Rio Tinto PLC Strategy to strengthen, decarbonise and grow (0506I)

November 30 2022 - 1:00AM

UK Regulatory

TIDMRIO

RNS Number : 0506I

Rio Tinto PLC

30 November 2022

30 November 2022

-----------------

Rio Tinto progresses strategy to strengthen, decarbonise and

grow

Rio Tinto is today providing an update at its Investor Seminar

on progress against its long-term strategy to strengthen the

business, grow in a decarbonising world and continue to deliver

attractive shareholder returns.

Updates will include Rio Tinto's market outlook, with the energy

transition expected to add as much as 25% in new demand above

traditional sources on a copper equivalent basis across the Group's

key products by 2035. Rio Tinto is targeting investment of up to $3

billion per year in growth to meet this demand, including the Oyu

Tolgoi copper, Rincon lithium and Simandou iron ore projects.

There are now 30 deployments of the Rio Tinto Safe Production

System (SPS) across 16 sites. Roll-outs are ongoing to continuously

improve safety, drive employee satisfaction and lift operational

performance across Rio Tinto's global portfolio, delivering

benefits such as up to 5 million tonnes of production uplift

expected at the Group's Pilbara iron ore assets in 2023.

Executives will outline projects underway to meet challenging

decarbonisation targets to halve Scope 1 & 2 emissions by 2030,

on the road to net zero by 2050. Six large emissions abatement

programmes are focused on renewable power, process heat, diesel and

the ELYSIS(TM) zero carbon aluminium smelting technology to drive

the transition to net zero by 2050, supported by high-quality

nature based solutions. Investments of around $7.5 billion are

expected between 2022 and 2030, including around $1.5 billion over

the next three years which will be back-end dated. Investments are

being prioritised and phased in the most logical way, with

consideration for near-term work around energy inputs and

attractive economics. New long-term power contracts will also be

required for the aluminium business to meet targets. Incremental

operating expenditure on building new teams and energy efficiency

initiatives remains around $200 million per year, in addition to

research and development investment.

Rio Tinto Chief Executive Jakob Stausholm said: "We are now

creating real momentum, to build a stronger Rio Tinto that is a

platform for delivering long-term value. From evolving our culture,

to operational improvements, a different approach on cultural

heritage, and technology breakthroughs to address climate change

and a changing customer environment, we are seeing early results

that give us conviction we have the right objectives, the right

team, and the right strategy. This is all captured in our newly

defined purpose: finding better ways to provide the materials the

world needs.

"Meeting the incremental demand of the energy transition and

ensuring local supplies of critical minerals globally deepens our

relevance in the world and provides new opportunities. We are

working hard to decarbonise our assets and products, as we invest

to grow in materials needed for the energy transition.

"The quality of our assets, resilience of cashflows and strength

of our balance sheet ensure we are well positioned to continue to

invest with discipline for the long term and deliver attractive

returns to our shareholders throughout the cycle."

Production guidance is being released for 2023. Pilbara iron ore

shipments (100% basis) of 320 to 335Mt are expected in 2023, with

mid-term capacity remaining at 345 to 360Mt.

Production guidance - Rio Tinto share, unless otherwise stated 2022 2023

--------------------------------------------------------------- ------------- -------------

Pilbara iron ore (shipments, 100% basis) (Mt) 320 to 335(1) 320 to 335(2)

Bauxite (Mt) 54 to 57 54 to 57

Alumina (Mt) 7.6 to 7.8 7.7 to 8.0

Aluminium (Mt) 3.0 to 3.1 3.1 to 3.3

Mined copper (kt) 500 to 575 550 to 600

Refined copper (kt) 190 to 220 180 to 210

Diamonds (M carats) 4.5 to 5.0 3.0 to 3.8

Titanium dioxide slag (Mt) 1.1 to 1.4 1.1 to 1.4

IOC(3) iron ore pellets and concentrate (Mt) 10.0 to 11.0 10.5 t o 11.5

Boric oxide equivalent (Mt) 0.5 0.5

--------------------------------------------------------------- ------------- -------------

(1) At the low end of the range.

(2) Pilbara shipments guidance remains subject to risks around

commissioning and ramp-up of new mines and management of cultural

heritage.

(3) Iron Ore Company of Canada.

Unit cost guidance 2023(1)

----------------------------- ---------

Pilbara iron ore (US$/tonne) $21.0 -

$22.5

Copper C1 (US cents/lb) 160 - 180

----------------------------- ---------

(1) FY23 guidance is based on A$:US$ exchange rate of 0.70 and

excludes COVID-19 response costs.

The full presentations will be made available at

www.riotinto.com .

Contacts Please direct all enquiries to media.enquiries@riotinto.com

Media Relations, UK Media Relations, Australia

Matthew Klar Matt Chambers

M+ 44 7796 630 637 M +61 433 525 739

David Outhwaite Jesse Riseborough

M +44 7787 597 493 M +61 436 653 412

Media Relations, Americas

Simon Letendre

M +1 514 796 4973

Malika Cherry

M +1 418 592 7293 Investor Relations, Australia

Tom Gallop

Investor Relations, UK M +61 439 353 948

Menno Sanderse Amar Jambaa

M +44 7825 195 178 M +61 472 865 948

David Ovington

M +44 7920 010 978

Clare Peever

M +44 7788 967 877

Rio Tinto plc Rio Tinto Limited

6 St James's Square Level 43, 120 Collins Street

London SW1Y 4AD Melbourne 3000

United Kingdom Australia

T +61 3 9283 3333

T +44 20 7781 2000 Registered in Australia

Registered in England ABN 96 004 458 404

No. 719885

This announcement is authorised for release to the market by

Steve Allen, Rio Tinto's Group Company Secretary.

riotinto.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFDISISEESEIF

(END) Dow Jones Newswires

November 30, 2022 02:00 ET (07:00 GMT)

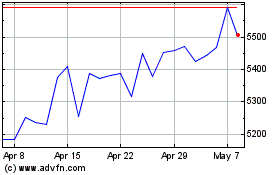

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Mar 2024 to Apr 2024

Rio Tinto (LSE:RIO)

Historical Stock Chart

From Apr 2023 to Apr 2024