TIDMPRES

RNS Number : 0258R

Pressure Technologies PLC

24 October 2023

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

UK version of the EU Market Abuse Regulation (2014/596) which is

part of UK law by virtue of the European Union (Withdrawal) Act

2018, ("MAR"), and is disclosed in accordance with the Group's

obligations under Article 17 of MAR. Upon the publication of this

announcement via a Regulatory Information Service, this inside

information will be considered to be in the public domain.

24 October 2023

Pressure Technologies plc

("Pressure Technologies" or "the Company" or "the Group")

Debt Refinancing - Agreement in Principle

Pressure Technologies plc (AIM: PRES), the specialist

engineering group, is pleased to announce it has reached agreement

in principle with Rockwood Strategic plc(1) and Peter Gyllenhammar

AB (together "the Lenders"), both major shareholders in the

Company, for the provision of a new Term Loan Facility of GBP1.5

million ("the Facility") that will be used to refinance the

existing debt facilities of the Group and provide additional

working capital headroom.

Background to the Debt Refinancing

The existing debt facilities of the Group currently comprise a

bank loan of GBP0.9 million provided by Lloyds Banking Group

("Lloyds") and finance leases totalling GBP1.1 million. The Lloyds

loan is secured against the assets of the Group and is due to be

repaid in full on 31 December 2023 at which point the facility will

expire. The finance leases are secured against specific assets and

have a range of expiry dates over the next 4 years.

During 2023, the Group has explored refinancing the Lloyds loan

with a number of mainstream lenders and challenger banks by way of

raising new asset-backed lending facilities secured against the

property assets, plant and debtors of the Group.

However, the challenging trading conditions experienced across

2022 and during the early part of 2023 subdued the financial

performance of the Group in that period. Whilst profitability for

the financial year ended 30 September 2023 ("FY23") reflected

materially improved trading on the prior year, as updated in the

Company announcement of 3 October 2023, it is expected to remain at

this level in the next 12 months. As a result, and alongside

tightening lending standards and credit availability, the debt

capacity of the Group has been restricted and a suitable mainstream

lending facility has not been made available.

Intention to divest Precision Machined Components ("PMC")

division

Further to the Company's announcement of 3 October 2023, the

Board has noted the continued improvement in oil and gas market

conditions which drove the much improved order intake and financial

performance of PMC in the second half of FY23. Considering the

current trading environment, improved outlook and positive

developments being made by PMC, the Board has decided that the

timing is now favourable to realise value through the divestment of

the PMC division.

The Group has appointed advisors to handle the sale process

which it expects to launch in November 2023. The sale process is

expected to run for approximately 6 months into the third quarter

of the financial year ending 30 September 2024 ("FY24").

Group Funding Requirement

The Group currently has available cash resources of

approximately GBP0.7 million, in addition to the debt facilities

noted above.

The sale of PMC is expected to deliver material cash proceeds

for the Group in the third quarter of FY24 which will underpin a

strong and stable financial position from which to transition

Chesterfield Special Cylinders into new UK defence, global defence

and hydrogen programmes during the remainder of FY24 and

beyond.

However, during the intervening period the cash position of the

Group is expected to tighten as a result of the final repayment

commitment to Lloyds of GBP0.9 million in December 2023 and reduced

activity levels around the Christmas shutdown.

The Group has therefore identified a short-term funding

requirement of up to GBP1.5 million to bridge the finances of the

Group to a sale of the PMC division.

New Term Loan Facility

The Group has arranged the proposed new Facility with Harwood

Capital LLP, as Investment Adviser to Rockwood Strategic plc (who

hold a 20.0% shareholding in the Company), and Peter Gyllenhammar

AB (who hold a 16.8% shareholding in the Company).

The Facility will provide GBP1.5 million on drawdown and will be

used to repay Lloyds, pay transaction expenses and provide working

capital headroom. The Facility is committed for a 5 year period and

is secured against the assets of the Group.

The Facility is subject to full capital repayment over the 5

year term with GBP0.5 million repayable in FY24, GBP0.25 million

repayable in October 2025 and GBP0.25 million repayable annually

thereafter to expiry in October 2028. An arrangement fee of 3% is

payable to the Lenders on drawdown and the Facility carries an

interest rate of 14.25% per annum. The Facility may be repaid at

any time by the Group without prepayment charges or penalties. Upon

a successful sale of the PMC division, the Facility will be repaid

in full.

In conjunction with the provision of the Facility, the Lenders

will also be issued with 1,933,358 warrants in aggregate

(representing 5% of the issued share capital) to subscribe for

ordinary shares in the Company ("the Warrants") at a price of 32

pence per share, representing a 20% premium to yesterday's closing

share price. The Warrants may be exercised at any time in the 5

years following drawdown of the Facility and continue to be

exercisable in the event the Facility is repaid before its final

expiry.

The Company and the Lenders expect to complete legal

documentation required for the Facility during November 2023.

Related Party Transaction

The Lenders are each substantial shareholders in the Company and

Richard Staveley, Non-Executive Director of the Company, is a board

representative of Harwood Capital LLP, investment manager of

Rockwood Strategic plc. The provision of the Facility, and the

associated grant of the Warrants, constitutes a related party

transaction pursuant to AIM Rule 13.

The Directors independent of the transaction (being all

Directors other than Richard Staveley), having consulted with the

Company's nominated adviser, Singer Capital Markets, consider that

the terms of the Facility and the grant of the Warrants are fair

and reasonable insofar as shareholders are concerned.

Chris Walters, Chief Executive of Pressure Technologies plc,

commented:

"We appreciate the strong support from two of our major

shareholders, demonstrated through this funding solution,

confirming their confidence in the Group's prospects whilst we

realise value from the sale of the PMC division in improving oil

and gas market conditions."

Additional Information

The person responsible for arranging release of this

announcement on behalf of the Company is Steve Hammell, Chief

Financial Officer.

(1) Harwood Capital LLP is the investment manager of Rockwood

Strategic plc.

For further information, please contact:

Pressure Technologies plc Tel: 0333 015 0710

Chris Walters, Chief Executive

Steve Hammell, Chief Financial

Officer

Singer Capital Markets (Nomad Tel: 0207 496 3000

and Broker)

Rick Thompson / Asha Chotai

Houston (Financial PR and Investor Tel: 0204 529 0549

Relations) pressuretechnologies@houston.co.uk

Kay Larsen / Ben Robinson

COMPANY DESCRIPTION

www.pressuretechnologies.com

With its head office in Sheffield, the Pressure Technologies

Group was founded on its leading market position as a designer and

manufacturer of high-integrity, safety-critical components and

systems serving global supply chains in oil and gas, defence,

industrial and hydrogen energy markets.

The Group has two divisions:

-- Chesterfield Special Cylinders (CSC) - www.chesterfieldcylinders.com

-- Precision Machined Components (PMC) - www.pt-pmc.com

o Includes the Al-Met, Roota Engineering and Martract sites.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

AGRUORWROVURUAA

(END) Dow Jones Newswires

October 24, 2023 02:05 ET (06:05 GMT)

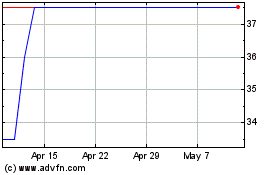

Pressure Technologies (LSE:PRES)

Historical Stock Chart

From Oct 2024 to Nov 2024

Pressure Technologies (LSE:PRES)

Historical Stock Chart

From Nov 2023 to Nov 2024