Mears Group PLC Pre-close trading update (4101T)

March 25 2021 - 2:00AM

UK Regulatory

TIDMMER

RNS Number : 4101T

Mears Group PLC

25 March 2021

25 March 2021

Mears Group PLC

("Mears", the "Group", or "the Company")

Pre-close trading update

Mears (LSE: MER), the UK Housing solutions provider, today

announces its pre-close trading update for the financial year

ending 31 December 2020 ("FY2020") and the year to date.

Financial results for the period ended 31 December 2020

The Group is expecting to announce results consistent with the

trading update released on 8 December 2020(1) . On a Continuing

basis, excluding revenues and profits from the Domiciliary Care and

Terraquest businesses disposed of in the period, the Group should

deliver second half revenues of c. GBP413m (H1: GBP398m) and a

second half profit before tax of c. GBP4.7m (H1 loss: GBP8.2m).

Accordingly, the Group expects to report full year FY2020

Continuing revenues of c. GBP811m (2019: GBP884m) and a full year

Continuing normalised loss before tax of c. GBP3.5m (2019: GBP31.8m

profit)(2) .

Cash performance has also been strong, delivering quarter on

quarter improvement across 2020. The Group expects to report an

adjusted(3) net cash position as at 31 December 2020 of GBP56.9m

(2019 net debt: GBP51.0m). This reflects net cash proceeds (after

transaction costs) of c. GBP52.5m from the disposal of Terraquest

in December 2020, and a number of Covid-19 related deferrals and

payments received on account which will unwind in the first half of

FY2021(3) . Average adjusted daily net debt for the year to 31

December 2020 was GBP97.3m (2019: GBP114.4m). The Group estimates

that its underlying average daily net debt at the year-end to be in

the region of GBP65m.(3)

Current trading

The Board is pleased with the resilient trading and liquidity

performance of the Group during the first quarter of FY2021 and is

confident of a full recovery as lockdown restrictions are lifted.

During the first national lockdown, the Group adapted quickly to

new ways of working safely and effectively. The Group has seen a

continuation of these working practices and methods through the

first quarter of 2021. Our clients and service users have also

adapted to the changing environment and as such, the Group has seen

a lesser impact on work volumes during the third lockdown compared

to the first, whilst focus has once again been towards the delivery

of essential and priority services to our vulnerable service

users.

David Miles, Chief Executive Officer of the Group,

commented:

" I am extremely proud of the resilience shown by the Group

during a year which has seen unprecedented challenges.

Notwithstanding the fact that much of the energy and focus in 2020

was expended in reacting to the operational challenges brought by

Covid-19, it is pleasing that the Group made strong progress

against all its key strategic objectives. These were to refocus on

housing activities, significantly to reduce indebtedness and to

improve the returns which we obtain on our invested capital.

Notwithstanding the headwind of a third national lockdown, I am

delighted at how well the Group has started the new year."

Notes :

1.Trading update released on 8 December 2020 referred to

expected FY2020 trading numbers inclusive of the activities of

Terraquest, comprising revenues of circa GBP20m and an operating

profit of circa GBP5m. The disposal of Terraquest has subsequently

completed and its financials will be included in discontinued in

FY2020 results.

2. 'Normalised' profit/loss before tax is before exceptional

items and amortisation of acquired intangibles

3. Adjusted net cash / (debt) excludes lease obligations.

One-off cash items includes VAT deferral, client payments received

on account and cost accruals relating to lump sum contracts,

aggregating to a circa GBP40m benefit to the reported spot 31

December 2020 net cash position.

For further information, contact:

David Miles, Chief Executive Officer Tel: +44(0)7778 220 185

Andrew Smith, Finance Director Tel: +44(0)7712 866 461

Alan Long, Executive Director Tel: +44(0)7979 966 453

Joe Thompson, Investor Relations Tel: +44(0)7980 844 580

The person responsible for arranging the release of this

announcement on behalf of Mears Group PLC is Ben Westran, Company

Secretary.

About Mears

Mears currently employs around 6,000 people and provides

services in every region of the UK. In partnership with our Housing

clients, we maintain, repair and upgrade the homes of hundreds of

thousands of people in communities from remote rural villages to

large inner-city estates. Mears has extended its activities to

provide broader housing solutions to solve the challenge posed by

the lack of affordable housing and to provide accommodation and

support for the most vulnerable.

We focus on long-term outcomes for people rather than short-term

solutions and invest in innovations that have a positive impact on

people's quality of life and on their communities' social, economic

and environmental wellbeing. Our innovative approaches and market

leading positions are intended to create value for our customers

and the people they serve while also driving sustainable financial

returns for our providers of capital, especially our

shareholders.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTMZGZFLDGGMZM

(END) Dow Jones Newswires

March 25, 2021 03:00 ET (07:00 GMT)

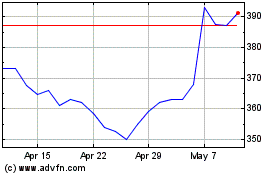

Mears (LSE:MER)

Historical Stock Chart

From Mar 2024 to Apr 2024

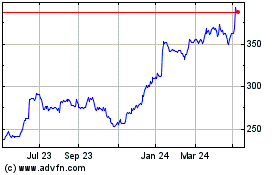

Mears (LSE:MER)

Historical Stock Chart

From Apr 2023 to Apr 2024