Royal Dutch Shell plc Royal Dutch Shell Plc First Quarter 2021 Interim Dividend

April 29 2021 - 1:32AM

Dow Jones News

TIDMRDSA TIDMRDSB

The Hague, April 29, 2021 - The Board of Royal Dutch Shell plc ("RDS" or

the "Company") today announced an interim dividend in respect of the

first quarter of 2021 of US$ 0.1735 per A ordinary share ("A Share") and

B ordinary share ("B Share").

Details relating to the first quarter 2021 interim dividend

It is expected that cash dividends on the B Shares will be paid via the

Dividend Access Mechanism and will have a UK source for UK and Dutch tax

purposes.

Per ordinary share Q1 2021

RDS A Shares (US$) 0.1735

------------------- -------

RDS B Shares (US$) 0.1735

------------------- -------

Cash dividends on A Shares will be paid, by default, in euros, although

holders of A Shares will be able to elect to receive dividends in US

dollars or pounds sterling.

Cash dividends on B Shares will be paid, by default, in pounds sterling,

although holders of B Shares will be able to elect to receive dividends

in US dollars or euros.

The pound sterling and euro equivalent dividend payments will be

announced on June 7, 2021.

Per ADS Q1 2021

RDS A ADSs (US$) 0.347

----------------- -------

RDS B ADSs (US$) 0.347

----------------- -------

Cash dividends on American Depository Shares ("ADSs") will be paid, by

default, in US dollars.

RDS A and B ADSs are listed on the New York Stock Exchange under the

symbols RDS.A and RDS.B, respectively. Each ADS represents two ordinary

shares, two A Shares in the case of RDS.A or two B Shares in the case of

RDS.B. ADSs are evidenced by an American Depositary Receipt (ADR)

certificate. In many cases the terms ADR and ADS are used

interchangeably.

Shell has introduced option to receive dividend in US dollars and moved

to full electronic settlement of its dividends

On December 18, 2019, Shell announced the introduction of US dollar as

additional currency election and highlighted that its dividend will be

settled with its shareholders fully electronically either in CREST or

via interbank transfers. The announcement provided an overview of the

actions needed by shareholders to ensure they continue to receive their

dividends. Please refer to the announcement of December 18, 2019 for

further information:

https://www.globenewswire.com/Tracker?data=a_-AsJSCoh5ivB6DKf22_Wlum2dF5m_VTpSN_zKOnjziu5dGiZnA-zW97IbeuS6wQekA3BpOPP3kXKzIQ5J6XlScOxuSw6mfvzBgvvvo1YfOV1FTL222bwgsWXV1u8yUVCdccaKqkVxZD6JtePqjmQ8iBr1HhgMBBAw5H4d--Vy6d9r55LY6Vyqdgyd20nq-_rARCuEhe-nHGkDJExpEiNVraM955eYJyeRQV9HZmpkREMXxB4WMyQs8BNz4afyG5r4cLMLysoGoCs3zWreA8jejZTff8sfagOWhfsLPdvaqlZNrK2XFUkxw8TXCzK4YRvztEbYVGzhbK2dZ7rOZLgYnlhsvYUsDOhCQ3uoRkdA=

https://www.shell.com/media/news-and-media-releases/2019/shell-introduces-option-to-receive-dividend-in-us-dollars.html

Dividend timetable for the first quarter 2021 interim dividend

Announcement date April 29 , 2021

Ex- Dividend Date for ADS.A and ADS.B May 13, 2021

Ex- Dividend Date for RDS A and RDS B May 13, 2021

Record date May 14, 2021

Closing of currency election date (see May 28, 2021

Note below)

Pound sterling and euro equivalents announcement June 7, 2021

date

Payment date June 21, 2021

Note

A different currency election date may apply to shareholders holding

shares in a securities account with a bank or financial institution

ultimately holding through Euroclear Nederland. This may also apply to

other shareholders who do not hold their shares either directly on the

Register of Members or in the corporate sponsored nominee arrangement.

Shareholders can contact their broker, financial intermediary, bank or

financial institution for the election deadline that applies.

Taxation - cash dividends

Cash dividends on A Shares will be subject to the deduction of Dutch

dividend withholding tax at the rate of 15%, which may be reduced in

certain circumstances. Non-Dutch resident shareholders, depending on

their particular circumstances, may be entitled to a full or partial

refund of Dutch dividend withholding tax.

If you are uncertain as to the tax treatment of any dividends you should

consult your tax advisor.

Dividend Reinvestment Programmes ("DRIP")

The following organisations operate Dividend Reinvestment Plans

("DRIPs") which enable RDS shareholders to elect to have their dividend

payments used to purchase RDS shares of the same class as those already

held by them:

-- Equiniti Financial Services Limited ("EFSL"), for those holding shares

(a) directly on the register as certificate holder or as CREST Member and

(b) via the Nominee Service;

-- ABN-AMRO NV ("ABN") for Financial Intermediaries holding 'A' shares or

'B' shares via Euroclear Nederland;

-- "JPMorgan Chase Bank, N.A." for holders of 'A' and 'B' American

Depository Shares; and

-- Other DRIPs may also be available from the intermediary through which

investors hold their shares.

Such organisations provide their DRIPs fully on their account and not on

behalf of Royal Dutch Shell plc. Interested parties should contact DRIP

Offerors directly.

More information can be found at

https://www.globenewswire.com/Tracker?data=a_-AsJSCoh5ivB6DKf22_Wlum2dF5m_VTpSN_zKOnjyc8a2hYjKfm0f4XXe4K_cjJvQRTGm5I3VXb3pqIFFoB3DIhjNk6ZZrCywfb3mTCeI=

https://www.shell.com/drip

To be eligible for the next dividend, shareholders must make a valid

dividend reinvestment election before the published date for the close

of elections.

Royal Dutch Shell plc

ENQUIRIES:

Media:

International +44 (0) 207 934 5550

Americas +1 832 337 4355

CAUTIONARY NOTE

The companies in which Royal Dutch Shell plc directly and indirectly

owns investments are separate legal entities. In this announcement

"Shell", "Shell Group" and "Group" are sometimes used for convenience

where references are made to Royal Dutch Shell plc and its subsidiaries

in general. Likewise, the words "we", "us" and "our" are also used to

refer to Royal Dutch Shell plc and its subsidiaries in general or to

those who work for them. These terms are also used where no useful

purpose is served by identifying the particular entity or entities.

"Subsidiaries", "Shell subsidiaries" and "Shell companies" as used in

this announcement refer to entities over which Royal Dutch Shell plc

either directly or indirectly has control. Entities and unincorporated

arrangements over which Shell has joint control are generally referred

to as "joint ventures" and "joint operations", respectively. Entities

over which Shell has significant influence but neither control nor joint

control are referred to as "associates". The term "Shell interest" is

used for convenience to indicate the direct and/or indirect ownership

interest held by Shell in an entity or unincorporated joint arrangement,

after exclusion of all third-party interest.

This announcement contains forward-looking statements (within the

meaning of the U.S. Private Securities Litigation Reform Act of 1995)

concerning the financial condition, results of operations and businesses

of Shell. All statements other than statements of historical fact are,

or may be deemed to be, forward-looking statements. Forward-looking

statements are statements of future expectations that are based on

management's current expectations and assumptions and involve known and

unknown risks and uncertainties that could cause actual results,

performance or events to differ materially from those expressed or

implied in these statements. Forward-looking statements include, among

other things, statements concerning the potential exposure of Shell to

market risks and statements expressing management's expectations,

beliefs, estimates, forecasts, projections and assumptions. These

forward-looking statements are identified by their use of terms and

phrases such as "aim", "ambition", "anticipate", "believe",

"could", "estimate", "expect", "goals", "intend", "may",

"objectives", "outlook", "plan", "probably", "project",

"risks", "schedule", "seek", "should", "target", "will" and

similar terms and phrases. There are a number of factors that could

affect the future operations of Shell and could cause those results to

differ materially from those expressed in the forward-looking statements

included in this announcement, including (without limitation): (a) price

fluctuations in crude oil and natural gas; (b) changes in demand for

Shell's products; (c) currency fluctuations; (d) drilling and production

results; (e) reserves estimates; (f) loss of market share and industry

competition; (g) environmental and physical risks; (h) risks associated

with the identification of suitable potential acquisition properties and

targets, and successful negotiation and completion of such transactions;

(i) the risk of doing business in developing countries and countries

subject to international sanctions; (j) legislative, fiscal and

regulatory developments including regulatory measures addressing climate

change; (k) economic and financial market conditions in various

countries and regions; (l) political risks, including the risks of

expropriation and renegotiation of the terms of contracts with

governmental entities, delays or advancements in the approval of

projects and delays in the reimbursement for shared costs; (m) risks

associated with the impact of pandemics, such as the COVID-19

(coronavirus) outbreak; and (n) changes in trading conditions. No

assurance is provided that future dividend payments will match or exceed

previous dividend payments. All forward-looking statements contained in

this announcement are expressly qualified in their entirety by the

cautionary statements contained or referred to in this section. Readers

should not place undue reliance on forward-looking statements.

Additional risk factors that may affect future results are contained in

Royal Dutch Shell plc's Form 20-F for the year ended December 31, 2020

(available at www.shell.com/investor and www.sec.gov). These risk

factors also expressly qualify all forward-looking statements contained

in this announcement and should be considered by the reader. Each

forward-looking statement speaks only as of the date of this

announcement, April 29, 2021. Neither Royal Dutch Shell plc nor any of

its subsidiaries undertake any obligation to publicly update or revise

any forward-looking statement as a result of new information, future

events or other information. In light of these risks, results could

differ materially from those stated, implied or inferred from the

forward-looking statements contained in this announcement.

We may have used certain terms, such as resources, in this announcement

that the United States Securities and Exchange Commission (SEC) strictly

prohibits us from including in our filings with the SEC. Investors are

urged to consider closely the disclosure in our Form 20-F, File No

1-32575, available on the SEC website www.sec.gov.

LEI number of Royal Dutch Shell plc: 21380068P1DRHMJ8KU70

Classification: Additional regulated information required to be

disclosed under the laws of a Member State

(END) Dow Jones Newswires

April 29, 2021 02:17 ET (06:17 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

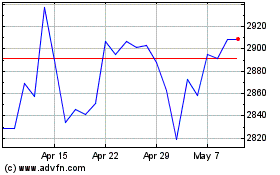

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

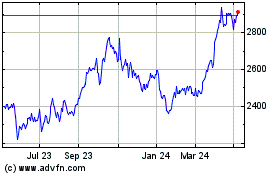

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024