TIDMDODS

RNS Number : 8409G

Dods Group PLC

30 November 2020

30 November 2020

Dods Group plc

("Dods", the "Company" or "the Group")

INTERIM RESULTS TO 30 SEPTEMBER 2020

Dods Group plc (AIM: DODS) announces its unaudited interim

results for the half year ended 30 September 2020.

Company Overview

Dods is a leading technology company specialising in business

intelligence, media and technology resourcing. With extensive

capability in machine learning and AI, we manage and transform

large volumes of data and information across multiple industries,

for some of the UK's leading business intelligence providers. In

the political and regulatory domains, we have built a reputation

for high quality, unbiased content across all of our products and

services in Westminster, Edinburgh, Paris and Brussels.

Financial Highlights

Continuing operations

H1 2021 H1 2020

30 Sept 20 30 Sept

19

Total revenue GBP10.2m GBP12.5m

Gross margin 31% 34%

Adjusted EBITDA (1) (GBP0.2m) GBP1.4m

Adjusted EBIT (2) (GBP1.9m) GBP0.2m

Loss before tax (GBP2.6m) (GBP0.3m)

Adjusted basic EPS (0.31p) 0.04p

Basic EPS (0.46p) (0.08p)

30 Sept 20 31 Mar 20

Cash at bank GBP4.1m GBP4.4m

Debt GBP3.0m GBP3.0m

Total assets GBP61.1m GBP63.9m

1. Adjusted EBITDA is calculated as earnings before interest,

tax, depreciation, amortisation of intangible assets, share based

payments and non-recurring items.

2. Adjusted EBIT is calculated as operating profit (loss) plus

non-recurring costs.

Operational Highlights

-- Formation of two new divisions; Dods Technology with

Cornelius (Con) Conlon as Managing Director and Dods Intelligence

with Munira Ibrahim as Managing Director;

-- Covid-19 pandemic accelerated move to a more technology enabled business;

-- Successful mobilisation of entire global workforce to remote

working; reviewing London office space requirements to reflect the

new hybrid working model with a consequential reduction in

costs;

-- Senior team strengthened across sales, technology, editorial,

creative, finance, legal and HR.

Outlook

The results for the period are in line with the Board's

expectations.

Despite the continued impact of Covid-19 on revenues, in

particular Events and Training, the Group is cash generative, has

additional liquidity available and has strengthened and diversified

its capabilities and senior management team, particularly through

the successful completion of the Merit acquisition in July

2019.

Due to the ongoing uncertainties around the global Covid-19

pandemic, the Board remains cautious about the outlook for the

second half of the year but confident in the Company's

transformational strategy and the long term outlook for the

Group.

Mark Smith, Non- Executive Chairman, commented:

" The Group's results for the first half of FY21 are in line

with the Board's expectations; whilst Covid-19 has had a huge

impact on parts of our core business our diversified portfolio

helped to mitigate the downside. The business adapted quickly to

remote working for all employees around the world and continues to

operate efficiently under flexible working conditions. We are

grateful for the continued support of our customers, suppliers,

shareholders, bankers and employees as we continue the

modernisation and transformation of Dods.

As announced last week we are delighted to welcome Vijay Vaghela

to the Board and Chairmanship of the Audit Committee. I am also

pleased to confirm my position as Chairman ."

This announcement is released by Dods Group plc and contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) 596/2014 ("MAR"), and is disclosed in

accordance with the Group's obligations under Article 17 of

MAR.

For the purposes of MAR and Article 2 of Commission Implementing

Regulation (EU) 2016/1055, this announcement is being made on

behalf of the Group by Simon Bullock, Chief Financial Officer.

For further information, please contact:

Dods Group plc

Mark Smith - Non-Executive Chairman 020 7593 5500

www.dodsgroup.com

Canaccord Genuity Limited (Nomad and Broker)

Bobbie Hilliam 020 7523 8150

Georgina McCooke

BUSINESS AND OPERATIONAL REVIEW

The interim results are in line with expectations and progress

continues to be made in transforming Dods from a publishing company

to a high-tech business services group as we emerge from the

initial impacts of the current global pandemic.

Dods Technology

The business is characterised by strong recurring revenues

amongst its clients and this has helped the company to weather a

Covid-19 dominated first half. Whilst short term, discretionary and

tactical revenue has been indirectly affected by the pandemic (down

by over 70%), the recurring revenue base means the business has

retained and delivered 95% of the overall revenue earned in the

same period last year. During the period the business has:

-- Shifted India based workers to a work from home operating model;

-- Secured new 'big data' projects in the pharmaceutical and publishing spaces;

-- Developed new products and delivered stronger IT support across the group as a whole;

-- Undertaken significant cost reduction measures; and

-- Grown several key accounts by more than 20%.

Dods Intelligence

The national UK lockdown on March 23(rd) and subsequent social

distancing requirements have significantly impacted revenues for

Dods Events (down 95% , but with improved margins ) and Dods

Training (down 51%), resulting in a rapid and accelerating switch

from physical to virtual events and training sessions and also

moving more of our media and publications from print to digital,

driving higher margins. Through the period, the team have:

-- Pivoted the delivery of events and training courses to

virtual - with 220 training courses and 50 events delivered. This

shift to virtual has resulted in higher margins due to lower

delivery costs;

-- Transitioned the majority of the publications to digital only

during lockdown which resulted in further cost savings and are

reviewing the print frequency on an ongoing basis;

-- Partnered with EY on delivering Civil Service Learning

contracts in addition to continuing a similar partnership with

KPMG;

-- Expanded the client base and now working directly with brands

including Oracle, SAP, Salesforce and Dell Boomi to provide access

to our niche and highly influential political audience;

-- Launched partnership with Politix to on-sell our unique UK

and EU monitoring product to German and Austrian clients;

-- Launched a new marketing franchise called Dods Insights that

brings together our editorial expertise and access across a variety

of topical news stories; and

-- Enacted a reduction in headcount in the events team by 30%

with smaller reductions across sales and delivery teams.

The team successfully implemented the above whilst in lockdown

and with staff levels reduced by 40% due to the Company benefitting

from the Government furlough scheme.

Covid-19 Update

The Group continues to address the challenges of Covid-19 which

is having an adverse impact on both revenues and profits

particularly in our events and training businesses; which will, in

part, be mitigated by strong recurring revenues within business

intelligence and resilience within Dods Technology (Merit).

The majority of employees are working from home with minimal

disruption to the business and this trend is expected to continue

into 2021.

Going Concern

The directors have considered the implications for Going Concern

and remain satisfied with the Company's funding and liquidity

position. See further comments under Statement of Financial

Position.

Outlook

The new team is continuing to innovate, build recurring

revenues, drive margin improvements and reduce costs to support the

Group's activities. Whilst it is impossible to predict the extent

of the continued global uncertainty around the pandemic, the Board

remains confident in the medium to long-term prospects of the

Group.

Con Conlon Munira Ibrahim

Managing Director Managing Director

Dods Technology Dods Intelligence

FINANCIAL REVIEW

Income statement

The Group's revenue from continuing operations decreased by 18%

to GBP10.2 million (H1 2020: GBP12.5 million) despite the benefit

of a full six month trading period from the Merit acquisition (H1

2020: 2.5 months).

Across Dods Intelligence, revenues from Events declined 95%

(from GBP4.6m to GBP0.2m) compared with the prior period and

Training revenues declined by 51% to GBP0.4m over the same period

as a direct consequence of the Covid-19 pandemic and Government

requirements on social distancing. Monitoring and Media revenues

were down 5% and 11% respectively. On a like-for-like basis

revenues from Dods Technology (Merit) were up GBP0.1m (2%).

During the period gross profit decreased by 24% to GBP3.2

million (H1 2020: GBP4.2 million) as a result of the revenue

shortfalls in Events and Training. Gross margin decreased from 34%

to 31% in the period, again driven by Events and Training.

Excluding these two businesses, overall margins were up 1.5%,

reflecting the migration from print to digital across all media

offerings.

Adjusted EBITDA decreased by GBP1.5 million to a loss of GBP0.2

million (H1 2020: GBP1.4 million profit). Operating loss was GBP2.3

million (H1 2020: GBP0.1 million loss), after a right-of-use assets

charge of GBP0.7 million (H1 2020: GBP0.5 million), an amortisation

charge of GBP0.4 million (H1 2020: GBP0.3 million) for business

combinations a charge of GBP0.2 million (H1 2020: GBP0.1 million),

for intangible assets depreciation charge of GBP0.3 million (H1

2020: GBP0.2 million) and non-recurring costs of GBP0.5 million (H1

2020: GBP0.3 million).

Net finance costs have increased for the period to GBP0.3

million (H1 2020: GBP0.2 million) reflecting borrowing costs

associated with the GBP3.0 million term loan from Barclays Bank

procured for the acquisition of Merit.

The taxation credit for the period was GBP3k (H1 2020: charge

GBP37k).The tax charge is based on the use of accumulated tax

losses.

Adjusted earnings per share, basic and diluted, from continuing

operations in the period were a loss of 0.31 pence and 0.30 pence

respectively (H1 2020: 0.04 pence profit) and were based on the

adjusted loss for the period of GBP1.7 million (H1 2020: GBP0.2

million profit) with a weighted average number of shares in issue

during the period of 564,786,453.

Earnings per share, both basic and diluted, from continuing

operations in the period were a loss of 0.46 pence (H1 2020: loss

of 0.08 pence) and were based on the loss after tax for the period

of GBP2.6 million (H1 2020: loss of GBP0.3 million).

The Board is not proposing a dividend (H1 2020: GBPnil).

Statement of Financial Position

Assets

Other non-current assets consisted of goodwill of GBP28.8

million (FY 2020: GBP28.9 million), intangible assets of GBP11.0

million (FY 2020: GBP11.2 million) and tangible fixed assets of

GBP1.9 million (FY 2020: GBP2.1 million).

The Group holds a 40% stake in the issued share capital of Sans

Frontières Associates (SFA) and has loaned SFA GBP0.6 million (FY

2020: GBP0.6 million) at the period end. The loan is unsecured and

carries no interest charge. Additionally, the Group holds a 30%

stake in Social 360 at a cost of GBP0.5 million (FY 2020: GBP0.5

million).

The Group had a cash balance of GBP4.1 million (FY 2020: GBP4.4

million) and gross borrowings of GBP3.0 million at the period end

(FY 2020: GBP3.0 million).

The Group has a term loan of GBP3.0 million (FY 2020: GBP3.0

million) over a 5-year period at an rate of 3.25% over LIBOR. The

current amount due is GBP0.9 million (FY 2020: GBP3.0 million) and

non-current is GBP2.1 million (FY 2020: GBPnil).

Current liabilities fell by GBP1.7 million to GBP16.3 million

(FY 2020: GBP18.0 million). Excluding the term loan, the current

liabilities increased primarily as a result of VAT and PAYE

deferrals available as part of the UK Government's support for

businesses impacted by Covid-19. GBP0.9m of VAT has been deferred

and will be paid between April 2021 and March 2022. The Group has

entered into a Time To Pay agreement with HMRC with respect to

GBP1.3 million of PAYE that will be fully settled by March

2021.

Deferred tax liability was GBP0.9 million (FY 2020: GBP0.9

million).

Total assets of the Group were GBP61.1 million (FY 2020: GBP63.9

million) with the main movements being a reduction in debtors of

GBP1.7 million and fall in fixed assets from amortisation and

depreciation charges.

Total equity reduced by GBP1.5 million to GBP34.3 million (FY

2020: GBP35.8 million), reflecting the loss for the period

partially offset by the issue of shares relating to deferred

consideration for the acquisition of Merit.

Liquidity and capital resources

The Group has generated cash from operations of GBP1.6 million

(H1 2020: GBP0.2 million) during the period primarily driven by

strong debtor collections and the deferral of VAT and PAYE.

The cash position at the period end was GBP4.1 million (2020:

GBP4.4 million). As at 30 September 2020 the Group had a net cash

position of GBP1.1 million (2020: GBP1.4 million).

The Group continues to benefit from an excellent relationship

with Barclays Bank plc; as previously reported capital payments on

the GBP3.0 million term loan have been deferred from April to

December 2020; all covenants have been waived through to January

2021 and the revolving credit facility of GBP2 million remains

available for draw-down. The Board is confident the business has

sufficient liquidity to meet its obligations, although this is an

area of continued focus due to the uncertainty arising from the

Covid-19 pandemic.

Simon Bullock

Chief Financial Officer

Condensed consolidated income statement

For the half year ended 30 September 2020

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

Note 30 Sept 2020 30 Sept GBP'000

GBP'000 2019

GBP'000

------------------------------------- ------- -------------- ----------- -------------

Revenue 2 10,227 12,524 27,796

Cost of sales (7,051) (8,326) (18,852)

------------------------------------- ------- -------------- ----------- -------------

Gross profit 3,176 4,198 8,944

Administrative expenses (3,373) (2,842) (6,154)

Adjusted EBITDA (197) 1,356 2,790

Depreciation of tangible fixed

assets (297) (243) (537)

Depreciation of right-of-use

assets (704) (507) (1,210)

Amortisation of intangible

assets acquired through business

combinations (426) (281) (711)

Amortisation of software intangible

assets (228) (144) (158)

Non-recurring items 3

Non-recurring acquisition

costs and

professional fees (272) (70) (171)

People-related costs (143) (121) (785)

Other non-recurring items (35) (116) (80)

Operating loss (2,302) (126) (862)

Net finance costs (300) (177) (555)

Share of profit of associate - - 158

------------------------------------- ------- -------------- ----------- -------------

Loss before tax (2,602) (303) (1,259)

Income tax (charge) / credit 3 (37) 76

------------------------------------- ------- -------------- ----------- -------------

Loss for the period (2,599) (340) (1,183)

------------------------------------- ------- -------------- ----------- -------------

Loss per share (pence)

Basic 4 (0.46p) (0.08p) (0.24p)

Diluted 4 (0.46p) (0.08p) (0.24p)

----------- -------- -------- --------

The notes on pages 11 to 16 form part of these unaudited interim

results.

Condensed consolidated statement of comprehensive income

For the half year ended 30 September 2020

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 2020 30 Sept GBP'000

GBP'000 2019

GBP'000

------------------------------------- -------------- ----------- -------------

Loss for the period (2,599) (340) (1,183)

Items that may be subsequently

reclassified to Profit and loss

Exchange differences on translation

of foreign operations 117 - 6

------------------------------------- -------------- ----------- -------------

Other comprehensive income for

the period 117 - 6

------------------------------------- -------------- ----------- -------------

Total comprehensive loss for the

period (2,482) (340) (1,177)

------------------------------------- -------------- ----------- -------------

The notes on pages 11 to 16 form part of these unaudited interim

results.

Condensed consolidated statement of financial position

As at 30 September 2020

Unaudited Unaudited Audited

30 Sept 2020 30 Sept 2019 31 Mar 2020

Note GBP'000 GBP'000 GBP'000

---------------------------------- ------- -------------- -------------- -------------

Non-current assets

Goodwill 5 28,845 28,218 28,911

Intangible assets 6 11,042 10,245 11,238

Property, plant and equipment 7 1,879 2,286 2,134

Right-of-use asset 7,412 8,629 7,926

Investment in associates 690 503 661

Long-term loan receivable 560 630 560

Total non-current assets 50,428 50,511 51,430

Current assets

Work in progress and inventories 434 35 273

Trade and other receivables 6,088 7,010 7,819

Cash and cash equivalents 4,100 6,787 4,368

Total current assets 10,622 13,832 12,460

Total assets 61,050 64,343 63,890

---------------------------------- ------- -------------- -------------- -------------

Capital and reserves

Issued capital 9 19,501 19,239 19,239

Share premium 20,866 20,082 20,082

Other reserves 415 409 409

Retained loss (6,473) (3,148) (3,991)

Share option reserve 85 55 75

Translation reserve (72) (67) (61)

Total equity 34,322 36,570 35,753

Current liabilities

Trade and other payables 12,633 9,381 12,423

Deferred consideration 10 1,318 1,318 1,046

Bank loan 857 353 3,000

Lease liability 1,515 1,524 1,515

Total current liabilities 16,323 12,576 17,984

Non-current liabilities

Deferred tax liability 862 487 862

Deferred consideration 10 272 1,590 1,590

Bank loan 2,143 4,647 -

Lease liability 7,128 8,473 7,701

---------------------------------- ------- -------------- -------------- -------------

Total non-current liabilities 10,405 15,197 10,153

Total equity and liabilities 61,050 64,343 63,890

---------------------------------- ------- -------------- -------------- -------------

The notes on pages 11 to 16 form part of these unaudited interim

results.

Condensed consolidated statement of changes in equity

For the half year ended 30 September 2020

Total

Share Retained Translation Share shareholders'

Share premium Merger earnings reserve(3) option funds

capital reserve(1) reserve(2) GBP'000 GBP'000 reserve(4) GBP'000

GBP'000 GBP'000 GBP'000 GBP'000

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

Unaudited

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

At 1 April 2019 17,096 8,142 409 (2,616) (67) 55 23,019

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

Effect of

adoption of

IFRS 16 Leases - - - (192) - - (192)

At 1 April 2019

(restated) 17,096 8,142 409 (2,808) (67) 55 22,827

Total

comprehensive

income

Loss for the

period - - - (340) - - (340)

Transactions with

owners

Issue of

ordinary

shares 2,143 11,940 - - - - 14,083

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

At 30 September

2019 19,239 20,082 409 (3,148) (67) 55 36,570

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

At 1 April 2020 19,239 20,082 409 (3,991) (61) 75 35,753

Total

comprehensive

income

Loss for the

year - - - (2,482) - - (2,482)

Transactions with

owners

Issue of

ordinary

shares 262 784 - - - - 1,046

Other

comprehensive

loss

Currency

translation

differences - - 6 - (11) - (5)

Share-based

payment - - - - - 10 10

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

At 30 September

2020 19,501 20,866 415 (6,473) (72) 85 34,322

------------------ ----------- ------------ ------------ ----------- ------------- ------------ ---------------

1 The share premium reserve represents the amount paid to the

Company by shareholders above the nominal value of shares

issued.

2 The merger reserve represents accounting treatment in relation

to historical business combinations.

3 The translation reserve comprises foreign currency translation

differences arising from the translation of financial statements of

the Group's foreign entities into sterling.

4 The share option reserve represents the cumulative expense

recognised in relation to equity-settled share-based payments.

The notes on pages 11 to 16 form part of these unaudited interim

results.

Condensed consolidated statement of cash flows

For the half year ended 30 Unaudited Unaudited Audited

September 2020 Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 30 Sept GBP'000

2020 2019

GBP'000 GBP'000

--------------------------------------- ----------- ----------- -------------

Cash flows from operating activities

Loss for the period (2,599) (340) (1,183)

Depreciation of property, plant

and equipment 297 243 573

Depreciation of right-of-use

assets 704 507 1,210

Amortisation of intangible

assets acquired through business

combinations 426 281 711

Amortisation of other intangible

assets 228 144 158

Share-based payments charge 10 - 20

Share of profit of associate - - (158)

Lease interest expense 228 200 420

Net finance costs 62 - 135

Non-recurring acquisition costs

and professional fees 450 1,670 2,010

Income tax charge / (credit) (3) 37 (76)

Operating cash flows before

movement in working capital (197) 2,742 3,784

Change in inventories (161) (18) (257)

Change in trade and other receivables 1,720 (1,363) (1,013)

Change in trade and other payables 210 (1,060) (282)

Cash generated by operations 1,572 301 2,232

Taxation paid 3 (85) (193)

---------------------------------------- ----------- ----------- -------------

Net cash from operating activities 1,575 216 2,039

---------------------------------------- ----------- ----------- -------------

Cash flows from investing activities

Interest and similar income

received - - 5

Non-recurring acquisition costs

and professional fees (272) (1,670) (2,010)

Additions to property, plant

and equipment (304) (45) (187)

Additions to intangible assets (196) (161) (1,400)

WIP on software not yet capitalised - (300) -

Investment in subsidiaries

(net of cash acquired) (29) (17,055) (17,055)

Net proceeds from bank loan - 5,000 3,000

Repayment of long-term loan

by associate - 70 140

---------------------------------------- ----------- ----------- -------------

Net cash used in investing

activities (801) (14,161) (17,507)

---------------------------------------- ----------- ----------- -------------

Cash flows from financing activities

Proceeds from issue of share

capital - 13,037 13,037

Interest and similar expenses

paid (300) - (140)

Payment of lease liabilities (756) (731) (1,487)

---------------------------------------- ----------- ----------- -------------

Net cash from / (used in) financing

activities (1,056) 12,306 11,410

---------------------------------------- ----------- ----------- -------------

Net decrease in cash and cash

equivalents (282) (1,639) (4,058)

Opening cash and cash equivalents 4,368 8,426 8,426

Effect of exchange rate fluctuations 14 - -

on cash held

--------------------------------------- ----------- ----------- -------------

Closing cash at bank 4,100 6,787 4,368

---------------------------------------- ----------- ----------- -------------

Comprised of:

Cash and cash equivalents 4,368 6,787 4,368

Closing cash at bank 4,100 6,787 4,368

---------------------------------------- ----------- ----------- -------------

The notes on pages 11 to 16 form part of these unaudited interim

results.

1. Basis of preparation

Dods Group plc is a Company incorporated in England and

Wales.

This condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the EU. The annual financial statements of the Group are prepared

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the EU. As required by AIM Rules, the

condensed set of financial statements has been prepared, and

applying accounting policies and presentation that were applied in

the preparation of the Group's published consolidated financial

statements for the year ended 31 March 2020.

The comparative figures for the year ended 31 March 2020 have

been extracted from the Group's statutory accounts for that

financial period. Those accounts have been reported on by the

company's auditor and delivered to the registrar of companies. The

report of the auditor was (i) unqualified, (ii) did not include a

reference to any matters to which the auditor drew attention by way

of emphasis without qualifying their report, and (iii) did not

contain a statement under section 498(2) or (3) of the Companies

Act 2006.

The taxation charge for the six months ended 30 September 2020

is based on the utilisation of accumulated tax losses.

Going concern

The Directors have considered the financial projections of the

Group, including cash flow forecasts and the availability of

committed bank facilities for the coming 12 months. They are

satisfied that the Group has adequate resources for the foreseeable

future and that it is appropriate to continue to adopt the going

concern basis in preparing these interim financial statements.

Accounting estimates and judgements

The Group makes estimates and judgements concerning the future

and the resulting estimates may, by definition, vary from the

actual results. The Directors considered the critical accounting

estimates and judgements used in the interim financial statements

and concluded that the main areas of judgement are:

-- Potential impairment of goodwill and other assets as a result

of the impact of COVID-19; and

-- Contingent deferred payments in respect of acquisitions.

The condensed set of interim financial statements have been

prepared on a going concern basis and were approved by the Board on

29 November 2020 .

2. Segmental information

Business segments

The Group now considers that it has two operating business

segments, Dods Intelligence and Dods Technology.

Dods Intelligences' business segment concentrates on the

provision of key information and insights into the political and

public policy environments around the UK and the European

Union.

The Dods Technology segment has extensive capability in machine

learning and AI and manages the transformation of large volumes of

data and information across multiple industries for some of the

UK's leading business intelligence providers.

The following table provides an analysis of the Group's segment

revenue by business segment.

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 2020 30 Sept GBP'000

GBP'000 2019

GBP'000

------------------- -------------- ----------- -------------

Dods Intelligence 5,210 10,394 20,154

Dods Technology 5,017 2,130 7,642

10,227 12,524 27,796

------------------- -------------- ----------- -------------

No client accounted for more than 10 percent of total

revenue.

Asset segment information has not been disclosed because this

information is not reviewed by the senior management team for the

purpose of allocating resources.

Note the prior year comparison for Dods Technology reflects only

the post-acquisition period of 2.5 months.

3. Non-recurring items

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 2020 30 Sept 2019 GBP'000

GBP'000 GBP'000

--------------------------------- -------------- -------------- -------------

Non-recurring acquisition costs

and professional fees 272 70 171

People-related costs 143 121 785

Other

- Professional services and

consultancy - 78 45

- Other 35 38 35

450 307 1,036

--------------------------------- -------------- -------------- -------------

4. Earnings per share

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 2020 30 Sept 2019 GBP'000

GBP'000 GBP'000

-------------------------------------- -------------- -------------- -------------

Loss attributable to shareholders (2,599) (340) (1,183)

Add: non-recurring items 450 307 1,036

Add: amortisation of intangible

assets acquired through business

combinations 426 281 711

Add: net exchange (gains) /

losses [included within net

finance costs] (12) (61) 23

Add: share-based payment expense 10 - 20

-------------------------------------- -------------- -------------- -------------

Adjusted post-tax profit /

(loss) attributable to shareholders (1,725) 187 607

-------------------------------------- -------------- -------------- -------------

Unaudited Unaudited Audited

Half year ended Half year Year ended

30 Sept 2020 ended 31 Mar 2020

Ordinary shares 30 Sept 2019 Ordinary

Ordinary shares

shares

------------------------------ ----------------- -------------- -------------

Weighted average number of

shares

In issue during the period

- basic 564,786,453 429,464,215 492,696,964

Adjustment for share options 1,662,000 1,812,000 1,674,500

In issue during the period

- diluted 566,448,453 431,276,215 494,371,464

------------------------------ ----------------- -------------- -------------

Unaudited Unaudited Audited

Half year ended Half year Year ended

30 Sept 2020 ended 31 Mar 2020

Pence per share 30 Sept 2019 Pence per

Pence per share

share

--------------------------------- ----------------- -------------- -------------

Earnings per share - continuing

operations

Basic (0.46) (0.08) (0.24)

Diluted (0.46) (0.08) (0.24)

Adjusted earnings per share

- continuing operations

Basic (0.31) 0.04 0.12

Diluted (0.30) 0.04 0.12

--------------------------------- ----------------- -------------- -------------

5. Goodwill

Unaudited Unaudited Audited

Half year Half year Year ended

ended ended 31 Mar 2020

30 Sept 2020 30 Sept 2019 GBP'000

GBP'000 GBP'000

--------------------------- -------------- -------------- -------------

Cost and net book value

Opening balance 28,911 13,282 13,282

Acquisition of subsidiary - 14,936 15,629

Reclass to intangibles (66) - -

Closing balance 28,845 28,218 28,911

--------------------------- -------------- -------------- -------------

6. Intangible assets

Other Capitalised

Assets acquired Costs

through business Software Total

combinations

GBP'000 GBP'000 GBP'000

------------------------ ------------------- ----------- ------------------ ---------

Cost

At 1 April 2019 23,956 3,419 - 27,375

Additions - internally

generated - 296 - 296

Additions - other - - 1,304 1,304

Impairment 4,086 - - 4,086

------------------------ ------------------- ----------- ------------------ ---------

At 31 March 2020 28,042 3,715 1,304 33,061

Reclass from goodwill - - 66 66

Additions - internally

generated - 30 368 398

At 30 September 2020 28,042 3,745 1,738 33,525

------------------------ ------------------- ----------- ------------------ ---------

Accumulated amortisation

At 1 April 2019 17,710 3,244 - 20,954

Charge for the year 711 158 - 869

-------------------------- ------- ------ ---- -------

At 31 March 2020 18,421 3,402 - 21,823

Charge for the period 426 131 103 660

-------------------------- ------- ------ ---- -------

At 30 September 2020 18,847 3,533 103 22,483

-------------------------- ------- ------ ---- -------

Net book value

At 31 March 2019 - audited 6,246 175 - 6,421

At 31 March 2020 - audited 9,621 313 1,304 11,238

------------------------------ -------- ------ ------ ---------

At 30 September 2020

- unaudited 9,195 212 1,635 11,042

------------------------------ -------- ------ ------ ---------

7. Property, plant and equipment

Equipment

and Fixtures

Leasehold Improvements and Fittings Total

GBP'000 GBP'000 GBP'000

--------------------------- ------------------------- -------------- --------

Cost

At 1 April 2019 2,010 1,121 3,131

Additions 15 172 187

Acquisition of subsidiary - 421 421

At 31 March 2020 2,025 1,714 3,739

Additions 54 - 54

Disposals - (25) (25)

At 30 September 2020 2,079 1,689 3,768

---------------------------- ------------------------- -------------- --------

Accumulated depreciation

At 1 April 2019 480 588 1,068

Charge for the year 212 325 573

At 31 March 2020 692 913 1,605

Charge for the period 126 158 284

At 30 September 2020 818 1,071 1,889

--------------------------- ------ ------ --------

Net book value

At 31 March 2019 - audited 1,530 533 2,063

At 31 March 2020 - audited 1,333 801 2,134

At 30 September 2020

- unaudited 1,261 618 1,879

------------------------------- -------- ------ --------

8. Interest-bearing loans and borrowings

During the period, the Group maintained a term loan of GBP3

million (H1 2020: GBP3 million), over a 5-year period carrying a

rate of 3.25% over LIBOR, with the first repayment of GBP0.2

million due on 31(st) December 2020.

In addition, it has access to a revolving credit facility (RCF)

of GBP2 million carrying a rate of 3.5% over LIBOR.

9. Share Capital

9p deferred 1p ordinary Total

shares shares GBP'000

Number Number

--------------------------------- ------------ ------------ ---------

Issued share capital as at

1 April 2020 151,998,453 555,929,713 19,239

Shares issued during the period - 26,141,667 262

Issued share capital as at

30 Sept 2020 151,998,453 582,071,380 19,501

--------------------------------- ------------ ------------ ---------

Holders of deferred shares do not have the right to receive

notice of any general meeting of the Company or any right to

attend, speak or vote at such meeting. The deferred shareholders

are not entitled to receive any dividend or distribution and shall

on a return of assets in a winding up of the Company entitle the

holders only to the repayment of 1 penny in aggregate. The deferred

shares are also incapable of transfer and no share certificates

will be issued.

During the period the Company issued 26,141,667 ordinary shares

related to the acquisition of Merit.

During the period the Group issued nil (2020: nil) ordinary

shares on the exercise of employee share options for cash

consideration of nil (2020: nil) of which GBPnil (2020: nil) was

credited to share capital and GBPnil (2020: nil) to share

premium.

10. Related party transactions

During the period, Artefact Partners LLP provided strategic

consultancy services to Dods Group plc to the value of GBPnil (H1

2020: GBP20,000). Current non-executive director Richard Boon is an

LLP designated member of Artefact Partners LLP.

During the period, the Group received a repayment of GBPnil (H1

2020: GBP70,000) on its interest free loan to its associate Sans

Frontieres Associates (SFA). At 30 September 2020 the balance of

this loan was GBP560,000 (H1 2020: GBP630,000).

During the period, an amount of GBP29,753 (H1 2020: GBP24,650)

was payable to an associate, Social 360 Limited, in relation to

profit-share for monitoring services provided. At 30 September

2020, GBPnil (H1 2020: GBP24,650) was outstanding.

On acquisition of Merit, an arm's length non-repairing 7-year

lease was entered into between a Merit subsidiary (Letrim

Intelligence Services Private Limited) and Merit Software Services

Private Limited. Cornelius Conlon, a director of the Group, is the

beneficial owner of Merit Software Services Private Limited. The

lease relates to the Chennai office of Merit. During the period,

payments of GBP339,000 ( H1 2020: GBP158,000) were made to Merit

Software Systems Private Limited in relation to the lease.

During the period the Company issued 13,333,819 ordinary shares

in connection with the deferred consideration payable as part of

the acquisition of Meritgroup Limited, to Con Conlon, Managing

Director of the Dods Technology division.

In addition, Con Conlon was paid GBP220,000 due to his continued

employment, post-acquisition (see note 11).

11. Contingent Liabilities

Upon the acquisition of Meritgroup Limited ("Merit") the Company

became obligated, under certain conditions, to make payments to two

employees of Merit. In the period GBP272K was paid and was reported

as a non-recurring charge.

Further payments of GBP272K per annum could become due in July

2021 and July 2022 contingent upon their continued employment.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLBMTMTMTTFM

(END) Dow Jones Newswires

November 30, 2020 02:00 ET (07:00 GMT)

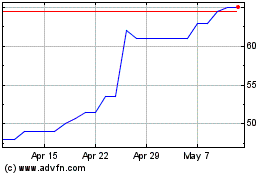

Merit (LSE:MRIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Merit (LSE:MRIT)

Historical Stock Chart

From Apr 2023 to Apr 2024