TIDMNCC

RNS Number : 7176Q

NCC Group PLC

23 June 2020

23 June 2020

NCC Group plc

Trading update and Notice of Final Results

NCC Group plc, (LSE: NCC, "NCC Group" or "the Group"), the

leading independent global cyber security and resilience advisor,

is pleased to provide the following update in advance of publishing

its preliminary results for the year ended 31 May 2020 (FY20).

Context

In line with our trading update on 23 March, the Group has

experienced delays, cancellations, and disruption to our business

operations since Q3 FY20, which have broadly followed the same

pattern as the spread of Covid-19 across the regions in which we

operate.

Our primary concern during this time has been the wellbeing of

our colleagues and customers. We switched quickly to remote working

- facilitated by the investments we have made in systems and

infrastructure through our Securing Growth Together transformation

programme - which has enabled us to continue to deliver robustly

for our clients throughout this period of disruption.

Trading update

The Board expects Revenue and Adjusted EBIT (1) (subject to

audit) to be comfortably ahead of latest FY20 analysts' consensus

expectations of GBP243m and GBP22.3m respectively. Revenue will be

higher than in FY19 and Adjusted EBIT (1) will be lower, owing to

our decision to preserve the capability and capacity of our

business in readiness for the economic recovery.

We believe that Covid-19 will continue to have an uncertain

impact on demand through FY21 and for this reason we are not yet in

a position to reintroduce guidance to the market on our future

financial performance. However, our r ecurring and long-term

revenues , particularly in our Software Resilience (Escrow) and

Managed Services businesses, provide us with some protection.

We remain confident in the long-term growth potential of the

cyber market. Therefore, consistent with our March trading update,

our two key priorities are to maintain a strong balance sheet and

to preserve our specialist capability and capacity in order to meet

the strong demand we expect in future years.

Strong balance sheet

The Group continues to have a strong balance sheet with access

to a committed multi-currency revolving credit facility of GBP100m,

due for renewal in June 2024.

During the year, our cash management discipline and short-term

discretionary cost saving actions have resulted in net debt as at

31 May 2020 falling to less than GBP5m (May 2019: GBP20.2m,

November 2019: GBP20.8m). This includes cash balances of c.GBP95m

(May 2019: GBP35m) following the full draw down of our revolving

credit facility in April 2020 (May 2019: GBP43m undrawn) which we

did to provide the Group with maximum cash flexibility.

The Group has benefited from certain government tax deferral

programmes, however the Group has not drawn down any government

loan support. The total cash timing benefit from tax deferral in

FY20 amounted to c.GBP5m, with reversal expected to occur in

FY21.

Preserve our specialist capability

In keeping with our objective to preserve our capability and

capacity, we have not made any Covid-19 related redundancies or

furloughed any colleagues. Our long-term objective is to be the

global hub for cyber talent and we are pleased that technical staff

attrition improved year-on-year.

Notice of Final Results

The Company expects to report its preliminary results for the

year ended 31 May 2020, on 3 September 2020. This takes into

account the logistical challenges our auditors and our finance team

face in completing due processes in a remote working

environment.

Management will host a remote presentation and Q&A session,

details of which will be circulated ahead of the event.

Adam Palser , Chief Executive Officer, commented:

"Thanks to the inspirational response of my NCC Group

colleagues, coupled with the investments we have made in systems

and processes as part of our Securing Growth Together

transformation programme, NCC is successfully weathering the

Covid-19 storm. During this period of uncertainty we have focused

on the wellbeing of our people, continued to deliver high impact

work to protect our customers from cyber threat and strengthened

our balance sheet.

I am very pleased with our performance and we stand ready to

take advantage of opportunities as the global pandemic

subsides."

Notes:

(1) Adjusted Earnings before interest and taxation (EBIT) is

Pre-IFRS 16.

Enquiries

NCC Group +44 (0)161 2095432

Adam Palser, CEO

Tim Kowalski, CFO

Maitland AMO +44 (0)7775 684934

Al Loehnis

About NCC Group

NCC Group exists to make the world safer and more secure.

As the leading independent global cyber security and resilience

advisor, NCC Group is trusted by over 15,000 clients worldwide to

protect their most critical assets from the ever-changing threat

landscape.

With the company's knowledge, experience and global footprint,

it is best placed to help businesses identify, assess, mitigate and

respond to the evolving cyber risks they face.

To support its mission, NCC Group continually invests in

research and innovation, and is passionate about developing the

next generation of cyber scientists.

With around 2,000 colleagues in 12 countries, NCC Group has a

significant market presence in North America, continental Europe

and the UK, and a rapidly growing footprint in Asia Pacific with

offices in Australia, Japan and Singapore.

www.nccgroup.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCKLLFLBQLLBBL

(END) Dow Jones Newswires

June 23, 2020 02:00 ET (06:00 GMT)

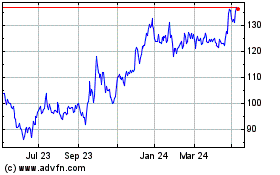

Ncc (LSE:NCC)

Historical Stock Chart

From Mar 2024 to Apr 2024

Ncc (LSE:NCC)

Historical Stock Chart

From Apr 2023 to Apr 2024