TIDMORPH

RNS Number : 2669V

Open Orphan PLC

13 April 2021

NOT FOR RELEASE, DISTRIBUTION OR PUBLICATION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF

AMERICA, AUSTRALIA, CANADA, JAPAN, OR SOUTH AFRICA OR ANY OTHER

JURISDICTION WHERE IT IS UNLAWFUL TO DISTRIBUTE THIS

ANNOUNCEMENT

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATIONS (EU) NO. 596/2014 ("MAR"). WITH THE

PUBLICATION OF THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION

SERVICE, THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

Open Orphan plc

("Open Orphan" or the "Company")

Potential demerger of certain non-core assets

Proposed Capital Reduction, Distribution in Specie and notice of

General Meeting

Open Orphan plc (AIM: ORPH), a rapidly growing specialist

pharmaceutical services clinical research organisation (CRO) and a

world leader in vaccine and antiviral testing using human challenge

clinical trials, announces that it is at an advanced stage in

planning for a possible spin-out of certain non-core Development IP

Assets. These Development IP Assets are a portfoilio of

intellectual property and development assets, including HVO-001

which has potential application in the treatment of respiratory

disease. These do not include the equity interests in Imutex

Limited and PrEP Biopharm Limited.

The Board believes that to maximise shareholder value that the

Development IP Assets are best developed separately from the core

services business. Furthermore, such a spin-out transaction could

provide the opportunity to secure separate financial resources for

these assets, to enable accelerated development of these assets and

achievement of commercial milestones. A spin-out transaction would

also allow Shareholders to benefit from both the value of the

development assets and the standalone value of the core services

business, as they progress through their own key milestones.

To this end, a circular (a "Circular") is being sent to

shareholders today providing background to, details of and reasons

for, a proposed Reduction of Capital and Distribution in Specie, to

facilitate the possible spin-out and admission to AIM of the

Company's non-core Development IP Assets. The reduction in capital

will also allow for the Company to pay dividends and distributions

to shareholders should the Board deem it appropriate in the

future.

The Board has decided to take the necessary preliminary steps in

preparation for a potential spin-out, including incorporating a new

subsidiary, further details of which are outlined in the Circular.

The Company has decided to proceed in obtaining the approvals

necessary for the Reduction of Capital and the Distribution in

Specie which are required to implement the demerger.

Notwithstanding that the Company is seeking the necessary approvals

for the Reduction of Capital and the Distribution in Specie now,

these considerations remain at an early stage, and there can be no

guarantee that the Reduction of Capital and/or the Distribution in

Specie will be completed. HMRC advance clearance for the Demerger

has been successfully obtained so any distribution would be exempt

for income tax purposes and have no capital gains implications for

UK shareholders. Further announcements will be made at the

appropriate time.

Notice of General Meeting

The Circular contains a notice convening the General Meeting to

be held at 11 a.m. on 29 April 2021 at which the Resolutions will

be proposed.

Full details are outlined in the Circular, which will be posted

to Shareholders today and will shortly be available, in accordance

with AIM Rule 20, here:

https://www.openorphan.com/investors/circulars-and-admission-document

Cathal Friel, Executive Chairman, said: "I am delighted that we

are putting in place the first steps needed to enable the

monetisation of some of our non-core assets. Over the last year we

have been busy transforming Open Orphan into a profitable

enterprise with a world leading position testing vaccines and

antivirals using human challenge studies. We now have an

opportunity to deliver significant further shareholder value by the

Demerger of these non-core assets. Their development and

commercialisation can be accelerated through the Demerger, which

offers the opportunity to access financing as a separate public

company listed on AIM and a separate business focussed on the

successful commercialisation of pharmaceutical products.

"It is well known in the global public markets that value is

better recognised in the life sciences space when profitable

services businesses are viewed separately from pharmaceutical

development businesses that have different funding needs. This is

now an excellent opportunity for shareholders in Open Orphan to

maximise value through separate shareholdings in both a profitable

pharma services company as well as an exciting pharma products

commercialisation company. I believe that both are well positioned

for success as we head into a decade of exponential capital

investment across a broad range of infectious disease and

respiratory illnesess. This is a sector that has been

under-invested in the last thirty years and as such, will be one of

the more exciting growth opportunities within the life sciences

industry."

Definitions contained in the Circular have the same meaning as

in this announcement.

Open Orphan plc www.openorphan.com

Cathal Friel, Executive Chairman +353 (0) 1 644 0007

Arden Partners plc (Nominated Adviser

and Joint Broker) +44 (0) 20 7614 5900

John Llewellyn-Lloyd / Benjamin Cryer

/ Nick Wright

finnCap plc (Joint Broker) +44 (0) 20 7220 0500

Geoff Nash / James Thompson/ Richard

Chambers

Davy (Euronext Growth Adviser and Joint

Broker) +353 (0) 1 679 6363

Anthony Farrell

Walbrook PR (Financial PR & IR) +44 (0)20 7933 8780 or openorphan@walbrookpr.com

Paul McManus / Sam Allen / +44 (0)7980 541 893 / +44 (0)7748 651

Lianne Cawthorne 727 /

+44 (0)7584 391 303

The information provided below includes information contained

within the Circular, which should be read as a whole.

Introduction

Open Orphan is a pharmaceutical service/contract research

company that is a world leader in testing vaccines and antivirals

using human challenge clinical trials. The Company provides

services to Big Pharma, biotech and government/public health

organisations. This was described in the Company's admission

document dated 9 December 2019, following the acquisition of hVIVO

by Open Orphan (the "Acquisition"). Since the Acquisition, the

enlarged group has pursued a services led strategy centred around

its leading position in vaccine and antiviral testing using human

challenge clinical trials. The Group further provides a suite of

consulting and clinical trial services to pharmaceutical and

biotech companies as a leading Clinical Research Organisation

("CRO").

The Group has continued to develop this services-led strategy

since the Acquisition and has completed a post-merger restructuring

and integration of its operations to drive efficiency and

competitiveness in order to increase profitability. This

restructuring, combined with renewed interest and investment in the

treatment and prevention of respiratory disease, has resulted in

the strong performance of the Group and its CRO services.

Prior to the Acquisition, hVIVO had made significant investments

and had developed a portfolio of intellectual property covering the

treatment and prevention of respiratory and infectious disease.

Having repositioned the Group's services the Directors have

undertaken a review of the Group's non-core assets. In order for

some of these assets to achieve their full commercial potential

further investment and deployment of management resource would be

required. As a result of having refocused the Group on services,

the Directors have taken the strategic decision to demerge certain

development assets from the existing CRO business to maximise the

future potential and value of both businesses. The Directors are

now undertaking the required preliminary steps in order that they

may execute a demerger of the Group's wholly owned Development IP

Assets later this year. This demerger would exclude the Group's

equity interests in Imutex Limited and PrEP Biopharm Limited. Such

a demerger would include certain intellectual property surrounding

these Development IP Assets. The Company will update Shareholders

in due course on its final plans and the timing of an expected

demerger. The demerger would allow for any required future

investment in the Development IP Assets without consuming existing

Group funds or management resource.

The Development IP Assets include HVO-001 with the Demerger

intended to enable accelerated development of this asset utilising

an outsourced partnership model and separate management team. It is

also intended to provide the financial resources required to

rapidly develop this molecule. A spin-out transaction of the

Development IP Assets could also allow Shareholders to benefit from

both the value of the Development IP Assets including HVO-001 and

the standalone value of the remaining business as it progresses

through its own key milestones.

The Board is now taking the necessary preliminary steps in

preparation for a potential spin-out of its wholly owned

Development IP Assets, including the incorporation of a new

subsidiary, ORPH Pharma IP, further details of which are set out

below. The Company has decided to proceed with obtaining the

approvals necessary for the Reduction of Capital and the

Distribution in Specie which are required to implement the

Demerger. Notwithstanding that the Company is seeking the necessary

approvals for the Reduction of Capital and the Distribution in

Specie now, these proposals remain at an early stage and there can

be no guarantee that the Reduction of Capital and/or the

Distribution in Specie will be completed. Further announcements

will be made at the appropriate time.

Demerger

As announced, the Company has been evaluating its plans for the

Development IP Assets, including HVO-001. HVO-001 is an orally

available, small molecule immunomodulator drug with potential as a

treatment for severe influenza and symptoms requiring treatment in

hospital with the drug unaffected by viral heterogeneity. It has

the potential to treat a broad range of serious unmet needs in

patients suffering from severe and fatal respiratory disease.

Having considered these plans in further detail, the Board has

decided that a spin-out and admission to AIM of the wholly owned

Development IP Assets may provide the opportunity to secure

separate financial resources for the Development IP Assets, with

the goal of enabling accelerated development of the asset portfolio

and achievement of development and commercial milestones. It is

anticipated that a spin-out pursuant to the Demerger would allow

the Company's shareholders to benefit from both the value of the

Development IP Assets and the standalone value of the remaining

business as they progress through their own key milestones.

The Company has completed various initial steps in anticipation

of the implementation of the potential Demerger, including the

transfer by HSL to ORPH Pharma IP, the Company's recently

incorporated wholly owned subsidiary, of the intellectual property

relating to the Development IP Assets including HVO-001. Pursuant

to the assignment and licence agreement executed by HSL in favour

of ORPH Pharma IP, HSL has assigned its interest in certain patents

and patent applications to ORPH Pharma IP and licensed to ORPH

Pharma IP certain trademarks, know-how, data and challenge agents;

and, in addition, HSL has sub-licensed and sub-contracted in favour

of ORPH Pharma IP its rights and obligations in relation to certain

further intellectual property. As part of the foregoing, HSL will

execute in favour of ORPH Pharma IP certain customary documents

which will allow ORPH Pharma IP to register itself formally as the

proprietor of the transferred intellectual property.

The next steps involve the Reduction of Capital to create

distributable reserves to allow the Distribution in Specie to be

declared pursuant to which the Demerger will be implemented and the

Development IP Assets moved to Newco.

The Directors believe that the Development IP Assets have the

potential to deliver significant upside value for Shareholders. The

Directors are therefore exploring funding options for that

business, including equity funding, and the Directors intend on

conducting initial market soundings in order to assist them in

determining the feasibility of Newco being admitted to trading on

AIM should the Demerger take place. Further announcements will be

made at the appropriate time.

The value of the proposed Distribution in Specie (the "Value")

has not yet been determined and the number of Newco Ordinary Shares

(the "Ratio") that each Shareholder would receive pursuant to the

proposed Distribution in Specie has not yet been determined. If the

results of the market sounding exercise for Newco are positive, the

Board intends to declare the Distribution in Specie shortly prior

to completion of the Fundraising and subsequent Admission, at which

point the Value and the Ratio will be determined and announced to

Shareholders via an RIS. The distribution in specie of the entire

issued share capital of ORPH Pharma IP by the Company to Newco will

be in return for Newco allotting and issuing Newco Ordinary Shares

to Open Orphan Shareholders who are registered on the Open Orphan

register of members at the specified demerger record date at a time

and date to be determined by the Company and notified to the

Shareholders in due course, on the basis of the determined Ratio

(save that fractions of a Newco Ordinary Share will not be

issued).

The Company plans to use an external agent to establish a trust

over the legal interest in the Newco Ordinary Shares allotted and

issued pursuant to the Demerger, from the allotment and issue of

such shares until the end of the Lock-In Period, pursuant to a

nominee arrangement. The intention is that, following the end of

the Lock-In Period, the agent will transfer legal title to the

Newco Ordinary Shares to those beneficially entitled to them.

Shareholders should therefore be aware that if the Demerger is

implemented they will not be able to sell, transfer or deal in the

Newco Ordinary Shares they receive for a period to be determined by

the Board and expected to be up to nine months following Admission.

During the period of such nominee arrangements, and except as

follows, such nominee will exercise the voting rights attaching to

the Newco Ordinary Shares held by it in accordance with the wishes,

if any, of the underlying beneficial owners of such shares.

However, prior to Admission it will be necessary for Newco to

re-register as a public limited company and, in order to facilitate

the passing of the necessary resolution(s), it is intended that, on

the basis that the Resolutions would already have been passed, the

Board will instruct such nominee to vote all of the Newco Ordinary

Shares held by it in favour of such resolution(s).

As mentioned above, Shareholders should note that the Board does

not intend to declare the Distribution in Specie until the

Fundraising for Newco process is near conclusion. The Fundraising

process is in its early stages and so the Fundraising and Admission

of Newco may or may not occur. The Distribution in Specie therefore

may or may not occur. In the event that the Distribution in Specie

does not occur ORPH Pharma IP will remain within the Open Orphan

Group and continue to be operated as a subsidiary of the Company.

The reserves created by the Reduction of Capital which were

intended to be used in the implementation of the Distribution in

Specie will be used, as with the balance of the reserves, to

facilitate the future consideration of payment of dividends to

Shareholders and the possible redemption or buy back of the

Company's shares where desirable. However, no assurance can be

given that any such dividend would be declared or redemption or

buy-back implemented.

Reduction of Capital

The Act only permits a company to make distributions to its

shareholders out of its profits available for that purpose. In

addition, a public company may only fund a purchase of its own

shares out of distributable profits. Such profits are, broadly, a

company's accumulated realised profits so far as not previously

utilised by distribution or capitalisation, less its accumulated

realised losses. The Company does not currently have distributable

profits and is therefore unable to make any distributions to its

Shareholders or fund a purchase of its own Open Orphan Ordinary

Shares out of distributable profits.

As at 31 December 2019, the Company had an accumulated retained

earnings deficit on its statement of financial position of

EUR3,513,000. At the same date, there was EUR19,041,000 standing to

the credit of the Company's share premium account. In addition, the

nominal value of the Deferred Shares (which are non-voting), which

the Directors consider to be effectively worthless due to the

extremely restricted rights which the shares confer on their

holders, was GBP62,833.34.

Since 31 December 2019, the Company's share premium account has

increased following the issue by the Company of Open Orphan

Ordinary Shares at the following prices: (i) 207,040,800 Open

Orphan Ordinary Shares at a price of GBP0.05775 per Open Orphan

Ordinary Share; (ii) 86,885,253 Open Orphan Ordinary Shares at a

price of GBP0.061 per Open Orphan Ordinary Share; (iii) 1,383,741

Open Orphan Ordinary Shares at a price of GBP0.001 per Open Orphan

Ordinary Share; (iv) 2,524,860 Open Orphan Ordinary Shares at a

price of GBP0.022 per Open Orphan Ordinary Share; (v) 114,821,824

Open Orphan Ordinary Shares at a price of GBP0.11 per Open Orphan

Ordinary Share; and (vi) 2,172,565 Open Orphan Ordinary Shares at a

price of GBP0.02 per Open Orphan Ordinary Share.

As at 31 December 2020, there was GBP44,494,997 standing to the

credit of the Company's share premium account and the accumulated

retained earnings deficit on the Company's statement of financial

position had also increased.

The Directors therefore feel it is appropriate to seek

shareholder approval to effect the Reduction of Capital and,

subject to the approval of the Shareholders and of the Court,

to:

2.1 cancel the Company's share premium account; and

2.2 cancel all of the Deferred Shares.

The Directors then propose to apply the reserve arising on the

Reduction of Capital to eliminate the Company's accumulated

retained earnings deficit on its statement of financial position

and, as to the balance, to create distributable profits on the

balance sheet of the Company of approximately GBP39,388,000.

As mentioned above, the Directors are planning to effect the

Demerger by way of the Distribution in Specie. However, in order to

do this the Company first needs to create realised profits of the

requisite amount which is the purpose of the Reduction of

Capital.

In addition, the Board believes that, subject to the future

performance of the Company, the creation of realised profits will

give the Company the ability to not only effect the Distribution in

Specie but also to make distributions to Shareholders and/or buy

back its own Open Orphan Ordinary Shares in the future if and when

the Directors may consider that it is appropriate to do so.

However, the Directors cannot give any guarantee either that the

Company will make the Distribution in Specie or make any

distributions or purchases of its own Open Orphan Ordinary Shares

or as to the size of any distributions or purchases of its own Open

Orphan Ordinary Shares which may be made.

The rights attaching to the Deferred Shares as set out in the

articles of association of the Company ("Articles") mean that the

proposed cancellation of such shares does not involve a variation

of such rights for any purpose and therefore the Company is

authorised at any time to reduce its share capital (subject to the

provisions of the Act) by cancelling the Deferred Shares without

obtaining the consent of the holders of such Deferred Shares. Once

the Reduction of Capital has been confirmed by the Court no further

communication will be received by the holders of the Deferred

Shares from the Company and all share certificates (if any) held in

respect of such Deferred Shares can be destroyed.

Cancellation of the share premium account and the Deferred

Shares

The cancellation of the Company's share premium account and the

Deferred Shares will only become effective if (in the following

order): (i) Resolution 1 as set out in the Notice of General

Meeting is approved by Shareholders at the General Meeting; (ii)

confirmation is given by the Court; and (iii) the Court order and a

statement of capital are delivered to and registered by Companies

House.

As noted above, the cancellation of the Company's share premium

account and the Deferred Shares should enable the Directors to

eliminate the current retained earnings deficit on the Company's

statement of financial position and create distributable

profits.

Notice of General Meeting

The Reduction of Capital and Distribution in Specie are

conditional upon, inter alia, the Shareholders approving the

Resolutions at the General Meeting.

In accordance with the UK Government's response to the COVID-19

outbreak, and to minimize public health risks, it is strongly

recommended that shareholders do not physically attend the General

Meeting, and instead appoint the Chairman of the meeting as a proxy

to exercise their right to vote.

The Circular contains a notice convening the General Meeting to

be held at 11 a.m. on 29 April 2021 at which the Resolutions will

be proposed.

Shareholders should note that, unless the Resolutions are

approved at the General Meeting, the spin-out of the Development IP

Assets cannot take place.

Recommendation

The Directors consider that the Resolutions are in the best

interests of the Company and would promote the success of the

Company for the benefit of its Shareholders as a whole.

Accordingly, the Directors unanimously recommend that Shareholders

vote in favour of the Resolutions to be proposed at the General

Meeting as they and their immediate families and connected persons

(within the meaning of section 252 of the Act) intend to do in

respect of their aggregate holdings of 53,810,871 Open Orphan

Ordinary Shares representing approximately 8.04 per cent. of the

existing issued share capital of the Company.

ENDS

Notes to Editors

Open Orphan plc (London and Euronext: ORPH) is a rapidly growing

pharmaceutical service/contract research company that is a world

leader in testing vaccines and antivirals using human challenge

clinical trials. The company provides services to Big Pharma,

biotech and government/public health organisations.

Open Orphan runs challenge studies in London from both its

19-bedroom Whitechapel quarantine clinic, opened in February 2021,

and its 24-bedroom QMB clinic which also has a highly specialised

virology and immunology laboratory on-site. Open Orphan has a

leading portfolio of eight human challenge study models for

conditions such as RSV, flu, asthma and COPD. In addition, Open

Orphan is also developing the world's first COVID-19 human

challenge study model as part of the Human Challenge Programme and

has signed a reservation contract with the UK Government for the

first three COVID-19 vaccine challenge studies.

Building upon its many years of challenge studies and virology

research, the Company is developing an in-depth database of

infectious disease progression data. Based on the Company's Disease

in Motion(R) platform, this unique dataset includes clinical,

immunological, virological and digital (wearable) biomarkers. The

Disease in Motion platform has many potential applications across a

wide variety of end users including big technology, wearables,

pharma and biotech companies. Following COVID-19 there is now a

renewed interest and investment in infectious diseases.

Open Orphan's Paris office has been providing biometry, data

management and statistics to its many European pharmaceutical

clients for over 20 years. For over 15 years, the Company's

Netherlands office has been providing drug development consultancy

and services, including CMC (chemistry, manufacturing and

controls), PK and medical writing, to a broad range of European

clients. Both offices are now also fully integrated with the London

office and working on challenge study contracts as well as

supporting third party trial contracts.

Interested in becoming a volunteer?

hVIVO recruits many of its volunteers for its challenge study

clinical trials through its dedicated volunteer recruitment

website, www.flucamp.com . By volunteering to take part in one of

our studies in a safe, controlled, clinical environment under

expertly supervised conditions you are playing your part to further

medical research and help increase the understanding of respiratory

illnesses.

Individuals interested in taking part in COVID-19 human

challenge study research can learn more at www.UKCovidChallenge.com

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCIJMATMTJBMPB

(END) Dow Jones Newswires

April 13, 2021 02:00 ET (06:00 GMT)

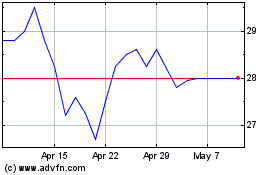

Hvivo (LSE:HVO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Hvivo (LSE:HVO)

Historical Stock Chart

From Apr 2023 to Apr 2024