Shell Oil and Gas Production Expected to Fall in 2Q After 1Q Rise -- Commodity Comment

April 29 2021 - 3:14AM

Dow Jones News

By Jaime Llinares Taboada

Royal Dutch Shell PLC on Thursday reported better-than-expected

profits for the first quarter of the year. Oil and gas production

rose from the fourth quarter of 2020, but is expected to drop in

April-June. Here's what the Anglo-Dutch energy major had to

say:

On integrated gas and upstream:

"Compared with the fourth quarter 2020, integrated gas adjusted

earnings primarily reflected higher realized prices for oil and

LNG, partly offset by higher operating expenses related to credit

provisions."

"Compared with the fourth quarter 2020, total oil and gas

production increased by 3% mainly due to the restart of production

at the Prelude floating LNG operations in Australia. LNG

liquefaction volumes decreased by 1% due to cargo timing, partly

offset by the restart of production at the Prelude floating LNG

operations in Australia."

On oil products:

"Compared with the fourth quarter 2020, oil products adjusted

earnings reflected higher contributions from trading and

optimization, higher realized refining margins, and lower operating

expenses. These were partly offset by the absence of the favorable

deferred tax movements in the fourth quarter 2020."

"Oil products sales volumes decreased due to the impact of

further lockdowns arising from Covid-19, and the Texas winter

storm, compared with the fourth quarter 2020."

On chemicals:

"Compared with the fourth quarter 2020, chemicals adjusted

earnings reflected higher realized margins in base chemicals and

intermediates from a stronger price environment."

"Chemicals manufacturing plant utilization remained at 79%

compared with the fourth quarter 2020, with the impact of the Texas

winter storm at the Deer Park site offsetting comparatively fewer

maintenance activities."

On second-quarter outlook:

"As a result of the Covid-19 pandemic, there continues to be

significant uncertainty in the macroeconomic conditions with an

expected negative impact on demand for oil, gas and related

products."

"Integrated Gas production is expected to be approximately

880-940 thousand boe/d. LNG liquefaction volumes are expected to be

approximately 7.6-8.2 million [metric tons]."

"Upstream production is expected to be approximately 2,150-2,350

thousand boe/d, reflecting lower seasonal gas demand and divestment

impacts."

"Refinery utilization is expected to be approximately 73%-81%.

Oil products sales volumes are expected to be approximately

4,000-5,000 thousand b/d."

"Chemicals manufacturing plant utilization is expected to be

approximately 76%-84%. Chemicals sales volumes are expected to be

approximately 3,500-3,800 thousand tons."

Write to Jaime Llinares Taboada at jaime.llinares@wsj.com;

@JaimeLlinaresT

(END) Dow Jones Newswires

April 29, 2021 03:59 ET (07:59 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

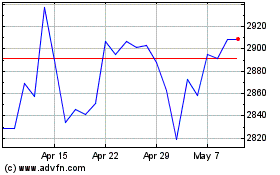

Shell (LSE:SHEL)

Historical Stock Chart

From Mar 2024 to Apr 2024

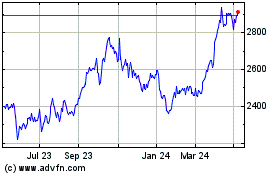

Shell (LSE:SHEL)

Historical Stock Chart

From Apr 2023 to Apr 2024