Parity Group PLC Trading Update (8904N)

January 26 2023 - 1:00AM

UK Regulatory

TIDMPTY

RNS Number : 8904N

Parity Group PLC

26 January 2023

Parity Group plc

("Parity" or the "Company")

Trading Update

Parity Group plc (AIM: PTY), the data and technology-focused

recruitment and professional services company, is pleased to issue

a trading update for the financial year ended 31 December 2022

("FY2022").

FY2022 Highlights

The board is pleased to report a significantly improved

operating performance despite the expected reduction in net fee

income during the year.

-- Net Fee Income for FY2022 expected to be GBP3.5m compared to GBP4.1m in FY2021.

-- Adjusted EBITDA(1) for FY2022 expected to be circa GBP0.4m vs GBP0.1m in the prior year.

-- Significant improvement in operating performance in FY2022

with anticipated break even at Adjusted Operating profit (2) level

compared to a GBP0.3m loss in the prior year.

-- Other income in FY2022 of GBP1m from the sale and licence

back of the Parity trademarks in the UK and EU.

-- Profit before Tax for FY2022 expected to be GBP0.5m vs loss of GBP1.1m in the prior year.

During FY2022, Parity has refocused its business around

recruitment, increasing customer-facing headcount and establishing

an efficient operating model. This has enabled the business to

significantly improve profitability during the period, and with the

sale and licence back of the trademark, to deliver a profit before

tax which we expect to be GBP0.5m.

The income from the trademark sale and licence back will enable

Parity to invest further in customer-facing roles to generate new

business and leverage the operating model of the business.

Mark Braund, Executive Chairman, said:

"We have successfully transitioned the business to focus on the

core commercial recruitment capability of Parity. As we look

forward, Parity is a more agile, albeit smaller business with a

strong work culture and a much-improved focus on what we are

'great' at.

"This foundation, along with the additional funding from the

sale of the trademark, creates a solid base from which we can

continue to evolve the business. Whilst the outlook for the wider

economy is becoming less certain, our strength in providing skilled

technology resources to support the almost relentless demand for

digital transformation services, places Parity in a reassuringly

solid position. We aim to take advantage of the platform we have

established to invest carefully in relevant new areas of business

that will support longer-term sustainable profit and growth.

"The enthusiasm, commitment and tenacity of all my colleagues is

at the core of Parity's turnaround. For this and on behalf of the

Board, we say a heartfelt "thank you".

"We remain focused on maintaining our positive momentum and

positioning the business for further growth."

(1) Adjusted EBITDA is defined as operating profit before

finance costs, tax, depreciation, amortisation and non-underlying

items.

(2) Adjusted Operating profit is defined as operating profit

before finance costs and non-underlying items.

Contacts

Parity Group plc Tel: + 44 (0) 20 8171

1729

Mark Braund, Executive Chairman www.parity.net

Mike Johns, Chief Financial Officer

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20 3328

and Broker) 5656

David Hart / Dan Dearden-Williams (Corporate

Finance)

Tony Quirke (Sales and Corporate Broking)

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBAMPTMTTTBJJ

(END) Dow Jones Newswires

January 26, 2023 02:00 ET (07:00 GMT)

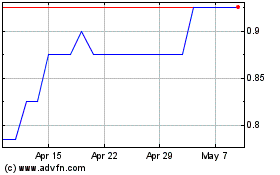

Partway (LSE:PTY)

Historical Stock Chart

From Jan 2025 to Feb 2025

Partway (LSE:PTY)

Historical Stock Chart

From Feb 2024 to Feb 2025