TIDMREL

RNS Number : 8279G

RELX PLC

29 July 2021

29 July 2021

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2021

RELX, the global provider of information-based analytics and

decision tools, reports results for the first half of 2021 and

updates the full year outlook.

Highlights

Ø Revenue GBP3,394m (GBP3,501m), constant currency growth +4%

Ø Adjusted operating profit GBP1,023m (GBP990m), constant currency

growth +11%

Ø Adjusted profit before tax GBP953m (GBP909m), constant currency

growth +13%

Ø Reported operating profit GBP860m (GBP747m)

Ø Reported profit before tax GBP825m (GBP666m)

Ø Adjusted EPS 40.0p (39.1p), constant currency growth +10%

Ø Interim dividend 14.3p (13.6p) +5%

Ø Reported EPS 34.5p (28.4p)

Ø Net debt/EBITDA 2.8x; adjusted cash flow conversion 112%

Full year 2021 outlook

Based on the improved performance in Risk, STM and Legal in the first

half, we expect full year underlying growth rates in revenue and adjusted

operating profit, as well as constant currency growth in adjusted earnings

per share, to be slightly above historical trends.

Chief Executive Officer, Erik Engstrom, commented:

"RELX delivered a strong first half with underlying growth

trends across almost all market segments returning to the improving

trajectory that we saw in the early part of 2020. We believe that

this improvement is a reflection of our continuing strategy of

focusing on the organic development of increasingly sophisticated

analytics and decision tools that deliver enhanced value to our

customers across market segments. Recent acquisitions, which have

supplemented our organic growth strategy, have continued to perform

well."

Chair, Paul Walker, commented:

"I am very pleased that RELX has continued to make good progress

both operationally and strategically in the first half of 2021. In

the few months since taking on the position of Chair I have been

impressed by the way in which RELX has prioritised supporting our

customers across all business areas, and has continued to invest

behind our strategic objectives whilst building on our strong ESG

performance. In recognition of the positive financial momentum we

have announced an increase in the interim dividend of 5% to

14.3p."

ENQUIRIES: Colin Tennant (Investors) Paul Abrahams (Media)

+44 (0)20 7166 5751 +44 (0)20 7166 5724

Operating and financial review

Revenue GBP3,394m (GBP3,501m); constant currency growth +4%: The

constant currency growth rate reflects good growth in electronic

revenues (90% of the total), driven by further development of

analytics and decision tools.

Adjusted operating profit GBP1,023m (GBP990m); constant currency

growth +11%: Growth in adjusted operating profit exceeded growth in

revenue, resulting in an improvement in adjusted operating margin

to 30.1%.

Reported operating profit GBP860 m (GBP747m): Reported operating

profit includes amortisation of acquired intangible assets of

GBP143m (GBP164m) and portfolio related costs of GBP16m

(GBP26m).

Adjusted profit before tax GBP953m (GBP909m); constant currency

growth +13%: Adjusted profit before tax benefited from lower

adjusted net interest expense of GBP70m (GBP81m) with the reduction

reflecting lower average net borrowings and lower average interest

rates.

Reported profit before tax GBP825m (GBP666m): Reported profit

before tax includes disposal net gains of GBP39m (GBP6m). Reported

net interest expense was GBP74m (GBP87m).

Tax: The adjusted tax charge was GBP185m (GBP162m), including

some non-recurring credits. The adjusted effective tax rate was

19.4% (17.8%). The reported tax charge was GBP164m (GBP124m).

Earnings per share: Adjusted EPS 40.0p (39.1p); Reported EPS

34.5p (28.4p).

Dividend: We are declaring an interim dividend of 14.3p (13.6p).

Our long-term dividend policy is unchanged.

Net debt/EBITDA 2.8x (3.2x) including leases and pensions: The

leverage ratio reduced compared to the end of 2020 as EBITDA

increased in line with higher adjusted operating profit. Net debt,

including leases, was GBP6.3bn (GBP7.5bn) at 30 June 2021.

Excluding leases and pensions, net debt/EBITDA was 2.5x ( 2.8x).

Adjusted cash flow conversion was 112% (101%).

Portfolio development: In the first half of 2021 we completed 5

small acquisitions for a total consideration of GBP46m, and

disposed of a number of small assets for a total consideration of

GBP5m.

Share buybacks : As previously announced, the share buyback was

suspended in April 2020. The Board does not intend to resume the

programme in 2021.

Environmental, social and governance (ESG) recognition: Since

the start of the year, RELX has achieved a AAA MSCI ESG rating for

a sixth consecutive year; moved up to first in its industry sector

in Sustainalytics ESG rankings; and improved its ranking to third

in the Responsibility100 Index, which measures the FTSE 100 against

the UN Sustainable Development Goals. RELX continues to be one of

41 LEAD companies of the UN Global Compact among approximately

10,000 business signatories.

RELX FINANCIAL SUMMARY

Six months ended 30 June

------------------------------ -----------------------------------------------

Change

2021 2020 at constant

GBPm GBPm Change currencies

------------------------------ ----------- ----- ------------- ------------

Revenue 3,394 3,501 -3% +4%

------------------------------ ----------- ----- ------------- ------------

Adjusted operating profit 1,023 990 +3% +11%

Adjusted operating margin 30.1% 28.3%

------------------------------ ----------- ----- ------------- ------------

Reported operating profit 860 747 +15%

------------------------------ ----------- ----- ------------- ------------

Adjusted net interest expense (70) (81)

------------------------------ ----------- ----- ------------- ------------

Adjusted profit before tax 953 909 +5% +13%

------------------------------ ----------- ----- ------------- ------------

Adjusted tax (185) (162)

Adjusted net profit 771 753 +2% +10%

------------------------------ ----------- ----- ------------- ------------

Reported net profit 664 548 +21%

------------------------------ ----------- ----- ------------- ------------

Reported net margin 19.6% 15.7%

------------------------------ ----------- ----- ------------- ------------

Adjusted earnings per share 40.0p 39.1p +2% +10%

------------------------------ ----------- ----- ------------- ------------

Reported earnings per share 34.5p 28.4p +21%

------------------------------ ----------- ----- ------------- ------------

Net borrowings 6,316 7,511

------------------------------ ----------- ----- ------------- ------------

Ordinary dividend per share 14.3p 13.6p +5%

------------------------------ ----------- ----- ------------- ------------

RELX uses adjusted figures as additional performance measures.

Adjusted figures primarily exclude the amortisation of acquired

intangible assets and other items related to acquisitions and

disposals, and the associated deferred tax movements. Prior year

adjusted amounts have been revised to exclude exceptional costs

incurred at Exhibitions in 2020 as set out on page 22.

Reconciliations between the reported and adjusted figures are set

out on page 30. Constant currency growth rates are based on 2020

full-year average and hedge exchange rates.

Disclaimer regarding forward-looking statements

This announcement contains forward--looking statements within

the meaning of Section 27A of the US Securities Act of 1933, as

amended, and Section 21E of the US Securities Exchange Act of 1934,

as amended. These statements are subject to risks and uncertainties

that could cause actual results or outcomes of RELX PLC (together

with its subsidiaries, "RELX", "we" or "our") to differ materially

from those expressed in any forward--looking statement. We consider

any statements that are not historical facts to be

"forward--looking statements". The terms "outlook", "estimate",

"forecast", "project", "plan", "intend", "expect", "should",

"will", "believe", "trends" and similar expressions may indicate a

forward--looking statement. Important factors that could cause

actual results or outcomes to differ materially from estimates or

forecasts contained in the forward--looking statements include,

among others: the impact of the Covid--19 pandemic as well as other

pandemics or epidemics; current and future economic, political and

market forces; changes in law and legal interpretation affecting

RELX intellectual property rights and internet communications;

regulatory and other changes regarding the collection or use of

third--party content and data; changes in the payment model for our

products; competitive factors in the industries in which we operate

and demand for our products and services; ability to realise the

future anticipated benefits of acquisitions; significant failure or

interruption of our systems; compromises of our cyber security

systems or other unauthorised access to our databases; legislative,

fiscal, tax and regulatory developments; exchange rate

fluctuations; and other risks referenced from time to time in the

filings of RELX PLC with the US Securities and Exchange Commission.

You should not place undue reliance on these forward--looking

statements, which speak only as of the date of this announcement.

Except as may be required by law, we undertake no obligation to

publicly

update or release any revisions to these forward--looking

statements to reflect events or circumstances after the date of

this announcement or to reflect the occurrence of unanticipated

events.

Notes for Editors

About RELX

RELX is a global provider of information-based analytics and

decision tools for professional and business customers. The Group

serves customers in 180 countries in more than 40 offices. It

employs more than 33,000 people of whom almost half are in North

America. The shares of RELX PLC, the parent company, are traded on

the London, Amsterdam and New York stock exchanges using the

following ticker symbols: London: REL; Amsterdam: REN; New York:

RELX. The market capitalisation is approximately

GBP39bn/EUR46bn/$55bn.

RELX PLC

1-3 Strand

London WC2N 5JR

United Kingdom

Click on, or paste the following link into your web browser, to

view the associated PDF document.

http://www.rns-pdf.londonstockexchange.com/rns/8279G_1-2021-7-28.pdf

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SEEFAAEFSEDW

(END) Dow Jones Newswires

July 29, 2021 02:00 ET (06:00 GMT)

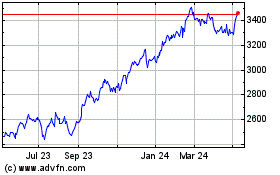

Relx (LSE:REL)

Historical Stock Chart

From Mar 2024 to Apr 2024

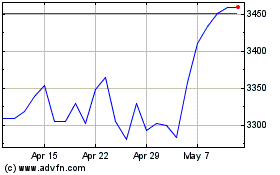

Relx (LSE:REL)

Historical Stock Chart

From Apr 2023 to Apr 2024