TIDMMDZ

28 June 2021

MediaZest Plc

("MediaZest", the "Company" or "Group"; AIM: MDZ)

Unaudited Interim Results for the six months ended 31 March 2021

MediaZest, the creative audio-visual company, announces its unaudited interim

results for the six months ended 31 March 2021 (the "Period").

MediaZest's interim results are set out below, with comparisons to the same

period in the previous year as well as to MediaZest's audited results for the

18 month period ended 30 September 2020.

CHAIRMAN'S STATEMENT

Introduction

The Board presents the consolidated unaudited results for the six months ended

31 March 2021 for MediaZest plc and its wholly owned subsidiary company

MediaZest International Ltd (together the "Group").

Financial Review

* Revenue for the Period was £846,000, down 42% (2020: £1,454,000) due to the

impact of Covid-19.

* Gross profit was down 38% accordingly to £410,000 (2020: £656,000).

* Gross margin rose to 48% (2020: 45%).

* Administrative expenses were £459,000, a reduction of 31% (2020: £667,000).

* EBITDA was a loss of £49,000 (2020: £11,000).

* Net loss for the period after taxation was £160,000 (2020: £43,000).

* The basic and fully diluted loss per share was 0.0115 pence (2020: loss per

share 0.0031 pence).

* Cash in hand at 31 March 2021 was £16,000 (2020: £16,000).

Operational Review

As highlighted in the Financial Review above, the unaudited financial results

for the six months to 31 March 2021 were adversely affected by nationwide UK

"lockdowns" in response to the ongoing Covid-19 pandemic (the "Pandemic"), by

way of comparison with the prior period.

However, since the end of the Period, business has improved significantly and

the Group is extremely busy pitching and delivering projects for a wide range

of both existing and new clients.

During December 2020 and January 2021 many clients ceased on-site installation

work, with projects only beginning to recommence from early February 2021

onwards. This had a negative impact on financial results, particularly in

January and February of 2021, the latter also impacted by the timing of revenue

recognition under IFRS 15.

As noted in recent announcements, since the beginning of the calendar year the

Group has seen a significant increase in new opportunities and in committed

projects. The timing of these projects themselves and recognition of the

resultant revenue to the Group (in accordance with accounting standards), has

resulted in the benefit of these new business wins being recognised in the

second half of the financial year rather than during the Period.

In light of the Pandemic, the Group continued to work hard to keep costs low

during the 6 months and utilised the Government Job Retention Scheme

appropriately during the Period.

Additional financing was not required and in the post balance sheet period the

Group has been able to repay some shareholder debt using free cashflow from

trading.

Client Work in the Period

The Group continued to work with long term clients such as Lululemon Athletica,

Pets at Home, Ted Baker, and Hyundai during the Period, with new project

installations as well as ongoing service and maintenance contractual work.

New store installations for Dermologica, Samsung and a number of digital kiosk

projects did also go ahead at the beginning of these 6 months, and again

towards the end of the Period as lockdown measures eased once more.

A number of new clients were added during the Period with smaller initial

projects but the potential to grow into more significant engagements in the

future.

Significant wins being delivered Post Period included the Vashi Covent Garden

project, announced recently on 18 June and forthcoming new projects with

Hyundai and Samsung.

Gross margins continued to hold up well reflecting the strong balance towards

the Group's high-quality managed service offering.

Outlook

It remains difficult to assess the extent to which the Pandemic will affect the

Group's forthcoming trading and financial performance as the situation

continues to evolve rapidly with the final stage of 'unlocking', which was

scheduled for 21 June, being deferred to 19 July in the light of recent data.

However, the number of new projects currently underway or already completed in

the second half of the year has been encouraging and the Board is looking for

the Group to deliver a much improved second half of Financial Year 21.

Recurring revenue streams have been robust throughout the last 18 months and

contracts continue to extend and grow in many cases. Developing these contracts

and growing opportunities that focus on this type of business has been a

priority in recent years and continues to show success and generate long term

value in the Group.

Performance of the Group over the second six months and into the next financial

year looks encouraging, subject to the uncertainty within which many businesses

are currently operating.

The Board continues to work on the assumption that the disruption caused by the

Pandemic will have an impact throughout 2021 and continues to plan accordingly,

searching for new revenue streams whilst managing costs tightly.

Lance O'Neill

Chairman

28 June 2021

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE SIX MONTHSED 31 MARCH 2021

Unaudited Unaudited Audited

6 months 6 months 18 months

Notes 31-Mar-21 31-Mar-20 30-Sep-20

£'000 £'000 £'000

Continuing Operations

Revenue 846 1,454 3,068

(436) (798) (1,544)

Cost of sales

------------ ------------ ------------

Gross profit 410 656 1,524

Other operating income - - 25

Administrative expenses before depreciation and (459) (667) (1,735)

amortisation

------------ ------------ ------------

EBITDA (49) (11) (186)

Administrative expenses - depreciation & amortisation (38) (41) (124)

------------ ------------ ------------

Operating (Loss)/Profit (87) (52) (310)

Finance Costs (73) (31) (168)

------------ ------------ ------------

(Loss)/Profit before taxation (160) (83) (478)

Taxation - 40 30

======== ======== ========

(Loss)/Profit for the period and total comprehensive (160) (43) (448)

loss/income for the period attributable to the owners of

the parent ======== ======== ========

Earnings/(Loss) per ordinary 0.01p (2020: 0.01p) share

Basic 2 (0.0115)p (0.0031)p (0.0324)p

Diluted 2 (0.0115)p (0.0031)p (0.0324)p

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 31 MARCH 2021

Unaudited Unaudited Audited

As at As at As at

31-Mar-21 31-Mar-20 30-Sep-20

£'000 £'000 £'000

ASSETS

Non-current assets

Goodwill 2,772 2,772 2,772

Owned 25 54 39

Property, plant and equipment

Right-of-use 149 157 171

Property, plant and equipment

------------ ------------ ------------

2,946 2,983 2,982

Current assets

Inventories 238 116 93

Trade and other receivables 408 548 493

Cash and cash equivalents 16 16 91

------------ ------------ ------------

662 680 677

TOTAL ASSETS 3,608 3,663 3,659

======== ======== ========

EQUITY

Shareholders' Equity

Called up share capital 3,656 3,656 3,656

Share premium 5,244 5,244 5,244

Share option reserve 146 146 146

Retained earnings (7,837) (7,500) (7,677)

------------ ------------ ------------

TOTAL EQUITY 1,209 1,546 1,369

======== ======== ========

LIABILITIES

Non-current liabilities

Financial liabilities - borrowings:

Interest bearing lease liabilities 136 118 157

Other interest bearing loans and 182 - 176

borrowings

------------ ------------ ------------

318 118 333

Current liabilities

Trade and other payables 1,175 1,252 968

Financial liabilities - borrowings:

Invoice discounting facility 131 183 245

Interest bearing lease liabilities 55 54 59

Other interest bearing loans and 720 510 685

borrowings

------------ ------------ ------------

2,081 1,999 1,957

TOTAL LIABILITIES 2,399 2,117 2,290

======== ======== ========

TOTAL EQUITY AND LIABILITIES 3,608 3,663 3,659

======== ======== ========

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE SIX MONTHSED 31 MARCH 2021

Share Share Share Options Retained Total

Capital Premium Reserves Earnings Equity

£'000 £'000 £'000 £'000 £'000

3,656 5,244 146 (7,227) 1,819

Balance at 31 March 2019

Impact of IFRS 16 implementation - - - (2) (2)

======= ======== ========= ======= =======

Balance at 1 April 2019 restated 3,656 5,244 146 (7,229) 1,817

======= ======== ========= ======= =======

Loss for the year - - - (271) (271)

----------- ----------- ----------- ----------- -----------

Total comprehensive loss for the - - - (271) (271)

year

======= ======== ========= ======= =======

Balance at 31 March 2020 3,656 5,244 146 (7,500) 1,546

======= ======== ========= ======= ======

Loss for the period - - - (177) (177)

----------- ----------- ----------- ----------- -----------

Total comprehensive loss for the - - - (177) (177)

period

======= ======== ========= ======= =======

Balance at 30 September 2020 3,656 5,244 146 (7,677) 1,369

======= ======== ========= ======= =======

Loss for the period - - - (160) (160)

----------- ----------- ----------- ----------- -----------

Total comprehensive loss for the - - - (160) (160)

period

======= ======== ========= ======= =======

Balance at 31 March 2021 3,656 5,244 146 (7,837) 1,209

======= ======== ========= ======= =======

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE SIX MONTHSED 31 MARCH 2021

Unaudited Unaudited Audited

6 months 6 months 18 months

Note 31-Mar-21 31-Mar-20 30-Sep-20

£'000 £'000

Net cash generated from operating activities 3 94 (14) (73)

Taxation - 40 30

---------- ---------- ----------

Net cash generated from operating activities 94 26 (43)

Cash flows used in investing activities

Purchase of plant and machinery (2) 8 (29)

---------- ---------- ----------

Net cash used in investing activities (2) 8 (29)

Cash flow from financing activities

Other loans (5) 19 (16)

Bounce back loan - - 50

Lease liability payments (20) (46) (47)

Shareholder loan receipts - 218 718

Shareholder loan repayments - (219) (515)

Interest paid (28) (28) (93)

---------- ---------- ----------

Net cash (used in)/ generated from financing (53) (56) 97

activities

---------- ---------- ----------

Net increase in cash and cash equivalents 39 (22) 25

---------- ---------- ----------

Cash and cash equivalents at beginning of year (154) (145) (179)

======= ======= =======

Cash and cash equivalents at end of year 4 (115) (167) (154)

======= ======= =======

NOTES TO THE FINANCIAL INFORMATION

1. Basis of Preparation

The Group's annual financial statements are prepared in accordance with

international accounting standards in conformity with the requirements of the

Companies Act 2006.

Accordingly, the consolidated six-month financial information in this report

has been prepared using accounting policies consistent with international

accounting standards. The international accounting standards are subject to

amendment and interpretation by the International Accounting Standards Board

(IASB). The financial information has been prepared on the basis of

international accounting standards expected to be applicable as at 30 September

2021.

This interim report does not comply with IAS 34 "Interim Financial Reporting"

as permissible under the AIM Rules for Companies.

Going Concern

The Directors have considered financial projections based upon known future

invoicing, existing contracts, pipeline of new business and the number of

opportunities it is currently working on. In addition, these forecasts have

been considered in the light of the ongoing challenges in the global economy,

previous experience of the markets in which the Group operates and the seasonal

nature of those markets, as well as the likely ongoing impact of the Covid-19

pandemic. These forecasts indicate that the Group will generate sufficient cash

resources to meet its liabilities as they fall due over the next 12-month

period from the date of this interim announcement.

As a result, the Directors consider that it is appropriate to draw up the

financial information on a going concern basis. Accordingly, no adjustments

have been made to reflect any write downs or provisions that would be necessary

should the Group prove not to be a going concern, including further provisions

for impairment to goodwill and investments in Group companies.

Non-statutory accounts

The financial information contained in this document does not constitute

statutory accounts within the meaning of Section 434 of the Companies Act 2006

("the Act").

The statutory accounts for the 18 months ended 30 September 2020 have been

filed with the Registrar of Companies. The report of the auditors on those

statutory accounts was unqualified, did include a reference to which the

auditor drew attention by way of emphasis without qualifying their report in

respect of going concern and did not contain a statement under section 498(2)

or 498(3) of the Companies Act 2006.

The financial information for the six months to 31 March 2021 has not been

audited.

2. Earnings per share

Basic earnings per share is calculated by dividing the loss attributed to

ordinary shareholders of £160,000 (2020: £43,000) by the weighted average

number of shares during the period of 1,396,425,774 (2020: 1,396,425,774). The

diluted earnings per share is identical to that used for basic earnings per

share as the warrants or share options are anti-dilutive.

3. Cash generated from operations

Unaudited Unaudited Audited

6 months 6 months 18 months

31-Mar-21 31-Mar-20 30-Sep-20

£'000 £'000

Loss after tax (160) (50) (478)

Taxation - - 30

Depreciation/amortisation charge 38 41 125

Finance Costs 26 38 73

Increase in inventories (145) (18) (24)

Increase in payables 252 169 242

Decrease/(increase) in receivables 83 (194) (41)

======== ======== ========

Net cash generated from/(absorbed by) operating activities 94 (14) (73)

======== ======== ========

4. Cash and cash equivalents

Unaudited Unaudited Audited

6 months 6 months 18 months

31-Mar-21 31-Mar-20 30-Sep-20

£'000 £'000 £'000

Cash held at bank 16 16 91

Invoice discounting facility (131) (183) (245)

======== ======== ========

(115) (167) (154)

======== ======== ========

5. Subsequent events

Subsequent to 31 March 2021, the Government's "roadmap" out of "lockdown" has

seen the re-opening of many of the Group's clients' stores, especially in the

retail sector, and an upswing in new projects coming through the pipeline, with

the expectation that the second half of the financial year ending 30 September

2021 will show significant improvement.

The repayment of the Group's Bounce Back Loan of £50,000 under the Government's

scheme, is due to commence from June 2021 at £887 per month. Interest on the £

150,000 Convertible Loan Note instrument, secured in August 2020 to provide

additional working capital for the Group, is being paid quarterly at an annual

rate of 7%.

In the post balance sheet period the Group has been able to repay some

shareholder debt using free cashflow from trading.

6. Distribution of the Interim Report

Copies of the Interim Report will be available to the public from the Company's

website, www.mediazest.com, and from the Company Secretary at the Company's

registered address at Unit 9, Woking Business Park, Albert Drive, Woking,

Surrey, GU21 5JY.

This announcement contains inside information for the purposes of Article 7 of

the Market Abuse Regulation (EU) 596/2014 as it forms part of UK domestic law

by virtue of the European Union (Withdrawal) Act 2018 ("MAR"), and is disclosed

in accordance with the Company's obligations under Article 17 of MAR.

Enquiries:

Geoff Robertson 0845 207 9378

Chief Executive Officer

MediaZest Plc

David Hignell/Adam Cowl 020 3470 0470

Nominated Adviser

SP Angel Corporate Finance LLP

Claire Noyce 020 3764 2341

Broker

Hybridan LLP

Notes to Editors:

About MediaZest

MediaZest is a creative audio-visual systems integrator that specialises in

providing innovative marketing solutions to leading retailers, brand owners and

corporations, but also works in the public sector in both the NHS and Education

markets. The Group supplies an integrated service from content creation and

system design to installation, technical support, and maintenance. MediaZest

was admitted to the London Stock Exchange's AIM market in February 2005. For

more information, please visit www.mediazest.com

END

(END) Dow Jones Newswires

June 28, 2021 02:00 ET (06:00 GMT)

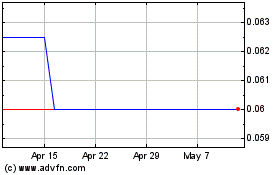

Mediazest (LSE:MDZ)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mediazest (LSE:MDZ)

Historical Stock Chart

From Apr 2023 to Apr 2024