TIDMSEIT

RNS Number : 8003J

SDCL Energy Efficiency Income Tst

24 December 2020

24 December 2020

SDCL Energy Efficiency Income Trust plc

("SEEIT" or the "Company")

Acquisition of Solar and Storage Projects in the United

States

SEEIT is pleased to announce that it has agreed to acquire a

series of portfolios of commercial and industrial ("C&I")

on-site solar and energy storage projects in the United States,

together with a 50% interest in the platform that has created them,

Onyx Renewable Partners ("Onyx") from funds managed by Blackstone

("Blackstone") for a consideration of approximately $150 million.

Blackstone will remain a 50% partner in Onyx.

SEEIT will acquire a 100% interest in four portfolios totalling

over 175 MW, which provide renewable energy generated on-site

directly to the end-user, and a 50% interest in Onyx's follow-on

pipeline, which is projected to exceed 500MW over the next 5 years.

The four portfolios comprise over 200 operational, construction and

development stage rooftop, carport and 'private wire' ground

mounted solar PV projects, located in 18 US states. Clients include

municipalities, universities, schools, hospitals, military housing

providers, utilities and corporates.

The operational projects are contracted under long-term power

purchase agreements with predominantly investment grade C&I

counterparties. At present c.27% of the portfolio (by installed

MWs) are operational or near operational, with the remainder

expected to become fully operational over the next 12 to 18 months.

All projects benefit from robust contracts as to construction and

operations with experienced EPC and O&M subcontractors.

Onyx has a highly experienced and dedicated project development

and asset management team based in New York. It will develop and

manage further C&I on-site solar and energy storage projects in

the United States, which SEEIT will have a right of first refusal

to purchase at a pre-agreed rate of return. The investment provides

SEEIT with a substantial initial portfolio and a scalable pipeline

of opportunities in a major growth market. It also has strong

diversification benefits with investments being made in portfolios

of projects, including smaller projects under 5 MW as well as

larger projects of 5 to 15+ MW.

The Onyx projects are well aligned to SEEIT's investment policy

as they increase the supply of renewable energy generated on-site

and help to reduce greenhouse gas emissions arising from the

supply, distribution and consumption of energy. They deliver

cheaper, cleaner and more reliable energy solutions directly to the

end user. The investment will help SEEIT to achieve its total

returns targets - offering the opportunity for capital growth from

the pipeline as well as income - and to support its progressive

dividend policy.

The acquisition will be funded from existing cash reserves and

debt facilities. Onyx's existing project debt finance facilities,

which are equivalent to c.GBP27 million at acquisition, will remain

in place.

Completion of the acquisition is expected in the coming weeks,

after satisfaction of certain customary conditions and

consents.

Commenting on the acquisition, Jonathan Maxwell, CEO of

Sustainable Development Capital LLP, said: "We are delighted to

further diversify the SEEIT portfolio through the acquisition of

these on-site solar and storage projects and to partner with

Blackstone in one of the largest sustainable energy initiatives of

its kind in the United States. The projects will make a meaningful

impact to reduce the carbon footprint of commercial and industrial

clients across the United States by providing cheaper, cleaner and

more reliable energy directly at the point of use and is strongly

aligned with SEEIT's investment policy and objectives, as well as

the global climate policy agenda."

For Further Information

Sustainable Development Capital T: +44 (0) 20 7287 7700

LLP

Jonathan Maxwell

Purvi Sapre

Keith Driver

Jefferies International Limited T: +44 (0) 20 7029 8000

Tom Yeadon

Gaudi le Roux

TB Cardew T: +44 (0) 20 7930 0777

Ed Orlebar M: +44 (0) 7738 724 630

Joe McGregor E: SEEIT@tbcardew.com

About SEEIT

SDCL Energy Efficiency Income Trust plc is the first UK listed

company of its kind to invest exclusively in the energy efficiency

sector. Since IPO, SEEIT has made nine investments and commitments

in a diversified portfolio of distributed generation and energy

efficiency projects totalling c.GBP500 million. The projects are

primarily located in the UK, Europe and North America and include,

inter alia, a portfolio of cogeneration assets in Spain, a

portfolio of recycled energy and cogeneration projects in the

United States and, most recently, a regulated gas distribution

network in Sweden.

The Company aims to deliver shareholders value through its

investment in a diversified portfolio of energy efficiency projects

which are driven by the opportunity to deliver lower cost, cleaner

and more reliable energy solutions to end users of energy.

The Company is targeting an attractive total return for

shareholders of 7-8 per cent. per annum (net of fees and expenses

and by reference to the initial issue price of GBP1.00 per Ordinary

Share), with a stable dividend income, capital preservation and the

opportunity for capital growth. The Company is targeting a dividend

of 5.5p per share in respect of the financial year to 31 March

2021. SEEIT's last published NAV was 102.0p per share as at 30

September 2020.

Further information can be found on the Company's website at

www.seeitplc.com .

Investment Manager

SEEIT's investment manager is Sustainable Development Capital

LLP ("SDCL"), an investment firm established in 2007, with a proven

track record of investment in energy efficiency and decentralised

generation projects in the UK, Continental Europe, North America

and Asia.

SDCL is headquartered in London and also operates worldwide from

offices in New York, Dublin, Madrid, Hong Kong and Singapore. SDCL

is authorised and regulated in the UK by the Financial Conduct

Authority.

Further information can be found on at www.sdclgroup.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPPGQGPUPUUQC

(END) Dow Jones Newswires

December 24, 2020 02:00 ET (07:00 GMT)

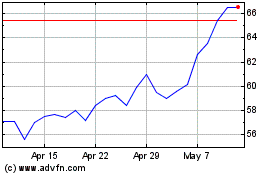

Sdcl Energy Efficiency I... (LSE:SEIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

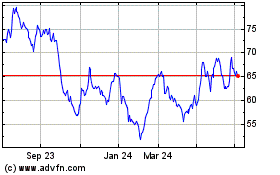

Sdcl Energy Efficiency I... (LSE:SEIT)

Historical Stock Chart

From Apr 2023 to Apr 2024