TIDMNXT

RNS Number : 5749X

Next PLC

06 January 2022

Date: Embargoed until 07:00 hrs, Thursday 6 January

2022

Contacts: Amanda James, Group Finance Director (analyst Tel: 0333 777

calls) 8888

Alistair Mackinnon-Musson, Rowbell PR Tel: 020 7717

5239

Photographs: https://www.nextplc.co.uk/media/image-gallery/campaign-images

NEXT PLC

Trading Statement - 6 January 2022

SUMMARY

-- In the eight weeks to 25 December full price sales were up

+20.0% versus two years ago. This was GBP70m ahead of our previous

guidance for the period.

-- We have increased our full year profit before tax guidance by

+GBP22m to GBP822m which would be up +9.8% versus two years

ago.

-- Our initial guidance for the year ending January 2023 is for

full price sales to be up +7.0% versus the current year (year

ending January 2022). We estimate that profit before tax will be up

+4.6% at GBP860m.

-- The Board is declaring a further special dividend of 160p per

share to be paid at the end of January 2022. We intend to return to

our pre-pandemic ordinary dividend cycle in the year ahead.

This statement is divided into two parts. Part One gives the

performance for the eight weeks to 25 December and profit guidance

for the current year (year ending January 2022). Part Two gives

sales and profit guidance for the year ahead.

PART 1: THE CURRENT YEAR

Full Price Sales for the Eight Weeks to 25 December

The table below sets out the full price sales performance for

the eight weeks to 25 December and for the year to date. Please

note that percentage variances are given against two years ago.

Online sales are broken down into (1) NEXT branded stock sold in

the UK, (2) LABEL third-party brands sold in the UK and (3) sales

Overseas. For completeness, the last row of the table shows our

sales performance compared to last year (2020/21).

Q4 Year

Full price sales (VAT exclusive) versus 2019 to 25 December to 25 December

================================================================ =============== ===============

Online NEXT UK +31% +36%

Online LABEL UK +85% +76%

Online Overseas +36% +51%

=============== ===============

Total Online +45% +49%

Retail (UK and Ireland) - 5.4% - 24%

=============== ===============

Total Product full price sales +21% +15%

Finance interest income - 2.5% - 7.8%

=============== ===============

Total full price sales including interest income +20% +13%

Total full price sales including interest income versus 2020/21 +23% +35%

2021/22 Full Price Sales by Quarter

We were expecting sales growth in Q4 to be weaker than Q3,

however, a strong revival in NEXT branded adult formal and

occasionwear significantly improved sales throughout the final

period.

In the run up to Christmas our stock levels were materially

lower than planned. We also experienced some degradation in

delivery service levels as a result of labour shortfalls in

warehousing and distribution networks. The fact that our sales

remained so robust in these circumstances is, we believe, testament

to the strength of underlying consumer demand in the period.

Click or paste the following link into your web browser to view

the chart titled 'Full Price Sales Variance by Quarter 2021 versus

2019'. Refer to page 2 for this chart.

http://www.rns-pdf.londonstockexchange.com/rns/5749X_1-2022-1-5.pdf

End-of-Season Sale

Surplus stock was much lower than expected, and stock for the

end-of-season Sale was down -18% versus two years ago. The

reduction in Sale stock was mainly the result of better than

expected full price sales in the period. Clearance rates, so far,

have been in line with our expectations.

Sales and Profit Guidance for the Current Year

For the full year we now expect full price sales growth of

+12.8% versus 2019/20, GBP70m ahead of our previous guidance. We

have increased our pre-tax profit guidance for the full year by

+GBP22m to GBP822m. (This forecast is based on full price sales in

January being +12% ahead of two years ago).

Guidance for the full year Full year Versus Previous Versus

2021/22 guidance 2019/20 guidance 2019/20

=========================== ========= ======== ========= ========

Full year full price sales GBP4.3bn +12.8% GBP4.2bn +11.0%

Group profit before tax GBP822m +9.8% GBP800m +6.9%

Earnings Per Share (Basic) 530.0p +12.2% 516.9p +9.4%

========= ======== ========= ========

Cash Flow and Special Dividends in the Current Year

We now expect to generate at least GBP345m of free cash(1) ,

before shareholder distributions. On 3 September 2021 we paid a

special dividend of 110p per share, with a total value of GBP140m.

The Board has decided to return a further GBP205m to shareholders

by way of a second special dividend of 160p per share. This

dividend will be paid on Friday 28 January 2022 to shareholders

registered at the close of business on 14 January 2022. Shares will

trade ex-dividend from 13 January 2022.

(1) 'Free cash' here is defined as cash generated after

interest, tax, capital expenditure, the financing of customer

receivables and working capital but before the payment of any

dividends.

PART 2: THE YEAR AHEAD

Economic Uncertainties for 2022

Our headline sales growth expectations of +7.0% sounds

uncontroversial. However, forecasting sales for the year ahead is

unusually difficult and the buoyancy of recent months makes it all

the harder. We are assuming no further disruption from COVID; but

there are five areas of uncertainty in the wider economic

environment that we need to bear in mind, these are:

Pent-up demand To what extent has the buoyancy of the last nine

& savings months been the result of pent-up demand combined

with the spending of savings accumulated over the

pandemic? How much of this will reverse out as

we move through next year?

Travel and To what extent will the return to spending on overseas

leisure holidays and other social activities depress demand

for discretionary goods?

Essential To what extent will inflation in essential goods

goods inflation and services (fuel, electricity, food, etc) reduce

discretionary spending on clothing and homeware?

NEXT goods To what extent will the inflation in our own selling

inflation prices, estimated at around 6% in the second half

(see below), serve to depress the demand for our

products?

Tax and To what extent will the 1.25% increase in National

interest Insurance and possible increases in mortgage rates

rates affect discretionary spending?

Clear answers to these questions are impossible at this stage

but they all point to a tougher environment as we move through next

year.

Full Price Sales Guidance for the Year Ahead

Our guidance for the year ahead assumes full price sales growth

of +7.0% versus 2021/22 (i.e. a one year comparison). This headline

growth rate represents +6.5% compound annual growth against

2019/20, which was the last year to be unaffected by COVID.

Our guidance reflects very strong growth in the first quarter

(when stores were shut in 2021) and anticipates much weaker

year-on-year growth in the last three quarters of 2022 as

comparative numbers improved in 2021. In the chart below, the blue

bars show the one year full price sales growth by quarter. The

green line shows the compound annual growth rate (CAGR) versus the

year ending January 2020 (i.e. over three years) for each quarter.

As can be seen, on a quarter by quarter basis, the compound annual

growth against three years ago looks more realistic.

Click or paste the following link into your web browser to view

the chart titled 'Full Price Sales Variance by Quarter' . Refer to

page 3 for this chart.

http://www.rns-pdf.londonstockexchange.com/rns/5749X_1-2022-1-5.pdf

Outlook for Inflation 2022

We have revised our estimates for selling price inflation in the

year ahead, mainly as a result of the unanticipated persistence of

higher freight rates into the back end of the year ahead, along

with some further increases in manufacturing costs. In addition to

the increases in the cost of our goods, we are also experiencing

increases in UK operating costs, mainly as a result of UK wage

inflation. We anticipate that average wage inflation across the

NEXT Group will be 5.4%, driven by the increase in the national

living wage of 6.6%(2) along with wage inflation in sectors where

there are labour shortages, most notably in Warehousing and

Technology.

(2) Effective from April 2022.

The table below sets out the expected inflation in our

like-for-like selling prices in the first and second half of the

year ahead. Our selling prices are increasing broadly in line with

the landed(3) cost of goods.

Spring & Summer Autumn & Winter

================================= ================ ================

UK like-for-like selling prices +3.7% +6.0%

================ ================

(3) Landed costs are the cost of goods including the cost of

freight.

Like-for-like price comparisons are given between identical or

very similar items. We expect our total average selling prices to

increase by more than the like-for-like price increases. This

change is, we believe, the result of consumers choosing to buy

slightly fewer items, but at moderately higher price points -

perhaps exchanging volume for quality.

Summary of Sales, Profit and Earnings Per Share Guidance

If full price sales are up +7.0%, we estimate that Group profit

before tax will be GBP860m, up +4.6% versus the current financial

year. In this scenario we have assumed that sales grow faster than

profits as a result of (1) the absence of COVID rates relief in the

first quarter and (2) a return to more normal levels of surplus

stock for our end-of-season Sales.

Guidance for the full year 2022/23 Full year guidance Versus 2021/22

=================================== ================== ==============

Full year full price sales GBP4.6bn +7.0%

Group profit before tax GBP860m +4.6%

Earnings Per Share (Basic) 553.8p +4.5%

================== ==============

Please note that the anticipated Earnings Per Share does not

account for any potential share buybacks in the year ahead.

Cash Flow Guidance for the Year Ahead

Based on the guidance above we anticipate underlying free cash

available for distribution to shareholders of GBP430m as set out

below.

Cash flow for year ending January 2023 GBPm (e)

======================================= ========

Profit before tax 860

Tax (145)

Depreciation 105

Capital expenditure (190)

Customer receivables (130)

Working capital and other (70)

========

Free cash flow anticipated in the year 430

There are two points within the cash flow that benefit from

further explanation:

Capital Our capital expenditure estimate of GBP190m is

expenditure GBP55m higher than the previous estimate of GBP135m,

given in April 2021. This is mainly due to the

acceleration of warehouse capacity projects and

new technology projects.

Customer receivables In the past we would have funded 85% of the receivables

growth with debt. In the year ahead, as part of

the process of re-setting our net debt to its

current level, we intend to fully fund the increase

in receivables with cash generated in the year.

Dividends and Shareholder Returns

In the year ahead we plan to return to our pre-pandemic ordinary

dividend cycle, with a final dividend proposed in March 2022 and,

subject to shareholder approval at the AGM, paid in August 2022;

and an interim dividend declared in September 2022 and paid in

January 2023.

Any remaining surplus cash(4) (after accounting for the costs of

any investments or acquisitions) will be returned to shareholders

by way of share buybacks or special dividends. Any share buybacks

would be subject to achieving a minimum 8% equivalent rate of

return (ERR). As a reminder, ERR is calculated by dividing the

anticipated pre-tax profits by the current market capitalisation(5)

of the Group. As always, our decisions concerning buybacks or

special dividends will be subject to market conditions and the

interests of shareholders generally.

(4) Surplus cash is free cash less the cost of ordinary dividends .

(5) Market capitalisation is calculated based on shares in

circulation of 127.6m, so excludes shares in NEXT's Employee Share

Option Trust.

FULL YEAR RESULTS ANNOUNCEMENT

We are scheduled to announce our results for the full year

ending January 2022 on Thursday 24 March.

Forward Looking Statements

Certain statements in this Trading Update are forward looking

statements. These statements may contain the words "anticipate",

"believe", "intend", "aim", "expects", "will", or words of similar

meaning. By their nature, forward looking statements involve risks,

uncertainties or assumptions that could cause actual results or

events to differ materially from those expressed or implied by

those statements. As such, undue reliance should not be placed on

forward looking statements. Except as required by applicable law or

regulation, NEXT plc disclaims any obligation or undertaking to

update these statements to reflect events occurring after the date

these statements were published.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFELLBLFLBBBE

(END) Dow Jones Newswires

January 06, 2022 01:59 ET (06:59 GMT)

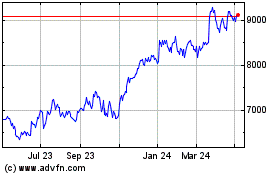

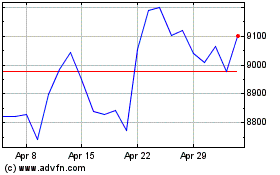

Next (LSE:NXT)

Historical Stock Chart

From Mar 2024 to Apr 2024

Next (LSE:NXT)

Historical Stock Chart

From Apr 2023 to Apr 2024