Hardman & Co Research: Pantheon International Plc (PIN): Just look at PIP's underlying company resilience

March 10 2021 - 8:00AM

EQS Newswire

|

Hardman & Co Research

10-March-2021 / 14:00

GMT/BST

Hardman & Co Research:

Just look at PIP's underlying company resilience

The key interim

results message is the spectacular operational outperformance that

PIP has achieved through the COVID-19 crisis so far. PIP's sample

of buyout companies (two thirds of that portfolio) reported

weighted average revenue and EBITDA growth of 17% and 15%. The MSCI

World Index reported falls of 17% and 31%, respectively, for the

same period. PIP's investee companies normally outperform (EBITDA

growth 2013-19 average 11% higher than the index), but, through

COVID-19 to November, it was 4x this level. EV/EBITDA ratings on

PIP's book are, despite this sharp outperformance, at a 1% discount

to this index.

Please click on

the link below for the full report

https://www.hardmanandco.com/research/corporate-research/just-look-at-pips-underlying-company-resilience/

If you are

interested in meeting the company, you can register your interest

by clicking on the above link

|

To contact

us:

Hardman &

Co

1 Frederick's

Place

London

EC2R

8AE

www.hardmanandco.com

Follow us on

Twitter @HardmanandCo

|

Contact:

Mark

Thomas

+44 (0) 20 3693

7075

|

mt@hardmanandco.com

|

Hardman

& Co Research can still be accessed for free after MiFID II.

Please

click here to read the

statement.

About

Hardman & Co: For the past 25 years Hardman

has been producing specialist research designed to improve

investors' understanding of companies, sectors, industries and

investment securities. Our analysts are highly experienced in their

sectors, and have often been highly

rated by professional investors for their

knowledge. Our focus is to raise

companies' profiles across the UK and abroad with outstanding

research, investor engagement programmes and advisory services.

Some of our notes have been commissioned by the company which is

the subject of the note; this is clearly stated in the disclaimer

where this is the case.

Hardman Research

Ltd, trading as Hardman & Co, is an appointed representative of

Capital Markets Strategy Ltd and is authorised and regulated by the

Financial Conduct Authority; our FCA registration number is 600843.

Hardman Research Ltd is registered at Companies House with number

8256259.

Our research is

provided for the use of the professional investment community,

market counterparties and sophisticated and high net worth

investors as defined in the rules of the regulatory

bodies. It is not intended to be made

available to unsophisticated retail investors. Anyone who is unsure

of their categorisation should consult their professional advisors.

This research is neither an offer, nor a solicitation, to buy or

sell any security. Please read the note for the full

disclaimer.

Dissemination of a CORPORATE NEWS,

transmitted by EQS Group.

The issuer is solely responsible for the content of this

announcement.

|

End of Announcement - EQS News Service

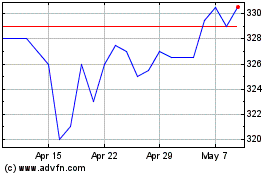

Pantheon (LSE:PIN)

Historical Stock Chart

From Mar 2024 to Apr 2024

Pantheon (LSE:PIN)

Historical Stock Chart

From Apr 2023 to Apr 2024