TIDMNWOR

RNS Number : 3276K

National World PLC

31 December 2020

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY IN OR INTO AUSTRALIA, CANADA, JAPAN,

THE REPUBLIC OF SOUTH AFRICA, THE UNITED STATES OR ANY OTHER

JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE

RELEVANT LAWS OF SUCH JURISDICTION

National World plc

("National World," or the "Company")

Acquisition of JPI Publishing Limited and its Subsidiaries ("JPI

Group") and

Directorate Change

National World, (LSE:NWOR) is pleased to announce that it has

acquired JPI Media Publishing Limited ("JPI") and its subsidiaries

("JPI Group") from JPI Media Limited for GBP10.2 million with

completion on 2 January 2021.

Highlights

-- The JPI Group is the third largest local news publisher in

the UK and its iconic titles and websites include: The Scotsman,

The Yorkshire Post, Belfast News Letter, Sheffield Star, Edinburgh

Evening News, Portsmouth News and Lancashire Evening Post.

-- In the year ending 2 January 2021 the JPI Group is estimated

to have revenue of GBP85.0 million and EBITDA (before exceptional

costs) of GBP6.0 million.

-- The JPI Group will provide a platform for National World to

implement its strategy of creating a sustainable local online news

publishing model. In the year to 2 January 2021 the JPI Group is

estimated to have digital revenue of GBP17.0 million.

-- Acquisition of JPI for GBP10.2 million with GBP5.2 million

satisfied in cash on completion and two deferred payments of GBP2.5

million each on 31 March 2022 and 31 March 2023.

-- The Company will provide GBP6.5 million working capital

facilities to JPI Group post completion.

-- National World has funded the acquisition from its own cash

resources and by the issue of GBP8.425 million of loan notes.

National World is seeking to issue further loan notes during

January 2021 and has also entered a committed obligation with one

of its shareholders to issue a further GBP2.0 million of loan notes

during January 2021.

-- The loan notes pay interest at 10% and are convertible into

shares in National World, subject to certain conditions.

-- Trading in the shares of National World will remain suspended

until such time as the Company has published a prospectus relating

to the JPI Group (approved by the FCA) and the shares are

re-admitted to trading on the Standard List of the London Stock

Exchange.

-- On 1 January 2021, Mark Hollinshead will be appointed Chief

Commercial Officer and Daniel Cammiade will be appointed as a

non-executive director.

Commenting on the acquisition, National World's Chairman, David

Montgomery, said:

"JPI 's historic publishing brands represent the best in

journalism and have reliably served their communities and supported

local businesses, in some cases for centuries, and never more than

in the last year. National World will uphold this tradition and

implement modern technology to grow the business across a wider

footprint based on high quality, unique content.

"I am pleased with the appointment of Mark as Chief Commercial

Officer and welcome Daniel to the Board. We have a very experienced

Board with extensive knowledge in digital and print publishing to

deliver our transformational strategy for growth."

For further information please contact:

National World plc c/o Montfort Communications

David Montgomery +44 (0)77 3970

Vijay Vaghela 1634

Dowgate Capital Limited - Financial Advisers

and Brokers +44 (0)20 3903

James Serjeant 7715

Alvarium MB (UK) Limited - Financial Advisers +44(0)20 7195

Zeph Sequeira 1400

Stanhope Capital LLP - Financial Advisers

Nigel Spray

Rakesh Sharma +44 (0)20 7725

Emmanuel Daïen 1800

Montfort Communications - Financial PR & +44 (0)77 3970

IR 1634

Nick Miles +44 (0)78 1234

Olly Scott 5205

Further information on National World and JPI Group

Introduction

The Company listed on the standard section of the London Stock

Exchange in September 2019 to create a modern platform for news

publishing by implementing a new operating model using the latest

technology. Its strategy involves consolidation and change by

combining digital innovation and traditional print assets to grow

revenue by aggregation of audiences and reduce costs via shared

services.

On 2 December 2019 the Company announced that it was

contemplating several acquisitions and had approached JPI Media

Limited following speculation about the sale process for its

regional titles. Since that date there have also been discussions

involving several potential acquisitions, some of which are

ongoing.

On 2 January 2021 the Company will complete the acquisition JPI

Media Publishing Limited ("JPI") and its subsidiaries ("JPI Group")

from JPI Media Limited.

JPI Group

The JPI Group is the third largest publisher of regional

newspapers and websites in the UK with over 100 newspapers

including 13 daily newspapers. Iconic brands and websites include:

The Scotsman, The Yorkshire Post, Belfast News Letter, Sheffield

Star, Edinburgh Evening News, Portsmouth News and Lancashire

Evening Post.

In the year ending 2 January 2021 the JPI Group will have

estimated revenues of GBP85 million and EBITDA (before exceptional

costs) of GBP6 million. Estimated digital revenue for the period to

2 January 2021 is GBP17 million.

The business will be acquired with no debt and has no historic

defined benefit pension obligations.

Reasons for the acquisition of the JPI Group

JPI Group provides a portfolio of iconic brands spanning across

the UK, which provides a strong base from which to implement the

National World strategy of creating a modern platform for news

publishing with a new operational model supporting local sites

across the entire UK.

Financing for the acquisition of JPI

National World is acquiring JPI for a total consideration of

GBP10.2 million. The consideration is to be satisfied by GBP5.2

million in cash at completion and two deferred payments of GBP2.5

million each on the 31 March 2022 and 31 March 2023.

The Company will provide GBP6.5 million working capital

facilities to JPI Group post completion.

National World has funded the acquisition from its own cash

resources and by the issue of GBP8.425 million of loan notes.

National World is seeking to issue further loan notes during

January 2021 and has also entered a committed obligation with one

of its shareholders to issue a further GBP2 million of loan notes

during January 2021

The loan notes:

- pay interest at 10% per annum payable twice annually on 30 June and 31 December;

- are redeemable on 31 December 2023 or on 31 December 2021 and

31 December 2022 at the option of the Company;

- are convertible into ordinary shares of the Company at a

conversion price of 11p per ordinary share when trading in the

ordinary shares on the London Stock Exchange resumes; and

- on conversion the loan note holders are entitled to receive a

bonus payment equal to 10% of the amount of loan notes subscribed

for, payable in ordinary shares in the Company at 11p per ordinary

share.

Conversion of the loan notes are conditional, inter alia,

upon:

- approval of the shareholders of National World at a general meeting; and

- admission of the ordinary shares to trading on the Official

List of the London Stock Exchange.

As conversion of the loan notes may result in one or more of the

loan note holders owning more than 30% of the issued share capital

of the Company the right to convert the loan notes is subject to

the publication of a circular to the shareholders of National World

(approved by the Takeover Panel) and the approval of the

shareholders of National World at a general meeting.

The GBP8.425 million of loan notes issued in December 2020 were

subscribed for by shareholders of National World. The Company

intends to make further issues of loan notes (on the same terms) to

provide further capital for its strategy in advance of re-admission

of the ordinary shares to trading on the Official List of the

London Stock Exchange and may also consider a further issue of

ordinary shares at that time.

The loan notes have been subscribed for by:

- the directors of the Company: David Montgomery GBP100,000;

Vijay Vaghela GBP100,000; Mark Hollinshead GBP25,000; John Rowe

GBP100,000 and Steve Barber GBP100,000;

- Mediaforce (Holdings) Limited ("Mediaforce") a company

controlled by Malcolm Denmark, GBP6 million. As part of the

agreement to subscribe for loan notes the Company has agreed that

Mediaforce may appoint two directors to the board of National World

if they have a shareholding of more than 20%; and

- Alasdair Locke GBP2 million. Alasdair Locke owns 5,000,000

ordinary shares in the Company (9.26% of the issued share capital).

Alasdair Locke has also agreed to subscribe for a further GBP2

million of loan notes during January 2021 should further funding be

required.

Changes to the Board of Directors

Following the acquisition of JPI, Mark Hollinshead, who is

currently a non-executive director will become Chief Commercial

Officer and Daniel Cammiade will be appointed to the Board as a

non-executive director.

Daniel Cammiade is the chief executive of Tindle Newspapers

Limited. National World confirms that there is no further

information to be disclosed under the requirements of Listing Rule

9.6.13 in relation to the appointment of Daniel Cammiade.

Trading in the ordinary shares

Trading in the ordinary shares has been suspended since 2

December 2019. For trading to resume the Company will be required

to publish a prospectus, prepared in accordance with the Prospectus

Regulation Rules, and setting out information on the JPI Group, the

loan notes and any further issue of ordinary shares.

Following publication of the prospectus application will be made

for the ordinary shares to be admitted to the standard segment of

the Official List and admitted to trading on the Main Market of the

London Stock Exchange. Applications will also be made in respect of

any future issue of shares in the Company's share capital

(including or pursuant to options or otherwise) to be admitted to

trading on standard segment of the Official List and to trading on

the London Stock Exchange's Main Market.

The Company anticipates that it will publish a prospectus and

that trading in the shares will resume in early April 2021. The

Prospectus will be available at the Company's website

(https://www.nationalworld.com) as soon as practicable following

its publication.

General Meeting

The Company intends to convene a general meeting prior to the

publication of a prospectus to pass resolutions to approve:

- the issue of ordinary shares to the loan note holders on conversion of the loan notes; and

- the issue of further ordinary shares to fund the Company's strategy.

Issued Shares and Total Voting Rights

As at 6.00pm on 30 December 2020 (being the latest practicable

date prior to the publication of this announcement) the Company's

issued share capital comprised 54,000,000 ordinary shares of

GBP0.10 each. Each Ordinary Share carries the right to one vote at

a general meeting of the Company and, therefore, the number of

voting rights in the Company as at 6.00pm on 30 December 2020 is

54,000,000.

Expected Timetable for issue of Prospectus

February 2021

-- Publication of a shareholder circular and notice of general meeting

March 2021

-- General meeting of the Company

-- Publication of the prospectus

April 2021

-- Re-admission of the ordinary shares to trading.

This announcement contains inside information for the purposes

of the Market Abuse Regulation (EU) NO. 596/2014. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain. The person responsible for

arranging for the release of this announcement on behalf of

National World is Vijay Vaghela, Chief Operating Officer.

- Ends -

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQLFLFXBLLXFBK

(END) Dow Jones Newswires

December 31, 2020 08:00 ET (13:00 GMT)

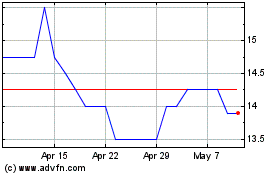

National World (LSE:NWOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

National World (LSE:NWOR)

Historical Stock Chart

From Apr 2023 to Apr 2024