TIDMRNWH

RNS Number : 8414H

Renew Holdings PLC

08 December 2020

8 December 2020

Renew Holdings plc

("Renew" or the "Group" or the "Company")

Final Results

Record results, well placed to benefit from increasing

investment in UK infrastructure

Renew (AIM: RNWH), the leading Engineering Services Group

supporting UK infrastructure, announces a set of record results for

the year ended 30 September 2020, reflecting the core strengths and

resilience of Renew's business model.

Financial Highlights

Year ended 30 September 2020 2020 2019 Change

GBPm GBPm

Group revenue(1) 620.4 600.6 +3.3%

------ ------- -------

Adjusted operating profit(1) 39.6 38.3 +3.4%

------ ------- -------

Operating profit 32.9 27.5 +19.3%

------ ------- -------

Adjusted operating margin(1) 6.4% 6.4% 0.0%

------ ------- -------

Profit before tax 32.1 27.0 +18.9%

------ ------- -------

Adjusted earnings per share(1) 41.2p 40.4p +2.0%

------ ------- -------

Full year dividend per share* 8.33p 11.50p -27.8%

------ ------- -------

-- Group's order book at 30 September 2020 strengthened by c.20% to GBP692m (2019: GBP581m)

-- Net cash(1) position at 30 September of GBP0.3m (2019: net

debt GBP10.2m), supported by c.GBP17m VAT deferral and after

funding the acquisition of Carnell during the year for GBP38m

-- Post year end de-risking of balance sheet with completion of Lovell Pension Scheme buy-in

Operational Highlights

-- Engineering Services, accounting for over 90 per cent of the

Group's adjusted(1) operating profit, delivered revenue growth of

2.4% to GBP577.2m (2019: GBP563.8m)

-- Engineering Services adjusted(1) operating profit increased to GBP40.8m (2019: GBP39.4m)

-- Positive contribution from Carnell, acquired in January 2020,

which provides specialist engineering services to the UK's

strategic highways network

-- Group continued to win and renew long-term framework appointments across its chosen markets

Outlook

-- Group has continued to deliver uninterrupted,

mission-critical services to clients through both UK lockdown

periods

-- Majority of activities now at pre-pandemic levels across Group's markets

-- Continue to evaluate a pipeline of acquisition opportunities

-- Well positioned to capitalise on the UK Government's

committed infrastructure investment and the increased focus on

maintaining and renewing existing assets

Paul Scott, Chief Executive Officer of Renew, commented:

"During what has been a year without precedent, I have been

humbled by the way our people have risen to the challenge of

continuing to deliver the essential services that support the UK's

critical infrastructure upon which we all rely, every day. Our

priority at all times has been to ensure both the safety of our

workforce and the continuous delivery of essential renewal and

maintenance operations in our markets.

"The pandemic has demonstrated like never before the core

defensive strengths and resilience of our high quality, low risk,

value-accretive business model in providing 24/7 specialist

engineering services to our clients in complex, challenging and

regulated environments.

"Thanks to our differentiated and cash generative earnings

model, we delivered a record trading performance, with a solid

margin, strong cash flow and continued EPS growth. We continue to

focus on bolstering our performance with highly selective, value

enhancing acquisitions to strengthen our presence in key markets.

Following the acquisition of Carnell earlier in the year, which

facilitated our entry into the strategic highways network, I am

very pleased with its positive contribution to the Group's

results.

"The growth prospects within our industry are highly attractive,

driven by non-discretionary Government spending in relation to UK

infrastructure, a greater focus on sustainability and renewable

energy, population growth, technological innovation driving a shift

towards digital transport networks and smart cities, along with

increased regulation. Renew's businesses operate in markets

underpinned by sustainable, long-term structural growth dynamics

and committed regulatory spend.

"Trading in the new financial year has started well and we are

ideally positioned to play a significant role in the long-term

recovery opportunities that will emerge across UK infrastructure, a

sector that will play an important role in rebuilding the economy

over the next decade and beyond."

(1) Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance of

the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory performance

measures, are included in note 10.

(*) No interim dividend paid to shareholders during the period.

Final dividend of 8.33p per share represents an increase of 8.6 per

cent over the prior year final dividend of 7.67p.

Analyst & Investor Webinar

A virtual meeting for sell-side analysts and investors will be

held at 10:30am today, 8 December 2020, the details of which can be

obtained from FTI Consulting.

For further information, please contact:

Renew Holdings plc www.renewholdings.com

Paul Scott, Chief Executive Officer via FTI Consulting

Sean Wyndham-Quin, Chief Financial 020 3727 1000

Officer

Numis Securities Limited (Nominated

Adviser)

Stuart Skinner/ Kevin Cruickshank 020 7260 1000

FTI Consulting (Financial PR) 020 3727 1000

Alex Beagley / James Styles Renew@fticonsulting.com

Certain information contained in this announcement would have

constituted inside information (as defined by Article 7 of

Regulation (EU) No 596/2014) prior to its release as part of this

announcement.

About Renew Holdings plc

Renew Holdings Group plc is a leading UK Engineering Services

business, performing a critical role in keeping the nation's

infrastructure functioning efficiently and safely. The Group

operates through independently branded subsidiaries across its

chosen markets, delivering non-discretionary maintenance and

renewal tasks through its highly skilled, directly employed

workforce.

Renew's activities are focused into two business streams.

Specialist Engineering, which accounts for over 95 per cent of the

Group's adjusted operating profit, focuses on the key markets of

Rail, Infrastructure, Energy (including Nuclear) and Environmental

which are largely governed by regulation and benefit from

non-discretionary spend with long-term visibility of committed

funding.

Specialist Building focuses on the High Quality Residential and

Science markets in London and the Home Counties.

For more information please visit the Renew Holdings plc

website: www.renewholdings.com

Chairman's Statement

Introduction

Despite the challenges of Covid-19, the Group is pleased to

announce a record revenue performance, sustained profit growth and

strong cash generation, all of which exceeded last year's

performance and reflect the core defensive strengths and resilience

of Renew's business model.

Following an excellent trading result in the first half of the

year, the Group continued to make strong progress in the second

half including winning and renewing long-term framework

appointments across our markets. We expanded into the Highways

market with the acquisition of Carnell, a company that delivers

specialist engineering services across the strategic road network.

We continue to focus on delivering essential asset maintenance and

critical infrastructure renewals which are underpinned by

non-discretionary regulatory requirements.

Results

Group revenue(1) increased to GBP620.4m (2019: GBP600.6m) with

adjusted operating profit(1) increasing to GBP39.6m (2019:

GBP38.3m). Statutory operating profit was GBP32.9m (2019:

GBP27.5m). The adjusted EPS(1) was 41.22p (2019: 40.43p) and basic

earnings per share was 26.78p (2019: 29.55p). The Group is also

pleased to report a return to net cash(1) of GBP0.3m (2019: net

debt GBP10.2m), in line with our expectations.

Covid-19

Covid-19 presented challenges across our entire business

although it also served to highlight the importance of the

mission-critical services we provide in the Rail, Infrastructure,

Energy and Environmental sectors. The initial lockdown, and

subsequent ongoing Government restrictions, have necessitated many

changes to our working practices. Our priority from the start has

been to ensure both the safety of our workforce and the continuous

delivery of essential renewal and maintenance operations. Our

employees continue to tirelessly implement Covid-19 precautions,

often in extremely difficult environments. The Group's culture of

robust governance, risk management and focus on health and safety

have together provided a strong platform from which we have been

able to continue to operate whilst delivering uninterrupted

services for our customers.

People

Our employees are critical to the continued success of the Group

and the Board would like to sincerely thank all its employees for

their ongoing dedication and hard work in what have been, and

remain, extremely difficult circumstances both at work and at

home.

Differentiated business model

Our differentiated business model and the services we provide to

support key infrastructure assets are more critical than ever,

providing the Group with ongoing growth opportunities across our

chosen markets. These markets enjoy committed funding which

provides visible, reliable and resilient revenues via long-term

maintenance and renewal programmes. We deliver non-discretionary

maintenance and renewals tasks and have little exposure to the

financial and contractual risks of larger enhancement schemes.

Operating in complex, challenging and highly regulated

environments, our markets have high barriers to entry and we

directly employ a highly skilled workforce which enables us to be

extremely responsive to our clients' needs.

Dividend

The Covid-19 pandemic saw the Board take a number of decisive

actions to preserve cash and protect liquidity. One of the prudent

measures, taken in April 2020, was the suspension of the Group's

interim dividend which would ordinarily have been paid to

shareholders in July 2020. We have continued to review our dividend

policy whilst understanding the importance of the dividend to our

shareholders. The Group's strong trading performance, cash position

and positive outlook has given the Board the confidence to propose

a final dividend of 8.33p per share, an increase of 8.6 per cent

over the prior year final dividend of 7.67p. This will be paid on 5

March 2021 to shareholders on the register as at 29 January 2021,

with an ex-dividend date of 28 January 2021. As no interim dividend

was paid to shareholders, this will represent a full year dividend

of 8.33p per share (2019: 11.50p). In the absence of unforeseen

circumstances, or a material adverse impact on trading caused by a

worsening of the Covid-19 situation, we expect dividend payments to

continue in line with our pre-Covid dividend policy going

forward.

Governance

We have continued to develop our approach to corporate

governance in the year. As a Board, we are responsible for ensuring

the effective application of high levels of governance within our

business, balancing the interests of all our stakeholders. As a

minimum, the Group complies with the QCA Corporate Governance Code,

more details of which can be found in the corporate governance

section of the Group's website.

Risk management

Risk management is led by the Board, which reviews the Group's

risk profile on an ongoing basis alongside the Audit and Risk

Committee. Subsidiary management teams are responsible for the

effective embedding and monitoring of the Board's agreed risk

management protocols and the Executive Directors provide regular

updates to the Board on the principal risks and controls across the

Group.

Board effectiveness

During the year, the Nomination Committee reviewed the Board's

structure and composition and undertook a detailed effectiveness

review, in order to ensure it continues to have the balance of

skills and experience to deliver the Group's strategy. Diversity in

its widest sense remains an area of focus as we move through

2021.

Board change

On 1 March 2020, we were pleased to announce the appointment of

Stephanie Hazell as a Non-executive Director. Stephanie has over 20

years' relevant experience working in high profile businesses

including PricewaterhouseCoopers LLP, Orange SA, Virgin Management

Ltd and National Grid Plc where she held the position of director,

strategy and corporate development. She is an industrial partner at

Infracapital and a non-executive director for a number of its

investments.

Future focus

The Board is committed to building on its track record of

consistently creating shareholder value through the delivery of its

strategic priorities whilst focusing on its environmental, social

and governance responsibilities. The Group is supported in the

delivery of its long-term strategy through its effective

relationships with our directly employed workforce, customers,

suppliers, shareholders, and wider stakeholders which are critical

to the continued success of our business.

Renew is a leading provider of engineering services and operates

in attractive markets underpinned by long-term growth drivers and

non-discretionary Government spending. Growth, both organic and

through strategic earnings-enhancing acquisitions, is focused on

maintenance and renewals tasks in markets where non-discretionary

spending programmes exist to maintain critical infrastructure. Our

differentiated business model and the reliable long-term nature of

the UK infrastructure markets give the Board continued confidence

in the Group's future and the significant growth opportunities

ahead.

David M Forbes

Chairman

8 December 2020

(1) Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance of

the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory performance

measures, are included in note 10.

Chief Executive's Review

Introduction

Renew is a leading provider of essential engineering services to

critical UK infrastructure networks, operating in regulated markets

including rail, highways, telecommunications, civil nuclear, water

and environmental. In March, the UK Government committed to a

record GBP640bn(2) investment in the UK's infrastructure and we

expect to benefit from an increased focus on maintaining and

renewing assets. These markets are underpinned by regulatory

requirements and therefore benefit from committed long-term

spending cycles and a visible pipeline of opportunities. This

exposure to non-discretionary, reliable and regulated expenditure

fully supports our low risk, high quality and value accretive

earnings model.

Covid-19

The pandemic has helped to fully demonstrate the core strengths

of Renew's differentiated business model. Despite the many

challenges presented by Covid-19, we have delivered extraordinary

and record results for the Group and strengthened our position

across our markets. This highlights our defensive characteristics

and the importance of our role in keeping the nation's

infrastructure functioning efficiently and safely at all times.

I am incredibly proud of the way our entire workforce continues

to deliver uninterrupted, mission-critical infrastructure services

to our clients despite challenging working environments and the

introduction of stringent Covid-19 protection measures across all

our sites. We remain focused on the health, safety and wellbeing of

all our employees and stakeholders.

Operations across our key sectors were designated critical to

the Covid-19 response and, as such, demand for our directly

delivered maintenance and renewal services remained strong with

over 80% of our operations continuing throughout the peak of the

first lockdown period. Since then, the majority of the Group's

operations have returned to levels similar to those experienced

prior to the pandemic across all of our markets, with the exception

of our nuclear operations at Sellafield where we do not expect the

site to be fully operational until April 2021.

At the interim results in May, the Group announced the actions

it had taken to preserve cash and protect liquidity. These included

the deferral of all non-essential capital expenditure, a hiring

freeze, deferral of VAT payments, utilisation of the Government's

Coronavirus Job Retention Scheme ("CJRS") and a temporary 20%

reduction in the salaries/fees of the Board and senior management,

as well as the suspension of an interim dividend payment to

shareholders. These measures, as well as the core defensive

qualities of our operating model and our resilience, have proven to

be extremely effective in responding to the challenges of Covid-19

whilst strengthening the Group's balance sheet.

As encouraged by the UK Government, we utilised the CJRS to

protect and retain jobs when the initial lockdown restrictions came

into force resulting in a temporary interruption to our services.

Given the positive progress we have made since then, and the fact

that the majority of our activities have returned to pre-pandemic

levels, we are no longer utilising the scheme and it is our

intention not to do so unless there are even tougher restrictions

imposed which start to affect our markets.

Currently the Group's working capital facilities include a

GBP44.2m revolving credit facility provided by HSBC UK Bank plc and

National Westminster Bank plc, expiring in January 2024 and a

GBP10m unsecured overdraft facility. The Group's cash generation

continued to be very strong in the second half of the year and we

returned to a small net cash position of GBP0.3m at the year end.

Our available cash and bank facilities mean we had headroom of

approximately GBP68m as at 30 September 2020. This position was

bolstered by the deferment of c.GBP17m of VAT that will now be paid

in the 2021 financial year.

Market drivers

Renew's businesses operate in markets underpinned by

sustainable, long-term structural growth dynamics and committed

regulatory spend. Increasing demand for the maintenance and renewal

of existing UK infrastructure is driven by a number of long-term

economic factors including:

-- a commitment by the Government to invest GBP640bn(2) in the UK's infrastructure;

-- greater focus on sustainability and climate change, the net

zero target, flood risk and investment in renewables and

electrification programmes;

-- population growth increasing the pressure on housing, energy,

water and demand for natural resources;

-- technological innovation driving a shift towards digital

roads, smart cities and the transformation of transport and

telecommunications networks; and

-- increased Government regulation.

Our track record of growth and long-term value creation

Renew has a strong track record of sustainable value creation

across the economic cycle. Over the past five years, we have

delivered:

-- adjusted earnings per share(1) growth of 58 per cent;

-- an increase in our adjusted operating margin(1) growth from

3.9 per cent to 6.4 per cent; and

-- revenue(1) growth of 19 per cent.

Our track record of reliable revenue growth and cash generation

has resulted in our ability to deliver highly predictable organic

earnings growth and funding for the acquisition of complementary

businesses that meet our strategic requirements.

Results

Despite the impact of Covid-19, the Group delivered an

extraordinary and record trading performance, with strong cash flow

and continued EPS growth. This performance reflects our

industry-leading capabilities, the fundamental strengths of our

differentiated, low-risk business model and the critical support

services we provide to clients in complex, challenging and

regulated environments.

Group revenue(1) increased to GBP620.4m (2019: GBP600.6m) with

an adjusted(1) operating profit of GBP39.6m (2019: GBP38.3m) and a

maintained adjusted(1) operating margin of 6.4% (2019: 6.4%). As at

30 September 2020 the Group had a net cash(1) position of GBP0.3m

(2019: net debt GBP10.2m) reflecting the Group's continued focus on

cash generation and conservative approach to gearing. These results

include a contribution from Carnell, a leading provider of

specialist engineering services on the strategic highways network.

Acquired in January 2020, the business continues to perform in line

with expectations. The Group's order book(1) at 30 September 2020

has strengthened to GBP692m (2019: GBP581m).

During the year, we conducted a detailed review of the remaining

liabilities relating to Allenbuild Limited, a business that was

sold in 2014. As a consequence of this review we have determined

that an additional provision of GBP5.3m is required to enable us to

deal with these legacy contractual issues. This is shown as a loss

for the year from discontinued operations in the Group income

statement.

We are pleased to report that after the end of the financial

year, the Trustees of the Lovell Pension Scheme, in consultation

with the Board of Renew, entered into a "buy-in" agreement with

Rothesay Life plc. This transaction significantly de-risks the

Group's balance sheet, further reduces the Group's pension exposure

risks and improves its cashflow in the medium term.

Engineering Services

Our Engineering Services activities, which account for over 90

per cent of the Group's adjusted(1) operating profit, delivered

revenue of GBP577.2m (2019: GBP563.8m) with an adjusted(1)

operating profit of GBP40.8m (2019: GBP39.4m) resulting in an

operating margin of 7.1% (2019: 7.0%). At 30 September 2020, the

Engineering Services order book was GBP603m (2019: GBP542m).

Continued positive momentum in our rail and telecommunications

businesses helped drive this strong performance as well as a

contribution from Carnell, which has performed well and leaves the

Group ideally positioned to capitalise on the growth opportunity

across the UK's strategic highways network.

Rail

Our largest customer, Network Rail, will invest GBP53bn(3) over

Control Period 6 ("CP6"), the current five year investment cycle,

which runs to 2024, with an increased focus on operational support

and maintenance compared to the previous CP5 period. In addition,

the Government is committed to its rail decarbonisation programme,

including a significant investment in electrification programmes,

as part of the overall UK target to deliver net zero by 2050.

As a major provider of multidisciplinary maintenance and

renewals engineering services to Network Rail, we support the

day-to-day operation of the rail network nationally, directly

delivering essential asset maintenance through our long-term CP6

frameworks. The Group now holds in excess of fifty CP6 maintenance

and renewals frameworks across all disciplines, covering the entire

UK rail network.

During the year we secured new positions on the CP6 Wales and

Western five year renewals frameworks across all five lots, where

we will deliver a programme of engineering services to assets

across the rail network including bridges, embankments, tunnels,

signalling and electrification and plant. We were also awarded an

additional rail drainage framework in Scotland, complementing our

existing rail drainage framework positions. We have existing

frameworks for the delivery of multidisciplinary maintenance and

renewals, minor signalling, geotechnical and earthworks,

devegetation, slab track, station information and security systems

and telecoms. We also provide a 24/7 emergency support service

across the rail network and during the period we responded to

significant events at Stonehaven and Falkirk.

We remain committed to adding value through innovation. We have

developed bespoke and unique solutions for devegetation, tunnel

maintenance and drainage to deliver safer and more sustainable

working practices that create high barriers to new entrants.

Since the lockdown restrictions were imposed in March, we have

seen our planned work for our rail customers continue with minimal

disruption, albeit with enhanced safety requirements in place to

comply with the Government's Covid-19 guidelines.

Infrastructure

Highways

The UK Government has committed to an investment of GBP27.4bn(4)

in the strategic road network over the next five years, as part of

its second Road Investment Strategy ("RIS2"). GBP11.9bn of this

funding will be ringfenced for operations, maintenance and

renewals, a significant increase from the GBP5.1bn(5) invested in

RIS1. This represents an attractive growth opportunity for Renew

and in January 2020 we announced the acquisition of Carnell, a

leading provider of specialist engineering services on the

strategic road network. Carnell directly delivers non-discretionary

renewals and maintenance through long-term framework agreements,

employing plant-led technologies as part of its unique range of

services deployed across the highways network.

Operating nationally, Carnell has built strong relationships

with key public and private sector clients, including its largest

customer, Highways England, for which it is one of only three

suppliers working across all Asset Delivery Areas. During the

period, Carnell performed in line with expectations and saw a

number of its existing frameworks extended as well as securing a

new Asset Delivery Framework for Highways England in the East

Region.

Carnell works closely with its clients and suppliers to develop

innovative solutions to improve safety, sustainability and value in

the delivery of drainage, infrastructure, specialist surveys and

highways technology across the strategic road network. In the last

year it recycled 53,000m(3) of filter drain using its STONEmaster

and STABLEdrain systems. This saved 62,000 litres of fuel and

reduced HGV journeys saving over 500 tonnes of CO(2) and was

recognised with an International Green Apple Award for

environmental best practice. Carnell was also awarded the HRH

Prince Michael International Road Safety Award for its mobile road

worker protection system SAFETYcam.

During the Covid-19 restrictions, our activities in Highways

have continued at levels similar to those seen prior to the

pandemic. We remained operational across all Highways England areas

which is reflective of the resilience of this new market sector for

Renew.

Wireless Telecoms

The Wireless Telecoms market continues to grow significantly as

5G networks are rolled out. The Government is investing GBP5bn(2)

to roll out gigabit broadband across the UK, a significant

component of which is 5G. In addition, the four major UK network

operators are also making significant investments in the deployment

of 5G.

Delivering all aspects of wireless telecoms infrastructure,

including 4G and 5G deployment, maintenance and decommissioning

services, we have long-term relationships with all the main UK

network operators, equipment vendors and managed service providers.

In the period, we have seen a significant increase in work across

all our frameworks as the 5G roll-out programme accelerates. We

were awarded positions on both Telefonica's and MBNL's new three

year 5G services frameworks as well as a contract to deliver

Telefonica's microwave services for the next two years.

In March 2020, the Government announced it would also invest

GBP500m(6) in the Shared Rural Network, a programme to extend 4G

mobile coverage to 95% of the UK. Collaboration between the main

network operators will see them provide 220 new sites in rural

areas that are currently without coverage. We have already secured

a large portion of the site search activities and this places us in

a strong position to deliver a full acquire, design and construct

turnkey programme.

Following the Government's announcement to remove Huawei

equipment from the UK's 5G networks by 2027, we are currently

working with EE and BT to deliver 95 trial sites in Hull, London

and Cardiff, and we expect to see significant growth in this

programme over the next three years.

Wireless telecoms was designated critical to the Covid-19

response and, as such, we continued to support the network

operators where it remained safe for our employees to do so. Our

multi-skilled, direct delivery teams have continued to provide a

responsive service with limited interruption.

Energy

Nuclear

As a major mechanical, electrical and instrumentation

("ME&I") services contractor, our operations in the nuclear and

chemical process environment focus on decontamination and

decommissioning services, operational support and asset care.

Working for over 75 years in civil nuclear, we deliver a

multidisciplinary service through our large complement of highly

skilled employees who operate to demanding nuclear standards.

The Nuclear Decommissioning Authority ("NDA") spends c.GBP3bn(7)

per annum on its nuclear decommissioning programme across its 17

nuclear licensed sites in the UK and we continue to support sites

that command approximately 90 per cent of this expenditure. The

Government's total nuclear decommissioning provision is estimated

at GBP124bn(8) over the next 120 years, with around 75% of the

total spend allocated to Sellafield which is the largest of the

NDA's sites and where we remain a principal ME&I

contractor.

Operating on the major Decommissioning Delivery Partnership

Framework, which runs to 2026, we deliver work across some of the

most hazardous areas of Sellafield including waste retrieval from

legacy storage ponds and silos. Our activities include

decontamination, decommissioning and waste management. Our

long-term frameworks include the SR&DP Asset Care, Magnox Swarf

Storage Silo, Bundling Spares and Tanks and Vessels Frameworks.

During the period, we were appointed to both lots of the four year

Fabrication and Machining Spares Framework for the delivery of

highly engineered nuclear components and we remain strongly

positioned for future opportunities that will emerge from the major

projects programme at the site.

In line with nuclear safety protocols, the Sellafield site

suspended the majority of operations at the start of the Covid-19

lockdown in March. The mobilisation of work programmes and

decommissioning at Sellafield continues to gain momentum; however,

we do not expect to be fully operational until April 2021. At

Springfields, where we deliver operational support and

decommissioning activities, we have seen a significant increase in

activity since the lockdown and we have recently been appointed to

a major programme of works associated with the decommissioning of

the Magnox Island.

We continue to build on our relationship with Rolls Royce to

secure further opportunities since our appointment to the Diesel

Generator Programme at Hinkley Point "C".

Thermal power and networks

Our essential engineering maintenance services continue at four

of the UK's thermal power stations at near normal levels. We remain

operational on the Minor Works Framework with National Grid as well

as securing a Minor Civils Framework with Western Power

Distribution in the period.

Environmental

Water

In the current five year investment period, AMP7 (which runs

from 2020 to 2025), an estimated c.GBP50bn(9) will be spent,

representing a 16% increase from AMP6, with higher expenditure

committed to capital maintenance and asset optimisation. Additional

investment is allocated to deliver supply resilience including dam

safety and infrastructure refurbishment schemes. These long-term

renewal programmes require sustained investment through our

clients' operational expenditure budgets.

For D r Cymru Welsh Water ("DCWW"), we continue to operate

across the region on the Pressurised Pipelines Framework, the Major

Civils Framework and the Capital Delivery Alliance Civils &

Pipeline Framework. In addition to ongoing maintenance and renewals

tasks, we have provided extensive 24/7 emergency reactive works

across the water network, in particular supporting the response to

the disruption caused by severe storms early in 2020. During the

year we were awarded seven schemes as part of DCWW's dam safety

programme, enhancing our position as an approved dam safety

contractor and providing ongoing opportunities.

Works continue with Wessex Water and Bristol Water as they

develop their plans for AMP7. With our new client Yorkshire Water,

we will carry out engineering works to existing assets on

operational treatment and distribution facilities over the next

five years through the AMP7 Minor Civils Framework where we have

recently been awarded our first project. Additionally, we were

appointed to a treatment works scheme for new client Thames

Water.

The Government has committed record investment of GBP5.2bn(2)

over a six year period to improve flood defences nationally. Our

clients in this market include the Environment Agency and the Canal

and River Trust where we deliver essential maintenance and

improvement works nationally. We continue to build on our success

with other water clients working for Scottish Canals, Peel Ports

and Natural Resources Wales during the year.

Work continues for all our water clients with minimal disruption

albeit with enhanced safety precautions in place to comply with the

UK Government's strict Covid-19 safety guidelines. The essential

nature of the maintenance and renewals tasks we undertake on the

water network ensured we remained fully operational across all

frameworks.

Land Remediation and Specialist Restoration

In Land Remediation during the year, we experienced significant

disruption across our site activities due to the Covid-19 pandemic.

This was particularly the case in Scotland where all of our schemes

were suspended during the first lockdown. All activity had returned

to pre-pandemic levels by July with enhanced safety protection

measures in place in line with the UK Government's Covid-19

guidelines.

In Specialist Restoration, despite a temporary cessation of

works, our operations at the Palace of Westminster have been at

normal capacity since June. During the period we have also been

appointed to a new five year conservation framework at this UNESCO

World Heritage Site.

Specialist Building

We specialise in the High Quality Residential and Science

markets in London and the Home Counties.

Revenue was in line with the Group's expectations at GBP43.2m

(2019: GBP36.1m) reflecting a continued focus on contract

selectivity and risk management. Operating profit was GBP1.0m

(2019: GBP0.9m), with an operating margin of 2.3% (2019: 2.4%). In

Specialist Building, the order book was GBP89m (2019: GBP39m).

During the initial lockdown period in March, we experienced some

disruption in the High Quality Residential sector in London

although operations returned to pre-pandemic levels by July. The

Group continues to be selective in these markets where we have a

long-established track record. During the period, work continued

uninterrupted on our critical science schemes for Defra and the MRC

London Institute of Medical Science where we continue to make good

progress.

New and emerging markets

As part of the Group's growth ambition, we entered the Highways

market with the acquisition of Carnell which delivers renewal and

maintenance services across the strategic highways network. We also

continue to explore opportunities for our existing portfolio of

subsidiaries to work together and to leverage their skills and

capabilities to enter adjacent market segments and exploit new

emerging opportunities.

Health and safety

We continue to make health and safety a priority, ensuring safe

working practices for the Group's employees and those who work with

us.

Our progress during the year was overshadowed by an accident in

April when our colleague Aden Ashurst was fatally injured in the

performance of his duties as a Controller of Site Safety. This

incident remains the subject of ongoing investigations and our

thoughts remain with the family, friends and colleagues of Aden who

lost his life in the conduct of delivering essential rail

services.

In addition to our ongoing safety programmes, the Covid-19

pandemic has necessitated significant changes to working practices

across all our operations to ensure we are able to continue to

operate safely whilst implementing the Government's Covid-19

prevention guidelines.

Sustainability

At Renew, our vision is to safely and responsibly deliver

essential engineering services to support and maintain the

country's key infrastructure assets. Our specialist engineering

services help to future-proof the critical infrastructure upon

which millions of people rely as they go about their day-to-day

business, from the rail network to roads and telecoms to the energy

we use. A long-term approach to sustainability has therefore always

been at the heart of our business.

We continue to align our business with the ESG requirements of

our stakeholders and during the year we further developed our

sustainability strategy which is now reported in five key areas:

customer value, climate action, operating responsibly, engaging our

people and supporting our local communities.

The pandemic has intensified the world's focus on climate change

and during the year we have introduced a number of initiatives

including trialling the use of electric powered plant. We have also

been rolling out the installation of electric vehicle charging

points at our offices and depots which supports our growing fleet

of electric vehicles and reduces the carbon footprint of our

operations.

This is our first year of reporting under the Streamlined Energy

and Carbon Reporting ("SECR") regulations which will provide us

with a baseline for future reporting and to ensure we continue to

support the UK target to deliver net zero carbon by 2050.

Outlook

These results demonstrate the resilient and long-term nature of

the UK infrastructure markets in which we operate and provide a

solid platform for our continued growth ambitions. The UK

Government remains committed to investing in infrastructure over

the long-term, and the Group's market leading capabilities mean we

are well positioned as a partner of choice in a number of

infrastructure sectors to take advantage of this investment.

Since the Covid-19 societal restrictions were imposed, we have

continued to demonstrate a safe and pro-active response to a

continuous demand for our essential services. This situation has

prevailed since the second lockdown was enforced on the 5 November

2020 and we have continued to operate safely, in compliance with

the latest guidance and without any reduction in the levels of

service demand. Given our positive progress, with the majority of

our activities at pre-pandemic levels, we do not intend to further

utilise the Government's Coronavirus Job Retention Scheme.

Our entry into the Highways market has broadened our offering

into a compelling new growth area and we continue to seek

opportunities in markets with similar characteristics of

non-discretionary regulated investment, ongoing renewal and

maintenance requirements and high barriers to entry. Our clients

have clear spending plans underpinned by strategic national need,

regulatory commitments and essential maintenance requirements

delivered through long-term programmes of investment, providing

visibility of spend over regulatory cycles.

Our differentiated and resilient business model, highly skilled

directly employed workforce and proven track record provide us with

a competitive advantage which is fundamental to the Group's success

in its chosen markets.

The Board remains confident that Renew is strongly positioned to

play a significant role in the long-term recovery opportunities

that will emerge across UK infrastructure, a sector that will play

an important role in rebuilding the economy over the next decade

and beyond.

Paul Scott

Chief Executive

8 December 2020

References:

1 Renew uses a range of statutory performance measures and

alternative performance measures when reviewing the performance

of the Group against its strategy. Definitions of the alternative

performance measures, and a reconciliation to statutory

performance measures, are included in Note 10

2 HM Treasury Budget 2020 12 March 2020

3 Network Rail Delivery Plan Control Period 6 High Level

Summary 26 March 2020

4 Department for Transport Road Investment Strategy 2: 2020-2025

March 2020

5 Department for Transport Road Investment Strategy: for

the 2015/16-2019/20 Road Period March 2015

6 UK Government press release 'GBP1bn deal to end poor rural

mobile coverage agreed' 9 March 2020

7 Nuclear Decommissioning Authority Business Plan 1 April

2020 to 31 March 2023

8 UK Government Nuclear Provision: the cost of cleaning up

Britain's historic nuclear sites 4 July 2019

9 Renew estimates from water companies' business plans

Group income

statement

for the year

ended 30 September

Before Exceptional Before Exceptional

exceptional items and exceptional items and

items and amortisation items and amortisation

of of

amortisation intangible amortisation intangible

of of

intangible assets intangible assets

(see Note (see Note

assets 3) Total assets 3) Total

2020 2020 2020 2019 2019 2019

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue: Group

including share

of joint venture 620,375 - 620,375 600,631 - 600,631

Less share of

joint venture's

revenue - - - (709) - (709)

Group revenue

from continuing

activities 2 620,375 - 620,375 599,922 - 599,922

Cost of sales (527,274) - (527,274) (514,299) - (514,299)

Gross profit 93,101 - 93,101 85,623 - 85,623

Administrative

expenses (53,453) (6,741) (60,194) (47,390) (10,788) (58,178)

Share of post-tax

result of joint

venture (39) - (39) 96 - 96

Operating profit 2 39,609 (6,741) 32,868 38,329 (10,788) 27,541

Finance income 44 - 44 50 - 50

Finance costs (1,343) - (1,343) (1,244) - (1,244)

Other finance

income - defined

benefit pension

schemes 532 - 532 615 - 615

Profit before

income tax 2 38,842 (6,741) 32,101 37,750 (10,788) 26,962

Income tax expense 5 (6,905) 1,146 (5,759) (7,306) 2,601 (4,705)

Profit for the

year from continuing

activities 31,937 (5,595) 26,342 30,444 (8,187) 22,257

Loss for the

year from discontinued

operations 4 (5,590) -

Profit for the

year attributable

to equity holders

of the parent

company 20,752 22,257

Basic earnings

per share from

continuing activities 7 34.00p 29.55p

Diluted earnings

per share from

continuing activities 7 33.72p 29.34p

Basic earnings

per share 7 26.78p 29.55p

Diluted earnings

per share 7 26.57p 29.34p

Group statement of comprehensive income

for the year ended 30 September

2020 2019

GBP000 GBP000

Profit for the year attributable to equity holders

of the parent company 20,752 22,257

Items that will not be reclassified to profit or

loss:

Movement in actuarial valuation of the defined benefit

pension schemes (2,775) 3,543

Movement on deferred tax relating to the pension

schemes 971 (1,240)

Total items that will not be reclassified to profit

or loss (1,804) 2,303

Items that are or may be reclassified subsequently

to profit or loss:

Exchange movement in reserves (23) 28

Total items that are or may be reclassified subsequently

to profit or loss (23) 28

Total comprehensive income for the year attributable

to

equity holders of the parent company 18,925 24,588

Group statement of changes

in equity

for the year ended

30 September

Share

Share Capital Cumulative based

Share premium redemption translation payments Retained Total

capital account reserve adjustment reserve earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 October 2018 7,527 51,684 3,896 1,311 698 10,355 75,471

Transfer from income

statement for the year 22,257 22,257

Dividends paid (7,905) (7,905)

New shares issued 6 220 226

Recognition of share

based

payments (122) (122)

Exchange differences 28 28

Actuarial movement recognised

in pension schemes 3,543 3,543

Movement on deferred

tax relating to the

pension schemes (1,240) (1,240)

At 30 September 2019 7,533 51,904 3,896 1,339 576 27,010 92,258

Transfer from income

statement for the year 20,752 20,752

Dividends paid (5,778) (5,778)

New shares issued 323 14,474 14,797

Recognition of share

based

payments 245 245

Exchange differences (23) (23)

Actuarial movement recognised

in pension schemes (2,775) (2,775)

Movement on deferred

tax relating to the

pension schemes 971 971

At 30 September 2020 7,856 66,378 3,896 1,316 821 40,180 120,447

Group balance sheet

At 30 September

2020 2019

GBP000 GBP000

Non-current assets

Intangible assets - goodwill 124,691 105,282

- other 23,062 9,463

Property, plant and equipment 14,806 20,932

Right of use assets 17,481 -

Investment in joint venture - 139

Retirement benefit asset 28,059 25,554

Deferred tax assets 2,164 1,416

210,263 162,786

----------- ------------------

Current assets

Inventories 1,619 2,632

Assets held for resale 1,500 1,500

Trade and other receivables 129,838 118,623

Current tax assets 2,174 -

Cash and cash equivalents 13,396 11,667

------------------

148,527 134,422

----------- ------------------

Total assets 358,790 297,208

----------- ------------------

Non-current liabilities

Borrowings (4,373) (13,123)

Lease liabilities (9,347) -

Obligations under finance leases - (3,214)

Deferred tax liabilities (14,252) (10,598)

Provisions (441) (452)

------------------

(28,413) (27,387)

----------- ------------------

Current liabilities

Borrowings (8,752) (8,752)

Trade and other payables (192,370) (164,450)

Lease liabilities (6,047) -

Obligations under finance leases - (2,546)

Current tax liabilities - (1,804)

Provisions (2,761) (11)

----------- ------------------

(209,930) (177,563)

----------- ------------------

Total liabilities (238,343) (204,950)

----------- ------------------

Net assets 120,447 92,258

----------- ------------------

Share capital 7,856 7,533

Share premium account 66,378 51,904

Capital redemption reserve 3,896 3,896

Cumulative translation adjustment 1,316 1,339

Share based payments reserve 821 576

Retained earnings 40,180 27,010

Total equity 120,447 92,258

----------- ------------------

Group cashflow statement

for the year ended 30 September

2020 2019

GBP000 GBP000

Profit for the year from continuing operating activities 26,342 22,257

Share of post-tax trading result of joint venture 39 (96)

Impairment and amortisation of intangible assets 5,529 6,528

Defined benefit pension scheme guaranteed minimum

pension equalisation - 4,260

Depreciation of property, plant and equipment and

right of use assets 9,672 5,561

Profit on sale of property, plant and equipment (483) (621)

Decrease/(increase) in inventories 301 (210)

Decrease in receivables 1,465 7,769

Increase/(decrease) in payables and provisions 17,010 (15,239)

Current and past service cost in respect of defined

benefit pension scheme 69 46

Cash contribution to defined benefit pension schemes (4,747) (5,279)

Charge/(credit in) respect of share options 245 (122)

Finance income (44) (50)

Finance expense 811 629

Interest paid (1,343) (1,244)

Income taxes paid (8,179) (5,524)

Income tax expense 5,759 4,705

-------- --------

Net cash inflow from continuing operating activities 52,446 23,370

Net cash (outflow)/inflow from discontinued operating

activities (592) 71

Net cash inflow from operating activities 51,854 23,441

-------- --------

Investing activities

Interest received 44 50

Dividend received from joint venture 100 80

Proceeds on disposal of property, plant and equipment 725 939

Purchases of property, plant and equipment (3,756) (2,619)

Acquisition of subsidiaries net of cash acquired (40,512) -

-------- --------

Net cash outflow from investing activities (43,399) (1,550)

-------- --------

Financing activities

Dividends paid (5,778) (7,905)

Issue of share equity 14,797 226

Loan repayments (8,750) (8,750)

Repayments of obligations under lease liabilities (6,972) (3,076)

-------- --------

Net cash outflow from financing activities (6,703) (19,505)

-------- --------

Net increase in continuing cash and cash equivalents 2,344 2,315

Net (decrease)/increase in discontinued cash and

cash equivalents (592) 71

-------- --------

Net increase in cash and cash equivalents 1,752 2,386

Cash and cash equivalents at beginning of year 11,667 9,179

Effect of foreign exchange rate changes on cash and

cash equivalents (23) 102

Cash and cash equivalents at end of year 13,396 11,667

-------- --------

Bank balances and cash 13,396 11,667

-------- --------

Notes

1 International Financial Reporting Standards

The consolidated financial statements for the year ended 30

September 2020 have been prepared in accordance with International

Financial Reporting Standards ("IFRS"). These preliminary results

are extracted from those financial statements.

2 Segmental analysis

The Group is organised into two operating business segments plus

central activities which form the basis of the segment information

reported below. These segments are:

Engineering Services, which comprises the Group's engineering

activities which are characterised by the use of the Group's

skilled engineering workforce, supplemented by specialist

subcontractors where appropriate, in a range of civil, mechanical

and electrical engineering applications;

Specialist Building, which comprises the Group's building

activities which are characterised by the use of a supply chain of

subcontractors to carry out building works under the control of the

Group as principal contractor; and

Central activities, which include the sale of land, the leasing

and sub-leasing of some UK properties and the provision of central

services to the operating subsidiaries.

Group revenue Group

revenue

from continuing from continuing

activities activities

Revenue is analysed 2020 2019

as follows:

GBP000 GBP000

Engineering Services 577,238 563,769

Specialist Building 43,207 36,125

Inter segment revenue (2,025) (1,461)

---------------- ----------------

Segment revenue 618,420 598,433

Central activities 1,955 1,489

----------------

620,375 599,922

---------------- ----------------

Before

exceptional Exceptional

items and items and

amortisation amortisation

of intangible of intangible

assets assets

2020 2020 2020 2019

GBP000 GBP000 GBP000 GBP000

Engineering

Services 40,754 (6,741) 34,013 32,622

Specialist Building 1,014 - 1,014 882

Segment operating profit 41,768 (6,741) 35,027 33,504

Central activities (2,159) - (2,159) (5,963)

-------------- -------------- -------- --------

Operating profit 39,609 (6,741) 32,868 27,541

Net financing

costs (767) - (767) (579)

-------------- -------- --------

Profit on ordinary activities

before income tax 38,842 (6,741) 32,101 26,962

-------------- -------------- -------- --------

Engineering Services segment operating profit for the year ended

30 September 2019 is stated after charging exceptional costs of

GBP260,000 and amortisation of GBP6,528,000, resulting in a total

charge before taxation of GBP6,788,000. Central activities incurred

GBP4,000,000 exceptional cost in the comparative year. Total

amortisation and exceptional costs before taxation in the

comparative year amounted to GBP10,788,000 (see Note 3).

3 Exceptional items and amortisation of intangible assets

2020 2019

GBP000 GBP000

Defined benefit pension scheme

guaranteed minimum pension equalisation - 4,260

Acquisition

costs 1,212 -

-------- --------

Total losses arising from

exceptional items 1,212 4,260

Amortisation of intangible

assets 5,529 6,528

-------- --------

Total exceptional items and amortisation

charge before income tax 6,741 10,788

Taxation credit on exceptional items

and amortisation (1,146) (2,601)

-------- --------

Total exceptional items and amortisation

charge 5,595 8,187

-------- --------

Acquisition costs relate to the acquisition of Carnell on 30

January 2020.

On 26 October 2018, the High Court handed down a judgment

involving the Lloyds Banking Group's defined benefit pension

schemes. The judgment concluded the schemes should be amended to

equalise pension benefits for men and women in relation to

guaranteed minimum pension benefits. The issues determined by the

judgment arise in relation to many other defined benefit pension

schemes. The impact of additional liabilities amounted to

GBP260,000 for the Amco Pension Scheme and GBP4,000,000 for the

Lovell Pension Scheme.

The Board has separately identified the charge of GBP5,529,000

(2019: GBP6,528,000) for the amortisation of the fair value

ascribed to certain intangible assets, other than goodwill, arising

from the acquisitions of Giffen Holdings Ltd, QTS Group Ltd and

Carnell Group Holdings Ltd.

4 Loss for the year from discontinued operations 2020 2019

GBP000 GBP000

Revenue - -

Expenses (5,590) -

-------- -------

Loss before income tax (5,590) -

Income tax charge - -

-------- -------

Loss for the year from discontinued

operations (5,590) -

-------- -------

During the year the group completed the closure of Lovell

America Inc having incurred GBP271,000 additional costs in

finalising historical taxation issues. Once any surplus cash has

been repatriated, the group will no longer have any overseas

exposure.

On 31 October 2014, the Board reached an agreement to sell

Allenbuild Ltd to Places for People Group Ltd. As a term of the

disposal Renew Holdings plc retained both the benefits and the

obligations associated with a number of Allenbuild contracts which

have resulted in the requirement for an additional GBP5,319,000

accrual. This is as a result of new latent defects coming to light

during the financial year and a subsequent internal reassessment of

the costs required to settle other known contractual disputes.

5 Income tax expense

(a) Analysis of expense in

year 2020 2019

GBP000 GBP000

Current tax:

UK corporation tax on profits

of the year (5,732) (5,291)

Adjustments in respect of previous

period 216 208

--------

Total current tax (5,516) (5,083)

-------- --------

Deferred tax - defined benefit pension

schemes (1,848) (556)

Deferred tax - other timing

differences 1,605 934

-------- --------

Total deferred tax (243) 378

-------- --------

Income tax expense in respect of

continuing activities (5,759) (4,705)

-------- --------

(b) Factors affecting income tax expense

for the year

2020 2019

GBP000 GBP000

Profit before income

tax 32,101 26,962

-------- --------

Profit multiplied by

standard rate

of corporation tax in the UK of 19%

(2019: 19%) (6,099) (5,123)

Effects of:

Expenses not deductible for

tax purposes (297) (114)

Timing differences not provided in

deferred tax 433 326

Change in tax rate (12) (2)

Adjustments in respect of previous

period 216 208

-------- --------

(5,759) (4,705)

-------- --------

Timing differences not provided for in deferred tax arise

principally from the utilisation of tax losses not previously

recognised.

Deferred tax has been provided at a rate of 19% (2019: 17%)

following the decision that the UK corporation tax rate should

remain at 19% (effective from 1 April 2020) and substantively

enacted on 17 March 2020. The Group has available further unused UK

tax losses of GBP29.3m (2019: GBP31m) to carry forward against

future taxable profits. A substantial element of these losses

relates to activities which are not forecast to generate the level

of profits needed to utilise these losses. A deferred tax asset has

been provided to the extent considered reasonable by the Directors,

where recovery is expected to be recognisable within the

foreseeable future. The unrecognised deferred tax asset in respect

of these losses amounts to GBP4.0m (2019: GBP4.5m).

6 Dividends

2020 2019

Pence/share Pence/share

Interim (related to the year ended 30 September

2020) - 3.83

Final (related to the year ended 30 September

2019) 7.67 6.67

------------ ------------

Total dividend

paid 7.67 10.50

------------ ------------

GBP000 GBP000

Interim (related to the year ended 30 September

2020) - 2,885

Final (related to the year ended 30 September

2019) 5,778 5,020

------------ ------------

Total dividend

paid 5,778 7,905

------------ ------------

Dividends are recorded only when authorised and are shown as a

movement in equity rather than as a charge in the income statement.

The Directors are proposing that a final dividend of 8.33p per

Ordinary Share be paid in respect of the year ended 30 September

2020. This will be accounted for in the 2020/21 financial year.

7 Earnings per share

2020

Earnings EPS DEPS Earnings 2019 DEPS

GBP000 Pence Pence GBP000 EPS Pence

Pence

Earnings before exceptional

items and amortisation 31,937 41.22 40.89 30,444 40.43 40.13

Exceptional items

and amortisation (5,595) (7.22) (7.17) (8,187) (10.88) (10.79)

--------- ------- ------- --------- -------- --------

Basic earnings per

share - continuing

activities 26,342 34.00 33.72 22,257 29.55 29.34

Loss for the year

from discontinued

operations (5,590) (7.22) (7.15) - - -

--------- ------- ------- ---------

Basic earnings

per share 20,752 26.78 26.57 22,257 29.55 29.34

--------- ------- ------- --------- -------- --------

Weighted average

number of shares 77,480 78,114 75,308 75,856

------- ------- -------- --------

The dilutive effect of share options is to increase the number

of shares by 634,000 (2019: 548,000) and reduce basic earnings per

share by 0.21p (2019: 0.21p).

8 Acquisition of subsidiary undertaking - Carnell Group Holdings

Ltd (formerly Agger Ltd)

On 30 January 2020, the Company acquired the whole of the issued

share capital of Carnell Group Holdings Ltd ("Carnell") for a cash

free/debt free consideration of GBP38m, after excluding a

locked-box working capital adjustment. The acquisition was funded

by a placement of 3,157,894 new ordinary shares raising GBP15m

gross and an expanded revolving credit facility provided by HSBC UK

Bank plc and National Westminster Bank plc.

The provisional value of the assets and liabilities of Carnell

at the date of acquisition were:

Book value Adjustments Fair value

GBP000 GBP000 GBP000

Non-current assets

Intangible assets - goodwill 12,142 7,267 19,409

- other - 19,128 19,128

Property, plant and equipment 905 - 905

13,047 26,395 39,442

----------- ------------ -----------

Current assets

Inventories 20 - 20

Trade and other receivables 13,523 - 13,523

Current tax

asset 540 - 540

Cash and cash equivalents 3,203 - 3,203

17,286 - 17,286

----------- ------------ -----------

Total assets 30,333 26,395 56,728

----------- ------------ -----------

Non-current liabilities

Deferred tax liabilities - (3,634) (3,634)

- (3,634) (3,634)

----------- ------------ -----------

Current liabilities

Trade and other payables (9,379) - (9,379)

(9,379) - (9,379)

----------- ------------ -----------

Total liabilities (9,379) (3,634) (13,013)

----------- ------------ -----------

Net assets 20,954 22,761 43,715

----------- ------------ -----------

Goodwill of GBP19,409,000 arises on acquisition and will be

reviewed annually for impairment. The goodwill is attributable to

the expertise and workforce of the acquired business. Other

intangible assets provisionally valued at GBP19,128,000, which

represent customer relationships and contractual rights, were also

acquired and will be amortised over their useful economic lives in

accordance with IAS 38. Deferred tax has been provided on this

amount. Amortisation of this intangible asset commenced from

February 2020.

Fair value adjustments arising from the acquisition

In accordance with IFRS 3, the Board will review the fair value

of assets and liabilities using information available up to 12

months after the date of acquisition. Fair value has been

calculated using Level 3 inputs as defined by IFRS 13.

Deferred tax liabilities

A deferred tax liability has been recognised in relation to the

amortisation of other intangible assets.

Goodwill impairment review

The Board has reviewed the goodwill arising on acquisition for

impairment as required by IFRS 3. No such impairment was

identified.

If the acquisition of Carnell had occurred on 1 October 2019,

Group revenue would have been approximately GBP638m and profit

before tax for the year ended 30 September 2020 would have been

approximately GBP32.4m.

9 Preliminary financial information

The financial information set out above does not constitute the

company's statutory accounts for the years ended 30 September 2020

or 2019. Statutory accounts for 2019 have been delivered to the

registrar of companies. The auditor has reported on those accounts;

his reports were (i) unqualified, (ii) did not include a reference

to any matters to which the auditor drew attention by way of

emphasis without qualifying their report and (iii) did not contain

a statement under section 498 (2) or (3) of the Companies Act 2006.

The statutory accounts for 2020 will be finalised on the basis of

the financial information presented by the Directors in this

preliminary announcement and will be delivered to the Registrar of

Companies in due course.

10 Alternative performance measures

Renew uses a variety of alternative performance measures ('APM')

which, although financial measures of either historical or future

performance, financial position or cash flows, are not defined or

specified by IFRSs. The Directors use a combination of APMs and

IFRS measures when reviewing the performance, position and cash of

the Group.

The Directors believe that APMs provide a better understanding

of the underlying trading performance of the business because they

remove the impact of non-trading related accounting adjustments.

Furthermore, they believe that the Group's shareholders use these

APMs when assessing the performance of the Group and it is

therefore appropriate to give them prominence in the Annual Report

and Accounts.

The APMs used by the Group are defined below:

Net Cash/(Debt) - This is the cash and cash equivalents less

bank debt. This measure is visible in Note 32 in the Annual Report

& Accounts. The Directors consider this to be a good indicator

of the financing position of the Group.

Adjusted operating profit (GBP39.609m) and adjusted profit

before tax (GBP38.842m) - Both of these measures are reconciled to

total operating profit and total profit before tax on the face of

the consolidated income statement. The Directors consider that the

removal of exceptional items and amortisation provides a better

understanding of the underlying performance of the Group. The

equivalent GAAP measures are operating profit (GBP32.868m) and

profit before tax (GBP32.101m).

Adjusted operating margin (6.4%) - This is calculated by

dividing operating profit before exceptional items and amortisation

of intangible assets (GBP39.609m) by group revenue including share

of joint venture (GBP620.375m) both of which are visible on the

face of the income statement. The Directors believe that removing

exceptional items and amortisation from the operating profit margin

calculation provides a better understanding of the underlying

performance of the Group. The equivalent GAAP measure is operating

profit margin (5.3%) which is calculated by dividing operating

profit (GBP32.868m) from

group revenue including share of joint venture

(GBP620.375m).

Adjusted earnings per share (41.22p) - This measure is

reconciled to the earnings per share calculation based on earnings

before exceptional items and amortisation in Note 7. The Directors

believe that removing exceptional items and amortisation from the

EPS calculation provides a better understanding of the underlying

performance of the Group.

Group Revenue (GBP620.375m) - This measure is visible on the

face of the income statement as Revenue: Group including share of

joint venture.

Group order book, Engineering Services order book and Specialist

Building order book - This measure is calculated by the Directors

taking a conservative view on secured orders and visible workload

through long-term frameworks.

Engineering Services revenue (GBP577.238m) - This measure is

visible in Note 2 business analysis as Engineering Services Revenue

including share of joint venture. The Directors consider this to be

a good indicator of the underlying performance of the Group's

Engineering Services business.

Adjusted Engineering Services operating profit (GBP40.754m) -

This measure is visible in Note 2 business analysis as Engineering

Services operating profit before exceptional items and amortisation

of intangible assets. The Directors consider this to be a good

indicator of the underlying performance of the Group's Engineering

Services business. The GAAP equivalent measure is engineering

services operating profit (GBP34.013m) which is also visible in

Note 2 part (a).

Adjusted Engineering Services operating profit margin (7.1%) -

This is calculated in the same way as adjusted operating profit

margin but based on the adjusted Engineering Services operating

profit (GBP40.754m) and the Engineering Services revenue

(GBP577.238m) figures as set out above. The equivalent GAAP measure

is engineering services operating profit margin (5.9%) which is

calculated by dividing engineering services operating profit

(GBP34.013m) from engineering services revenue including share of

joint venture (GBP577.238m).

11 Posting of Report & Accounts

The Group confirms that the annual report and accounts for the

year ended 30 September 2020 will be posted to shareholders as soon

as practicable and a copy will be made available on the Group's

website:

www.renewholdings.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR UBUURRWUURUA

(END) Dow Jones Newswires

December 08, 2020 02:00 ET (07:00 GMT)

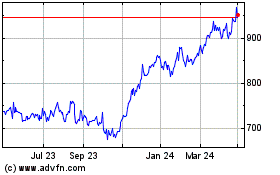

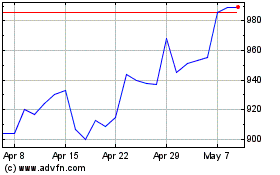

Renew (LSE:RNWH)

Historical Stock Chart

From Mar 2024 to Apr 2024

Renew (LSE:RNWH)

Historical Stock Chart

From Apr 2023 to Apr 2024