have been

no changes to the accounting policies adopted since the last

consolidated financial statements were published.

2. FINANCIAL INFORMATION

The financial information set out in this Preliminary

Announcement does not constitute the Group's statutory financial

statements for the years ended 31 December 2020 or 2019. The

financial information has been extracted from the Group's statutory

financial statements for the years ended 31 December 2020 and 2019.

The auditors have reported on those financial statements; their

report was unqualified, did not include references to any matters

to which the auditors drew attention by way of emphasis and did not

contain a statement under Section 498(2) or (3) of the Companies

Act 2006.

The statutory accounts for the year ended 31 December 2020 will

be filed with the Registrar of Companies following the Company's

Annual General Meeting. The report of the auditors on those

statutory accounts was unqualified, did not include references to

any matters on which the auditors drew attention by way of emphasis

and did not contain a statement under section 498(2) or (3) of the

Companies Act 2006. The statutory accounts for the year ended 31

December 2019 have been filed with the Registrar of Companies. The

report of the auditors on those statutory accounts was unqualified,

and did not contain a statement under section 498(2) or (3) of the

Act. The Report did draw attention to the accounting policy in the

financial statements concerning the Group's ability to continue as

a going concern connected with the declaration of Covid-19 as a

pandemic by the World Health Organisation noting this as a material

uncertainty.

The financial information is presented in sterling and all

values are rounded to the nearest thousand pounds (GBP000) except

when otherwise indicated.

3. EARNINGS PER SHARE

Basic

The calculation of earnings per share from continuing operations

based upon the profit for the year of GBP4,933,000 (2019:

GBP8,604,000) and 93,680,537 (2019: 91,463,549) weighted average

number of ordinary shares.

Diluted

The calculation of diluted earnings per share from continuing

operations based upon the profit for the year of GBP4,933,000

(2019: GBP8,604,000) and 99,368,224 (2019: 93,632,839) weighted

average number of ordinary shares.

4. Alternative performance measure reconciliation

Income Statement

Year Year

ended ended

notes 31-Dec-20 31-Dec-19 2020/

2019

------ ---------- ----------- --------

GBP000 GBP000

------ ---------- ----------- --------

Turnover 52,044 53,523 -2.8%

------ ---------- ----------- --------

Reported Gross Profit 21,519 21,905 -1.8%

------ ---------- ----------- --------

Reported Gross Margin 41.3% 40.9%

------ ---------- ----------- --------

Cost of sales adjustment re Floren

brick stocks 1 - 52

------ ---------- ----------- --------

Underlying Gross Profit 21,519 21,957 -2.0%

------ ---------- ----------- --------

41.3% 41.0% 0.3%

------ ---------- ----------- --------

Reported Operating profit 7,584 11,065 -31.5%

------ ---------- ----------- --------

Exclude exceptional treatment of Floren

acquisition 2 - (1,856)

------ ---------- ----------- --------

Treat Planbaten as Exceptional 3 - (103)

------ ---------- ----------- --------

Cost of sales adjustment re Floren

brick stocks 1 - 52

------ ---------- ----------- --------

Amortisation of intangibles 4 1,170 1,166

------ ---------- ----------- --------

'Underlying' operating profit 2 8,755 10,324 -15.2%

------ ---------- ----------- --------

Finance costs - reported (713) (698)

------ ---------- ----------- --------

'Underlying' profit before taxation 2 8,041 9,626 -16.5%

------ ---------- ----------- --------

'Underlying' operating profit (as above) 8,755 10,324 -15.2%

------ ---------- ----------- --------

Depreciation 3,544 3,313

------ ---------- ----------- --------

'Underlying' EBITDA 12,298 13,637 -9.8%

------ ---------- ----------- --------

Reported underlying Basic EPS 5.27p 9.41

p

------ ---------- ----------- --------

8.41

'Underlying' Basic EPS 6.28p p -25.3%

------ ---------- ----------- --------

Net cash generated by operations 12,885 16,622 -22.5%

------ ---------- ----------- --------

Notes:

1 Cost of sales adjustment re Floren brick stocks were made

under acquisition treatment and to reflect Group accounting policy

adjustments in the year of acquisition.

2 The bargain purchase and costs of acquisition relating to

Floren are excluded from this analysis as they are

non-recurring.

3 Floren received an exceptional credit as a result in change of

regulatory treatment of land taxes which is non-recurring.

4 Amortisation of intangible assets is commonly excluded to

display Operating Profit as a financial metric .

5. DIVIDEND

The Board has recommended a final dividend for the year of 2.5

pence per share, to be paid on 9 July 2021 to shareholders whose

names appear of the register of members at the close of business on

4 June 2021.

6. REPORT & ACCOUNTS

Copies of this announcement are available and the Annual Report

will be available in due course on the Group's website

www.mbhplc.co.uk and from the Company's registered office at

Freshfield Lane, Danehill, Haywards Heath, West Sussex RH17

7HH.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR JLMPTMTJTBBB

(END) Dow Jones Newswires

March 30, 2021 02:00 ET (06:00 GMT)

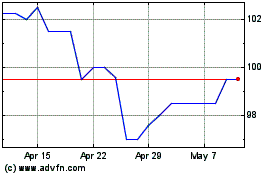

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Michelmersh Brick (LSE:MBH)

Historical Stock Chart

From Apr 2023 to Apr 2024