TIDMNWOR

RNS Number : 2331W

National World PLC

22 April 2021

National World plc

("National World," or the "Company")

Results for the year ended 31 December 2020

Notice of Annual General Meeting

National World, (LSE: NWOR.L), the investment business

established to create a modern platform for news publishing through

acquisition and transformation, announces its results for the year

ended 31 December 2020, together with details of its forthcoming

Annual General Meeting, ("AGM").

During the year, the Company continued to evaluate a number of

acquisition opportunities. F ollowing a three month due diligence

process, it completed the acquisition of JPIMedia Publishing

Limited and its subsidiaries, (the "JPI Group") on 2 January 2021

("the Acquisition). As the Acquisition was completed after the 2020

financial year end, the National World results for the year ended

31 December 2020 do not consolidate the results of JPI Group.

JPI Group was acquired for GBP10.2 million, on a debt free, cash

free basis with a normalised level of working capital, with GBP5.2

million paid in cash on completion of the Acquisition on 2 January

2021 ("Completion") (GBP500,000 for equity and GBP4.7 million

repayment of debt due to the previous vendors, JPIMedia Limited

("JPIMedia")) and two deferred payments of GBP2.5 million each on

31 March 2022 and 31 March 2023. Following Completion, a further

payment of GBP1.7 million to JPIMedia was made on 31 March 2021

representing the cash left in the business on Completion (GBP0.5

million) and working capital in the JPI Group on Completion being

higher than the normalised level of working capital. The initial

consideration was funded by the issue of GBP8.4 million convertible

secured loan notes and the Company's existing cash resources.

Following Completion, the Company issued a further GBP11.6 million

convertible secured loan notes and GBP1 million interest only

unsecured loan notes to provide working capital facilities and

headroom to explore further acquisitions and investments.

David Montgomery, Executive Chairman, said:

"We are pleased to have commenced the implementation of our

strategy with the acquisition of JPI Group. We have already made

progress with our Localise, Energise, Digitise, Monetise programme,

empowering local news teams and reenergising titles.

"In addition, we have launched NationalWorld.com, a website

serving the whole of the UK, edited outside London and drawing on

the quality of our regional publishing strength.

"We have exciting plans for the future and look forward to

continuing the development of the business on a UK wide footprint

and securing new acquisition opportunities as they become

available."

Since the acquisition of JPI Group, management has:

-- Streamlined the head office function, reorganising operations

into seven regional media divisions and providing commercial teams

with new digital marketing skills;

-- United P&L responsibility with regional editorial and commercial resources;

-- Enhanced existing news websites and developed launch plans in

contiguous markets to strengthen market share and grow

audience;

-- Increased unique local content to enhance the quality and

appeal of newspapers and websites;

-- Begun trialling a new subscription platform to drive daily

engagement with premium content; and

-- Management is confident that annualised savings of GBP5.0

million (GBP4.0 million annualised already secured) will be

delivered during 2021 with restructuring costs of GBP4.0

million.

Results for period ended 31 December 2020

The 2020 Annual Report is available on our website:

https://www.nationalworldplc.com/investors/reports-presentations-and-publications/year/2021

.

The consolidated financial statements of JPIMedia Publishing

Limited will be made available on our website (

https://www.nationalworldplc.com ) until such time as they are

available at Companies House.

Excerpts of the consolidated report and audited financial

statements of the Company for the year ended 31 December 2020 are

set out below.

Notice of AGM

A notice of the AGM of the Company, together with a form of

proxy, will be posted to shareholders in the coming days. The AGM

is to be held on 30 June 2021 at 11.00 am.

In light of efforts to prevent a new wave of COVID-19

infections, the Company will hold the AGM as a virtual meeting in

accordance with the provisions of its articles of association.

All voting at the resolutions at the AGM will be conducted on a

poll which means that shareholders should submit their proxy (by

post or online voting) as soon as possible. We ask that all

questions which shareholders wish to raise be submitted to

ir@nationalworld.com in advance.

Full details will be contained in the AGM documents to be sent

to shareholders and made available on the Company's website:

https://www.nationalworldplc.com/investors/reports-presentations-and-publications/year/2021

.

This announcement contains inside information for the purposes

of Article 7 of Regulation 2014/596/EU (which forms part of

domestic UK law pursuant to the European Union (Withdrawal) Act

2018 ("UK MAR"). Upon the publication of this announcement, this

inside information (as defined in UK MAR) is now considered to be

in the public domain. For the purposes of UK MAR, the person

responsible for arranging for the release of this announcement on

behalf of National World is Vijay Vaghela, Chief Operating

Officer.

- Ends -

For further information please contact:

National World plc

David Montgomery

Vijay Vaghela

c/o Montfort Communications

Montfort Communications

Nick Miles +44 (0)78 1234

Olly Scott 5205

Excerpts from the consolidated report and audited financial

statements of National World plc for the year ended 31 December

2020.

Chairman's statement

National World Plc was launched to create a modern platform for

news publishing through acquisition and transformation.

On 2 January 2021 the Company completed its first acquisition,

JPIMedia Publishing Limited and its subsidiaries, (the "JPI Group")

owner of 13 regional and city daily newspapers and over one hundred

other franchises in print and online. The historic titles purchased

include the Yorkshire Post, The Scotsman, The Portsmouth News and

The Sheffield Star stretch from the south of England to the north

of Scotland. In addition, the Northern Ireland titles include The

Newsletter, the oldest English language newspaper in the world, and

The Derry Journal.

In the last four months the JPI Group has been undergoing a

comprehensive overhaul in line with the Company's policy of

Localise, Energise, Digitise, Monetise in pursuit of a sustainable

news platform.

The centralised structure is in the process of being dismantled,

transferring resources to the local franchises to bring journalists

and sales staff closer to the communities and the advertisers they

serve. Content and commercial responsibility have been transferred

to the individual franchises, grouped in seven regions.

Many titles, print and online, are in the process of being

upgraded with richer and exclusive content. This accords with

National World's strategy to introduce payment for premium online

content at an early stage which recognises that original and unique

local content is highly prized by social media platforms. Those

platforms are now making payment for such content, including to JPI

Group, and this trend is likely to increase either through

voluntary arrangements or as seems possible through legislative

intervention.

The Company is also planning to leverage the JPI Group's market

position and talent to launch new online products and exploit its

UK wide footprint. The Company has liberated itself from the

traditional geographical restrictions of regional publishing by

launching nationalworld.com as a website serving the whole of the

UK. This has been facilitated by an expansion of high quality

content generated by our existing editorial team and exploiting

specialist knowledge in a number of key consumer areas.

NationalWorld.com is edited outside London but with the authority

and stance of a national newspaper and featuring an illustration of

the front page on the website each day. In parallel with this,

National World is expanding e-commerce operations across its

regional and national estate to take account of the attractive

demographics of its quality audience that some other publishers

lack.

Since inception, National World has been forging partnerships

with technology businesses in order to match content to audiences,

optimising sales and subscription revenue. The Company expects to

announce further launches and technology partnerships in the near

future. These will be accompanied by a rolling programme of product

enhancements and relaunches.

Since the completion of the acquisition, the pace of change has

been swift with a focus on preparing the business to deliver on the

revenue potential of the country emerging from lockdown in the

second quarter of 2021. National World's management team has

previous experience of many of the franchises and the regions in

which the JPI Group operates. This has been of assistance as the

acquisition and transformation to date has been conducted remotely

in accordance with COVID-19 pandemic restrictions.

Whilst trading in the first quarter of 2021 has been adversely

impacted by the lockdown arising from COVID-19, management has

taken appropriate steps to mitigate the impact to support profits

and cash flow.

On behalf of the Board, I thank the JPI Group's staff for the

enthusiasm with which they have supported the restructure and the

commitment shown to the publications and the communities

served.

National World expects to issue an update on trading after its

shares return to trading on the London Stock Exchange.

David Montgomery

Executive Chairman

22 April 2021

Strategic report

The Directors present the Strategic Report of National World Plc

for the year ended 31 December 2020.

Review of Business in the Period

Operational Review

The Company was set up by David Montgomery to pursue

opportunities in the news publishing and digital media sector

and/or in associated complementary technologies. Vijay Vaghela

joined the Company in July 2019 following his retirement from Reach

plc.

Upon admission on 19 September 2019, ("Admission") the Company

issued 50,000,000 ordinary shares at 10 pence per share and all

ordinary shares were admitted to Standard Listing on the Official

List in accordance with Chapter 14 of the Listing Rules of the FCA

and to trading on the Main Market of the London Stock Exchange.

Since September 2019, when the Company's shares started trading

on the London Stock Exchange, the Company evaluated several

potential acquisitions, a number of which were deemed unsuitable

due to either the outlook and/or valuation. Following a three month

due diligence process supported by our investment banking advisers,

brokers, lawyers and external accounting support, the Company

completed the acquisition of JPIMedia Publishing Limited and its

subsidiaries (the "JPI Group") on 2 January 2021. JPI Group was

acquired for GBP10.2 million, on a debt free, cash free basis with

a normalised level of working capital, with GBP5.2 million paid in

cash on Completion (GBP500,000 for equity and GBP4.7 million

repayment of debt due to the previous vendors, JPIMedia Limited)

and two deferred payments of GBP2.5 million each on 31 March 2022

and 31 March 2023. Following Completion, a further payment of

GBP1.7 million to the previous vendors was made on 31 March 2021

representing the cash left in the business on Completion (GBP0.5

million) and working capital in the JPI Group on Completion being

higher than the normalised level of working capital.

The acquisition was funded by the issue of GBP8.4 million

convertible secured loan notes issued on 31 December 2020 and cash

resources of GBP4.2 million held by the Company at that time.

During January and February 2021, the Group issued a further

GBP11.6 million convertible secured loan notes and GBP1.0 million

of interest only unsecured loan notes to provide working capital

facilities and headroom to explore further acquisitions and

investments. The convertible secured loan notes have a right to

elect to convert into new ordinary shares in the Company when its

shares are readmitted to trading on the London Stock Exchange. The

Company has received irrevocable elections from the holders of all

the convertible secured loan notes to convert their loan notes into

new ordinary shares at admission.

The JPI Group is the UK's third largest local news publisher and

its iconic titles and websites include: The Scotsman, The Yorkshire

Post, Belfast Newsletter, Sheffield Star, Edinburgh Evening News,

Portsmouth News and Lancashire Evening Post.

In the 52 week period ended 2 January 2021 the JPI Group had

revenue of GBP88.2 million and EBITDA (before non-recurring costs)

of GBP7.7 million.

The Board will continue to evaluate acquisitions and will update

the market on progress once exclusivity has been granted and/or

there is a high probability that a transaction can be

completed.

Since December 2019, the Company's ordinary shares have been

suspended from trading on the London Stock Exchange as it was

considering a potential acquisition. The Company anticipates the

publication of a prospectus by no later than May 2021 to seek

re-admission to a Standard Listing and trading on the Main Market

of the London Stock Exchange.

Business Strategy

The Company's objective is:

"To create a modern platform for news publishing through the

implementation of a new operating model across multiple brands and

platforms by acquiring a number of media and digital technology

assets and leveraging its portfolio to launch new media brands

across the UK."

Key pillars of transformation

In a world of media commoditisation and increasing domination by

a handful of tech behemoths, National World's strategy is to create

a new publishing business model that enables us to "localise,

energise, digitise and monetise" relevant and unique content:

-- Localise - Our publishing assets provide compelling content

for local communities; both consumers and businesses. A greater

sense of community awareness has also been generated during the

COVID-19 pandemic as more consumers have lived their lives in a

smaller locale. With this new spirit of localism, we will ensure

our journalists and commercial teams are more connected with the

local communities they serve.

-- Energise - Enhance users' experience of our products and

services to increase engagement and provide a strong platform to

leverage our unique quality content to launch new products and

services across multiple platforms. While our print news-brands

will be managed creatively and profitably, our strategic focus is

on growing local, regional and national online audiences who are

deeply engaged with our content.

-- Digitise - Enhance our digital infrastructure to improve

responsiveness, engagement, data analytics, AI content generation

and user insights.

-- Monetise - Create enhanced first party data and use the

latest available digital technology to more effectively define

audiences to drive multiple digital revenue streams: digital

display advertising - targeting growth in higher yielding video

content and local digital advertising, digital subscription -

targeting both consumers and businesses and e-commerce -focusing on

specific categories of content.

National World will retain, recruit and develop talented people,

appropriately incentivised and motivated, and provide them with the

pre-requisite digital skills that will aid the execution of it's

strategy.

The Company's strategy will involve consolidation and change by

combining acquired digital technology innovation and traditional

print assets in a new industry model designed to grow revenue by

aggregation of audiences and maximising efficiencies.

As the operating model can be applied to many territories, the

Company will not be limited to particular geographic regions.

However, the initial focus will be to invest in the UK.

Implementation plans

National World will deliver its vision through a clear set of

strategic initiatives:

-- Materially reduce the size of the central infrastructure -

Minimise central infrastructure for the key functions of editorial

and commercial to ensure all parts of the organisation have full

clarity and responsibility for the delivery of product and

performance enhancements. The central function will provide

efficient back office functions (IT, Finance, HR, etc) and will

have editorial and commercial expertise to support local management

to drive engagement and revenue;

-- Significantly strengthen local management to prioritise the

generation of unique local content and building revenue supported

by a focused central expertise;

-- Focused portfolio management to ensure the right titles on

the appropriate platforms are serving the right local communities

and businesses. The titles in both print and digital need to be

energised through relaunch with enhancements to content, layout and

commercial appeal increasing engagement with consumers and

providing advertisers with an improved response on their marketing

spend;

-- Capitalise on opportunities to launch new products and

services by , leveraging the strong base of editorial and

commercial expertise initially across the UK; and

-- Continue to evaluate acquisitions, investments and strategic

partnerships to build scale, accelerate digitisation, product

enhancement and drive efficiencies.

Key deliverables

To monitor progress, the Board will assess the appropriate KPIs

which will be actively monitored and reported and will cover:

-- Digital audience . Including unique users, page views and registrations;

-- Digital revenue. Build through display, subscriptions, video and e-commerce;

-- Revenue trends. Improve revenue trends with KPIs that monitor

a transition from dependency on print sales to an accelerating

digital performance; and

-- Cash generation and financial flexibility . Provide headroom

for investment and the return of capital to shareholders through

either dividends and/or share buy backs. Management are keen to

ensure financial flexibility will be a key KPI.

During the first half of 2021 the Board has and will focus on

stabilising the JPI Group and establishing the appropriate

organisation structure. It will present detailed KPIs for

monitoring performance in the 2021 interim results.

Acquisition strategy

In selecting acquisition opportunities, the Board will focus

on:

-- media assets where opportunities exist to implement its new strategy and add value; and

-- new technologies to enable and accelerate implementation of the change strategy.

The acquisition of the JPI Group provides a strong base from

which to build the strategy. As the acquisition of the JPI Group is

a reverse takeover, the Company anticipates the publication of a

prospectus by no later than May 2021 to seek re-admission to a

Standard Listing and trading on the Main Market of the London Stock

Exchange.

The Company's investments or acquisitions may be in companies,

partnerships, special purpose vehicles, joint ventures or direct

interests in new digital applications or traditional publishing

media assets where the Directors believe the opportunity exists to

apply the strategy and achieve improved financial returns. The

Company will be focused on those acquisitions that offer either a

material shareholding and/or management control.

Events since the year end

-- The acquisition of JPI Group announced on 31 December 2020, completed on 2 January 2021.

-- On 1 January 2021, Mark Hollinshead was appointed Chief

Commercial Officer and Daniel Cammiade was appointed as a

non-executive director.

-- On 4 January 2021, the Company paid GBP4,717,000 to JPI Media

Limited representing the outstanding borrowing due at

Completion.

-- On 21 January 2021, the Company issued a further GBP5.7

million convertible secured loan notes.

-- On 8 February 2021, the Company issued a further GBP5.9

million secured convertible loan notes, bringing the total

convertible secured loan notes issued to GBP20 million.

-- On 12 February 2021, the Company issued GBP1 million interest only unsecured loan notes.

-- On 31 March 2021, the Company paid GBP1,686,000 (including

GBP472,000 cash retained in the business on Completion) to JPI

Media Limited representing the amount by which the working capital

in the JPI Group on Completion was greater than normalised working

capital.

-- On 20 April 2021, Steve Barber was appointed as Senior Independent Director.

Loan notes of GBP21 million, (GBP20 million convertible secured

and GBP1 million interest only unsecured) have been issued to fund

the acquisition of the JPI Group, future investment and ongoing

working capital requirements. As at 22April 2021 the Company had

received irrevocable elections to convert all GBP20 million of

convertible secured loan notes into new ordinary shares conditional

upon the Company's shares being admitted to trading on the London

Stock Exchange.

From the beginning of 2021, the Company has commenced the

transformation process for the JPI Group and has made good progress

on:

-- streamlining a large head office function and transformation

of the operating structure with the creation of seven regional

media divisions covering commercially homogeneous geographical

markets;

-- realigning local and regional editorial and commercial

resource, with P&L responsibility vested with local

management;

-- enhancement of existing news websites and development of

launch plans in contiguous markets to strengthen market share and

grow audience;

-- enhancing the quality and appeal of newspapers and websites

with increased unique local content;

-- development and launch of a new national news website which

will have a particular emphasis on promoting life outside

London;

-- trialling of a new subscription platform to engage on our

website for premium content on a daily basis;

-- training and development of commercial teams in digital marketing skills; and

-- the delayering and flattening of the management structures

and other efficiencies is expected to deliver annualised savings of

GBP5.0 million (GBP4.0 million annualised already secured) during

2021 with restructuring costs of GBP4.0 million.

The reorganisation of the operations will provide a strong base

to drive shareholder value.

Financial review

Results for the year ended 31 December 2020

The Company incurred a loss for the year ended 31 December 2020

of GBP1.1 million (2019: GBP0.3 million loss). The loss for the

year results from: the on-going administrative expenses of GBP0.2

million ( 2019 : GBP0.2 million) required to operate the Company;

and non-recurring costs related to the acquisition of the JPI Group

of GBP0.8 million.

Cash flow

Net cash inflow for 2020 was GBP8.3 million (2019: inflow GBP4.4

million). This represents the GBP8.4 million raised through the

issue of convertible secured loan notes partially offset by net

cash outflows of GBP0.1 million in relation to ongoing

administration costs, working capital and interest receipts.

As at 31 December 2020, the Company held GBP12.7 million (2019:

GBP4.4 million) of cash.

Key Performance Indicators

Other than continued monitoring and minimisation of all

operating costs expenditure, there are no key performance

indicators for the year ended 31 December 2020 as the Company had

not completed an acquisition.

During the first half of 2021 the Board has and will focus on

stabilising and establishing the appropriate organisation structure

of the JPI Group and will present detailed KPIs for monitoring

performance in the 2021 interim results.

Position of Company's Business

As at 31 December 2020 the Company's Statement of Financial

Position shows net assets totalling GBP3.3 million (2019: GBP4.4

million). The Company has minimal liabilities apart from the

convertible secured loan notes and is considered to have a strong

cash position of GBP12.7 million at 31 December 2020.

The Board contains personnel with a good history of running

businesses that have been compliant with all relevant laws and

regulations and there have been no instances of non-compliance in

respect of environmental matters.

The Company endeavours to ensure that its employment practices

consider the necessary diversity requirements and compliance with

all employment laws. The Board has experience in dealing with such

issues and sufficient training and qualifications to ensure they

meet all requirements.

The government of the United Kingdom has issued guidelines

setting out appropriate procedures for companies to follow to

ensure that they are compliant with the UK Bribery Act 2010. The

Company has conducted a review into its operational procedures to

consider the impact of the UK Bribery Act 2010 and the Board has

adopted an anti-corruption and anti-bribery policy.

Statement of Comprehensive Income

31 Dec 20 29 May 19

to 31 Dec

19

Note GBP'000 GBP'000

------------------------------------- ----- ---------- -----------

Continuing operations

Non-recurring costs to establish

National World - (88)

Listing expenses 6 - (81)

Acquisition costs 7 (839) -

Administrative expenses 8 (244) (167)

Operating loss (1,083) (336)

---------- -----------

Finance income 9 12 1

Finance expense 10 (2) -

---------- -----------

Loss before tax (1,073) (335)

---------- -----------

Taxation 11 - -

---------- -----------

Total comprehensive loss for the

period attributable to the equity

owners (1,073) (335)

========== ===========

Loss per share

Basic and diluted (pence per share) 12 (2.0) (1.2)

---------- -----------

The notes form part of these financial statements.

Statement of Financial Position

As at As at

31 Dec 31 Dec

20 19

Note GBP'000 GBP'000

----------------------------- ----- -------- ---------

ASSETS

Current assets

Trade and other receivables 13 8 128

Cash and cash equivalents 14 12,693 4,383

-------- ---------

Total current assets 12,701 4,511

-------- ---------

Total assets 12,701 4,511

-------- ---------

LIABILITIES

Current liabilities

Trade and other payables 15 904 68

Total current liabilities 904 68

-------- ---------

Non-Current Liabilities

Borrowings 16 8,427 -

Total liabilities 9,331 68

-------- ---------

NET ASSETS 3,370 4,443

======== =========

EQUITY

Share capital 17 54 54

Share premium 18 4,724 4,724

Accumulated losses 18 (1,408) (335)

-------- ---------

Total equity 3,370 4,443

======== =========

The financial statements were approved by the Board of Directors

and authorised for issue on 22April 2021.

David Montgomery

Executive Chairman

Statement of Changes in Equity

Share Capital Share Premium Accumulated Total Equity

Losses

GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------------- -------------- ------------ -------------

As at 29 May 2019 - - - -

Comprehensive income

Loss for the period - - (335) (335)

-------------- -------------- ------------ -------------

Transactions with

owners

Issue of ordinary

shares 54 5,046 - 5,100

Cost to issue shares - (322) - (322)

As at 31 December

2019 54 4,724 (335) 4,443

============== ============== ============ =============

As at 1 January 2020 54 4,724 (335) 4,443

Comprehensive income

Loss for the period - - (1,073) (1,073)

-------------- -------------- ------------ -------------

As at 31 December

2020 54 4,724 (1,408) 3,370

============== ============== ============ =============

Statement of Cash Flows

31 Dec 20 31 Dec 19

Note GBP'000 GBP'000

---------------------------------------- ----- ---------- ----------

Cash flow from operating activities

Operating loss (1,073) (335)

Adjustments for non-cash/non-operating

items:

Finance income 9 (12) (1)

Finance expense 10 2 -

---------- ----------

Cash outflow from operating activities (1,083) (336)

Changes in working capital

Decrease/(Increase) in trade and

other receivables 13 121 (128)

Increase in trade and other payables 15 897 68

---------- ----------

Net cash used in operating activities (125) (396)

---------- ----------

Cash flows from investing activities

Interest received 9 12 1

---------- ----------

Net cash generated from investing

activities 12 1

---------- ----------

Cash flows from financing activities

Proceeds from issue of shares,

net of issue costs - 4,778

Issue of convertible loan notes 16 8,423 -

---------- ----------

Net cash generated from financing

activities 8,423 4,778

---------- ----------

Net increase in cash and cash

equivalents 8,310 4,383

Cash and cash equivalents at the 4,383 -

beginning of the period

---------- ----------

Cash and cash equivalents at the

end of the period 12,693 4,383

========== ==========

Notes

1 Company information

National World Plc (the "Company" or "National World") is a

public company listed on the London Stock Exchange in England and

Wales. The Company is domiciled in England and its registered

office is 201 Temple Chambers, 3-7 Temple Avenue, London, United

Kingdom, EC4Y 0DT.

The principal activity of the Company is to operate in the news

publishing sector.

The prior period was from incorporation on 29 May 2019 to 31

December 2019. Therefore, the comparative figures are not directly

comparable.

2 Summary of significant accounting policies

The principal accounting policies applied in the preparation of

these financial statements are set out below. The policies have

been consistently applied to all the years presented, unless

otherwise stated.

2.1 Basis of preparation

These financial statements of the Company have been prepared on

a going concern basis in accordance with International Financial

Reporting Standards (IFRS) and IFRIC interpretations issued by the

International Accounting Standards Board (IASB) and adopted by the

European Union, in accordance with the Companies Act 2006.

Measurement bases

The financial statements have been prepared under the historical

cost convention. Historical cost is generally based on the fair

value of the consideration given in exchange for assets.

The preparation of the financial statements in compliance with

adopted IFRS requires the use of certain critical accounting

estimates and management judgements in applying the accounting

policies. The significant estimates and judgements that have been

made and their effect is disclosed in note 3.

2.2 Going concern

The Company had GBP 12.7 million cash as at 31 December 2020 and

raised a further GBP11.6 million through the issue of convertible

secured loan notes and GBP1.0 million through the issue of interest

only unsecured loan notes during January and February 2021

providing significant headroom to fund operating expenses and costs

associated with evaluating acquisitions and investments, including

due diligence. On this basis, the Board considers the Company to

have sufficient resources to remain in operational existence for

the foreseeable future.

2.3 Functional and presentation currency

The financial information is presented in the functional

currency, pounds sterling ("GBP") except where otherwise

indicated.

2.4 New standards, amendments and interpretations

New standards, interpretations and amendments

The following standards have been endorsed by the EU and are

effective in the Company's accounting year beginning 1 January

2020:

-- Definition of Material (Amendments to IAS 1 and IAS 8); and

-- Definition of a Business (Amendments to IFRS 3).

-- These standards have no material impact on the Company.

Standards, interpretations and amendments in issue but not yet

effective and not early adopted

-- There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Company has decided

not to adopt early. The most significant of these are as follows,

which are all effective for the period beginning 1 January

2022:

-- Onerous Contracts - Cost of Fulfilling a Contract (Amendments to IAS 37);

-- Property, Plant and Equipment: Proceeds before Intended Use (Amendments to IAS 16);

-- Annual Improvements to IFRS Standards 2018-2020 (Amendments

to IFRS 1, IFRS 9, IFRS 16 and IAS 41); and

-- References to Conceptual Framework (Amendments to IFRS 3).

National World is currently assessing the impact of these new

accounting standards and amendments; however, they are not expected

to have a material impact on the Company.

2.5 Segment reporting

Identifying and acquiring investment projects was the only

activity the Company was involved in during 2020 and is therefore

considered as the only operating segment.

The financial information therefore of the single segment is the

same as that set out in the Statement of Comprehensive Income,

Statement of Financial Position, Statement of Changes in Equity and

the Statement of Cash Flows.

2.6 Net finance costs

Finance income

Finance income comprises interest receivable on funds invested

and other interest receivable. Interest income is recognised in

profit or loss as it accrues using the effective interest

method.

Finance expense

Finance expense comprises interest on convertible debt.

2.7 Financial assets

Classification

The Company classifies all its financial assets at amortised

cost. Financial assets do not comprise prepayments. Management

determines the classification of its financial assets at initial

recognition.

Amortised cost

The Company's financial assets held at amortised cost comprise

solely of cash and cash equivalents in the statement of financial

position.

The cash and cash equivalents in the statement of financial

position is entirely made up of deposits held with Barclays Bank

Plc, a counterparty with independent credit ratings of a minimum of

A-.

2.8 Financial Liabilities

The Company classifies its financial liabilities in the category

of financial liabilities at amortised cost. All financial

liabilities are recognised in the statement of financial position

when the Company becomes a party to the contractual provision of

the instrument. Trade and other payables and borrowings are

included in this category.

Trade and other payables

Trade and other payables are initially recognised at fair value

and subsequently measured at amortised cost using the effective

interest rate method. Accounts payable are classified as current

liabilities if payment is due within one year or less. If not, they

are presented as non-current liabilities.

Convertible debt

The proceeds received on issue of the Company's convertible debt

are allocated into their liability and equity components. The

amount initially attributed to the debt component equals the

discounted cash flows using a market rate of interest that would be

payable on a similar debt instrument that does not include an

option to convert.

Subsequently, the debt component is accounted for as a financial

liability measured at amortised cost until extinguished on

conversion or maturity of the bond. The remainder of the proceeds

is allocated to the conversion option and are recognised in other

reserves.

2.9 Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of the Company after deducting all of its

liabilities. Equity instruments issued by the Company are recorded

at the proceeds received net of direct issue costs.

2.10 Income tax

Income tax for the period presented comprises current and

deferred tax. Income tax is recognised in profit or loss except to

the extent that it relates to items recognised directly in equity,

in which case it is recognised in equity.

Deferred income tax is recognised on temporary differences

arsing between the tax bases of assets and liabilities and their

carrying amounts only to the extent that it is likely that they

will be recovered in the foreseeable future.

2.11 Share-based payments

Where share options are awarded to directors or employees, the

fair value of the options at the date of grant is charged to the

statement of comprehensive income over the vesting period.

Non-market vesting conditions are considered by adjusting the

number of equity instruments expected to vest at each balance sheet

date so that, ultimately, the cumulative amount recognised over the

vesting period is based on the number of options that eventually

vest. Market vesting conditions are factored into the fair value of

the options granted. The cumulative expense is not adjusted for

failure to achieve a market vesting condition. No charge was made

for the Value Creation Plan as the Company had not completed an

acquisition in the reporting period.

2.12 Non-recurring costs

Non-recurring costs are disclosed separately in the financial

statements where it is necessary to do so to provide further

understanding of the financial performance of the Company. They are

items that are material, either because of their size or their

nature and are presented within the line items to which they best

relate.

3 Significant judgements and estimates

The preparation of the Company's financial statements under IFRS

as endorsed by the EU requires the Directors to make estimates and

assumptions that affect the reported amounts of assets and

liabilities at the reporting date, amounts reported for revenues

and expenses during the period, and the disclosure of contingent

liabilities, at the reporting date.

Estimates and judgements are continually evaluated and are based

on historical experiences and other factors, including expectations

of future events that are believed to be reasonable under the

circumstances.

The Directors consider that there are no critical accounting

judgements or estimates relating to the financial information of

the Company.

4 Directors and employees

Average monthly number of people (including all directors)

employed by activity:

31 Dec 20 31 Dec 19

No. No.

------------------------------- ---------- ----------

Directors 5 5

Management and administration - -

---------- ----------

5 5

========== ==========

Directors' emoluments:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

------------------------ ---------- ----------

Directors' emoluments:

Salaries and fees 19 5

Other pension costs - -

---------- ----------

19 5

========== ==========

31 Dec 20 31 Dec 19

GBP'000 GBP'000

------------------------ ---------- ----------

Highest paid director:

Salaries and fees 5 1

Other pension costs - -

---------- ----------

5 1

========== ==========

There are no other employees other than the directors of the

Company.

5 Loss before income tax

The loss before income tax is stated after charging:

31 Dec 31 Dec 19

20

GBP'000 GBP'000

------------------------------------------- -------- ----------

Fees payable to the Company's auditors

- audit of the Company's annual accounts 18 18

Fees payable to the Company's auditors

- non-statutory audit in relation to

the Company's re-registration as a plc. - 3

Fees payable to the Company's auditors

- Reporting Accountant fees - 15

======== ==========

6 Listing Expenses

During the year ended 31 December 2020, the Company incurred

GBPnil (2019: GBP81,268) in IPO costs and other fees.

7 Acquisition costs

The Company incurred costs of GBP839,038 which were considered

to be one-off in relation to the acquisition of the JPI Group that

completed on 2 January 2021, therefore these costs have been

disclosed separately in the Statement of Comprehensive Income.

8 Analysis of expenses by nature

The breakdown by nature of administrative expenses is as

follows:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

--------------------------------------------------------------- ---------- ----------

Staff costs 19 5

Accounting fees 29 8

Audit fees 18 18

Tax fees 2 -

Professional fees 17 97

Other costs, including financial PR, insurance and other fees 159 39

---------- ----------

Total administrative expenses 244 167

========== ==========

9 Finance income

31 Dec 20 31 Dec 19

GBP'000 GBP'000

---------------------- ---------- ----------

Bank interest 12 1

---------- ----------

Total finance income 12 1

========== ==========

10 Finance expense

31 Dec 20 31 Dec 19

GBP'000 GBP'000

----------------------------------- ---------- ----------

Interest on convertible loan notes 2 -

---------- ----------

Total finance expense 2 -

========== ==========

11 Taxation

31 Dec 20 31 Dec 19

GBP GBP

------------------------------------------ ---------- ----------

Analysis of charge in period

Loss before tax on continuing operations (1,073) (335)

---------- ----------

Tax at the UK corporation tax rate

of 19% (204) (64)

Effects of:

Expenses not allowable 159 32

Deferred tax asset not recognised

for tax losses 45 32

---------- ----------

Tax charge for the period - -

========== ==========

The standard rate of corporation tax applicable for the period

was 19 per cent.

The Company has tax losses carried forward of GBP400,139 (2019

GBP166,184). The unutilised tax losses have not been recognised as

a deferred tax asset due to the uncertainty over the timing of

future profits and gains.

12 Loss per share

The loss per share has been calculated using the loss for the

period and the weighted average number of ordinary shares entitled

to dividend rights which were outstanding during the period, as

follows:

31 Dec 20 31 Dec 19

Loss for the period attributable to

equity holders of the Company (GBP'000) (1,073) (335)

Weighted average number of ordinary

shares ('000) 54,000 26,813

---------- ----------

Loss per share (pence) (2.0) (1.2)

========== ==========

13 Trade and other receivables

31 Dec 20 31 Dec 19

GBP'000 GBP'000

-------------------------------------- ---------- ----------

Amounts falling due within one year:

Prepayments 4 42

Other receivables 4 86

---------- ----------

8 128

========== ==========

It is the Company's policy to assess receivables for

recoverability based on historical data available to management in

addition to forward looking information utilising management's

knowledge. The Directors consider that the carrying amount of trade

and other receivables is approximately equal to their value.

14 Cash and cash equivalents

31 Dec 20 31 Dec 19

GBP'000 GBP'000

-------------------------------- ---------- ----------

Cash at bank 6,693 4,383

Cash held in escrow by Lawyers 6,000 -

---------- ----------

12,693 4,383

========== ==========

GBP6.0 million of cash was held in escrow by the Company's

lawyers at year end in advance of the completion of the acquisition

of the JPI Group on 2 January 2021. On 4 January 2021 and 5 January

2021, the Company advanced GBP7.9 million and GBP2.6 million

respectively to the JPI Group for working capital purposes and to

fund the repayment of GBP4.7 million of debt payable to the former

vendors.

All bank balances are denominated in pounds sterling with GBP4.2

million held on a term deposit with Barclays Bank plc which

requires 30 days' notice for any withdrawal. Notice was given on 24

December 2020 to withdraw the funds from this account, and it was

received by the Company on 23 January 2021.

15 Trade and other payables

31 Dec 20 31 Dec 19

GBP'000 GBP'000

------------------------------------ ---------- ----------

Amounts falling due in one year:

Other taxation and social security - 1

Trade payables 4 32

Other payables - 1

Accruals 900 34

---------- ----------

904 68

========== ==========

16 Borrowings

31 Dec 20 31 Dec 19

GBP'000 GBP'000

------------------------------- ---------- ----------

Non-current

Convertible secured loan notes 8,427 -

---------- ----------

8,427 -

========== ==========

On 31 December 2020, the Company issued 8,425,000 convertible

secured loan notes at a face value of GBP1 each with interest of

10%. The loans are repayable in 3 years from the issue date on 31

December 2023 at the total face value of GBP8,425,000 or can be

converted into shares when the Company relists on the London Stock

Exchange at a rate of 1 share per GBP0.11 of loan. Under the terms

of the convertible secured loan, circumstances can arise where a

variable number of shares are issued, on this basis the instrument

fails the fixed for fixed criteria under IAS 32 and therefore the

instrument is recorded as a liability. A fair value exercise was

performed on the conversion option but has not been disclosed

separately as it is not material to the financial statements. One

day's interest of GBP2,308 has been accrued on the loan balance of

GBP8,425,000 at year end.

A maturity analysis of the Company's borrowings is shown

below:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

------------------------------------ ---------- ----------

Less than one year - -

One to two years - -

Two to five years 8,427 -

---------- ----------

Total including interest cash flows 8,427 -

---------- ----------

Less: interest cash flows (2) -

---------- ----------

Total principal cash flows 8,425 -

========== ==========

17 Share capital

2020 2019

Number GBP'000 Number GBP'000

---------------------------------------------------- ----------- -------- ----------- --------

Issued and fully paid Ordinary shares of 0.1p each

At 31 December 54,000,000 54 54,000,000 54

=========== ======== =========== ========

No Ordinary shares were issued by the Company during the year

ended 31 December 2020.

Voting rights

The holders of ordinary shares are entitled to one voting right

per share.

Dividends

The holders of ordinary shares are entitled to dividends out of

the profits of the Company available for distribution.

18 Reserves

Share premium

Includes all premiums in excess of the nominal value of shares

received on issue of share capital.

Accumulated losses

Includes all losses incurred in the period.

19 Financial instruments

Financial assets

Financial assets measured at amortised cost comprise cash and

cash equivalents, as follows:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

-------------------------------- ---------- ----------

Cash at bank 6,693 4,383

Cash held in escrow by lawyers 6,000 -

---------- ----------

12,693 4,383

========== ==========

Financial liabilities

Financial liabilities measured at amortised cost comprise trade

and other payables and borrowings, as follows:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

-------------------------------- ---------- ----------

Trade payables 4 32

Other payables - 1

Accruals 900 34

Convertible secured loan notes 8,427 -

---------- ----------

9,331 67

========== ==========

The Company's major financial instruments include bank balances

and amounts payables to suppliers. The risks associated with these

financial instruments, and the policies on how to mitigate these

risks are set out below. Risk management is carried out by the

Board. The Company uses financial instruments to provide

flexibility regarding its working capital requirements and to

enable it to manage specific financial risks to which it is

exposed.

Liquidity risk

Liquidity risk arises from the Company's management of working

capital.

The Company regularly reviews its major funding positions to

ensure that it has adequate financial resources in meeting its

financial obligations. The Directors have considered the liquidity

risk as part of their going concern assessment (note 2). Controls

over expenditure are carefully managed in order to maintain its

cash reserves whilst it targets a suitable transaction. Trade and

other payables are all due within one year, a maturity analysis of

borrowings is shown in note 16.

The COVID-19 pandemic resulted in a significant fall in the

value of global stock markets during March 2020. The pandemic has

created a unique environment, which adds additional challenges for

any companies seeking future funding from the capital markets.

Credit risk

The Company's credit risk is wholly attributable to its cash

balance. The credit risk from its cash and cash equivalents is

limited because the counter parties are banks with high credit

ratings and have not experienced any losses in such accounts.

Interest risk

The Company's exposure to interest rate risk is the interest

received on the cash held, which is immaterial.

Capital risk management

The Company's objective when managing capital is to safeguard

the Company's ability to continue as a going concern, in order to

provide returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure. In order

to maintain or adjust the capital structure, the Company may adjust

the amount of dividends paid to shareholders, return capital to

shareholders or issue new shares.

Currency risk

The Company is not exposed to any currency risk at present.

20 Related party transactions

The related parties are considered to be the Directors who each

have shares in the Company. Their remuneration is as follows:

31 Dec 20 31 Dec 19

GBP'000 GBP'000

---------------------------------- ---------- ----------

Directors' emoluments, including

salary and fees:

D Montgomery 5 1

V Vaghela 5 1

M Hollinshead 3 1

J Rowe 3 1

S Barber 3 1

---------- ----------

19 5

========== ==========

Of this amount, GBPNil was payable at 31 December 2020. (2019:

GBP1,000).

21 Ultimate controlling party

The Company has no ultimate controlling party.

22 Subsequent events

The acquisition of JPIMedia Publishing Limited and its

subsidiaries announced on 31 December 2020 completed on 2 January

2021. The principal reason for this acquisition is that the JPI

Group's portfolio of iconic brands provides a strong base from

which to implement the Company's strategy of creating a modern

platform for news publishing with a new operational model

supporting local sites across the entire UK. The Company obtained

control of the JPI Group by acquiring 100% of the share capital.

The acquisition was a reverse takeover. However, as the Company was

incorporated as a special purpose acquisition vehicle, the

acquisition meets the definition of a business combination and will

be accounted for using the acquisition accounting method in

accordance with the Company's accounting policies.

Details of the provisional fair value of identifiable assets and

liabilities acquired purchase consideration and goodwill are as

follows:

Provisional

fair values

GBP'000

-------------------------------------------- -------------

Publishing and Digital Intangible assets -

provisional 10,968

Property, plant and equipment 4,614

Trade and other receivables 13,251

Inventory 16

Cash 472

Trade and other payables (13,772)

Provisions (500)

Lease obligations (3,179)

Borrowings due to JPIMedia Limited (4,717)

---------------------------------------------- -------------

Net assets 7,153

Goodwill - provisional 33

---------------------------------------------- -------------

Total purchase consideration 7,186

---------------------------------------------- -------------

GBP'000

------------------------------------------------- --------

Initial cash consideration for equity 500

Working capital in excess of normalised working

capital on Completion 1,686

Deferred cash consideration* 5,000

--------------------------------------------------- --------

Total purchase consideration 7,186

--------------------------------------------------- --------

Initial cash consideration for equity 500

Working capital in excess of normalised working

capital on Completion 1,686

Cash acquired (472)

Cash outflow on acquisition (net of cash acquired) 1,714

------------------------------------------------------ ------

*Deferred consideration of GBP5.0 million payable in two

instalments, GBP2.5m on 31 March 2022 and GBP2.5m on 31 March

2023.

The goodwill represents the potential growth opportunities and

synergy effects from the acquisition. The goodwill is not

deductible for tax purposes. The initial accounting for the

business combination is incomplete as the identifiable intangible

assets, expected to be publishing titles and digital assets and

have not yet been measured. During the measurement period in 2021,

the Company will identify and measure the identifiable intangible

assets and adjust the provisional amounts recognised at the

acquisition date.

On 1 January 2021, Mark Hollinshead was appointed Chief

Commercial Officer and Daniel Cammiade was appointed as a

Non-Executive director.

On 4 January 2021, the Company paid GBP4,717,000 to JPIMedia

Limited representing the outstanding borrowing due at

Completion.

On 21 January 2021, the Company issued a further GBP5.7 million

convertible secured loan notes.

On 8 February 2021, the Company issued a further GBP5.9 million

convertible secured loan notes, bringing the total convertible

secured loan notes issued to GBP20 million.

On 12 February 2021, the Company issued GBP1 million interest

only unsecured loan notes.

On 31 March 2021, the Company paid GBP1,686,000 (including

GBP472,000 cash retained in the business on Completion) to JPIMedia

Limited representing the amount by which the working capital in JPI

Group on Completion was greater than normalised working

capital.

On 20 April 2021, Steve Barber was appointed as Senior

Independent Director.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UARRRAAUSUUR

(END) Dow Jones Newswires

April 22, 2021 02:15 ET (06:15 GMT)

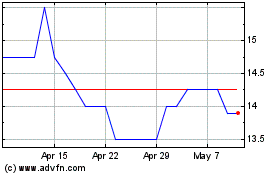

National World (LSE:NWOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

National World (LSE:NWOR)

Historical Stock Chart

From Apr 2023 to Apr 2024