TIDMSEIT

RNS Number : 9383N

SDCL Energy Efficiency Income Tst

04 February 2021

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, DIRECTLY OR

INDIRECTLY, IN WHOLE OR IN PART, TO US PERSONS OR INTO THE UNITED

STATES, AUSTRALIA, CANADA, JAPAN, NEW ZEALAND OR THE REPUBLIC OF

SOUTH AFRICA OR INTO ANY OTHER JURISDICTION WHERE TO DO SO MIGHT

CONSTITUTE A VIOLATION OR BREACH OF ANY APPLICABLE LAW. PLEASE SEE

THE IMPORTANT NOTICE AT THE OF THIS ANNOUNCEMENT.

THIS ANNOUNCEMENT HAS BEEN DETERMINED TO CONTAIN INSIDE

INFORMATION.

4 February 2021

SDCL Energy Efficiency Income Trust plc

(the "Company")

Proposed Placing

The Board of Directors (the "Board") of SDCL Energy Efficiency

Income Trust plc announces a proposed Placing to raise

approximately GBP100 million through an issue of new Ordinary

Shares in the capital of the Company ("New Ordinary Shares") at a

price of 106.0 pence per Ordinary Share (the "Placing").

Highlights:

-- Placing of approximately 94.3 million New Ordinary Shares at

106.0 pence per New Ordinary Share (the "Placing Price") by way of

a Placing pursuant to the Company's existing Share Issuance

Programme;

-- The Placing Price of 106.0 pence represents a 3.9 per cent

premium to the Company's 30 September 2020 Net Asset Value ("NAV")

of 102.0 pence per Ordinary Share and a discount of 1.4 per cent to

the Company's closing share price of 107.5 pence per Ordinary Share

on 3 February 2021 (being the last business day prior to this

Announcement);

-- Investors in the Placing will be entitled to receive the next

quarterly dividend declared by the Company for the three-month

period to 31 December 2020, which is expected to be declared in

March 2021;

-- The Company's portfolio continues to perform as expected,

with no material operational matters to report since the 30

September 2020 interim report and subsequent acquisitions improving

portfolio diversification;

-- The Company has several 'organic' opportunities to make

further investments into projects or frameworks within its existing

portfolio as well as specific asset management initiatives at an

individual project level, with a value of approximately GBP100

million. These include:

o investments into commercial and industrial solar projects

across the United States in conjunction with Onyx;

o investments into energy efficiency projects across the United

States in conjunction with Sparkfund;

o investments into electric vehicle charging infrastructure

projects across the UK in conjunction with EV Networks;

-- In addition, the Investment Manager is currently progressing

a number of new investment opportunities, with a combined value in

excess of GBP100 million, which are at advanced stages of

negotiation or due diligence, which, if acquired, would provide

further geographic and technological diversification to the

existing portfolio.

The Placing is being conducted under the Company's existing

Share Issuance Programme in accordance with the Prospectus dated 19

June 2020.

Tony Roper, Chairman of SDCL Energy Efficiency Income Trust plc

said:

"We have made significant progress since our IPO in December

2018. By employing a disciplined acquisition strategy and rigorous

asset management, we have grown our portfolio to approximately

GBP600 million and delivered total shareholder returns of 17 per

cent.

Our issuance programme has allowed us to carefully align our

investment pipeline with our ongoing equity requirements and we

were delighted to rapidly deploy the GBP105 million we raised in

our oversubscribed placing in October into three significant new

acquisitions.

The importance of energy efficiency in ensuring that climate

targets can be met is becoming ever clearer and as this market

develops and matures, we are excited by the pipeline of investment

opportunities which the Investment Manager has assembled which not

only meet our strict investment criteria, but will also enhance and

further diversify our portfolio."

Background to the Issue

S DCL Energy Efficiency Income Trust plc is the first UK listed

company of its kind to invest exclusively in the energy efficiency

sector and listed on the London Stock Exchange in December

2018.

The Company currently has a portfolio of approximately GBP600

million(1) , including 34 different projects , diversified across

several technologies, sectors and geographies and has proven to be

robust in the face of the wider challenges posed by the Covid-19

pandemic over the last 12 months.

The Company currently has a market capitalisation of

approximately GBP560 million and continues to target a total return

for shareholders of 7-8 per cent. per annum by reference to the IPO

Share Price of GBP1.00 per Ordinary Share. The Company remains

focused on providing its investors with stable and long-term

income, with a dividend target of 5.5 pence per Ordinary Share for

the financial year to 31 March 2021, which represents a dividend

yield of 5.2 per cent at the Placing Price.

Investors in the Placing will be entitled to receive the next

quarterly dividend declared by the Company for the three-month

period to 31 December 2020, which is expected to be declared in

March 2021.

Trading Update

As at 30 September 2020, the Company had a portfolio valued at

GBP319 million, diversified across technology, geography and credit

counterparty. In October 2020, the Company raised GBP105 million

via a placing of New Ordinary Shares pursuant its existing Share

Issuance Programme.

Since 30 September 2020, the Company has acquired, or committed

to acquiring:

1. a 100% interest in a portfolio of six operating energy

efficient assets installed at the premises of five leading

industrial counterparties in Singapore for a consideration of

approximately GBP2 million;

2. a 100% interest in Värtan Gas Stockholm AB, the owner of the

established, operational and regulated gas distribution network for

Stockholm, Sweden for a consideration of approximately GBP107

million;

3. a 100% interest in a series of portfolios of commercial and

industrial on-site solar and energy storage projects across the

United States, together with a 50% interest in the platform that

has created them, Onyx Renewable Partners, for a consideration of

approximately GBP112 million; and

4. an additional 15% interest in Primary Energy, a portfolio of

recycled energy and cogeneration projects located in Indiana, USA

for a consideration of approximately GBP26 million.

Following these acquisitions, the Company's pro forma portfolio

is currently valued at approximately GBP600 million(1) . The

Company's portfolio continues to perform as expected, with no

material operational matters to report since the interim report for

the period ending 30 September 2020. Cashflows remain in-line with

the Company's underlying financial models supporting both the

Company's dividend as well as providing funds for re-investment

into the portfolio and the pipeline. The Investment Manager

continues to monitor any impact resulting from the COVID-19

pandemic and government restrictions on a project-by-project basis

but notes that it expects the capital value of the Company's

portfolio to have remained stable since 30 September 2020,

notwithstanding the implications of the COVID-19 pandemic.

All of the Company's projects benefit from legally contracted

revenues with approximately 65 per cent (by pro-forma value(1) ,

excluding cash) of the Company's investments being in projects

associated with investment grade or equivalent client

counterparties. In addition to this, many of the portfolio's assets

benefit from protective features which help to further reduce

credit risk. These include the strategic importance of the asset to

the economy, community or industrial process in which it sits; the

portfolio's overarching diversification across sector,

technologies, counterparties and end users; and additional security

packages including performance covenants and revenue guarantees

that are typically embedded into individual asset contracts.

The portfolio has a weighted average contract term of 14 years

and, noting the estimated useful economic life of several of the

assets, opportunities exist to expand this over time through

contract renegotiations and extensions.

The Company currently has a conservative level of gearing. The

Company takes into account non-recourse borrowings at the portfolio

level, as well as borrowings at the Company level, when calculating

its gearing limits. As at 31 December 2020, the total borrowings

across the portfolio on a consolidated basis were approximately

GBP208 million, equivalent to approximately 40% of pro-forma NAV(2)

and a Loan to Value(3) ratio of approximately 30 per cent.

On 1 October 2020, the Company published its first ESG Report

for the year ended 31 March 2020. SEEIT is dedicated to

accelerating the global transition to a low carbon economy and over

the reporting period delivered energy solutions that saved 156,000

tonnes of CO(2) emissions and produced 113,000 MWh of renewable

energy, as well as saving another 44,500 MWh via demand side energy

efficiency measures. In total, SEEIT's portfolio projects provided

3.6 million 'negawatts' of demand side energy reduction capacity

and supported nearly 1,300 jobs in this crucial sector of the

economy. The Company was awarded the London Stock Exchange's Green

Economy Mark in 2019 which recognises companies which derive the

majority of their revenue from environmental solutions.

The Company also hopes to benefit from a supportive global

government policy backdrop, with significant policy tailwinds such

as The Biden Plan's $2 trillion commitment to boost clean energy

and rebuild infrastructure over the next four years in the U.S.,

including upgrading four million buildings to make them more energy

efficient. In addition, the European Green Deal's renovation wave

strategy seeks to achieve large scale energy efficiency in

buildings across all member States, with Europe already

representing approximately 40% (between EUR85 and EUR90 billion

annually) of worldwide investments in this area.

Use of Proceeds

As the Company grows in size, it is seeing an increasing number

of 'organic' investment opportunities to make further or follow-on

investments into projects or frameworks within its existing

portfolio as well as specific asset management initiatives at an

individual project level. In assessing these opportunities, the

Company benefits from the increased visibility and access to the

projects that it enjoys as an existing owner, as well as

potentially transacting through existing pre-emption rights and/or

options which may allow the Company to profit from pre-determined

prices and increase the value of its investment. The Investment

Manager has identified approximately GBP100 million of follow-on

opportunities which it believes will be available over the coming

months including:

-- investments into commercial and industrial solar projects

across the United States in conjunction with Onyx;

-- investments into energy efficiency projects across the United

States in conjunction with Sparkfund;

-- investments into electric vehicle charging infrastructure

projects across the UK in conjunction with EV Networks.

The Investment Manager is also progressing a number of new

investment opportunities, with a combined value in excess of GBP100

million, which are at advanced stages of negotiation or due

diligence. The majority of these opportunities have been negotiated

either privately or on a bilateral basis and hence outside of a

competitive process, which helps ensure ongoing price discipline.

These include potential investments in energy efficiency, smart

metering, CHP/microgrid, renewable natural gas, hydrogen,

commercial and industrial solar and other solutions in the UK,

Europe, North America and in Asia which will enable further

technological and geographic diversification to the portfolio.

As part of its ongoing treasury management, the Company also

expects to repay its existing short term debt facilities (being an

acquisition debt facility of GBP30 million, which is fully drawn

and a revolving credit facility of GBP40 million, of which

approximately GBP35 million is drawn) post Admission and then

re-draw on the facilities in conjunction with new investments.

The Company has established a proven track record of sourcing

assets in advance of a fundraise and efficiently executing on

subsequent acquisitions. As with prior fundraise pipelines, the

Company does not intend to invest in all the opportunities it has

identified. However, the size and diversification of the pipeline

allows it to exercise pricing discipline when negotiating with

vendors as well as helping to minimize the potentially negative

effect of cash drag on financial returns.

Given the size and compelling nature of the current pipeline,

the Board and the Investment Manager believe that it is now an

appropriate time for the Company to issue new equity in order to

take advantage of these opportunities.

Benefits of the Placing

The Board believes that proceeding with the Placing will have

the following benefits for the Company:

-- Allow the Company to invest further capital in the Company's

identified pipeline opportunities to enable it to further diversify

its existing portfolio and secure value from new and organic

follow-on investments;

-- Provide the Company with immediate capital to allow it to act

quickly in securing existing investment opportunities as well as

having sufficient capital to fund new opportunities;

-- Create the potential to enhance the NAV per share of the

existing Ordinary Shares through the issuance of New Ordinary

Shares at a premium to NAV, after the related costs have been

deducted;

-- Spread the Company's fixed running costs across a wider base

of shareholders, and benefit from the reducing scale of charges for

the Investment Manager, thereby reducing the total expense ratio;

and

-- Increase the size of the Company which should help make the

Company more attractive to a wider base of investors and improve

market liquidity in the Ordinary Shares.

Further details

Jefferies International Limited ("Jefferies") is acting as sole

sponsor, global co-ordinator and bookrunner to the Company in

connection with the Placing. Jefferies will today commence a

bookbuild process in respect of the Placing at the Placing Price.

The Placing will be non-pre-emptive pursuant to the terms set out

in the Prospectus and is expected to close no later than 11.00 a.m.

on 11 February 2021 but may be closed earlier or later at the

absolute discretion of Jefferies and the Company.

The Placing is conditional, inter alia, on the Ordinary Shares

being admitted to listing on the premium listing segment of the

Official List of the FCA, and to trading on the main market for

listed securities of the London Stock Exchange (together,

"Admission"). Subject to Admission becoming effective, it is

expected that settlement of subscriptions by placees in respect of

the Ordinary Shares and trading in the Ordinary Shares will

commence at 8.00 a.m. GMT on 16 February 2021, or such later time

and/or date as may be announced by the Company after the close of

the Placing.

The new Ordinary Shares issued pursuant to the Placing will rank

pari passu in all respects with the existing Ordinary Shares,

including the right to receive all dividends and other

distributions declared, made or paid after the date of issue. For

the avoidance of doubt, investors who acquire Ordinary Shares in

the Placing will be entitled to receive the next quarterly dividend

which relates to the period 30 September 2020 to 31 December 2020

and is expected to be declared in March 2021.

The target number of Ordinary Shares to be issued pursuant to

the Placing is approximately 94.3 million but the Board may

increase the number of Ordinary Shares to be issued under the

Placing if it, in consultation with Jefferies and the Investment

Manager, believes there is sufficient investor demand for those

shares and suitable assets available for investment in which to

deploy the Placing proceeds in a timely and efficient manner.

The Placing is not underwritten. The Placing may be scaled back

by the Company for any reason, including where it is necessary to

scale back allocations to ensure the Placing proceeds align with

the Company's post fundraise acquisition targets. Details of the

number of Ordinary Shares to be issued pursuant to the Placing will

be determined by the Board (following consultation with Jefferies

and the Investment Manager) and will be announced as soon as

practicable after the close of the Placing.

The Placing Price is 106.0 pence per New Ordinary Share. The

Placing Price has been set by the Board following their assessment

of market conditions.

The New Ordinary Shares acquired in the Placing should be

eligible to be held in a stocks and shares ISA, subject to

applicable annual subscription limits. In addition, the New

Ordinary Shares should be eligible for inclusion in a self-invested

personal pension ("SIPP") or a small self-administered scheme

("SSAS"), subject to the discretion of the trustees of the SIPP or

the SSAS, as the case may be. Individuals wishing to invest in New

Ordinary Shares through an ISA, SSAS or SIPP should contact their

professional advisers regarding their eligibility.

By choosing to participate in the Placing and by making an oral

and legally binding offer to subscribe for Ordinary Shares,

investors will be deemed to have read and understood this

Announcement and the Prospectus in their entirety and to be making

such offer on the terms and subject to the conditions in the

Prospectus, and to be providing the representations, warranties and

acknowledgements contained therein.

A copy of the Prospectus is available on National Storage

Mechanism at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism as well as

on the Company's website at www.sdcleeit.com. Full details of the

Terms and Conditions of the Placing are available in the

Prospectus.

Expected Timetable

Placing opens 4 February 2021

Latest time and date for applications 11.00 a.m. 11 February 2021

under the Placing

Results of the Placing announced 7 .00 a.m. GMT on 12 February

2021

Admission of the Ordinary Shares 8.00 a.m. GMT on 16 February

to the Official List and commencement 2021

of dealings on the London Stock

Exchange's main market for listed

securities

The dates and times specified above are subject to change. In

particular, the Directors may (with the prior approval of

Jefferies) bring forward or postpone the closing time and date for

the Placing. In the event that a date or time is changed, the

Company will notify persons who have applied for Ordinary Shares by

post, by electronic mail or by the publication of a notice through

a Regulatory Information Service.

References to all times are to London times unless otherwise

stated.

Dealing codes

Ticker SEIT

ISIN for the Ordinary Shares GB00BGHVZM47

SEDOL for the Ordinary Shares BGHVZM4

Legal Entity Identifier (LEI) 213800ZPSC7XUVD3NL94

Unless otherwise defined, capitalised terms used in this

announcement shall have the same meaning as set out in the

Prospectus published on 19 June 2020.

For Further Information

Sustainable Development Capital T: +44 (0) 20 7287 7700

LLP

Jonathan Maxwell

Purvi Sapre

Eugene Kinghorn

Keith Driver

Jefferies International Limited T: +44 (0) 20 7029 8000

Tom Yeadon

Gaudi Le Roux

Neil Winward

TB Cardew T: +44 (0) 20 7930 0777

Ed Orlebar M: +44 (0) 7738 724 630

Joe McGregor E: seeit@tbcardew.com

(1) Pro forma portfolio value is as at the latest published

valuation date (30 September 2020) with post period investments

held at cost. Includes cash and undrawn commitment for Onyx for

which the Purchase and Sale Agreement was executed on 23 December

2020 and completion expected in February 2021. FX rates as at 31

December 2020

(2) Pro forma NAV based on 30 September 2020 NAV adjusted for

capital raising in October 2020, subsequent acquisitions at cost

and working capital movements (all in GBPm)

(3) Loan to value ("LTV") calculated by total debt divided by

total assets (grossed up for the same debt)

Important Information

This announcement is not an offer to sell or a solicitation of

any offer to buy the Shares in the Company in the United States,

Australia, Canada, New Zealand or the Republic of South Africa,

Japan, or in any other jurisdiction where such offer or sale would

be unlawful.

This communication is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This communication is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities Act of 1933, as

amended, and may not be offered or sold in the United States,

except pursuant to an applicable exemption from registration. No

public offering of securities is being made in the United

States.

The Company has not been and will not be registered under the US

Investment Company Act of 1940 (the "Investment Company Act") and,

as such, holders of the Shares will not be entitled to the benefits

of the Investment Company Act. No offer, sale, resale, pledge,

delivery, distribution or transfer of the Shares may be made except

under circumstances that will not result in the Company being

required to register as an investment company under the Investment

Company Act.

This communication is only addressed to, and directed at,

persons in member states of the European Economic Area who are

"qualified investors" within the meaning of Article 2(e) of the

Prospectus Regulation ("Qualified Investors"). For the purposes of

this provision, the expression "Prospectus Regulation" means

Regulation (EU) 2017/1129. In the United Kingdom, this

communication is being distributed only to, and is directed only

at, "qualified investors" (as defined in the UK version of the

Prospectus Regulation, which forms part of UK law by virtue of the

European Union (Withdrawal) Act 2018 (as amended from time to

time)): (i) who have professional experience in matters relating to

investments who fall within the definition of "investment

professional" in Article 19(5) of the Financial Services and

Markets Act 2000 (Financial Promotion) Order 2005, as amended (the

"Order"), or (ii) who are high net worth companies, unincorporated

associations and partnerships and trustees of high value trusts as

described in Article 49(2) of the Order, and (iii) other persons to

whom it may otherwise lawfully be communicated (all such persons

together being referred to as "relevant persons"). Any investment

or investment activity to which this communication relates is

available only to and will only be engaged in with such persons.

This communication must not be acted on or relied on in any member

state of the European Economic Area who are not Qualified Investors

or in the United Kingdom by persons who are not relevant

persons.

The merits or suitability of any securities must be

independently determined by the recipient on the basis of its own

investigation and evaluation of the proposed investment trust. Any

such determination should involve, among other things, an

assessment of the legal, tax, accounting, regulatory, financial,

credit and other related aspects of the securities.

This announcement may not be used in making any investment

decision. This announcement does not contain sufficient information

to support an investment decision and investors should ensure that

they obtain all available relevant information before making any

investment. This announcement does not constitute and may not be

construed as an offer to sell, or an invitation to purchase or

otherwise acquire, investments of any description, nor as a

recommendation regarding the possible offering or the provision of

investment advice by any party. No information in this announcement

should be construed as providing financial, investment or other

professional advice and each prospective investor should consult

its own legal, business, tax and other advisers in evaluating the

investment opportunity. No reliance may be placed for any purposes

whatsoever on this announcement or its completeness.

Nothing in this announcement constitutes investment advice and

any recommendations that may be contained herein have not been

based upon a consideration of the investment objectives, financial

situation or particular needs of any specific recipient.

The information and opinions contained in this announcement are

provided as at the date of the document and are subject to change

and no representation or warranty, express or implied, is or will

be made in relation to the accuracy or completeness of the

information contained herein and no responsibility, obligation or

liability or duty (whether direct or indirect, in contract, tort or

otherwise) is or will be accepted by the Company, SDCL, Jefferies

or any of their affiliates or by any of their respective officers,

employees or agents in relation to it. No reliance may be placed

for any purpose whatsoever on the information or opinions contained

in this announcement or on its completeness, accuracy or fairness.

The document has not been approved by any competent regulatory or

supervisory authority.

The Company has a limited trading history. Potential investors

should be aware that any investment in the Company is speculative,

involves a high degree of risk, and could result in the loss of all

or substantially all of their investment. Results can be positively

or negatively affected by market conditions beyond the control of

the Company or any other person. The returns set out in this

document are targets only. There is no guarantee that any returns

set out in this document can be achieved or can be continued if

achieved, nor that the Company will make any distributions

whatsoever. There may be other additional risks, uncertainties and

factors that could cause the returns generated by the Company to be

materially lower than the returns set out in this announcement.

Past performance cannot be relied on as a guide to future

performance.

The information in this announcement may include forward-looking

statements, which are based on the current expectations and

projections about future events and in certain cases can be

identified by the use of terms such as "may", "will", "should",

"expect", "anticipate", "project", "estimate", "intend",

"continue", "target", "believe" (or the negatives thereon) or other

variations thereon or comparable terminology. These forward-looking

statements, as well as those included in any related materials, are

subject to risks, uncertainties and assumptions about the Company,

including, among other things, the development of its business,

trends in its operating industry, and future capital expenditures

and acquisitions. In light of these risks, uncertainties and

assumptions, the events in the forward-looking statements may not

occur.

Each of the Company, SDCL, Jefferies and their affiliates and

their respective officers, employees and agents expressly disclaim

any and all liability which may be based on this announcement and

any errors therein or omissions therefrom.

No representation or warranty is given to the achievement or

reasonableness of future projections, management targets,

estimates, prospects or returns, if any. Any views contained herein

are based on financial, economic, market and other conditions

prevailing as at the date of this announcement. The information

contained in this announcement will not be updated.

This announcement does not constitute or form part of, and

should not be construed as, any offer or invitation or inducement

for sale, transfer or subscription of, or any solicitation of any

offer or invitation to buy or subscribe for or to underwrite, any

share in the Company or to engage in investment activity (as

defined by the Financial Services and Markets Act 2000) in any

jurisdiction nor shall it, or any part of it, or the fact of its

distribution form the basis of, or be relied on in connection with,

any contract or investment decision whatsoever, in any

jurisdiction. This announcement does not constitute a

recommendation regarding any securities.

Prospective investors should take note that the Company's Shares

may not be acquired by: (i) investors using assets of: (A) an

"employee benefit plan" as defined in Section 3(3) of US Employee

Retirement Income Security Act of 1974, as amended ("ERISA") that

is subject to Title I of ERISA; (B) a "plan" as defined in Section

4975 of the US Internal Revenue Code of 1986, as amended (the "US

Tax Code"), including an individual retirement account or other

arrangement that is subject to Section 4975 of the US Tax Code; or

(C) an entity which is deemed to hold the assets of any of the

foregoing types of plans, accounts or arrangements that is subject

to Title I of ERISA or Section 4975 of the US Tax Code; or (ii) a

governmental, church, non-US or other employee benefit plan that is

subject to any federal, state, local or non-US law that is

substantially similar to the provisions of Title I of ERISA or

Section 4975 of the US Tax Code.

Jefferies is authorised and regulated in the United Kingdom by

the Financial Conduct Authority. Jefferies is acting for the

Company and no one else in connection with the Placing, and will

not be responsible to anyone other than the Company for providing

the protections afforded to clients of Jefferies or for affording

advice in relation to any transaction or arrangement referred to in

this announcement. This announcement does not constitute any form

of financial opinion or recommendation on the part of Jefferies or

any of its affiliates and is not intended to be an offer, or the

solicitation of any offer, to buy or sell any securities. Regulated

services with respect to EU27 countries and EU27 investors shall be

undertaken by such of Jefferies International Limited's affiliates

as Jefferies acting in good faith thinks fit and references to

Jefferies International Limited shall be read as references to such

affiliate(s).

In accordance with the UK version of the Packaged Retail and

Insurance-based Investment Products Regulation (EU) No 1286/2014

which forms part of UK law by virtue of the European Union

(Withdrawal) Act 2018 (as amended from time to time), the Key

Information Document relating to the Company is available to

investors at www.seeitplc.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IOEDDGDDLDGDGBX

(END) Dow Jones Newswires

February 04, 2021 02:00 ET (07:00 GMT)

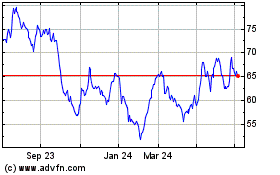

Sdcl Energy Efficiency I... (LSE:SEIT)

Historical Stock Chart

From Mar 2024 to Apr 2024

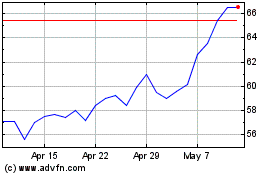

Sdcl Energy Efficiency I... (LSE:SEIT)

Historical Stock Chart

From Apr 2023 to Apr 2024