TIDMPGH

RNS Number : 1100T

Personal Group Holdings PLC

23 March 2021

23 March 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

The Market Abuse Regulation (EU 596/2014) pursuant to the Market

Abuse (Amendment) (EU Exit) Regulations 2018. Upon the publication

of this announcement via a Regulatory Information Service ("RIS"),

this inside information is now considered to be in the public

domain.

Personal Group Holdings plc

("the Company" or "Group")

Preliminary Results & Final Dividend for the Year Ended 31

December 2020

Robust financial results alongside clear strategic progress

Personal Group Holdings Plc (AIM: PGH), the digitally-enabled

employee benefits and services provider, is pleased to announce its

preliminary results for the year ended 31 December 2020.

Financial Highlights

-- Group revenue resilient at GBP71.5m (2019: GBP70.9m)

despite the COVID-19 impact, owing to a high level

of recurring revenue and diverse income streams

-- Adjusted EBITDA, the Group's key performance metric,

of GBP10.1m (2019: GBP11.0m)

-- Statutory profit before tax of GBP8.6m (2019: GBP10.5m,

with the benefit of a GBP1.3m tax provision release)

-- Basic EPS of 22.1p (2019: 28.4p)

-- Strong balance sheet and liquidity with cash and

deposits as at year end of GBP20.2m, and no debt

-- Dividend announced post-period end of 5.1p per share

Operational Highlights

-- Introduced new sales channels of virtual visits and

telesales in the core insurance business to mitigate

inability to perform face to face visits on client

premises due to COVID-19, but new annualised insurance

premium still impacted at GBP2.4m (2019: GBP9.0m)

-- Significant new contracts secured with Royal Mail

and post-period end with Kingfisher, together adding

an extra 180,000 potential customers able to buy

insurance products

-- Successful launch of the Sage Employee Benefits offering,

targeting the SME sector

-- Expansion of Public Sector customer base, signing

contracts with 13 public sector clients and being

accepted onto six public sector frameworks

-- Hapi users up c.15% to over 470,000 with over 175

organisations using our employee engagement platform

Post-period trading and Outlook

-- Limited new insurance sales during 2020 and the current

lockdown will impact insurance revenues in 2021

-- Sage Employee Benefits currently delivering in excess

of GBP1m gross annualised recurring revenues, representing

an exciting mid-term opportunity and potential access

to approximately 10m additional employees

-- Growing pipeline of opportunities both direct and

through partners

-- Clear strategy in place, which will enable the Group

to capitalise on market trends including the increased

importance of supporting employee wellbeing

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based payment expenses, corporate acquisition

costs, restructuring costs and release of tax provision.

Deborah Frost, Chief Executive of Personal Group, commented:

"There is no doubt it has been a very challenging year, with the

restrictions in 2020 impacting new insurance sales in 2020 and into

2021, but looking past this one-off headwind, we believe the

business has entered the new year in a very strong position.

I am proud of the way that the team has responded. We were able

to quickly pivot our core insurance sales approach so that it could

be delivered virtually where client availability allowed, and

continued to press forward with other strategic initiatives, such

as broadening our services into SME and the public sector. Thanks

to the hard work of everyone in the business we have delivered

robust financial results alongside a number of significant new

client wins and the fruition of our partnership with Sage.

Looking after the health and wellbeing of all employees, from

key workers to SME employees, is high on the agenda for many UK

managers, and we have an excellent proposition to make this a

reality. Our strategy to expand our footprint into new markets has

begun to be executed over recent months as we have substantially

expanded the pipeline of employees to whom we can sell our

products. We have a winning team creating a brighter future for the

UK workforce and look toward to the future with excitement.

I want to thank Mark Winlow, our outgoing chairman, for his

support and drive over the last eight years and welcome Martin

Bennett to the team as we enter the next chapter in our

development."

An overview of the preliminary results from Deborah Frost, Chief

Executive, is available to watch here:

https://youtu.be/QkGAbk8v1PU

-S-

For more information please contact:

Personal Group Holdings Plc

Deborah Frost (CE) / Sarah Mace Via Alma PR

(CFO)

Cenkos Securities Plc

Max Hartley / Callum Davidson (Nomad) +44 (0)20 7397 8900

Russell Kerr (Sales)

Alma PR +44 (0)20 3405 0205

Susie Hudson / Caroline Forde / personalgroup@almapr.co.uk

Harriet Jackson

Notes to Editors

Personal Group Holdings Plc (AIM: PGH) is a digitally-enabled

employee benefits and services provider. The Group enables

employers across the UK to improve employee engagement and support

their people's physical, mental, social and financial wellbeing.

Its vision is to create a brighter future for the UK workforce.

Personal Group provides health insurance services and a broad

range of employee benefits, engagement and wellbeing products. Many

of these services are delivered through its proprietary app,

Hapi.

The Group's growth strategy is centred around widening the

footprint of the business into the SME, talent-led & Public

Sectors, thereby expanding the addressable customer base. In

addition, it aims to grow in its existing industrial heartlands, to

re-invigorate growth in insurance policyholders and to drive the

use of its SaaS offerings.

Clients include: Arsenal FC, Barchester Healthcare, DHL Supply

Chain Limited, Merseyrail, Randstad, Royal Mail Group, the Sandwell

& Birmingham NHS trust and Stagecoach Group plc. c.40% of

clients are served by two or more group companies.

For further information, please see www.personalgroup.com

Chairman's Statement

Navigating a challenging year

As we are well aware, 2020 was a highly challenging year for all

following the outbreak of the COVID-19 pandemic. We are therefore

particularly pleased that Personal Group demonstrated its

resilience in this most challenging year - we have again delivered

a good profit from our operations and have driven forward key

strategic initiatives. We also continued to pay dividends, albeit

reduced, to shareholders, balancing the importance of income to

this stakeholder group with a programme of prudent cost

management.

Most critically, we continued to deliver benefits, both in

financial terms and in peace of mind, to individual employees, many

of whom make up the working backbone of Britain as "Key Workers".

The risks that these individuals were taking in the early days of

the pandemic were unknown and consequently, our products were

starkly important in providing protections to individuals and their

families should they become hospitalised or, as sadly happened in

some cases, die. I am proud that we have managed to Connect the

Unconnected, Protect the Unprotected, and equipped employers to

engage and reward their loyal employees during 2020.

I sincerely thank all the people at Personal Group who have

enabled us to provide support to our policyholders, in particular.

Behind the scenes our people have shown tremendous flexibility to

continue providing a seamless service. It is with great pride that

I tell those outside our business about what we do and how we have

responded. Deborah Frost covers this in more detail in her Chief

Executive report however I would also like to take this opportunity

to recognise that all we have achieved this year flows from the

efforts and attitude of all of our Personal Group employees.

Group priorities responding to COVID-19

During 2020 we have seen a considerable change in the behaviour

of employers. Our clients are becoming more thoughtful in how they

approach engaging their workforces and improving their wellbeing.

This has become a key business imperative.

As a result, many of our clients now have more complex

communication and engagement needs and Personal Group has responded

to this well. Our methods of engaging with our existing and

prospective clients have changed; we have become more targeted and

consistent in our account management which has led to successes

with Royal Mail and other significant clients. We have also

developed a much more integrated style that takes advantage of the

strengths of our combined business propositions and our unique

salesforce. Furthermore, we have adapted to selling our products

remotely.

Nevertheless, two of our businesses have faced significant

challenges in the year - the face-to-face selling of insurance was

impossible for large parts of 2020 and Innecto, our reward

consulting business, was similarly affected. However, we were

pleased to see our Software as a Service (SaaS)-based offering grew

well. It is also well positioned for 2021 as our partnership with

Sage has started to have a positive effect with a marked increase

in SME clients signing up to the offering. Let's Connect, our

business delivering consumer technology as a benefit, performed

well but was hindered by global supply chain shortages during its

peak trading period in the run up to Christmas. In the round, our

results stood up due to our high level of repeat business and

recurring fees from a diverse business model. Overall, our business

delivered Revenue up GBP0.6m from last year with Profit Before Tax

(PBT) down circa GBP2m.

We consider Adjusted EBITDA to be the most appropriate measure

of our performance as it has a consistent composition and does not

include one-off elements that might distract from the underlying

performance. Adjusted EBITDA for 2020 was only marginally lower

than 2019, a remarkable performance given all that happened in 2020

and demonstrating the resilient nature of our business model.

As well as thanking our colleagues for their hard work, it is

worth noting that we do not take for granted the continued support

of our shareholders, large and small. We greatly appreciate their

belief in the business and remain focused on creating value for

both them and all our stakeholders.

Progression on our ESG journey

As a business that is driven by a passion and commitment to

improving people's health and wellbeing, and that wants to make a

positive impact on our communities and our environment, ESG is very

important to us and a priority at Board level. We have identified a

number of ambitious ESG targets that we are now working towards,

such as reducing our carbon footprint and having a positive social

impact on the communities that we work with. I am particularly

pleased that Personal Group is at the vanguard of diversity at the

board and senior executive levels. Further information on the

Group's ESG goals and targets are detailed in our annual

report.

Board appointments and succession

This is my last report as chairman of Personal Group. I will be

stepping down from the business immensely proud that we weathered

the tidal wave of 2020 and remain buoyant as we progress in

2021.

The world in which we operate has changed rapidly in the last

eight years and I am pleased how the business has adapted. I leave

the business still facing challenges and opportunities ahead but in

the extremely capable hands of Deborah, our Chief Executive and my

successor Martin Bennett, former CEO of HomeServe UK, who joined

the board in January. I thank the entire board for their

support.

2020 saw some significant changes to our leadership team and

Board. Long-serving executive directors, CFO Mike Dugdale, and Andy

Lothian, MD of PGB, respectively retired in September and stepped

down as an executive in December. Andy remains a Director, but in a

non-Executive capacity. Ken Rooney has also retired from the

Personal Group Holdings board but will remain a director of our

regulated insurance company, Personal Assurance. They have all

provided extremely valuable counsel to Personal Group with support

and challenge brought to the Senior Leadership Team, especially in

the last year. We also welcomed Sarah Mace, as interim CFO in

September 2020, a position which became permanent post-period end

in January 2021. Sarah was formerly our Group Financial Controller

and Company Secretary so brings Personal Group experience alongside

her broader skillset. When I step down, our board will be equally

split by gender.

Dividend

Following the outbreak of COVID-19, in May 2020 the Board took

the decision to reduce the second quarter dividend as a measure of

prudence amidst the uncertain trading environment resulting from

the pandemic. In November 2020, the Company also announced that, in

light of further national lockdown restrictions and ongoing

uncertainty at that time, any payment of its fourth and final

dividend in respect of its financial year ending 31 December 2020

would be made following publication of its audited full year

results in March 2021.

As noted with the release of these accounts, a final dividend of

5.1p will be paid to shareholders on 12 May 2021.

We also announced in November 2020 that from 2021 the Board has

decided to adopt a more typical dividend payment profile with two

dividends scheduled each year following the respective half-year

and full year financial reporting periods. This revised profile

will enable the Board to have greater clarity on operational

results for the year before declaring the dividend to be paid. We

will seek to continue dividend payments in line with the historic

pay-out ratio over the past three years.

Outlook

Whilst we have faced quite a different year than expected.

Personal Group has demonstrated its underlying strength and

resilience. I close with the same sentiments as last year.

"Fairness is an often-stated aspiration, but making it happen is

rarely discussed. Making aspects of financial security accessible

to more people at a fair price is what Personal Group does,

consistently". Personal Group did so again in 2020 and I wish all

involved every success in making it happen in the future.

Mark Winlow

Non-Executive Chairman

22 March 2021

Chief Executive Statement

An eventful year

It has been a tumultuous year, and no one could have predicted

back in January 2020 all that has happened since. Not only have we

faced the coronavirus pandemic and pivoted our core insurance

business in response, but it has also been a milestone year for

several other reasons, as we won major new clients and saw the

start of long- awaited results from our partnership with Sage in

the SME market.

I am extremely proud of how everyone in the business has

persevered and innovated to maintain services to our clients

throughout the year, no matter what was thrown at them. I

congratulate them for their unfailing determination and hard work.

I would also like to take this opportunity to thank our

shareholders for their support. In any year it is helpful to know

that our shareholders believe in the Board and leadership team, but

this year your support has been especially welcome.

For many UK employees, this was the year when access to our

insurance products, wellbeing support and engagement from their

employers demonstrated their value, and we are pleased to have been

able to make available those much-needed services to over 1,260,000

UK employees. I send condolences to the families of our

policyholders who have been bereaved and good wishes to those who

have been ill and are now recovering. I am glad that we could

provide assurance and help to those individuals through these tough

times.

Financial review

Our financial performance in 2020 was robust, with our

underpinning recurring revenue model demonstrating its resilience

despite unprecedented upheaval in our business operations.

Adjusted EBITDA has been driven by the strength of our insurance

book and the value our employer clients place on the benefits

platform. Let's Connect, our consumer technology benefits business,

retained clients but global stock shortages and increased

distribution costs hit their EBITDA contribution. Innecto, our

reward consultancy, also suffered as consultancy projects stalled,

although new sales and client retention of the Digital suite

supported their recovery opportunities. Alongside this the

contribution from the SaaS business continued to grow.

Our costs reduced in the year due to our Insurance Field Sales

team being unable to work, which resulted in a saving in

policyholder acquisition costs. However, the impact of this will be

felt in 2021 and beyond where, despite our best endeavours, there

is a gap in new insurance premium to set against our planned

acquisition costs for policyholders in 2021. Whilst it will take

some time to build back profitability, we are pleased to have over

650,000 potential buyers in our pipeline, a c.43% increase on the

figure at the end of 2019.

Impact of COVID-19 and pivoting our core business

In 2020 our core business sales process - sitting down with

employees in their place of work, connecting them to their benefits

platform, and talking to them about the advantages of holding an

insurance policy - was halted almost overnight in March. However,

the team immediately switched to different distribution methods

through phone, and later, virtual visits, connecting with

policyholders via video calls in their workplace. Although

inevitably our new approach was impacted by ongoing restrictions,

which meant there were generally fewer people in work, conversion

rates of the virtual visits that took place were comparable with

that which we have historically seen in-person. It is clear that we

have developed an effective, lasting and lower cost new channel to

add to our distribution model.

Our policyholders have demonstrated their belief in the value of

our products, with retention rates increasing to reach over 80%

year-on-year retention. We are proud to have kept our promises

through the pandemic, paid out claims promptly and in full, as well

as developing an immediate response to assisting financially

vulnerable customers. Our genuine desire to protect our

policyholders remains an important part of why they choose to stay

with us.

Performance against growth strategy

Our growth strategy centres around widening our footprint across

a broader range of industries as part of our vision to create a

brighter future for the UK workforce.

We aim to ensure the insurance, employee benefits and wellbeing

services we provide can be delivered in an appropriate,

easy-to-access and cost effective medium. To this end we are

pursuing the greater use of technology across the business,

including through our proprietary platform and app, Hapi. This also

means that the Group will increasingly benefit from a growing level

of recurring revenue and high margins.

We also intend to accelerate cross-selling across the Group.

With a solid base of 140 clients (c.40% of our base) being served

in 2020 by two or more lines of business, we have identified this

as a core KPI for building future value.

Entering the SME market with the conversion of Sage clients

beginning

For some time, we have been in the process of working with Sage

to launch Sage Employee Benefits ("SEB"), a digital benefits

platform for SMEs, and this has begun to bear fruit over the

period. Following limited-time free trials through the summer and

autumn, we now have clear evidence that companies are seeing value

in the offering and are converting to paid at the end of the trial

period.

We took the on-boarding and mobilisation of new customers

in-house, and this has been positive in allowing us to develop

predictive analytics about which customers stay and pay, improving

our set-up and engagement levers.

The launch of Sage Employee Benefits has shown what we have

always believed; that the SME market is a major market for growth.

The challenge has always been how to reach it at cost-effective

scale, and we are now seeing the scope our partnership offers us to

reach an available market of c. 10 million employees. We are

pleased to confirm that post-period end SEB is generating GBP1m

gross annualised recurring revenues.

Gaining a greater foothold in the Public Sector

The Public Sector is another market where we have been looking

to increase out foothold, and we were therefore pleased to have

signed contracts with 13 new NHS and public sector clients. In

addition, we were accepted onto six public sector frameworks during

the year. This makes the onerous procurement process for NHS Trusts

and local government far simpler and demonstrates that the value of

our products is understood by this target market.

Maintaining focus on the growth of our insurance book

In our Insurance segment, our mission to 'Protect the

Unprotected and Connect the Unconnected' has resonated strongly

with clients as they seek to prioritise their employees'

welfare.

We secured the opportunity to sell insurance to Royal Mail Group

on a three-year contract, strengthening an existing relationship

with the Group. In addition, we agreed a roll-out with Kingfisher

plc post-period end, to deliver a new Hapi benefits platform and

insurance offer. Together, these two wins alone give us an extra

180,000 additional employees who can buy insurance.

Added to the c. 450,000 employees we currently have in our

client book, there are significant opportunities for developing our

insurance book over future years.

Our goal for 2021 and 2022 is to reverse the impact of the

COVID-19 shutdown on this segment of our business, to take

advantage of our new channel distribution methods and to ensure

that our good-value simple policies protect as many as possible,

recognising the effect of COVID-19 has been to change people's

perception of risk.

Driving an increased use of digital platforms with a SaaS

model

The pandemic has driven increased adoption of services delivered

digitally, and the same is true in the employee benefits and

insurance market, where employees began to increasingly want and

expect their benefits to be accessible through consumer-grade

technology.

With the Hapi mobile app being a core part of our product offer

we were in a strong position to address the demand, especially for

key workers who are often on the move rather than sitting behind a

desk. We have developed the capability to also offer our insurance

products digitally through Hapi, allowing us to reach more

potential policyholders, albeit conversion rates are as yet

untested through this delivery method Our development of virtual

visits and usage of video calls has opened up sites and employers

who previously were too geographically remote, or too small to

reach with our face-to-face model. We ended the year with 92%

client retention on the Hapi platform, demonstrating its enduring

value to clients.

Our long-term strategy has been to develop more margin on our

SaaS solutions and to drive subscription revenue through widening

our sector footprint beyond our industrial heartlands. Product

adoption growth with existing clients for Hapi, new clients for

Innecto Digital and the take-off of Sage Employee Benefits

demonstrate the merit of our platforms and the results of our

investments into Sales and Marketing over the last couple of years.

SaaS clients build future value for our business and add to the

security of our recuring revenue model.

The Group's 2025 aspiration is to have 1 million users of the

Group's Hapi platform, and we currently stand at over 470,000

activated users, an increase of c.15% in-year, despite the pandemic

impact.

Our People

Our teams have performed exceptionally well, in difficult

circumstances, working from home on kitchen tables and in bedrooms.

I salute them all for their unwavering support for our clients and

policyholders through what has been, at times, a harrowing

year.

In recognition of our employees' commitment, we made

shareholders of all employees who had worked through the pandemic

by offering GBP500 each of free shares - to both thank them for

their contribution but also allow them to share in our future

success as the business grows over the years.

Outlook

Our plans for growth are centred around our aspiration to double

profits by widening our footprint into new industry sectors and

delivering new products and services to existing and new clients.

The impact of the pandemic will be seen in an EBTIDA decline in

2021 as a result of limitations in insurance sales during lockdown,

yet we retain a strong level of ambition and today affirm our

continued desire to reach the profit growth aspiration in the

mid-term. Our strategy remains the right one and reasons abound for

continued excitement about our future prospects.

The market opportunity is accelerating. The importance of

looking after employee wellbeing in running a successful,

sustainable business has never been more apparent, and will be an

important macro growth trend in years to come. We have proven

access and delivery into a number of sectors, including the vast

SME market, and look forward to building on the results we've seen

so far.

Finally, following the successful integration of Let's Connect

and Innecto we are actively seeking further complementary

acquisition opportunities. To accelerate entry into key markets,

and provide an opportunity to both cross-sell and vertically

integrate key supply chains we are actively looking for

acquisitions which:

-- Fit our recurring revenue model;

-- Bring access to new clients and markets; and

-- Bring attractive propositions to post COVID-19 fast-growth sectors

We have a strong and motivated team in place and a high-quality,

well-invested offering. We are confident we are positioned for long

term success.

Deborah Frost

Chief Executive

22 March 2021

CFO Review

Group revenue

Group revenue for the year of GBP71.5m (2019: GBP70.9m) reflects

a mixed performance across the various business areas. The COVID-19

pandemic directly impacted performance on the insurance side, where

our field sales team were unable to carry out their traditional

face-to face approach for new insurance sales, and PG Let's Connect

was affected by global supply shortages of technology products

during its peak trading period.

However, this was outweighed by strong revenue growth from the

SaaS business, from both transactional spend through the Hapi

platform and the platform subscriptions themselves. The Group

undoubtedly benefitted from its high levels of recurring revenue

and repeat business in a very challenging trading environment.

Adjusted EBITDA*

Adjusted EBITDA* for the year was GBP10.1m (2019: 11.0m).

Performance in both SaaS and PG Let's Connect reflected the revenue

trend in those respective areas, but contribution from the

insurance business increased by GBP0.5m on the previous year,

predominantly as a result of the savings in acquisition costs with

our field sales team off the road. In 2020 the Group recovered

GBP0.6m through utilisation of the Government furlough scheme, with

the vast majority related to this area. The furlough scheme was the

only COVID-19 Government initiative utilised by the Group.

We believe Adjusted EBITDA* remains the most appropriate measure

of performance for our business, reflecting the underlying

profitability of the business and removing the impact of one-off

items arising from past acquisitions on the Group's reported Profit

Before Tax. The definition remains unchanged from previous

years.

Profit before and after tax

Profit before tax was GBP8.6m during the year (2019: GBP10.5m).

This reflects both the reduction in Adjusted EBITDA* and also the

fact that 2019 benefitted from a GBP1.3m tax provision release. The

tax charge for the year was GBP1.7m (2019: GBP1.6m), and profit

after tax for the year of GBP6.9m (2019: GBP8.8m).

EPS

Resulting earnings per share was 22.1p (2019: 28.4p).

Insurance

Revenue from the Group's core insurance business in 2020 reduced

by GBP1.4m to GBP28.8m (2019: GBP30.2m).

The lockdowns enforced on us by COVID-19 had a direct impact on

our ability to write new insurance sales through our traditional

face-to-face model and, whilst we were able to mitigate this in

part through our adoption of virtual visits and telesales, our

annualised new business insurance premiums dropped significantly to

GBP2.4m (2019: GBP9.0m). This had an impact on revenue in the year

but will also impact further in 2021 as the shortfall in new sales

flows through. Continuing restrictions in the first quarter of 2021

will compound this in the short-term, however the additional

180,000 employees available from our 2020 new business wins,

together with the c. 450,000 employees from our existing clients,

gives us significant opportunities to write new insurance business

over the next few years.

In contrast, our year-on-year retention rates for existing

policyholders strengthened during 2020 to over 80%, helping to

alleviate the shortfall from new business. This reflects the value

that policyholders place on our simple, low-cost hospital,

convalescence and death benefit plans, that have been particularly

relevant to our policyholder base of essential and key workers

during the pandemic. Notwithstanding the short- term impact of

COVID-19, the Group's insurance income remains a high quality and

relatively stable revenue stream to the Group.

Claims ratios for the year remained fairly stable at 24.4%

(2019: 22.1%) despite the Group paying out GBP0.5m, and holding a

significantly increased reserve at the year-end, in relation to

COVID-19 claims. We understandably saw an increase in our loss

ratio for death benefit, which represents c20% of our insurance

book, but this was mitigated by an offsetting reduction for

hospital and convalescence, reflective of the capacity of the NHS

being largely consumed by its COVID-19 response. With NHS waiting

lists having increased, we may potentially see claims for ordinary

operations begin to rise as the NHS catches up postponed

procedures. We will continue to monitor for any evidence of any

rises.

Despite the reduction to underwriting profit, Adjusted EBITDA*

was up GBP0.5m on the prior year at GBP8.8m (2019: GBP8.3m). This

was primarily due to the savings in new insurance acquisition

costs. With the majority of the field sales team and support staff

furloughed for a significant portion of the year, this area of the

business benefitted from temporary savings in salary costs together

with the related 'on-the-road' costs. The utilisation of furlough

has enabled us to keep our trained and regulated salesforce with us

until they are able to return to the field post lockdown.

SaaS

The Group's SaaS business saw revenue increase by GBP4.5m in

2020 to GBP26.0m (2019: 21.5m).

Transactional spend and commissions through the Hapi platform,

on products such as e-vouchers and reloadable cards, increased to

GBP22.7m (2019: 18.4m). Whilst this predominantly represents

pass-through revenue, it demonstrates an increased usage of the

platform, validating its value to clients.

Outside of this, the recurring revenue from the SaaS business

continued to show year-on-year growth. Hapi platform subscriptions

increased with the addition of some new 'SaaS only' clients,

combined with strong retention of existing clients, and growth in

SaaS sales. We continue to see our SaaS segment growing to provide

the Group with another high quality, very scalable revenue

stream.

The contribution from Sage Employee Benefits (SEB), the Group's

SME proposition being taken to market through its partner Sage,

increased with Sage supporting the cost of the platform. During the

year the product was offered to a section of Sage's client base on

a free trial basis. Initial conversion rates to a per-employee

monthly user fee have been encouraging and ahead of initial

expectations for the small sample that have converted to date.

Again, this provides opportunity for future growth.

Innecto, the Group's pay and reward subsidiary, which represents

around a third of the non-transactional revenue, saw a temporary

decline in its higher margin consultancy income as clients focussed

on their own COVID-19 activity. However, it made good operational

progress developing its 'Innecto digital' product range and has

entered 2021 with a strong pipeline of customers.

The combined impact of these resulted in Adjusted EBITDA* ending

slightly ahead of the prior year at GBP0.7m (2019: GBP0.6m).

PG Let's Connect

PG Let's Connect saw revenues reduce to GBP16.4m (2019:

GBP18.8m).

The business remained open and fulfilling orders throughout the

year however sales in the first half the year were impacted by some

clients deferring or postponing their schemes during the onset of

the pandemic.

The Company benefitted from its major client, Royal Mail Group,

whose contract was extended for a further 3 years in September

2020, continuing to run its 'always-on' scheme and had a healthy

end to the year, with those schemes that chose to run for the

Christmas period performing broadly in line with 2019. However

nationwide stock availability issues for some key in-demand items,

together with general supply chain disruption caused by COVID-19

restrictions, limited its potential performance for the year. This

does provide additional opportunity for 2021 when these products

become available.

Adjusted EBITDA* reduced to GBP0.5m (2019: GBP1.7m) reflecting

the lower revenues but also a temporary reduction in gross margin

as desired products were sourced from alternative suppliers. In

addition, margin was impacted by a reduction in commissions

received from third- party finance providers, in line with reduced

interest rates, together with an increased cost of insurances and

warranties.

Balance sheet

As at 31 December 2021 the Group's balance sheet remained

strong, with cash and deposits of GBP20.2m (2019: GBP17.0m) and no

debt.

The increase in cash balances reflects the Company's decision to

defer the payment of its fourth and final dividend of the year

until May 2021 as explained further below.

The Group's main underwriting subsidiary, Personal Assurance Plc

(PA), continues to maintain a conservative solvency ratio of 308%

(unaudited), with a surplus over its Solvency Capital Requirement

of GBP8.4m. The Company has consistently maintained a prudent

position in relation to its Solvency II requirement. Personal

Assurance (Guernsey) Limited, the Group's subsidiary which

underwrites the death benefit policy, also maintained a healthy

solvency ratio of 216% under its own regime, despite the increase

in death claims seen over the year.

No impairment was deemed necessary for the goodwill balances

held in respect of the acquisitions of PG Let's Connect and

Innecto.

Dividend

The Company paid a total dividend of 13.3p per share over the

year (2019: 23.3p).

Following the outbreak of COVID-19, in May 2020 the Board took

the decision to reduce its second quarter dividend as a measure of

prudence amidst the uncertain trading environment resulting from

the pandemic.

In November 2020, the Company also announced that, in light of

further national lockdown restrictions and ongoing uncertainty at

that time, any payment of its fourth and final dividend in respect

of its financial year ending 31 December 2020 would be made

following publication of its audited full year results in March

2021.

As noted with the release of these accounts, a final dividend of

5.1p will be paid on 12 May 2021 to members on the register as at 6

April 2021 (the record date). Shares will be marked ex-dividend on

1 April 2021. The last day for elections will be on 20 April

2020.

Also as announced in November 2020, from 2021 the Board has

decided to adopt a more typical dividend payment profile with two

dividends scheduled each year following the respective half- year

and full year financial reporting periods. This revised profile

will enable the Board to have greater clarity on operational

results for the period, prior to declaring the amount to be

paid.

The Board seeks to continue dividend payments in line with the

historic pay-out ratio over the past three years.

Sarah Mace

Chief Financial Officer

22 March 2021

Consolidated Income Statement

2020 2019

GBP'000 GBP'000

Continuing Operations

Gross premiums written 29,265 30,369

Outward reinsurance premiums (182) (204)

Change in unearned premiums (245) 59

Change in reinsurers' share

of unearned premiums (8) (10)

(_________) (_________)

Earned premiums net of reinsurance 28,830 30,214

Other insurance related income 138 191

IT salary sacrifice income 16,421 18,794

SaaS income 25,963 21,459

Other non-insurance income 98 100

Investment income 74 131

(_________) (_________)

Revenue 71,524 70,889

(_________) (_________)

Claims incurred (7,031) (6,670)

Insurance operating expenses (13,504) (15,964)

Other insurance related expenses (266) (210)

IT salary sacrifice expenses (16,057) (17,157)

SaaS costs (25,458) (20,930)

Share-based payment expenses (8) (19)

Charitable donations (100) (100)

Amortisation of intangible assets (470) (489)

(___________) (___________)

Expenses (62,894) (61,539)

(___________) (___________)

Operating profit 8,630 9,350

Finance costs (73) (131)

Release of provisions - 1,259

Share of profit of equity-accounted

investee net of tax - 9

(_________) (_________)

Profit before tax 8,557 10,487

Tax (1,663) (1,649)

(_________) (_________)

Profit for the year 6,894 8,838

The profit for the year is attributable to equity holders

of Personal Group Holdings Plc

Earnings per share Pence Pence

Basic 22.1 28.4

Diluted 22.1 28.4

There is no other comprehensive income for the year and, as a

result, no statement of comprehensive income has been produced. All

operations are classed as continuing activities.

Consolidated Balance Sheet at 31 December 2020

2020 2019

GBP'000 GBP'000

ASSETS

Non-current assets

Goodwill 12,696 12,696

Intangible assets 1,254 1,301

Property, plant and equipment 5,456 5,984

(_________) (_________)

19,406 19,981

(__) (______) (________)

Current assets

Financial assets 2,587 2,565

Trade and other receivables 18,346 18,549

Reinsurance assets 78 121

Inventories - Finished Goods 861 746

Cash and cash equivalents 17,589 14,476

Current tax assets 55 -

(_________) (_________)

39,516 36,457

(___) (______) (_________)

Total assets 58,922 56,438

(__________) (__________)

Consolidated Balance Sheet at 31 December 2020

2020 2019

GBP'000 GBP'000

EQUITY

Equity attributable to equity

holders

of Personal Group Holdings

Plc

Share capital 1,561 1,561

Share premium 1,134 1,134

Capital redemption reserve 24 24

Other reserve (21) (230)

Profit and loss reserve 38,076 35,526

(_________) (_________)

Total equity 40,774 38,015

(_________) (_________)

LIABILITIES

Non-current liabilities

Deferred tax liabilities 399 302

Trade and other payables 352 290

Current liabilities

Trade and other payables 14,274 15,043

Insurance contract liabilities 3,123 2,104

Current tax liabilities - 684

(_________) (_________)

17,397 17,831

(_________) (_________)

(_________) (_________)

Total liabilities 18,148 18,423

(_________) (_________)

(_________) (_________)

Total equity and liabilities 58,922 56,438

(_________) (_________)

Consolidated Statement of Changes in Equity for the year ended

31 December 2020

Equity attributable to equity holders of Personal Group Holdings

Plc

Share Share Capital Other Profit Total

capital Premium redemption reserve and loss equity

Reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 January

2020 1,561 1,134 24 (230) 35,526 38,015

(________) (______) (______) (______) (________) (________)

Dividends - - - - (4,147) (4,147)

Employee share-based

compensation - - - - 8 8

Proceeds of SIP* share

sales - - - - 26 26

Cost of SIP shares sold - - - 231 (231) -

Cost of SIP shares purchased - - - (22) - (22)

Shares issued in the - - - - - -

year

(________) (________) (________) (________) (________) (________)

Transactions with owners - - - 209 (4,344) (4,135)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 6,894 6,894

(________) (________) (________) (________) (________) (________)

Total comprehensive income for

the year - - - - 6,894 6,894

(________) (_______) (________) (________) (________) (________)

Balance as at 31 December

2020 1,561 1,134 24 (21) 38,076 40,774

(________) (______) (______) (________) (__________) (_________)

* PG Share Ownership Plan (SIP)

Consolidated Statement of Changes in Equity for the year ended

31 December 2019

Equity attributable to equity holders of Personal Group Holdings

Plc

Share Share Capital Other Profit Total

capital Premium redemption reserve and loss equity

Reserve reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance as at 1 January

2019 1,544 - 24 (210) 33,937 35,295

(________) (______) (______) (______) (________) (________)

Dividends - - - - (7,244) (7,244)

Employee share-based

compensation - - - - 19 19

Proceeds of SIP* share

sales - - - - 20 20

Cost of SIP shares sold - - - 44 (44) -

Cost of SIP shares purchased - - - (64) - (64)

Shares issued in the

year 17 1,134 - - - 1,151

(________) (________) (________) (________) (________) (________)

Transactions with owners 17 1,134 - (20) (7,249) (6,118)

(________) (________) (________) (________) (________) (________)

Profit for the year - - - - 8,838 8,838

(________) (________) (________) (________) (________) (________)

Total comprehensive

income for the year - - - - 8,838 8,838

(________) (_______) (________) (________) (________) (________)

Balance as at 31 December

2020 1,561 1,134 24 (230) 35,526 38,015

(________) (______) (______) (________) (__________) (_________)

* PG Share Ownership Plan (SIP)

Consolidated Cash Flow Statement

2020 2019

GBP'000 GBP'000

Net cash from operating activities

(see next page) 8,100 8,668

(__________) (__________)

Investing activities

Additions to property, plant and equipment (341) (734)

Additions to intangible assets (424) (266)

Proceeds from disposal of property, plant and

equipment 382 398

Proceeds from disposal of investment property - 188

Purchase of financial assets (22) (34)

Interest received 74 131

Dividends received from equity accounted

investee - 59

Acquisition of subsidiary, net of cash

acquired - (2,714)

(__________) (__________)

Net cash used in investing activities (331) (2,972)

(__________) (__________)

Financing activities

Proceeds from the issue of shares - 1,151

Interest paid (2) (2)

Purchase of own shares by the SIP (22) (64)

Proceeds from disposal of own shares

by the SIP 26 20

Payment of lease liabilities (511) (229)

Dividends paid (4,147) (7,244)

(__________) (__________)

Net cash used in financing activities (4,656) (6,368)

(__________) (__________)

Net change in cash and cash equivalents 3,113 (672)

Cash and cash equivalents, beginning

of year 14,476 15,148

Cash and cash equivalents, end of year 17,589 14,476

(_________) (_________)

Consolidated Cash Flow Statement 2020 2019

GBP'000 GBP'000

Operating activities

Profit after tax 6,894 8,838

Adjustments for

Depreciation 1,003 970

Amortisation of intangible assets 470 489

Profit on disposal of property, plant

and equipment (150) (127)

Profit on disposal of investment property - (60)

Interest received (74) (131)

Interest charge 73 131

Share of profit of equity-accounted

investee, net of tax - (9)

Share-based payment expenses 8 19

Taxation expense recognised in income

statement 1,663 1,649

Changes in working capital

Trade and other receivables 247 (1,520)

Trade and other payables 384 1,406

Provisions - (1,259)

Inventories (115) (103)

Taxes paid (2,303) (1,625)

(__________) (__________)

Net cash from operating activities 8,100 8,668

(__________) (__________)

Notes to the Financial Statements

1 Segment analysis

The segments used by management to review the operations of the

business are disclosed below.

1) Core Insurance

Personal Assurance Plc (PA), a subsidiary within the Group, is a

PRA regulated general insurance Company and is authorised to

transact accident and sickness insurance. It was established in

1984 and has been underwriting business since 1985. In 1997

Personal Group Holdings Plc (PGH) was created and became the

ultimate parent undertaking of the Group.

Personal Assurance (Guernsey) Limited (PAGL), a subsidiary

within the Group, is regulated by the Guernsey Financial Services

Commission and has been underwriting death benefit policies since

March 2015.

This operating segment derives the majority of its revenue from

the underwriting by PA and PAGL of insurance policies that have

been bought by employees of host companies via bespoke benefit

programmes. During 2020 PAGL began underwriting employee default

insurance for a proportion of LC customers.

2) IT Salary Sacrifice

IT salary sacrifice refers to the trade of PG Let's Connect, a

salary sacrifice technology Company purchased in 2014.

3) SaaS

Revenue in this segment relates to the annual subscription

income and other related income arising from the licensing of Hapi,

the Group's employee benefit platform. This includes sales to both

the large corporate and SME sectors. Also included in this segment,

from 1 March 2019, is consultancy and license income derived from

selling Innecto digital platform subscriptions.

4) Other

The other operating segment consists exclusively of revenue

generated by Berkeley Morgan Group (BMG) and its subsidiary

undertakings along with any investment and rental income obtained

by the Group.

IT Salary

Core Insurance Sacrifice SaaS Other Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2020

Revenue

Earned premiums net

of reinsurance 28,826 - 4 - 28,830

Other income - Insurance

Related - - - 138 138

Other income - IT Salary

Sacrifice - 16,421 - - 16,421

Other income - Platform - - 3,229 - 3,229

Other income - Transactional

and commission - - 22,734 - 22,734

Other income - - - 98 98

Investment income - - - 74 74

(_________) (_________) (_________) (_________) (_________)

28,826 16,421 25,967 332 71,524

Total revenue (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 7,909 288 271 89 8,557

Amortisation - Acquisition

intangibles - - 205 - 205

Interest 47 14 12 - 73

Share based payments - - - 8 8

Depreciation 674 106 215 8 1,003

Amortisation (other) 182 61 22 - 265

Adjusted EBITDA* 8,812 469 725 105 10,111

(_________) (_________) (_________) (_________) (_________)

Segment assets 26,573 11,748 6,020 14,581 58,922

Segment liabilities 7,566 6,937 3,645 - 18,148

Depreciation and amortisation 856 167 442 8 1,473

* Adjusted EBITDA is defined as earnings before interest, tax,

depreciation, amortisation of intangible assets, goodwill

impairment, share-based payment expenses, corporate acquisition

costs, restructuring costs, and release of tax provision.

IT Salary

Core Insurance Sacrifice SaaS Other Group

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Operating segments

2019

Revenue

Earned premiums net

of reinsurance 30,205 - 9 - 30,214

Other income - Insurance

Related 3 - - 188 191

Other income - IT Salary

Sacrifice - 18,794 - - 18,794

Other income - Platform - - 3,104 - 3,104

Other income - Transactional

and commission - - 18,355 - 18,355

Other income - - - 100 100

Investment income - - - 131 131

(_________) (_________) (_________) (_________) (_________)

30,208 18,794 21,468 419 70,889

Total revenue (_________) (_________) (_________) (_________) (_________)

Net result for year

before tax 7,322 2,764 219 182 10,487

PG Let's Connect - Tax

provision - (1,259) - - (1,259)

Amortisation - Acquisition

intangibles - 53 171 - 224

Acquisition costs - - - 145 145

Interest 91 23 17 - 131

Share based payments - - - 19 19

Depreciation 791 112 58 9 970

Amortisation (other) 79 55 131 - 265

Adjusted EBITDA* 8,283 1,748 596 355 10,982

(_________) (_________) (_________) (_________) (_________)

Segment assets 25,195 12,023 4,669 14,551 56,438

Segment liabilities 7,948 7,045 3,430 - 18,423

Depreciation and amortisation 870 220 360 9 1,459

2. Taxation comprises United Kingdom corporation tax of

GBP1,566,000 (2019: GBP1,600,000) and a deferred tax charge of

GBP97,000 (2019: GBP49,000)

3. The basic and diluted earnings per share are based on profit

for the financial year of GBP6,894,000 (2019: GBP8,838,000) and on

31,164,809 basic (2019: 31,118,589) and 31,172,720 diluted (2019:

31,122,136) ordinary shares, the weighted average number of shares

in issue during the year.

4. The total dividend paid in the year was GBP4,147,000 (2019: GBP7,244,000)

This preliminary statement has been extracted from the 2020

audited financial statements that will be posted to shareholders in

due course. The statutory accounts for each of the two years to 31

December 2020 and 31 December 2019 received audit reports, which

were unqualified and did not contain statements under section 498

(2) or (3) of the Companies Act 2006. The 2019 accounts have been

filed with the Registrar of Companies but the 2020 accounts are not

yet filed.

Alternative Performance Measures

The Group uses an alternative (non-Generally Accepted Accounting

Practice (non-GAAP)) financial measure when reviewing performance

of the Group, evidenced by executive management bonus performance

targets being measured in relation to Adjusted EBITDA*. As such,

this measure is important and should be considered alongside the

IFRS measures.

For Adjusted EBITDA*, the adjustments taken into account in

addition to the standard IFRS measure, are those that are

considered to be non-underlying to trading activities and which are

significant in size. For example, goodwill impairment is a non-cash

item relevant to historic acquisitions; share-based payments are a

non-cash item which have historically been significant in size, can

fluctuate based on judgemental assumptions made about share price

and have no impact on total equity; corporate acquisition costs and

reorganisation costs are both one-off items which are not incurred

in the regular course of business; and the movement in the PG Let's

Connect tax provision are both considered to be non-underlying

items, relates to a liability inherited on acquisition of that

business and have the potential to fluctuate and be of significant

size.

This methodology is unchanged from previous years.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR JTMTTMTTTTTB

(END) Dow Jones Newswires

March 23, 2021 03:00 ET (07:00 GMT)

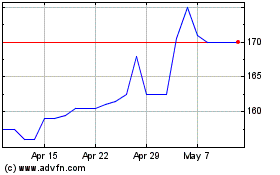

Personal (LSE:PGH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Personal (LSE:PGH)

Historical Stock Chart

From Apr 2023 to Apr 2024