SAGA PLC Corporate and cruise ship finance facilities (2566R)

March 05 2021 - 1:00AM

UK Regulatory

TIDMSAGA

RNS Number : 2566R

SAGA PLC

05 March 2021

5 March 2021

Saga plc (the "Group" or "Saga")

Update on corporate and cruise ship finance facilities

Saga plc, the UK's specialist in products and services for

people over 50, today announces the conclusion of discussions

regarding options to increase financial flexibility. The Group has

reached agreement to amend covenants on the term loan and revolving

credit facilities and the agreement, which is expected to complete

next week, of a one-year extension to the debt deferral on its

cruise ship facilities.

Given the backdrop of continued disruption to the Travel

business, the actions taken provide sufficient headroom should the

period of Travel suspension, which is subject to government

guidance, continue well into the second half of the year. The

specific details of the amendments are shown in the appendix

below.

Euan Sutherland, Group Chief Executive Officer, says:

"The successful conclusion of these discussions is the latest

step in reinforcing Saga's financial position, and I would like to

thank our funding partners for their ongoing support. We continue

to see strong pent-up demand for travel among our customers and

remain well placed to deliver on this opportunity when the guidance

on international travel changes."

Date of Financial Results

Saga will publish its Preliminary Results on 7 April 2021.

For further information please contact:

Saga plc

Mark Watkins - Treasury Tel: 07738 777 479

Email: mark.watkins@saga.co.uk

Emily Roalfe - Equity Tel: 07732 093 007

Email: emily.roalfe@saga.co.uk

Headland Consultancy

Susanna Voyle Tel: 07980 894 557

Henry Wallers Tel: 07876 562 436

Email: saga@headlandconsultancy.com

Notes to editors

About Saga

Saga is a specialist in the provision of products and services

for people over 50. The Saga brand is one of the most recognised

and trusted brands in the UK and is known for its high level of

customer service and its high quality, award winning products and

services including cruises and holidays, insurance, personal

finance and publishing. www.saga.co.uk

Appendix

Term loan and revolving credit facilities

The covenants within the Group's term loan and revolving credit

facilities have been amended as follows:

Leverage ratio Interest cover

(ex Cruise)

Old New Old New

------------------ -------- -------- -------

30 April 2021* 4.75x 4.75x 1.25x 1.25x

-------- ------- -------- -------

31 July 2021 4.75x 4.75x 1.50x 1.25x

-------- ------- -------- -------

31 October 2021* 4.50x 4.50x 1.75x 1.25x

-------- ------- -------- -------

31 Jan 2022 4.00x 4.25x 2.50x 1.50x

-------- ------- -------- -------

31 July 2022 3.00x 3.00x 3.50x 3.50x

-------- ------- -------- -------

* Quarterly covenants are only tested if leverage is above 4.0x

times at the previous covenant test date.

In addition, the following amendments have also been made:

-- The Group is subject to a minimum liquidity requirement of

GBP40 million, which can be met either through cash or undrawn and

committed facilities.

-- The permitted indebtedness to the Cruise Group is GBP50m

until September 2022, and then reduces to GBP25m.

-- Dividends remain restricted while leverage (excluding Cruise) is above 3.0x.

Cruise ship debt deferral

As part of an industry-wide package of measures to support the

cruise industry, an extension of the existing debt deferral has

been agreed to 31 March 2022. The key terms of this deferral

are:

-- All principal payments to 31 March 2022 (GBP51.8 million) are

deferred and repaid over 5 years.

-- All financial covenants until 31 March 2022 are waived.

-- Dividends remain restricted while the deferred principal is outstanding.

-- The Group is now subject to a minimum liquidity requirement

of GBP40 million, which can be met through either cash or undrawn

and committed facilities.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDDKQBQKBKBQNK

(END) Dow Jones Newswires

March 05, 2021 02:00 ET (07:00 GMT)

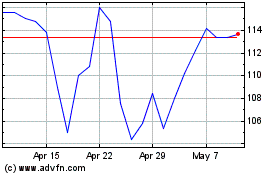

Saga (LSE:SAGA)

Historical Stock Chart

From Mar 2024 to Apr 2024

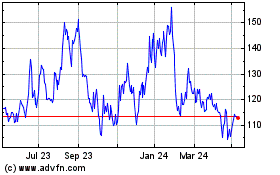

Saga (LSE:SAGA)

Historical Stock Chart

From Apr 2023 to Apr 2024