Rio Tinto PLC Rio Tinto completes sale of Cortez Gold Royalty (5814U)

August 02 2022 - 1:15AM

UK Regulatory

TIDMRIO

RNS Number : 5814U

Rio Tinto PLC

02 August 2022

2 August 2022

--------------

Rio Tinto completes sale of Cortez Gold Royalty for $525 million

in cash

Rio Tinto has completed the sale of a royalty it holds on an

area including the Cortez mine operational area and the Fourmile

development project in Nevada (the "Cortez Complex") to RG

Royalties LLC, a direct wholly-owned subsidiary of Royal Gold Inc.,

for $525 million in cash.

The Cortez Royalty is a 1.2% [1] gross production royalty on (i)

the Cortez gold mine that is operated by Nevada Gold Mines, a joint

venture between Barrick Gold Corporation ("Barrick") and Newmont

Corporation; and (ii) the Fourmile project which is 100% owned and

operated by Barrick. Rio Tinto obtained the royalty as partial

consideration for the sale of its 40% interest in the Cortez

Complex to Barrick in 2008. Royalty payments commence once the

Cortez Complex has produced a total of 15 million ounces of gold

since 2008. This is expected to occur imminently.

Rio Tinto Chief Financial Officer Peter Cunningham said: "This

transaction unlocks hidden value from our portfolio and releases

cash immediately."

[1] Royalty calculated as 1.2% at current gold prices. The

royalty rate is determined based on a scale from 0% at gold prices

less than US$400/oz up to 3% at gold prices greater than $900/oz,

calculated on 40% of the production from the undivided Cortez

Complex land package.

Contacts Please direct all enquiries to media.enquiries@riotinto.com

Media Relations, UK Media Relations, Australia

Illtud Harri Jonathan Rose

M +44 7920 503 600 M +61 447 028 913

Matthew Klar Matt Chambers

M + 44 7796 630 637 M +61 433 525 739

David Outhwaite Jesse Riseborough

M +44 7787 597 493 M +61 436 653 412

Media Relations, Americas Investor Relations, Australia

Simon Letendre Amar Jambaa

M +514 796 4973 M +61 472 865 948

Malika Cherry

M +1 418 592 7293

Investor Relations, UK

Menno Sanderse

M: +44 7825 195 178

David Ovington

M +44 7920 010 978

Clare Peever

M +44 7788 967 877

Rio Tinto plc Rio Tinto Limited

6 St James's Square Level 7, 360 Collins Street

London SW1Y 4AD Melbourne 3000

United Kingdom Australia

T +61 3 9283 3333

T +44 20 7781 2000 Registered in Australia

Registered in England ABN 96 004 458 404

No. 719885

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto's Group Company Secretary.

riotinto.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DISGSGDICDGDGDD

(END) Dow Jones Newswires

August 02, 2022 02:15 ET (06:15 GMT)

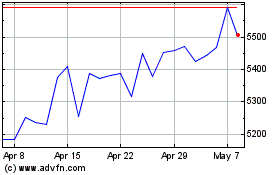

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024