TIDMMKS

RNS Number : 8964N

Marks and Spencer Group PLC

07 June 2022

Marks and Spencer Group plc (the "Company")

Annual Report and Financial Statements 2022

In compliance with Listing Rule 9.6.1, the Company announces

that the following documents have today been submitted to the UK

Listing Authority, and will shortly be available for inspection via

the National Storage Mechanism at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism:

-- Annual Report and Financial Statements 2022;

-- Notice of Annual General Meeting of the Company, which will

be held at and broadcast from Waterside House, 35 North Wharf Road,

London W2 1NW at 11am on Tuesday 5 July 2022;

-- Proxy form for the 2022 Annual General Meeting; and

-- Amended Rules of the Marks and Spencer Group plc Share

Incentive Plan, proposed for approval.

In accordance with DTR 6.3.5(3) the Annual Report and Financial

Statements 2022 and the Notice of Annual General Meeting are

accessible on corporate.marksandspencer.com/investors . The Annual

Report and Financial Statements 2022 have been prepared using the

single electronic reporting format specified in the TD ESEF

Regulation.

A condensed set of Marks and Spencer Group plc financial

statements and information on important events that have occurred

during the year and their impact on the financial statements were

included in the Company's preliminary results announcement on 25

May 2022. That information together with the information set out

below which is extracted from the Annual Report and Financial

Statements constitute the requirements of DTR 6.3.5 which is to be

communicated via an RIS in unedited full text. This announcement is

not a substitute for reading the full Annual Report and Financial

Statements. Page and note references in the text below refer to

page numbers in the Annual Report and Financial Statements 2022. To

view the preliminary results announcement, visit the Company

website: corporate.marksandspencer.com/investors .

For further information, please contact:

Group Secretariat: +44 (0)20 3934 3043

Additional Information

Principal risks and uncertainties

Below are details of our principal risks and uncertainties and

the mitigating activities in place to address them. It is

recognised that the Group is exposed to risks wider than those

listed. However, we have disclosed those we believe are likely to

have the greatest impact on our business at this moment in time and

those that have been the subject of debate at recent Board or Audit

Committee meetings.

DESCRIPTION & CONTEXT MITIGATING ACTIVITIES

AN UNCERTAIN TRADING ENVIRONMENT

Our ability to deliver continued * Strong, varied and complementary senior leadership

improvements in trading performance team capabilities.

could be significantly affected

by the individual or aggregate

impact of an increasingly complex * Planned senior leadership continuity.

set of external factors. The

ongoing consequences of the pandemic,

geo-political and economic uncertainties * An established operating model consisting of a family

(both national and international) of accountable businesses who share M&S brand values,

and the resultant cost of living support functions, technology and customer data.

crisis, are combining to generate

difficult and unpredictable headwinds.

* M&S operates in an increasingly competitive sector * A clear three-year plan constructed to remain

against a backdrop of continued cost and pricing relevant to the current challenges.

pressures, changing consumer behaviours and a broad

range of macroeconomic uncertainties.

* Improved budgeting processes, including detailed

sensitivity analysis to anticipate the potential

* Over recent months the consequences of Covid-19 have impact of external uncertainty.

continued to evolve and combine with other external

macro factors to contribute to widespread, ongoing

uncertainty across the communities in which we * Formal operating reviews for all business and

operate. Continued lockdown measures; labour functional teams to enable effective executive

shortages across transport, distribution, oversight and governance of each business.

manufacturing and service industries; threats to

supplier resilience and viability; ongoing changes to

customer behaviours; price inflation, including * Effective business continuity and crisis management

energy; the potential for further interest rate processes to support business-wide response to issues

rises; increases in taxation; socio-political as they arise.

tensions; and disruption to the supply of natural,

refined and manufactured resources, have combined to

create a challenging environment for our, and all * Prioritised focus and discipline across the business

businesses, to operate within. on cost, range, trusted value and availability.

* The cost of living crisis will further influence * Effective and proactive working with critical third

customer behaviour and buying choices which could parties - for example, a structured supplier

impact our performance and strategic decisions as we engagement programme to both anticipate and support

respond to these changes. management of escalating issues such as cost

inflation.

* The potential consequences of the Russian invasion of

Ukraine further highlight the fragility linked to * Continued commitment to initiatives that maintain and

high-impact "shock" events. These include the support improved and sustained customer engagement

long-term impact on our franchise operations in the including the Sparks loyalty programme, broader

region, and on key materials and products including digital engagement, personalisation of offers and

sunflower oil, grains, natural gas, fuel, fertiliser, shop your way.

nickel and microchips that could impact manufacture,

cost and availability of products.

* While the business has demonstrated continued

resilience in the face of this range of pressures,

and remained relevant to customers throughout the

period, continued turbulence in the external

environment could negatively impact the business's

ability to continue delivering an improved trading

performance.

* In addition, the possibility of future new variants

of Covid-19 combined with restrictive government

interventions, either in the UK or other countries,

could negatively impact future performance.

Operational oversight by Executive

Committee

------------------------------------------------------------

BUSINESS TRANSFORMATION

A failure to successfully implement * Clear prioritisation of the required transformation

the suite of critical transformation activities as part of our three-year planning

projects could impact medium- process.

and longer-term growth ambitions.

While each initiative is individually

significant and has its own inherent * Initiatives underpinned by function-specific

risks, the aggregate impact of strategic plans and leadership governance structures.

simultaneously delivering these

challenging projects could also

create further risks to successful * Dedicated strategy and transformation roles to

implementation. support focus, consistency and challenge across our

While significant change is ongoing family of businesses.

across the business, the three

critical projects underpinning

our transformation agenda comprise: * Application of programme governance principles for

* modernising of our supply chain and logistics all core projects, with clear accountabilities and

activities to improve speed, operational milestones in place.

effectiveness and availability and reduce costs;

* Ongoing benefits tracking of initiatives in line with

* improving our IT infrastructure and underlying spend targets and value outcomes.

systems

* Periodic reporting on key business activities to the

* while also adopting new technologies and digital Audit Committee.

products to support operational efficiency, improved

data-driven decision-making, creation of a

customer-centric "ecosystem", increased

personalisation and the shift to omni-channel; and

* reshaping and modernising our UK store estate to be

fit for the future, with the right-sized stores in

the right spaces, supporting omni-channel growth and

meeting the expectations of our customers.

The ability to balance cost-effective

programme execution at pace and

to deliver on time, while also

managing the consequences of

the external pressures discussed

above, is key to improving operational

efficiency, competitiveness and

growth. Any significant delays,

failure to achieve the anticipated

outcomes, or excess implementation

costs could also impact delivery

of the planned business benefits.

Operational oversight by Executive

Committee, Property Committee

------------------------------------------------------------

OCADO RETAIL

A failure to effectively manage * M&S nominated directors are part of the Ocado Retail

the strategic and operational Board, with collective sign-off of business plans

relationship with Ocado Retail directing the growth of the business.

could significantly impact the

value of our investment, the

achievement of our multi-channel * Jointly agreed investment plans to support the

food strategy, our Brand and continued investment in the Customer Fulfilment

our ability to deliver shareholder Centre network, to expand presence in the ultra-fast

value. grocery delivery market and the planned migration to

The investment in Ocado Retail the new Ocado service platform.

is part of our strategy for improving

our online reach and capability.

There are three core aspects * Established data and technology interfaces with Ocado

of our relationship with Ocado Retail.

Retail that the business is actively

focusing on:

* developing our relationship with Ocado Retail and * A dedicated M&S Ocado delivery team, supported by

evolving our ways of working to ensure alignment of senior leadership, to coordinate sourcing, product

strategies in a way that supports innovation and development, ranging, customer data and marketing.

growth and prioritising areas for future investment;

* planning for our long-term strategic relationship

with the partner, including its role in the M&S

ecosystem; and

* maintaining a seamless supply process to support

customer fulfilment - existing and in line with

future growth - and seeking opportunities to expand

and refine product ranges.

Operational oversight by Executive

Committee, representation on

the Ocado Retail Board

------------------------------------------------------------

TALENT AND CAPABILITY

An inability to attract, retain * Direct Executive Committee ownership of the people

and develop the right talent, plan.

skills and capabilities or to

successfully adapt to the expectations

of a post-pandemic labour market * Continued investment in internal and external talent

could impact the delivery of to strengthen capability at all levels, develop our

core operational activities and future leaders and drive internal career progression.

longer-term strategic objectives,

including aspects of our transformation

programme. * Ongoing delivery of improvements in core people

The business employs more than management systems and processes, including a

65,000 talented and passionate refreshed performance and talent management process

colleagues and remains an attractive to drive consistency and improved decision-making.

brand to future colleagues. However,

the current labour market conditions

create a heightened risk around * An established colleague skills framework to support

recruitment. role-based performance, development and progression.

* The consequences of the pandemic, including skills

shortages and wage inflation, have contributed to a

tight labour market in some key specialist areas * Ongoing review and maintenance of succession plans

(including digital, technology and data science) and for key roles.

other critical operational roles (such as in supply

chain and logistics).

* Continued investment in skills and capabilities with

a particular focus on driving digital literacy and

* In addition, colleagues and potential candidates are capability building.

demonstrating a preference for roles and employers

that offer increasing flexibility to support life

choices, work-life balance and career development in * Investment in pay and wellbeing benefits following

addition to attractive pay and benefits. Linked to completion of a business-wide reward review.

these influences, the need for employers to

demonstrate a cultural alignment in other areas such

as sustainability, diversity and ethical values are * A focus on externally benchmarked, market-relevant

becoming increasingly important. pay including full consideration of gender, ethnicity

,

disability and age.

* The broader implications on the availability of

labour and key skills post-Brexit also continue to be

monitored. * A well-established Business Involvement Group which

is actively involved in business-wide colleague

engagement and representation, including at Board

To support the continued delivery meetings.

of improved trading performance

and our transformation ambitions,

it is essential that we have * Improved usage of our M&S Alumni community to engage,

the right processes in place, energise and re-attract great talent.

underpinned by effective technology,

to identify, develop and retain

talented colleagues.

Operational oversight by Executive

Committee

------------------------------------------------------------

EU BORDER CHALLENGES

A failure to manage the cost * Regular engagement with the Board to discuss the

consequences and operational actions being taken to manage evolving border

friction arising from the complexity challenges by our accountable businesses.

of border arrangements following

the UK's exit from the European

Union (EU) or further developments * Strengthening the management and accountabilities of

in the Trade and Cooperation Irish operations to support targeted mitigation of

Agreement ("TCA"), including costs, including opportunities for local sourcing.

the Northern Ireland Protocol,

could have a significant and

long-term impact on our Irish * Operation of a virtual customs warehouse environment

business and overall trading and implementation of an EU hub to mitigate tariff

performance. costs.

The business continues to manage

a range of complexities that

have arisen following the UK's * Continued engagement with key government departments

exit from the EU. Key challenges and other external experts to represent M&S views and

include: review our mitigation strategies. These include

* continued uncertainty as the requirements of the ministers, industry bodies, the Border and Protocol

Northern Ireland Protocol evolve and our ability to Delivery Group, the Department for Environment, Food

implement sustainable solutions to manage the impact & Rural Affairs (Defra), HM Revenue & Customs, the

on our Irish business, including the movement of Foreign Office, and the Northern Ireland Executive.

goods across to the Republic of Ireland, our largest

EU export business;

* Ongoing work with Defra and our supply base in

readiness for the rules for moving goods from the EU

* further increases in the cost base following the to Great Britain.

introduction of checks to inbound goods from the EU

to the UK (expected in 2022) and the consequent

pressure on the supply base including viability of * Proactively managing our franchise arrangements with

suppliers and the impact on product availability; partners.

* managing the consequences of introducing more locally

sourced products; and

* monitoring and implementing solutions for any

longer-term divergence of UK and EU rules that may

add additional cost and complexity to the business,

particularly in Ireland.

Operational oversight by Executive

Committee

------------------------------------------------------------

BUSINESS CONTINUITY AND RESILIENCE

Significant operational failures * A dedicated and experienced Business Continuity (BC)

or resilience issues at key business team with established Group Crisis and Incident

locations, such as Castle Donington, Management processes.

our primary online Clothing &

Home distribution centre, or

any of our key international * Risk-based BC assessments for stores, sourcing

sourcing locations, could result offices and warehouses and validation of key supplier

in significant business interruption. arrangements.

More broadly, an inability to

effectively respond to global

events, such as the pandemic * Up-to-date BC plans for key activities across our

or Russia's invasion of Ukraine, operations, including offices, warehouses and IT

a shortage of raw materials or sites, that continue to evolve in response to new

other products used in our business, threats including, where needed, work with critical

or significant supply chain disruption, third parties.

could also impact business performance.

The business has continued to

demonstrate resilience through * Enhanced capabilities at Castle Donington to manage

the pandemic and in responding technology failure and fulfilment capabilities

to other significant changes, through in-store fulfilment and the use of other

such as the Russian invasion warehouses in our network.

of Ukraine however, threats to

business continuity remain:

* As our online business grows, the potential risk * Proactive testing of plans for key business

linked to our sales and growth ambitions from a continuity risk scenarios.

sustained period offline or an inability to fulfil

online orders due to a major incident at our Castle

Donington fulfilment centre increases. * Live digital platform to support the business

continuity governance programme.

* The loss of, or major disruption at other locations,

such as primary supply countries like Bangladesh, * Active engagement with external organisations

China or Sri Lanka; the dedicated warehouses that including the Retail BC Association, government-led

store specific food products in the UK; or support forums and membership of the National Counter

facilities (such as IT), could also impact us Terrorism Information Exchange.

significantly.

* Enhanced incident reporting with live data-driven

* A specific, unexpected or unplanned shortage of dashboard.

product or materials such as those being created by

Russia's invasion of Ukraine (including sunflower oil

or fertiliser), or the global shortage of microchips,

could also impact core trading or transformation

activities.

* The potential widespread consequences from currently

unknown/new Covid variants on both our business and

third parties could also have severe operational

consequences.

* In addition, our dependency on major third parties

means that significant incidents, long-term

resilience issues and recoverability in these

businesses would also impact our own.

Operational oversight by Executive

Committee, Crisis Management

Team

------------------------------------------------------------

PRODUCT SAFETY AND INTEGRITY

Failure to prevent and/or effectively * Group-wide assessment of all safety risks with

respond to a food or product specific Executive Committee and business unit

safety incident, or to maintain ownership.

their integrity, could impact

customer confidence in our brand

and business performance. * Relevant Safety Policy and Standards, Terms of Trade,

* The safety of our products - food and all other product safety and "from farm to fork" specifications

product categories - is vital for our business and we with clear accountability set at all levels,

need to effectively manage the potential risks to including processes to comply with overseas

customer health and safety and consumer confidence requirements.

that face all retailers.

* Compliance standards included in contracts with

* This includes considering how external pressures, third-party brands.

including economic and environmental changes, could

impact the integrity of our products and the ability

to effectively operate and maintain all key controls * Risk-based store, supplier and warehouse audit

throughout the supply chain. programmes completed by independent third parties and

own second-line functions, including franchise

operations.

* These external pressures, including the ongoing

consequences of the pandemic, inflationary costs,

labour quality and availability, and regulatory * Established processes for the development of products

changes, are becoming increasingly acute. While some and the associated packaging, including independent

of these events are outside of our control, they must review and approval before launch.

nevertheless be monitored and mitigated against.

* Qualified Food and Product Technology teams with

Operational oversight by Executive access to external experts where appropriate.

Committee, Group Safety Committee,

Consumer Brand Protection Committee

* Regular engagement with expert bodies and third-party

consultants to understand and respond to changes in

safety standards.

* Tested crisis management plan for safety incidents.

* Monitoring of product quality and customer

complaints.

------------------------------------------------------------

INFORMATION SECURITY

Failure to adequately prevent * Information security and data protection policies in

or respond to a data breach or place, with a mandatory training programme for

cyber-attack could adversely colleagues.

impact our reputation, result

in significant fines, business

disruption, loss of information * Information Security function, with multidisciplinary

for our customers, employees specialists, supported by a 24-hour Security

or business and/or loss of stakeholder Operations Centre and mature incident management

and customer confidence. plan.

* The sophistication and frequency of cyber-attacks in

the retail industry continue to increase and

highlight an escalating information security threat. * Network of Data Protection Officers in priority

This threat is further exacerbated by the pandemic business areas.

and other external events, such as the increased

threat of cyber warfare linked to current global

uncertainty. * Continued delivery of our improvement programme with

prioritised investment in response to an increase in

security events, breaches and the potential threat of

* As we continue to use data more intelligently across cyber warfare.

the business, move away from legacy systems to new

technology and digital solutions, transition to the

cloud, enhance omni-channel customer experiences and * Risk-based cyber security assurance programme,

build a broader "ecosystem", the profile of including assessment of controls in overseas

information security and the overall threats locations.

landscape will continue to change.

* Information security obligations included in

* Our reliance on several third parties hosting third-party contracts with a risk-based assurance

critical services and holding M&S and customer data programme to monitor our exposure.

also means that continued assessment and monitoring

is required to ensure that vulnerabilities in their

cyber and data controls do not impact us or our * Active monitoring of our threat environment.

customers.

* Focused security assurance, architecture and hygiene

* Longer-term changes such as the increase in customers around our digital product lifecycle, operations

using e-commerce, the growing number of digital and model and significant change activities, like

mobile shopping channels, the development of new omni-channel and new technologies.

technologies and digital touchpoints, and permanent

changes in the pattern of office/home working, will

all continue to impact the overall risk.

Operational oversight by Executive

Committee

------------------------------------------------------------

CORPORATE COMPLIANCE AND RESPONSIBILITY

A failure to deliver against * Code of Conduct in place and underpinned by policies

our legal and regulatory obligations and procedures in core areas of regulation and

or broader corporate responsibility responsibility that is shared with suppliers and

commitments would undermine our third parties where relevant and published

reputation as a responsible retailer, externally.

may result in legal exposure

or regulatory sanctions, and

could negatively impact our ability * Group-wide mandatory training programme for

to operate and/or remain relevant higher-risk regulatory areas, like health and safety,

to our customers and other stakeholders. anti-bribery and corruption, data privacy, and

* The increasingly broad and stringent legal and information security.

regulatory framework for retailers creates pressures

on business performance and management of market

sentiment requiring frequent changes or improvements * Established in-house regulatory legal team in place,

in how we operate. including specialist solicitors.

* New and evolving regulatory requirements include: * Dedicated subject-area leaders embedded in the

restrictions on the promotion of foods high in fat, business.

sugar and salt becoming effective from October 2022;

sanctions and export controls linked to Russia;

extended producer responsibility for packaging * Continuous horizon scanning, including monitoring of

plastics recycling targets; the proposed EU Directive sanctions and export controls.

on corporate due diligence and accountability in the

supply chain; anticipated changes in UK corporate

governance requirements, development of Taskforce on * Risk-based assurance and monitoring systems in place

Climate-related Financial Disclosures (TCFD) covering legal and regulatory compliance, and ethical

requirements; and potential new reporting under the and social considerations, including for our overseas

Taskforce on Nature-related Financial Disclosures. operations and suppliers.

* The diligence required to remain compliant is also * Cross-business Fraud Committee and controls

impacted by the global nature of activities, framework.

particularly our supply chains, where changes in the

external environment and challenging economic

conditions, including the impact of Covid-19 and the * A Confidential Reporting line to allow colleagues and

Russian invasion of Ukraine, leave ethical and social other stakeholders to report areas of concern,

responsibilities open to a heightened risk of including breaches.

mismanagement or exploitation.

* Established Worker Voice programme in the Food

* Non-compliance may result in fines, criminal business and transparency initiatives within Clothing

prosecution for M&S or colleagues, litigation, & Home.

additional investment to rectify breaches, disruption

or cessation of business activity, as well as

impacting our reputation. * Active monitoring of customer feedback and public

sentiment on compliance and responsibility, including

social media trends.

Operational oversight by Executive

Committee, Group Safety Committee,

Consumer Brand Protection Committee, * Proactive engagement with regulators, legislators,

Bank and Services Compliance trade bodies and policy makers.

Monitoring Committee, Fraud Committee

------------------------------------------------------------

CLIMATE CHANGE AND ENVIRONMENTAL

RESPONSIBILITY * Established Plan A programme with clear

An inability to reduce the environmental accountabilities for each area of the business

impact of our business and progress relating to our environmental objectives.

towards our net zero targets,

including those linked to our

supply chains, as well as managing * Net zero targets agreed with the Board.

the consequences of climate change

on our business, would fail to

meet the expectations of our * Alignment of carbon commitments with our revolving

customers, colleagues, investors credit facility.

and other stakeholders, impacting

our brand, future trading performance

and other business costs, including * Appointment of c.120 cross-business carbon champions,

financing. and launch of an internal Green Network with c.600

* We operate in a world and sector with increasing cross-business colleagues.

pressure from carbon-conscious customers, investors

and government bodies to operate in a more

environmentally conscious manner, where * Established product and raw material standards and

sustainability forms a core part of decision-making. processes outlining environmental and sustainability

This includes, for example, our response to the considerations for own activities and the supply

growth in the circular economy, waste reduction, chain.

low-carbon products and use of recycled fabrics.

* Clothing Quality Charter and Environmental and

* Future business performance will be impacted by our Chemical Policy in place for all suppliers.

ability to effectively manage the transition to a

low-carbon economy - balancing commercial decisions

with environmental responsibility, agreeing * ESG Committee, with Board membership, in place to

business-wide decarbonisation priorities and managing oversee the delivery of our carbon commitments and

changes in customer preferences. This includes broader ESG risks.

management of the increasing costs associated with

sustainable materials, recycling, carbon pricing and

further technological, policy and regulatory * Developed our response to TCFD including quantitative

interventions. scenario analysis in key areas (cotton, animal

protein and property) to enhance external reporting.

* Early engagement and planning with partners and

suppliers to support their decarbonising activities * Inclusion of specific climate-related risks and

is also becoming increasingly important in the mitigations linked to Plan A in business and

delivery of our net zero commitment. functional risk registers.

* From an operational perspective, the physical impact * Linkage of financing with the delivery of our net

of climate change on the availability of raw zero roadmap.

materials and food products, the geography of the

locations from which we source and operate, and the

condition of our buildings will need to be managed

effectively to reduce the impact on trade and the

income statement.

Operational oversight by ESG

Committee

------------------------------------------------------------

LIQUIDITY AND FUNDING

An inability to maintain short- * A GBP850m undrawn, revolving credit facility and

and long-term funding to meet GBP1,197.9m of cash and cash equivalents.

business needs or to effectively

manage associated risks could

impact our ability to transform * Review and refinement of our three-year plan, linked

at pace, as well as have an adverse to strategic priorities, with sensitivity analysis to

impact on business viability. assessthe impact of the changing economic

* While active management of our cash, liquidity and environment.

debt position through the pandemic and an improvement

in trade have resulted in a strong cash performance,

we maintain a continued focus on our liquidity and * Continued focus on working capital management to

funding requirements. continue to improve cash flow and reduce reliance on

bank facilities.

* Availability of, and access to, appropriate sources

and levels of funding remain vital for the continued * Ongoing scrutiny and challenge of discretionary

operation of business activity and the next phase of expenditure and capital spend controls that were

our transformation. Our ability to repay debt and strengthened during the pandemic.

fund working capital, capital expenditures and other

expenses depends on our operating performance,

ability to generate cash and to refinance existing * Close monitoring and stress testing of projected cash

debt. and debt capacity, financial covenants and other

rating metrics.

* We also have pension fund commitments that require

active management and monitoring. * Treasury operations are managed and monitored in line

with a Board approved Treasury Policy.

Operational oversight by Executive

Committee * Frequent engagement and dialogue with the market and

rating agencies.

------------------------------------------------------------

The risks listed do not comprise all those associated with Marks

& Spencer and are not presented in any order of priority. In

addition to the risks disclosed, a wide range of lesser impacting

risks and uncertainties that Marks & Spencer is exposed to, or

could be exposed to in the near future, are actively monitored and

managed. These less material risks are kept in view in case their

likelihood or impact should show signs of increasing.

Further information on the financial risks we face and how they

are managed is provided on pages 165 to 175 of the 2022 Annual

Report.

Directors' Responsibility Statement

The 2022 Annual Report contains the following statements

regarding responsibility for the financial statements in compliance

with DTR 4.1.12. Responsibility is for the full Annual Report and

Financial Statements 2022 and not the condensed statements required

to be set out in the Annual Financial Report announcement.

The directors are responsible for preparing the Annual Report,

the Remuneration Report and Policy and the financial statements in

accordance with applicable law and regulations. Company law

requires the directors to prepare financial statements for each

financial year. Under that law the directors are required to

prepare the Group financial statements in accordance with

international accounting standards in conformity with the

requirements of the Companies Act 2006 and International Financial

Reporting Standards ("IFRS"). Under company law, the directors must

not approve the financial statements unless they are satisfied that

they give a true and fair view of the state of affairs of the Group

and the Company and of the profit or loss of the Group and the

Company for that period.

In preparing these financial statements, the directors are

required to:

- Select suitable accounting policies and then apply them consistently.

- Make judgements and accounting estimates that are reasonable and prudent.

- State whether applicable IFRS (as adopted by the UK) have been

followed, subject to any material departures disclosed and

explained in the financial statements.

- Prepare the financial statements on a going concern basis

unless it is inappropriate to presume that the Company will

continue in business.

The directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Company's

transactions and disclose with reasonable accuracy at any time the

financial position of the Company and enable them to ensure that

the financial statements comply with the Companies Act 2006. They

are also responsible for safeguarding the assets of the Group and

the Company and hence for taking reasonable steps for the

prevention and detection of fraud and other irregularities.

The directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the UK governing the

preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

Each of the current directors, whose names and functions are

listed on pages 60 and 61, confirms that, to the best of their

knowledge:

- The Group financial statements, prepared in accordance with

the applicable set of accounting standards, give a true and fair

view of the assets, liabilities, financial position and profit or

loss of the Company and the undertakings included in the

consolidation taken as a whole.

- The Management Report includes a fair review of the

development and performance of the business and the position of the

Company and the undertakings included in the consolidation taken as

a whole, together with a description of the principal risks and

uncertainties that they face.

- The Annual Report, taken as a whole, is fair, balanced and

understandable, and provides the necessary information for

shareholders to assess the Group's position, performance, business

model and strategy.

The Directors of Marks and Spencer Group plc are listed in the

Group's 2022 Annual Report, and on the Group's website:

corporate.marksandspencer.com.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSSSFFMMEESEFM

(END) Dow Jones Newswires

June 07, 2022 05:00 ET (09:00 GMT)

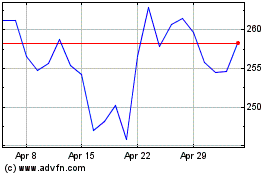

Marks And Spencer (LSE:MKS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Marks And Spencer (LSE:MKS)

Historical Stock Chart

From Apr 2023 to Apr 2024