TIDMSAFE

RNS Number : 1671P

Safestore Holdings plc

16 February 2021

16 February 2021

Safestore Holdings plc

First quarter trading update for the period 1 November 2020 to

31 January 2021

Continued momentum results in strong Q1 performance

Group Operating Performance Q1 2021 Q1 2020 Change Change-

(2) CER (1)

-------------------------------- -------- -------- --------- ---------

Revenue (GBP'm) 44.4 39.9 11.3% 9.8%

Closing Occupancy (let sq ft-

million)(3) 5.506 4.960 11.0% n/a

Maximum Lettable Area (MLA)(4) 6.87 6.71 2.4% n/a

Closing Occupancy (% of MLA) 80.1% 74.0% +6.1ppts n/a

Average Storage Rate (GBP) 26.47 26.07 1.5% 0.1%

Group Operating Performance- Q1 2021 Q1 2020 Change Change-

like-for-like(3) (2) CER (1)

--------------------------------- -------- -------- --------- ---------

Storage Revenue (GBP'm) 35.3 32.3 9.3% 7.7%

Ancillary Revenues (GBP'm) 7.3 7.1 2.8% 1.4%

Revenue (GBP'm) 42.6 39.4 8.1% 6.6%

Closing Occupancy (let sq ft-

million)(4) 5.321 4.839 10.0% n/a

Closing Occupancy (% of MLA)(5) 80.6% 73.7% +6.9ppts n/a

Average Occupancy (let sq ft-

million) 5.300 4.888 8.4% n/a

Average Storage Rate (GBP) 26.44 26.32 0.5% (0.9%)

Highlights

-- Group revenue for the quarter in CER(1) up 9.8% and 11.3% at actual exchange rates.

-- Like-for-like(5) Group revenue for the quarter in CER(1) up 6.6%

o UK up 8.3%

o Paris up 1.6%

-- Like-for-like(5) occupancy up 6.9ppts at 80.6% (2020: 73.7%)

o UK up 7.8ppts at 80.8% (2020: 73.0%)

o Paris up 3.1ppts at 79.8% (2020 76.7%)

-- Like-for-like (5) average rate down (0.9%) in CER(1) .

o UK down (0.1%)

o Paris down (1.8%)

-- New 18-year lease agreed on Hayes store commencing in June 2027 on expiry of current lease

-- In December 2020, the Group's joint venture with Carlyle

acquired the three-store portfolio of Opslag XL in the Netherlands.

Safestore's equity investment in the joint venture, relating to

Opslag XL, was c.EUR0.9m funded from the Group's existing

resources.

-- Recent store openings and acquisitions (including owned

through the Group's joint venture) performing in line with or ahead

of business plans

Frederic Vecchioli, Chief Executive Officer commented:

"I am pleased to report that the strong performance of the final

quarter of our 2020 financial year has continued throughout the

first quarter of 2021 driven by an excellent UK result,

complemented by solid performances from Paris and Spain. In

addition, our JV with Carlyle, operating in Belgium and the

Netherlands, is performing in line with its business plan.

"Our recently opened developments in the UK in Carshalton,

Sheffield and Gateshead are performing well and our Birmingham

Middleway and Paris Magenta stores are due to open in the first

half of 2021. We anticipate that our new store pipeline will grow

over the coming months and our strong and flexible balance sheet

provides significant funding capacity, allowing us to continue to

consider strategic, value-accretive investments as and when they

arise.

"Our priority, and largest opportunity, remains the significant

upside from filling the 1.4m square feet of fully invested

currently unlet space in our UK, Paris and Barcelona markets.

Whilst the potential for disruption arising from current COVID

restrictions remains, the inherent resilience of our business model

as well as our recent and current trading allows me to look forward

with confidence. The first quarter's trading performance has

provided us with a strong base for the rest of the financial year

and, if the current momentum continues, we would anticipate that

the business delivers Adjusted Diluted EPRA Earnings per Share (7)

for 2020/21 towards the top of the range of analysts' forecasts (8)

".

Business highlights

UK Trading Performance

UK Operating Performance Q1 2021 Q1 2020 Change

(2)

-------------------------------- -------- -------- ---------

Revenue (GBP'm) 33.6 30.3 10.9%

Closing Occupancy (let sq ft-

million)(3) 4.366 3.859 13.1%

Maximum Lettable Area (MLA)(4) 5.45 5.29 3.0%

Closing Occupancy (% of MLA) 80.1% 73.0% +7.1ppts

Average Storage Rate (GBP) 24.37 24.47 (0.4%)

UK Operating Performance- like-for-like(3) Q1 2021 Q1 2020 Change

(2)

-------------------------------------------- -------- -------- ---------

Storage Revenue (GBP'm) 26.1 23.7 10.1%

Ancillary Revenues (GBP'm) 6.4 6.3 1.6%

Revenue (GBP'm) 32.5 30.0 8.3%

Closing Occupancy (let sq ft-

million)(4) 4.275 3.832 11.6%

Closing Occupancy (% of MLA)(5) 80.8% 73.0% +7.8ppts

Average Occupancy (let sq ft-

million) 4.258 3.879 9.8%

Average Storage Rate (GBP) 24.32 24.34 (0.1%)

The UK has performed very strongly in the first quarter of 2021.

Like-for-like revenue growth of 8.3% was driven by an excellent

occupancy performance, whilst maintaining the like-for-like average

rate, finishing the quarter at GBP24.32 (2020: GBP24.34). The

like-for-like closing occupancy, as measured by sq ft occupied, was

up 11.6% and like-for-like closing occupancy at the end of the

quarter as a percentage of MLA was up 7.8ppts at 80.8% (2020:

73.0%). The occupancy performance was strong across the UK with

Regional UK slightly out-performing London and the South East.

Like-for-like ancillary revenues were up 1.6% in the period,

continuing the improving momentum seen in Q4 2020.

Total revenue growth of 10.9% reflected the like-for-like growth

as well as the 2020 store openings in Carshalton, Gateshead and

Sheffield and the annualisation of the acquisitions of our St

John's Wood and Chelsea stores. The UK also benefited from the

contribution of management fees from our joint venture operations

in the Netherlands and Belgium (included in ancillary revenues)

which is managed by our UK team. All acquisitions and new store

developments are performing in line with or ahead of their business

cases, with our new store at Birmingham-Middleway expected to open

in the first half of 2021.

Paris Trading Performance

Paris Operating Performance Q1 2021 Q1 2020 Change

(2)

-------------------------------- -------- -------- ---------

Revenue (EUR'm) 11.23 11.05 1.6%

Closing Occupancy (let sq ft-

million)(3) 1.046 1.007 3.9%

Maximum Lettable Area (MLA)(4) 1.31 1.31 =

Closing Occupancy (% of MLA) 79.8% 76.7% +3.1ppts

Average Storage Rate (EUR) 39.10 39.81 (1.8%)

Revenue (GBP'm) 10.1 9.4 7.4%

Paris Operating Performance- Q1 2021 Q1 2020 Change

like-for-like(3) (2)

--------------------------------- -------- -------- ---------

Storage Revenue (EUR'm) 10.26 10.10 1.6%

Ancillary Revenues (EUR'm) 0.97 0.95 2.1%

Revenue (EUR'm) 11.23 11.05 1.6%

Closing Occupancy (let sq ft-

million)(4) 1.046 1.007 3.9%

Closing Occupancy (% of MLA)(5) 79.8% 76.7% +3.1ppts

Average Occupancy (let sq ft-

million) 1.042 1.009 3.3%

Average Storage Rate (EUR) 39.10 39.81 (1.8%)

Revenue (GBP'm) 10.1 9.4 7.4%

Our Paris business had a good quarter, growing total and

like-for-like storage revenue by 1.6%. Like-for-like occupancy

performance was strong for the quarter with closing occupancy at

79.8%, up 3.1ppts compared to 2020. The like-for-like average rate,

which was down by (1.8%), partially offset the occupancy growth.

Like-for-like ancillary revenues showed improving momentum and were

up 2.1%.

Sterling equivalent revenue was impacted by the 5.2% weakening

in the Sterling: Euro exchange rate for the quarter compared to Q1

2020. As a result, sterling equivalent total and like-for-like

revenue grew by 7.4% compared to Q1 2020.

Our new 50,000 sq ft store in central Paris at Boulevard Magenta

is anticipated to open in the first half of 2021.

Barcelona Trading Performance(6)

Our Barcelona business which was acquired in December 2019,

continued, as expected, to see a small seasonal outflow of

occupancy and ended the quarter at a closing occupancy of 88.6%

(2020: 88.6%). However, the average rate grew by 4.2% to EUR31.09

compared to EUR29.85 for Q1 2020.

Lease Extensions and Assignments

In the period, we agreed a new 18-year lease on our Hayes store

which starts at the expiry of the current lease in June 2027. The

new lease is protected under the Landlord and Tenant Act. A

six-month rent-free period was granted immediately under the

current lease with a further three-month rent-free period when the

new lease commences.

As part of our ongoing asset management programme, we have now

extended the leases on 23 stores or 64% of our leased store

portfolio in the UK since 2012.

Joint Venture with Carlyle- Investment in Opslag XL

As announced as part of our 14 January 2021 results

announcement, the Group's joint venture with Carlyle acquired the

three-store portfolio of Opslag XL in the Netherlands in December

2020. Safestore's equity investment in the joint venture, relating

to Opslag XL, was c.EUR0.9m funded from the Group's existing

resources. Safestore also earns a fee for providing management

services to the joint venture. Safestore expects to earn an initial

return on investment of 12% before transaction related costs for

the first full year reflecting its share of expected joint venture

profits and fees for management services.

Opslag XL has three locations in The Hague, Hilversum and

Amsterdam. The Hague and Hilversum are freehold; the Amsterdam

store is a short leasehold (December 2021). The business had 7,000

sq metres (75,000 sq ft) of MLA and an occupancy of 58%. This

acquisition complements the six stores in Amsterdam and Haarlem in

the Netherlands acquired in August 2019. In total, the joint

venture will own stores with 53,300 sq metres (574,000 sq ft) of

MLA.

The Group's further investment in the joint venture is has been

immediately accretive to Group earnings per share from completion

and will support the Group's future dividend capacity.

Our joint venture provides an earnings-accretive opportunity to

gain detailed operational exposure to new markets while carefully

managing the investment risk. The Group's leading digital platform

has already delivered substantial marketing benefits both in terms

of costs and in terms of volume of enquiries. The operational

integration has been completed in an efficient manner, leveraging

the skills and capacities of our existing Head Offices in the UK

and Paris.

Our local property development team also enables us to further

our understanding of local property markets, which will allow the

Group to allocate equity investment efficiently with a risk/reward

profile similar to that of our historical core markets.

Ends

1 - CER is Constant Exchange Rates (Euro denominated results for

the current period have been retranslated at the exchange rate

effective for the comparative period, in order to present the

reported results on a more comparable basis).

2 - Q1 2020 is the quarter ended 31 January 2020.

3 - Occupancy excludes offices but includes bulk tenancy. As at

31 January 2021, closing occupancy includes 14,000 sq ft of bulk

tenancy (31 January 2020: 14,000 sq ft).

4 - MLA is Maximum Lettable Area.

5 - Like-for-like information includes only those stores which

have been open throughout both the current and prior financial

years, with adjustments made to remove the impact of new and closed

stores, as well as corporate transactions.

6 - The Barcelona business was acquired on 30 December 2019. As

a result, only one month of revenue is included in the comparative

quarter, Q1 2020.

7 - Adjusted Diluted EPRA EPS is based on the European Public

Real Estate Association's definition of Earnings and is defined as

profit or loss for the period after tax but excluding corporate

transaction costs, change in fair value of derivatives, gain/loss

on investment properties and the associated tax impacts. The

Company then makes further adjustments for the impact of

exceptional items, IFRS 2 share-based payment charges, exceptional

tax items and deferred tax charges. This adjusted earnings is

divided by the diluted number of shares. The IFRS 2 cost is

excluded as it is written back to distributable reserves and is a

non-cash item (with the exception of the associated National

Insurance element). Therefore neither the Company's ability to

distribute nor pay dividends are impacted (with the exception of

the associated National Insurance element). The financial

statements will disclose earnings on a statutory, EPRA and Adjusted

Diluted EPRA basis and will provide a full reconciliation of the

differences in the financial year in which any LTIP awards may

vest.

8- The analyst consensus for Adjusted Diluted EPRA EPS for the

current financial year is 32.6p. Analyst forecasts range from 31.2p

to 34.6p.

This announcement contains inside information.

Enquiries

Safestore Holdings plc 020 8732 1500

Frederic Vecchioli, Chief Executive Officer

Andy Jones, Chief Financial Officer

www.safestore.com

Instinctif Partners 020 7457 2020

Guy Scarborough

Catherine Wickman

Notes to editors:

-- Safestore is the UK's largest self-storage group with 159

stores at 31 January 2021, comprising 127 wholly owned stores in

the UK (including 71 in London and the South East with the

remainder in key metropolitan areas such as Manchester, Birmingham,

Glasgow, Edinburgh, Liverpool, Sheffield, Leeds, Newcastle and

Bristol), 28 wholly owned stores in the Paris region and 4 stores

in Barcelona. In addition, the Group operates 9 stores in the

Netherlands and 6 stores in Belgium under a joint venture agreement

with Carlyle.

-- Safestore operates more self-storage sites inside the M25 and

in central Paris than any competitor providing more proximity to

customers in the wealthiest and more densely populated UK and

French markets.

-- Safestore was founded in the UK in 1998. It acquired the

French business "Une Pièce en Plus" ("UPP") in 2004 which was

founded in 1998 by the current Safestore Group CEO Frederic

Vecchioli.

-- Safestore has been listed on the London Stock Exchange since

2007. It entered the FTSE 250 index in October 2015.

-- The Group provides storage to around 75,000 personal and business customers.

-- As at 31 January 2021, Safestore had a maximum lettable area

("MLA") of 6.871 million sq ft (excluding the expansion pipeline

stores, and the Carlyle Joint Venture) of which 5.506 million sq ft

was occupied.

-- Safestore employs around 660 people in the UK, Paris and Barcelona.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTDZGMZVKMGMZM

(END) Dow Jones Newswires

February 16, 2021 02:00 ET (07:00 GMT)

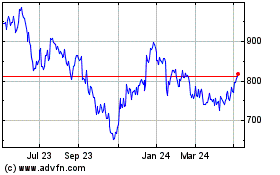

Safestore (LSE:SAFE)

Historical Stock Chart

From Mar 2024 to Apr 2024

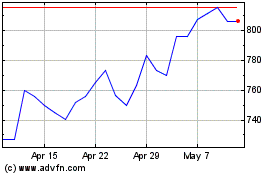

Safestore (LSE:SAFE)

Historical Stock Chart

From Apr 2023 to Apr 2024