TIDMPIN

RNS Number : 6347P

Pantheon International PLC

19 February 2021

19 February 2021

For immediate release

The information contained in this announcement is restricted and

is not for publication, release or distribution in the United

States of America, Canada, Australia (other than to persons who are

both wholesale clients and professional or sophisticated investors

in Australia), Japan, the Republic of South Africa or any other

jurisdiction where its release, publication or distribution is or

may be unlawful.

Pantheon International Plc

("PIP" or the "Company")

Performance Update at 31 January 2021

Performance Update at 31 January 2021

3,094.7p NAV per share

+0.1% NAV per share movement for the month

GBP1.7bn Net asset value

-GBP2.5m Net portfolio cash flow*

4.7x Financing cover**

+90% Total shareholder return (5Y)***

Month to 31 January 2021

PIP announced an unaudited net asset value ("NAV") per share as

at 31 January 2021 of 3,094.7p, an increase of +3.3p (+0.1%) from

the NAV per share as at 31 December 2020.

In the month to 31 January 2021, valuation gains* added +23.6p

(+0.8%), investment income* added +1.5p (+0.0%), foreign exchange

movements* were -17.9p (-0.6%), and expenses and taxes**** were

-3.9p (-0.1%)

At 31 January 2021, PIP's private equity assets stood at

GBP1,584m, whilst net available cash balances^ were GBP137m. The

Asset Linked Note^^ ("ALN") outstanding as at 31 January 2021

amounted to GBP47m. Undrawn commitments to investments stood at

GBP427m as at 31 January 2021, calculated using exchange rates at

that date. PIP's multi-currency revolving credit facilities

comprise a US$269.8m facility and a EUR101.6m facility, which

remained undrawn as at the month end.

PIP made one new commitment during the month:

-- A GBP1.7m co-investment alongside Parthenon Capital in Oasis

Financial, a provider of consumer litigation finance solutions in

the USA.

*Figures are stated net of movements associated with the ALN

share of the reference portfolio.

**Ratio of net available cash, portfolio value and undrawn loan

facility to outstanding commitments.

***Based on the change in the ordinary share price over the

period.

****Withholding taxes on investment distributions.

^Net available cash calculated as cash and net current assets /

(liabilities) less undistributed net cashflows associated with the

ALN.

^^Unlisted 10-year note issued on 31 October 2017 whose cost and

repayments are linked to a reference portfolio consisting of the

Company's older vintage funds.

Performance as at 31 January 2021^^^

1 Year 3 Years 5 Years 10 Years Since Inception

(%) (% p.a.) (% p.a.) (% p.a.) (% p.a.)

NAV TR per share 11.8% 12.9% 12.5% 12.2% 11.6%

Ordinary share price (3.1%) 8.1% 13.7% 14.3% 11.1%

FTSE All-Share TR (7.5%) (0.5%) 5.6% 5.5% 7.3%

MSCI World (GBP)

TR 13.5% 11.2% 15.4% 12.2% 8.3%

====== ========= ========= ========= ===============

^^^PIP was launched on 18 September 1987. The performance

figures for PIP assume reinvestment of dividends, capital

repayments and cash flows from warrants.

Largest Holdings

Largest managers by value as at 30 November 2020

Region % of portfolio

1 Insight Venture Partners USA 5.7%

2 Providence Equity Partners USA 5.3%

3 Essex Woodlands USA 4.9%

4 Apax Partners SA Europe 2.8%

5 Baring Private Equity Asia Asia and EM 2.6%

Largest companies by value as at 30 September 2020(uu)

Country Sector % of portfolio

1 EUSA Pharma UK Healthcare 3.9%

2 JFrog Israel IT 1.8%

3 Allegro Poland Consumer 1.1%

4 Insurance Company

(u) USA Financials 1.0%

5 Abacus Data Systems USA IT 1.0%

(u) The private equity manager does not permit disclosure of this information.

(u u) Based on valuations as at 30 September 2020 adjusted for

known calls and distributions to 30 November 2020.

Monthly Report

The January monthly newsletter can be accessed on PIP's website

at www.piplc.com in the Investor Relations section under the

heading "Newsletters".

This announcement contains inside information.

Ends

LEI: 2138001B3CE5S5PEE928

For more information please visit PIP's website at www.piplc.com

or contact:

Pantheon

Helen Steers / Vicki Bradley

020 3356 1800

Follow us on LinkedIn: https://www.linkedin.com/company/pantheon-international-plc

NOTES

PIP

PIP is a listed FTSE 250 private equity investment trust,

overseen by an independent Board of Directors and managed by

Pantheon, one of the leading private equity investment managers

globally. PIP offers investors a liquid, differentiated entry point

to the excellent growth potential of global private equity, with

access to the primary, secondary and co-investment opportunities of

some of the best managers in the world. The Company has a track

record of outperformance and manages risk through diversification

and rigorous selection based on Pantheon's extensive experience and

international platform.

Pantheon

Pantheon is a leading global private equity, infrastructure,

real assets and debt fund investor that invests on behalf of over

600 investors. Founded in 1982, Pantheon has developed an

established reputation in primary, co-investment and secondary

private asset solutions across all stages and geographies. Pantheon

has $58.4 billion in AUM^^ (as at 30 September 2020) and 359

employees (as at 31 December 2020), including 104 investment

professionals, located across offices in London, San Francisco, New

York, Hong Kong, Seoul, Bogotá, Tokyo and Dublin.

^^ This figure includes assets subject to discretionary or

non-discretionary management, advice or those limited to a

reporting function.

Important Information

A copy of this announcement will be available on the Company's

website at www.piplc.com . Neither the content of the Company's

website, nor the content on any website accessible from hyperlinks

on its website for any other website, is incorporated into, or

forms part of, this announcement nor, unless previously published

by means of a recognised information service, should any such

content be relied upon in reaching a decision as to whether or not

to acquire, continue to hold, or dispose of, securities in the

Company.

Sir Laurie Magnus

Chairman, Pantheon International Plc

Beaufort House, 51 New North Road, Exeter, Devon, EX4 4EP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDSFSFMAEFSEEE

(END) Dow Jones Newswires

February 19, 2021 02:00 ET (07:00 GMT)

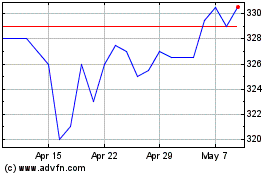

Pantheon (LSE:PIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pantheon (LSE:PIN)

Historical Stock Chart

From Apr 2023 to Apr 2024