TIDMPSDL

RNS Number : 8567U

Phoenix Spree Deutschland Limited

04 August 2022

4 August 2022

Phoenix Spree Deutschland Limited

("PSD" or the "Company")

Investment property valuation and business update

Phoenix Spree Deutschland Limited (LSE: PSDL.LN), the UK listed

investment company specialising in Berlin residential real estate,

announces the valuation for the portfolio of investment properties

held by the Company and its subsidiaries (the "Portfolio") as at 30

June 2022.

Financial performance

-- Portfolio value increased by 1.4 percent to EUR812.4 million

(31 December 2021: EUR801.5 million)

-- 9 condominiums units notarised for sale for an aggregate

value of EUR3.0 million, representing a 20 percent premium to book

value

-- A further 0.9 percent of the ordinary share capital bought

back for a total consideration of GBP4.0 million at an average 24.2

percent discount to NAV

-- Strong balance sheet with net LTV of 37 percent

Portfolio valuation

Pricing in the Berlin residential property market has remained

stable in the first half of the financial year. Although there has

been a deterioration in buyer sentiment and, consequently,

transaction volumes were significantly below peak levels,

investment demand observed by Jones Lang LaSalle GmbH, the

Company's independent valuers, continues to support current

pricing.

As at 30 June 2022, the Portfolio was valued at EUR812.4 million

(31 December 2021: EUR801.5 million). This represents a 1.4 percent

increase over the six-month period. On a like-for-like basis,

excluding the impact of disposals, the Portfolio value increased by

1.9 percent during the first half of the financial year and 5.7

percent versus the first half of the prior year. This reflects an

increase in rental values, improvements in the micro locations of

certain Portfolio assets, investments in the Brandenburg asset and

completion of the condominium splitting process in one building.

The property valuation excludes the prepayment relating to the

acquisition of Erkner which will be held at cost of EUR5.55m.

The valuation represents an average value per square metre of

EUR4,318 (31 December 2021: EUR4,225), at a gross fully occupied

yield of 2.8 per cent. (31 December 2021: 2.8 percent). Included

within the Portfolio valuation are six properties valued as

condominiums, with an aggregate value of EUR32.8 million (31

December 2021: eight properties, aggregate value EUR38.8

million).

Condominium notarisations of EUR3.0 million, at a 20 percent

premium to book value.

During the first half of 2022, nine condominiums units were

notarised for sale for an aggregate value of EUR3.0 million (H1

2021: EUR4.3 million).

Condominium notarisations during the second quarter of 2022 have

been negatively impacted by concerns over increases in the cost of

living, higher borrowing costs and uncertainty surrounding the

crisis in Ukraine which have led to a deterioration in buyer

sentiment and reduced investment volumes.

The average achieved notarised value per sqm for the residential

units was EUR5,291, representing a 20 percent premium to book value

and a 25.2 percent premium to PSD's average Berlin residential

portfolio value as at 30 June 2022.

Share buybacks at a 24.2% discount to NTA

During six months ended 30 June 2022, the Company bought back a

further 930,509 Ordinary Shares, representing 0.9 percent of the

Ordinary Share capital, for a total consideration of GBP4.0

million. The average price paid represents a 24.2 percent discount

to EPRA NTA per share as at 31 December 2021.

Since commencing its share buyback programme in September 2019,

a total of 8,879,802 shares have been bought back, representing 8.8

percent of the issued share capital of the Company, for a total

consideration of GBP30.5 million. The capital made available for

the buyback programme has been funded through a combination of

existing cash balances, refinancing and condominium sale

proceeds.

Outlook

The last two months have seen a significant change in capital

markets in reaction to inflationary pressures, consequential

interest rate rises and expectations for future global central bank

monetary policy. Investor and consumer confidence has additionally

been impacted by the ongoing conflict in Ukraine. Although PSD's

share price has significantly outperformed its listed peers during

the first half of the financial year, these circumstances have

created a degree of uncertainty across global equity markets from

which PSD is not immune. However, PSD remains well positioned to

withstand any current dislocations as they affect the Berlin

residential real estate operating environment.

With a net LTV of 37 percent, the Company's balance sheet

remains conservative, with an average remaining duration of the

loan book exceeding four years. Its first loan is not due to reach

maturity until September 2026. Moreover, following a transition

away from negative rates, the Company's interest rate hedging

policy has seen cash borrowing costs decline, despite rising long

term rates.

The Board considers the current level of gearing and cash

balances to be appropriate at this stage in the real estate cycle

and will not look to increase debt levels until such time as the

market outlook becomes more stable. Accordingly, further buybacks

will be dependent on condominium sales and non-core asset disposals

rather than refinancing. The Board keeps disposal opportunities

under regular review and, in view of the continuing significant

discount of PSD's share price to EPRA NTA per share, it remains the

current intention of the Board to deploy any proceeds over and

above amounts required to fund normal working capital requirements

and payment of dividends in the ordinary course to share

buybacks.

Interim results

The Company intends to publish its interim results for the six

months to 30 June 2022 in the final week of September 2022.

Robert Hingley, Chairman of Phoenix Spree Deutschland

commented:

"The first six months of the financial year were characterised

by significant market disruption caused by the combined effects of

global inflationary pressures, rising interest rates and the

ongoing conflict in Ukraine. Against this backdrop, it is pleasing

that the Portfolio was able to deliver further valuation gains

during the first half of the financial year.

Although financial market conditions have become more

challenging, demographic trends within the Berlin market remain

positive, with a significant undersupply of private rental

property. Affordability comparisons with other German cities remain

favourable and the reversionary potential that exists within the

Portfolio will continue to support rental values."

Legal Entity Identifier: 213800OR6IIJPG98AG39

For further information, please contact:

Phoenix Spree Deutschland Limited

Stuart Young +44 (0)20 3937 8760

Numis Securities Limited (Corporate Broker)

David Benda

+44 (0)20 3100 2222

Tulchan Communications (Financial PR)

Elizabeth Snow

Oliver Norgate +44 (0)20 7353 4200

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUPUGARUPPPGW

(END) Dow Jones Newswires

August 04, 2022 02:00 ET (06:00 GMT)

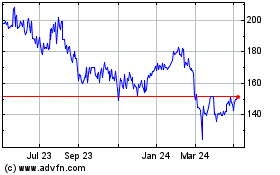

Phoenix Spree Deutschland (LSE:PSDL)

Historical Stock Chart

From Oct 2024 to Nov 2024

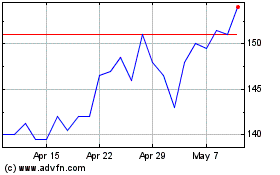

Phoenix Spree Deutschland (LSE:PSDL)

Historical Stock Chart

From Nov 2023 to Nov 2024