Paypoint plc Disposal

April 08 2021 - 10:24AM

UK Regulatory

TIDMPAY

8 April 2021

PayPoint Plc

("PayPoint")

PayPoint completes the disposal of Romanian business to Innova Capital

Transaction completed at significant profit, underpinning step change in

UK-focused strategy

Further to the announcement of 21 October 2020, PayPoint is pleased to

announce that it has completed the disposal of its Romanian business,

PayPoint Services SRL* ("PayPoint Romania"), to Innova Capital

("Innova"), a private equity firm operating in Central and Eastern

Europe, after receiving regulatory and other customary approvals. The

cash consideration for the disposal is GBP48 million based on current

exchange rates on a cash free debt free basis, after closing balance

sheet adjustments.

The sale is consistent with PayPoint's focus on its key strategic

priorities and the delivery of enhanced growth and value in its core UK

markets.

PayPoint has been operating in Romania since 2007, where it has

partnered with local retailers through circa 19,000 sites to enable

people to make cash bill payments, money transfers, road tax payments

and mobile phone top-ups. In the financial year ended 31 March 2020,

PayPoint Romania delivered gross revenue of GBP69.7 million, adjusted

EBITDA (before non-recurring revenues and costs) of GBP7.3 million and a

profit before tax of GBP6.8 million. The gross assets of PayPoint

Romania at 31 March 2020 were GBP48.5 million.

PayPoint Plc's financial statements for the year ended 31 March 2021

will include a full year's net profit from the Romanian business.

Nick Wiles, Chief Executive Officer of PayPoint Plc, said: "Consistent

with the step change in our UK-focused strategy, we are pleased to have

completed the sale of PayPoint Romania. I would like to thank the

Romanian management team and employees for their contribution to

PayPoint over the last 13 years. We believe that Innova Capital is the

right owner to take the business forward and we wish PayPoint Romania

and Innova well for the future."

Krzysztof Kulig, Senior Partner at Innova Capital, explained: "We are

pleased to conclude the purchase of PayPoint Romania, a trusted payments

operator and a market leader. Our goal is now to bring our sector

experience and help its expansion into new services which will introduce

an even higher level of customer satisfaction to its clients - retailers,

consumers and utility providers. We look forward to working with its

management team to continue the company's growth journey."

Ernst & Young LLP acted as lead financial adviser and Mills & Reeve LLP

as legal adviser to PayPoint on the sale.

Except as disclosed above, there has been no significant change

affecting any matter contained in the announcement of 21 October 2020

and no other significant new matter has arisen since that announcement

which would require disclosure.

*The sale includes PayZone SA, which was merged with PayPoint Services

SRL on 27 March 2021

For further information please contact:

Enquiries:

PayPoint Plc Finsbury

01707 600 300 0207 251 3801

Nick Wiles, Chief Executive (Mobile: 07768 636801 Rollo

Head

Alan Dale, Finance Director (Mobile: 07778 043962) Nidaa

Lone

(Email: Paypoint@finsbury.com)

ABOUT PAYPOINT

For tens of thousands of businesses and their customers, we make life

and payments more convenient.

For retailers, we offer innovative and time-saving technology that

empowers them to achieve higher footfall and increased spend so they can

grow their businesses profitably. Our innovative retail services

platform, PayPoint One, is now live in over 17,000 shops in the UK and

offers everything a modern convenience store needs. More broadly, we

also provide card payments services to thousands of growing businesses

across the food services, garage and hospitality sectors. Our

technology helps companies to serve customers quickly, improve business

efficiency and modernise their operations.

For clients of all sizes, we also provide market-leading payments

technologies without the need for capital investment. Our seamlessly

integrated omnichannel solution -- MultiPay -- is a one-stop shop for

digital and other customer payments, via any channel and on any device.

Together, these solutions help millions of consumers to control their

household finances, make essential payments and access services like

cash withdrawals, eMoney and parcel collections and drop-offs. Our UK

network of more than 27,700 stores is bigger than all banks,

supermarkets and Post Offices together, putting us at the heart of

communities nationwide.

ABOUT INNOVA CAPITAL

Innova Capital is an independent private equity advisor, operating from

Poland and investing in majority buyouts in mid-sized enterprises with

activities in Central and Eastern Europe. From its the inception in

1994, Innova Capital has invested close to EUR 1 billion in almost 60

companies located in 10 countries in the region. Innova was recognized

by the Polish Private Equity and Venture Capital Association (PSIK) as

PE Management Firm of the Year 2019.

https://www.globenewswire.com/Tracker?data=etCwgRrkN5_oTT76KMWvNKdA8lT73vj7PN-X0-Xo_GvhroJcMGWG0nuicbgAdmk4hHhl6NnhDU7SJmbhw1btV10KqC-u_46qfI7qLEEGyos=

https://innovacap.com/

(END) Dow Jones Newswires

April 08, 2021 11:24 ET (15:24 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

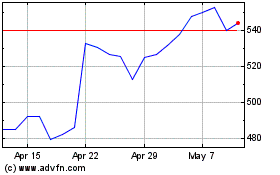

Paypoint (LSE:PAY)

Historical Stock Chart

From Mar 2024 to Apr 2024

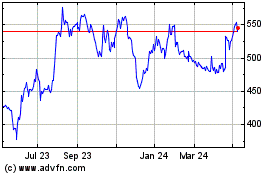

Paypoint (LSE:PAY)

Historical Stock Chart

From Apr 2023 to Apr 2024