Premier Miton Group PLC Q2 AuM Update (7505U)

April 08 2021 - 1:00AM

UK Regulatory

TIDMPMI

RNS Number : 7505U

Premier Miton Group PLC

08 April 2021

8 April 2021

Premier Miton Group plc

('Premier Miton', 'Group' or the 'Company')

Q2 AuM update

Premier Miton AuM increases to GBP 12.6 billion with second

consecutive quarter of positive net inflows

Premier Miton Group plc (AIM: PMI) today provides an update on

its unaudited statement of Assets under Management ('AuM') for the

second quarter of its current financial year (the 'Quarter' or

'Period').

-- Closing AuM of GBP12.6 billion at 31 March 2021 (31 December 2020: GBP12.0 billion)

-- Net inflows of GBP193 million during the Quarter

-- Financial year to date net inflows of GBP359 million

Mike O'Shea, Chief Executive Officer, commented:

"The Group's AuM grew by 19% from the position at 30 September

2020 to end the Period at GBP12.6 billion. It was pleasing to see

the continued growth in AuM and to record a second successive

quarter of net positive fund flows.

For the first time in many months, and as we had expected at the

time of our last update to shareholders, we saw increasing demand

for our UK equity-focused strategies. This sector has been out of

favour with investors for some time and it is one where we have a

broad and strongly performing range of funds. Should this recent

improvement in investor sentiment be maintained, we believe that

the Group is well placed to benefit from increasing fund flows

given our excellent track record in the area.

Our new Premier Miton Global Smaller Companies Fund was

successfully launched on 22 March 2021 and has already attracted

good investor interest. We continue to believe that smaller

companies represent an area where investors will be able to find

value over the coming years and we are confident that our new team

will do a very good job for investors.

We look forward to the launch of the Premier Miton European

Sustainable Leaders Fund on 10 May 2021. This new fund will focus

on companies with strong environmental, social and governance

('ESG') profiles and those the fund managers believe offer longer

term sustainable growth themes. The fund will be managed by the

highly-regarded investment team of Carlos Moreno and Thomas Brown

who have successfully managed the GBP2.4 billion(1) Premier Miton

European Opportunities Fund since launch in December 2015. As a

Group, we currently manage four funds with specific sustainable,

ESG or ethical objectives designed to meet increasing demand for a

specialist responsible investing approach from our investors.

Finally, during the Quarter, we completed a number of changes to

our multi-asset funds with the objective of reducing overall costs

for investors. Of the GBP3.9 billion the Group now manages in

multi-asset funds, some GBP2.2 billion is managed on a

multi-manager basis and GBP1.7 billion is managed through direct

investment in underlying securities. We continue to believe that

both strategies have a role to play in client portfolios and we are

proud of our long-term investment records in both areas. It is also

pleasing to see that short-term investment performance for both

groups of multi-asset funds is very strong. For those multi-asset

funds where an industry sector is an appropriate comparator, we

have 97%(2) of our AuM performing ahead of median and 94%(2) in the

first quartile over the last year."

Assets under Management:

Opening Closing

AuM Quarter Quarter Year to Market AuM

1 Oct 1 2 date / investment 31 Mar

2020 net flows net flows net flows performance 2021

GBPm GBPm GBPm GBPm GBPm GBPm

Equity funds 5,404 196 425 621 1,023 7,048

Multi-asset funds 4,119 (384) (243) (627) 445 3,937

Fixed income

funds 486 31 (11) 20 14 520

Investment trusts 599 (17) (1) (18) 150 731

Segregated mandates - 340 23 363 3 366

Total 10,608 166 193 359 1,635 12,602

(1) Fund size as at 31 March 2021

(2) Source: FE Analytics, data to 31 March 2021 using the main

representative post-RDR share class based on Investment Association

sector classifications. Performance period relates to the twelve

months to 31 March 2021 for the fifteen Premier Miton multi-asset

funds, representing GBP3.5 billion of AuM at the Period end. This

figure excludes the Premier Miton Multi-Asset Absolute Return Fund

and the Premier Miton Liberation fund range (where sector

comparisons are inappropriate)

ENDS

For further information, please contact:

Premier Miton Group plc

Mike O'Shea, Chief Executive Officer 01483 306 090

Numis Securities Limited (NOMAD and Broker)

Charles Farquhar / Kevin Cruickshank 020 7260 1000

Liberum Capital Limited (Joint Broker)

Richard Crawley / Jamie Richards 020 3100 2000

020 3047 2544

Smithfield Consultants (Financial PR) /

John Kiely / Andrew Wilde / Imogen Gardam 07785 275665

Notes to editors:

Premier Miton Investors is focused on delivering good investment

outcomes for investors through relevant products and active

management across its range of investment strategies, which include

equity, fixed income, multi-asset and absolute return.

LEI Number: 213800LK2M4CLJ4H2V85

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCSSFFAWEFSELL

(END) Dow Jones Newswires

April 08, 2021 02:00 ET (06:00 GMT)

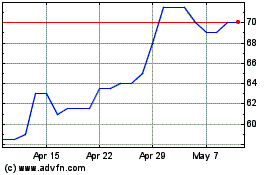

Premier Miton (LSE:PMI)

Historical Stock Chart

From Mar 2024 to Apr 2024

Premier Miton (LSE:PMI)

Historical Stock Chart

From Apr 2023 to Apr 2024