TIDMNWOR

RNS Number : 4971A

National World PLC

30 September 2020

National World plc

("National World," or the "Company")

Results for the six month period to 30 June 2020

National World, (LSE: NWOR.L), the investment business

established to create a modern platform for news publishing by

implementing a new operating model powered by the latest

technology, today announces its results for the six month period to

30 June 2020.

David Montgomery, Executive Chairman, said:

"The Covid-19 pandemic has impacted the news publishing sector,

accelerating the structural impact we outlined at the time of our

IPO. We remain confident in our strategy which we continue to

refine in conjunction with evaluating a number of opportunities.

Further updates will be provided to shareholders as

appropriate."

Results for the six month period to 30 June 2020

The results for the six month period to 30 June 2020 is

available on our website:

https://www.nationalworld.com/investors/reports-presentations-and-publications/year/2020

Excerpts of the results are set out below.

This announcement contains inside information for the purposes

of the Market Abuse Regulation (EU) NO. 596/2014. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain. The person responsible for

arranging for the release of this announcement on behalf of

National World is Vijay Vaghela, Chief Operating Officer.

- Ends -

For further information please contact:

National World plc

David Montgomery

Vijay Vaghela

c/o Montfort Communications

Montfort Communications

Nick Miles

Olly Scott +44 (0)78 1234 5205

Interim Management Report

I am pleased to present the Interim Report and Financial

Statements for the six month period ended30 June 2020 for National

World Plc (the "Company")

The Company has been established to pursue opportunities in the

news publishing and digital media sector and/or in associated

complementary technologies. Our objective is to create a modern

platform for news publishing by implementing a new operating model

powered by the latest technology.

National World will jettison legacy systems and archaic

industrial practices to create efficient dissemination of news and

to monetise it by matching content to audience.

The Company has continued to progress with efforts towards

identifying suitable assets for acquisition. Whilst the Company has

been engaged on a number of potential acquisitions during the

period, no acquisitions or investments have progressed to a stage

where exclusivity has been granted. Progress has been impacted by

the uncertainty created by the COVID-19 outbreak which has

adversely impacted news publishing businesses.

The impact of COVID 19 on the news publishing sector further

highlights the importance and urgent need for a transformation of

the industry with a new operating model and increased

collaboration. We continue to explore a range of opportunities

despite a rapidly changing situation.

The Company incurred a loss for the six month period ended 30

June 2020 of GBP 118,177 from the on-going administrative expenses

required to operate the Company. The Board continues to tightly

manage ongoing operating costs.

The Group had a cash balance of GBP 4,312,865 and net assets of

GBP4,324,871 as at 30 June 2020.

Since December 2019, the Company's Ordinary Shares have been

suspended from trading on the Main Market of the LSE as the Company

was considering a potential acquisition. The shares remain

suspended as the directors continue to work on potential

acquisitions and look forward to presenting a value enhancing

opportunity for consideration by shareholders.

All statements other than historical facts are forward-looking

statements and the Company does not undertake any obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise. There

are a number of potential risks and uncertainties which may have

material impact on the Company's performance over the remaining six

months of the financial year and could cause actual results to

differ materially from expected and historical results. The

directors do not consider that there are any changes to the

principal risks and uncertainties since the publication of the 2019

Annual Report and Accounts which are available on the Company's

website at www.nationalworld.com.

David Montgomery

Executive Chairman

30 September 2020

Statement of Comprehensive Income

For the six months ended 30 June 2020

Note Unaudited Unaudited Audited

Six months 29 May 2019 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

------------------------------ ----- ------------ ------------- -----------

Continuing operations

Non-recurring costs to

establish National World 5 - - (87,615)

Listing expenses 6 - - (81,268)

Administrative expenses 7 (127,900) - (167,392)

------------ ------------- -----------

Operating loss (127,900) - (336,275)

------------ ------------- -----------

Finance income 8 9,723 - 1,208

------------ -------------

Loss before tax (118,177) - (335,067)

------------ ------------- -----------

Taxation - - -

------------ -------------

Total comprehensive loss

for the period attributable

to the equity owners (118,177) - (335,067)

============ ============= ===========

Loss per share

Basic and diluted 9 (0.002) (0.00) (0.012)

------------ ------------- -----------

The above results were derived from continuing operations.

The notes form part of these Interim Financial Statements.

Statement of Financial Position

As at 30 June 2020

Company Number: 12021298 Note Unaudited Unaudited Audited

As at As at As at

30 Jun 20 30 Jun 31 Dec 19

19

GBP GBP GBP

----------------------------- ----- ------------ ----------- -----------

ASSETS

Current assets

Trade and other receivables 10 40,396 100 127,628

Cash and cash equivalents 11 4,312,865 - 4,383,077

Total current assets 4,353,261 100 4,510,705

------------ ----------- -----------

Total assets 4,353,261 100 4,510,705

------------ ----------- -----------

LIABILITIES

Current liabilities

Trade and other payables 12 28,390 - 67,657

Total current liabilities 28,390 - 67,657

------------ ----------- -----------

Total liabilities 28,390 - 67,657

------------ ----------- -----------

NET ASSETS 4,324,871 - 4,443,048

============ =========== ===========

EQUITY

Share capital 13 54,000 100 54,000

Share premium 14 4,724,115 - 4,724,115

Accumulated losses 14 (453,244) - (335,067)

------------ ----------- -----------

TOTAL EQUITY 4,324,871 100 4,443,048

============ =========== ===========

The Interim Report and Financial Statements were approved by the

Board of Directors and authorised for issue on 30 September

2020.

David Montgomery

Executive Chairman

The notes form part of these Interim Financial Statements.

Statement of Changes in Equity

For the six months ended 30 June 2020

Share Capital Share Premium Accumulated Total

Losses Equity

GBP GBP GBP GBP

---------------------------- -------------- -------------- ------------ ----------

As at 29 May 2019 - - - -

Transactions with owners

Issue of ordinary shares 100 - - 100

As at 30 June 2019 100 - - 100

============== ============== ============ ==========

Share Capital Share Premium Accumulated Total

Losses Equity

GBP GBP GBP GBP

---------------------------- -------------- -------------- ------------ ----------

As at 30 June 2019 100 - - 100

Comprehensive income

Loss for the period - - (335,067) (335,067)

Transactions with owners

Issue of ordinary shares

and subdivision of shares 53,900 5,046,000 - 5,099,900

Cost to issue shares - (321,885) - (321,885)

As at 31 December 2019 54,000 4,724,115 (335,067) 4,443,048

============== ============== ============ ==========

Share Capital Share Premium Accumulated Total

Losses Equity

GBP GBP GBP GBP

---------------------------- -------------- -------------- ------------ ----------

As at 31 December 2019 54,000 4,724,115 (335,067) 4,443,048

Comprehensive income

Loss for the period - - (118,177) (118,177)

As at 30 June 2020 54,000 4,724,115 (453,244) 4,324,871

============== ============== ============ ==========

The notes form part of these Interim Financial Statements.

Statement of Cash Flows

For the six months ended 30 June 2020

Note Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

------------------------------- ----- ------------ ----------- -----------

Cash flow from operating

activities

Operating loss (127,900) - (336,275)

Cash outflow from operating

activities (127,900) - (336,275)

Changes in working capital

Decrease/(Increase) in

trade and other receivables 10 87,232 - (127,628)

(Decrease)/Increase in

trade and other payables 12 (39,267) - 67,657

------------ ----------- -----------

Net cash used in operating

activities (79,935) - (396,246)

------------ ----------- -----------

Cash flows from investing

activities

Interest received 8 9,723 - 1,208

------------ ----------- -----------

Net cash generated from

investing activities 9,723 - 1,208

------------ ----------- -----------

Cash flows from financing

activities

Proceeds from issue of

shares, net of issue costs - - 4,778,115

------------ ----------- -----------

Net cash generated from

financing activities - - 4,778,115

------------ ----------- -----------

Net (decrease)/increase

in cash and cash equivalents (70,212) - 4,383,077

Cash and cash equivalents 4,383,077 - -

at the beginning of the

period

------------ ----------- -----------

Cash and cash equivalents

at the end of the period 4,312,865 - 4,383,077

============ =========== ===========

The notes form part of these Interim Financial Statements.

Notes to the Interim Financial Statements

1. Company information

National World PLC (the "Company") is a public company listed on

the London Stock Exchange in England and Wales. The Company is

domiciled in England and its registered office is 201 Temple

Chambers, 3-7 Temple Avenue, London, United Kingdom, EC4Y 0DT.

The principal activity of the Company is that of identifying and

acquiring investment projects.

The Company was incorporated on 29 May 2019 and the first

audited financial statements for the Company were for the period 29

May 2019 to 31 December 2019. Therefore, the comparative results

for the 2019 interim financial results cover the period from 29 May

2019 to 30 June 2019.

2. Accounting policies

2.1 Basis of preparation

These financial statements of the Company have been prepared on

a going concern basis in accordance with International Financial

Reporting Standards (IFRS) and IFRIC interpretations issued by the

International Accounting Standards Board (IASB) and adopted by the

European Union, in accordance with the Companies Act 2006.

Measurement bases

The financial statements have been prepared under the historical

cost convention. Historical cost is generally based on the fair

value of the consideration given in exchange for assets.

The preparation of the financial statements in compliance with

adopted IFRS requires the use of certain critical accounting

estimates and management judgements in applying the accounting

policies. The significant estimates and judgements that have been

made and their effect is disclosed in note 3.

2.2 Going concern

The Company had GBP 4,312,865 cash as at 30 June 2020 and

ongoing operational costs of cGBP300,000 per annum providing

significant headroom to fund costs associated with evaluating

acquisitions and investments, including due diligence. On this

basis, the Board considers the company to have sufficient resources

to remain in operational existence for the foreseeable future.

2.3. Significant accounting policies

The accounting policies adopted are consistent with those

followed in the preparation of the Annual Report and Accounts of

the Company for the year ended 31 December 2019. A copy of the

Annual Report and Accounts is available on the Company's website at

https://www.nationalworld.com/ .

3. Significant judgments and estimates

The preparation of the Company's financial statements under IFRS

as endorsed by the EU requires the Directors to make estimates and

assumptions that affect the reported amounts of assets and

liabilities at the statement of financial position date, amounts

reported for revenues and expenses during the period, and the

disclosure of contingent liabilities, at the reporting date.

Estimates and judgements are continually evaluated and are based

on historical experiences and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Directors consider that there are no critical accounting

judgements or estimates relating to the financial information of

the Company.

4. Loss before income tax

The loss before income tax is stated after charging:

Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

---------------------------------- ------------ ----------- -----------

Fees payable to the Company's

auditors - audit of the

Company's annual accounts 9,000 - 18,000

Fees payable to the Company's

auditors - non-statutory

audit in relation to the

Company's re-registration

as a plc. - - 2,500

Fees payable to the Company's

auditors - Reporting Accountant

fees - - 15,000

============ =========== ===========

5. Non-recurring costs to establish National World

The Company incurred costs of GBP87,615 in the second half of

2019 which were considered to be one-off to establish National

World Plc, therefore these costs were disclosed separately in the

Statement of Comprehensive Income in the year ended 31 December

2019.

6. Listing Expenses

During the second half of 2019, the Company incurred GBP81,286

in IPO costs and other fees which were disclosed separately in the

Statement of Comprehensive Income in the year ended 31 December

2019.

7. Analysis of expenses by nature

The breakdown by nature of administrative expenses is as

follows:

Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to to 30 Jun to 31 Dec

30 Jun 20 19 19

GBP GBP GBP

------------------------------- ------------ ----------- -----------

Staff costs 9,500 - 4,750

Accounting fees 12,800 - 8,000

Audit fees 9,000 - 18,000

Professional fees 18,400 - 97,577

Other costs, including

financial PR, insurance,

and other fees 78,200 - 39,065

------------ ----------- -----------

Total administrative expenses 127,900 - 167,392

============ =========== ===========

8. Finance income

Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

---------------------- ------------ ----------- -----------

Bank interest 9,723 - 1,208

------------ ----------- -----------

Total finance income 9,723 - 1,208

============ =========== ===========

9. Loss per share

The loss per share has been calculated using the loss for the

period and the weighted average number of ordinary shares entitled

to dividend rights which were outstanding during the period, as

follows:

Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

---------------------------------- ------------ ----------- -----------

Loss for the period attributable

to equity holders of the

Company (118,177) - (335,067)

Weighted average number

of ordinary shares 54,000,000 100 26,813,426

------------ ----------- -----------

Loss per share (0.002) - (0.012)

============ =========== ===========

10. Trade and other receivables

Unaudited Unaudited Audited

30 Jun 20 30 Jun 19 31 Dec 19

GBP GBP GBP

---------------------------- ----------- ----------- -----------

Amounts falling due within

one year:

Prepayments 27,764 - 41,863

Other receivables 12,632 100 85,765

40,396 100 127,628

=========== =========== ===========

The Directors consider that the carrying amount of trade and

other receivables is approximately equal to their value.

Other receivables comprise VAT due on expenses.

11. Cash and cash equivalents

Unaudited Unaudited Audited

30 Jun20 30 Jun 19 31 Dec 19

GBP GBP GBP

-------------- ---------- ----------- -----------

Cash at bank 4,312,865 - 4,383,077

---------- ----------- -----------

4,312,865 - 4,383,077

========== =========== ===========

All bank balances are denominated in pounds sterling with GBP4.2

million held on a term deposit with Barclays Bank plc which

requires 30 days' notice for any withdrawal.

12. Trade and other payables

Unaudited Unaudited Audited

30 Jun 20 30 Jun 19 31 Dec 19

GBP GBP GBP

--------------------------- ----------- ----------- -----------

Amounts falling due in

one year:

Other taxation and social

security 329 - 699

Trade payables 2,361 - 31,969

Other payables - - 1,234

Accruals 20,700 - 33,755

23,390 - 67,657

=========== =========== ===========

13. Share capital

Number of Share Capital Share premium

Shares GBP GBP

Issued and fully paid

Ordinary shares of GBP1

each

At 30 June 2019 100 100 -

=========== ============== ==============

Issued and fully paid

Ordinary shares of 0.1

pence each

At 31 December 2019 54,000,000 54,000 4,724,115

At 30 June 2020 54,000,000 54,000 4,724,115

=========== ============== ==============

The Company was incorporated on 29 May 2019. On incorporation,

100 ordinary shares of GBP1 per par value were issued at par. On 22

July 2019, the Company performed a share subdivision to split the

existing 100 ordinary shares into 100,000 ordinary shares. The new

par value of the shares was 0.1p.

On 25 July 2019, a further 1,700,000 ordinary shares of 0.1p

were issued at 2.64p for a cash consideration of GBP44,900 and

2,200,000 ordinary shares of 0.1p were issued at 2.5p for a cash

consideration of GBP55,000.

On 19 September 2019, 50,000,000 ordinary shares of 0.1p were

issued at 10p, this totalled further cash consideration of

GBP5,000,000.

The holders of ordinary shares are entitled to one voting right

per share and are entitled to dividends out of the profits of the

Company available for distribution.

14. Reserves

Share premium

Includes all premiums in excess of the nominal value of shares

received on issue of share capital.

Accumulated losses

Includes all losses incurred since incorporation.

15. Related party transactions

The related parties are considered to be the Directors who each

have shares on the Company. Their remuneration is as follows:

Unaudited Unaudited Audited

Six months 29 May 19 29 May 19

to 30 Jun to 30 Jun to 31 Dec

20 19 19

GBP GBP GBP

----------------------------- ------------ ----------- -----------

Directors emoluments,

including salary and fees:

D Montgomery 2,500 - 1,250

V Vaghela 2,500 - 1,250

M Hollinshead 1,500 - 750

J Rowe 1,500 - 750

S Barber 1,500 - 750

------------ ----------- -----------

9,500 - 4,750

============ =========== ===========

16. Contingent Liabilities

The Company has agreed that it will pay its former solicitors,

Cooley LLP, GBP90,000 if the Company completes an acquisition. As

this is wholly contingent on an acquisition being made, a liability

has not been recognised at 30 June 2020.

17. Ultimate controlling party

The Company has no ultimate controlling party.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDCRXDDGGC

(END) Dow Jones Newswires

September 30, 2020 02:00 ET (06:00 GMT)

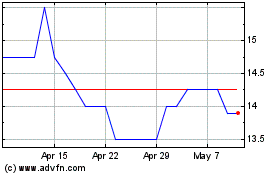

National World (LSE:NWOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

National World (LSE:NWOR)

Historical Stock Chart

From Apr 2023 to Apr 2024