TIDMRIO

RNS Number : 8044A

Rio Tinto PLC

27 September 2022

Rio Tinto to start underground mining at Kennecott copper

operations

Rio Tinto has approved a $55 million[1] investment in

development capital to start underground mining and expand

production at its Kennecott copper operations in Utah, United

States.

Underground mining will initially focus on an area known as the

Lower Commercial Skarn (LCS), which will deliver a total of around

30kt[2] of additional high quality mined copper through the period

to 2027 alongside open cut operations. The first ore is expected to

be produced in early 2023, with full production in the second half

of the year. It will be processed through the existing facilities

at Kennecott, one of only two operating copper smelters in the

United States.

Kennecott holds the potential for significant and attractive

underground development. The LCS is the first step towards this,

with a Mineral Resource of 7.5 Mt at 1.9% copper, 0.84 g/t gold,

11.26 g/t silver, and 0.015% molybdenum identified based on

drilling and a Probable Ore Reserve of 1.7 Mt at 1.9% copper, 0.71

g/t gold, 10.07 g/t silver, and 0.044% molybdenum[3].

Underground battery electric vehicles are currently being

trialed at Kennecott to improve employee health and safety,

increase productivity and reduce carbon emissions from future

underground mining fleets. A battery electric haul truck and loader

supplied by Sandvik Mining and Rock Solutions are being used to

evaluate performance and suitability as part of underground

development work.

Rio Tinto Copper chief executive Bold Baatar said, "This

investment will allow us to quickly bring additional volumes of

high quality copper to the market and build our knowledge and

capabilities as we evaluate larger scale underground mining at

Kennecott. We are progressing a range of options for a significant

resource that is yet to be developed at Kennecott, which could

extend our supply of copper and other critical materials needed for

electric vehicles and renewable power technologies."

"Trialling underground battery electric vehicles is an exciting

step in our work to create a safer workplace for our employees,

increase the productivity of the mine and reduce emissions from our

operations. We look forward to seeing their potential for

deployment."

Existing undergound infrastructure is currently being extended

to enable early access to the next underground resource and

undertake characterisation studies. A Feasibility Study to inform

decisions on the next phase of underground production is expected

to be completed in 2023. This will be one of several potential

stages currently being investigated.

Feasibility studies are also being progressed to extend open pit

mining at Kennecott beyond 2032.

The Table 1 Release was made in accordance with the JORC Code

and the ASX Listing Rules. Mineral Resources are reported in

addition to Ore Reserves. Mineral Resources and Ore Reserves are

quoted on a 100 per cent basis.

Mineral Resource declaration

The Table 1 Release sets out Measured, Indicated and Inferred

Mineral Resources at the Kennecott Copper operation with the first

time reporting of the Lower Commercial Skarn. A tabulation of the

additions to Mineral Resource due to the LCS is provided in Table

A.

Table A Rio Tinto Kennecott Lower Commercial Skarn Mineral Resources as at 31 July 2022

Measured resources Indicated Inferred Total mineral

resources resources resources

========== ========

as at July as at July as at July as at July

2022 2022 2022 2022

==================== ===== ===== ==================== =========== ==================== ===== ===== ==================================

Likely Rio

mining Tinto

method(a) Tonnage Grade Tonnage Grade Tonnage Grade Tonnage Grade Interest

=========== ========== ======= ===== ==== ===== ===== ======= ===== ==== ==== ===== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== ========

Copper Mt % g/t g/t % Mt % g/t g/t % Mt % g/t g/t % Mt % g/t g/t %

(b) Cu Au Ag Mo Cu Au Ag Mo Cu Au Ag Mo Cu Au Ag Mo %

Bingham

Canyon (US)

=========== ========== ======= ===== ==== ===== ===== ======= ===== ==== ==== ===== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== ========

- Lower

Commercial

Skarn U/G 0.2 2.52 1.27 10.56 0.056 1.1 2.08 0.72 9.43 0.029 6.2 1.84 0.86 11.62 0.011 7.5 1.89 0.84 11.26 0.015 100.0

=========== ========== ======= ===== ==== ===== ===== ======= ===== ==== ==== ===== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== ========

(a) Likely mining method:

O/P = open pit/surface;

U/G = underground.

(b) Copper Resources

are stated on a dry

in situ weight basis.

Ore Reserve declaration

The Table 1 Release also sets out additional Probable Ore

Reserves at the Kennecott Copper operation, with the first time

reporting of Ore Reserves associated with the Lower Commercial

Skarn. A tabulation of the additions to Ore Reserve due to the LCS

is provided in Table B.

Table B Rio Tinto Kennecott Lower Commercial Skarn Ore Reserves as at 31 July 2022

Probable Total ore reserves Average Rio

ore reserves mill recovery Tinto

% share

======== =============== ========

as at July as at July Recoverable

2022 2022 Metal

==================== ============ =========================== ===== ===

Type Rio

of Tinto

mine(a) Tonnage Grade Tonnage Grade Interest

=========== ======== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== === ======== ===== ===== ===== =====

Copper Mt % g/t g/t % Mt % g/t g/t % Cu Au Ag Mo % Mt Moz Moz Mt

(b) Cu Au Ag Mo Cu Au Ag Mo Cu Au Ag Mo

Bingham

Canyon (US)

=========== ======== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== === ======== ===== ===== ===== =====

- Lower

Commercial

Skarn U/G 1.7 1.90 0.71 10.07 0.044 1.7 1.90 0.71 10.07 0.044 90 71 76 71 100 0.030 0.028 0.421 0.001

=========== ======== ======= ===== ==== ===== ===== ======= ===== ==== ===== ===== === ======== ===== ===== ===== =====

(a) Type of mine:

O/P = open pit/surface,

U/G = underground.

(b) Copper Reserves

are reported as dry

mill feed tonnes.

A copy of the Table 1 Release is available on Rio Tinto's

website at

riotinto.com/invest/financial-news-performance/resources-and-reserves

Contacts Please direct all enquiries to media.enquiries@riotinto.com

Media Relations, UK Media Relations, Australia

Illtud Harri Jonathan Rose

M +44 7920 503 600 M +61 447 028 913

Matthew Klar Matt Chambers

M + 44 7796 630 637 M +61 433 525 739

David Outhwaite Jesse Riseborough

M +44 7787 597 493 M +61 436 653 412

Media Relations, Americas

Simon Letendre

M +514 796 4973

Malika Cherry Investor Relations, Australia

M +1 418 592 7293 Tom Gallop

M +61 439 353 948

Investor Relations, UK Amar Jambaa

Menno Sanderse M +61 472 865 948

M: +44 7825 195 178

David Ovington

M +44 7920 010 978

Clare Peever

M +44 7788 967 877

Rio Tinto plc Rio Tinto Limited

6 St James's Square Level 43, 120 Collins Street

London SW1Y 4AD Melbourne 3000

United Kingdom Australia

T +61 3 9283 3333

T +44 20 7781 2000 Registered in Australia

Registered in England ABN 96 004 458 404

No. 719885

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto's Group Company Secretary.

riotinto.com

[1] All dollar values are in USD.

[2] Lower Commercial Skarn production targets referred to in

this release are reported as recoverable copper and are underpinned

as to 100% by Probable Ore Reserves. These estimates of Ore

Reserves were reported in a release to the Australian Securities

Exchange (ASX) dated 31 August 2022 "Rio Tinto Kennecott Mineral

Resources and Ore Reserves" (Table 1 Release) and have been

prepared by Competent Persons in accordance with the requirements

of the Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves, 2012 (JORC Code).

[3] The Mineral Resource and Ore Reserve estimates referred to

in this release were set out in the Table 1 Release. The Competent

Person responsible for the information in that release that relates

to Mineral Resources is Mr Ryan Hayes, a Member of the Australasian

Institute of Mining and Metallurgy (MAusIMM). The Competent Person

responsible for the information in that release that relates to Ore

Reserves is Mr Stephen McInerney, a Member of the Australasian

Institute of Mining and Metallurgy (MAusIMM). Rio Tinto confirms

that it is not aware of any new information or data that materially

affects the information included in the Table 1 Release, that all

material assumptions and technical parameters underpinning the

estimates in the Table 1 Release continue to apply and have not

materially changed, and that the form and context in which the

Competent Persons' findings are presented have not been materially

modified.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCEAKNXADPAEEA

(END) Dow Jones Newswires

September 27, 2022 04:00 ET (08:00 GMT)

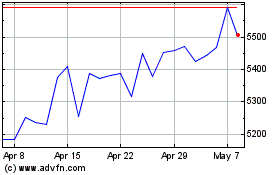

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024