TIDMMSMN

RNS Number : 8820S

Mosman Oil and Gas Limited

19 March 2021

19 March 2021

Mosman Oil and Gas Limited

("Mosman" or the "Company")

GBP1.5m Placing completed for Helium, Hydrogen and

Hydrocarbon

Exploration at EP-145 and Update on Falcon well

Mosman Oil and Gas Limited (AIM: MSMN) the oil exploration,

development and production company announces an update on its 100%

owned EP-145 project in the Amadeus Basin, in the Northern

Territory of Australia and the completion of a GBP1.5 million

Placing to fund the next phase of development of this project.

Mosman also provides an update in respect of recent developments at

the Falcon well where the Operator of the Falcon-1 well in East

Texas, USA, has reported that the downhole logs have been completed

and a course of action agreed.

Placing to fund EP145 exploration

Mosman had considered joint venture partnerships to develop

EP-145, however, on further review the Board believes it is an

exciting opportunity and would be beneficial to retain its 100%

ownership. With the benefit of a GBP1.5m Placing, Mosman now plans

further exploration on this project in the Amadeus Basin where

drilling results in nearby permits have demonstrated the commercial

production of hydrocarbons and the presence of significant amounts

of helium (up to 6% in Magee-1) and hydrogen.

The Placing will fund all the following work planned for 2021.

It does not include drilling wells.

-- Airborne gravity survey in June 2021 to provide more detail

regarding the deep geology in the permit, in particular the

presence and distribution of salt deposits that provide the seal

for helium, hydrogen and hydrocarbons.

-- The processing and interpretation of gravity data and updating the geological model.

-- The acquisition of seismic in September/October 2021 aimed at defining a drilling prospect.

-- The processing and interpretation of seismic data November/December 2021.

-- Planning and long lead items for drilling.

John W Barr, Chairman, said: " Mosman has always seen the

potential in EP-145 and with a global shortage of helium and demand

increasing, combined with the opportunity to fund this exciting

exploration project, we look forward to the results of the next

phase of the exploration programme later this year."

Details of the Fundraising

To fund the exploration programme and drilling at EP-145, the

Company has raised GBP1.5m (before expenses) by way of a placing of

1,000,000,000 new ordinary shares of no par value in the capital of

the Company ("Placing Shares") through the company's broker Monecor

(London) Ltd, trading as ETX Capital, at a placing price of 0.15p

per share (the "Placing Price") (the "Placing"). Investors are also

receiving a one for two warrant exercisable at a price of 0.25p

with a term of 24 months (the "Placing Warrants").

Helium

Helium has become an increasingly valuable strategic resource,

used in medical, nuclear and space technology and a vital element

in the manufacture of MRIs, semiconductors, and is critical for

fibre optic cable manufacturing. The demand for Helium

significantly exceeds current production levels and this

undersupply has pushed prices to over 100 times that of natural gas

resources.

Until relatively recently most of the Helium resources were

supplied by the US, however, Australia is currently one of the

leading producers of Helium, producing 3% of the world's supply and

holds significant potential resources to expand production.

The Bayu-Undan gasfield located offshore in the Timor Sea is a

source of Helium to the LNG plant in Darwin. The Helium accounts

for 0.1-0.3% of raw feed gas and after processing comprises A grade

liquid Helium.

Two wells have drilled into the older Proterozoic stratigraphy

of the Amadeus Basin and both have encountered naturally occurring

helium gas. The first well, Magee-1, drilled in 1992 flowed gas

containing 6.2% Helium from the Heavitree Quartzite which directly

overlies fractured grantic basement. A second well, Mt Kitty-1

drilled in 2014, encountered gas within fractured basement,

containing up to 12% Helium. These extremely high concentrations

are amongst the highest in the world to date.

Helium production has been primarily associated with natural gas

production these high concentrations observed in the Amadeus Basin

may be sufficient to enable helium extraction independent of

natural gas (Waltenberg, 2015).

Mosman Australian Operations

Mosman Oil and Gas operate its Australian permits from Sydney,

Australia and have a highly experienced technical team. Technical

director, Andy Carroll has 40 years of international operating

experience including drilling and production with BP. Geological

Advisor, Dr Julie Daws has over 25 years in the oil and gas

industry working with large multi-national companies including

ConocoPhillips, Statoil and independent Australian producers in

hydrocarbon basins across the world. Andy and Julie have been

involved in progressing EP 145 for several years with visits to EP

145 and meetings with the government and the Central Land Council.

The team utilizes the expertise of Australian based Geophysical

companies, including Synterra Technologies to acquire seismic and

other geophysical surveys.

EP-145

Permit EP145 contains proven hydrocarbon resources in

traditional post-salt plays and there is evidence from seismic of

large, pre-salt structures with the potential to hold significant

resources of helium and hydrogen in addition to natural gas.

Operators of adjacent permits EP 112 and EP 115 have identified

large prospects including Dukas and Zorba (ref Central Petroleum

Limited).

Other Matters

The fundraising is being completed by the company's broker

Monecor (London) Ltd, trading as ETX Capital. ETX will receive 20

million two year warrants exercisable at 0.15p (the placing

price).

Admission to AIM and Total Voting Rights

The Placing is conditional on, inter alia, the Placing Shares

being admitted to trading on AIM. Application will be made to the

London Stock Exchange for the Fundraising Shares, which will rank

pari passu with the Company's existing issued ordinary shares, to

be admitted to trading on AIM and dealings are expected to commence

at 8:00 a.m. on or about 25 March 2021.

Following the issue of the Fundraising Shares, the Company's

share and total voting rights will comprise 3,646,513,052 Ordinary

Shares of no par value and the Company does not hold any shares in

treasury .

Consequently, the above figure may be used by shareholders in

the Company as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the share capital of the Company

under the Financial Conduct Authority's Disclosure and Transparency

Rules.

Falcon well update

The Operator of the Falcon-1 well in East Texas, USA, has

reported that the downhole logs have been completed.

The recent production logs indicate water is entering the well

bore through the lowest perforation. The well continues to produce

oil, gas and water. The Operator is preparing an AFE to squeeze

cement and re-perforate the same pay zone to attempt to reduce the

water flow. Subject to the results of that workover, the JV may

consider completing the well in a higher zone.

Mosman has a 50% working interest in the well and will provide

further updates as appropriate including in relation to the impact

of reduced Falcon production on the expected results for the

financial year ended 30 June 2021.

Competent Person's Statement

The information contained in this announcement has been reviewed

and approved by Andy Carroll, Technical Director for Mosman, who

has over 35 years of relevant experience in the oil industry. Mr.

Carroll is a member of the Society of Petroleum Engineers.

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

Enquiries:

Mosman Oil & Gas Limited NOMAD and Joint Broker

John W Barr, Executive Chairman SP Angel Corporate Finance LLP

Andy Carroll, Technical Director Stuart Gledhill / Richard Hail

jwbarr@mosmanoilandgas.com / Adam Cowl

acarroll@mosmanoilandgas.com +44 (0) 20 3470 0470

Alma PR Joint Broker

Justine James Monecor (London) Ltd trading as

+44 (0) 20 3405 0205 ETX Capital

+44 (0) 7525 324431 Thomas Smith

mosman@almapr.co.uk +44 (0) 20 7392 1432

Updates on the Company's activities are regularly posted on its

website: www.mosmanoilandgas.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFKLFFFXLLBBB

(END) Dow Jones Newswires

March 19, 2021 07:22 ET (11:22 GMT)

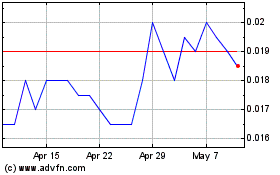

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Mosman Oil And Gas (LSE:MSMN)

Historical Stock Chart

From Apr 2023 to Apr 2024