TIDMPDL

20 April 2022 LSE: PDL

Petra Diamonds Limited

Trading Update for the three and nine months ended 31 March 2022

Petra Diamonds Limited ("Petra", the "Company" or the "Group") announces its

unaudited Trading Update for the three months ended 31 March 2022 (the

"Quarter", "Q3 FY 2022" or "Q3") and the nine months to 31 March 2022 ("9M FY

2022", "Year to Date" or "YTD").

Richard Duffy, Chief Executive of Petra Diamonds, commented:

"Petra has benefitted from strong diamond prices during the Quarter underpinned

by strong operational, cost and safety performance. The 43% increase in the YTD

revenue to US$405.4 million was driven by Exceptional Stones sales contributing

US$83.3 million YTD, coupled with the upward trend in diamond prices. This

culminated in the significant like-for-like 37.6% price increase we saw in the

4th Tender in March compared to the preceding December 2021 tender. Petra's

production of Exceptional Stones in the Year to Date in part reflects our

investment in throughput as part of Project 2022. This Project is now

integrated throughout our business and is expected to deliver net free cash of

over US$200 million for the three years to June 2022, a significant improvement

over our target of US$100-150 million. We also confirm our production, cost and

capex guidance as announced at the Investor Day held in February 2022.

"Petra's balance sheet strengthened further during the Quarter with net debt of

US$107.0 million and unrestricted cash balances totalling US$233.2 million at

Period end after settling the Group's first lien facilities of US$88.9 million

(including interest) during the Quarter.

"Although we anticipate some pull back in diamond prices from the elevated

March tender levels as a result of the economic impact of the war in Ukraine,

the structural shift in the diamond market continues to provide positive

momentum. This, coupled with our operational improvements driving margin and

cash generation, supports a positive outlook for the business with the

potential for further reductions in our debt levels."

HIGHLIGHTS

Strong performance with quarterly revenue growth of 33%

* Strong YTD safety performance

+ Lost Time Injury Frequency Rate ("LTIFR") down 62% to 0.18 (9M FY 2021:

0.47)

+ Total injuries, including LTIs, down 20% to 24 (9M FY 2021: 30)

* Q3 revenue up 33% to US$140.6 million (Q3 FY 2021: US$106.0 million) driven

by:

+ Strong prices achieved in the 4th Tender in March 2022 with

like-for-like prices up 37.6% compared to the preceding December 2021

tender

+ The sale of one Exceptional Stone in the Quarter, a 157.88ct Type IIa

white stone from Cullinan for US$5.5 million

* Notwithstanding the revenue increase, carats sold were down 31% and 16% in

the Quarter and YTD respectively, given that there was only one sales

tender in Q3. However, no impact is foreseen on expected sales volumes for

the full year with further tenders in April and June 2022

* Quarterly production up 18% to 830,456 carats (Q3 2021: 704,498 carats)

with YTD production up 7% to 2,607,880 carats (9M FY 2021: 2,445,360

carats), largely attributable to Williamson's resumption of production

following a period of care and maintenance. In addition, the remedial steps

taken at Finsch following waste ingress in Q2 FY 2021 positively affected

the quarterly comparison

* Balance Sheet as at 31 March 2022:

+ Consolidated net debt of US$107.0 million (31 December 2021: US$152.3

million)

+ Gross cash of US$249.2 million (31 December 2021: US$272.3 million) and

unrestricted cash of US$233.2 million (31 December 2021: US$256.7

million) following settlement of the ZAR404.6 million (US$27.7 million)

revolving credit facility ("RCF") and ZAR893.2 million (US$61.2

million) term loan under the first lien facilities during the Quarter.

The agreements for the new ZAR1 billion (c. US$68 million) RCF with

Absa Bank, as announced in February, are in the process of being

finalised with the new facility expected to become effective during

April 2022

+ Diamond debtors of US$nil (31 December 2021: US$0.4 million)

+ Diamond inventory valued at US$98.1 million (31 December 2021: US$79.6

million)

Q3 Diamond Production up 18% with the resumption of production at Williamson

Production and sales summary

Unit Q3 FY Q3 FY Var. 9M FY 2022 9M FY Var. FY 20211

2022 2021 2021

Ore processed Mt 2.9 1.8 +61% 8.6 6.1 +41% 8.1

Diamonds MCts 830,456 704,498 +18% 2,607,880 2,445,360 +7% 3,240,312

recovered

Diamonds sold MCts 735,225 1,069,205 -31% 2,331,076 2,782,002 -16% 3,960,475

Revenue US$M 140.6 106.0 +33% 405.4 284.2 +43% 406.9

Note 1: For comparative purposes the FY 2021 figures have been restated to

include Williamson as it is no longer a discontinued operation

Credit rating upgrades

On 23 March, Moody's Investor Services upgraded Petra's Corporate Family Rating

(CFR) and its second lien bond rating from Caa1 to B3, taking the outlook from

Positive to Stable. This reflects "Petra's stronger financial and business

outlook". On 26 February, S&P Global Ratings upgraded its outlook for Petra's

bonds to positive "reflecting the recovery in the diamond market and improved

liquidity" while maintaining its B rating.

Guidance reiterated

Key operational guidance

Unit FY22E FY23E FY24E FY25E

Total carats recovered Mcts 3.3 - 3.6 3.3 - 3.6 3.3 - 3.6 3.6 - 3.9

Cash on-mine costs and G&A1 $m 300 - 310 300 - 320 300 - 320 300 - 320

Expansion capex1 $m 47 - 50 105 - 115 125 - 135 115 - 120

Sustaining capex1 $m 28 - 30 30 -32 30 - 32 26 - 28

Note 1: Opex and Capex guidance is stated in FY 2022 real terms and based on an

exchange rate of ZAR15 / USD1.

Detailed guidance is available on Petra's website at https://

www.petradiamonds.com/investors/analysts/analyst-guidance/

* Petra reiterates the detailed operational guidance provided for the FY 2022

to 2025 period and the guidance for expansion capital expenditure, of US$61

million, beyond the FY 2025 guidance period.

* Petra does not provide guidance on diamond pricing. However, it should be

noted that Exceptional Stones have contributed an average of US$47 million

per annum over the last three years, and US$37 million per annum over the

last five years, to Group revenue.

Outlook

Our confidence in the outlook for Petra is supported by the structural changes

in diamond market supply and demand which continue to underpin prices, despite

some expected softening from the highs seen in the March tender as a result of

the economic uncertainty arising from the war in Ukraine. The supportive

structural market dynamic, coupled with the operational improvements we have

made to drive margin and cash generation, give the potential for both improved

financial performance and further reduction in our debt.

CONFERENCE CALLS

09:30am and 16:00 BST today

Petra's Chief Executive, Richard Duffy, and Finance Director, Jacques

Breytenbach, will host calls today to discuss this trading update at 09:30 and

16:00 BST.

Registration for calls:

United Kingdom 0800 640 6441

United Kingdom (Local) 020 3936 2999

United States 1 646 664 1960

All other locations +44 20 3936 2999

09:30: Access code: 122879

16:00: Access code: 853531

Press *1 to ask a question, *2 to withdraw your question, or *0 for operator

assistance.

Link for recording (available later today):

https://www.petradiamonds.com/investors/results-reports/

FURTHER INFORMATION

Please contact

Petra Diamonds, London

Telephone: +44 207494 8203

Jill Sherratt

investorrelations@petradiamonds.com

Julia Stone

REVIEW

Q3 and 9M FY 2022 production and sales summary

Unit Q3 Q3 Variance 9M 9M Variance

FY FY 2021 FY FY

2022 2022 2021

Revenue US$M 140.6 106.0 +33% 405.4 284.2 +43%

Exceptional US$M 5.5 12.2 -55% 83.4 52.5 +59%

Stones

Total production Mt 2.9 1.8 +61% 8.6 6.1 +41%

Total diamonds Carats 830,456 704,498 +18% 2,607,880 2,445,360 +7%

Strong YTD revenue growth in a robust diamond market

The 43% increase in revenue for the nine months to 31 March 2022 to US$405.4

million (9M FY 2021: US$284.2 million) was driven in part by the sale of

Exceptional Stones totalling US$83.4 million (9M FY 2021: US$52.5 million)

comprising the following:

* 39.34 carat blue diamond from the Cullinan mine which sold for US$40.2

million

* 342.92 carat Type IIa white diamond from the Cullinan mine which sold for

US$10 million (the Company has retained a 50% interest in the profit uplift

of the polished proceeds, after costs, of the 342.92 carat white diamond,

as well as an 18.30 carat Type IIb blue diamond which sold for US$3.5

million)

* 32.32 carat pink diamond from the Williamson mine which sold for US$13.8

million

* 295.79 carat white diamond from the Cullinan mine which sold for US$13.9

million

* 157.88 carat white diamond from Cullinan mine which sold for US$5.5 million

Revenue also benefited from a 37.6% like-for-like rise in realised diamond

prices in the 4th tender as compared to the preceding tender which closed in

December 2021.

YTD carats sold reduced by some 16% compared to the comparative period when

significantly higher volumes were sold, mostly off-tender, following the

inventory build-up witnessed late in FY 2020 after the initial COVID-19

outbreak, while sales in Q3 FY 2022 were limited to one tender during the

Quarter. Two further sales tenders are planned in this last quarter, in April

and June, as previously announced. The higher diamond inventory at the end of

Q3 is expected to unwind to normal year-end levels during the fourth quarter.

Production benefiting from operational improvements and good safety performance

Health and safety

The Lost Time Injury Frequency Rate ("LTIFR") for 9M FY 2022 decreased to 0.18

(9M FY 2021: 0.47). The LTIs during the Period continued to be of low severity

and mostly behavioural in nature. The various remedial actions and

behaviour-based intervention programmes previously announced have assisted in

achieving the strong improvement in the safety trend. The total number of

injuries during 9M FY 2022, which includes LTIs, decreased to 24 (9M FY 2021:

30). Petra continues to target a zero-harm working environment.

COVID-19 remains a risk to the health and safety of the Group's workforce.

Petra has implemented systems and strategies across all of its operations aimed

at preventing and/or containing the spread of the virus with an ongoing drive

to vaccinate its employees. In South Africa, 2,479 employees have been fully

vaccinated (58.4% of the workforce) and 244 partially vaccinated (6% of the

workforce), while at Williamson the roll-out has been slower with 173 employees

fully vaccinated (14% of the workforce).

Production

9M FY 2022 production was in line with guidance, totalling 2,607,880 carats (9M

FY 2021: 2,445,360 carats). Williamson resumed production during the period,

having been on care and maintenance since April 2020. The previously reported

waste ingress at Finsch has been largely mitigated through the implementation

of enhanced drill and blast and draw controls. The convergence of tunnel 41 at

Cullinan has been remediated and will continue to be monitored in terms of

re-accessing the tunnel.

The Business Re-engineering Projects at Finsch and Koffiefontein concluded in

transition plans with recommended deliverables and due dates.

* The cost savings and production improvement initiatives at Finsch, to

enhance margins and ensure a long-term sustainable operation, are being

implemented as part of the annual three year planning cycle.

* While the conclusion for Koffiefontein reaffirmed running the mine to

closure by 2025 as well as exploring other alternatives in parallel, we

have been considering options to curtail the negative cash flow. To this

end, we have been engaging with the Future Forum, comprising organised

labour and management, with the intention of aligning the operations to a

reduced tonnage profile and improved efficiencies. Regretfully, this is

expected to result in job losses.

Production ramp-up at Williamson commenced during the first half and 2.4 Mt ROM

was processed in 9M FY2022, yielding 147,876 carats, including the exceptional

32.32 carat pink stone sold during H1 FY 2022.

The diamond market

The strength of the diamond market was evident in the sales results from

Petra's 4th Tender in March. Strong demand for rough diamonds, with resultant

price increases, was seen across all size and quality categories. Like-for-like

rough diamond prices increased by 37.6% on Tender 3, which closed in December

2021.

The much stronger diamond market has been evident since mid-2021 with Q3

pricing for rough driven by strong sales of polished and increased demand from

the manufacturing centres, bolstered by record sales during the festive season.

We believe this market dynamic reflects the structural change in underlying

supply and demand, which we expect to continue to be supportive. However, the

effects of the current conflict in Ukraine have led to some uncertainty as to

the impact on the global economy, which we expect will result in some softening

in prices from the highs seen in Q3 FY 2022.

Petra is closely monitoring the impact of the war in Ukraine and sanctions on

Russian companies. We also continue to monitor COVID-19 and the impact it may

have on clients' ability to attend tenders and we will remain flexible in our

approach to planning upcoming sales events. The final sales for FY 2022 are

planned for April and June, bringing the number of tenders to six for FY 2022.

Strong cash generation supported by Project 2022

Project 2022, a three-year project that commenced in July 2019, is now in its

final three months. It has successfully increased cash generation through

increased production levels and reduced operating and capital expenditure. The

benefits are particularly reflected in the improving operating performance at

Cullinan and Finsch. Having achieved net free cash flow of US$182 million for

the thirty months to 31 December 2021, we are confident that the Project will

deliver over US$200 million in net free cash flow for the three years to end

June 2022, comfortably exceeding its US$100 to US$150 million target.

Continuous business improvement processes are now embedded in the Company's

Operating Model and Organisational Design and is expected to continue to drive

future performance improvement.

Williamson Mine - Human Rights update

As previously announced, Petra has implemented remedial initiatives and is

putting in place the Independent Grievance Mechanism ("IGM") as well as

community programmes to address the historical allegations of human rights

abuses at the Williamson mine in Tanzania. The Government of Tanzania gave its

approval to proceed with local stakeholder engagement on the IGM in February

2022 and the first phase commenced during March. Further engagement will take

place before the IGM is launched. Following delays in the necessary stakeholder

engagements, the current target is for the IGM to become operational during Q4

of this calendar year.

A number of other projects are being put in place to provide sustainable

benefits to the communities located close to the mine funded by the one million

pounds escrow account established by Petra. The Gender Based Violence project

completed all planned activities in the first quarter of this calendar year and

the next step is to confirm community action plans with the district

commissioner. The medical services project continues to provide physiotherapy

services and further services are being considered. Feasibility studies for the

income generating projects (agri business and artisanal mining) are also

progressing.

More information on this can be found on Petra's website at: https://

www.petradiamonds.com/our-operations/our-mines/williamson/

allegations-of-human-rights-abuses-at-the-williamson-mine/.

Notes:

1. The following definitions have been used in this announcement:

a. Exceptional Stones: diamonds with a valuation and selling price of US$5m or

more per stone

b. cpht: carats per hundred tonnes

c. Kcts: thousand carats

d. Kt: thousand tonnes

e. LOM: life of mine

f. LTI: lost time injury

g. LTIFR: lost time injury frequency rate

h. Mcts: million carats

i. Mt: million tonnes

j. FY: financial year

k. Q: quarter of the financial year

l. ROM: run-of-mine (i.e. production from the primary orebody)

m. SLC: sub level cave

n. m: million

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 230 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's US$336.7 million notes due in

2026 are listed on the Irish Stock Exchange and admitted to trading on the

Global Exchange Market. For more information, visit www.petradiamonds.com.

APPIX

Corporate and financial summary 31 March 2022

Unit As at 31 As at 31 As at 30 June As 31 March

March December 2021 2021 2021

2022

Cash at bank - US$m 249.2 272.3 173.0 153.8

(including

restricted

amounts)¹

Diamond debtors US$m - 0.4 38.3 2.6

Diamond US$m 98.1 79.6 56.5 75.5

inventories2,3 Cts 914,402 819,252 637,676 1,020,973

US$336.7m loan US$m 356.2 346.4 327.3 338.7

notes (issued

March 2021)4

Bank loans and US$m - 78.6 103.0 108.4

borrowings5

Consolidated Net US$m 107.0 152.3 228.2 290.7

debt6

Bank facilities US$m 24.5 0.6 7.7 10.8

undrawn and

available5

Note: The following exchange rates have been used for this announcement:

average for 9M FY 2022 US$1: ZAR15.10 (9M FY 2021: US$1: ZAR15.84, FY 2021:

US$1: ZAR15.41); closing rate as at 31 March 2022 US$1: ZAR14.60 (31 March 2021

US$1: ZAR14.77, 30 June 2021: US$1: ZAR14.27).

Notes:

1. Cash at bank and diamond inventories include balances at Williamson as at

31 March 2022 following the Company entering into the MoU with Caspian

during December 2021. Comparatives for 31 December 2021, 30 June 2021 and

31 March 2021 have been adjusted to include balances attributable to

Williamson.

2. Recorded at the lower of cost and net realisable value.

3. Diamond inventories includes the Williamson 71,654.45 carat parcel of

diamonds blocked for export during August 2017, with a carrying value of

US$10.6 million. Under the framework agreement reached with the Government

of Tanzania, as announced on 13 December 2021, the proceeds from the sale

of this parcel are required to be allocated to Williamson.

4. The US$336.7 million loan notes have a carrying value of US$356.2 million

which represents the gross capital of US$336.7 million of notes, plus

accrued interest and net of unamortised transaction costs capitalised,

issued following the capital restructuring (the "Restructuring") completed

during March 2021.

5. Bank loans and borrowings represent amounts drawn under the Group's

refinanced South African bank facilities as part of the Restructuring and

comprise the term loan and revolving credit facility. Under the revolving

credit facility, ZAR358.4 million (US$24.5 million) remains undrawn and

available. During the Period, the Group settled the revolving credit

facility of ZAR404.6 million (US$27.7 million) (capital plus interest) and

the term loan of ZAR893.2 million (US$61.2 million) (capital plus

interest). The revolving credit facility remains available for drawdown

with the term loan being cancelled upon settlement.

6. Consolidated Net Debt is bank loans and borrowings plus loan notes, less

cash and diamond debtors.

Q3 and 9M FY 2022 production and sales summary

Group

Unit Q3 Q3 Variance 9M 9M Variance

FY 2022 FY 2021 FY 2022 FY 2021

Sales

Diamonds sold Carats 735,225 1,069,205 -31% 2,331,076 2,782,002 -16%

Revenue US$M 140.6 106.0 +33% 405.4 284.2 +43%

Production

ROM tonnes Mt 2.8 1.7 +65% 8.2 5.8 +41%

Tailings & Mt 0.1 0.1 n.a. 0.4 0.3 +33%

other1 tonnes

Total tonnes Mt 2.9 1.8 +61% 8.6 6.1 +41%

treated

ROM diamonds Carats 780,896 656,461 +19% 2,430,885 2,301,307 +6%

Tailings & Carats 49,560 48,037 +3% 176,995 144,053 +23%

other1 diamonds

Total diamonds Carats 830,456 704,498 +18% 2,607,880 2,445,360 +7%

Cullinan - South Africa

Unit Q3 Q3 Variance 9M 9M Variance

FY 2022 FY 2021 FY 2022 FY 2021

Sales

Revenue US$M 73.7 62.9 +17% 241.4 170.2 +42%

Diamonds sold Carats 409,030 651,268 -37% 1,281,334 1,546,026 -17%

Average price per US$ 180 97 +86% 188 110 +71%

carat

ROM production

Tonnes treated Tonnes 1,053,631 1,054,978 -0% 3,360,618 3,394,451 -1%

Diamonds produced Carats 404,473 388,666 +4% 1,247,675 1,302,292 -4%

Grade1 cpht 38.4 36.8 +4% 37.1 38.4 -3%

Tailings production

Tonnes treated Tonnes 112,414 105,825 +6% 350,706 327,210 +7%

Diamonds produced Carats 49,560 48,037 +3% 176,995 144,053 +23%

Grade1 cpht 44.1 45.4 -3% 50.5 44.0 +15%

Total production

Tonnes treated Tonnes 1,166,045 1,160,803 +0% 3,711,324 3,721,661 +0%

Diamonds produced Carats 454,033 436,703 +4% 1,424,670 1,446,345 -1%

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Finsch - South Africa

Unit Q3 Q3 Variance 9M FY 9M FY Variance

FY 2022 FY 2021 2022 2021

Sales

Revenue US$M 39.2 31.4 +25% 104.9 86.2 +22%

Diamonds sold Carats 259,164 391,921 -34% 935,459 1,160,568 -19%

Average price per US$ 151 80 +89% 112 74 +51%

carat

ROM production

Tonnes treated Tonnes 656,408 460,057 +43% 2,079,527 1,783,057 +17%

Diamonds produced Carats 303,591 253,607 +20% 1,005,134 948,915 +6%

Grade1 cpht 46.3 55.1 -16% 48.3 53.2 -9%

Total production

Tonnes treated Tonnes 656,408 460,057 +43% 2,079,527 1,783,057 +17%

Diamonds produced Carats 303,591 253,607 +20% 1,005,134 948,915 +6%

Note: 1. Petra is not able to precisely measure the ROM / tailings grade split

because ore from both sources is processed through the same plant; the Company

therefore back-calculates the grade with reference to resource grades.

Koffiefontein - South Africa

Unit Q3 Q3 Variance 9M 9M Variance

FY 2022 FY 2021 FY 2022 FY 2021

Sales

Revenue US$M 5.4 11.7 -54% 16.5 22.9 -28%

Diamonds sold Carats 6,269 26,007 -76% 26,907 44,951 -40%

Average price per US$ 856 451 +90% 612 509 +20%

carat

ROM production

Tonnes treated Tonnes 76,453 130,494 -41% 393,763 624,155 -37%

Diamonds produced Carats 7,829 14,188 -45% 30,200 50,101 -40%

Grade cpht 10.2 10.9 -6% 7.7 8.0 -4%

Total production

Tonnes treated Tonnes 76,453 130,494 -41% 393,763 624,155 -37%

Diamonds produced Carats 7,829 14,188 -45% 30,200 50,101 -40%

Williamson - Tanzania

Unit Q3 Q3 Variance 9M FY 9M FY Variance

FY 2022 FY 2021 2022 2021

Sales

Revenue US$M 22.4 0 n.a 42.6 4.6 n.a

Diamonds sold Carats 60,759 0 n.a 87,370 30,339 n.a

Average price per US$ 369 0 n.a 488 150 n.a

carat

ROM production

Tonnes treated Tonnes 1,005,901 0 n.a 2,360,017 0 n.a

Diamonds produced Carats 65,003 0 n.a 147,876 0 n.a

Grade cpht 6.5 0 n.a 6.3 0 n.a

Total production

Tonnes treated Tonnes 1,005,901 0 n.a 2,360,017 0 n.a

Diamonds produced Carats 65,003 0 n.a 147,876 0 n.a

END

(END) Dow Jones Newswires

April 20, 2022 02:00 ET (06:00 GMT)

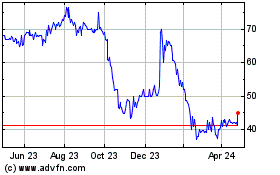

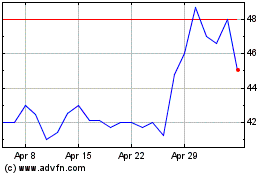

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Apr 2023 to Apr 2024