TIDMPIP

RNS Number : 6994C

PipeHawk PLC

21 October 2020

This announcement contains inside information as stipulated

under the Market Abuse Regulations (EU) no. 596/2014 ("MAR"). With

the publication of this announcement via a Regulatory Information

Service, this inside information is now considered to be in the

public domain.

21 October 2020

PipeHawk plc

("PipeHawk", "Company" or the "Group")

Final Results for the year ended 30 June 2020

Highlights

- Turnover of GBP8.3 million, an increase of 23.9% (2019: GBP6.7 million)

- Profit before tax of GBP194,000, and increase of 1517% (2019: GBP12,000)

- Earnings per share of 1.69p, up 86% (2019: 0.91p)

- QM Systems has its best year ever both in terms of turnover and profit

Chairman's Statement

I am pleased to report that turnover for the year ended 30 June

2020 was GBP8.3 million (2019: GBP6.7 million), an increase of

23.9%. The Group made an operating profit in the year of GBP405,000

(2019: GBP57,000) and a profit before taxation for the year of

GBP194,000 (2019: GBP12,000) and a profit after taxation of

GBP590,000 (2019: GBP312,000) . The earnings per share for the year

was 1.69p (2019: 0.91p).

Last year we had the politicians faffing around with Brexit

causing delays to orders until Boris Johnson and the British public

gave us a degree of certainty. This lasted for all of four months

until Coronavirus hit and lockdown began. Nevertheless, that window

of opportunity enabled orders to be placed and allowed some

optimism to return which the PipeHawk group and its employees have

taken advantage of and wrestled into an excellent trading result.

Just imagine what we, and the nation as a whole, can achieve once

we are through Coronavirus and freed from the continual negativity

of the naysayers and doom mongers.

QM Systems

At QM Systems, trading during the first eight months was

excellent, with many more orders in the pipeline. Then Coronavirus

came into play and, like most companies within the UK, we

experienced significant disruption. Despite the extensive lockdown

we all experienced for three months followed by the easing of the

lockdown, QM Systems has continued to operate effectively.

Employees that could were set up to work from home. However, our

assembly, installation and commissioning teams were also extremely

busy assembling systems at QM Systems' facility in Worcester or

carrying out installation and commissioning work at client

facilities. The initial four-week period of lockdown created

significant disruption to our activities, However, as our clients

and we learned to adjust to the 'new normal', clean hands, socially

distanced way, business activity stabilised. We were able to regain

access to client facilities to continue to build activity and the

situation actually created opportunities for QM Systems in

supporting overseas companies installing systems into the UK

market.

Despite the setback that Coronavirus has presented, QM Systems

has managed to achieve its best year ever both in terms of turnover

and profit. This is a great achievement given that the order intake

effectively switched off for almost five months from the start of

the strict lockdown period, when many projects we were expecting to

win were placed on hold. During this period, however, our sales

team has worked diligently to open new opportunities and to

continue to keep previous opportunities live and we now sit on a

potential orderbook that is larger than we have ever experienced

previously. Project orders are flowing again and we had been

expecting a return to pre-Coronavirus levels within the next few

months with a number of key larger projects in final contractual

negotiation. This has been helped in no small measure by the work

we have undertaken to diversify our client base across numerous

industries and has enabled us to recover more quickly than a number

of our competitors. Recent measures brought in by the Government to

combat the worsening Coronavirus situation will inevitably have

some delaying effect on securing orders but with the regional

approach being adopted by the Government it is hard to forecast

what effect it will have on trading at QM Systems.

During the year QM Systems has completed the installation and

commissioning work with Cox Powertrain for its Marine Diesel

Outboard Engine, introduced and commissioned a new larger variant

of Carbon Fibre delivery POD with our partner Penso, who are now

selling the vehicle in volume, and installed and commissioned a

QMAC-3 60 station conveyor system with one of QM Systems' key

automotive clients as well as a multitude of other significant

contracts. The products that QM Systems has developed and

manufacture for the Aerospace and Petrochemical industries continue

to sell, seemingly unaffected by Coronavirus factors. QM Systems

has completed the integration of Wessex test equipment into the

business unit and sales have continued to flow nicely into the

business. QM Systems has been working to re-engineer a number of

the Wessex products to reduce costs and increase technology levels

ensuring the products become more IT connected and thus user

friendly.

QM Systems has recently started work on a new GBP1.7 million

project to deliver a bespoke machining and handling system to

Isoclad Limited, one of the UK's largest independent composite

panel manufacturers, for the manufacture of specialist clad panels

for its Customclad service.

The outlook for the current year and beyond for QM Systems is

extremely positive.

Thomson Engineering Design ("TED")

TED has had an exceptionally busy year with key staff stretched

to the limit and a requirement to recruit new members to the team.

Turnover increased by 42% on a year-on-year basis and TED delivered

a genuine pre-tax profit for the first time despite the additional

costs of keeping the workplace a safe and secure environment for

our employees. An excellent result given the difficult climate TED

has endured.

During the year TED developed a number of new, innovative and

exciting products, many of which have been designed for the export

market. Whilst UK sales remained largely stagnant, the export

market, particularly in Southern Asia, has gone from strength to

strength. TED continues to establish itself as the 'Go To' company

in the rail industry for any client who has a requirement for

something that is a little different to the norm. During the year

TED has delivered bespoke rail equipment into New Zealand, a range

of products into plant equipment companies within the UK as well as

products and projects into Canada, the US, France and Australia. It

has continued to focus on new innovation that TED fully expects

will realise future growth with higher volume product sales within

domestic and international markets. These products are expected to

secure sales within the current financial year.

TED has also launched a new website which provides an up-to-date

summary of the products and services offered together with a

significant increase in the use of social media to tell the world

about the quality service which it can offer. The news seems to be

getting through both nationally and internationally.

Technology Division

This has been a disappointing year in terms of European unit

sales of the eSafe technology which has still to recover to

pre-Brexit levels. However; sales to Asia continue to show a

positive trend.

Previous R&D investment into innovative servicing &

maintenance systems is also bearing fruit with noticeable interest

being shown by overseas distributors and resellers.

As UK unit sales continue to be affected by CAPEX restrictions

across key markets, opportunities for long term/project-based hire

are now being explored in those and other markets, while many

existing customers continue their loyalty to the PipeHawk brand

with investment in the maintenance and upgrade of existing

equipment fleets.

With the cancellation of many industry events around the globe,

the opportunity for face-to-face marketing has taken a knock in

recent months but use of virtual communications and outdoor

presentations has maintained a semblance of direct customer contact

in the face of difficult times.

Adien

Adien started the year very well with the renewal of significant

long-term contracts, which provided a strong order book and good

staff utilisation. Then trading at Adien was struck by the

repercussions of the Coronavirus pandemic. Adien adapted and

evolved; it quickly adopted remote working coupled with the

installation of new software which reshaped the business profoundly

in a short period of time and was able to continue to provide its

service throughout the period from March to present day in a most

effective manner suffering principally in the initial stages. Adien

encountered many challenges both external and internal, in terms of

H&S management, organisation, control and communications

through to denial of access to site as clients gradually came to

terms with the outdoor nature of our work and relatively easy

ability to maintain social distancing.

Adien are undertaking several new contracts for all the major

Telecom networks involved in the 5G rollout and this business will

secure 18 to 24 months of additional work. Consolidation of

existing contracts in Energy, Defence and Infrastructure is

expected to continue over a 3 to 5 year period running in tandem

with the Telecom contracts.

Reducing the size of the survey teams, whilst expanding single

working, allows larger volumes of specific contract sites to be

completed in the same time period. Remote/home working provides

more effective time use and long-term cost savings with the

potential to move to less costly premises in 2021. The realignment

of the vehicle fleet to more compact and less costly, more

economical vehicles is also under way. Those cost efficiencies,

taken with the increased levels of business as a result of being

able to offer Adien's services throughout lockdown, bodes extremely

well for the current and next years' expected outturn.

Financial position

The Group continues to be in a net liability position and is

still reliant on my continuing financial support.

My letter of support dated 7 October 2019 was renewed on 28

September 2020 for a further year. Loans due to me, other than

those covered by the CULS agreement, are unsecured and accrue

interest at an annual rate of Bank of England base rate plus

2.15%.

The CULS agreement for GBP1 million, provided by myself, was

renewed last year and extended on identical terms, such that the

CULS are now repayable on 13 August 2022.

In addition to the loans I have provided to the Company in

previous years, I have deferred a certain proportion of fees and

the interest due until the Company is in a suitably strong position

to make the full payments.

Historically, my fees and interest payable have been deferred.

During the year under review, the deferred element amounted to

GBP213,000. At 30 June 2020, these deferred fees and interest

amounted to approximately GBP1.6 million in total, all of which

have been recognised as a liability in the Company's accounts.

Strategy & Outlook

The PipeHawk group remains committed to creating sustainable

earnings-based growth and focusing on the expansion of its business

with forward-looking products and services. PipeHawk acts

responsibly towards its shareholders, business partners, employees,

society and the environment in each of its business areas.

PipeHawk is committed to technologies and products that unite

the goals of customer value and sustainable development. All

divisions of the Group are currently performing well and I remain

optimistic in my outlook for the Group, subject always to any

unusually negative impact from further Coronavirus lockdown or an

absurd reaction from the EU if there is a WTO terms Brexit.

Gordon Watt

Chairman

20 October 2020

Enquiries:

PipeHawk Plc Tel. No. 01252 338 959

Gordon Watt (Chairman)

Allenby Capital (Nomad and Broker) Tel. No. 020 3328 5656

David Worlidge/Asha Chotai

Notes to Editors

For further information on the Company and its subsidiaries, please visit: www.pipehawk.com

Consolidated Statement of Comprehensive Income

For the year ended 30 June 2020

30 June 2020 30 June 2019

Note GBP'000 GBP'000

Revenue 2 8,325 6,680

Staff costs 5 (3,776) (3,265)

Operating costs (4,144) (3,358)

-------------------- ---------------------

Operating profit 4 405 57

Profit before interest and

taxation 405 57

-------------------- ---------------------

Finance costs 3 (211) (45)

-------------------- ---------------------

Profit before taxation 194 12

Taxation 7 396 300

Profit for the year attributable

to equity holders of the parent 590 312

-------------------------- -----------------------

Other comprehensive income - -

-------------------- ---------------------

Total comprehensive profit/(loss)

for the year attributable to

equity

holders of the parent 590 312

==================== =====================

Profit per share (pence) - basic 8 1.69 0.91

Profit per share (pence) - diluted 8 0.93 0.72

The notes to the financial statements form an integral part of

these financial statements.

Consolidated Statement of Financial Position

at 30 June 2020

Note 30 June 2020 30 June 2019

Assets GBP'000 GBP'000

Non-current assets

Property, plant and equipment 9 811 525

Goodwill 10 1,345 1,190

2,156 1,715

------------------- -------------------

Current assets

Inventories 11 151 134

Current tax assets 394 315

Trade and other receivables 12 1,654 1,592

Cash and cash equivalents 250 774

------------------- -------------------

2,449 2,815

Total assets 4,605 4,530

=================== ===================

Equity and liabilities

Equity

Share capital 17 349 344

Share premium 5,215 5,205

Retained earnings (8,306) (8,896)

------------------- -------------------

(2,742) (3,347)

------------------- -------------------

Non-current liabilities

Borrowings 13 3,255 2,661

Trade and other payables 14 6 3

------------------- -------------------

3,261 2,664

------------------- -------------------

Current liabilities

Trade and other payables 14 1,949 3,270

Borrowings 15 2,137 1,943

------------------- -------------------

4,086 5,213

Total equity and liabilities 4,605 4,530

=================== ===================

The notes to the financial statements form an integral part of

these financial statements.

The financial statements were approved by the board and

authorised for issue on 20 October 2020 and signed on its behalf

by:

Gordon G Watt

Director

Company No: 3995041

Consolidated Statement of Cash Flow

For the year ended 30 June 2020

Note 30 June 2020 30 June 2019

GBP'000 GBP'000

Cash flows from operating

activities

Profits from operations 405 57

Adjustments for:

Depreciation 191 90

Profit on disposal of fixed

asset - (13)

----------------- -----------------

596 134

(Increase)/decrease in inventories (18) 44

Increase in receivables (52) (417)

(Decrease)/increase in liabilities (1,036) 1,570

----------------- -----------------

(Cash used in)/generated by

operations (510) 1,331

Interest paid (69) (147)

Corporation tax received 318 358

----------------- -----------------

Net cash (used in)/generated

from operating activities (261) 1,542

----------------- -----------------

Cash flows from investing

activities

Proceeds from sale of joint

venture - 17

Acquisition of subsidiary

net of cash acquired 23 -

Purchase of plant and equipment (474) (75)

Proceeds from disposal of

fixed assets - 16

----------------- -----------------

Net cash used in investing

activities (451) (42)

----------------- -----------------

Cash flows from financing

activities

Proceeds from borrowings 523 -

Repayment of loan (165) (676)

Repayment of finance leases (170) (69)

----------------- -----------------

Net cash generated from/(used

in) financing activities 188 (745)

----------------- -----------------

Net (decrease)/increase in

cash and cash equivalents (524) 755

Cash and cash equivalents

at beginning of year 774 19

Cash and cash equivalents

at end of year 250 774

================= =================

The notes to the financial statements form an integral part of

these financial statements.

Statement of Changes in Equity

For the year ended 30 June 2020

Share capital Share premium Retained Total

account earnings

GBP'000 GBP'000 GBP'000 GBP'000

As at 1 July 2018 340 5,191 (9,208) (3,367)

Profit for the year - - 312 312

Other comprehensive - - - -

income

-------------- -------------- ---------- --------

Total comprehensive

income - - 312 312

Issue of shares 4 14 - 18

-------------- -------------- ---------- --------

As at 30 June 2019 344 5,205 (8,896) (3,347)

============== ============== ========== ========

Profit for the year - - 590 590

Other comprehensive - - - -

income

-------------- -------------- ---------- --------

Total comprehensive

income - - 590 590

Issue of shares 5 10 - 15

As at 30 June 2020 349 5,215 (8,306) (2,772)

============== ============== ========== ========

The share premium account reserve arises on the issuing of

shares. Where shares are issued at a value that exceeds their

nominal value, a sum equal to the difference between the issue

value and the nominal value is transferred to the share premium

account reserve.

The notes to the financial statements form an integral part of

these financial statements.

1. Summary of Significant Accounting Policies

General information

PipeHawk plc (the Company) is a limited company incorporated in

the United Kingdom under the Companies Act 2006

The financial statements are presented in pounds sterling, the

functional currency of all companies in the Group.

Basis of preparation

The financial information set out in this announcement does not

constitute the Company's statutory accounts for the years ended 30

June 2020 or 2019. The financial information for the year ended 30

June 2019 is derived from the statutory accounts for that year,

which were prepared under IFRSs, and which have been delivered to

the Registrar of Companies. The financial information for the year

ended 30 June 2020 is derived from the audited statutory accounts

for the year ended 30 June 2020 on which the auditors have given an

unqualified report, that did not contain a statement under section

498(2) or 498(3) of the Companies Act 2006.

The financial statements have been prepared in accordance with

international financial reporting standards as adopted by the EU

and under the historical cost convention. The principal accounting

policies are set out below.

The Group has applied the practical expedient available on

transition to IFRS 16 not to reassess whether a contract is or

contains a lease. Accordingly, the definition of a lease in

accordance with IAS 17 will continue to apply to those leases

entered into before 1 January 2019. For more information see Leased

assets accounting policy below.

Basis of preparation - Going concern

The directors have reviewed the Parent Company and Group's

funding requirements for the next twelve months which show positive

anticipated cash flow generation, prior to any repayment of loans

advanced by the Executive Chairman. The directors have furthermore

obtained a renewed pledge from GG Watt to provide ongoing financial

support for a period of at least twelve months from the approval

date of the Group and Parent Company statement of financial

positions. The directors therefore have a reasonable expectation

that the entity has adequate resources to continue in its

operational exercises for the foreseeable future. It is on this

basis that the directors consider it appropriate to adopt the going

concern basis of preparation within these financial statements.

However a material uncertainty exists regarding the ability of the

Group and Parent Company to remain a going concern without the

continuing financial support of the Executive Chairman.

Basis of consolidation

The consolidated financial statements incorporate the financial

statements of the Company and entities controlled by the Company

(its subsidiaries). Control is achieved where the Company has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities.

The results of subsidiaries acquired or disposed of during the

year are included in the consolidated statement of comprehensive

income from the effective date of acquisition or up to the

effective date of disposal, as appropriate. Where necessary,

adjustments are made to the financial statements of subsidiaries to

bring their accounting policies into line with those used by other

members of the Group. All intra-group transactions, balances,

income and expenses are eliminated in full on consolidation

Business combinations

Acquisitions of subsidiaries and businesses are accounted for

using the acquisition method. The cost of the business combination

is measured as the aggregate of the fair values (at the date of

exchange) of assets given, liabilities incurred or assumed, and

equity instruments issued by the Group in exchange for control of

the acquiree. The acquiree's identifiable assets, liabilities and

contingent liabilities that meet the conditions for recognition

under IFRS 3 Business Combinations (revised) are recognised at

their fair values at the acquisition date, except for non-current

assets (or disposal groups) that are classified as held for sale in

accordance with IFRS 5 Non-current Assets Held for Sale and

Discontinued Operations, which are recognised and measured at fair

value less costs to sell.

Goodwill arising on acquisition is recognised as an asset and

initially measured at cost, being the excess of the cost of the

business combination over the Group's interest in the net fair

value of the identifiable assets, liabilities and contingent

liabilities recognised.

Goodwill

Goodwill arising on the acquisition of a subsidiary or a jointly

controlled entity represents the excess of the cost of acquisition

over the Group's interest in the net fair value of the identifiable

assets, liabilities and contingent liabilities of the subsidiary or

jointly controlled entity recognised at the date of acquisition.

Goodwill is initially recognised as an asset at cost and is

subsequently measured at cost less any accumulated impairment

losses.

For the purpose of impairment testing, goodwill is allocated to

each of the Group's cash-generating units expected to benefit from

the synergies of the combination. Cash-generating units to which

goodwill has been allocated are tested for impairment annually, or

more frequently when there is an indication that the unit may be

impaired. If the recoverable amount of the cash-generating unit is

less than the carrying amount of the unit, the impairment loss is

allocated first to reduce the carrying amount of any goodwill

allocated to the unit and then to the other assets of the unit

pro-rata on the basis of the carrying amount of each asset in the

unit. An impairment loss recognised for goodwill is not reversed in

a subsequent period.

On disposal of a subsidiary or a jointly controlled entity, the

attributable amount of goodwill is included in the determination of

the profit or loss on disposal.

Revenue recognition

For the year ended 30 June 2020 the Group used the five-step

model as prescribed under IFRS 15 on the Group's revenue

transactions. This included the identification of the contract,

identification of the performance obligations under the same,

determination of the transaction price, allocation of the

transaction price to performance obligations and recognition of

revenue.

The point of recognition arises when the Group satisfies a

performance obligation by transferring control of a promised good

or service to the customer, which could occur over time or at a

point in time.

Sale of goods

Revenue generated from the sale of goods is recognised on

delivery of the good to the customer on this basis revenue is

recognised at a point in time.

Sale of services

In relation to the design and manufacture of complete software

and hardware test solutions and the provision of specialist

surveying, revenue is recognised through a review of the man-hours

completed on the project at the year-end compared to the total

man-hours required to complete the projects. Provision is made for

all foreseeable losses if a contract is assessed as

unprofitable.

Revenue represents the amount of consideration to which the

Group expects to be entitled in exchange for transferring promised

goods or services to a customer, excluding amounts collected on

behalf of third parties.

Revenue from goods and services provided to customers not

invoiced as at the reporting date is recognised as a contract asset

and disclosed as accrued income within trade and other

receivables.

Although payment terms vary from contract to contract invoices

are in general raised in advance of services performed. Where

billing has exceeded the revenue recognised in a period a contract

liability is recognised and this is disclosed as payments received

on account in trade and other payables.

Property, plant and equipment

Property, plant and equipment are stated at cost less

accumulated depreciation and accumulated impairment losses.

Depreciation is charged so as to write off the cost of assets over

their estimated useful lives, using the straight-line method. The

estimated useful lives, residual values and depreciation method are

reviewed at each year end, with the effect of any changes in

estimate accounted for on a prospective basis. Assets held under

leases are depreciated over their expected useful lives on the same

basis as owned assets or, where shorter, the term of the relevant

lease. Gains and losses on disposals are determined by comparing

the proceeds with the carrying amount and are recognised within the

Statement of Comprehensive Income.

The principal annual rates used to depreciate property, plant

and equipment are:

Equipment, fixtures and fittings 25%

Motor vehicles 25%

Inventories and work in progress

Inventories are stated at the lower of cost and net realisable

value. Costs, including an appropriate portion of fixed and

variable overhead expenses, are assigned to inventories by the

method most appropriate to the particular class of inventory, with

the majority being valued on a first-in-first-out basis. Net

realisable value represents the estimated selling price for

inventories less all estimated costs of completion and costs

necessary to make the sale.

Work in progress is valued at cost, which includes expenses

incurred on behalf of clients and an appropriate proportion of

directly attributable costs on incomplete assignments. Provision is

made for irrecoverable costs where appropriate.

Financial assets

The Group's financial assets consist of cash and cash

equivalents and trade and other receivables. The Group's accounting

policy for each category of financial asset is as follows:

Financial assets held at amortised cost

Trade receivables and other receivables are classified as

financial assets held at amortised cost. They are initially

recognised at fair value plus transaction costs that are directly

attributable to their acquisition or issue and are subsequently

carried at amortised cost using the effective interest rate method,

less provision for impairment.

Impairment provisions are recognised when there is objective

evidence (such as significant financial difficulties on the part of

the counterparty or default or significant delay in payment) that

the Group will be unable to collect all of the amounts due under

the terms receivable, the amount of such a provision being the

difference between the net carrying amount and the present value of

the future expected cash flows associated with the impaired

receivable. For receivables, which are reported net, such

provisions are recorded in a separate allowance account with the

loss being recognised within administrative expenses in the

statement of comprehensive income. On confirmation that the

receivable will not be collectable, the gross carrying value of the

asset is written off against the associated provision.

The Group's financial assets held at amortised cost comprise

other receivables and cash and cash equivalents in the statement of

financial position.

Derecognition of financial assets

The Group derecognises a financial asset only when the

contractual rights to the cash flows from the asset expire; or it

transfers the financial asset and substantially all the risks and

rewards of ownership of the asset to another entity.

Equity instruments

An equity instrument is any contract that evidences a residual

interest in the assets of an entity after deducting all of its

liabilities. Equity instruments issued by the Group are recorded at

the proceeds received, net of direct issue costs.

Financial liabilities

Financial liabilities, including borrowings, are initially

measured at fair value, net of transaction costs. Financial

liabilities are subsequently measured at amortised cost using the

effective interest method, with interest expense recognised on an

effective yield basis.

The effective interest method is a method of calculating the

amortised cost of a financial liability and of allocating interest

expense over the relevant period. The effective interest rate is

the rate that exactly discounts estimated future cash payments

through the expected life of the financial liability, or, where

appropriate, a shorter period.

Derecognition of financial liabilities

The Group derecognises financial liabilities when, and only

when, the Group's obligations are discharged, cancelled or they

expire.

Leased assets

During the year, the Group has changed its accounting policy for

leases where the group is the lessee. The new policy is set out

below and the impact of the change is described in note 20.

Until the 30 June 2019, leases of property, plant and equipment

where the Group, as lessee, had substantially all the risks and

rewards of ownership were classified as finance leases. Finance

leases were capitalised at the lease's inception at the fair value

of the leased property or, if lower, the present value of the

minimum lease payments. The corresponding rental obligations, net

of finance charges, were included in other short-term and long-term

payables.

Leases in which a significant portion of the risks and rewards

of ownership were not transferred to the Group as lessee were

classified as operating leases. Payments made under operating

leases (net of incentives received from the lessor) were charged to

profit or loss on a straight-line basis over the period of the

lease.

IFRS has introduced a single, on-balance sheet accounting model

for lessees, eliminating the distinction between operating and

finance leases. IFRS 16 has impacted how the Group

accounts for leases under IAS 17. On initial application at 1

July 2019 and followed the modified retrospective method, the group

has performed the following:

o Recognised right of use assets and lease liabilities in the

Consolidated Statement of Financial Position, measured at the

present value of future lease payments, discounted using the rate

implicit in the lease or the lessee's incremental borrowing rate,

if this is not stated. These are included within Property, plant

and equipment and current and non-current borrowing.

o Recognised depreciation of right of use assets and interest on

lease liabilities in the Consolidated Statement of Comprehensive

income.

o Separated the total amount of cash paid into a principal

portion and interest, presented within financing activities within

the Consolidated Statement of cash flow.

The incremental borrowing rate is calculated on a lease by lease

basis. The weighted average leasee's borrowing rate applied on the

lease liability on 1 July 2019 was 3.19% - See note 20

For contracts entered into on or after 1 July 2019, the Group

assesses at inception whether the contract is, or contains, a

lease. A lease exists if the contract conveys the right to control

the use of an identified asset for a period of time in exchange for

consideration. The group assessment includes whether:

-- the contract involves the use of an identified asset;

-- the Group has the right to obtain substantially all of the

economic benefit from the use of the asses throughout the contract

period, and;

-- the Group has the right to direct the use of the asset.

At the commencement of a lease, the Group recognises a

right-of-use asset along with a

corresponding lease liability.

The leases liability is initially measured at the present value

of the remaining lease payments, discounted using the individual

entities incremental borrowing rate. The lease term comprises the

non-cancellable period of the contract, together with periods

covered by an option to extend the lease where the Group is

reasonable certain to exercise that option based on operational

needs and contractual terms. Subsequently, the lease liability is

measured at amortised cost by increasing the carrying amount to

reflect interest on the lease liability, and reducing it by the

lease payments made. The lease liability is remeasured when the

Group changes its assessment of whether it will exercise an

extension or termination option.

Right-of-use assets are initially measured at cost, comprising

the initial measurement of the lease liability adjusted for any

lease payments made at or before the commencement date, lease

incentives received and initial direct costs. Subsequently,

right-of-use assets are measured at cost, less any accumulated

depreciation and any accumulated impairment losses, and are

adjusted for certain remeasurement of the lease liability.

Depreciation is calculated on a straight-line basis over the

length of the lease. The Group has elected to apply exemptions for

short-term leases and leases for which the underlying asset is

of

low value. For these leases, payments are charged to the income

statement on a straight-line basis over the term of the relevant

lease. Right-of-use assets are presented within non-current assets

on the face of the balance sheet, and lease liabilities are shown

separately on the statement of financial position in current

liabilities and non-current liabilities depending on the maturity

of the lease payments.

Under IFRS16, right-of-use assets will be tested for impairment

in accordance with IAS36 Impairment of Assets. This has replaced

the previous requirements to recognise a provision for onerous

lease contracts.

Payments associated with short-term leases are recognised on a

straight-line basis as an expense in the profit or loss. Short term

leases are leases with a lease term of 12 months or less.

Pension scheme contributions

Pension contributions are charged to the statement of

comprehensive income in the period in which they fall due. All

pension costs are in relation to defined contribution schemes.

Share based payments

Equity-settled share-based payments to employees and others

providing similar services are measured at the fair value of the

equity instruments at the grant date. Details regarding the

determination of the fair value of equity-settled share-based

transactions are set out in note 18.

The fair value determined at the grant date of the

equity-settled share-based payments is expensed on a straight-line

basis over the vesting period, based on the Group's estimate of

equity instruments that will eventually vest. At each statement of

financial position date, the Group revises its estimate of the

number of equity instruments expected to vest. The impact of the

revision of the original estimates, if any, is recognised in profit

or loss over the remaining vesting period, with a corresponding

adjustment to reserves.

Foreign currencies

Monetary assets and liabilities denominated in foreign

currencies are translated into sterling at the rates of exchange

ruling at 30 June. Transactions in foreign currencies are recorded

at the rates ruling at the date of the transactions.

Taxation

Income tax expense represents the sum of the tax currently

payable and deferred tax.

Current tax

The tax currently payable is based on taxable profit for the

year. Taxable profit differs from profit as reported in the

consolidated statement of comprehensive income because it excludes

items of income or expense that are taxable or deductible in other

years and it further excludes items that are never taxable or

deductible. The Group's liability for current tax is calculated

using tax rates that have been enacted or substantively enacted by

the year end date.

Deferred tax

Deferred tax is recognised on differences between the carrying

amounts of assets and liabilities in the financial statements and

the corresponding tax bases used in the computation of taxable

profit, and is accounted for using the statement of financial

position liability method. Deferred tax liabilities are generally

recognised for all taxable temporary differences, and deferred tax

assets are generally recognised for all deductible temporary

differences to the extent that it is probable that taxable profits

will be available against which those deductible temporary

differences can be utilised. Such assets and liabilities are not

recognised if the temporary difference arises from goodwill or from

the initial recognition (other than in a business combination) of

other assets and liabilities in a transaction that affects neither

the taxable profit nor the accounting profit.

Deferred tax liabilities are recognised for taxable temporary

differences associated with investments in subsidiaries and

associates, and interests in joint ventures, except where the Group

is able to control the reversal of the temporary difference and it

is probable that the temporary difference will not reverse in the

foreseeable future. Deferred tax assets arising from deductible

temporary differences associated with such investments and

interests are only recognised to the extent that it is probable

that there will be sufficient taxable profits against which to

utilise the benefits of the temporary differences and they are

expected to reverse in the foreseeable future.

The carrying amount of deferred tax assets is reviewed at each

statement of financial position date and reduced to the extent that

it is no longer probable that sufficient taxable profits will be

available to allow all or part of the asset to be recovered.

Deferred tax assets and liabilities are measured at the tax rates

that are expected to apply in the year in which the liability is

settled or the asset realised, based on tax rates (and tax laws)

that have been enacted or substantively enacted by the year end

date. The measurement of deferred tax liabilities and assets

reflects the tax consequences that would follow from the manner in

which the Group expects, at the reporting date, to recover or

settle the carrying amount of its assets and liabilities.

Deferred tax assets and liabilities are offset when there is a

legally enforceable right to set off current tax assets against

current tax liabilities and when they relate to income taxes levied

by the same taxation authority and the Group intends to settle its

current tax assets and liabilities on a net basis.

Current and deferred tax for the year

Current and deferred tax are recognised as an expense or income

in the statement of comprehensive income, except when they relate

to items credited or debited directly to equity, in which case the

tax is also recognised directly in equity.

Impairment of property, plant and equipment

At each year end date, the Group reviews the carrying amounts of

its property, plant and equipment to determine whether there is any

indication that those assets have suffered an impairment loss. If

any such indication exists, the recoverable amount of the asset is

estimated in order to determine the extent of the impairment loss

(if any). Where it is not possible to estimate the recoverable

amount of an individual asset, the Group estimates the recoverable

amount of the cash-generating unit to which the asset belongs.

Where a reasonable and consistent basis of allocation can be

identified, corporate assets are also allocated to individual

cash-generating units, or otherwise they are allocated to the

smallest group of cash-generating units for which a reasonable and

consistent allocation basis can be identified.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have not been

adjusted.

If the recoverable amount of an asset (or cash-generating unit)

is estimated to be less than its carrying amount, the carrying

amount of the asset (or cash-generating unit) is reduced to its

recoverable amount. An impairment loss is recognised immediately in

profit or loss.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (or cash-generating unit) is increased to the

revised estimate of its recoverable amount, but so that the

increased carrying amount does not exceed the carrying amount that

would have been determined had no impairment loss been recognised

for the asset (or cash-generating unit) in prior years. A reversal

of an impairment loss is recognised immediately in the statement of

comprehensive income.

Research and development

The Group undertakes research and development to expand its

activity in technology and innovation to develop new products that

will begin directly generating revenue in the future. Expenditure

on research is expensed as incurred, development expenditure is

capitalise only if the criteria for capitalisation are recognised

in IAS 38. The Company claims tax credits on its research and

development activity and recognises the income in current tax.

Government Grants

During the period, the Group received benefits from Government

grants. Revenue based Government grants are recognised through the

consolidated statement of comprehensive income by netting off

against the costs to which they relate. Where the grant is not

directly associated with costs incurred during the period, it is

recognised as 'other income'.

Critical judgements in applying accounting policies and key

sources of estimation uncertainty

The following are the critical judgements and key sources of

estimation uncertainty that the directors have made in the process

of applying the entity's accounting policies and that have the most

significant effect on the amounts recognised in these financial

statements.

Impairment of goodwill

Determining whether goodwill is impaired requires an estimation

of the value in use of the cash-generating units to which goodwill

has been allocated. A similar exercise is performed in respect of

investment and long term loans in subsidiary.

The value in use calculation requires the directors to estimate

the future cash flows expected to arise from the cash-generating

unit and a suitable discount rate in order to calculate present

value, see note 10 for further details.

The carrying amount of goodwill at the year-end date was

GBP1,299,000 (2019: GBP1,190,000). The investment in subsidiaries

at the year-end was GBP1,197,000 (2018: GBP1,197,000).

The methodology adopted in assessing impairment of Goodwill is

set out in note 10 as is sensitivity analysis applied in relation

to the outcomes of the assessment.

Impairment investment in subsidiaries and inter-company

receivables

As set out in note 11, an impairment assessment of the carrying

value of investments in subsidiaries and inter-company receivables

is in line with the methodologies adopted in the assessment of

impairment of goodwill.

2. Segmental analysis

2020 2019

GBP'000 GBP'000

Turnover by geographical market

United Kingdom 8,285 6,509

Europe 19 29

Other 21 142

-------- --------

8,325 6,680

======== ========

The Group operates out of one geographical location being the

UK. Accordingly, the primary segmental disclosure is based on

activity. Per IFRS 8 operating segments are based on internal

reports about components of the Group, which are regularly reviewed

and used by Chief Operating Decision Maker ("CODM") for strategic

decision making and resource allocation, in order to allocate

resources to the segment and to assess its performance. The Group's

reportable operating segments are as follows:

-- Adien - Utility detection and mapping services - Sale of services

-- Technology Division - Development, assembly and sale of GPR equipment - Sale of goods

-- QM Systems - Test system solutions - Sale of services

-- TED - Rail trackside solutions (included in the test system

solutions segment) - Sale of services

-- Wessex Precision Instruments Limited - Slip testing equipment

(included in the test system solutions segment) - Sale of goods

The CODM monitors the operating results of each segment for the

purpose of performance assessments and making decisions on resource

allocation. Performance is based on revenue generations and profit

before tax, which the CODM believes are the most relevant in

evaluating the results relative to other entities in the

industry.

In utility detection and mapping services two customers

accounted for 22% of revenue in 2020 and one customer for 20% in

2019. In development, assembly and sale of GPR equipment one

customers accounted for 68% of revenue in 2020 and one customer for

39% in 2019. In automation and test system solutions three

customers accounted for 42% of revenue and one customer for 35% in

2019.

Information regarding each of the operations of each reportable

segment is included below, all non-current assets owned by the

Group are held in the UK.

Utility Development, Automation Total

detection assembly and test

and mapping and sale system solutions

services of GPR equipment

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30 June 2020

Total segmental

revenue 1,344 81 6,900 8325

------------- ------------------ ------------------ ---------

Operating profit/(loss) 75 (15) 345 405

Finance costs (33) (141) (37) (211)

Profit /(loss) before

taxation 42 (156) 308 194

------------- ------------------ ------------------ ---------

Segment assets 771 1,527 2,307 4,605

Segment liabilities 664 4,379 2,304 7,347

Non-current asset

additions 225 1 258 484

Depreciation and

amortisation 95 1 95 191

============= ================== ================== =========

Utility Development, Automation Total

detection assembly and test

and mapping and sale system solutions

services of GPR equipment

GBP'000 GBP'000 GBP'000 GBP'000

Year ended 30 June 2019

Total segmental

revenue 1,314 192 5,174 6,680

------------- ------------------ ------------------ ---------

Operating profit (47) 34 70 57

Finance costs (10) (1) (34) (45)

Profit / loss before

taxation (57) 33 36 12

------------- ------------------ ------------------ ---------

Segment assets 529 1,322 2,679 4,530

Segment liabilities 481 4,239 3,157 7,877

Non-current asset

additions 75 - 62 137

Depreciation and

amortisation 55 - 35 90

============= ================== ================== =========

3. Finance costs

2020 2019

GBP'000 GBP'000

Interest receivable and other income - (155)

Interest payable 211 200

211 45

======== ========

Interest receivable and other income

comprises of:

Loan adjustment (see below) - 129

Other income - 26

- 155

======== ========

Interest payable comprises interest

on:

Leases 17 14

Right of use assets - IFRS 16 9 -

Directors' loans 141 147

Other 44 39

211 200

======== ========

Loan adjustment

In 2019, the vendors of Thomson Engineering Limited agreed to

amend the terms of the acquisition and the liability owed to them

was reduced from GBP200,000 to GBP71,000, resulting in an

adjustment of GBP129,000.

4. Operating profit for the year

This is arrived at after charging for the Group:

2020 2019

GBP'000 GBP'000

Research and development costs not

capitalised 2,141 1,774

Depreciation 191 89

Auditor's remuneration

- Fees payable to the Company's auditor

for the audit of the Group's financial

statements 43 43

- Fees payable to the Company's auditor

and its subsidiaries for the provision

of tax services 7 7

Lease rentals:

- other including land and buildings 163 100

======== ========

The Company audit fee is GBP9,000 (2019: GBP9,000).

5. Staff costs

2020 2019

No. No.

Average monthly number of employees, including directors:

Production and research 85 71

Selling and research 10 10

Administration 6 6

-------- ------------

101 87

======== ============

2020 2019

GBP'000 GBP'000

Staff costs, including directors:

Wages and salaries 3,382 2,928

Social security costs 326 284

Other pension costs 68 53

-------- ------------

3,776 3,265

======== ============

6. Directors' Remuneration

Salary Benefits 2020 2019

and fees in kind Total Total

GBP'000 GBP'000 GBP'000 GBP'000

G G Watt 71 - 71 71

S P Padmanathan 26 - 26 25

R MacDonnell 2 - 2 4

---------- --------- -------- --------

Aggregate emoluments 99 - 99 100

========== ========= ======== ========

Directors' pensions 2020 2019

No. No.

The number of directors who are accruing

retirement benefits under:

- defined contributions policies - -

======== ========

The directors represent key management personnel.

Directors' share options

No. of options

At start Granted At end Exercise Date from

of year during of year price which exercisable

year

S P Padmanathan 200,000 - 200,000 3.875p 15-Nov-19

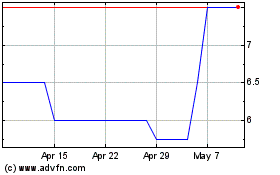

The Company's share price at 30 June 2020 was 4.50. The high and

low during the period under review were 7.00 and 3.75p

respectively.

In addition to the above, in consideration of loans made to the

Company, G G Watt has warrants over 3,703,703 ordinary shares at an

exercise price of 13.5p and a further 6,000,000 ordinary shares at

an exercise price of 3.0p.

7. Taxation

2020 2019

GBP'000 GBP'000

United Kingdom Corporation Tax

Current taxation (396) (306)

Adjustments in respect of prior

years - 6

-------- --------

(396) (300)

Deferred taxation - -

-------- --------

Tax on profits (396) (300)

======== ========

Current tax reconciliation 2020 2019

GBP'000 GBP'000

Taxable profit for the year 194 12

-------- --------

Theoretical tax at UK corporation

tax rate 19% (2019: 19%) 37 2

Effects of:

- R&D tax credit adjustments (414) (333)

- Income not taxable (3) (3)

- other expenditure that is not

tax deductible 1 6

- adjustments in respect of prior

years (17) 4

- short term timing differences 24

-------- --------

Total income tax credit (396) (300)

======== ========

The Group has tax losses amounting to approximately GBP2,855,000

(2019: GBP2,650,000), available for carry forward to set off

against future trading profits. No deferred tax assets have been

recognised in these financial statements due to the uncertainty

regarding future taxable profits.

Potential deferred tax assets not recognised are approximately

GBP535,000 (2019: GBP450,000)

8. Profit per share

Basic (pence per share) 2020 - 1.69 profit per share; 2019 -

0.91 profit per share

This has been calculated on a profit of GBP590,000 (2019:

GBP312,000) and the number of shares used was 34,860,515 (2019:

34,126,707) being the weighted average number of shares in issue

during the year.

Diluted (pence per share) 2020 - 0.93 profit per share; 2019 -

0.72 profit per share

The current year calculation used earnings of GBP510,000 (2019:

GBP392,000) being the profit for the year, plus the interest paid

on the convertible loan note (net of 20% tax) of GBP80,000 (2019:

GBP80,000) and the number of shares used was 55,095,386 (2019:

54,657,116) being the weighted average number of shares outstanding

during the year of 34,860,515 (2019: 34,126,707) adjusted for

shares deemed to be issued for no consideration relating to options

and warrants of 530,409 (2019: 530,409) and the impact of the

convertible instrument of 20,000,000 (2019: 20,000,000).

9. Property, plant and equipment

Freehold Equipment, Leasehold Motor Total

fixtures improvements vehicles

and fittings

GBP000 GBP'000 GBP'000 GBP'000 GBP'000

Cost

At 1 July 2019 265 1,775 223 291 2,554

Adjustment for change

in accounting policy

- see note 20 172 - - 26 198

Restated opening

balance 437 1,775 223 317 2,752

Additions 76 118 - 81 275

Transferred in on

Acquisition of subsidiary - 11 - - 11

Disposals - - - (10) (10)

At 30 June 2020 513 1,904 223 388 3,028

========= ============== ============== ========== ==================

Depreciation

At 1 July 2019 16 1,502 223 288 2,029

Charged in year 57 100 - 34 191

Transfer in on acquisition

of subsidiary - 7 - - 7

Disposals - - (10) (10)

At 30 June 2020 73 1,609 223 312 2,217

========= ============== ============== ========== ==================

Net book value

At 30 June 2020 440 295 - 76 811

At 30 June 2019 249 273 - 3 525

========= ============== ============== ========== ==================

The net book value of the property, plant and equipment includes

GBP471,506 (2019: GBP398,744) in respect of assets held under lease

agreements. These assets have been offered as security in respect

of these lease agreements. Depreciation charged in the period on

those assets amounted to GBP148,397 (2019: GBP79,901).

This is split by category as follows:

Asset Group Net book value Depreciation

2020 2019 2020 2019

GBP000 GBP000 GBP000 GBP000

Freehold 192,557 171,992 55,551 5,068

Equipment, fixtures

and fittings 186,796 200,268 61,143 55,040

Motor vehicles 92,153 26,484 31,703 19,793

------------------- ------------------- ------------------- -------------------

Total 471,506 398,744 148,397 79,901

=================== =================== =================== ===================

10. Goodwill

Goodwill Total

GBP'000 GBP'000

Cost

At 1 July 2019 1,250 1,250

Additions 108 108

At 30 June 2020 1,358 1,358

========= ==================

Depreciation

As at 30 June 2019 and 30 June 2020 60 60

========= ==================

Net book value

At 30 June 2020 1,298 1,298

At 30 June 2019 1,190 1,190

========= ==================

The goodwill carried in the statement of financial position of

GBP1,298,000 arose on the acquisition of Adien Limited in 2002

(GBP212,000), the acquisition of QM Systems Limited in 2006

(GBP849,000), the acquisition of TED in 2017 (GBP129,000) and the

acquisition of Wessex in 2019 (GBP108,000).

Adien Limited represents the segment utility detection and

mapping services and QM Systems Limited represents the segment test

system solutions.

QM Systems Limited, TED and Wessex are involved in projects

surrounding:

-- The creation of innovative automated assembly systems for the

manufacturing, food and pharmaceutical sectors.

-- The provision of inspection systems for the automotive,

aerospace, rail and pharmaceutical sectors.

-- Slippage testing

-- Automated test systems.

The Group tests goodwill annually for impairment or more

frequently if there are indicators that it might be impaired.

The recoverable amounts are determined from value in use

calculations which use cash flow projections based on financial

budgets approved by the directors covering a five year period. The

key assumptions are those regarding the discount rates, growth

rates and expected changes to sales and direct costs during the

period. Management estimates discount rates using pre-tax rates

that reflect current market assessments of the time value of money

and the risks specific to the business. This has been estimated at

10% per annum reflecting the prevailing pre-tax cost of capital in

the Company. The growth rates are based on forecasts and historic

margins achieved in both Adien Limited, QM Systems Limited and TED.

For Adien these have been assessed as 19% growth for revenue in

years 1 and 5% for years 2 and 3 and 2.5% thereafter and 2.5% for

overhead growth. For QM Systems these have been assessed as 1%

growth for revenue in year 1 and 10 % in year 2 and 3 and 5% for

years 3 to 5 and 5% for overhead growth. For TED these have been

assessed as 27% growth for revenue in year 1 and 20 % in year 2 and

3 and 5% for years 3 to 5 and 5% for overhead growth. No terminal

growth rate was applied. The reason for the significant Year 1

revenue growth in Adien and TED is an expectation based on current

trading and the pipeline.

11. Inventories

2020 2019

GBP'000 GBP'000

Raw materials 72 71

Finished goods 79 63

--------------- --------

151 134

=============== ========

The replacement cost of the above inventories would not be

significantly different from the values stated.

The cost of inventories recognised as an expense during the year

amounted to GBP2,726,000 (2019: GBP2,241,000). For the Parent

Company this was (GBP3,533) (2019: GBP35,000).

12. Trade and other receivables

2020 2019

GBP'000 GBP'000

Current

Trade receivables 1,010 1,038

Amounts owed by Group - -

undertakings

Prepayment and accrued

income 644 554

-------- --------

1,654 1,592

======== ========

13. Non-current liabilities: borrowings

2020 2019

GBP'000 GBP'000

Borrowings (note 16) 3,255 2,661

14. Trade and other payables

2020 2019

Current GBP'000 GBP'000

Trade payables 528 1,071

Other taxation and social

security 699 272

Payments received on

account 195 1,431

Accruals and other creditors 527 496

-------- ----------

1,949 3,270

======== ============

2020 2019

Non-current GBP'000 GBP'000

Trade payables - -

Amounts owed to Group - -

undertakings

Other creditors 6 3

-------- ----------

6 3

======== ============

The performance obligations of the IFRS 15 contract liabilities

(payments received on account) are expected to be met within the

next financial year.

15. Borrowing analysis

2020 2019

GBP'000 GBP'000

Due within one year

Bank and other loans 275 146

Directors' loan 1,718 1,714

Right of use asset - IFRS

16 69 -

Obligations under lease

agreements 75 83

-------- --------

2,137 1,943

======== ========

Due after more than one

year

Obligations under lease

agreements Right of use

asset - IFRS 16 96 89

180 -

Bank and other loans 576 139

Directors' loan 2,403 2,433

-------- --------

3,255 2,661

======== ========

Repayable

Due within 1 year 2,137 1,943

Over 1 year but less than

2 years 2,470 2,472

Over 2 years but less than

5 years 785 189

-------- --------

5,392 4,604

======== ========

Directors' loan

Included with Directors' loans and borrowings due within one

year are accrued fees and interest owing to GG Watt of GBP1,614,000

(2019: GBP1,601,000). The accrued fees and interest is repayable on

demand and no interest accrues on the balance.

The director's loan due in more than one year is a loan of

GBP2,349,000 from G G Watt. Directors' loans comprise of two

elements. A loan attracting interest at 2.15% over Bank of England

base rate. At the year end GBP1,349,000 (2019: GBP1,433,000) was

outstanding in relation to this loan. During the year to 30 June

2020 GBP84,000 (2019: GBP100,000) was repaid. The Company has the

right to defer repayment for a period of 366 days.

On 13 August 2010 the Company issued GBP1 million of Convertible

Unsecured Loan Stock ("CULS") to G G Watt, the Chairman of the

Company. The CULS were issued to replace loans made by G G Watt to

the Company amounting to GBP1 million and has been recognised in

non-current liabilities of GBP2,349,000.

Pursuant to amendments made on 13 November 2014 and 9 November

2018, the principal terms of the CULS are as follows:

- The CULS may be converted at the option of Gordon Watt at a

price of 3p per share at any time prior to 13 August 2022;

- Interest is payable at a rate of 10 per cent per annum on the

principal amount outstanding until converted, prepaid or repaid,

calculated and compounded on each anniversary of the issue of the

CULS. On conversion of any CULS, any unpaid interest shall be paid

within 20 days of such conversion;

- The CULS are repayable, together with accrued interest on 13

August 2022 ("the Repayment Date").

No equity element of the convertible loan stock was recognised

on issue of the instrument as it was not considered to be

material.

Leases

Lease agreements with Close Motor Finance are at a rate of 4.5%

and 5.19% over base rate. The future minimum lease payments under

lease agreements at the year end date was GBP157,119 (2019:

GBP133,822) and GBP14,038 (2019: GBP38,102). The difference between

the minimum lease payments and the present value is wholly

attributable to future finance charges.

Bank and other loans

A new working capital loan of GBP240,000 was given by Mirrasand

Partnership from a trust settled by Mr G Watt, on 12 August 2019.

The loan attracts interest at 10% per annum. The balance was

settled in full post year end.

Included in bank and other loans is an invoice discounting

facility of GBP3,505 (2019 GBP127,000).

Included in bank and other loans is a secured mortgage of

GBP146,871 which incurs an interest rate of 2.44% over base rate

for 10 years and at a rate of 2.64% over base thereafter. The

mortgage is secured over the freehold property. As a result of

COVID 19, the capital element of the mortgage was deferred for 6

months, extending the mortgage term for 6 months.

As a result of COVID 19, Coronavirus Business Interruption Loan

Scheme (CBILS) became available for the business. This enabled the

group to secure a loan of GBP400,000, on 15 May 2020 for a term of

6 year at a rate of 3.54% with the 1(st) year being interest free

and without repayment.

The business was also able to secure a Bounce Back loan through

Wessex Precision Engineering of GBP24,000, on 5 June 2020, with an

interest rate of 2.5% with the 1(st) year being interest free and

without repayment.

2020

Brought Cash flows Non-cash: Non-cash: Carried forward

forward New leases Accrued

fees/interest

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Director loan 4,147 (165) - 140 4,121

Leases 172 (82) 64 17 171

Right of use

asset - IFRS

16 198 (88) 130 9 249

Other 285 523 - 43 851

--------- ----------- ------------ --------------- ------------------

Loans and borrowings 4,802 188 194 209 5,392

========= =========== ============ =============== ==================

2019

Brought Cash flows Cash: advance Non-cash: Carried forward

forward Accrued

costs

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Director loan 4,195 (207) - 159 4,147

Leases 180 (69) 62 (1) 172

Other 737 (469) - 17 285

--------- ----------- -------------- ---------- ----------------

Loans and borrowings 5,112 (745) 62 175 4,604

========= =========== ============== ========== ================

*Included in working capital adjustments in cashflow

statement

16. Financial Instruments and derivatives

The Group uses financial instruments, which comprise cash and

various items, such as trade receivables and trade payables that

arise from its operations. The main purpose of these financial

instruments is to finance the Group's operations.

The main risks arising from the Group's financial instruments

are credit risk, liquidity risk and interest rate risk. A number of

procedures are in place to enable these risks to be controlled. For

liquidity risk these include profit/cash forecasts by business

segment, quarterly management accounts and comparison against

forecast. The board reviews and agrees policies for managing this

risk on a regular basis.

Credit risk

The credit risk exposure is the carrying amount of the financial

assets as shown in note 13 (with the exception of prepayments which

are not financial assets) and the exposure to the cash balances. Of

the amounts owed to the Group at 30 June 2020, the top 3 customers

comprised 45.00% (2019: 56.78%) of total trade receivables.

The Group has adopted a policy of only dealing with creditworthy

counterparties and the Group uses its own trading records to rate

its major customers, also the Group invoices in advance where

possible. The Group's exposure and the credit ratings of its

counterparties are continuously monitored and the aggregate value

of transactions concluded is spread amongst approved

counterparties. Having regard to the credit worthiness of the

Groups significant customers the directors believe that the Group

does not have any significant credit risk exposure to any single

counterparty.

An analysis of trade and other receivables:

2020 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000

Performing 0.00% 1,654 -

2019 Weighted Gross carrying Impairment

average loss value loss allowance

rate

GBP'000 GBP'000

Performing 0.00% 1,592 -

Interest rate risk

The Group finances its operations through a mixture of

shareholders' funds and borrowings. The Group borrows exclusively

in Sterling and principally at fixed and floating rates of interest

and are disclosed at note 16.

As disclosed in note 16 the Group is exposed to changes in

interest rates on its borrowings with a variable element of

interest. If interest rates were to increase by one percentage

point the interest charge would be GBP15,000 higher. An equivalent

decrease would be incurred if interest rates were reduced by one

percentage point.

Liquidity risk

As stated in note 1 the Executive Chairman, G G Watt, has

pledged to provide ongoing financial support for a period of at

least twelve months from the approval date of the Group statement

of financial position. It is on this basis that the directors

consider that neither the Group nor the Company is exposed to a

significant liquidity risk. Notes 15 and 16 disclose the maturity

of financial liabilities.

Contractual maturity analysis for financial liabilities, (see

note 16 for maturity analysis of borrowings):

2020 Due or Due between Due between Due between Total

due in 1-3 months 3 months-1 1-5 years

less than year

1 month

Trade and

other payables 1,055 - - 6 1,061

=========== ============ ============ ============ ======

2019 Due or due Due between Due between Due between Total

in less 1-3 months 3 months-1 1-5 years

than 1 month year

Trade and

other payables 1,567 - - 3 1,570

============== ============ ============ ============ ======

Financial liabilities of the Company are all due within less

than one month with the exception of the intercompany balances that

are due between 1 and 5 years.

Fair value of financial instruments

Loans and receivables are measured at amortised cost. Financial

liabilities are measured at amortised cost using the effective

interest method. The directors consider that the fair value of

financial instruments are not materially different to their

carrying values.

Capital risk management

The Group's objectives when managing capital are to safeguard

the Group's ability to continue as a going concern in order to be

able to move to a position of providing returns for shareholders

and benefits for other stakeholders and to maintain an optimal

capital structure to reduce the cost of capital.

The Group manages trade debtors, trade creditors and borrowings

and cash as capital. The entity is meeting its objective for

managing capital through continued support from GG Watt as

described per Note 1.

17. Share capital

2020 2020 2019 2019

No GBP'000 No GBP'000

Authorised

Ordinary shares

of 1p each 40,000,000 400 40,000,000 400

Allotted and fully

paid

Brought forward 34,360,515 344 34,020,515 340

Issued during the

year 500,000 5 340,000 4

Carried forward 34,860,515 349 34,360,515 344

=========== ======== =========== ========

Fully paid ordinary shares carry one vote per share and carry a

right to dividends.

On 4 February 2020, the Company issued 500,000 ordinary 1p

shares at an issue price of 3p per share as a result of the

exercise of share options.

10,903,703 (2019:11,403,703) share options were outstanding at

the year end, comprising the 1m employee options and the 9,903,703

share options and warrants held by directors disclosed below.

Share based payments have been included in the financial

statements where they are material. No share based payment expense

has been recognised.

No deferred tax asset has been recognised in relation to share

options due to the uncertainty of future available profits.

The director and employee share options were issued as part of

the Group's strategy on key employee remuneration, they lapse if

the employee ceases to be an employee of the Group during the

vesting period.

Employee options

Date Options Exercisable Number of Shares Exercise Price

Between March 2015 and March

2022 500,000 3.75p

Between July 2016 and July

2023 100.000 3.00p

Between November 2019 and

November 2026 400,000 3.875p

Directors' share options

No. of options

At start Granted At end Exercise Date from

of year during of year price which exercisable

year

S P Padmanathan 200,000 - 200,000 3.875p 15-Nov-19

The Company's share price at 30 June 2020 was 4.50. The high and

low during the period under review were 7.00p and 3.75p

respectively.

In addition to the above, in consideration of loans made to the

Company, G G Watt has warrants over 3,703,703 ordinary shares at an

exercise price of 13.5p and a further 6,000,000 ordinary shares at

an exercise price of 3.0p..

The weighted average contractual life of options and warrants

outstanding at the year-end is 2.89 years (2019: 3.89 years).

18. Related party transactions

Directors' loan disclosures are given in note 16. The interest

payable to directors in respect of their loans during the year

was:

G G Watt - GBP141,700

The directors are considered the key management personnel of the

Company. Remuneration to directors is disclosed in note 6.

Included within the amounts due from and to Group undertakings

were the following balances:

2020 2019

GBP GBP

Balance due from:

Adien Limited - -

QM Systems Limited - -

TED Limited 377,323 322,603

Wessex Precision Engineering

Limited 66,766 -

Balance due to:

Adien Limited 53,194 106,858

QM Systems Limited 1,009,923 1,125,390

These intergroup balances vary through the flow of working

capital requirements throughout the Group as opposed to intergroup

trading.

There is no ultimate controlling party of PipeHawk plc.

19. IFRS 16 - implementation

Reconciliation of operating lease commitments to lease the lease

liability at 1 July 2019:

GBP'000

--------

Operating leases disclosed at 30 June 2019 224

Discounted using the weighted average incremental

borrowing rate (26)

--------

Lease liability recognised at 1 July 2019 198

========

At 1 July 2019 the right of use asset recognised was GBP198,000

and a corresponding lease liability was GBP198,000.

At 30 June 2020 the financial impact following the introduction

of IFRS 16 is as follows:

Right of use asset GBP'000

--------

At 1 July 2019 198

Additions 130