Polar Capital Holdings PLC AuM Update (5118V)

April 15 2021 - 1:00AM

UK Regulatory

TIDMPOLR

RNS Number : 5118V

Polar Capital Holdings PLC

15 April 2021

15 April 2021 Polar Capital Holdings plc

AuM Update

Polar Capital Holdings plc ("Polar Capital" or the "Group"), the

specialist asset management group, today provides its regular

quarterly update of its unaudited statement of its Assets under

Management ("AuM") for the financial year to 31 March 2021.

Group AUM (unaudited)

Polar Capital reports that as at 31 March 2021 its AuM were

GBP20.9bn compared to GBP12.2bn at the end of March 2020, an

increase of 71% over the year. During the period, AuM increased by

GBP8.7bn which comprised net subscriptions of GBP2.1bn, inflows

from reported acquisitions of GBP1.7bn, offset by outflows from a

previously reported fund closure of GBP0.3bn and an increase of

GBP5.2bn related to market movement and fund performance.

AuM movement in twelve Long-only Alternative Total

months to 31 March 2021 funds funds

AuM at 1 April 2020 GBP11,078m GBP1,083m GBP12,161m

----------- ------------ -----------

Net subscriptions/(redemptions) GBP2,130m GBP(22)m GBP2,108m

----------- ------------ -----------

Reported acquisitions GBP1,618m GBP81m GBP1,699m

----------- ------------ -----------

Closure of fund - GBP(301)m GBP(301)m

----------- ------------ -----------

Market movement and performance GBP5,023m GBP173m GBP5,196m

----------- ------------ -----------

Total AuM at 31 March GBP19,849m GBP1,014m GBP20,863m

2021

----------- ------------ -----------

Gavin Rochussen, Chief Executive, commented:

"AuM increased by 10% over the quarter to 31 March and by 71%

over the year from GBP12.2bn on 1 April 2020 to GBP20.9bn on 31

March 2021. The increase in AuM of GBP8.7bn comprised net inflows

of GBP2.1bn, an increase of GBP1.7bn due to the arrival of the

Phaeacian and Dalton teams, a reduction of GBP0.3bn due to a fund

closure, and market movement and fund performance added

GBP5.2bn.

"We are pleased to report a good finish to the financial year in

terms of flow momentum with net inflows into 14 of our funds

amounting to GBP643m in the quarter ended 31 March. The fact we

have also increased our AuM to over GBP20bn, doubling the size of

our business over three and a half years, is testament to our

strategic focus of offering a diversified range of funds whilst

maintaining a rigorous focus on performance and active

management.

"It is also pleasing that the pipeline for flows into our

Emerging Markets Stars range of funds, which have sustainability at

the core of their processes, continues to remain strong as the

funds approach their three-year track records at Polar Capital.

"Fund performance across our fund range in the current calendar

year is resilient with 57% of our funds outperforming benchmark

calendar year to date.

"On a three-year annualised basis, 78% of AuM has performed

ahead of benchmark at the end of March.

"70% of AuM in our UCITS fund range is ranked in the first

quartile against peers in the Lipper universe over three years.

"The integration of the Dalton business onto the Polar Capital

platform continues according to schedule and is anticipated to be

completed by our financial half-year end.

"We remain confident that with our diverse range of funds and

focus on performance in our actively managed complementary funds we

are positioned to continue to perform well for our clients and will

continue to generate net inflows. The net inflow momentum of the

last quarter has continued into the first two weeks of April."

Polar Capital aims to announce its results for the financial

year to 31 March 2021 on 1 July 2021.

For further information please contact:

Polar Capital

Gavin Rochussen (Chief Executive)

John Mansell (Executive Director)

Samir Ayub (Finance Director) +44 (0)20 7227 2700

Numis Securities Limited - Nomad and

Joint Broker

Charles Farquhar

Stephen Westgate

Kevin Cruickshank (QE) +44 (0)20 7260 1000

Peel Hunt LLP - Joint Broker

Andrew Buchanan

Rishi Shah +44 (0)20 3597 8680

Camarco

Ed Gascoigne-Pees

Jennifer Renwick

Monique Perks +44 (0)20 3757 4995

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAXLLFFFFEFA

(END) Dow Jones Newswires

April 15, 2021 02:00 ET (06:00 GMT)

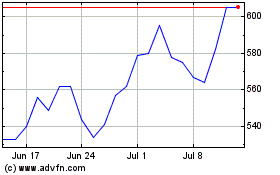

Polar Capital (LSE:POLR)

Historical Stock Chart

From Mar 2024 to Apr 2024

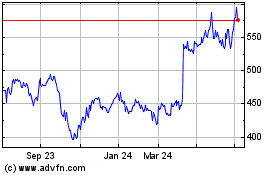

Polar Capital (LSE:POLR)

Historical Stock Chart

From Apr 2023 to Apr 2024