TIDMPET

RNS Number : 4952Z

Petrel Resources PLC

21 September 2020

21(st) September 2020

Petrel Resources plc

("Petrel" or "the Company")

Interim Statement for the six months ended 30 June 2020

Petrel Resources plc (AIM: PET) today announces financial

results for the six months ended 30(th) June 2020.

Petrel is a hydrocarbon explorer with interests in Iraq, Ghana

and offshore Ireland. The world oil and gas industry has taken a

public relations hammering in recent times yet world demand

continues, and will continue, to grow. Society is very dependent on

oil, gas and petrochemicals.

As an example, the world in 2020 relies on sterile plastic

packaging for syringes, PPE, etc.

Our daily lives are improved by a multitude of hydrocarbon based

products. Renewables are growing and will continue to grow, but for

the coming decades, oil and gas will be the dominant source of

energy. This will require new discoveries, Petrel will play a part

in this.

Petrel has three areas of interest. Iraq, where we have had a

presence since 1999, Ghana, where discussions are ongoing since

2008 and offshore Ireland, where Petrel operated in the 1980s and

re-entered six years ago.

Iraq

Petrel is active once more in Iraq after a hiatus since 2010 due

to political and financial instability. We negotiated a large

exploration block, Block 6, in the Western Desert in 2005. Nothing

has happened there in the recent past. In discussions in early

2020, before the Covid-19 pandemic, with Ministry officials we

renewed our Block 6 interest and re-presented the technical slides

done by the Company on the Merjan-Kefl-West Kifl oil discoveries

which remain undeveloped. We did extensive work under a Technical

Co-operation Agreement on possible ways to develop these

discoveries.

With appropriate terms and pipeline access, the Merjan oil-field

seems poised for early development: it was discovered, as an oil

reservoir, by Mobil in 1982, but work did not proceed, mainly for

political reasons. Petrel's work on Merjan did not suggest that the

area was gas-prone. The discovery well - Me-1- was located using 2D

seismic on a Jurassic reef. No reef or oil was found in the

Jurassic, but the well discovered oil in the Upper Cretaceous

Hartha Formation. Recent analysis of 3D data focusses on the

Jurassic seismic feature, and does not discuss the nature of any

hydrocarbons in the well or the area. The Hartha reservoir in the

well tested oil and water, without a significant flow of gas.

Given the scope to reduce emissions through gas development, we

should also bear Iraq's gas potential in mind: a staggering 16

billion cm (0.6 tcf) of gas are flared yearly (including valuable

liquids), which is about half Iraq's gas output. We proposed gas

and condensate recovery on Subba & Luhais, at various times,

from 2004 through 2010, but the necessary legal framework was not

then in place. With appropriate terms and infrastructure, gas

economics are also attractive.

As lowest cost oil producer Iraq is well poised to benefit from

the development of the oil market. Their output can easily double

in size.

Tano 2A Offshore Block - Ghana

Petrel holds a 30% interest in the Tano 2A block (Clontarf 60%

and local interests 10%) Negotiations began in 2008, were finalised

in 2010 and ratification was expected shortly thereafter. The saga

has dragged on for close to a decade. In the past year high level

contacts were reopened. A series of meetings proposed for March

2020 were cancelled indefinitely due to the pandemic.

Despite low oil prices, offshore Ghana remains attractive with

good geology and acceptable financial terms. In recent weeks the

country is re-opening from lockdown so the cancelled meetings are

expected to occur by year end.

Offshore Ireland

This is sad scene. State policy has effectively stymied offshore

exploration. All new licences are banned and while existing

licences may proceed it is highly probable that any discovery will

not be commercialised, it will likely take years to get an

exploration permit, if ever, and maybe decades to get planning

permission in the face of a small vociferous objecting minority

Petrel holds a 10% working interest in Licence FEL 11/18 in the

Porcupine. Excellent work has been done by the operator Woodside

Petroleum but it is difficult to see how Woodside will commit the

tens of millions to drill.

Tamraz Group

The acquisition of a 29% stake by the Tamraz group in July 2019

was widely welcomed by shareholders followed by approval to go to

51%.

The new investors were unable to complete the purchase of the

additional shares while the ownership of most of the 29% became

uncertain. High Court proceedings stopped any dealings in shares

held by the Tamraz Group. This position persists though there is

ongoing contact.

Future

Petrel is well funded for ongoing activities. The focus is once

again Iraq.

John Teeling

Chairman

18(th) September 2020

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this announcement.

In addition, market soundings (as defined in MAR) were taken in

respect of the matters contained in this announcement, with the

result that certain persons became aware of inside information (as

defined in MAR), as permitted by MAR. This inside information is

set out in this announcement. Therefore, those persons that

received inside information in a market sounding are no longer in

possession of such inside information relating to the company and

its securities.

S

For further information please visit http://www.petrelresources.com/ or contact:

Petrel Resources

John Teeling, Chairman +353 (0) 1 833 2833

David Horgan, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

Blytheweigh - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Madeleine Gordon-Foxwell +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

Ross Murphy +353 (0) 1 661 4055

Petrel Resources plc

Financial Information (Unaudited)

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE

INCOME

Six Months Ended Year Ended

30 June 30 June 31 Dec

20 19 19

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

Administrative expenses (243) (115) (345)

Impairment of deferred development costs - - (1,614)

------------------- ------------------- -------------------

OPERATING LOSS (243) (115) (1,959)

LOSS BEFORE TAXATION (243) (115) (1,959)

Income tax expense - - -

------------------- ------------------- -------------------

LOSS FOR THE PERIOD (243) (115) (1,959)

Items that are or may be reclassified

subsequently to profit or loss

Exchange differences (9) 24 (119)

TOTAL COMPREHENSIVE PROFIT FOR THE PERIOD (252) (91) (2,078)

=================== =================== ===================

LOSS PER SHARE - basic and diluted (0.16c) (0.11c) (1.50c)

=================== =================== ===================

30 June 30 June 31 Dec

CONDENSED CONSOLIDATED BALANCE SHEET 20 19 19

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

ASSETS:

NON-CURRENT ASSETS

Intangible assets 985 2,593 984

------------------- ------------------- -------------------

985 2,593 984

------------------- ------------------- -------------------

CURRENT ASSETS

Trade and other receivables 49 59 38

Cash and cash equivalents 409 178 368

------------------- ------------------- -------------------

458 237 406

TOTAL ASSETS 1,443 2,830 1,390

------------------- ------------------- -------------------

CURRENT LIABILITIES

Trade and other payables (654) (643) (630)

------------------- ------------------- -------------------

(654) (643) (630)

------------------- ------------------- -------------------

NET CURRENT LIABILITIES (196) (406) (224)

NET ASSETS 789 2,187 760

=================== =================== ===================

EQUITY

Share capital 1,963 1,307 1,867

Capital conversion reserve fund 8 8 8

Capital redemption reserve 209 209 209

Share premium 21,786 21,601 21,601

Share based payment reserve 27 27 27

Translation reserve 367 519 376

Retained deficit (23,571) (21,484) (23,328)

------------------- ------------------- -------------------

TOTAL EQUITY 789 2,187 760

=================== =================== ===================

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Capital Capital Share based

Share Share Redemption Conversion Payment Translation Retained Total

Capital Premium Reserves Reserves Reserves Reserves Losses Equity

EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000 EUR'000

As at 1 January

2019 1,307 21,601 209 8 27 495 (21,369) 2,278

Total

comprehensive

income - 24 (115) (91)

-------- -------- ----------- ----------- ------------------ ------------ --------- --------

As at 30 June

2019 1,307 21,601 209 8 27 519 (21,484) 2,187

Shares issued 1,360 0 1,360

Shares cancelled (800) 0 (800)

Total

comprehensive

income - (143) (1,844) (1,987)

-------- -------- ----------- ----------- ------------------ ------------ --------- --------

As at 31

December 2019 1,867 21,601 209 8 27 376 (23,328) 760

Shares issued 96 185 281

Total

comprehensive

income - (9) (243) (252)

----------- ----------- ------------------ ------------

As at 30 June

2020 1,963 21,786 209 8 27 367 (23,571) 789

======== ======== =========== =========== ================== ============ ========= ========

CONDENSED CONSOLIDATED CASH FLOW Six Months Ended Year Ended

30 June 30 June 31 Dec

20 19 19

unaudited unaudited audited

EUR'000 EUR'000 EUR'000

CASH FLOW FROM OPERATING ACTIVITIES

Loss for the period (243) (115) (1,959)

Impairment charge 0 0 1,614

---------- ---------- -----------

(243) (115) (345)

Movements in Working Capital 13 9 (28)

---------- ---------- -----------

CASH USED IN OPERATIONS (230) (106) (373)

NET CASH USED IN OPERATING ACTIVITIES (230) (106) (373)

---------- ---------- -----------

INVESTING ACTIVITIES

Payments for exploration and evaluation

assets (2) (47) (151)

---------- ---------- -----------

NET CASH USED IN INVESTING ACTIVITIES (2) (47) (151)

---------- ---------- -----------

FINANCING ACTIVITIES

Shares issued 281 0 560

---------- ---------- -----------

NET CASH GENERATED FROM FINANCING ACTIVITIES 281 0 560

---------- ---------- -----------

NET INCREASE/(DECREASE) IN CASH AND

CASH EQUIVALENTS 49 (153) 36

Cash and cash equivalents at beginning

of the period 368 330 330

Effect of exchange rate changes on

cash held in foreign currencies (8) 1 2

CASH AND CASH EQUIVALENT AT THE

OF THE PERIOD 409 178 368

========== ========== ===========

Notes:

1. INFORMATION

The financial information for the six months ended 30 June 2020

and the comparative amounts for the six months ended 30 June 2019

are unaudited.

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by

the European Union. The interim financial statements have been

prepared applying the accounting policies and methods of

computation used in the preparation of the published consolidated

financial statements for the year ended 31 December 2019.

The interim financial statements do not include all of the

information required for full annual financial statements and

should be read in conjunction with the audited consolidated

financial statements of the Group for the year ended 31 December

2019, which are available on the Company's website

www.petrelresources.com

The interim financial statements have not been audited or

reviewed by the auditors of the Group pursuant to the Auditing

Practices board guidance on Review of Interim Financial

Information.

2. No dividend is proposed in respect of the period.

3. LOSS PER SHARE

30 June 30 June 31 Dec

20 19 19

EUR EUR EUR

Loss per share - Basic and Diluted (0.16c) (0.11c) (1.50c)

Basic and diluted loss per share

The earnings and weighted average number of ordinary shares

used in the calculation of basic loss per share are as follows:

EUR'000 EUR'000 EUR'000

Loss for the period attributable

to equity holders (243) (115) (1,959)

Weighted average number of ordinary

shares for the purpose of basic

earnings per share 150,821,396 104,557,246 130,647,568

Basic and diluted loss per share are the same as the effect of

the outstanding share options is anti-dilutive.

4. INTANGIBLE ASSETS

30 June 30 June 31 Dec

20 19 19

Exploration and evaluation assets: EUR'000 EUR'000 EUR'000

Opening balance 984 2,523 2,523

Additions 2 47 196

Impairment - - (1,614)

Exchange translation adjustment (1) 23 (121)

________ ________ ________

Closing balance 985 2,593 984

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ireland and Ghana. The directors are aware that

by its nature there is an inherent uncertainty in Exploration and

evaluation assets and therefore inherent uncertainty in relation to

the carrying value of capitalized exploration and evaluation

assets.

Due to legislative uncertainty since 2017, exacerbated by the

Taoiseach's public statements in September 2019 against the issue

of new Atlantic oil exploration licences, Petrel has discontinued

farm-out discussions with a gas super-major. Also, the board

reluctantly dropped our 100% owned and operated Frontier

Exploration Licence (FEL) 3/14, despite multiple identified

targets. Similarly, the board decided not to apply to convert our

prospective Licensing Option (LO) 16/24 into a Frontier Exploration

Licence. Accordingly, the directors have impaired in full all

expenditure relating to the above mentioned licences, resulting in

an impairment charge of EUR1,613,591 in the prior year.

Petrel continues as a 10% working interest partner with Woodside

in Frontier Exploration Licence (FEL) 11/18, in the Irish

Atlantic's Porcupine Basin.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- Licence obligations;

-- Funding requirements;

-- Political and legal risks, including title to licence, profit

sharing and taxation;

-- Exchange rate risk;

-- Financial risk management;

-- Geological and development risks;

Directors' remuneration of EURNil (2019: EUR30,000) and salaries

of EURNil (2019: EUR15,000) were capitalised as exploration and

evaluation expenditure during the financial year.

Regional Analysis 30 Jun 20 30 Jun 19 31 Dec 19

EUR'000 EUR'000 EUR'000

Ghana 932 918 931

Ireland 53 1,675 53

_______ _______ _______

985 2,593 984

5. SHARE CAPITAL

2019 2019

EUR'000 EUR'000

Authorised:

800,000,000 ordinary shares of EUR0.0125 10,000 10,000

Allotted, called-up and fully paid:

Number Share Capital Premium

EUR'000 EUR'000

At 1 January 2019 104,557,246 1,307 21,601

Issued during the period - -

At 30 June 2019 104,557,246 1,307 21,601

Issued during the period 108,824,869 1,360 -

Cancellation of shares subsequent to year end (64,035,976) (800,450) -

At 31 December 2019 149,346,159 1,867 21,601

Issued during the period 7,692,308 96 185

At 30 June 2020 157,038,467 1,963 21,786

Movements in issued share capital

On 30 July 2019 a total of 44,788,913 shares ("tranche 1

shares") were placed at a price of 1.25 cents per share. Proceeds

were used to provide additional working capital and fund

development costs.

*On 21 November 2019 the company held an Extraordinary General

Meeting and received shareholder approval for the following

transaction:

"64,035,976 Ordinary Shares of 1.25 cent each were to be issued

to the Tamraz group at the placing price of 1.25 cent each."

These shares (known as the "tranche 2 shares") were issued and

allotted to the Tamraz group on 21 November. The share certificates

were retained by the Company until payment was received from the

Tamraz group.

It became known to Petrel that prior to 31 December 2019 the

Tamraz group had offered the tranche 1 shares in Petrel as

collateral to lenders. This was in breach of lock in terms which

were attached to those shares. In addition during December part of

the tranche 1 shares were transferred to a third party, further

breaching the terms of the lock in agreement in relation to those

shares.

The Tamraz group also failed to pay proceeds due in relation to

the tranche 2 shares within the timeline required by Petrel. As a

result of these factors the tranche 2 shares were considered

forfeited and were cancelled by the Group subsequent to year

end.

Although the shares were not legally cancelled until after year

end, they are considered to be forfeited as of year-end given the

circumstances noted above and in particular, the fact that Tamraz

were considered to be in default of funding arrangements and lock

in terms.

Had these circumstances been known to the Group on 21 November

2019 the shares would not have been allotted or issued. The Group

did not suffer any economic loss due to the transaction as they

were able to cancel the tranche 2 shares. As a result the shares

are considered to be economically forfeited at year end and have

been deducted from share capital on the balance sheet.

On 18 May 2020 the Company announced that the tranche 2 shares

have now been cancelled.

On 26 May 2020 a total of 7,692,308 shares were placed at a

price of 3.25 pence per share. Proceeds were used to provide

additional working capital and fund development costs.

6. POST BALANCE SHEET EVENTS

There are no material post balance sheets events affecting the

Group.

7. The Interim Report for the six months to 30(th) June 2020 was

approved by the Directors on 18(th) September 2020.

8. The Interim Report will be available on the Company's website at www.petrelresources.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAKNPFAKEEFA

(END) Dow Jones Newswires

September 21, 2020 02:00 ET (06:00 GMT)

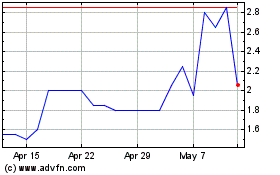

Petrel Resources (LSE:PET)

Historical Stock Chart

From Mar 2024 to Apr 2024

Petrel Resources (LSE:PET)

Historical Stock Chart

From Apr 2023 to Apr 2024