TIDMRIO

RNS Number : 3582Z

Rio Tinto PLC

14 September 2022

14 September 2022

-----------------

Rio Tinto and Baowu agree to form joint venture to develop

Western Range

Rio Tinto (54 per cent) and China Baowu Steel Group Co. Ltd

(Baowu) (46 per cent) have agreed to enter into a joint venture

with respect to the Western Range iron ore project in the Pilbara,

Western Australia, investing $2 billion ($1.3 billion Rio Tinto

share[1]) to develop the mine.

Western Range's annual production capacity of 25 million tonnes

of iron ore will help sustain production of the Pilbara Blend from

Rio Tinto's existing Paraburdoo mining hub. The project includes

construction of a primary crusher and an 18 kilometre conveyor

system linking it to the existing Paraburdoo processing plant.

Construction is expected to begin in early 2023 with first

production anticipated in 2025. The construction phase will support

approximately 1,600 jobs with the mine requiring about 800 ongoing

operational roles which are expected to be filled by existing

workers transitioning from other sites in the Paraburdoo mining

hub.

Rio Tinto's share of the capital costs are already included in

the Group's capital expenditure guidance of around $9-10 billion

for each of 2023 and 2024. Both parties will pay their portion of

capital costs for the development of the mine, and mine operating

costs, plus a nominal ongoing resource contribution fee calculated

by reference to Western Range production volumes. There is no

upfront consideration being paid by either party.

Rio Tinto and Baowu have also agreed to enter into an iron ore

sales agreement at market prices covering a total of up to 126.5

million tonnes of iron ore over approximately 13 years (together

with the joint venture, the "Transaction"). This volume represents

Baowu's 46 per cent interest in the anticipated 275 million tonnes

of production from Western Range through the Joint Venture.

Rio Tinto has a long history of successfully partnering and

investing with customers to develop new mines in the Pilbara. Rio

Tinto and Baowu's partnership in the Pilbara dates back to the 2002

Bao-HI Joint Venture to develop the Eastern Range deposits in the

Hamersley Ranges (Eastern Range) and Western Range, subject to a

production cap of 200 million tonnes. It is now expected the

production cap will be sourced entirely from Eastern Range, and

this Transaction will continue Rio Tinto's relationship with Baowu

through development of Western Range.

Rio Tinto Iron Ore Chief Executive Simon Trott said "This is a

very significant milestone for both Rio Tinto and Baowu, our

largest customer globally. We have enjoyed a strong working

relationship with Baowu for more than four decades, shipping more

than 200 million tonnes of iron ore under our original joint

venture, and we are looking forward to extending our partnership at

Western Range.

"The development of Western Range represents the commencement of

the next significant phase of investment in our iron ore business,

helping underpin future production of the Pilbara Blend, the market

benchmark.

"At the same time, Rio Tinto and Baowu continue to work together

on low-carbon steelmaking research, exploring new methods to reduce

carbon emissions and improve environmental performance across the

steel value chain."

Baowu Resources Chairman Shi Bing said "The signing of the joint

venture agreement for the Western Range Project is a significant

event in the history of cooperation between Baowu and Rio Tinto. We

fully appreciate the persistent efforts of both teams in

accomplishing the important achievement. The Bao-HI joint venture

has been successfully operating for more than 20 years, leading us

to a win-win result, and reaping friendship and trust.

"We hope that the two parties will deepen the mutually

beneficial and win-win partnership, continue to carry forward the

spirit of sincere cooperation and further expand cooperation in

more fields and aspects on the basis of working together to operate

the project well."

Rio Tinto has worked closely with the Traditional Owners on

whose country Western Range is situated, the Yinhawangka People, to

co-design a Social and Cultural Heritage Management Plan for the

project, designed to protect signiticant cultural and heritage

values in the area.

The plan, which was agreed with Yinhawangka Aboriginal

Corporation and announced earlier this year, outlines protocols for

joint decision-making on environmental matters and mine

planning.

Simon Trott said "We have worked in partnership with the

Yinhawangka People to jointly develop a Social, Cultural and

Heritage Management Plan as part of our commitment to protecting

significant cultural and environmental values at Western

Range."

Entry into the Transaction with Baowu is subject to satisfaction

of various conditions precedent, including approvals from Rio Tinto

shareholders, the Australian Government, Chinese Government

regulatory agencies and the Western Australian Government, among

others.

As a result of Baowu having common ownership with Aluminum

Corporation of China (Chinalco) due to both being Chinese

state-owned entities, and Chinalco indirectly holding 11.3% of

shares in the Rio Tinto Group, Baowu may be considered to be an

associate of a substantial holder or related party of Rio Tinto for

the purpose of the ASX Listing Rules and UK Listing Rules,

respectively.

As the Transaction is considered the sale of a "substantial

asset" to the associate of a substantial shareholder under Chapter

10 of the ASX Listing Rules, it is subject to approval from a

majority of independent Rio Tinto Limited shareholders (that is,

not including Chinalco and any other entities considered to be

associates of Chinalco under the ASX Listing Rules).

Although the Transaction is a related party transaction under

the UK Listing Rules, it is classified as a smaller related party

transaction under UK Listing Rule 11.1.10 and as such, shareholder

approval is not required under the UK Listing Rules. However, as

Rio Tinto operates under a dual-listed structure, approval for the

Transaction under the ASX Listing Rules is required to be sought

from shareholders of both Rio Tinto Limited and Rio Tinto plc

voting as a joint electorate under the agreement that regulates the

dual-listed structure. As such, general meetings of both Rio Tinto

Limited and Rio Tinto plc are planned for 25 October 2022, with

further details to be announced and the relevant notices of meeting

and associated materials to be made available to Rio Tinto

shareholders shortly.

In accordance with UK Listing Rule 11.1.10, Rio Tinto plc has

obtained written confirmation from a sponsor that the terms of the

Transaction are fair and reasonable as far as Rio Tinto plc's

shareholders are concerned.

Notes to editors

Rio Tinto's Paraburdoo hub is comprised of three operating

mines, Paraburdoo, Channar and Eastern Range.

Western Range contains two deposits, 36W-50W and 55W-66W, which

are located within the Hamersley Basin of Western Australia. The

deposits' mineralisation is primarily hosted by the Brockman Iron

Formation with additional detrital mineralisation present.

The 36W-50W and 55W-66W deposits contain a Measured Mineral

Resource of 22 Mt at 59.1% Fe, Indicated Mineral Resource of 102 Mt

at 61.5% Fe, and an Inferred Mineral Resource of 108 Mt at 61.4%

Fe.

The 36W-50W deposit contains a Proven Ore Reserve of 109 Mt at

62.1% Fe and a Probable Ore Reserve of 56 Mt at 61.7% Fe[2].

Mineral Resources are reported in addition to Ore Reserves.

Mineral Resources and Ore Reserves are quoted on a 100 per cent

basis.

Contacts Please direct all enquiries to media.enquiries@riotinto.com

Media Relations, UK Media Relations, Australia

Illtud Harri Jonathan Rose

M +44 7920 503 600 M +61 447 028 913

Matthew Klar Matt Chambers

M + 44 7796 630 637 M +61 433 525 739

David Outhwaite Jesse Riseborough

M +44 7787 597 493 M +61 436 653 412

Media Relations, Americas Investor Relations, Australia

Simon Letendre Amar Jambaa

M +1 514 796 4973 M +61 472 865 948

Malika Cherry

M +1 418 592 7293

Investor Relations, UK

Menno Sanderse

M: +44 7825 195 178

David Ovington

M +44 7920 010 978

Clare Peever

M +44 7788 967 877

Rio Tinto plc Rio Tinto Limited

6 St James's Square Level 43, 120 Collins Street

London SW1Y 4AD Melbourne 3000

United Kingdom Australia

T +61 3 9283 3333

T +44 20 7781 2000 Registered in Australia

Registered in England ABN 96 004 458 404

No. 719885

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto's Group Company Secretary.

riotinto.com

[1] Rio Tinto share includes 100% of funding costs for

Paraburdoo plant upgrades

[2] These Mineral Resource and Ore Reserve estimates have been

reported in accordance with the Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves, 2012 (JORC

Code) and the ASX Listing Rules in a release to the ASX dated 14

September 2022 titled "Western Range Mineral Resources and Ore

Reserves" which is available at Resources & reserves

(riotinto.com) ("Table 1 Release"). The Competent Person

responsible for reporting the Mineral Resources was Mr Philip

Savory, who is a Fellow of The Australasian Institute of Mining and

Metallurgy. The Competent Person responsible for reporting the Ore

Reserves was Mr Ryan Bleakley, who is a Member of The Australasian

Institute of Mining and Metallurgy. Rio Tinto is not aware of any

new information or data that materially affects these Mineral

Resource or Ore Reserve estimates and confirms that all material

assumptions and technical parameters underpinning the estimates

continue to apply and have not materially changed. The form and

context in which the Competent Persons' findings are presented have

not been materially modified from the Table 1 Release.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDXGDCLDBDGDX

(END) Dow Jones Newswires

September 14, 2022 02:02 ET (06:02 GMT)

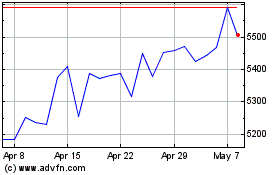

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024