TIDMOCN

RNS Number : 1803S

Ocean Wilsons Holdings Ltd

15 March 2021

The information communicated within this announcement is deemed

to constitute inside information. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Ocean Wilsons Holdings Limited

Preliminary results for the year ended 31 December 2020

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") today announces its preliminary results for the year

ended 31 December 2020.

Highlights

-- Profit after tax for the year of US$48.0 million which is US$13.0 million lower than the prior

year (2019: US$61.0 million) principally due to the impact of foreign exchange losses and

increased income tax.

-- The investment portfolio (including cash under management) increased US$25.0 million to US$310.3

million (2019: US$285.3 million).

-- Operating profit decreased 2.9% to US$66.9 million (2019: US$68.9 million) mainly due to foreign

exchange losses of $7.6 million (2019: $0.1 million) driven by a weaker Brazilian Real ("BRL")

against the US$ and there being no impairment charge in the current year (2019: US $13.0 million).

Overall expenses were lower year over year. Raw materials costs were 23.8% lower reflecting

lower shipyard activity and other operating expenses declined reflecting the reduction of

operational activity as a result of Covid-19.

-- Group revenue for the year was 13.1% lower at US$352.8 million (2019: US$406.1 million) principally

due to the impact of the weaker BRL and lower revenues at the offshore bases due to the impact

of Covid-19 on the oil industry.

-- Net cash inflow from operating activities for the year was US$105.7 million (2019: US$106.3

million).

-- Proposed dividend unchanged at US 70 cents per share (2019: US 70 cents per share).

-- Earnings per share for the year down US 23 cents per share to US 109.5 cents (2019: US 132.5

cents per share).

About Ocean Wilsons Holdings Limited

Ocean Wilsons Holdings Limited ("Ocean Wilsons" or the

"Company") is a Bermuda investment holding company which, through

its subsidiaries, operates a maritime services company in Brazil

and holds a portfolio of international investments. The Company is

listed on both the London Stock Exchange and the Bermuda Stock

Exchange. It has two principal subsidiaries: Wilson Sons Limited

and Ocean Wilsons (Investments) Limited (together with the Company

and their subsidiaries, the "Group").

Wilson Sons Limited ("Wilson Sons") is a Bermuda company listed

on the São Paulo Stock Exchange (BOVESPA) and Luxembourg Stock

Exchange. At 31 December 2020 Ocean Wilsons holds a 57.77% interest

in Wilson Sons which is fully consolidated in the Group accounts

with a 42.23% non-controlling interest. Wilson Sons is one of the

largest providers of maritime services in Brazil with over three

thousand employees and activities including towage, container

terminals, offshore oil and gas support services, small vessel

construction, logistics and ship agency.

Ocean Wilsons (Investments) Limited is a wholly owned Bermuda

investment company and holds a portfolio of international

investments .

Objective

Ocean Wilsons focuses on long-term performance and value

creation. This approach applies to both the investment portfolio

and our investment in Wilson Sons. The long-term strategy, managed

by the Board, enables Wilson Sons' investments to grow and develop

sustainable results with less pressure to produce short-term

performance at the expense of longer-term value creation. This same

view allows our Investment Manager to make investment decisions to

achieve long-term capital growth.

Chairman's Statement

Introduction

While this year has presented the most challenging economic and

operational environment for businesses globally due to the Covid-19

pandemic, it is important to remember that our business has been

through other challenges in the past that have had a significant

impact on our results in Wilson Sons and our investment portfolio,

including the world financial crisis in 2008 and 2009 and the

Brazilian market crash of 2015 and 2016. For most economies and

industries, the longer-term financial and social impacts from this

pandemic are likely to be far more significant than those two

events combined. The economic uncertainty in the earlier days of

the pandemic were demonstrated by the global financial market crash

and significant terminal activity decline in the operations of

Wilson Sons. As the year progressed, markets recovered beyond most

forecasters expectations and Wilson Sons' results proved to be more

resilient than originally feared.

Wilson Sons' container terminal operations have been negatively

impacted by the Covid-19 pandemic resulting in lower import

volumes. However, towage volumes improved in the fourth quarter,

and Wilson Sons' fourth quarter after tax profit increased and

their liquidity remains strong as the Brazilian economy works

toward recovery and the new normal.

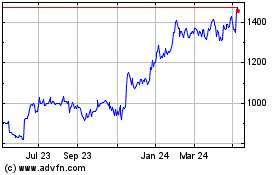

The investment portfolio performed well while markets recovered

from the initial Covid-19 market crash in March. Driven by rising

equity markets, the investment portfolio rose 10.9% on a

time-weighted net return basis over the year to US$310.3 million

(2019: US$285.3 million), outperforming its benchmark of 4.4%.

Growth in the Brazilian economy has been a struggle since the

2015-2016 crash and is now exacerbated with the uncertainty of the

economic impact of the Covid-19 pandemic. Real GDP growth in 2019

was 1.1%, compared to negative 4.0% real GDP in 2020. Additionally,

the BRL fell 28.9% against the US$. Notwithstanding these economic

headwinds, Wilson Sons reported better than expected trade linked

volumes in its container terminal business and increased days in

operation of its Offshore Vessels.

These key operational indicators at our container terminals and

towage businesses declined only slightly by year end against the

2019 comparative, as trade volumes increased in the second half of

the year both domestically and internationally.

Operating volumes 2020 2019 % Change

--------------------------------------------------------- ------- ------- --------

Container Terminals (container movements in TEU '000s) * 1,017.6 1,027.3 (1.0%)

Towage (number of harbour manoeuvres performed) 52,873 53,088 (0.4%)

Offshore Vessels (days in operation) 5,356 5,128 4.4%

--------------------------------------------------------- ------- ------- --------

*TEUs stands for "twenty-foot equivalent units".

Results

Profit for the year at US$48.0 million was US$13.0 million lower

than the prior year (2019: US$61.0 million) primarily due to the

significant impact of the BRL weakening against the US$ by 28.9%

during the year and the impact of Covid-19 on offshore services to

the oil and gas industry. While the investment portfolio increased

10.9%, returns on the investment portfolio were US$1.3 million

lower than the prior year at US$33.4M (2019: US$34.7 million).

Operating profit at US$66.9 million (2019: US$68.9 million)

declined by US$2.0 million, due to increased foreign exchange

losses because of the weaker BRL. Operating expenses generally

declined with austerity measures taken to improve liquidity as part

of managing through the Covid-19 pandemic and there being no

impairment charge in the current year.

Earnings per share for the year were US 109.5 cents compared

with US 132.5 cents in 2019.

Covid-19

The priority during the Covid-19 crisis is to protect our

employees and balance the needs of our stakeholders. In response to

the pandemic, the Group has implemented working practices and

protocols to ensure the health and safety of our teams and all

stakeholders across our businesses and is focused on business

continuity and fiscal prudence. During the year multiple austerity

measures were put in place and Wilson Sons was granted "stand-still

agreements" with lenders that allowed for the postponement of loan

repayment instalments to reinforce liquidity during this market

uncertainty. A detailed overview of our Covid-19 response and

business risk assessments can be found in Note 37 to the Financial

Statements.

Wilson Sons

In October 2020, Wilson Sons concluded a US$110 million

expansion project at the Salvador container terminal which extended

the terminal's principal quay to 800 metres. This allows for the

simultaneous berthing of two super-post-Panamax ships which will

increase our capacity to handle more volumes of containers and

improve operational efficiency. The completion of this extension

solidifies the Group's position as operating the only dedicated

terminal in Bahia, the largest economy in the Northeast of Brazil,

which connects Brazil to all major worldwide markets. Additionally,

this extra capacity supports initiatives to reinforce economic

growth and job creation in this region.

During the year, the Brazilian Government designated Wilson Sons

as an essential service provider, removing any operation

restrictions during Covid-19 restrictions. This allowed us to

remain operational, albeit with lower overall demand and volumes

due to the pandemic.

Container volumes at the Salvador terminal grew 2.4% in 2020 to

342,400 TEUs despite the impact of Covid-19 with increased

transhipment volumes. Import, export and cabotage volumes were

lower year over year at both the Salvador and Rio Grande terminals

as global and domestic demand for goods were negatively impacted by

the pandemic. Rio Grande volumes declined 2.6% to 675,200 TEUs

(2019: 693,100). In the fourth quarter of 2020, the Rio Grande

terminal was certified with a deeper draft for the navigation

channel that will allow for the berthing of the larger super-post

Panamax vessels which is expected to increase volumes for

transhipment containers. Transhipment volumes at the Rio Grande

Terminal increased 5.7% in 2020.

Wilson Sons continues to be the leader in Brazilian towage

services. With a fleet of 80 tugboats, we have the largest and most

modern fleet in the country. The number of harbour towage

manoeuvres performed in the year was consistent at 52,873 (2019:

53,088). Towage revenue results continued to improve despite volume

declines as pricing has improved. Six new 80-tonne tugboats have

been approved for construction to be completed during 2022-2025

which will support the capacity of our expanded terminals and the

increased number of larger ships calling in Brazil.

Our offshore support bases and our offshore support fleet, which

service the oil and gas industries continue to face demand

weakness. The support base revenue declined US$11.3 million to

US$8.0 million (2019: US$19.3 million). The number of operating

days at our offshore vessel joint venture, Wilson Sons Ultratug

Offshore, at 5,356 was 4.4% higher than the prior year (2019:

5,128) although our share of revenue was 7.8% lower at US$ 60.8

million (2019 US$65.5 million) due to softer average daily rates on

new contracts given current market conditions. Our joint venture

continues to explore alternative revenue streams for our off-hire

vessels. During the year, the platform support vessels ("PSV")

Cormoran, Sterna and Torda commenced new two-year contracts. At the

year end, the joint venture had a fleet of 23 offshore support

vessels ("OSVs") of which 16 were under contract. Subsequent to

year end, 18 vessels are under contract with the remainder

available in the Brazilian spot market or laid up until market

conditions improve.

Investment Portfolio Performance

The investment portfolio out-performed the 2020 benchmark of

4.4% (2019: 5.3%) by 6.5% (2019: 6.8%) despite the Covid-19 market

crash in March 2020. With a rebound in both equity and bond markets

globally, the portfolio's holdings produced better than originally

anticipated results. The portfolio increased US$25.0 million to

US$310.3 million (2019: US$285.3 million) after paying dividends of

US$5.0 million to Ocean Wilsons Holdings Limited and deducting

management and other fees of US$2.8 million. This represents a net

return in the year of 10.9%. Over the three-year period ended 31

December 2020, the portfolio produced a time-weighted net return of

6.0% per annum compared with the performance benchmark of 4.9% per

annum.

At 31 December 2020 the top ten investments account for 46.7% of

the investment portfolio valuation (US$144.9 million).

Investment Manager and Management Fee

Ocean Wilson (Investments) Limited ("OWIL"), a wholly owned

subsidiary of the Company registered in Bermuda, holds the Group's

investment portfolio. OWIL has appointed Hanseatic Asset Management

LBG, a Guernsey registered and regulated investment group, as its

Investment Manager.

The Investment Manager receives an investment management fee of

1% of the valuation of funds under management and an annual

performance fee of 10% of the net investment return which exceeds

the benchmark, provided that the high-water mark has been exceeded.

The portfolio performance is measured against a benchmark

calculated by reference to Urban Consumers NSA plus 3% per annum

over rolling three-year periods. Payment of performance fees are

subject to a high-water mark and are capped at a maximum of 2% of

the portfolio NAV. The Board considers a three-year measurement

period appropriate due to the investment mandate's long-term

horizon and an absolute return inflation-linked benchmark

appropriately reflects the Company's investment objectives while

having a linkage to economic factors.

In 2020, the investment management fee paid was US$2.8 million

(2019: US$2.8 million) and a US$0.3 million performance fee is

payable to the Investment Manager (2019: US$0.7 million).

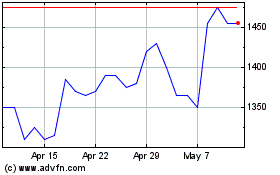

Net Asset Value

At the close of markets on 31 December 2020, the Wilson Sons'

share price was R$45.30 (US$8.73), resulting in a market value for

the Ocean Wilsons holding of 41,444,000 shares (57.77% of Wilson

Sons) totalling approximately US$361.5 million which is the

equivalent of US$10.22 (GBP7.48) per Ocean Wilsons share.

Adding the market value per share of Wilsons Sons of US$10.22

and the investment portfolio at 31 December 2020 of US$8.77 results

in a net asset value per Ocean Wilsons Holdings Limited share of

US$19.00 (GBP13.89). The Ocean Wilsons Holdings Limited share price

was GBP8.45 at 31 December 2020.

Dividend

Dividends are set in US Dollars and are normally paid annually.

The Ocean Wilsons dividend policy is to pay a percentage of the

average capital employed in the investment portfolio determined

annually by the Board and the Company's full dividend received from

Wilson Sons in the period after deducting funding for the parent

company costs. The Board may review and amend the dividend policy

from time to time in light of our future plans and other

factors.

The Board is recommending a dividend of US 70 cents per share to

be paid on 4 June 2021 to shareholders of the Company as of the

close of business on 14 May 2021. Shareholders will receive

dividends in Sterling by reference to the exchange rate applicable

to the USD on the dividend record date (14 May 2021) except for

those shareholders who elect to receive dividends in USD. Based on

the current share price and exchange rates a dividend of US 70

cents per share represents a dividend yield of approximately

6.1%.

Brexit

Shareholders will be aware that the United Kingdom ("UK") left

the European Union ("EU") on 31 January 2020 ("Brexit"). The

Company is domiciled in Bermuda and does not operate directly

within the EU, however Ocean Wilsons (Investments) Limited invests

in investment vehicles domiciled both within and outside the EU,

and a number of those investment vehicles have direct and / or

indirect exposure to the UK and/or the EU.

We are not aware of any tangible direct or indirect impact on

the investment portfolio's performance arising from Brexit. The

consequences of Brexit for London financial markets, in which some

of the investment vehicles participate and where the Company's

shares are traded on the London Stock Exchange, is uncertain.

Environmental Social and Governance Practices (ESG)

The Group is continuously improving and monitoring its ESG

practices. In September 2020, Wilson Sons published its Greenhouse

Gas Emissions Inventory for 2019 emissions. Since 2013, emissions

have been reduced by 12%. As part of our plan to improve on

emission reduction rates, we seek increasingly advanced

technologies to utilise that will contribute to these reductions.

For example, Wilson Sons has implemented diesel-electric systems on

offshore vessels, moved to the use of electric yard cranes and when

commissioning new vessels, ensures that they are compliant with EU

emission standards.

Workplace safety at Wilson Sons, is ingrained in the day-to-day

operations with a relentless commitment to ensuring the safety of

our employees and reducing accident rates through a safety

programme in partnership with DuPont. Our target was to reduce and

maintain a lost-time injury frequency rate (LTIFR) below or equal

to 0.5 per million hours worked. The Company has successfully met

this target with a 91% reduction in LTIFR from 2011 to 2020. LTIFR

was 0.42 (2019: 0.48).

The Board has established corporate governance arrangements

which it believes are appropriate for the operation of the Company.

The Board has considered the principles and recommendations of the

2018 UK Corporate Governance Code ("the Code") issued by the

Financial Reporting Council and decided to apply those aspects

which are appropriate to the business. This reflects the fact that

Ocean Wilsons is an investment holding company incorporated in

Bermuda with significant operations in Brazil. The Company complies

with the Code where it is appropriate for both its wider

stakeholders and its business to do so. The areas where the Company

does not comply with the Code, and an explanation of why, are

contained in the section on Corporate Governance in the Annual

Report. The position is regularly reviewed and monitored by the

Board.

Board Appointments and Retirements

During the year we were pleased to announce the appointment of

two new independent non-executive directors, Ms. Fiona Beck and Ms.

Caroline Foulger. Ms. Beck joined the Board effective 13 April 2020

and Ms. Foulger joined the Board effective 1 June 2020. Ms. Foulger

will be subject to election as a director at the Company's next

Annual General Meeting.

Mr. Colin Maltby retired from the Board effective 1 January 2021

and Mr. Keith Middleton will be retiring from the Board and the

Company on March 26, 2021. I would like to thank both Mr. Maltby

and Mr. Middleton for their time and dedication to the Group.

Outlook

While there has been some worsening in numbers relating to the

pandemic in Brazil recently, the forecasts for economic growth in

2021 remain positive with exports expecting to rise due to the

depreciation of the BRL in 2020 and a recovery in global economic

activity. The impacts from the Covid-19 pandemic in 2020 on our

results were less than we initially anticipated when news of the

pandemic broke. While it is unclear how the pandemic will playout

in 2021, we expect our operations to continue to be affected and

the safety protocols and other measures that were implemented

during 2020 to remain in place for the foreseeable future. The roll

out of the vaccines are a positive development although the new

variant mutations make it unclear how the pandemic will unfold. The

Brazilian offshore oil and gas market is expected to remain soft in

2021. However, we are seeing some green shoots and expect some

recovery from 2022 onwards as the offshore oil concessions move

towards production. The competitive Brazilian towage market we have

experienced in the last few years remains unchanged. The coming

year will continue to present a number of challenges for the Group.

However, the resilient performance delivered by the Group in 2020

means we are confident in the strength of our Brazilian businesses

and believe that the Group will continue to

prosper as Brazil and the World recovers from the Covid-19

pandemic.

The financial markets closed 2020 with major equity indices

increasing with the MSCI World up 16.2% and the S&P 500 up

18.4% notwithstanding one of the biggest post-war market crashes in

March. Bond markets also performed surprisingly well with the

global bond index rising 9.5%. Investor confidence continues to be

strong as vaccines are being administered globally, spurring

anticipation of the world getting back to the normal that we once

knew, and we continue to have a positive view on equity markets

going into 2021. However, we continue to be alert and exercise

caution for any events that could cause the markets to slide. We

have particular focus on the impacts of the Biden administration on

US and global markets and the speed and success of the Covid-19

vaccine roll-out which is anticipated to allow more social movement

that will stimulate and drive economic recovery in those sectors

hit hard by the pandemic.

Management and Employees

On behalf of the Board and shareholders, I would like to thank

our management and employees for their efforts and hard work during

this incredibly difficult year. We understand that our workforce

has been faced with day to day personal and professional struggles

as we navigate through the new normal of living and working through

this pandemic. We are extremely proud of how our teams have managed

and responded to the challenges that Covid-19 has created.

J F Gouvêa Vieira

Chairman

Ocean Wilsons Holdings Limited

12 March 2021

Financial Review

Operating Profit

Operating profit of US$66.9 million was US$2.0 million lower

than prior year (2019: US$68.9 million) principally due to the

negative impact of the BRL devaluation against the US, lower

revenues being offset by reduced operating costs and no impairment

charges in the current financial year (2019: US$13.0 million).

Operating margin for the year was 18.9% (2019: 20.2% - excluding

the impairment charge) principally due to the increase in foreign

exchange losses on monetary items, negatively offsetting lower

operating costs as the Company implemented cost savings strategies

in the face of Covid-19 and lower depreciation expense.

Raw materials and consumables used were US$6.0 million lower at

US$19.3 million (2019: US$25.3 million) reflecting lower shipyard

activity. Employee expenses were US$30.3 million lower at US$110.0

million (2019: US$140.3 million) principally due to the effect of

the stronger average USD/BRL exchange rate. Amortisation of

right-of-use assets was $10.7 million (2019: US$12.4 million).

The headcount at the year-end was 3,675 compared with 3,939 in

2019. Employee expenses as a percentage of revenue declined from

34.6% in 2019 to 31.2% in the current year. Other operating

expenses were US$4.9 million lower at US$87.7 million (2019:

US$92.6 million) largely driven by a weaker BRL exchange rate

throughout 2020. Depreciation and amortisation expense at US$50.6

million was US$3.1 million lower than the comparative period (2019:

US$53.7 million) due to the devaluation of the BRL during the

year.

Revenue from Maritime Services

Group revenue for the year in BRL terms increased by 13.3% while

in USD terms revenue was 13% lower at US$352.8 million (2019:

US$406.1 million). The decline in revenue is principally due to the

negative impact of BRL devaluation against the USD, with volume

declines in logistics revenues due to the end of a specific high

value contract, lower offshore support base revenues against a

backdrop of lower demand in the oil and gas sector and the overall

impact of Covid-19 on operations and trading volumes.

Towage and agency services revenue at US$181.7 million was

US$12.9 million higher than the prior year (2019: US$168.8 million)

with increased volumes in ports that operate larger ships, a focus

on improving the revenue mix and the full year impact of firming

market prices from the end of the prior year. Harbour towage

manoeuvres performed in the year decreased 0.4% to 52,873 (2019:

53,088). Special operations revenues increased US$3.2 million to

US$14.5 million (2019: US$11.1 million). Special operations are

project based, with current year revenue increases being driven by

support to two vessels that suffered damage in accidents. Ship

agency revenue at US$8.1 million was 12% lower than the prior year

(2019: US$9.2 million).

Port terminals revenue at US$140.2 million was US$47.0 million

lower than the prior year (2019: US$187.2 million) principally due

to the lower average BRL exchange rate and the reduction in

economic activity caused by Covid-19 on both imports and exports

and oil and gas support base activity. Container volumes handled

fell 1.0% to 1,017,600 TEUs (2019: 1,027,600 TEUs) mainly due to

lower volumes in imports and cabotage flows. Due to the decrease in

container volumes handled, lower import warehouse revenue and the

higher average USD/BRL exchange rate in the year container terminal

revenue declined 21.2% to US$132.2 million (2019: US$167.8

million). Revenue at our offshore support base decreased US$11.3

million to US$8.0 million (2019: US$19.4 million) mainly due to

reduced or delayed activity as the oil and gas sector manage

reduced oil demand and currency impacts.

Revenue at our logistics business was 37% lower at US$28.6

million (2019: US$45.7 million) primarily as a result of the ending

of a large warehousing contract at one of our logistics centres,

the impact of Covid-19 on import volumes driving lower demand for

logistics services and the lower average BRL exchange rate.

Third-party shipyard revenue was US$2.3 million lower at US$2.2

million (2019: US$4.5 million). The shipyard continues to provide

important vessel construction and maintenance services for our

towage and joint venture offshore vessel fleets.

All Group revenue is derived from Wilson Sons' operations in

Brazil.

Share of Results of Joint Ventures

The share of results of joint ventures is Wilson Sons' 50% share

of net profit for the period from our offshore joint ventures. Our

joint ventures had 16 offshore support vessels under contract out

of a total fleet of 23 at year end. Operating profit for a 50%

share in the joint ventures in the year decreased US$3.3 million to

US$5.5 million compared to US$8.9 million in 2019. Revenue was 7%

lower at US$60.8 million (2019: US$65.5 million) while operating

days at 5,356 days were 4.4% higher than the prior year (2019:

5,128). The reduction in operating profit, driven by lower revenues

and increased exchange losses on monetary items of US$9.1 million

for the period resulted in a loss for the year of US$4.2 million

(2019: US$0.6 million profit).

Returns on the Investment Portfolio at Fair Value Through Profit

or Loss

Returns on the investment portfolio of US$33.4 million (2019:

US$34.7 million) comprise realised profits on the disposal of

financial assets at fair value through profit or loss of US$1.0

million (2019: US$7.5 million), income from underlying investment

vehicles of US$3.3 million (2019: US$2.8 million) and unrealised

gains on financial assets at fair value through profit or loss of

US$29.1 million (2019: US$24.4 million).

Other Investment Income

Other investment income for the year declined US$4.5 million to

US$1.6 million (2019: US$6.1 million). Lower interest on bank

deposits of US$1.1million (2019: US$1.7 million) and lower other

interest income of US$0.6 million (2019: US$4.3 million) were the

contributing factors. Other interest in the prior year of US$4.3

million included a one-time income adjustment on the judicial

deposits of US$2.8 million and US$0.6 million on tax credits.

Finance Costs

Finance costs for the year at US$23.2 million were US$4.5

million lower than the prior year (2019: US$27.7 million) as

interest on lease liabilities decreased US$3.1 million to US$12.8

million (2019: US$15.9 million). Exchange losses on foreign

currency borrowings were zero (2019: US$0.8 million) as the Group

repaid borrowings in currencies other than the functional

currencies of the subsidiaries in the prior period. Interest on

bank loans and overdrafts decreased US$0.5 million to US$10.3

million (2019: US$10.8 million) due to lower variable interest

rates.

Exchange Rates

The Group reports in USD and has revenues, costs, assets and

liabilities in both BRL and USD. Therefore, movements in the

USD/BRL exchange rate influence the Group's results both positively

and negatively from year to year. During 2020 the BRL depreciated

28.9% against the USD from R$4.03 at 1 January 2020 to R$5.20 at

the year end. In 2019 the BRL depreciated 4.0% against the USD from

R$3.87 at 1 January 2019 to R$4.03 at the year end. The principal

effects from the movement of the BRL against the USD on the income

statement are set out in the table below:

2020 2019

US$ million US$ million

-------------------------------------------------- ----------- -----------

Exchange losses on monetary items(i) (7.4) (0.6)

Exchange losses on foreign currency borrowings - (0.8)

Deferred tax on retranslation of fixed assets(ii) (14.0) 0.6

Deferred tax on exchange variance on loans(iii) 15.1 (2.0)

-------------------------------------------------- ----------- -----------

Total (6.3) (2.8)

-------------------------------------------------- ----------- -----------

(i) This arises from the translation of BRL denominated monetary items in USD functional currency

entities.

(ii) The Group's fixed assets are located in Brazil and therefore future tax deductions from depreciation

used in the Group's tax calculations are denominated in BRL. When the BRL depreciates against

the US Dollar the future tax deduction in BRL terms remain unchanged but is reduced in US

Dollar terms.

(iii) Deferred tax credit arising from the exchange losses on USD denominated borrowings in Brazil.

The movement of the BRL against the USD in 2020 resulted in a

negative impact of US$6.3 million on the income statement in the

year compared with a US$2.8 million negative impact in 2019.

A currency translation adjustment loss of US$51.8 million (2019:

US$11.1 million) on the translation of operations with a functional

currency other than USD is included in other comprehensive expense

for the year and recognised in other comprehensive income.

The average USD/BRL exchange rate during 2020 was 30.6% higher

than prior year at 5.16 (2019: 3.95). A higher average exchange

rate negatively affects BRL denominated revenues and positively

impacts BRL denominated costs when converted into our USD reporting

currency.

Profit Before Tax

Profit before tax for the year decreased US$7.9 million to

US$74.6 million compared to US$82.5 million in 2019. The decline in

profit before tax is primarily due to the US$4.7 million negative

movement of results from joint ventures, US$1.3 million in lower

returns from the investment portfolio, US$7.4 million negative

movement in foreign exchange losses on monetary items and a US$4.4

million reduction in other investment income. Prior year other

investment income included a one-time adjustment on US$2.8 million

in judicial deposits.

Taxation

Although taxable profit was US$7.9 million lower at US$74.6

million, (2019: US$82.5 million), the tax charge for the year at

US$26.6 million was US$5.1 million higher than prior year (2019:

US$21.5 million). This represents an effective tax rate for the

year of 36.0% (2019: 26.0%) compared with the corporate tax rate

prevailing in Brazil of 34%. The higher effective tax rate is

principally due to higher net expenses not included in determining

taxable profit. Net expenses not included in determining taxable

profit were higher due to higher foreign exchange losses and losses

at our joint ventures.

The principal impacts from these items on the tax charge in the

income statement are set out in the table below:

2020 2019

% of % of

US$ taxable US$ taxable

million profit million profit

----------------------------------------------------------------- ------- ------- ------- -------

Deferred tax items not included in determining taxable profit(i) (2.2) (3.0%) (1.2) (1.5%)

Net expenses not included in determining taxable profit(ii) (7.9) (10.6%) (1.7) (2.1%)

Net income/(expenses) incurred outside Brazil 8.9 12.0% 9.7 11.6%

Total (1.2) (1.6%) 6.6 8.0%

----------------------------------------------------------------- ------- ------- ------- -------

(i) The principal deferred tax items not included in determining taxable

profit are a deferred tax credit arising on the retranslation of BRL

denominated fixed assets in Brazil, the deferred tax charge on the

exchange losses on USD denominated borrowings and tax losses at our

Brazilian subsidiaries not recognised in deferred tax.

(ii) The main items not included in determining taxable profit are the

tax effect of foreign exchange gains/(losses) on monetary items, the

tax effect of the share of results of joint ventures and non-deductible

expenses.

A more detailed breakdown is provided in note 10.

Profit for the Year

Profit attributable to equity holders of the parent company for

the year is US$38.7 million (2019: US$46.9 million) after deducting

profit attributable to non-controlling interests of US$9.3 million

(2019: US$14.2 million).

Earnings per Share

Earnings per share for the year was US 109.5 cents compared with

US 132.5 cents in 2019.

Cash Flow

Net cash inflow from operating activities for the period at

US$105.7 million was US$0.6 million lower than prior year (2019:

US$106.3 million) mainly due to the lower operating profit in the

year offset by improvements in working capital balances. Capital

expenditure in the year at US$58.4 million was US$27.3 million

lower than the prior year (2019: US$85.7 million) as capital

expenditure in 2019 on the expansion of Wilson Sons Salvador

container terminal contributed to higher spend. This work has now

been completed.

The Group drew down new loans of US$51.5 million (2019: US$113.6

million) to finance capital expenditure, while making loan

repayments of US$25.7 million in the year (2019: US$85.9 million).

Dividends of US$24.8 million were paid to shareholders (2019:

US$24.8 million) with a further US$17.4 million paid to

non-controlling interests in our subsidiary (2019: US$$17.4

million).

Cash and cash equivalents at 31 December 2020 decreased US$5.7

million from the prior year end to US$63.3 million, (2019: US$69.0

million) of which US$53.8 million was denominated in Brazilian Real

(2019: US$35.7 million). Wilson Sons held a further US$39.6 million

in USD denominated fixed rate certificates which are classified as

financial assets at fair value through profit or loss (2019:

US$14.1 million) which are not part of the Group's investment

portfolio managed by Hanseatic Asset Management LBG and are

intended to fund Wilson Sons.

Balance Sheet

Equity attributable to shareholders of the parent company at the

balance sheet date was US$14.0 million lower at US$555.8 million

compared with US$569.8 million at 31 December 2019. The main

movements in equity in the year were profits for the period of

US$38.7 million, less dividends paid of US$24.8 million and a

negative currency translation adjustment of US$29.8 million. The

currency translation adjustment arises from exchange differences on

the translation of operations with a functional currency other than

USD.

Net Debt and Financing

All debt at the year-end was held in the Wilson Sons group with

no recourse to the parent company, Ocean Wilsons, or the investment

portfolio held by Ocean Wilsons (Investments) Limited. The Group's

borrowings are used principally to finance vessel construction and

the development of our container terminal business.

Borrowings are mainly long-term with defined repayment schedules

payable over different periods of up to 18 years. At 31 December

2020 all the Group's borrowings are denominated in BRL with 65%

linked to the USD and the remaining 35% denominated in BRL. The

Group's borrowings denominated in BRL linked to the USD loans are

fixed rate loans while BRL denominated debt is variable rate. A

significant portion of the Group's Brazilian pricing is denominated

in USD which acts as a natural hedge to our long-term exchange rate

exposure. In addition to borrowings, the Group has lease

liabilities of US$157.9 million (2019: US$194.1 million).

Net debt including lease liabilities at 31 December 2020 was

US$397.7 million (2019: US$446.0 million) as set out in the

following table:

2020 2019

US$ million US$ million

-------------------------- ----------- -----------

Debt

Short-term 76.9 58.6

Long-term 423.7 470.5

Total debt 500.6 529.1

Short term investments (39.6) (14.1)

Cash and cash equivalents (63.3) (69.0)

-------------------------- ----------- -----------

Net debt 397.7 446.0

-------------------------- ----------- -----------

The Group's reported borrowings do not include US$211.9 million

(2019: US$220.3 million) of debt from the Company's 50% share of

borrowings in our Offshore Vessel joint venture.

Leslie J. Rans, CPA

Chief Operating and Financial Officer

Ocean Wilsons Holdings Limited

12 March 2021

Wilson Sons Limited

The Wilson Sons 2020 Earnings Report released on 12 March 2021

is posted on www.wilsonsons.com.br.

In the report, Mr. Cezãr Baião, Deputy Chairman of Wilson Sons,

said:

"Wilson Sons reported that cash flows from operating activities

of US$114.5 million increased 3.0% against 2019 (US$111.1 million)

remaining very resilient notwithstanding the Covid-19 pandemic. In

BRL terms, operating cash flow grew 34.5%. A weaker average BRL

exchange rate reduced revenues and costs, with costs being further

reduced, driven by austerity measures in addressing the financial

impacts of Covid-19 on our business.

Container terminal results were impacted by lower import volumes

during the year due to the pandemic with business confidence and

Brazilian economic indicators remaining soft through Q4. The

Salvador terminal reported a 2.4% increase in annual operating

volumes and civil works to extend the terminal's principal quay

were completed in October 2020. The Rio Grande terminal was

certified with a 15-metre draft for the navigation channel in 4Q20

allowing the terminal to receive larger super-post-Panamax vessels,

further increasing the terminal's competitiveness as a hub port and

potentially attracting more transhipment volume. Although the Rio

Grande terminal showed a 2.5% decrease in annual operating volumes,

transhipment volume was up 5.6% over the prior year.

Towage results continued to be solid despite the competitive

environment and Covid-19 crisis. We recently approved the

construction of six new 80-tonne tugboats to be delivered by our

shipyard between 2022 and 2025. These new vessels will further

expand the capacity of our towage fleet to service the larger ships

now calling in to Brazilian ports.

Our oil services businesses, including offshore support vessels

("OSV") and support bases, still face weak demand, although we

expect to see a recovery in the medium term. We continue to explore

alternative revenue streams for the base areas and our off-hire

vessels, which are well positioned to profit from the expected

recovery in the industry.

The outlook heading into 2021 remains a challenging operational

environment with the persisting effects of Covid-19 and exchange

rate volatility remains an item to be monitored. We expect trade

flows to recover faster than oil and gas services. Debt standstill

agreements have benefitted a number of businesses through this

unique period.

In this context, we reaffirm our commitment to the safety and

well-being of our employees, clients, suppliers and the communities

in which we operate to ensure the continuity of the essential

services that we provide. All our operations and facilities are

applying rigorous health and safety protocols established by

Brazilian authorities and agencies, and we are closely monitoring

the evolution of the pandemic in the country."

The Wilson Sons Strategy

The Wilson Sons strategy is to grow and strengthen its

businesses while looking for new opportunities in the maritime and

transport sector, focusing on Brazil and Latin America. Wilson Sons

looks to develop its businesses by maximising economies of scale

and efficiency and improving the quality and range of services it

provides to customers. Wilson Sons' principal services are

container terminals, logistics, oil and gas support terminals,

towage, shipyard and through our joint venture, offshore support

vessels.

Utilising capacity in our container terminals. To meet demand

from domestic and international trade, we have expanded both

container terminals since the beginning of the concessions. By

maximising installed capacity utilisation, we can continue to

increase productivity and the level of service to our clients

through economies of scale. Additionally, we will evaluate new

opportunities to invest in the development of new terminals, and

the ability for these opportunities to provide a strong return on

shareholders' equity.

Maximising capacity utilization of our offshore support bases.

Our bases in Niterói and Rio de Janeiro have a total capacity of

eight berths which provide logistics support for offshore vessels.

With excellent access to the Campos and Santos petroleum basins,

including to the pre-salt region, our assets are strategically

positioned as one of the largest operators of offshore support

bases in Brazil. We continuously monitor the offshore exploration

and production activities across the Brazilian coast to meet demand

as activity in this sector improves.

Strengthening our position as the leading provider of towage

services in Brazil. We will continue to modernise and expand our

tugboat fleet to consistently provide high-quality services to our

customers and solidify our leading position in the Brazilian towage

market. We also look to contribute to the expansion of activities

in the Brazilian ports, offering state-of-the-art vessels that are

suitable for the operation of new classes of ships, as well as for

the oil and gas industry. We regularly review our fleet deployment

to optimise efficiency and to seek out new market niches where we

may be able to provide additional services or expand our

geographical footprint to new ports in Brazil.

Maximising the potential of our shipyard facilities. Through a

mix of in-house and third-party vessel construction, repair,

maintenance, conversion and dry-docking services we seek to

maximise the potential of our shipyards to meet the demands of

local and international shipowners operating in Brazil.

Solidifying our offshore support vessel services to oil and gas

platforms. Using our knowledge and experience, we look to

consolidate our activities maintaining our position amongst the

leading suppliers of services to the offshore oil and gas industry

in Brazil. We are exploring alternative revenue streams to increase

utilisation of our offshore support vessel fleet.

Exploring innovative opportunities and strategies to provide the

best and most complete set of services to our customers. We will

continue to foster a culture of innovation and digital

transformation. We have formed relationships with technology

start-ups, to strive for innovative digital solution to support

strategic goals of creating efficiencies, improving margins and

driving improved customer service throughout our businesses. We are

always looking to provide innovative services to our customers, as

well as to anticipate their needs. Through a solid nationwide

footprint, we will continue our strategy of providing comprehensive

logistics solutions to support domestic and international trade

activities, as well as the oil and gas industry.

Increasing economies of scale, productivity, synergies, and cost

savings across our segments. We continuously seek to optimise our

operations productivity and reduce costs through digital

transformation and synergies among our businesses. We will continue

to be focused on driving digital transformation of Wilson Sons to

meet stakeholder needs in a rapidly changing market as well as

integrating similar activities to achieve economies of scale and

reduce costs wherever possible.

Economic Social and Governance (ESG) best practices are key to

our overall strategy. We will ensure that ESG best practices are

implemented throughout the organization to achieve and maintain

excellence in these areas, in line with our strategy of a

sustainable and ethical business.

Investment Portfolio

Investment Objective

Ocean Wilsons is run with a long-term outlook. The objective of

the investment portfolio is to make investments that create

long-term capital growth without pressure to produce short-term

results at the expense of long-term value creation.

Investment Policy

The Investment Manager will seek to achieve the investment

objective through investments in publicly quoted and private

(unquoted) assets across three 'silos':

(i) Core regional funds which form the core of our holdings, enabling us to capture the natural

beta within markets;

(ii) Sector specific silo, represented by those sectors with long-term growth attributes, such

as technology and biotechnology; and

(iii) Diversifying silo, which are those asset classes and sectors which will add portfolio protection

as the business cycle matures. Cash levels will be managed to meet future commitments (e.

g. to private assets) whilst maintaining an appropriate balance for opportunistic investments.

Commensurate with the long-term horizon, it is expected that the

majority of investments will be concentrated in equity, across both

'public' and 'private' markets. In most cases, investments will be

made either through collective funds or limited partnership

vehicles, working alongside expert managers in specialised sectors

or markets to access the best opportunities.

The Investment Manager maintains a global network to find the

best opportunities across the three silos worldwide. The portfolio

contains a high level of investments which would not normally be

readily accessible to investors without similar resources.

Furthermore, a large number of holdings are closed to new

investors. There is currently no gearing although the Board would,

under the appropriate circumstances, be open-minded to modest

levels of gearing. Likewise, the Board may, from time to time,

permit the Investment Manager opportunistically to use derivative

instruments (such as index hedges using call and put options) to

actively protect the portfolio.

Investment Process

Manager selection is central to the successful management of the

investment portfolio. Potential individual investments are

considered based on their risk--adjusted expected returns in the

context of the portfolio as a whole. Initial meetings are usually a

result of: (i) a 'top-down' led search for exposure to a certain

geography or sector; (ii) referrals from the Investment Manager's

global network; or (iii) relationships from sell-side institutions

and other introducers. The Investment Manager reviews numerous

investment opportunities each year, favouring active specialist

managers who can demonstrate an ability to add value over the

longer-term, often combining a conviction-based approach, an

unconstrained mandate and the willingness to take unconventional

decisions (e.g., investing according to conviction and not fearing

short-term underperformance versus an index).

Excessive size is often an impediment to continued

outperformance and the bias is therefore towards managers who are

prepared to restrict their assets under management to a level

deemed appropriate for the underlying opportunity set. Track

records are important, but transparency is an equally important

consideration. Alignment of interests is essential, and the

Investment Manager will always seek to invest on the best possible

terms. Subjective factors are also important in the decision-making

process - these qualitative considerations would include an

assessment of the integrity, skill and motivation of a fund

manager.

When the Investment Manager believes there is a potential fit,

thorough due diligence is performed to verify the manager's

background and identify the principal risks. The due diligence

process would typically include visiting the manager in their

office (in whichever country it may be located), onsite visits to

prospective portfolio companies, taking multiple references and

seeking a legal opinion on all relevant documentation. With travel

restrictions related to Covid-19, the due diligence process has

been amended to include virtual meetings and onsite visits will

resume once travel restrictions have been removed.

All investments are reviewed on a regular basis to monitor the

ongoing compatibility with the portfolio, together with any 'red

flags' such as signs of 'style drift', personnel changes or lack of

focus. Whilst the Investment Manager is looking to cultivate

long-term partnerships, every potential repeat investment with an

existing manager is assessed as if it were a new relationship.

Portfolio Characteristics

The portfolio has several similarities to the 'endowment model'.

These similarities include an emphasis on generating real returns,

a perpetual time horizon and broad diversification, whilst avoiding

asset classes with low expected returns (such as government bonds

in the current environment). This diversification is designed to

make the portfolio less vulnerable to permanent loss of capital

through inflation, adverse interest rate fluctuations and currency

devaluation and to take advantage of market and business cycles.

The Investment Manager believes that higher returns can be

generated from investments in illiquid asset classes (such as

private equity). In comparison to public markets, the pricing of

assets in private markets is less efficient and the outperformance

of superior managers is more pronounced.

Investment Manager's Report

Market Backdrop

Had you asked at the beginning of 2020 how stock markets would

fair in the face of a global pandemic, one of the deepest post-war

economic declines and with companies in many sectors on the brink

of bankruptcy, it would not have been unreasonable to expect

responses of 20%, 30% or even 50% declines. The fact that this

happened when we were in the eleventh year of one of the longest

market cycles in history, arguably made the market even more

vulnerable to bad news.

It seems surreal then that the year ended with major equity

indices increasing 16.2%, 18.4% and 29.5% for the MSCI World,

S&P 500 and MSCI China. German and French indices somewhat

lagged, up by 13.5% and 3.5% respectively and the UK and EMs

ex-Asia declined by 10.5% and 10.0%. The MSCI Information

Technology index was up 45.6% for the year while the MSCI World

Value index was down by 1.2% with sub-sectors such as retail and

leisure falling sharply over the period.

The bond markets were also robust at the headline level with the

global bond index rising by 9.5% for the year. Investment grade

debt rose by 10.4% and high yield by 7.0% but at the trough in

March, they were down 10.4% and 21.2% respectively when the

prospect of widespread corporate default seemed very real.

The commodity markets were a case of contrasting fortunes.

Gold's defensive attributes came to the fore as is often the case

at points of extreme distress, rising by 25.1% over the year. In

contrast, oil, which saw demand fall sharply due to a collapse in

travel, especially air travel, fell by 20.5% over the year.

Cumulative portfolio returns

2020 3 years p.a. 5 years p.a. 10 years p.a.

----------------------------------------------- ----- ------------ ------------ -------------

OWIL 12.2% 7.3% 7.8% 5.0%

OWIL (Net)(1) 10.9% 6.0% 6.6% 3.9%

Performance benchmark(2) 4.4% 4.9% 4.9% 4.0%

MSCI ACWI + FM NR 16.2% 10.0% 12.2% 9.1%

MSCI Emerging Markets NR 18.3% 6.2% 12.8% 3.6%

Bloomberg Barclays Global Treasury TR Unhedged 9.5% 4.8% 4.7% 2.2%

Barclays 3 Month US$ LIBOR 0.3% 1.8% 1.5% 0.9%

----------------------------------------------- ----- ------------ ------------ -------------

1. The OWIL net performance is after charging investment management and

performance fees.

2. The OWIL performance benchmark which came into effect on 1st January

2015 is US CPI Urban Consumers NSA +3% p.a. This has been combined

with the old benchmark (USD 12 Month LIBOR +2%) for periods prior

to the adoption of the current benchmark.

Portfolio Review

The investment portfolio returned 10.9% on a net basis over the

year, whilst its benchmark returned 4.4%. Despite the COVID-19

induced crash in March, markets tended to take a longer-term view

into 2021 looking past the pandemic with vaccine announcements and

the eventual election of Joe Biden as US President seeing investors

become increasingly bullish towards the end of the year.

The portfolio's public market investments in North America

continued to be some of the larger contributors to performance.

Pershing Square Holdings generated excellent returns with a yearly

gain of 85.5%. The manager placed a lucrative credit hedge at the

beginning of the year, before most investors realized the impact

COVID-19 would have on markets, which then significantly benefited

from the market falls in March. The manager subsequently ploughed

these profits into equity markets, particularly consumer focused

companies including Chipotle Mexican Grill and Starbucks, who have

both been able to successfully adapt their operations to cater

towards delivery and takeaway services. Both have rebounded

significantly following the market sell-off, with Chipotle more

than doubling its value from its trough in mid-March to the end of

2020. Other contributors in North America were Vulcan Value Equity,

Select Equity and Findlay Park American which were up 9.5%, 16.0%

and 15.8%, respectively, over the year.

Our emerging markets holdings NTAsian Discovery, a value-biased

fund, had a rollercoaster year ending with an annual return of

10.6%. There was a large drawdown in the first quarter caused by

the COVID-19 driven market sell off with the performance then

rebounding over the rest of the year, particularly during a strong

final quarter when the fund was up 25.3%. One of the investments,

BFI Finance, an Indonesian consumer finance firm, saw a significant

rally in its share price during the final quarter as it reported a

significant drop in debt levels and continued to have a lower ratio

of non-performing loans than its peers. Another of the fund's

investments, I.T, a Hong Kong based fashion brand, was another

strong contributor as the firm announced that it was teaming up

with a private equity fund to take itself private at a 54.6%

premium over the closing share price.

Schroder Asia Total Return, another fund in the Asian segment,

was up 31.0% over the year. The fund's 28% exposure to information

technology benefited it this year with large holdings in TSMC and

Samsung Electronics increasing significantly in value over the

course of the year. The focus that Prince Street Opportunities has

on emerging and frontier market companies that use data and

technology to build market share led it to perform very strongly,

gaining 35.7% over the last twelve months. Holdings such as Public

Power Corp in Greece and Sea Ltd in Singapore were among the fund's

biggest contributors.

In Europe, Adelphi European Select Equity and BlackRock European

Hedge Fund continue to exhibit great performance, up 19.7% and

39.5% for 2020, respectively. The portfolio's Japanese holdings

have been more mixed with Indus Japan Long Only performing strongly

returning 27.4% while Goodhart Partners: Hanjo returned only 4.9%

as Japanese small cap stocks lagged their large cap comparators

over the course of the year.

In the portfolio's thematic holdings, the technology focused GAM

Disruptive Growth produced a strong annual return, up 62.8%. The

fund benefited from a wide variety of holdings such as Walt Disney

which was up 25% over the year following the successful launch of

its streaming service, and Uber which gained 71% on the back of a

surge in demand for its food delivery service. Impax Environmental

Markets also performed well with an annual return of 28.8%. Energy

transition holdings saw a rally in their share prices following

Biden's US election victory with his campaign promising a US$2

trillion green energy plan. Ormat Technologies, a renewable energy

developer, performed well following management changes including a

new CEO. Other positions which positively contributed were PTC Inc,

a software company, and Clean Harbors, a waste disposal and

generator firm. The portfolio's healthcare holdings all enjoyed

positive years with RA Capital International Healthcare, BB Biotech

and Worldwide Healthcare Trust returning 34.2%, 27.4% and 22.9%,

respectively.

In the diversifying segment, Global Event Partners returned

15.6% over the year. Despite the pandemic the year was a busy one

in terms of mergers with an investment in the LVMH/Tiffany proving

turbulent but ultimately contributing positively as both companies

settled litigation and moved forward with the acquisition at a

modestly reduced price. CZ Absolute Alpha had a positive year with

an annual return of 4.2%. The market neutral equity long/short fund

struggled for much of the year with its strong value bias meaning

that its investments typically underperformed the market in the

second and third quarters. Large positions that did perform well

were William Hill where the manager felt the stock was oversold in

March, providing an entry opportunity, before bouncing back and

then being boosted by takeover approaches by Caesars Entertainment

and Apollo in the final quarter of the year. Hudson Bay

International and BioPharma Credit were also positive contributors

returning 16.3% and 7.7%, respectively.

On the private asset side of the portfolio, the delayed nature

of private asset valuations means that the impact of the strong

market performance towards the end of the year will not yet have

fully fed through. KKR Americas XII, LP has been busy deploying

capital with over 50% of the fund now committed. This 2017 vintage

fund is carried at a 1.3x net multiple and a 15.9% net IRR with

several investments looking like they will be strong performers.

AppLovin Corporation, a high-growth mobile gaming platform that

publishes its own games as well as enabling user acquisition and

monetization for the global mobile gaming market, increased

significantly in value over the latter part of 2020 with the gaming

industry being a beneficiary of the COVID-19 crisis. The company

also acquired two complementary businesses in Machine Zone and

Zenlife with their integration the current focus. Nature's Bounty,

a manufacturer of vitamins, supplements and nutrition products, is

an older investment that is also performing well having

significantly increased in value during the last quarter of the

year. Many of the investments in this fund are still held at around

cost and so we would expect to see some of them moving up in value

over the next year as the manager starts to enact their growth plan

for each business.

Baring Asia Private Equity Fund VII, LP is a more recent

Asia-focused commitment that has started to accelerate this year

with several investments growing strongly. JD Health, one of the

two largest e-commerce platforms for consumer health and pharma

products in China, has seen a 35% increase in the number of active

users this year. The fund invested more capital in a recent

fundraising round to enable the company to continue to expand the

number of services it can provide to customers through its online

platform. The company has now gone through an IPO which was

received well by the market. TS Group, a recruitment agency for

care and construction workers in Japan, has also reported strong

growth with revenue and EBITDA up 28% and 9% year-on-year

respectively despite the COVID-19 pandemic. The fund has made two

recent investments in Shinhan Financial Group, Korea's largest

financial group, and Hexaware, an Indian IT and business process

outsourcing services provider, with the fund now looking to

implement their business plans. This fund is currently held at a

1.5x net multiple and a 53.5% net IRR, albeit still at an early

stage of its life.

More mature investments in the portfolio that have performed

well include TA XII-B, LP (2.0x net multiple, 33.2% net IRR) and

Great Point Partners II, LP (2.4x net multiple, 27.5% net IRR).

Greenspring Global Partners IV, LP (2.8x net multiple, 17.7% net

IRR) and Greenspring Global Partners VI, LP (2.7x net multiple,

23.3% net IRR) also continued to perform strongly returning

significant capital to investors throughout the course of the

year.

Summary

Whilst clearly not yet of out woods, especially as we sit here

at home writing these comments in the midst of yet another

lockdown, 2021 is looking more optimistic as the vaccine roll-out

programme starts in earnest. The blend of better growth together

with still abundant liquidity should serve to underpin risk assets

and, as a result, we see little reason to deviate from our positive

stance on equities and more cautious view on bonds. There are

clearly risks to this scenario and, not least, the amount of good

news already baked into markets as we enter the year will

undoubtedly make them vulnerable to any disappointments.

Most worrying would be anything that derails the expected

rebound in economic growth. Be it delays in the vaccine roll-out

programme or, worse, that vaccines are found to be ineffective in

treating new variants of the virus, these outcomes would be

extremely damaging to sentiment given the already considerable

growth expectations built into asset prices. We continue to be

optimistic on most markets for 2021 but as ever remain alert for

any events that could cause market disruption.

Hanseatic Asset Management LBG

March 2021

Investment Portfolio at 31 December 2020

Fair market

value % of

US$000 NAV Primary Focus

--------------------------------------------------------- ----------- ----- -------------------------------------

Findlay Park American Fund 31,896 10.3 US Equities - Long Only

Adelphi European Select Equity Fund 18,155 5.8 Europe Equities - Long Only

BlackRock European Hedge Fund 16,419 5.3 Europe Equities - Hedge

Egerton Long - Short Fund Limited 15,238 4.9 Europe/US Equities - Hedge

GAM Star Fund PLC - Disruptive Growth 14,435 4.6 Technology Equities - Long Only

Select Equity Offshore, Ltd. 11,568 3.7 US Equities - Long Only

Vulcan Value Equity Fund 10,776 3.5 US Equities - Long Only

Goodhart Partners: Hanjo Fund 9,642 3.1 Japan Equities - Long Only

Schroder ISF Asian Total Return Fund 9,604 3.1 Asia ex-Japan Equities - Long Only

Pangea II, LP 7,186 2.3 Private Assets - GEM

--------------------------------------------------------- ----------- ----- -------------------------------------

Top 10 Holdings 144,919 46.7

--------------------------------------------------------- ----------- ----- -------------------------------------

NG Capital Partners II, LP 6,375 2.1 Private Assets - Latin America

Greenspring Global Partners, VI, LP 5,864 1.9 Private Assets - US Venture Capital

Pershing Square Holdings Ltd. 5,770 1.9 US Equities - Long Only

Hudson Bay International Fund Ltd. 5,528 1.8 Market Neutral - Multi Strategy

NTAsian Discovery Fund 5,499 1.8 Asia ex-Japan Equities - Long Only

Prince Street Opportunities Fund 5,128 1.7 Emerging Markets Equities - Long Only

Indus Japan Long Only Fund 5,125 1.7 Japan Equities - Long Only

Helios Investors II, LP 4,862 1.6 Private Assets - Africa

Impax Environmental Markets Fund 4,798 1.5 Environmental Equities - Long Only

Silver Lake Partners IV, LP 4,723 1.5 Private Assets - Global Technology

--------------------------------------------------------- ----------- ----- -------------------------------------

Top 20 Holdings 198,591 64.0

--------------------------------------------------------- ----------- ----- -------------------------------------

Primary Capital IV, LP 4,521 1.5 Private Assets - Europe

Global Event Partners Ltd. 4,494 1.4 Market Neutral - Event-Driven

Worldwide Healthcare Trust PLC 4,217 1.4 Healthcare Equities - Long Only

Dynamo Brazil VIII 3,922 1.3 Brazil Equities - Long Only

Greenspring Global Partners IV, LP 3,845 1.2 Private Assets - US Venture Capital

Silver Lake Partners V, LP 3,724 1.2 Private Assets - Global Technology

Prosperity Quest Fund 3,702 1.2 Russia Equities - Long Only

EQT Mid-Market Europe, LP 3,390 1.1 Private Assets - Europe

KKR Americas XII, LP 3,360 1.1 Private Assets - North America

BB Biotech AG 3,273 1.1 Healthcare Equities - Long Only

--------------------------------------------------------- ----------- ----- -------------------------------------

Top 30 Holdings 237,039 76.3

--------------------------------------------------------- ----------- ----- -------------------------------------

Remaining Holdings 67,635 21.8

--------------------------------------------------------- ----------- ----- -------------------------------------

Cash, money market funds and other working capital items 5,633 1.8

--------------------------------------------------------- ----------- ----- -------------------------------------

TOTAL 310,307 100.0

--------------------------------------------------------- ----------- ----- -------------------------------------

Consolidated Statement of Comprehensive Income

for the year ended 31 December 2020

Year ended Year ended

31 December 31 December

2020 2019

Notes US$'000 US$'000

Revenue 3 352,792 406,128

Raw materials and consumables used (19,266) (25,290)

Employee charges and benefits expense 6 (110,016) (140,348)

Depreciation & amortisation expense (owned assets) 5 (50,617) (53,733)

Amortisation of right-of-use assets 5, 15.3 (10,706) (12,389)

Reversal/(impairment charge) 13 382 (13,025)

Other operating expenses (87,731) (92,624)

Gain/(loss) on disposal of property, plant and equipment (317) 294

Foreign exchange losses on monetary items (7,551) (79)

---------------------------------------------------------------------- ------- ----------- -----------

Operating profit 66,905 68,934

Share of results of joint ventures 18 (4,142) 564

Returns on investment portfolio at fair value through profit or loss 7 33,383 34,716

Other investment income 3,8 1,644 6,052

Finance costs 9 (23,210) (27,736)

Profit before tax 5 74,580 82,530

Income tax expense 10 (26,577) (21,481)

---------------------------------------------------------------------- ------- ----------- -----------

Profit for the year 5 48,003 61,049

---------------------------------------------------------------------- ------- ----------- -----------

Other comprehensive income:

Items that will never be reclassified subsequently to profit and loss

Post-employment benefits 351 (1,168)

Items that are or may be reclassified subsequently to profit and loss

Exchange differences arising on translation of foreign operations (51,824) (11,137)

Effective portion of changes in fair value of derivatives (35) 689

---------------------------------------------------------------------- ------- ----------- -----------

Other comprehensive expense for the year (51,508) (11,616)

---------------------------------------------------------------------- ------- ----------- -----------

Total comprehensive income/(expense) for the year (3,505) 49,433

---------------------------------------------------------------------- ------- ----------- -----------

Profit for the period attributable to:

Equity holders of parent 38,712 46,852

Non-controlling interests 9,291 14,197

---------------------------------------------------------------------- ------- ----------- -----------

48,003 61,049

---------------------------------------------------------------------- ------- ----------- -----------

Total comprehensive income/(expense) for the period attributable to:

Equity holders of parent 9,064 40,030

Non-controlling interests (12,569) 9,403

---------------------------------------------------------------------- ------- ----------- -----------

(3,505) 49,433

---------------------------------------------------------------------- ------- ----------- -----------

Earnings per share

Basic and diluted 12 109.5c 132.5c

---------------------------------------------------------------------- ------- ----------- -----------

Consolidated Balance Sheet

as at 31 December 2020

As at As at

31 December 31 December

2020 2019

Notes US$'000 US$'000

Non-current assets

Goodwill 13,14 13,429 14,090

Right-of-use assets 15 149,278 189,011

Other intangible assets 16 16,967 22,313

Property, plant and equipment 17 579,138 627,049

Deferred tax assets 25 29,716 31,820

Investment in joint ventures 19 26,185 30,334

Related party loans 34 30,460 30,132

Recoverable taxes 23 11,006 26,501

Other non-current assets 27 4,905 9,407

Other trade receivables 22 9 354

------------------------------------------------------- ----- ----------- -----------

861,093 981,011

------------------------------------------------------- ----- ----------- -----------

Current assets

Inventories 21 11,764 10,507

Financial assets at fair value through profit and loss 20 347,464 298,840

Trade and other receivables 22 47,807 56,743

Recoverable taxes 23 22,479 25,547

Cash and cash equivalents 63,255 68,979

------------------------------------------------------- ----- ----------- -----------

492,769 460,616

------------------------------------------------------- ----- ----------- -----------

Total assets 1,353,862 1,441,627

------------------------------------------------------- ----- ----------- -----------

Current liabilities

Trade and other payables 26 (47,298) (56,608)

Tax liabilities (114) (496)

Lease liabilities 15.2 (18,192) (21,938)

Bank overdrafts and loans 24 (58,672) (36,636)

------------------------------------------------------- ----- ----------- -----------

(124,276) (115,678)

------------------------------------------------------- ----- ----------- -----------

Net current assets 368,493 344,938

------------------------------------------------------- ----- ----------- -----------

Non-current liabilities

Bank loans 24 (283,989) (298,342)

Post-employment benefits 36 (1,641) (2,369)

Deferred tax liabilities 25 (50,987) (52,525)

Provisions for tax, labour and civil cases 27 (9,560) (14,643)

Lease liabilities 15 (139,702) (172,210)

------------------------------------------------------- ----- ----------- -----------

(485,879) (540,089)

------------------------------------------------------- ----- ----------- -----------

Total liabilities (610,155) (655,767)

------------------------------------------------------- ----- ----------- -----------

Net assets 743,707 785,860

------------------------------------------------------- ----- ----------- -----------

Capital and reserves

Share capital 28 11,390 11,390

Retained earnings 603,996 588,160

Capital reserves 31,991 31,991

Translation and hedging reserve (91,595) (61,748)

------------------------------------------------------- ----- ----------- -----------

Equity attributable to equity holders of the parent 555,782 569,793

Non-controlling interests 187,925 216,067

------------------------------------------------------- ----- ----------- -----------

Total equity 743,707 785,860

------------------------------------------------------- ----- ----------- -----------

The accounts were approved by the Board 12 March 2021. The

accompanying notes are part of this Consolidated Balance Sheet.

F. Beck K. W. Middleton

Director Director

Consolidated Statement of Changes in Equity

for the year ended 31 December 2020

Hedging Attributable

and to equity Non-

Share Retained Capital Translation holders of controlling Total

capital earnings reserves reserve the parent interests equity

For the year ended 31 December 2019 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000 US$'000

Balance at 1 January 2019 11,390 566,678 31,760 (55,603) 554,225 223,484 777,709

Currency translation adjustment - - - (6,546) (6,546) (4,591) (11,137)

Post-employment benefits (note 36) - (677) - - (677) (491) (1,168)

Effective portion of changes in fair

value of derivatives - - - 401 401 288 689

Profit for the year - 46,852 - - 46,852 14,197 61,049

Total comprehensive income/(expense)for

the year - 46,175 - (6,145) 40,030 9,403 49,433

Dividends - (24,754) - - (24,754) (17,428) (42,182)

Tax incentives - - 231 - 231 166 397

Share options exercised in subsidiary

(note 28) - 61 - - 61 72 133