TIDMMLVN

RNS Number : 2775U

Malvern International PLC

01 April 2021

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS NOT

FOR PUBLICATION, RELEASE OR DISTRIBUTION, DIRECTLY OR INDIRECTLY,

IN WHOLE OR IN PART, IN OR INTO THE UNITED STATES OF AMERICA,

CANADA, AUSTRALIA, NEW ZEALAND, THE REPUBLIC OF SOUTH AFRICA OR

JAPAN OR IN OR INTO ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

ITSELF CONSTITUTE AN OFFER FOR SALE OR SUBSCRIPTION OF ANY

SECURITIES IN THE COMPANY. THIS ANNOUNCEMENT DOES NOT CONSTITUTE OR

CONTAIN ANY INVITATION, SOLICITATION, RECOMMENDATION, OFFER OR

ADVICE TO ANY PERSON TO SUBSCRIBE FOR, OTHERWISE ACQUIRE OR DISPOSE

OF ANY SECURITIES OF AFC ENERGY PLC IN ANY JURISDICTION WHERE TO DO

SO WOULD BREACH ANY APPLICABLE LAW OR REGULATION.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR"). UPON

THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE INFORMATION IS

NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN.

1 April 2021

Malvern International plc

("Malvern", the "Company" or the "Group")

Result of Fundraising

Malvern International plc (AIM: MLVN), is pleased to announce

that further to its announcement at 16.35 yesterday, it has

successfully completed and closed the Fundraising which has been

increased in size in order to meet demand. Terms and expressions in

this announcement will have the same meaning as in that

announcement.

The Fundraising has raised gross proceeds of GBP1.70 million

through the placing of 620,150,000 New Ordinary Shares and a

subscription to the Company of 230,000,000 New Ordinary Shares all

at a price of 0.2 pence per share. In aggregate 850,150,000 New

Ordinary Shares will be issued pursuant to the Placing and

Subscription.

A total of 620,150,000 Placing Shares in the Company have been

placed by WH Ireland with institutional and other investors at a

price of 0.2 pence per share (the "Issue Price") pursuant to the

Firm Placing and the Conditional Placing raising in aggregate

GBP1.24 million.

In addition, a total of 230,000,000 New Ordinary Shares in the

Company have been subscribed for by Boost & Co., the principal

lender to the Company at the Issue Price pursuant to the Firm

Subscription and the Conditional Subscription raising aggregate

gross proceeds of GBP0.46 million.

The Issue Price represents a discount of 13 per cent. to the

closing price of 0.23 on 30 March 2021, the latest practicable date

prior to the announcement of the Fundraising.

The proceeds of the Fundraising announced today will be used is

to ensure Malvern has the cash resources to trade through the

continued difficulties caused by COVID-19 and to build on the very

significant progress that it has made in many areas of its business

since the June 2020 Fundraise and take advantage of the

opportunities for the business that are emerging.

The Fundraising Shares will rank pari passu with the New

Ordinary Shares following the proposed Subdivision. The Fundraising

Shares will represent approximately 40.7 per cent. of the Enlarged

Issued Ordinary Share Capital on Admission (assuming no other

issuance of ordinary shares prior to Admission).

The Firm Placing and Firm Subscription are conditional only upon

compliance by the Company in all material respects with its

obligations under the Placing Agreement and the occurrence of First

Admission. The Conditional Placing and Conditional Subscription are

is subject upon, inter alia, shareholder approval, Admission

becoming effective and the Placing Agreement becoming unconditional

and not being terminated in accordance with its terms.

The Company expects to publish a circular in connection with the

Fundraising, in due course, which will contain a notice convening

the General Meeting in order to approve certain matters necessary

to implement the Fundraising.

A copy of the Circular will be made available on the Company's

website: www.malverninternational.com .

The Circular sets out arrangements for the General Meeting in

light of the current British Government restrictions placed on

public gatherings in response to the COVID-19 outbreak. Under the

current prohibition on non-essential travel and public gatherings,

it will not be possible for Shareholders to attend the General

Meeting in person. Shareholders are strongly urged to vote by proxy

in advance of the deadline by completing their form of proxy in

accordance with the instructions and further details are set out in

the Circular and the form of proxy. The General Meeting is expected

to be convened for 11 a.m. on 20 April 2021, with the minimum

necessary quorum of two shareholders (which will be facilitated by

the Company).

The actions that Shareholders should take to vote on the

Resolutions will be set out in the Circular to be posted in due

course, along with the recommendations of the Directors.

First Admission and Total Voting Rights

The issue of the Firm Fundraising Shares, being 240,933,450 New

Ordinary Shares, is being carried out within the Company's existing

share authority to issue Ordinary Shares for cash.

Application has been made to the London Stock Exchange for the

Firm Fundraising Shares to be admitted to trading on AIM. It is

expected that the Firm Fundraising Shares will be admitted to

trading on AIM at 8.00 a.m. on or around 8 April 2021 (or such

later date as may be agreed between the Company and WH Ireland, but

no later than 15 April 2021).

Following First Admission, the total number of Ordinary Shares

in the Company in issue will be 1,445,900,690 and the total number

of voting rights will be 1,445,900,690. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Second Admission and Total Voting Rights

The issue of the Conditional Fundraising Shares and the Creditor

Conversion Shares, being in aggregate 641,566,550 New Ordinary

Shares respectively, is being carried out within the Company's

existing share authority to issue Ordinary Shares for cash is

conditional upon (amongst other things) the passing of the

Resolution 1 at the General Meeting.

Application has been made to the London Stock Exchange for the

Conditional Fundraising Shares to be admitted to trading on AIM. It

is expected that the Conditional Fundraising Shares will be

admitted to trading on AIM at 8.00 a.m. on or around 21 April 2021

(or such later date as may be agreed between the Company and WH

Ireland, but no later than 30 April 2021).

Following Second Admission, the total number of Ordinary Shares

in the Company in issue will be 2,087,467,240 and the total number

of voting rights will be 2,087,467,240. This figure may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the FCA's

Disclosure Guidance and Transparency Rules.

Enquiries

Malvern International plc www.malverninternational.com

Richard Mace (Chief Executive Officer)

Mark Elliott (Chairman) Via Communications Portfolio

WH Ireland - Nominated Adviser and +44 (0) 207 220 1666

Broker www.whirelandcb.com

Mike Coe / Chris Savidge (Corporate

Finance)

Jasper Berry (Corporate Broking)

Communications portfolio - Public +44 (0) 203 727 1000

Relations ariane.comstive@communications-portfolio.co.uk

Ariane Comstive

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROIEAXLFEEFFEEA

(END) Dow Jones Newswires

April 01, 2021 03:05 ET (07:05 GMT)

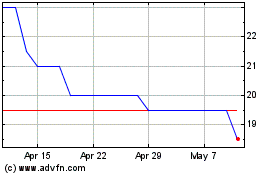

Malvern (LSE:MLVN)

Historical Stock Chart

From Mar 2024 to Apr 2024

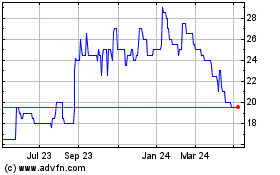

Malvern (LSE:MLVN)

Historical Stock Chart

From Apr 2023 to Apr 2024