TIDMSDX

RNS Number : 7919S

SDX Energy PLC

19 March 2021

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

SDX TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER THE MARKET

ABUSE REGULATION (EU) NO. 596/2014 ("MAR"). ON THE PUBLICATION OF

THIS ANNOUNCEMENT VIA A REGULATORY INFORMATION SERVICE ("RIS"),

THIS INSIDE INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC

DOMAIN.

19 March 2021

SDX ENERGY PLC

("SDX" or the "Company")

VESTING OF LTIP AWARDS & PDMR SHAREHOLDING

SDX Energy Plc (AIM: SDX), the MENA-focused oil and gas company,

announces the partial vesting of share options awarded under the

terms of the SDX Energy Plc LTIP scheme ("LTIP" or "Plan").

As part of the Board's commitment to facilitating and

encouraging share ownership amongst senior management and selected

employees of the Company, the awards made on 5 March 2018 to

existing employees and on 24 August 2018 to new joiners contained

performance targets set with reference to the following:

-- Earnings Before Interest, Taxation, Depreciation,

Amortisation and Exploration Expense ("EBITDAX") in US$

millions;

-- Working interest production in barrels of oil equivalent per day;

-- Proved Developed Producing and Proved Undeveloped Reserves in

barrels of oil equivalent; and

-- Total Shareholder Return relative to the FTSE All Share Oil & Gas Index.

The Board has, in its discretion, determined that performance

targets have been partially achieved such that a total of 258,137

nil-cost options will vest over ordinary shares, representing

0.126% of the Company's current issued share capital, of which

239,546 vested on 19 March 2021, with 18,591 to vest on 24 August

2021.

A total of 125,843 nil-cost options awarded to persons

discharging managerial responsibility ("PDMR") vested on 19 March

2021, 112,360 to Mark Reid and 13,483 to Nick Box. Assuming all

nil-cost options are exercised, including those previously vested,

upon exercise of their nil-cost options, Mark Reid would own

927,553 shares, representing 0.452% of the Company's then issued

share capital, and Nick Box would own 125,420 shares, representing

0.061% of the Company's then issued share capital.

For further information:

SDX Energy Plc

Mark Reid

Chief Executive Officer

Tel: +44 203 219 5640

Stifel Nicolaus Europe Limited (Nominated Adviser and Joint Broker)

Callum Stewart

Jason Grossman

Ashton Clanfield

Tel: +44 (0) 207 710 7600

Peel Hunt LLP (Joint Broker)

Richard Crichton

David McKeown

Tel: +44 (0) 207 418 8900

Cantor Fitzgerald Europe (Joint Broker)

David Porter

Tel: +44 (0) 207 7894 7000

Camarco (PR)

Billy Clegg

Owen Roberts

Violet Wilson

Tel: +44 (0) 203 757 4980

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Mark Reid

---------------------------- ------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------

a) Position/status CEO

---------------------------- ------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------------- ------------------------------------------

3 Details of the issuer

------------------------------------------------------------------------

a) Name SDX Energy PLC

---------------------------- ------------------------------------------

b) LEI 213800ALYZJ5JN26DY75

---------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

------------------------------------------------------------------------

a) Description of the financial

instrument, type of Nil-cost options over Ordinary shares of

instrument GBP GBP0.01

Identification Code GB00BJ5JNL69

---------------------------- ------------------------------------------

c) Nature of the transaction Acquisition

---------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Award - nil 112,360

---------

---------------------------- ------------------------------------------

d) Aggregated information Price(s) Volume(s)

- Aggregated volume Award - nil 112,360

- Price ---------

---------------------------- ------------------------------------------

e) Date of the transaction 19 March 2021

---------------------------- ------------------------------------------

f) Place of the transaction XOFF

---------------------------- ------------------------------------------

1 Details of the person discharging managerial responsibilities

/ person closely associated

a) Name Nicholas Box

---------------------------- ------------------------------------------

2 Reason for the notification

------------------------------------------------------------------------

a) Position/status CFO

---------------------------- ------------------------------------------

b) Initial notification Initial notification

/Amendment

---------------------------- ------------------------------------------

3 Details of the issuer

------------------------------------------------------------------------

a) Name SDX Energy PLC

---------------------------- ------------------------------------------

b) LEI 213800ALYZJ5JN26DY75

---------------------------- ------------------------------------------

4 Details of the transaction(s): section to be repeated for (i)

each type of instrument; (ii) each type of transaction; (iii)

each date; and (iv) each place where transactions have been

conducted

------------------------------------------------------------------------

a) Description of the financial

instrument, type of Nil-cost options over Ordinary shares of

instrument GBP GBP0.01

Identification Code GB00BJ5JNL69

---------------------------- ------------------------------------------

c) Nature of the transaction Acquisition

---------------------------- ------------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Award - nil 13,483

---------

---------------------------- ------------------------------------------

d) Aggregated information Price(s) Volume(s)

- Aggregated volume Award - nil 13,483

- Price ---------

---------------------------- ------------------------------------------

e) Date of the transaction 19 March 2021

---------------------------- ------------------------------------------

f) Place of the transaction XOFF

---------------------------- ------------------------------------------

About SDX

SDX is an international oil and gas exploration, production and

development company, headquartered in London, United Kingdom, with

a principal focus on MENA. In Egypt, SDX has a working interest in

two producing assets: a 55% operated interest in the South Disouq

gas field in the Nile Delta and a 50% non-operated interest in the

West Gharib concession, which is located onshore in the Eastern

Desert, adjacent to the Gulf of Suez. In Morocco, SDX has a 75%

working interest in five development/production concessions, all

situated in the Gharb Basin. The producing assets in Morocco are

characterised by attractive gas prices and exceptionally low

operating costs. SDX has a strong weighting of fixed price gas

assets in its portfolio with low operating costs and attractive

margins throughout, providing resilience in a low commodity price

environment. SDX's portfolio also includes high impact exploration

opportunities in both Egypt and Morocco.

For further information, please see the Company's website at

www.sdxenergy.com or the Company's filed documents at www.sedar.com

.

Forward-Looking Information

Certain statements contained in this press release may

constitute "forward-looking information" as such term is used in

applicable Canadian securities laws. Any statements that express or

involve discussions with respect to predictions, expectations,

beliefs, plans, projections, objectives, assumptions or future

events or are not statements of historical fact should be viewed as

forward-looking information.

The forward-looking information contained in this document is

based on certain assumptions, and although management considers

these assumptions to be reasonable based on information currently

available to them, undue reliance should not be placed on the

forward-looking information because SDX can give no assurances that

they may prove to be correct. This includes, but is not limited to,

assumptions related to, among other things, commodity prices and

interest and foreign exchange rates; planned synergies, capital

efficiencies and cost - savings; applicable tax laws; future

production rates; receipt of necessary permits; the sufficiency of

budgeted capital expenditures in carrying out planned activities,

and the availability and cost of labour and services.

All timing given in this announcement, unless stated otherwise,

is indicative, and while the Company endeavours to provide accurate

timing to the market, it cautions that, due to the nature of its

operations and reliance on third parties, this is subject to

change, often at little or no notice. If there is a delay or change

to any of the timings indicated in this announcement, the Company

shall update the market without delay.

Forward-looking information is subject to certain risks and

uncertainties (both general and specific) that could cause actual

events or outcomes to differ materially from those anticipated or

implied by such forward - looking statements. Such risks and other

factors include, but are not limited to, political, social, and

other risks inherent in daily operations for the Company, risks

associated with the industries in which the Company operates, such

as: operational risks; delays or changes in plans with respect to

growth projects or capital expenditures; costs and expenses;

health, safety and environmental risks; commodity price, interest

rate and exchange rate fluctuations; environmental risks;

competition; permitting risks; the ability to access sufficient

capital from internal and external sources; and changes in

legislation, including but not limited to tax laws and

environmental regulations. Readers are cautioned that the foregoing

list of risk factors is not exhaustive and are advised to refer to

SDX's Financial Review for the year ended 31 December 2020, which

can be found on SDX's SEDAR profile at www.sedar.com, for a

description of additional risks and uncertainties associated with

SDX's business, including its exploration activities.

The forward-looking information contained in this press release

is as of the date hereof and SDX does not undertake any obligation

to update publicly or to revise any of the included forward --

looking information, except as required by applicable law. The

forward -- looking information contained herein is expressly

qualified by this cautionary statement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHDBGDXXDBDGBI

(END) Dow Jones Newswires

March 19, 2021 03:01 ET (07:01 GMT)

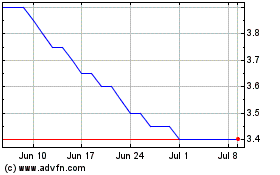

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Apr 2023 to Apr 2024