TIDMPAGE

RNS Number : 9044U

PageGroup plc

09 April 2021

9 April 2021

PAGEGROUP PLC

FIRST QUARTER 2021 TRADING UPDATE

Q1 Highlights*

-- Group gross profit of GBP184.2m, +2.0% vs. Q1 2020 and -9.9% vs. Q1 2019

-- Monthly sequential improvement through the quarter, exiting

March at +31% vs. 2020 and -2% vs. 2019

-- Large, High Potential markets (36% of Group) +10%

-- EMEA +3.6%: France -7%; Germany +15%

-- Asia Pacific +15.3%: Greater China +45%; SE Asia +12%; India +15%

-- Americas -4.3%: US -9%; Latin America +4%

-- UK -11.0%: Michael Page -5%; Page Personnel -27%

-- Strong cash position, net cash of c. GBP136m (Q4 2020: GBP166m, Q1 2020: GBP83m)

-- Increase in fee earner headcount of 122 to 5,267 (Q1 2020: 5,923)

Outlook

-- Full year operating profit expected to be within the range of GBP90m - GBP100m

* In constant currencies except where stated otherwise

Q1 Gross Profit Analysis

Given the magnitude of the impact of COVID-19 in 2020, we are

also including comparisons against 2019 to ensure the most

appropriate representation of current trading.

Reported (GBPm) Constant vs. 2020 Constant

vs. 2019

Year-on-year % of Group Q1 2021 Q1 2020 % % %

----------- -------- -------- ------- ------------------ ----------

EMEA 52% 95.9 91.2 +5.1% +3.6% -8.4%

----------- -------- -------- ------- ------------------ ----------

Asia Pacific 19% 35.9 31.3 +14.8% +15.3% -4.2%

----------- -------- -------- ------- ------------------ ----------

Americas 15% 26.8 30.9 -13.5% -4.3% -5.6%

----------- -------- -------- ------- ------------------ ----------

UK 14% 25.6 28.9 -11.0% -11.0% -25.1%

----------- -------- -------- ------- ------------------ ----------

Total 100% 184.2 182.3 +1.0% +2.0% -9.9%

----------- -------- -------- ------- ------------------ ----------

Steve Ingham, Chief Executive Officer, PageGroup, said:

"Throughout the pandemic we have continued to focus on the

protection and wellbeing of our employees, candidates and clients,

whilst progressing strategic investments in our platform to take

advantage of the recovery.

"I am pleased to report that year-on-year results in each of the

three months of the first quarter improved sequentially, continuing

the monthly trend since May last year. January and February were

down 13% and 10% respectively, compared to 2020, with March growing

31%. Significantly, our performance in March was down just 2% on

2019. This noticeable improvement in March was seen throughout the

Group and was achieved despite the backdrop of continued and

increasing restrictions or lockdowns in many of our markets. We

delivered record months in March in markets such as Germany, Italy,

Spain and South East Asia. At this stage of the recovery, it is not

easy to determine whether the improved performance is the result of

pent-up supply and demand, or the beginning of a sustainable trend.

Our fee earner headcount is currently down 12.6% on the

pre-pandemic levels in 2019. As visibility develops, our fee earner

headcount will react accordingly.

"We remain confident in our strategy of maintaining and

investing in our platform by continuing to invest carefully in

headcount, exemplified by the 400 experienced hires we added in

2020, plus a further 200 added in Q1 2021, as well as rolling-out

new technology and innovation. We are the clear leader in many of

our markets, with a highly experienced senior management team,

which, we believe, positions us well to take advantage of

opportunities to grow and improve our business. We have maintained

our focus on driving progress towards our long-term strategic

goals.

"Looking ahead, there continues to be a high degree of global

macro-economic uncertainty as COVID-19 remains a significant issue

and lockdowns have returned in a number of the Group's markets.

However, and notwithstanding the early stage in the year, the

strength of our performance in Q1, and notably in March, has

increased confidence in our outlook for the year. Subject to other

unexpected events, we now expect full year operating profit to be

within the range of GBP90m - GBP100m."

Headcount

We reduced our fee earner headcount by 882 in 2020, primarily

those on performance review or those with very limited experience

in recruitment. This was net of adding c. 400 experienced fee

earners. As conditions continued to improve in Q1, we increased our

fee earner headcount by 122. Our operational support headcount rose

by 19, and, as such, our ratio of fee earners to operational

support staff was maintained at 77:23. Overall, the Group had 5,267

fee earners and a total headcount of 6,835.

Geographical Analysis (unless otherwise stated all growth rates

are in constant currency)

EMEA Gross Profit (GBPm) Growth Rates

(52% of Group) Reported Constant Constant

vs. 2020 vs. 2019

---------- ---------- ---------- ---------- ----------

Q1 2021 vs. Q1 2020 95.9 91.2 +5.1% +3.6% -8.4%

---------- ---------- ---------- ---------- ----------

* March +35.0%, -2.6% vs 2019

* France (15% of Group) -7%

* Germany (11% of Group) +15%

* Southern Europe +18%

o Italy +19%

o Spain +18%

* Benelux -6%

* Middle East and Africa, flat

Headcount at 31 March 2021: 3,048 (31 December 2020: 2,979)

In Europe, Middle East and Africa, the improvement in trading

conditions we experienced at the end of Q4 2020 continued into Q1,

which was up 3.6% overall. However, this was partly as a result of

the weak comparator in March 2020, when the region started to be

impacted by the COVID-19 pandemic. Against Q1 2019, we were down

8.4%. France, currently our largest market declined 7% (-19% vs

2019). March showed an improvement, exiting the quarter up 23%

(-15% vs. 2019). With a higher proportion of temporary workers,

Page Personnel was impacted more significantly by the lockdown. The

Netherlands performed similarly to France. However, Germany, the

Group's third largest market, delivered a record quarter, up 15%,

with March up 37% (+17% vs. 2019). Belgium, Italy and Spain exited

the quarter up 17%, 104% and 74% respectively vs. 2020 and up 11%,

6% and 7% vs. 2019, with Italy and Spain delivering record months

in March.

Asia Pacific Gross Profit (GBPm) Growth Rates

(19% of Group) Reported Constant Constant

vs. 2020 vs.

2019

---------- ---------- --------- ----------- ---------

Q1 2021 vs. Q1 2020 35.9 31.3 +14.8% +15.3% -4.2%

---------- ---------- --------- ----------- ---------

* March +37.6%, +5.5% vs 2019

* Asia (15% of Group) +22%

o Greater China (8% of Group and 50% of Asia) +45%

o Mainland China +66%

o Hong Kong +25%

* South East Asia +12%

o Singapore, flat

* India +15%

* Japan -2%

* Australia -4%

Headcount at 31 March 2021: 1,463 (31 December 2020: 1,385)

In Asia Pacific, gross profit for Q1 was up 15.3%. Mainland

China was up 66% for the quarter (+16% vs. 2019). We exited the

quarter up 26% on 2019. Whilst Hong Kong was up 25%, we remain down

35% on Q1 2019. Overall, Greater China grew 45% for the quarter.

South East Asia delivered a record month in March and was up 12%

for the quarter, with Singapore flat. Japan was down 2% against a

strong comparator of +5% in Q1 2020. India delivered a record

quarter, growing 15%, up from -3% in Q4 2020 and exited the quarter

up 41% compared to 2019. Australia declined 4%, a significant

improvement from a decline of 26% in Q4, with March up 4% on

2019.

Americas Gross Profit (GBPm) Growth Rates

(15% of Group) Reported Constant Constant

vs. vs.

2020 2019

----------- --------- ---------- ---------- ----------

Q1 2021 vs. Q1 2020 26.8 30.9 -13.5% -4.3% -5.6%

----------- --------- ---------- ---------- ----------

* March +24.8%, +7.2% vs. 2019

* North America (9% of Group) -9%

o US -9%

* Latin America (6% of Group) +4%

o Brazil +15%

o Mexico, flat

Headcount at 31 March 2021: 1,131 (31 December 2020: 1,155)

In the Americas, one of the worst COVID-19 affected regions,

gross profit for Q1 was down 4.3%. However, this was a significant

improvement on Q4 2020, which was down 23.2%. The US declined 9%.

Having been down 27% in both January and February, the performance

in March improved significantly, increasing 22% (+8% vs. 2019). In

Latin America, gross profit grew 4% (-2% vs. 2019). Mexico, our

largest country in the region, was flat for the quarter (March -12%

vs. 2019), and Brazil was up 15% (March +19% vs. 2019). Elsewhere

in Latin America, the remaining countries were flat for the

quarter, collectively.

UK Gross Profit (GBPm) Growth Rate Growth Rate

(14% of Group) vs. 2020 vs. 2019

---------- ---------- ------------- -------------

Q1 2021 vs. Q1 2020 25.6 28.9 -11.0% -25.1%

---------- ---------- ------------- -------------

* March +16.4%, -18.6% vs 2019

* Michael Page -5%

* Page Personnel -27%

Headcount at 31 March 2021: 1,193 (31 December 2020: 1,175)

In the UK, gross profit declined 11.0% in the quarter, improving

from a decline of 34.2% in Q4 2020. Conditions remained

challenging, with a nationwide lockdown imposed for the majority of

the quarter. Our Michael Page business (-5% in Q1) was more

resilient than Page Personnel (-27% in Q1). Having been down 29% in

January and February combined vs. 2019, the UK's performance in

March improved to a decline of 19% vs. 2019.

Financial Position

Save for the effects of Q1 trading detailed above, the purchase

of shares into the Employee Benefit Trust (EBT) of c. GBP10m and

the furlough repayment of GBP3.4m to the UK Government, there have

been no other significant changes in the financial position of the

Group since the publication of the results for the year ended 31

December 2020. Net cash at 31 March 2021 was c. GBP136m (Q4 2021:

GBP166m; Q1 2020: GBP83m).

Shares

At 31 March 2021 there were 328,618,774 Ordinary shares in

issue, of which 13,993,682 were held by the Employee Benefit Trust

(EBT). The rights to receive dividends and to exercise voting

rights have been waived by the EBT over 12,511,597 shares and

consequently these shares should be excluded when calculating

earnings per share. The total number of voting rights in the

Company is 328,618,774.

Cautionary Statement

This First Quarter 2021 Trading Update has been prepared solely

to provide additional information to shareholders to assess the

Group's strategies and the potential for those strategies to

succeed. The Trading Update should not be relied on by any other

party or for any other purpose. This Trading Update contains

certain forward-looking statements. These statements are made by

the Directors in good faith based on the information available to

them up to the time of their approval of this Trading Update and

such statements should be treated with caution due to the inherent

uncertainties, including both economic and business risk factors,

underlying any such forward-looking information. This Trading

Update has been prepared for the Group as a whole and therefore

gives greater emphasis to those matters that are significant to

PageGroup and its subsidiary undertakings when viewed as a

whole.

The Group will issue its Q2 results on 14 July 2021.

This announcement contains inside information for the purposes

of article 7 of EU Regulation 596/2014 and Article 7 of Onshored

Regulation (EU) 596/2014 as it forms part of domestic law by virtue

of the EUWA. The person responsible for making this announcement on

behalf of PageGroup is Kelvin Stagg, Chief Financial Officer.

Enquiries:

PageGroup +44 (0)20 3077 8172

Steve Ingham, Chief Executive Officer

Kelvin Stagg, Chief Financial Officer

FTI Consulting +44 (0)20 3727 1340

Richard Mountain / Susanne Yule

The Company will host a conference call and presentation for

analysts and investors at 9:00am today. The live presentation can

be viewed by following the link:

https://www.investis-live.com/pagegroup/6059b7779a138810006bbfe5/mles

Please use the following dial-in numbers to join the

conference:

United Kingdom (Local) 020 3936 2999

All other locations +44 20 3936 2999

Please quote participant access code 37 09 38 to gain access to

the call.

A presentation and recording to accompany the call will be

posted on the Company's website during the course of the morning of

9 April 2021 at:

https://www.page.com/presentations/year/2021

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIGDSCXGDGBI

(END) Dow Jones Newswires

April 09, 2021 02:00 ET (06:00 GMT)

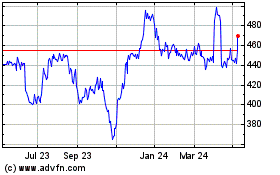

Pagegroup (LSE:PAGE)

Historical Stock Chart

From Mar 2024 to Apr 2024

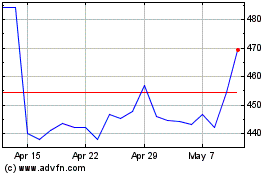

Pagegroup (LSE:PAGE)

Historical Stock Chart

From Apr 2023 to Apr 2024