TIDMN4P

RNS Number : 0952Q

N4 Pharma PLC

24 February 2021

24 February 2021

N4 Pharma plc

("N4 Pharma", the "Company" or the "Group")

Final Results

N4 Pharma Plc (AIM: N4P), the specialist pharmaceutical company

developing Nuvec(R), a novel delivery system for cancer treatments

and vaccines, is pleased to announce its audited results for the

year ended 31 December 2020.

Nigel Theobald, Chief Executive Officer of N4 Pharma Plc,

commented:

"The last 12 months have seen us make considerable progress in

the dispersion and formulation work for Nuvec(R) which will put us

in a stronger position for our collaboration discussions as we

continue to present our data to potential licensing partners. The

next few months will generate further important in vivo antibody

response data using a SARS COV-2 plasmid both with our original and

optimised Nuvec(R) formulations.

We have also recently announced that the European Patent Office

has notified The University of Queensland of the intention to grant

the patent that we have licensed the exclusive rights to. This has

been followed more recently by the Australian patent office

confirming its intention to grant a patent and we expect other key

territories to follow suit in 2021. This again strengthens our

commercial discussions.

This is a pivotal time for the Company, we are now finalising

the data we feel will give third parties the confidence to explore

testing of Nuvec(R) with their own constructs and we continue to

expand that dataset all the time.

We are continuing work on other applications for Nuvec(R) both

for cancer treatment and also to explore the potential for oral

delivery of vaccines. This work on oral delivery will continue in

the background as there is much that needs doing to establish the

potential for Nuvec(R) in this area as no one experiment will

provide a definitive conclusion either way on this potential."

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014.

Enquiries:

N4 Pharma plc

Nigel Theobald, CEO Via IFC Advisory

Luke Cairns, Executive Director

SP Angel Corporate Finance LLP Tel: +44(0)20 3470

0470

Nominated Adviser and Joint Broker

Matthew Johnson/Caroline Rowe (Corporate

Finance)

Vadim Alexandre/Rob Rees (Corporate Broking)

Turner Pope Investments (TPI) Limited Tel: +44(0)20 3657

0050

Joint Broker

Andy Thacker/Zoe Alexander

IFC Advisory Ltd Tel: +44(0)20 3934

Financial PR 6630

Graham Herring

Zach Cohen

About N4 Pharma

N4 Pharma is a specialist pharmaceutical company developing a

novel delivery system for cancer and vaccine treatments using its

unique silica nanoparticle delivery system called Nuvec(R).

N4 Pharma's business model is to partner with companies

developing novel antigens for cancer and vaccine treatments to use

Nuvec(R) as the delivery vehicle to get their antigen into cells to

express the protein needed for the required immunity. As these

products progress through pre clinical and clinical programs, N4

Pharma will seek to receive up front payments, milestone payments

and ultimately royalty payments once products reach the market.

N4 Pharma plc

Chairman's Report

N4 Pharma Plc (the "Company"), is the holding company and Parent

Company for N4 Pharma UK Limited ("N4 UK"), and together form the

Group (the "Group").

In the comparative year results N4 Biotech also forms part of

the Group. N4 Biotech was dissolved on 14 January 2020.

N4 UK is a specialist pharmaceutical company engaged in the

development of mesoparticulate silica delivery systems to improve

the cellular delivery and potency of vaccines .

The Board has not presented a Strategic Report for the year. All

relevant information on the strategy and performance of the Group

is included in the Chairman's report below and the Directors'

Report on page 9 of the annual report.

Review of operations for the financial year ended 31 December

2020

During the year to 31 December 2020, as anticipated, no revenue

was generated by the Group (31 December 2019: GBPnil).

The operating loss for the year was GBP1,564,421 (31 December

2019: GBP947,340 loss). Expenditure was broadly in line with budget

and increased in line with study results determining the next

expenditure requirements to progress work streams.

During the course of the year the Company raised in excess of

GBP4.15m, through a placing of 50,731,250 new ordinary shares in

May and a further 25,000,000 shares in December with the remainder

being through the exercise of warrants and options. In total the

Company issued 79,617,812 new ordinary shares of 0.4p in 2020.

Cash at the year-end stood at GBP3,555,579 (31 December 2019:

GBP 965,752) . Our cash position is the strongest it has ever been

and leaves us well positioned to complete our current work streams,

plan for follow on work and fund our costs in any initial

collaboration work.

Key Operational Events and Opportunities

The first part of 2020 saw the Group focus on the optimisation

of Nuvec(R) starting with the improved manufacture and dispersion

of the particle. In parallel, we entered into a research

collaboration agreement with Nanomerics Limited ("Nanomerics") to

focus on the stability of a number of different formulations of

Nuvec(R) using both a well characterised plasmid DNA and a novel

small interfering RNA (siRNA). Whilst these work streams remained

ongoing, the advent of the Covid-19 pandemic presented significant

local and global challenges but also created an opportunity as to

how Nuvec(R) may be applied as a potential delivery technology to

any of the multiple Covid-19 vaccines recently approved and in

development across the world.

Whilst we did not initially envisage a material disruption to

our studies, the scale of lockdown created minor but inevitable

delays to our optimisation work. As working practices have evolved

against the backdrop of the pandemic, these work streams are now

very much on track and continue to expand our data set for

Nuvec(R). With such attention on Covid-19 and potential vaccines,

we took the decision to undertake a proof of concept study prior to

a full in vivo study to assess the efficacy of Nuvec(R) loaded with

the Coronavirus plasmid DNA. This work was undertaken by an

experienced contract research organisation, Evotec, and concluded

having demonstrated the successful in vitro transfection of HEK

cells resulting in the decision to move to a full in vivo study as

set out further below.

As announced previously our current strategy has been divided

across three work streams:

1. Completion of the optimisation work including the

establishment of optimal dispersion, loading ratios and the tech

transfer for consistent manufacture of naked nanosilica

particles;

2. The scoping and implementation of our most comprehensive in vivo study to date; and

3. Feasibility studies on other applications for Nuvec(R) such

as for oral vaccines and in oncology.

Updates on each stream are as follows:

Optimisation and tech transfer

Over the last 12 months, our program of optimisation work has

been undertaken to further characterise Nuvec (R) nanoparticulate

silica with the objective of developing a colloidally stable

monodisperse formulation suitable for scaled manufacture. This work

has been successful, and a process has been developed which results

in a monodisperse nanoparticulate formulation which can be freeze

dried and reconstituted without loss of colloidal stability.

Importantly this formulation also retains in vitro transfection

activity when stored dry for up to 14 days at 0-4C and room

temperature, before reconstitution. Longer term stability

assessment will be conducted in due course.

Other studies have also been conducted to optimise the PEI

content, determine need for phosphonation and to assess the optimal

pH and buffer capacity of the medium in which Nuvec (R) is

dissolved.

In September we appointed Ardena as our contract development and

manufacturing organisation ('CDMO') partner for the technology

transfer and upscaling manufacturing of Nuvec(R). Work has been on

schedule and Ardena is currently working on the process

optimisation and scale-up resulting in the manufacture and analysis

of a non-GMP 50g batch of Nuvec(R) prior to moving towards the

manufacture, testing and product certification of Nuvec(R) for GMP

status.

In Vivo study plans and implementation

The in vivo study to compare the reactions of the original

Nuvec(R) loaded with the Coronavirus plasmid and another generic

plasmid in generating relevant antibodies, has recently commenced

at the University of Queensland. The commencement of this work is a

little later than originally envisaged, following delays in

obtaining the relevant customs clearance to transport the

Coronavirus plasmid expressing the spike protein into

Australia.

Having optimised Nuvec(R) as described above, we are now

planning the commencement of further in vivo studies to determine

whether the improved properties noted in vitro can also be seen in

vivo. These studies will be undertaken by Evotec with study

initiation expect by early March.

The optimised Nuvec(R) in vivo studies in mice are planned to

assess the following points:

(1) to determine antibody production following dosing with

optimised Nuvec(R);

(2) To explore dose relationship to determine minimum and

maximum plasmid dose required for effect. This information may also

provide information on dose-sparing i.e. reduced DNA use; and

(3) to confirm activity is retained after freeze drying and

reconstitution at different intervals.

These studies will again involve the Coronavirus plasmid and

another generic plasmid. Results from both studies should be known

during the first half of 2021.

Oral and oncology applications

In November we announced the launch of our Nuvec(R) oncology

treatment programme with Nanomerics Limited. The programme will

explore the role of Nuvec(R) as a delivery system for DNA and SiRNA

in a proof of concept preclinical tumour model. The two-stage

programme will focus initially on the formulation of Nuvec(R) with

a therapeutic DNA plasmid, whilst stage two will see the candidate

formulation evaluated in vivo in a subcutaneous tumour model to

examine tumour regression following multiple local or systemic

injections.

Our work to understand the viability of Nuvec(R) in oral

delivery remains ongoing and is currently focussed on extensive in

vitro work. In particular we are assessing the ability to transfect

epithelial cells in the gut as well as the impact of mucus and

other variables. Whilst the commercial potential of successfully

demonstrating Nuvec's(R) efficacy in oral delivery would be huge we

are still at the early stages of establishing whether it is

feasible. As this work continues in the background our primary

focus remains Nuvec's(R) potential use to improve the cellular

delivery and potency of vaccines.

The strengthening of our balance sheet through the funds raised

in May of this year, means that we are well funded to complete all

our currently planned work streams whilst the recent placing in

December means we can plan for more supplementary studies whilst

being able to budget for the next stage of work following the

current in vivo studies and the oral and oncology work.

Intellectual Property

As announced on 11 February the University of Queensland ("UQ")

has been notified by the European Patent Office ("EPO") of its

intention to grant a European Patent in relation to Nuvec(R)

specifically in respect of its composition, particulate materials

and methods for making the particulate materials (the "Patent"). N4

Pharma has the exclusive worldwide rights to Nuvec(R) for

therapeutic uses in humans and animals.

Having received the notification, the next steps prior to formal

grant will require UQ to confirm the particulars and translations

with the EPO prior to publication of the grant after which the

Patent will be validated on a country by country basis throughout

Europe as determined by UQ and the Company. This process, resulting

in the full grant of the Patent in each chosen territory, should

take six to eight months.

The Patent application process for other jurisdictions remains

on course and the board is optimistic that now the Patent has

successfully been processed by the EPO other jurisdictions should

follow suit in due course. In line with this optimism I am

delighted to announce that the Australian patent office has also

notified UQ of its intention to grant an Australian Patent.

Board Changes

On 15 July 2020 Luke Cairns, previously a Non-Executive

Director, became an Executive Director, overseeing the Group's

finance, corporate and investor relations activities allowing Nigel

Theobald, Chief Executive Officer, more time to focus on driving

the Group's development programmes and potential commercial

collaborations .

Future Prospects

What is increasingly clear with the ongoing Coronavirus pandemic

is that even with the great success of the recently approved

vaccines, as the virus evolves, so will the vaccines and there will

be multiple iterations in the years to come. Cost effective

storage, transportation and effective delivery are areas where any

improvements could have a material impact on the successful role

out of vaccines, particularly in emerging markets where wide scale

accessibility to vaccines remains challenging. It is our hope that

as we look to conclude our most comprehensive Nuvec(R) studies to

date, we will be able to present Nuvec(R) as a viable delivery

solution to vaccine developers.

It is important to stress that we see Nuvec(R) as a platform

delivery technology and whilst it may suit some plasmids better

than others it is our intention that it be used across multiple

vaccines and not just those addressing Coronavirus. Through our

oral studies we are also examining how Nuvec(R) could simplify the

way vaccines are administered. Whilst the majority of our data has

been gathered using plasmid DNA we are increasing our work with

mRNA. Together with our oncology programme, 2021 could turn out to

be a pivotal year for N4 Pharma, as our various applications for

Nuvec(R) advance to the point where we can engage further with

potential collaborators and partners. In parallel we are also

exploring other assets that could be complimentary to Nuvec(R).

On behalf of the Board, I would like to thank all of our

shareholders for their continued patient support and look forward

to providing further updates on our progress.

By order of the Board

John Chiplin

Chairman

N4 Pharma Plc

Consolidated Statement of Comprehensive Income for the year

ended 31 December 2020

Notes 2020 2019

GBP GBP

------------ ------------

Research and development

costs (900,410) (216,948)

General and administration

costs (664,011) (730,392)

Operating loss for the

year (1,564,421) (947,340)

Finance expenditure (1,963) (1,385)

Loss for the year before

tax 4 (1,566,384) (948,725)

Taxation 5 261,541 72,352

Loss for the year after

tax (1,304,843) (876,373)

Other comprehensive income

net of tax - -

Total comprehensive loss

for the year attributable

to equity owners of N4

Pharma Plc (1,304,843) (876,373)

------------------------------ ------ ------------ ------------

Loss per share attributable

to owners of the parent

Weighted average number

of shares:

Basic 136,303,141 100,168,016

Diluted 139,432,226 100,168,016

Basic loss per share (0.96) (0.87p)

Diluted loss per share (0.94) (0.87p)

All activities derive from continuing operations.

N4 Pharma Plc

Consolidated Statement of Financial Position as at 31 December

2020

Notes 2020 2019

GBP GBP

Current assets

Trade and other receivables 6 270,837 99,269

Cash and cash equivalents 3,555,579 965,752

3,826,416 1,065,021

Total assets 3,826,416 1,065,021

----------------------------- ------ ------------- -------------

Liabilities

Current liabilities

Trade and other payables 7 (142,484) (51,547)

Accruals and deferred

income (26,598) (26,136)

----------------------------- ------ ------------- -------------

(169,082) (77,683)

Total assets less

current liabilities 3,657,334 987,338

----------------------------- ------ ------------- -------------

Net assets 3,657,334 987,338

----------------------------- ------ ------------- -------------

Equity

Share capital 9 8,995,146 8,676,675

Share premium 9 13,945,602 10,327,258

Share option reserve 9 63,290 25,266

Reverse acquisition

reserve (14,138,244) (14,138,244)

Merger reserve 279,347 279,347

Retained earnings (5,487,807) (4,182,964)

----------------------------- ------ ------------- -------------

Total equity 3,657,334 987,338

----------------------------- ------ ------------- -------------

N4 Pharma Plc

Consolidated Statement of Changes in Equity for the year ended

31 December 2020

(i) Year ended Share Share Share option Reverse Merger Retained Total equity

31 December capital premium reserve acquisition reserve earnings

2020 reserve

GBP GBP GBP GBP GBP GBP GBP

----------- ------------- ------------- -------------- ------------- ------------ -------------

Balance at 1

January 2020 8,676,675 10,327,258 25,266 (14,138,244) 279,347 (4,182,964) 987,338

Total

comprehensive

loss for

the year - - - - - (1,304,843) (1,304,843)

Share issue 318,471 3,618,344 - - - - 3,936,815

Share option

reserve - - 38,024 - - - 38,024

----------- ------------- ------------- -------------- ------------- ------------ -------------

At 31 December

2020 8,995,146 13,945,602 63,290 (14,138,244) 279,347 (5,487,807) 3,657,334

----------- ------------- ------------- -------------- ------------- ------------ -------------

(ii) Year Share Share Share option Reverse Merger Retained Total equity

ended 31 capital premium reserve acquisition reserve earnings

December reserve

2019

GBP GBP GBP GBP GBP GBP GBP

----------- ------------- ------------- -------------- ------------- ------------ -------------

Balance at 1

January 2019 8,634,675 9,328,848 81,909 (14,138,244) 279,347 (3,306,591) 879,944

Total

comprehensive

loss for

the year - - - - - (876,373) (876,373)

Share issue 42,000 998,410 - - - - 1,040,410

Share option

reserve - - (56,643) - - - (56,643)

At 31 December

2019 8,676,675 10,327,258 25,266 (14,138,244) 279,347 (4,182,964) 987,338

N4 Pharma Plc

Consolidated Statement of Cash Flow for the year ended 31

December 2020

2020 2019

GBP GBP

----------------------------------- -------------- ------------

Operating activities

Loss before tax (1,566,384) (948,725)

Finance expenditure 1,963 1,385

Share based payments to employees 3,977 5,713

Operating loss before changes

in working capital (1,560,444) (941,627)

Movements in working capital:

(Increase)/Decrease in trade

and other receivables (30,534) 29,441

Decrease in trade, other payables

and accruals 91,399 (112,440)

Taxation 120,507 220,568

Cash used in operations (1,379,072) (804,058)

------------------------------------ -------------- ------------

Net cash flows used in operating

activities (1,379,072) (804,058)

------------------------------------ -------------- ------------

Financing activities

Finance expenditure (1,963) (1,385)

Net proceeds of ordinary share

issue 3,970,862 978,054

Net cash flows from financing

activities 3,968,899 976,669

------------------------------------ -------------- ------------

Net increase in cash and cash

equivalents 2,589,827 172,611

Cash and cash equivalents

at beginning of the year 965,752 793,141

Cash and cash equivalents

at 31 December 3,555,579 965,752

Notes to the Consolidated Financial Statements for the year

ended 31 December 2020

1. Accounting policies

1.1 Reporting entity

N4 Pharma Plc (the "Company"), is the holding Company for N4

Pharma UK Limited ("N4 UK"), and together form the Group (the

"Group"). N4 Pharma UK Limited is a specialist pharmaceutical

company engaged in the development of mesoparticulate silica

delivery systems to improve the cellular delivery and potency of

vaccines . The nature of the business is not deemed to be impacted

by seasonal fluctuations and as such performance is expected to be

consistent.

The Company is domiciled in England and Wales and was

incorporated and registered in England and Wales on 6 July 1979 as

a public limited company and its shares are admitted to trading on

AIM (LSE: N4P). The Company's registered office is located at 6th

Floor, 60 Gracechurch Street, London, EC3V 0HR.

The Accounts have been prepared in accordance with International

accounting standards in conformity with the requirements of the

Companies Act 2006 and applied to the Parent Company Accounts in

accordance with the provisions of the Companies Act 2006.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in these

Consolidated Financial Statements.

The Company has taken advantage of the exemption granted by

Section 408 of the Companies Act 2006 from presenting its own

Income Statement. The loss generated by the Company is disclosed

under the Company Statement of Financial Position.

1.2 Measurement convention

The Consolidated Financial Statements are prepared on the

historical cost basis, except for the following items:

-- Share-based payments related to investment acquisition are

measured at fair value shown in the Merger Reserve.

-- Share-based payments related to employee costs are measured

at fair value shown in the Statement of Comprehensive Income.

-- Share Warrants and Options are measured at fair value using

the Black Scholes model (see note 9).

The Consolidated Financial Statements are presented in Great

British Pounds ("GBP" or "GBP").

1.3 Going concern

These Consolidated Financial Statements have been prepared on

the basis of accounting principles applicable to a going concern.

The Directors consider that the Group will have access to adequate

resources, as set out below, to meet the operational requirements

for at least 12 months from the date of approval of these

Consolidated Financial Statements. For this reason, they continue

to adopt the going concern basis in preparing the Consolidated

Financial Statements.

The Group currently has no source of operating cash inflows,

other than interest and grant income, and has incurred net

operating cash outflows for the year ended 31 December 2020 of

GBP1,379,072 (2019: GBP804,058 outflow). At 31 December 2020, the

Group had cash balances of GBP3,555,579 (2019: GBP965,752) and a

surplus in net working capital (current assets, including cash,

less current liabilities) of GBP3,657,334 (2019: GBP987,338).

The Group prepares regular business forecasts and monitors its

projected cash flows, which are reviewed by the Board. Forecasts

are adjusted for reasonable sensitivities that address the

principal risks and uncertainties to which the Group is exposed,

thus creating a number of different scenarios for the Board to

challenge. In those cases, where scenarios deplete the Group's cash

resources too rapidly, consideration is given to the potential

actions available to management to mitigate the impact of one or

more of these sensitivities, in particular the discretionary nature

of costs incurred by the Group, in order to ensure the continued

availability of funds.

As the Group did not have access to bank debt and future funding

is reliant on issues of shares in the Parent Company, the Board has

derived a mitigation plan for the scenarios modelled as part of the

going concern review.

The Group has considered COVID-19 and the impact it will have on

its operations. COVID-19 has not had any material negative impact

on the operations of the Group during the year and it is

anticipated that the Group will remain a going concern despite the

unknown developments of COVID-19.

On the basis of this analysis, the Board has concluded that

there is a reasonable expectation that the Company will have

adequate resources to continue in operational existence for the

foreseeable future being a period of at least twelve months from

the Consolidated Statement of Financial Position date.

1.4 Basis of consolidation

Intra-Group balances and transactions, and any unrealised income

and expenses arising from intra-Group transactions, are eliminated

in preparing the Consolidated Financial Statements.

1.5 Revenue

Revenue is recognised to the extent this it is probable that

economic benefit will flow to the Group and the revenue can be

reliably measured. Revenue is measured at the lower of value of the

consideration received or receivable for the sale of goods or

services, excluding discounts, rebates, VAT and other sales taxes

and duties.

The Group has not recognised any revenue to date.

1.6 Government grant income

Government grants are recognised only when there is reasonable

assurance that the Group will comply with the conditions attaching

to them and that the grants will be received.

Government grants are recognised in the Consolidated Statement

of Comprehensive Income on a systematic basis over the periods in

which the Group recognises and expenses the related costs for which

the grants are intended to compensate.

Government grants that are receivable as compensation for

expenses or losses already incurred or for the purpose of giving

immediate financial support to the Group with no future related

costs are recognised in Consolidated Statement of Comprehensive

Income in the period in which they become receivable.

1.7 Expenses

Financing income and expenses

Financing expenses comprise interest expense and finance

charges. Financing income comprises interest receivable on funds

invested.

Interest income and interest payable is recognised in the

Consolidated Statement of Comprehensive Income as it accrues, using

the effective interest method.

Research and development

Research costs are charged against the Consolidated Statement of

Comprehensive Income as they are incurred. Certain development

costs will be capitalised as intangible assets when it is probable

that the future economic benefits will flow to the Group. Such

intangible assets will be amortised on a straight-line basis from

the point at which the assets are ready for use, over the period of

the expected benefit, and are reviewed for impairment at each year

end date. Other development costs are charged against income as

incurred since the criteria for their recognition as an asset is

not met.

The criteria for recognising expenditure as an asset are:

-- It is technically feasible to complete the product;

-- Management intends to complete the product and use or sell

it;

-- There is an ability to use or sell the product;

-- It can be demonstrated how the product will generate probable

future economic benefits;

-- Adequate technical, financial and other resources are

available to complete the development, use and sale of the product;

and

-- Expenditure attributable to the product can be reliably

measured.

The costs of an internally generated intangible asset comprise

all directly attributable costs necessary to create, produce and

prepare the asset to be capable of operating in the manner intended

by management. Directly attributable costs include employee costs

incurred on technical development, testing and certification,

materials consumed and any relevant third-party cost. The costs of

internally generated developments are recognised as intangible

assets and are subsequently measured in the same way as externally

acquired intangible assets. However, until completion of the

development project, the assets are subject to impairment testing

only.

1.8 Taxation

Taxation

Taxation for the year comprises current and deferred tax. Tax is

recognised in the Consolidated Statement of Comprehensive Income,

except to the extent that it relates to items recognised directly

in equity.

Current or deferred taxation assets and liabilities are not

discounted.

Current tax

Current tax is recognised at the amount of tax payable using the

tax rates and laws that have been enacted or substantively enacted

by the Consolidated Statement of Financial Position date.

Deferred tax

Deferred tax is recognised in respect of all timing differences

that have originated but not reversed at the Consolidated Statement

of Financial Position date.

Timing differences arise from the inclusion of income and

expenses in tax assessments in periods different from those in

which they are recognised in Consolidated Financial Statements.

Deferred tax is measured using tax rates and laws that have been

enacted or substantively enacted by the year end and that are

expected to apply to the reversal of the timing difference.

Unrelieved tax losses and other deferred tax assets are

recognised only to the extent that it is probable that they will be

recovered against the reversal of deferred tax liabilities or other

future taxable profits.

1.9 Earnings per share

The Group presents basic and diluted earnings or loss per share

data for its ordinary shares. Basic earnings/loss per share is

calculated by dividing the profit or loss attributable to ordinary

shareholders of the Company by the weighted average number of

ordinary shares outstanding during the period, adjusted for own

shares held. Diluted earnings/loss per share is determined by

adjusting the profit or loss attributable to ordinary shareholders

and the weighted average number of ordinary shares outstanding,

adjusted for own shares held, for the effects of all dilutive

potential ordinary shares, which comprise share options

granted.

1.10 Operating segments

Segment results that are reported to the Chief Executive Officer

include items directly attributable to a segment as well as those

that can be allocated on a reasonable basis. Unallocated items

comprise mainly corporate assets, head office expenses, and income

tax assets and liabilities.

Segment capital expenditure is the total cost incurred during

the period to acquire plant and equipment, and intangible assets

other than goodwill.

The Group operated in one business segment, that of the

development and commercialisation of medicines via its delivery

system called Nuvec(R). No revenue has yet been generated by any of

the work undertaken by the Group.

The Directors consider that there are no identifiable business

segments that are subject to risks and returns different to the

core business. The information reported to the Directors, for the

purposes of resource allocation and assessment of performance, is

based wholly on the overall activities of the Group.

1.11 Presentation and classification of financial instruments issued by the Group

In accordance with IAS 32, financial instruments issued by the

Group are treated as equity only to the extent that they meet the

following two conditions:

(a) they include no contractual obligations upon the Group to

deliver cash or other financial assets or to exchange financial

assets or financial liabilities with another party under conditions

that are potentially unfavourable to the Group; and

(b) where the instrument will or may be settled in the Company's

own equity instruments, it is either a non-derivative that includes

no obligation to deliver a variable number of the Company's own

equity instruments or is a derivative that will be settled by the

Company exchanging a fixed amount of cash or other financial assets

for a fixed number of its own equity instruments.

To the extent that this definition is not met, the proceeds of

issue are classified as a financial liability. Where the instrument

so classified takes the legal form of the Company's own shares, the

amounts presented in these Consolidated Financial Statements for

called up share capital and share premium account exclude amounts

in relation to those shares.

Where a financial instrument that contains both equity and

financial liability components exists these components are

separated and accounted for individually under the above

policy.

1.12 Non-derivative financial instruments

Non-derivative financial instruments comprise investments, trade

and other receivables, cash and cash equivalents and trade and

other payables.

Investments

Investments are investments held in subsidiaries accounted for

at cost under IAS 27.

Trade and other receivables

Trade and other receivables are recognised initially at fair

value. Subsequent to initial recognition they are measured at

amortised cost less impairment.

Trade and other payables

Trade and other payables are recognised initially at fair value.

Subsequent to initial recognition they are measured at amortised

cost using the effective interest method.

Cash and cash equivalents

Cash and cash equivalents are basic financial assets and

comprise cash in hand, deposits held at call with banks, other

short-term liquid investments with original maturities of three

months or less, and bank overdrafts. Any overdrafts are shown

within borrowings in current liabilities.

1.13 Impairment

A financial asset not carried at fair value through profit or

loss is assessed at each reporting date to determine whether there

is objective evidence that it is impaired. A financial asset is

impaired if objective evidence indicates that a loss event has

occurred after the initial recognition of the asset, and that the

loss event had a negative effect on the estimated future cash flows

of that asset that can be estimated reliably.

An impairment loss in respect of a financial asset measured at

amortised cost is calculated as the difference between its carrying

amount and the present value of the estimated future cash flows

discounted at the asset's original effective interest rate.

Interest on the impaired asset continues to be recognised through

the unwinding of the discount. When a subsequent event causes the

amount of impairment loss to decrease, the decrease in impairment

loss is reversed through the Statement of Comprehensive Income.

The carrying amounts of the Group's non-financial assets are

reviewed at each reporting date to determine whether there is any

indication of impairment. If any such indication exists, then the

asset's recoverable amount is estimated.

The recoverable amount of an asset is the greater of its value

in use and its fair value less costs to sell. In assessing value in

use, the estimated future cash flows are discounted to their

present value using a pre-tax discount rate that reflects current

market assessments of the time value of money and the risks

specific to the asset. For the purpose of impairment testing,

assets that cannot be tested individually are grouped together into

the smallest Group of assets that generates cash inflows from

continuing use that are largely independent of the cash inflows of

other assets or Groups of assets (the "cash-generating unit").

An impairment loss is recognised if the carrying amount of an

asset or its cash generating unit exceeds its estimated recoverable

amount. Impairment losses are recognised in profit or loss.

Impairment losses recognised in respect of cash generated units are

allocated first to reduce the carrying amount of any goodwill

allocated to the units, and then to reduce the carrying amounts of

the other assets in the unit (Group of units) on a pro rata

basis.

Impairment losses recognised in prior periods are assessed at

each reporting date for any indications that the loss has decreased

or no longer exists. An impairment loss is reversed if there has

been a change in the estimates used to determine the recoverable

amount. An impairment loss is reversed only to the extent that the

asset's carrying amount does not exceed the carrying amount that

would have been determined, net of depreciation or amortisation, if

no impairment loss had been recognised.

1.14 Share based payment arrangements

Share-based payment arrangements in which the Group receives

goods or services as consideration for its own equity instruments

are accounted for as equity-settled share-based payment

transactions, regardless of how the equity instruments are obtained

by the Group.

Share-based transactions, other than those with employees, are

measured at the value of goods or services received where this can

be reliably measured. Where the services received are not

identifiable, their fair value is determined by reference to the

grant date fair value of the equity instruments provided. Should it

not be possible to measure reliably the fair value of identifiable

goods and services received, their fair value shall be determined

by reference to the fair value of the equity instruments provided

measured over the period of time that the goods and services are

received.

The expense is recognised in the Consolidated Statement of

Comprehensive Income or capitalised as part of an asset when the

goods are received or as services are provided, with a

corresponding increase in equity.

The grant date fair value of share-based payment awards granted

to employees is recognised as an employee expense, with a

corresponding increase in equity, over the period that the

employees become unconditionally entitled to the awards. The fair

value of the options granted is measured using an option valuation

model, taking into account the terms and conditions upon which the

options were granted. The amount recognised as an expense is

adjusted to reflect the actual number of awards for which the

related service and non-market vesting conditions are expected to

be met, such that the amount ultimately recognised as an expense is

based on the number of awards that do meet the related service and

non-market performance conditions at the vesting date. For

share-based payment awards with non-vesting conditions, the grant

date fair value of the share-based payment is measured to reflect

such conditions and there is no "true-up" for differences between

expected and actual outcomes.

Share-based payment transactions in which the Group receives

goods or services by incurring a liability to transfer cash or

other assets that is based on the price of the Group's equity

instruments are accounted for as cash-settled share-based payments.

The fair value of the amount payable to recipients is recognised as

an expense, with a corresponding increase in liabilities, over the

period in which the recipients become unconditionally entitled to

payment. The liability is re-measured at each Consolidated

Statement of Financial Position date and at settlement date. Any

changes in the fair value of the liability are recognised in the

Consolidated Statement of Comprehensive Income.

1.15 Adoption of new and revised International Financial Reporting Standards

The following IFRS standards, amendments or interpretations

became effective during the year ended 31 December 2020 but have

not had a material effect on this Consolidated Financial

Information:

Standard

-------------------------------------------------------

Amendments to References to the Conceptual Framework

in IFRS Standards

Amendments to IFRS 3 Business Combinations (Definition

of a Business)

Amendments to IAS 1 and IAS 8: Definition of Material

Amendments to IFRS 9, IAS 39 and IFRS 7: Interest

Rate Benchmark Reform

Amendments to IFRS 16: Leases (Covid-19-Related Rent

Concessions)

All new standards and amendments to standards and

interpretations effective for annual periods beginning on or after

1 January 2020 that are applicable to the Group have been applied

in preparing these Consolidated Financial Statements.

The standards and interpretations that are issued, but not yet

effective, up to the date of issuance of the Consolidated Financial

Statements are disclosed below. The Group intends to adopt these

standards, if applicable, when they become effective.

Effective

Standard date

----------------------------------------------------------- ----------

Amendments to IAS 1 Classification of Liabilities 1 January

as Current or Non-Current 2023

Amendments to IFRS 3 Reference to the Conceptual 1 January

Framework 2022

Amendments to IAS 16 Property Plant and Equipment 1 January

(Proceeds before intended use) 2022

Amendments to IAS 37 Onerous Contracts (Cost of fulfilling 1 January

a contract) 2022

Annual Improvements to IFRS Standards 2018-2020 1 January

2022

IFRS 17 - Insurance Contracts 1 January

2023

The Directors are continuing to assess the potential impact that

the adoption of the standards listed above will have on the

Consolidated Financial Statements for the year ended 31 December

2021.

1.16 Use of estimates and judgements

The preparation of Consolidated Financial Statements in

conformity with IFRSs requires management to make certain

judgements, estimates and assumptions that affect the application

of accounting policies and the reported amounts of assets,

liabilities, income and expenses during the period. Actual results

may differ from these estimates.

Estimates and underlying assumptions are reviewed on an ongoing

basis. Revisions to accounting estimates are recognised in the

period in which the estimates are revised and in any future periods

affected.

In the process of applying the Group's accounting policies,

management has decided the following estimates and assumptions are

material to the carrying amounts of assets and liabilities

recognised in the Consolidated Financial Statements.

Critical judgements

Research and development expenditure

The key estimates and judgements surrounding the capitalisation

of Research & Development expenditure is whether the

expenditure meets the criteria for capitalisation. Expenditure will

only be capitalised when the recognition criteria is met and is

otherwise written off to the Consolidated Statement of

Comprehensive Income. The recognition criteria include the

identification of a clearly defined project with separately

identifiable expenditure where the outcome of the project, in terms

of its technical feasibility and commercial viability, can be

measured or assessed with reasonable certainty and that sufficient

resources exist to complete a profitable project. In the event that

these criteria are met, and it is probable that future economic

benefit attributable to the product will flow to the Group, then

the expenditure will be capitalised.

Impairment of investments and intercompany debtors

N4 UK has sustained losses and the Statement of Financial

position is in deficit. This is a potential indicator of

impairment. The recoverability of intercompany debtor and the cost

of investment is dependent on the future profitability of the

entity. No provision for impairment has been made in these accounts

and this is a significant judgement.

2. Risk management

Overview

The Group has exposure to the following risks:

-- Credit risk;

-- Liquidity risk;

-- Tax risk;

-- Market risk; and

-- Operational risk

-- Regulatory and legislative risk

This note presents information about the Group's exposure to

each of the above risks, its objectives, policies and processes for

measuring and managing risk, and its management of capital. Further

quantitative disclosures are included throughout these Consolidated

Financial Statements.

Risk management framework

The Board of Directors has overall responsibility for the

establishment and oversight of the risk management framework and

developing and monitoring the Group's risk management policies. Key

risk areas have been identified and the Group's risk management

policies and systems will be reviewed regularly to reflect changes

in market conditions and the Group's activities.

The Audit Committee oversees how management monitors compliance

with the Group's risk management policies and procedures and

reviews the adequacy of the risk management framework in relation

to the risks faced by the Group.

Credit risk

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations and arises principally from the Group's

bank deposits and receivables. See note 12 for further detail. The

risk of non-collection is considered to be low. This risk is deemed

low at present due to the Group not yet trading and generating

revenue but is a consideration for future risks.

There is an intercompany debtor balance between the Company and

N4 UK. The recoverability of this debtor is dependent on the future

profitability of the entity. As N4 UK has sustained losses and the

Statement of Financial position is in deficit it is currently not

in a position to repay this amount and this therefore poses a

credit risk.

Liquidity risk

Liquidity risk is the risk that the Group will encounter

difficulty in meeting the obligations associated with its financial

liabilities that are settled by delivering cash or another

financial asset. The Group's approach to managing liquidity is to

ensure, as far as possible, that it will always have sufficient

liquidity to meet its liabilities when due, under both normal and

stressed conditions, without incurring unacceptable losses or

risking damage to the Group's reputation. The Group monitors cash

flow on a monthly basis through forecasting to help mitigate this

risk.

Tax risk

Any change in the Group's tax status or in taxation legislation

or its interpretations could affect the value of the investments

held by the Group or the Group's ability to provide returns to

shareholders or alter post-tax returns to shareholders.

Market risk and competition

The Group operates as a specialist pharmaceutical Company

engaged in the development of mesoparticulate silica delivery

systems to improve the cellular delivery and potency of vaccines.

The Group is entering into a market with existing competitors and

the prospect of new entrants entering the current market. There is

no guarantee that current competitors or new entrants to the market

will not appeal to a wider portion of the Group's target market or

command broader band awareness.

In addition, the Group's future potential revenues from product

sales will be affected by changes in the market price of

pharmaceutical drugs and could also be subject to regulatory

controls or similar restrictions.

Market risk is monitored continuously by the Group and the Board

reacts to any changes in market conditions as and when they

arise.

Operational risk

The Group is at an early stage of development and is subject to

several operational risks. The commencement of the Group's material

revenues is difficult to predict and there is no guarantee the

Group will generate material revenues in the future. The Group has

a limited operational history upon which its performance and

prospects can be evaluated and faces the risks frequently

encountered by developing companies. The risks include the

uncertainty as to which areas of pharmaceuticals to target for

growth.

Operational risk is managed by adapting the future plans of the

Group based on results and feedback from employees, suppliers and

contractors.

Regulatory and legislative risk

The operations of the Group are such that it is exposed to the

risk of litigation from its suppliers, employees and regulatory

authorities. Exposure to litigation or fines imposed by regulatory

authorities may affect the Group's reputation even though monetary

consequences may not be significant.

Any changes to regulations or legislation are reviewed by the

Board on a regular basis and the Group applies any that are

relevant accordingly.

Changes to legislation, regulations, rules and practices may

change and is often the case in the pharmaceutical industry which

is highly regulated and susceptible to regular change. Any changes

may have an adverse effect on the Group's operations.

Protection of intellectual property

The Group's ability to compete significantly relies upon the

successful protection of its intellectual property, in particular

its licenced and owned patent applications for Nuvec(R). The Group

seeks to protect its intellectual property through the filing of

worldwide patent applications, as well as robust confidentiality

obligations on its employees. However, this does not provide

assurance that a third party will not infringe on the Group's

intellectual property, release confidential information about the

intellectual property or claim technology which is registered to

the Group.

Capital management

The Group has no loans or borrowings and has sufficient

resources, in the view of the Directors, to meet its working

capital requirements for the next 12 months.

The Group manages its capital through the preparation of

detailed forecasts, and tracks actual receipts and outlays against

the forecasts on a regular basis, to ensure that the Group will be

able to continue as a going concern while maximising the return to

shareholders.

The capital structure of the Group consists of cash and cash

equivalents and equity comprising, capital, reserves and

accumulated losses.

3. Employees and directors

The average monthly number of employees during the year was 5

(2019: 5). The Directors of the Group are employed by both the

Company and N4 Pharma UK Limited UK and as such are included in the

employee figure. Total Directors remuneration is detailed in note

13 of these Consolidated Financial Statements.

Year to 31 December Year to 31 December

2020 2019

GBP GBP

Wages and Salaries 204,768 276,752

Social security costs 20,370 34,956

Pension costs 219 1,209

---------------------- ----------------------

225,357 312,917

---------------------- ----------------------

4. Loss before tax

Year to 31 Year to 31

December 2020 December 2019

GBP GBP

Loss before taxation is arrived

after charging:

Fees payable to the Group's auditors

for the audit

of the Group's financial statements 21,600 21,200

---------------- ----------------

Other fees payable to auditors:

* Other assurance services 4,500 700

---------------- ----------------

5. Taxation

2020 2019

GBP GBP

Current tax

Research and development tax credit

receivable for the current period (214,884) (72,352)

Adjustments in respect of prior

periods (46,657) -

---------- ---------

(261,541) (72,352)

---------- ---------

Deferred tax

Origination and reversal of temporary

differences - -

---------- ---------

Tax in income statement (261,541) (72,352)

---------- ---------

The tax charge for the year can be reconciled to the loss in the

Consolidated Statement of Comprehensive Income as follows:

2020 2019

GBP GBP

Loss before taxation (1,566,384) (948,725)

------------ ----------

Tax at the UK corporation tax rate

of 19% (2019: 19%) (297,613) (180,258)

Expenses not deductible - -

Net Research and development tax

credits (214,884) (72,352)

Changes in unrecognized deferred

tax 297,613 180,258

Prior year adjustment (46,657) -

------------ ----------

Tax charge for the year (261,541) (72,352)

------------ ----------

At the year end the Group had trading losses carried forward of

GBP8,084,975 (2019: GBP6,868,627) for use against future

profits.

6. Trade and other receivables

Group Group Company Company

2020 2019 2020 2019

GBP GBP GBP GBP

Prepayments 16,009 11,758 15,320 10,478

VAT due 39,944 13,660 14,677 3,575

Corporation tax due 214,884 73,851 - -

Loan interest receivable - - 382,916 229,492

Other debtors - - 4,400 3,500

-------- ------- -------- --------

270,837 99,269 417,313 247,045

-------- ------- -------- --------

7. Trade and other payables

Group Group Company Company

2020 2019 2020 2019

GBP GBP GBP GBP

Trade creditors 116,871 27,157 - 7,512

Employee creditors 3,439 8,152 1,219 1,230

Loan due to directors - 16,000 - -

Other creditors 22,174 238 22,129 -

-------- ------- -------- --------

142,484 51,547 23,348 8,742

-------- ------- -------- --------

8. Share-based payments

a) Options

The Company has the ability to issue options to Directors to

compensate them for services rendered and incentivise them to add

value to the Group's longer-term share value. Equity settled

share-based payments are measured at fair value at the date of

grant. The fair value determined is charged to the Comprehensive

Income Statement on a straight-line basis over the vesting period

based on the Group's estimate of the number of shares that will

vest.

Cancellations of equity instruments are treated as an

acceleration of the vesting period and any outstanding charge is

recognised in full immediately.

Fair value is measured using a Black Scholes pricing model. The

key assumptions used in the model have been adjusted based on management's

best estimate for the effects of non-transferability, exercise restrictions

and behavioral considerations. The inputs into model for the current

year were as follows:

2020 Options

Share price 4.800p

Exercise price 4.800p

Expected volatility 29.9%

Expected option

life 6.5 years

Risk free rate 5.00%

As at 31 December 2020, there were 7,046,513 (2019: 7,679,370) options

in existence over ordinary shares of the Company allocated as follows:

Ordinary Exercise

Date of shares under Lapse Price

Name Grant option Date GBP

2015 Options

Gavin Burnell 14.10.15 1,351,210 14.10.25 0.0280

Luke Cairns 14.10.15 675,302 14.10.25 0.0280

2017 Options

Luke Cairns 03.05.17 717,143 03.05.20 0.0700

David Templeton 03.05.17 717,143 03.05.20 0.0700

Paul Titley 03.05.17 717,143 03.05.20 0.0700

2019 Options

John Chiplin 21.05.19 717,143 21.05.29 0.0355

Christopher Britten 21.05.19 717,143 21.05.29 0.0355

2020 Options

David Templeton 18.05.20 717,143 18.05.30 0.0480

Luke Cairns 18.05.20 717,143 18.05.30 0.0480

Total options 7,046,513

--------------

Share options outstanding:

Number

of shares

At 1 January 2019 7,249,084

Lapse of options (1,004,000)

Options granted 1,434,286

At 31 December 2019 7,679,370

Exercise of options (1,350,000)

Lapse of options (717,143)

Options granted 1,434,286

At 31 December 2020 7,046,513

------------

Each option entitles the holder to subscribe for one ordinary

share in N4 Pharma Plc. Options do not confer any voting rights on

the holder.

An amount of GBP3,977 has been recognised in the Statement of

Comprehensive Income in relation to the share options (2019:

GBP5,713).

On 18 May 2020 717,143 options over ordinary shares were granted

to both David Templeton and Luke Cairns under the Company's share

option scheme and are exercisable at a price of 4.8p per share.

On 8 September 2020 the Company received a notification to

exercise 1,350,000 options from Gavin Burnell a former director

representing 1,350,000 ordinary shares of 0.4 pence each, for a

total consideration of GBP37,800. At the date of exercise, the

options had a fair value of GBP12,319. The 1,350,000 ordinary

shares issued following the exercise of options were admitted to

trading on AIM on 14 September 2020. Gavin Burnell now has

1,351,210 options remaining in issue.

Options exercised in the year ended 31 December 2020 had a

weighted average fair value per share of GBP0.0571 (2019:

GBP0.0522).

The aggregate fair value of the share options issued is as

follows:

2020 2019

GBP GBP

2015 Options 18,493 17,831

2017 Options 26,884 3,037

2018 Options - 2,999

2019 Options 12,270 1,399

2020 Options 5,643 -

------- -------

63,290 25,266

------- -------

a) Warrants

A total of 2,536,562 placing warrants were issued as part of the

Placing on 20 May 2020 which raised GBP2,029,250 before fees and

expenses.

The warrants entitled holders to subscribe for new ordinary

shares at any time in the period of two years following the grant

of the warrants. The expiry date of the placing warrants was 20 May

2022.

2020

Date of Grant Warrant E xp i E xerc Exercised Number of Remaining

balance ry Date ise Pr Warrants Shares issued Warrants

at 1 January i ce GBP (1:1) at 31 December

2020 2020

20.05.2020 - 20.05.2022 0.04 2,536,562 2,536,562 -

--------------- --------------- ------------ ---------- ---------- --------------- ----------------

2019

Date of Grant Warrant E xp i E xerc Exercised Number of Remaining

balance ry Date ise Pr Warrants Shares issued Warrants

at 1 January i ce GBP (1:1) at 31 December

2019 2019

03.05.2017 11,054,071 03.05.2019 0.085 - - -

--------------- -------------- ----------- ---------- ---------- --------------- ----------------

During the year ended 31 December 2020 the full amount of the

warrants issued on 20 May 2020 were exercised on 14 August and 26

August respectively. The total consideration for the warrants was

GBP101,462 and resulted in the issue of 2,536,562 ordinary shares.

At the date of exercise, the warrants had a fair value of

GBP28,758.

The fair value of the warrants in issue and not yet exercised

was determined using the Black Scholes model. The fair value of the

warrants at 31 December 2020 is GBPNil (2019: GBPNil).

9. Capital and reserves

2020 2019

GBP GBP

181,080,349 Ordinary Shares of

0.4p each (2019: 101,462,537 Ordinary

Shares of 0.4p each) 724,321 405,850

137,674,431 Deferred Shares of

4p each (2019: 137,674,431 Deferred

Shares of 4p each) 5,506,977 5,506,977

279,176,540 Deferred Shares of

0.99p each (2019: 279,176,540 Deferred

Shares of 0.99p each) 2,763,848 2,763,848

---------- ----------

8,995,146 8,676,675

========== ==========

All ordinary shares rank equally in all respects, including for

dividends, shareholder attendance and voting rights at meetings, on

a return of capital and in a winding-up.

During the year 79,617,812 (2019:10,500,000) new ordinary shares

of 0.4p each were issued through two placings and the exercise of

warrants and options.

The first placing for 50,731,250 ordinary shares on 21 May 2020

for a total consideration of GBP2,029,250 and the second placing

for 25,000,000 ordinary shares on 9 December 2020 for a total

consideration of GBP2,000,000 had total placing costs of

GBP221,755.

The 137,674,431 deferred shares of 4p, have no right to

dividends nor do the holders thereof have the right to receive

notice of or to attend or vote at any general meeting of the

Company. On a return of capital or on a winding up of the Company,

the holders of the deferred shares shall only be entitled to

receive the amount paid up on such shares after the holders of the

ordinary shares have received their return on capital.

The 279,176, 540 deferred shares of 0. 99p shall be entitled to

receive a special dividend, which is payable upon the repayment to

the Company of any amount owed under certain loan agreements, after

which the Company shall, in priority to any distribution to any

other class of share, pay to the holders of the Special Deferred

Shares an aggregate amount equal to the amount repaid pro rata

according to the number of such shares paid up as to their nominal

value held by each shareholder. They shall be entitled to no other

distribution save for a special dividend and shall not be entitled

to receive notice of or attend or vote at a general meeting of the

Company. On a return of capital on a winding up of the Company,

they shall only be entitled to receive the amount paid up on such

shares up to a maximum of 0.9 pence per share after the holders of

the Ordinary Shares and the Deferred Shares have received their

return on capital .

Reserves

Share premium reserve

The share premium reserve comprises the excess of consideration

received over the par value of the shares issued, plus the nominal

value of share capital at the date of redesignation at no par

value.

Share option reserve

The share option reserve comprises the fair value of warrants

and options granted, less the fair value of lapsed and expired

warrants and options.

Reserves in the Consolidated Statement of Financial Position

comprise the share option reserve, reverse acquisition reserve and

the merger reserve.

10. Earnings per share

The calculation of basic loss per share at 31 December 2020 was

based on the loss of GBP1,304,843 (2019: GBP876,373), and a

weighted average number of ordinary shares outstanding of

136,303,141 (2019: 100,168,016), calculated as follows:

2020 2019

GBP GBP

Losses attributable to ordinary shareholders 1,304,843 876,373

Weighted average number of ordinary shares

Issued ordinary shares at 1 January 100,168,016 89,440,373

Effect of shares issued during the year 36,135,125 10,727,643

------------ ------------

Weighted average number of shares at 31 December 136,303,141 100,168,016

------------ ------------

2020 pence 2019 pence

per share per share

Basic loss per share (0.96) (0.87)

----------- -------------

Diluted loss per share

Diluted earnings per share is calculated by adjusting the

weighted average number of shares outstanding to assume conversion

of all potential dilutive shares, namely share options. In 2019

options existing at 31 December 2019 had an exercise price greater

than the market price of the shares and as a result were excluded

from the diluted loss per share calculation.The calculation of

diluted loss per share at 31 December 2020 was based on the loss of

GBP1,304,843 (31 December 2019: GBP876,373), and a weighted average

number of ordinary shares outstanding of 139,432,226 (2019:

100,168,016).

2020 pence 2019 pence

per share per share

Diluted loss per share (0.94) (0.87)

----------- -----------

11. Financial instruments

(a) Fair values of financial instruments

The fair values of all financial assets and financial

liabilities are equal to their carrying amounts shown in the

Consolidated Statement of Financial Position.

Trade and other receivables

The fair value of trade and other receivables is estimated as

the present value of future cash flows, discounted at the market

rate of interest at the reporting date if the effect is

material.

Trade and other payables

The fair value of trade and other payables is estimated as the

present value of future cash flows, discounted at the market rate

of interest at the reporting date if the effect is material.

Cash and cash equivalents

The fair value of cash and cash equivalents is estimated as its

carrying amount where the cash is repayable on demand. Where it is

not repayable on demand then the fair value is estimated at the

present value of future cash flows, discounted at the market rate

of interest at the reporting date.

(b) Credit risk

Financial risk management

Credit risk is the risk of financial loss to the Group if a

customer or counterparty to a financial instrument fails to meet

its contractual obligations and arises principally from the Group's

receivables and cash and cash equivalents. The carrying amount of

cash, cash equivalents and term deposits represents the maximum

credit exposure on those assets. The cash and cash equivalents are

held with UK bank and financial institution counterparties which

are rated at least A .

Exposure to credit risk

The carrying amount of financial assets represents the maximum

credit exposure. Therefore, the maximum exposure to credit risk at

the reporting date of the Group was GBP3,810,407 (2019:

GBP1,053,263), being the total of the carrying amount of financial

assets, shown in the Consolidated Statement of Financial

Position.

(c) Liquidity risk

Liquidity risk is the risk that the Group will not be able to

meet its financial obligations as they fall due.

The following are the contractual maturities of financial

liabilities, including estimated interest payments and excluding

the impact of netting agreements.

Group:

Financial liabilities Carrying Contractual 6 months 6-12 1 -2 years

amount cash flows or less months

GBP GBP GBP GBP GBP

31 December 2020

Trade and other

payables 142,484 142,484 142,484 - -

--------- ------------ --------- -------- -----------

31 December 2019

Trade and other

payables 51,547 51,547 51,547 - -

--------- ------------ --------- -------- -----------

(d) Currency risk

The Group does not have significant exposure to foreign currency

risk at present. The Group does not have any monetary financial

instruments which are held in a currency that differs from that

entity's functional currency.

(e) Interest rate risk

Profile

At the reporting date the interest rate profile of

interest-bearing financial instruments was:

Carrying amount

Group:

2020 2019

GBP GBP

Variable rate instruments

---------- --------

Cash and cash equivalents 3,555,579 965,752

---------- --------

Cash flow sensitivity analysis for variable rate instruments

The Group's interest-bearing assets at the reporting date were

invested with financial institutions in the United Kingdom with a

S&P rating of A2 and comprised solely of bank accounts.

A change in interest rates would have increased/(decreased)

profit or loss by the amounts shown below. This analysis assumes

that all other variables remain constant. This analysis is

performed on the same basis for 2019.

Group: 2020 2019

Profit or loss Profit or loss

100 bp increase 100 bp decrease 100 bp increase 100 bp decrease

Variable rate instruments 35,555 (35,555) 9,658 (9,658)

---------------- ---------------- ---------------- ----------------

12. Related parties

Key management personnel

As at the year end, there are no key management personnel

employed by the Group in addition to the Directors.

Directors' remuneration and interests

The below remuneration relates to the Directors of the Group.

There is no other Key Management Personnel remuneration.

2020 Remuneration Interests

Director Cash-based Share-based Totals Shares Options

payments payments

GBP GBP GBP No. No.

Nigel Theobald (Chief

Executive Officer) 71,538 - 71,538 16,981,319 -

David Templeton 41,538 3,836 45,374 - 1,434,286

Luke Cairns 32,000 3,836 35,836 142,857 2,109,588

Christopher Britten 24,000 3,806 27,806 - 717,143

John Chiplin 24,000 3,806 27,806 - 717,143

193,076 15,284 208,360 17,124,176 4,978,160

=========== ============ ======== =========== ==========

2019 Remuneration Interests

Director Cash-based Share-based Totals Shares Options

payments payments

GBP GBP GBP No. No.

Nigel Theobald (Chief

Executive Officer) 70,000 - 70,000 16,981,319 -

Paul Titley (resigned

20 May 2019) 15,282 1,330 16,612 142,857 717,143

David Templeton 38,310 1,330 39,640 - 717,143

Luke Cairns 24,000 1,330 25,330 142,857 1,392,445

Christopher Britten

(appointed 20 May

2019) 14,923 2,329 17,252 - 717,143

John Chiplin (appointed

20 May 2019) 14,667 2,329 16,996 - 717,143

----------- ------------ -------- ----------- ----------

177,182 8,648 185,830 17,267,033 4,261,017

=========== ============ ======== =========== ==========

No contributions are paid by the Group to a pension scheme on

behalf of the Directors.

N4 Pharma PLC has a loan receivable from N4 Pharma UK Limited at

31 December 2020 of GBP3,659,000 (2019: GBP2,659,000). It is

repayable in December 2025 and interest is receivable at 5%.

Amounts owed to the Directors of the Group was nil at the

year-end (2019: GBP16,000).

There are no further related parties identified.

13. Subsequent events

There have been no material events subsequent to the

Consolidated Statement of Financial Position date that require

adjustment or disclosure in these Consolidated Financial

Statements.

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR BLGDDLXDDGBX

(END) Dow Jones Newswires

February 24, 2021 02:00 ET (07:00 GMT)

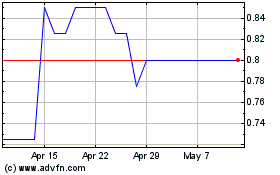

N4 Pharma (LSE:N4P)

Historical Stock Chart

From Mar 2024 to Apr 2024

N4 Pharma (LSE:N4P)

Historical Stock Chart

From Apr 2023 to Apr 2024