TIDMSFOR

RNS Number : 4656T

S4 Capital PLC

25 March 2021

25 March 2021

S(4) Capital plc

("S(4) Capital" or the "Company")

Unaudited 2020 preliminary results

New age/new era digital marketing model starts to convert at

scale

Significant growth in like-for-like and pro-forma billings,

revenue, gross profit and EBITDA

Announcement of MediaMonks conditional combination with Jam3

Financial Highlights

-- Billings* GBP653.4 million, up 43.4% reported, up 19.6%

like-for-like*** and pro-forma** billings GBP768.4 million, up

22.3%.

-- Revenue GBP342.7 million, up 59.3% reported from GBP215.1

million, like-for-like up 15.2%, pro-forma up 20.1%.

-- Gross profit GBP295.2 million, up 72.3% reported from

GBP171.3 million, like-for-like up 19.4%, pro-forma up 23.7%.

-- Operational EBITDA**** GBP62.2 million, up 86.1% reported,

like-for-like up 18.3%, pro-forma up 30.6%.

-- Operational EBITDA margin 21.1%, up 1.6 margin points on 2019

reported, like-for-like down 0.2 margin points, pro-forma up 1.2

margin points.

-- Operating profit GBP8.1million versus an operating loss of

GBP3.8 million in 2019. Operating profit is after charging GBP49.9

million of Adjusting Items relating to acquisitions, amortisation

and share based payments (including GBP7.4 million in deferred,

contingent combination payments tied to continued employment).

Pro-forma operating profit of GBP16.9 million versus an operating

loss of GBP1.2 million in 2019.

-- Profit before income tax GBP3.1 million, after charging

adjusting items, versus a loss of GBP9.2 million in 2019 and

pro-forma profit before income tax of GBP12.1 million

-- Statutory result for the period GBP3.9 million (loss) after

charging adjusting items after taxation versus GBP10.0 million

(loss) in 2019 and pro-forma result for the period of GBP1.2

million (loss)

-- Adjusted basic net result per share 7.9p versus 5.2p in 2019 and 9.8p pro-forma

-- Basic and diluted net result per share 0.8p (loss) which

includes adjusting items after tax versus 2.7p (loss) in 2019 and

pro-forma adjusted basic net result per share 0.2p (loss)

-- Year-end net cash***** GBP51.6 million, even after

significant combination payments since GBP113 million net

fundraising in July 2020, reflecting strong liquidity from

operations and EBITDA conversion to cash flow from operating

activities of 99% versus 74% in 2019

-- Good start to 2021 with like-for-like January gross profit

well ahead of budget and with budgeted gross profit growth

like-for-like for 2021 of 25%

*Billings is gross billings to client including pass through

costs

**Pro-forma numbers relate to unaudited full year non-statutory

and non-GAAP consolidated results in constant currency as if the

group had existed in full for the year and have been prepared under

comparable GAAP with no consolidation eliminations

***like-for-like relates to 2019 being restated to show the

unaudited numbers for the previous year of the existing and

acquired businesses consolidated for the same months as in 2020

applying currency rates as used in 2020

****Operational EBITDA is EBITDA adjusted for non-recurring

items and recurring share-based payments and is a non-GAAP measure

management uses to assess the underlying business performance.

Operational EBITDA margin is operational EBITDA divided by Gross

Profit.

*****Net cash including bank loans

Strategic and operational Highlights

-- In January, MediaMonks announced a combination with Circus

Marketing, a fully integrated digital agency, based in the Americas

and Spain (consolidated as from March 2020).

-- In May, MightyHive announced a combination with Digodat, a

leading Latin American data & analytics consultancy

(consolidated as from July).

-- In June, MightyHive announced a combination with Lens 10, a

leading Australian digital strategy & analytics consultancy

(consolidated as from October).

-- In July, MightyHive announced a combination with Orca

Pacific, a Seattle-based, Amazon-managed service provider

(consolidated as from August) and raised GBP113 million net

proceeds from a placing.

-- In August, MightyHive, announced a combination with

BrightBlue Consulting, an award-winning UK-based, data analytics

and measurement consultancy (consolidated as from September).

-- In September, BMW/MINI announced a new agency partner network

in Europe, called THE MARCOM ENGINE which included MediaMonks,

which would be "at the heart of the new constellation". On the same

day, MediaMonks announced a combination with Dare.Win, an

award-winning, Paris-based, digital creative agency.

-- In November, Mondēlez International confirmed that MediaMonks

had won its competitive pitch to manage its tech infrastructure and

websites globally, plus content production for North America, Latin

America, Asia, Middle-East and Africa.

-- Post year end:

o In January 2021, MediaMonks announced combinations with

Decoded Advertising, an integrated, creative, technology and media

agency, based in New York and also combined with Tomorrow, an

award-winning, Shanghai-based, creative agency and with Staud

Studios, a high-end creative, production studio, specialising in

the automotive industry.

o Also, in January, MightyHive announced a combination with

Metric Theory, an integrated performance marketing agency,

providing services across search, social and commerce media. Metric

Theory and Decoded Advertising were completed on 31 December, 2020

after the market was closed. As a result, the balance sheets of

both combinations are included in the consolidated balance sheet of

the Group.

o In February, MightyHive acquired the assets of Datalicious Australia, a Sydney, Melbourne and Brisbane-based data & analytics company.

o Today, S(4) Capital announced that it has entered into a

conditional agreement in relation to a combination of MediaMonks

with highly awarded design and experience agency, Jam3, based in

Toronto with offices in Amsterdam, Los Angeles and Uruguay.

o The pace of on-boarding both the new BMW/MINI and Mondēlez

"Whoppers" has intensified during the first and second quarters of

2021.

-- Addition of functional talent teams in fashion and luxury,

social media and government communications from leading

competitors, the first during 2020 and the last two in 2021.

-- Launch of both S4 Fellowship Programme for students from

Historically Black Colleges and Universities and in due course,

High Schools in the United States and S4 Women Leadership Programme

in association with UC Berkeley in California.

-- The Group now has approximately 4,400 people in 31 countries,

trending towards double where we were this time last year.

-- In addition to new client BMW/MINI and the significant

broadening of our relationship with Mondēlez, there were major new

remits from clients such as Google, Facebook, Amazon, Netflix,

Procter & Gamble, T-Mobile, Bayer & HP and major new

assignments from Cisco, Embibe, Harley Davidson, PayPal, LA28,

Shopify and Verizon amongst others, reflecting the strong tech

orientation of the Company's client base and the growing healthcare

and FMCG focus.

-- Current pipeline running at stronger level than last year

-- Appointment of Miles Young, a leading, industry-knowledgeable

Non-Executive Director, to the Board.

Sir Martin Sorrell, Executive Chairman of S(4) Capital plc

said:

"Our second full financial year was again outstandingly

successful. Having established brand awareness and secured brand

trial in the back end of 2018 and in 2019, we set about converting

client relationships at scale and now have five "Whoppers" secure

or in sight, in line with our ultimate 20 squared objective, that

is 20 clients each generating revenues of over $20 million per

annum.

Pride of place for these achievements should go to our (now)

over 4,400 people in 31 countries, who have responded unflinchingly

to the colossal strain and challenge of the pandemic. Their

creativity, adaptability, resilience and hard work have made this

success possible and have started to prove the potency of our new

age/new era, digital, data-driven, unitary model, which has started

to gain significant traction. The pandemic has, at the same time,

accelerated adoption of digital transformation amongst consumers,

across all media and within enterprises and, in turn, stimulated

the demand from clients for digital marketing expertise.

We continued to grow our top line and bottom line at industry

leading rates, despite covid-19 and exhibited agility in developing

new content revenue streams quickly, such as robotic production,

animation and on-line events and driving data & digital

marketing net revenues, particularly in the fourth quarter and into

this year. We continued to broaden and deepen our Content and Data

& digital media practices through organic growth and by the

addition of a further four Content and six Data & digital media

companies in 2020 and so far in early 2021. We further integrated

our unitary client offering around our Content and Data &

digital media practices. We broadened and deepened our client

roster. We embraced the diversity, equity and inclusion and ESG

opportunities and challenges with unique black-orientated

fellowship and female executive leadership programmes, changed

hiring practices and education programmes and made zero carbon

commitments targeting 2024. We achieved double $ and GBP Unicorn

status in terms of stock market value, in only our second full

year, while strengthening our balance sheet to take advantage of

short-term opportunities.

2021 has started strongly, well in line with our latest three

year plan to double organically in three years and we are focused

on three objectives for the year - to bed down our two new

"Whoppers" and develop and identify five more; to roll-out our

unitary branding; and to continue to broaden and deepen our digital

client offering by combination. We believe 2021 and 2022 will be

very strong years economically, as the world rebounds from the

pandemic and spends and invests the huge pandemic-driven fiscal and

monetary stimulus. Digital marketing expenditure is closely

correlated, but not dependent on GDP growth, just as traditional

media spending used to be in the last century."

Results webcast and conference call

A webcast will be held at 8.00am GMT. A live webcast of the

presentation will be available during the event at:

https://brrmedia.news/9ms2h

For Q&A:

UK: +44 (0)330 336 9125

US: +1 323-794-2093

Confirmation code: 6050306

A further live webcast conference call to cover the results will

be held today at 9.00am EDT / 13.00pm GMT and will be available at:

https://brrmedia.news/9fjjd

For Q&A

US: +1 323-794-2093

UK: +44 (0)330 336 9434

Confirmation code: 2926753

Enquiries to:

+44 (0)20 3793

S(4) Capital plc 0003

Sir Martin Sorrell, Executive Chairman

Peter Rademaker, Chief Financial Officer

Scott Spirit, Chief Growth Officer

Dowgate Capital Limited +44 (0)20 3903

(Joint Corporate Broker to S(4) Capital plc) 7715

James Serjeant

David Poutney

Jefferies International Limited +44 (0)20 7029

(Joint Corporate Broker to S(4) Capital plc) 8000

Tony White

Harry Le May

Morgan Stanley & Co. International plc +44 (0)20 7425

(Joint Corporate Broker to S(4) Capital plc) 8000

Paul Baker

Alex Smart

+44 (0)7970 246

725 / (0)7917 886

Powerscourt (PR Advisor) 576

Elly Williamson

Jack Shelley

Chairman's Letter

Dear Shareowner,

My Executive colleagues, Victor Knaap, Wesley ter Haar, Pete

Kim, Christopher Martin, Peter Rademaker, Scott Spirit, Michel de

Rijk and I are delighted to present our third full year results for

the period ending 31 December 2020 to our fellow shareowners.

In 2020, we continued to build our existing relationships with

clients such as Google, Facebook, Amazon, Netflix, Procter &

Gamble, T-Mobile, Bayer and Mondēlez and won significant new

business from BMW/MINI, Cisco, Embibe, Harley Davidson, PayPal,

LA28, Shopify and Verizon. Tech clients account for around 55% of

revenues, with a growing cadre of healthcare and FMCG clients.

We now project five "Whoppers" (clients with revenues over $20

million per annum), as opposed to only two at this time last year.

We have also now identified five more potential "Whoppers", where

we currently project $5-15 million of revenue per annum and

potentially could break through the $20 million per annum level. We

are also in the process of identifying five more potential

"Whoppers" currently generating under $10 million per annum,

bringing the total actual and potential "Whoppers" to 15 out of the

target of 20.

2020 also saw significant strengthening and deepening of our

Content and Data & digital media practices. MediaMonks

broadened and deepened its geographical footprint in 2020 and so

far in 2021, adding North and Latin American and Spanish content

capabilities with Circus Marketing, entering the French market with

Dare.Win , combining with Decoded in the United States, doubling up

in Shanghai with Tomorrow and opening up in Germany with Staud

Studios to build on the BMW/MINI relationship. MediaMonks also

added significant talent from competitors in the areas of fashion

and luxury, new digital media social content and digital government

communications. MightyHive was even more active in 2020 and so far

in 2021 , building its data & analytics capability inside and

outside the United States through the addition of Digodat in Latin

America, Lens 10 in Australia and New Zealand, Orca Pacific

specialising in the Amazon platform in Seattle, BrightBlue

Consulting in the UK and a second Datalicious operation in

Australia to complement South Korea. MightyHive also stepped up its

performance media capabilities adding Metric Theory.

Both MediaMonks and MightyHive have integrated each combination

into our Content and Data & digital media practices and brands

and we are starting to roll out our unitary brand. We already

operated as a single P&L, pretty much from inception, so as to

develop and maintain a seamless, fully integrated offer for our

clients. In addition, although nothing good can be said to have

come from it , the pandemic did enable us to consolidate separate

offices on a city-by-city basis faster, as existing leases were

terminated more quickly . In addition, property consolidation will

be assessed faster as vaccinations start to kick-in and lockdowns

ease, starting in the second quarter of 2021. There is little doubt

that we will not go back to the old normal in terms of office

location, layout and use. There will be more flexible working from

home, probably about 40% of the working week, with more flexible

commuting times, more dispersed working and living patterns and

different office layouts, with separate spaces for our people to

meet, to work and to engage with clients. We are also starting to

increasingly consolidate our strategic, client content and data and

programmatic offer at the S (4) Capital level.

Our focus on both developing our advertising and marketing

services know how and geographical expansion, particularly in Asia

Pacific, was further underlined by the appointment of Miles Young,

Warden of New College, Oxford University as a non-executive

director . He was formerly my colleague at WPP, where he was at

Ogilvy for 35 years and ran it very successfully for eight years

until 2016, expanding their footprint aggressively in growth areas

such as digital content and media and Asia Pacific, particularly

China and India - truly one of David Ogilvy's "Gentlemen with

Brains".

Summary of results

Condensed Consolidated Income Statement

For the period ended 31 Dec 2020 (unaudited)

Like

Year Year for like

ended ended cc Proforma Proforma

Year Year Year

31 ended ended ended

Dec 31 Dec 31 Dec 31 Dec 30 Dec

2020 2019 2019 2020 2019

For the period

ended 31

December LIR'000 LIR'000 YoY% LIR'000 YoY% LIR'000 LIR'000 YoY%

---------------- ---- ------------ ------------ ------------ ------------ ------------

Revenue 342,687 215,132 59% 297,410 15% 421,092 350,576 20%

Cost of sales 47,505 43,814 8% 50,129 -5% 52,137 52,324 0%

------------------------ ------------ ------------ ------------ ------------ ------------

Gross profit 295,182 171,318 72% 247,281 19% 368,955 298,252 24%

Net operating

expenses 287,049 175,153 64% 247,079 16% 352,008 299,422 18%

Operating profit/

(loss) 8,133 (3,835) - 202 3919% 16,948 (1,170) -

------------------------ ------------ ------------ ------------ ------------ ------------

Adjusted operating

profit 57,950 31,148 86% 50,019 16% 80,453 62,335 29%

Adjusting items (49,817) (34,983) - (49,817) - (63,505) (63,505) -

------------------------ ------------ ------------ ------------ ------------ ------------

Operating profit/

(loss) 8,133 (3,835) - 202 3919% 16,948 (1,170) -

Net finance

expense (5,037) (5,360) - (5,672) - (4,821) (5,530) -

------------------------ ------------ ------------ ------------ ------------ ------------

Profit / (loss)

before income

tax 3,096 (9,195) - (5,469) - 12,126 (6,700) -

Income tax

expense (7,025) (845) - (3,436) - (13,323) (6,543) -

------------------------ ------------ ------------ ------------ ------------ ------------

Loss for the

period (3,929) (10,040) - (8,905) - (1,197) (13,243) -

------------------------ ------------ ------------ ------------ ------------ ------------

Reconciliation

to operational

EBITDA

Operating profit

/ (loss) 8,133 (3,835) 202 16,948 (1,170)

Adjusting items 49,817 34,983 49,817 63,505 63,505

Depreciation

(excluding

right-of-use asset

depreciation) 4,228 2,260 2,520 4,679 2,829

-----------------------

Operational

EBITDA 62,178 33,408 86% 52,539 18% 85,132 65,164 31%

Central costs 6,112 5,817 5,859 6,112 5,859

------------------------

Operational EBITDA

before central costs 68,290 39,225 74% 58,398 17% 91,244 71,023 28%

======================= ============ ============ ====== ============ ====== ============ ============ ======

Reconciliation

to adjusted

operating

profit

---------------- ---- ------------ ------------ ------------ ------------ ------------

Operating profit

/ (loss) 8,133 (3,835) 202 16,948 (1,170)

Adjusting items 49,817 34,983 49,817 63,505 63,505

Adjusted operating

profit 57,950 31,148 86% 50,019 16% 80,453 62,335 29%

======================== ============ ============ ====== ============ ====== ============ ============ ======

Reconciliation

to adjusted result

before income

tax

---------------------- ------------ ------------ ------------ ------------ ------------

Result before

income tax 3,096 (9,195) (5,469) 12,126 (6,700)

Adjusting items 49,817 34,983 49,817 63,505 63,505

Adjusted result

before income

tax 52,913 25,788 105% 44,348 19% 75,631 56,805 33%

======================== ============ ============ ====== ============ ====== ============ ============ ======

Reconciliation

to adjusted

result for

the period

---------------- ---- ------------ ------------ ------------ ------------ ------------

Result for

the period (3,929) (10,040) (8,905) (1,197) (13,243)

Adjusting items 49,817 34,983 49,817 63,505 63,505

Tax on adjusting

items (6,996) (5,957) (6,996) (10,401) (10,401)

Adjusted result

for the period 38,892 18,986 105% 33,916 15% 51,907 39,861 30%

======================== ============ ============ ====== ============ ====== ============ ============ ======

Earnings per

share

---------------- ---- ------------ ------------ ------------ ------------ ------------

Weighted average number

of shares in issue for

the purpose of basic

and adjusted net

result

per share 493,290,974 368,067,662 493,290,974 529,788,744 529,788,744

Net result attributable

to equity owners of

the

Company (GBP'000) (3.929) (10,040) (8,905) (1,197) (13,243)

Basic net result

per share (pence) -0.8 -2,7 -1.8 -0.2 -2.5

Diluted net

result per

share (pence) -0.8 -2,7 -1.8 -0.2 -2.5

Adjusted non-recurring

expenses and

acquisition

related expenses 15,768 12,806 15,768 15,768 15,768

Share based

compensation 12,331 7,177 12,331 12,331 12,331

Revaluation contingent

considerations (1,430) 0 (1,430) (1,430) (1,430)

Adjusted amortisation

of intangible assets

related to

acquisitions 23,148 15,000 23,148 36,836 36,836

Adjusted tax

on adjustments (6,996) (5,957) (6,996) (10,401) (10,401)

Adjusted net

result 38,892 18,986 33,916 51,907 39,861

Adjusted Basic net

result per share

(pence) 7.9 5.2 53% 6.9 15% 9.8 7.5 30%

======================= ============ ============ ====== ============ ====== ============ ============ ======

Gross margin

per territory

---------------- ---- ------------ ------------ ------------ ------------ ------------

Americas 206,316 117,062 76% 173,258 19% 270,550 216,543 25%

EMEA 58,233 40,765 43% 52,776 10% 65,216 58,618 11%

Asia-Pacific 30,633 13,490 127% 21,248 44% 33,190 23,091 44%

Total 295,182 173,318 72% 247,281 19% 368,955 298,252 24%

======================== ============ ============ ====== ============ ====== ============ ============ ======

Gross margin

per practice

---------------- ---- ------------ ------------ ------------ ------------ ------------

Content 220,497 113,365 95% 182,792 21% 264,671 210,117 26%

Programmatic 74,685 57,953 29% 64,489 16% 104,285 88,135 18%

Total 295,182 171,318 72% 247,281 19% 368,955 298,252 24%

======================== ============ ============ ====== ============ ====== ============ ============ ======

Turning to the results themselves, we thought it would be most

useful to compare the reported results not only with last year's

reported results, but also on an unaudited like-for-like and

unaudited pro-forma basis, particularly given the continued rapid

inorganic expansion of the Company in 2020.

Billings were GBP653.4 million, up 43.4% on a reported basis, up

19.6% like-for-like and up 22.3% pro-forma. Controlled Billings,

that is billings we influenced in addition to billings that flowed

through our income statement, were approximately GBP2.3 billion

(2019: GBP1.9 billion). Revenue was GBP342.7 million, up 59.3% from

GBP215.1 million on a reported basis, up 15.2% like-for-like, and

up 20.1% on a pro-forma basis. Gross profit was GBP295.2 million,

up 72.3% reported, up 19.4% like-for-like, and up 23.7% pro-forma.

Operating profit was GBP8.1 million versus an operating loss of

GBP3.8 million in 2019. Operational EBITDA was GBP62.2 million, up

86.1% reported, up 18.3% like-for-like, and up 30.6% pro-forma.

Operational EBITDA margin was 21.1%, up 1.6 margin points versus

19.5% reported in 2019, down 0.2 margin points like-for-like and,

up 1.2 margin points pro-forma. Adjusted basic net result per share

was 7.9p versus 5.2p in 2019, 6.9p like-for-like and 9.8p

pro-forma. Statutory result for the period was GBP3.9 million

(loss), versus a reported GBP10.0 million (loss) in 2019, after

charging under IFRS GBP7.4 million of combination payments, which

were tied to the continued employment of key merger share-owning

principals. Although such contractual provisions result in a

non-cash charge to the income statement, your Board believes this

is a better commercial approach given the nature of our business.

Basic and diluted net result per share were 0.8p (loss) per share,

versus 2.7p (loss) in 2019, like-for-like 1.8p (loss) per share and

pro-forma 0.2p (loss) per share. Year-end net cash was GBP51.6

million, despite making GBP83 million in cash combination payments,

since the GBP113 million gross equity fundraising in July 2020 and

reflecting strong cash flow from operating activities with 99%

operating cash flow conversion from EBITDA. In line with our first

half statement in September 2020, Operational EBITDA margins

improved significantly in the second half from 14.5% to 25.8%, as

the first half increased investment in people yielded higher

productivity in the second half.

Pro-forma billings were GBP768.4 million. Pro-forma revenue was

GBP421.1 million and pro-forma gross profit was GBP369.0 million up

20.1% and 23.7% respectively in 2019. Pro-forma operational EBITDA

was GBP85.1 million, up 30.6% on 2019, with operational EBITDA

margin at 23.1%, up 1.2 margin points on the previous year.

Pro-forma adjusted operating profit excluding adjusting items of

GBP63.5 million, is GBP80.5 million, up 29.1% on the previous year.

Pro-forma adjusted pre-tax profits were GBP75.6 million versus

GBP56.8 million in the previous year, up 33.1%. Pro-forma adjusted

result for the period was GBP51.9million, up 30.2%. Adjusted

pro-forma basic earnings per share before exceptional items were

9.8p, up from 7.5p in the previous year. The Board continues to

recommend no dividend given the growth opportunities that

beckon.

By geography, on a pro-forma basis, the Americas accounted for

73.3% of gross profit against 72.6% in 2019. Europe, the

Middle-East and Africa represented 17.7% of gross profit against

19.7% in 2019. Asia-Pacific represented 9.0% of gross profit

against 7.7% in 2019. Growth in gross profit was up 24.9% in the

Americas, 11.3% in Europe, Middle-East and Africa and 43.7% in

Asia-Pacific. Our long-term objective is to achieve a geographic

distribution of 40% in the Americas, 20% in Europe, the Middle-East

and Africa and 40% in Asia-Pacific, particularly given the likely

continuing rise of China and India and despite the US/China trade

frictions.

By practice, on a pro-forma basis, Content accounted for 71.7%

of gross profit against 70.4% in 2019. The Data & digital media

practice represented 28.3% of gross profit against 29.6% in 2019.

Growth in gross profit was up 26.0% like-for-like at the Content

practice and up 18.3% at the Data & digital media practice. Our

long-term objective is to achieve a practice distribution around

two-thirds Content and one-third Data & digital media,

emphasising the growing importance of digital video.

Significant new business wins include assignments from Google,

Facebook, Amazon, Netflix, Procter & Gamble, T-Mobile, Bayer,

HP, Cisco, Embibe, Harley Davidson, PayPal, LA28, Shopify and

Verizon amongst others as we expanded our tech client portfolio and

presence in healthcare and FMCG. Encouragingly, our current

pipeline is proportionally ahead of last year's level.

The Environment, Social and Governance

In 2020, the Company upped its game significantly in all three

areas. We actively track our CO(2.) emissions and perform

competitively with a sample of other similar companies in the areas

of gender and diversity. We have committed to achieving zero

greenhouse gas emissions by 2024, in response to the World Economic

Forum 2020 Davos Manifesto and were the first advertising and

marketing firm to commit to the Amazon Climate Challenge, which has

a longer term objective in relation to zero emissions. We are

seeking B Corp status by the end of the year.

Last year, we averaged a 0.82 female to male ratio across the

firm, representing a significant improvement over last year's ratio

of 0.47. In response to the tragic killing of George Floyd and the

surge behind the Black Lives Matter movement, we organised a

firm-wide, matched contribution campaign, which raised $0.3 million

for four key black charities. We, immediately, also began to

intensify changes in our hiring and educational policies in

relation to diversity, equality and inclusion, with a public

commitment to publish annually and improve our diversity numbers so

as to be representative of the communities we work in. We are

already approximately 40% People of Colour in the United States,

with strong Hispanic and Asian representation, in particular. In

the markets we can legally measure, we are approximately 5% Black,

which, for example in the United States, still represents

significant under-representation of the communities we work in. In

California, such a percentage may be representative, but

nationally, where the proportion is 13% and in New York, where it

is 25%, it is unacceptable. These are our objectives. We have also

hired our first Fellows (and Fellowesses) in the S4 Fellowship

Programme, who exclusively come from Historically Black Colleges

and Universities in the United States. We have outstanding recruits

for this four-year, multi-practice programme, who will be

evangelising the programme across the United States shortly into

High Schools too. Finally, we have just started the S4 Women

Leadership Programme, identifying 50 female leaders from across the

firm to study on-line with UC Berkeley, California for the next 18

months.

Across S(4) Capital we donated an additional $0.4 million to

charities and also aim to contribute to society and the needs of

the planet with our Projects for Good, which are all related to the

United Nations Sustainable Development Goals. In 2020, we delivered

41 Projects for Good.

We also launched S(4) Impact Day globally, a volunteering day

when all our 4,400 people in 31 countries can tangibly give back to

the communities of which they are a part.

As regards Governance, we continued to enhance the Board with

the addition of one new Director, now with four female and four

male Non-Executive Directors. The recommendations of Lord Hill's

Report to the UK's Chancellor of the Exchequer also provides a

possible pathway to a premium or standard listing with fund

indexation, if, of course, the recommendations are accepted.

Outlook and current trading

All-in-all, we continued to fire on all cylinders in 2020, with

like-for-like revenue and gross profit up 15.2% and 19.4% and

pro-forma revenue and gross profit growth of 20.1% and 23.7% and a

pro-forma operational EBITDA margin of over 23%, after central

costs. January 2021 like-for-like gross profit growth was strong

and ahead of budget . This performance is planned to continue into

2021, with budgets and plans targeting strong revenue, gross profit

growth and improving operational EBITDA margin and the three-year

plan for 2021-3 targeting a doubling of the firm organically,

excluding combinations.

There is no doubt that covid-19 has had a devastating impact on

the global economy and society. Our people have been put under

immense strain, particularly with the illness and loss of family

members. We applaud their resilience, hard work and success and

thank them for all their efforts. We took the view that we would

not make significant reductions in the number of people in the

firm, nor rely in any significant way on government support or

funding. This was a bold thing to do, particularly in the pressure

cooker of the end of the first quarter and beginning of the second

quarter in 2020. Our Content practice, representing about three

quarters of our business pivoted very quickly to robotic production

and animation and converting live events to virtual ones. We,

therefore, created significant new content revenue streams very

quickly, with April 2020 being the weakest like-for-like growth

month, but still a growth month. There was then a steady

progression in the Content practice gross profit organic growth

rate through 2020 and into 2021. The Data & digital media

practice was more impacted by covid-19 in Quarters 2 and 3 2020,

but still grew gross profit organically significantly over those

quarters, with the growth accelerating markedly in Quarter 4 and

into 2021.

Overall, it is clear that covid-19 has accelerated the adoption

of digital transformation and digital media at three levels.

Firstly, at the consumer level, with consumers buying groceries and

essentials on-line, educating their kids on-line, using financial

services on-line and gorging on on-line entertainment and gaming.

Secondly, media trends have been accelerated, with the streamers

like Netflix and Disney+ gaining on free to air tv, traditional

newspapers and magazines under greater pressure from digital

alternatives and traditional outdoor being increasingly eclipsed by

digital outdoor. Finally, enterprise adoption of digital

transformation has accelerated, as covid-19 disrupted steady state

growth and during that disruption "change agents" have been given

more oxygen to implement digital organisational change.

It is also clear that the Company's purely digital model based

on first party data (reinforced by the recent privacy policy

decisions by Apple and Google) fuelling the creation, production

and distribution of digital advertising content and distributed by

digital media is increasingly resonating with clients. Our tag line

"faster, better, cheaper" or "speed, quality, value" and unitary,

one P&L structure also appeal strongly. The imperatives for

2021 continue to be to move beyond brand awareness and brand trial

to greater client conversion at scale and achieving our 20 squared

objective as rapidly as possible; to roll out our unitary branding;

and to broaden and deepen our service capability through mergers

and combination .

Best wishes,

Sir Martin Sorrell

Executive Chairman

About S(4) Capital

S(4) Capital plc (SFOR.L) is the tech-led, new age/new era

digital advertising and marketing services company, established by

Sir Martin Sorrell in May 2018.

Its strategy is to build a purely digital advertising and

marketing services business for global, multinational, regional,

local clients and millennial-driven influencer brands. This will be

achieved initially by integrating leading businesses in two

practice areas: Data & digital media and Content, along with an

emphasis on "faster, better, cheaper" executions in an always-on

consumer-led environment, with a unitary structure.

Digital is by far the fastest-growing segment of the advertising

market. S (4) Capital estimates that in 2020 digital accounted for

over 50% (for the first time) or $290 billion of total global

advertising spend of $525 billion (excluding over $500 billion of

trade promotion marketing, the primary target of the Amazon

advertising platform), and projects that by 2022 this share will

grow to approximately 60% and by 2024 to approximately 66%,

accelerated by the impact of covid-19.

S(4) Capital combined with MediaMonks, the leading AdAge

A-listed creative digital content production company led by Victor

Knaap and Wesley ter Haar, in July 2018 and with MightyHive, the

market-leading digital media solutions provider for future thinking

marketers and agencies, led by Peter Kim and Christopher S. Martin,

in December 2018.

In April 2019, MightyHive combined with ProgMedia to expand

operations into Latin America and MediaMonks acquired film studio

Caramel Pictures to expand content studio capabilities. In June

2019, MediaMonks announced a planned combination with

Australia-based BizTech, a leading marketing transformation and

customer experience company. In August 2019, MediaMonks combined

with Amsterdam-based digital influencer marketing agency IMA. In

October 2019, MediaMonks combined with Firewood Marketing, the

largest digital marketing agency based in Silicon Valley, that was

recently ranked, along with MediaMonks and Circus (see below), as

one of the fastest growing agencies by Adweek, and MightyHive

combined with award-winning UK-based digital analytics, biddable

media and data science company ConversionWorks and South

Korea-based data and analytics consultancy MightyHive Korea. In

November 2019, MediaMonks announced its combination with

Delhi-based content creation and production company WhiteBalance

(completed in August 2020 - the delay due to necessary merger

clearance procedures) and then with fully integrated digital agency

Circus Marketing in January 2020 (completed in March 2020).

In May 2020, MightyHive announced a combination with Digodat,

one of the leading Latin American data and analytics consultancies,

and in June 2020, MightyHive announced its combination with Lens10,

a leading Australian digital strategy and analytics consultancy. In

July 2020, MightyHive announced a combination with Orca Pacific, a

market leading full-service Amazon agency and boutique consultancy

firm based in Seattle. In August 2020, MightyHive announced a

combination with London-based Brightblue, an econometric and media

optimisation consultancy. In September 2020, MediaMonks announced

its combination with Dare.Win, expanding its geographical presence

to France. In January 2021, MediaMonks announced its combination

with integrated creative, technology and media agency Decoded

Advertising, Shanghai based creative agency TOMORROW and Stuttgart

based automotive specialist STAUD STUDIOS. MightyHive also

announced its combination with integrated digital performance

marketing agency Metric Theory. In February 2021, MightyHive

acquired the assets of Datalicious, a leading Google Marketing

Platform, Google Cloud and Google Analytics partner in Asia

Pacific.

On 16 July 2020, S(4) Capital announced the successful placing

of 36,766,642 new ordinary shares at a price of 315p raising

approximately GBP116 million gross proceeds which will be used for

further expansion and combination purposes.

Victor Knaap, Wesley ter Haar, Pete Kim, Christopher Martin,

Peter Rademaker and Scott Spirit all joined the S(4) Capital Board

as Directors. The S(4) Capital Board also includes Rupert Faure

Walker, Paul Roy, Daniel Pinto, Sue Prevezer, Elizabeth Buchanan,

Naoko Okumoto, Margaret Ma Connolly and Miles Young.

The Company now has over 4,400 people in 31 countries across the

Americas, Europe, the Middle East and Africa and Asia-Pacific and a

current market capitalisation of approximately GBP2.5 billion

(c.$3.5 billion), and would rank around the FTSE 150. It achieved

Unicorn status in a little over one year, unique in the advertising

and marketing services industry

Sir Martin was CEO of WPP for 33 years, building it from a GBP1

million "shell" company in 1985 into the world's largest

advertising and marketing services company with a market

capitalisation of over GBP16 billion on the day he left. Today its

market capitalisation is GBP11 billion. Prior to that Sir Martin

was Group Financial Director of Saatchi & Saatchi Company Plc

for nine years.

Unaudited consolidated statement of profit or loss

For the year ended 31 December 2020

2020 2019

Unaudited Unaudited

======================================

Notes GBP'000 GBP'000

====================================== ===== ========== ==========

Revenue 342,687 215,132

Cost of sales 47,505 43,814

Gross profit 295,182 171,318

Personnel costs 205,135 111,572

Other operating expenses 30,561 25,803

Acquisition and set-up related

expenses 14,338 12,806

Depreciation and amortisation 37,015 24,972

Total operating expenses 287,049 175,153

Operating profit (loss) 8,133 (3,835)

Adjusted operating profit 57,950 31,148

Adjusting items (49,817) (34,983)

Operating profit (loss) 8,133 (3,835)

--------------------------------------- ----- ---------- ----------

Finance income 698 20

Finance expenses (5,735) (5,380)

Net finance expenses (5,037) (5,360)

Profit (loss) before income

tax 3,096 (9,195)

Income tax expense 5 (7,025) (845)

Loss for the year (3,929) (10,040)

======================================= ===== ========== ==========

Attributable to owners of the Company (3,929) (10,040)

Attributable to non-controlling - -

interests

(3,929) (10,040)

====================================== ===== ========== ==========

Loss per share is attributable to the ordinary equity holders of

the Company

Basic loss per share (pence) 3(0.8) (2.7)

Diluted loss per share (pence) 3(0.8) (2.7)

Unaudited consolidated statement of comprehensive income

For the year ended 31 December 2020

2020 2019

Unaudited Unaudited

======================================

GBP'000 GBP'000

====================================== ========== ==========

Profit (loss) for the year (3,929) (10,040)

Other comprehensive income (loss)

Items that may be reclassified

to profit or loss

Foreign operations - foreign currency

translation differences 2,905 (20,620)

Total other comprehensive

income (loss) 2,905 (20,620)

Total comprehensive loss

for the year (1,024) (30,660)

============================================= ========== ==========

Attributable to owners of the Company (1,024) (30,660)

Attributable to non-controlling - -

interests

(1,024) (30,660)

========================================= ========== ==========

Unaudited consolidated balance sheet

At 31 December 2020

2020 2019

Unaudited Unaudited

======================================

Notes GBP'000 GBP'000

====================================== ===== ========== ==========

Assets

Non-current assets

Intangible assets 4 799,129 540,129

Right-of-use assets 21,653 25,779

Property, plant and equipment 14,537 9,730

Deferred tax assets 2,068 1,086

Other receivables 2,125 2,731

839,512 579,455

Current assets

Trade and other receivables 181,391 126,353

Cash and cash equivalents 142,052 66,106

323,443 192,459

Total assets 1,162,955 771,914

======================================= ===== ========== ==========

Liabilities

Non-current liabilities

Deferred tax liabilities 62,100 54,834

Loans and borrowings 44,819 42,374

Lease liabilities 5 15,942 18,787

Contingent consideration 32,593 3,669

Other payables 1,941 2,007

157,395 121,671

Current liabilities

Trade and other payables 191,125 118,014

Contingent consideration

and holdback 35,742 51,202

Loans and borrowings 45,623 -

Lease liabilities 7,047 7,975

Tax liabilities 12,480 6,751

292,017 183,942

Total liabilities 449,412 305,613

======================================= ===== ========== ==========

Net assets 713,543 466,301

======================================= ===== ========== ==========

Equity

Attributable to owners of the Company

Share capital 135,516 117,307

Reserves 577,927 348,894

713,443 466,201

Non-controlling interests 100 100

Total equity 713,543 466,301

======================================= ===== ========== ==========

Unaudited consolidated statement of cash flows

For the year ended 31 December 2020

2020 2019

Unaudited Unaudited

==========================================

GBP'000 GBP'000

========================================== ========== ==========

Cash flows from operating

activities

Profit (loss) before income

tax 3,096 (9,195)

Financial income and expenses 5,037 5,360

Depreciation and amortisation 37,015 24,972

Share based compensation 12,331 7,177

Acquisition and set-up

related expenses 14,338 12,806

Increase in trade and other

receivables (29,282) (31,288)

Increase in trade and other

payables 29,893 22,310

Cash flows from operations 72,428 32,142

Income taxes paid (10,758) (7,571)

Net cash flows from operating

activities 61,670 24,571

================================================= ========== ==========

Cash flows from investing

activities

Investments in intangible assets (34) (1,578)

Investments in property, plant

and equipment (7,396) (7,865)

Acquisition of subsidiaries, net

of cash acquired (124,155) (56,954)

Financial fixed assets 871 (779)

Cash flows from investing

activities (130,714) (67,176)

================================================= ========== ==========

Cash flows from financing activities

Proceeds from issuance

of shares 113,386 97,451

Additional borrowings 45,378 22,418

Payment of lease liabilities

and interest (12,175) (6,687)

Repayments of loans and

borrowings (24,119)

Interest paid (742) (4,744)

Cash flows from financing

activities 145,847 84,319

================================================= ========== ==========

Net movement in cash and cash equivalents 76,803 41,714

Cash and cash equivalents beginning

of the year 66,106 25,005

Exchange gain/(loss) on cash and

cash equivalents (857) (613)

Cash and cash equivalents

at 31 December 142,052 66,106

================================================= ========== ==========

Unaudited consolidated statement of changes in equity

For the year ended 31 December 2020

Foreign

Number Share Share Merger Other exchange Accumulated Non-controlling Total

of shares capital premium reserves reserves(1) reserves losses Total interests equity

==============

Equity GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============== =========== ======= ======= ======== =========== ======== =========== ======== =============== ========

Balance at 1

January

2019 363,396,923 90,849 52,871 205,717 (847) 1,870 (8,266) 342,194 100 342,294

Comprehensive

loss

for the year

Loss for the

year - - - - - - (10,040) (10,040) - (10,040)

Foreign

currency

translation

differences - - - - - (20,620) - (20,620) - (20,620)

Total

comprehensive

loss for the

year - - - - (20,620) (10,040) (30,660) (30,660)

Transactions

with

owners of the

Company

Issue of

Ordinary

Shares 105,324,634 26,331 121,182 - - - - 147,513 - 147,513

Employee

share

schemes 505,702 127 249 - (313) - 7,091 7,154 - 7,154

Balance at 31

December

2019 469,227,259 117,307 174,302 205,717 (1,160) (18,750) (11,215) 466,201 100 466,301

Comprehensive

loss

for the year

Profit for

the

year - - - - (3,929) (3,929) - (3,929)

Foreign

currency

translation

differences - - - - 2,905 - 2,905 - 2,905

Total

comprehensive

loss for the

year - - - 2,905 (3,929) (1,024) - (1,024)

Transactions

with

owners of the

Company

Issue of

Ordinary

Shares 36,766,642 9,192 103,995 113,187 - 113,187

Business

combinations 34,744,022 8,686 84,564 28,655 121,905 - 121,905

Employee

share

schemes 1,327,535 331 1,334 (454) 11,963 13,174 - 13,174

723,729

Balance at 31

December

2020 542,065,458 135,516 364,195 205,717 27,041 (15,845) (3,181) 713,443 100 713,543

============== =========== ======= ======= ======== =========== ======== =========== ======== =============== ========

Notes to the consolidated financial statements

General information

S(4) Capital plc ('S(4) Capital' or 'Company'), is a public

Company, limited by shares, incorporated on 14 November 2016 in the

United Kingdom. The Company has its registered office at 12 St

James's Place, London, SW1A 1NX, United Kingdom.

The unaudited preliminary consolidated condensed financial

statements represent the results of the Company and its

subsidiaries (together referred to as 'S(4) Capital Group' or the

'Group').

S(4) Capital Group is a new age/new era digital advertising and

marketing services company.

Basis of preparation

The financial statements have been prepared in accordance with

the Disclosure Guidance and Transparency Rules of the Financial

Conduct Authority. They have been prepared in accordance with

International Accounting Standards in conformity with the

requirements of the Companies Act 2006 and International Financial

Reporting Standards (IFRSs) adopted pursuant to Regulation (EC) No

1606/2002 as it applies in the EU.

On 31 December 2020 EU-adopted IFRS was brought into UK law and

became UK-adopted international accounting standards, with future

changes to IFRS being subject to endorsement by the UK Endorsement

Board. The Consolidated Financial Statements will transition to

UK-adopted international accounting standards for financial periods

beginning 1 January 2021.

The financial information set out above does not constitute the

company's statutory accounts for the years ended 31 December 2020.

The statutory accounts for 2020 will be finalised on the basis of

the financial information presented by the directors in this

preliminary announcement and will be delivered to the Registrar of

Companies in due course. The unaudited financial information is

prepared under the historical cost basis, unless stated otherwise

in the accounting policies.

Accounting policies

The accounting policies will be included in the Annual Report

and Accounts 2020. The accounting policies are materially

consistent with those described in the Annual Report and Accounts

2019, which were set out on pages 87 to 95.

New and amended standards adopted by the Group

Certain new accounting standards and interpretations have been

published that are not mandatory for 31 December 2020 reporting

periods and have not been early adopted by the Group. These

standards are not expected to have a material impact on the Group

in the current or future reporting periods and on foreseeable

future transactions.

Critical accounting estimates and judgements

The critical accounting estimates and judgments will be included

in the Annual Report and Accounts 2020. These are consistent with

those described in the Annual Report and Accounts 2019, which were

set out on pages 87 and 89.

1. Operating segments

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision-maker.

The chief operating decision maker has been identified as the

Directors and executive management of S Capital Group.

During the year, S Capital Group has been active in two

segments.

// Content Practice: Creative content, campaigns and assets at a

global scale for paid, social and earned media - from digital

platforms and apps to brand activations that aim to convert

consumers at every possible touchpoint.

// Data & Digital media: this technology and services

practice encompasses full-service campaign management analytics,

creative production and ad serving, platform and systems

integration and transition and training and education.

The customers are primarily businesses across technology, FMCG

and media & entertainment.

The Directors and executive management monitor the results of

the operating segments separately for the purpose of making

decisions about resource allocation and performance assessment

prior to charges for tax, depreciation and amortisation.

Operating segment information under the primary reporting format

is disclosed below:

Data &

Content Digital

Practice media Total

=======================================

2020 GBP'000 GBP'000 GBP'000

======================================= ========= ======== ========

Gross profit 220,497 74,685 295,182

Segment profit (1) 45,609 21,603 67,212

Overhead cost (5,034)

Adjusted non-recurring and acquisition

related expenses (26,669)

Depreciation(2) and amortisation (27,376)

Net finance expenses (5,037)

Profit before income tax 3,096

========================================== ========= ======== ========

(1) Including GBP 9.6 million depreciation on right-of-use

assets

(2) Excluding GBP 9.6 million depreciation on right-of-use

assets

Data &

Digital

Content media Total

=======================================

2019 GBP'000 GBP'000 GBP'000

======================================= ======= ======== ========

Gross profit 113,365 57,953 171,318

Segment profit(1) 25,570 13,654 39,224

Overhead cost (5,817)

Adjusted non-recurring and acquisition

related expenses (19,983)

Depreciation(2) and amortisation (17,259)

Net finance expenses (5,360)

Loss before income tax (9,195)

========================================== ======= ======== ========

(1) Including GBP 7.7 million depreciation on right-of-use

assets

(2) Excluding GBP 7.7 million depreciation on right-of-use

assets

Key management of S(4) Capital Group uses gross profit rather

than revenue to manage the Group due to the fluctuating amounts of

third-party costs and/or pass-through expenses, which form part of

revenue.

2. Adjusting items

S Capital Group uses certain adjusted earnings measures to

provide additional clarity about the performance of the business.

Therefore, the operating profit in the condensed consolidated

income statement is also adjusted for the following items, which

comprise:

// Acquisition and set-up related expenses are not considered

part of underlying trading and are material one-off expense or

income, which are relevant to an understanding of the underlying

performance of the Group.

// Amortisation of certain fair value adjustments recorded in

respect of finite-life intangible assets recognised in the purchase

price allocation of the acquisitions.

// Share based compensation.

The adjusting items amount to GBP49.8 million for the financial

year ended 31 December 2020 (for the financial year ended 31

December 2019: GBP35.0 million). The tables below provide a

reconciliation of the Group's reported statutory earnings measures

to its adjusted measures

Acquisition

and set-up

related Share based

Reported Amortisation(1) expenses(2) compensation Adjusted

===========================

January to December 2020 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

=========================== ======== =============== ============ ============= ========

Operating profit 8,133 23,148 14,338 12,331 57,950

Net finance expenses (5,037) - - - (5,037)

Profit before income tax 3,096 23,148 14,338 12,331 52,913

Income tax expense (7,025) (5,758) (1,238) - (14,021)

(Loss) profit for the year (3,929) 17,390 13,100 12,331 38,892

(1) Amortisation relates to the amortisation of certain

intangible assets recognised as a result of the acquisitions.

(2) Acquisition and set-up related expenses relate to

acquisition related bonuses of GBP2.2 million and transaction

related advisory fees of GBP13.6 million and the accounting for

contingent considerations of GBP1.4 million.

Acquisition

and set-up

related Share based

Reported Amortisation(1) expenses(2) compensation Adjusted

================================

January to December 2019 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

================================ ======== =============== ============ ============= ========

Operating (loss) profit (3,835) 15,000 12,806 7,177 31,148

Net finance expenses (5,360) - - - (5,360)

(Loss) profit before income tax (9,195) 15,000 12,806 7,177 25,788

Income tax credit / (expense) (845) (3,893) (2,064) - (6,802)

(Loss) profit for the year (10,040) 11,107 10,742 7,177 18,986

================================= ======== =============== ============ ============= ========

(1) Amortisation relates to the amortisation of certain

intangible assets recognised as a result of the acquisitions.

(2) Acquisition and set-up related expenses relate to

acquisition related bonuses of GBP7.2 million and transaction

related advisory fees of GBP5.7 million.

3. Earnings per share

2020 2019

========================================== =========== ===========

Income (Loss) attributable to shareowners

of the Company (GBP'000) (3,929) (10,040)

Weighted average number of ordinary

shares 493,290,974 368,067,622

Basic loss per share (pence) (0.8) (2.7)

============================================== =========== ===========

Diluted loss per share (pence) (0.8) (2.7)

---------------------------------------------- ----------- -----------

Earnings per share is calculated by dividing the net result

attributable to the shareowners of the S(4) Capital Group by the

weighted average number of Ordinary Shares in issue during the

year.

4. Intangible assets

Customer

Goodwill relationships Brands Order Backlog Other Total

==============================

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

============================== ======== ============== ======= ============= ======= ========

Net book value at 1 January

2019 238,237 148,085 13,697 180 1,937 402,136

============================== ======== ============== ======= ============= ======= ========

Acquired through business

combinations 106,610 66,231 2,082 1,098 2,590 178,611

Additions - - - - 1,578 1,578

Amortisation charge for

the year - (12,017) (1,117) (1,212) (654) (15,000)

Foreign exchange differences (16,011) (10,191) (681) (66) (247) (27,196)

Total transactions during

the year 90,599 44,023 284 (180) 3,267 137,993

============================== ======== ============== ======= ============= ======= ========

Cost 328,836 206,706 15,276 5,464 6,364 562,646

Accumulated amortisation - (14,598) (1,295) (5,464) (1,160) (22,517)

Net book value at 31 December

2019 328,836 192,108 13,981 - 5,204 540,129

============================== ======== ============== ======= ============= ======= ========

Acquired through business

combinations 228,376 39,379 1,059 3,065 2,269 274,148

Addition 34 34

Reclassifications (2,793) 2,298 211 (284)

Amortisation charge for

the year (17,747) (1,866) (1,919) (1,616) (23,148)

Foreign exchange differences 5,503 2,303 294 56 94 8,250

Total transactions during

the year 231,086 26,233 (302) 1,202 781 259,000

============================== ======== ============== ======= ============= ======= ========

Cost 559,922 250,583 16,799 8,805 8,745 844,854

Accumulated amortisation - (32,243) (3,121) (7,604) (2,757) (45,725)

Net book value at 31 December

2020 559,922 218,340 13,678 1,201 5,988 799,129

============================== ======== ============== ======= ============= ======= ========

Acquisitions 2020

Details of the fair value of identifiable assets and liabilities

acquired, purchase consideration and provisional goodwill of the

subsidiaries acquired in financial year 2020 are as follows:

Data &

Content digital Total

Practice media practice Fair value

==============================

GBP'000 GBP'000 GBP'000

============================== ====== === === ========= =============== =============

Intangible assets - Customer

relationships 21,836 17,543 39,379

Intangible assets - Brand

names 663 396 1,059

Intangible assets - Order

backlog 1,652 1,413 3,065

Intangible assets - Software - 2,269 2,269

Property, plant and equipment 2,110 343 2,453

Financial fixed assets 165 102 267

Cash and cash equivalents 12,259 7,555 19,814

Trade and other receivables 30,753 7,408 38,160

Trade and other payables (34,601) (5,423) (40,026)

Current taxation 567 (985) (418)

Lease liabilities (674) - (674)

Other non-current liabilities (385) (1,553) (1,937)

Deferred taxation (6,619) (5,045) (11,664)

Net assets 27,726 24,023 51,749

Goodwill 126,908 101,469 228,376

Total purchase consideration 154,634 125,492 280,125

================================================== ========= =============== =============

Payment in kind (common

stock) 24,293 49,379 73,671

Cash 73,361 50,079 123,442

Deferred consideration 29,222 5,890 35,111

Contingent consideration 27,757 20,143 47,899

Total purchase consideration 154,634 125,492 280,125

================================================== ========= =============== =============

Purchase consideration

- cash 73,361 50,079 123,440

Cash and cash equivalents 12,259 7,555 19,814

Cash outflow on acquisition

(net of cash acquired) 61,102 42,524 103,626

================================================== ========== =============== ===========

In 2020, S(4) Capital Group combined with the following

businesses:

Content Practice

Combinations in 2020 of the Group's Content Practice are:

// On 8 January 2020, S(4) Capital plc announced (completed and

control passed on 12 March 2020) the combination of MediaMonks with

the fully integrated digital agency Circus Network.

// On 10 September 2020, S(4) Capital plc announced that

MediaMonks has entered into exclusivity in relation to a

combination with Dare.Win, an award-winning Paris based digital

creative agency. The combination expands MediaMonks' geographical

presence to France, Europe's third largest advertising market. At

the end of the reporting year, the opening balance sheet has not

been agreed upon and therefore the calculated goodwill is

provisional.

// In November 2019, S(4) Capital plc announced (completed and

control passed on 27 August 2020) the combination of MediaMonks

with WhiteBalance, Indian-based digital creative and production

agency.

// On 4 January 2021, S(4) Capital plc announced (completed and

control passed on 31 December 2020) the combination of MediaMonks

with Decoded Advertising, a San Francisco-based marketing agency.

Decoded Advertising buys media across search, social and ecommerce

properties.

Data & digital media practice

Combinations in 2020 of the Group's Data & digital media

practice are:

// On 26 May 2020, S(4) Capital plc announced (completed and

control passed on 10 July 2020) the combination of MightyHive with

Digodat, a leading Latin American data and analytics

consultancy.

// On 30 June 2020, S(4) Capital plc announced the combination

of MightyHive with Lens10, a leading Australian digital strategy

and analytics consultancy, pending Foreign Investment Review Board

and Australian Competition and Consumer Commission.

// On 29 July 2020, S(4) Capital plc announced the combination

of MightyHive with Orca Pacific, a market leading full-service

Amazon agency and boutique consultancy firm based in Seattle.

// On 27 August 2020, S(4) Capital plc announced the combination

of MightyHive with Brightblue Consulting, an award-winning UK based

data analytics and measurement consultancy

// On 4 January 2021, S(4) Capital plc announced (completed and

control passed on 31 December 2020) the combination of MightyHive

with Metric Theory, an US-based agency fully integrated agency

covering creative, media and technology

The goodwill represents the potential growth opportunities and

synergy effects from the acquisition. The goodwill is not

deductible for tax purposes. Trade receivables net of expected

credit losses acquired are considered to be fair value and are

expected to be collectable in full.

The contingent considerations are contingent on the acquired

companies achieving their 2020 results and, in some cases their

2021 and 2022 results, as determined upon acquiring the subsidiary.

The contingent considerations are included for the maximum amount

of the consideration expected.

The total acquisition costs of GBP10.8 million (2019: GBP4.7

million) have been recognised under acquisition and set-up related

expenses in the statement of profit or loss.

Firewood

Contingent consideration arising from business combinations is

fair valued, with key inputs including the probability of success,

consideration of potential delays and the expected levels of future

revenues. In 2020, Management has identified changes in certain key

assumptions with respect to the acquisition of Firewood Marketing

Inc that caused the calculated fair value to vary compared to the

initial calculated fair value. Revaluations of Contingent

consideration are recognised in Selling, general and administrative

costs and include a decrease of GBP8.8 million in 2020 (2019: nil)

based on revised milestone probabilities, and revenue forecasts,

relating mainly to the acquisition of Firewood Marketing.

Events occurring after the reporting period

On 11 January 2021, S(4) Capital plc announced that TOMORROW, an

award-winning Shanghai-based creative agency, is combined with

MediaMonks, S (4) Capital's Content Practice. The combination

expands MediaMonks' existing capabilities and presence in China,

the world's second largest advertising market.

On 20 January 2021, S(4) Capital plc announced a combination

with Staud Studios, a German high-end creative production studio

specialising in the automotive industry. Pursuant to the terms of

the Transaction, we have agreed to issue 661,927 ordinary shares of

25 pence each in the capital of the Company, credited as fully

paid, as initial consideration. The Initial Consideration Shares

will be subject to a restriction on sale until 22 January 2023.

On 1 February 2021, S(4) Capital plc announced that MightyHive

has acquired the assets of Datalicious, a leading Google Marketing

Platform, Google Cloud and Google Analytics partner in Asia

Pacific. Datalicious is a specialised data and analytics

consultancy, helping marketers make sense of their data.

Datalicious tracks and analyzes customer interactions across

multiple marketing channels, so clients can drive the most impact

from their marketing dollars and create targeted and personalised

customer experiences and staff and clients in the financial

services, telecommunications and media industries will become part

of S (4) Capital's expanding Data and Digital media practice at

MightyHive.

On 25 March 2021, S(4) Capital announced that it has entered

into a conditional agreement in relation to a combination of

MediaMonks with the highly awarded design and experience agency,

Jam3, based in Toronto with offices in Amsterdam, Los Angeles and

Uruguay

5. Income tax expense

The corporate income tax charge comprises the following:

2020 2019

GBP'000 GBP'000

================================= ========= ========

Current tax for the year (12,970) (4,022)

Adjustments for current tax of

prior years (203) (36)

Total current tax (13,173) (4,058)

Movement in deferred tax 6,148 3,213

Income tax expense in profit or

loss (7,025) (845)

================================== ========= ========

2020 2019

GBP'000 GBP'000

======== ========

Income (Loss) before income taxes 3,096 (9,195)

Tax credit at the UK rate of 19%

(2019:19%) (589) 1,747

Tax effect of amounts which are

non-deductible (taxable) (4,245) (2,074)

Differences in overseas tax rates (1,988) (554)

Adjustment for current taxes of

prior years (203) 36

Income tax expense in profit

or loss (7,025) (845)

======================================= ======== ========

The applicable tax rate is based on the proportion of the

contribution to the result by the Group entities and the tax rate

applicable in the respective countries. The applicable tax rate in

the respective countries ranges from 17% to 35%. The effective tax

rate used to calculate the actual tax charge for the year deviates

from the applicable tax rate mainly because of non-deductible

items, amortisation, accelerated capital allowances over

depreciation on plant, property and equipment and differences in

overseas tax rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR PPUUAWUPGUQA

(END) Dow Jones Newswires

March 25, 2021 03:00 ET (07:00 GMT)

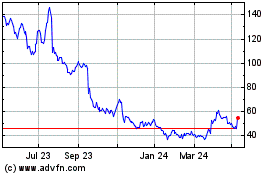

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

S4 Capital (LSE:SFOR)

Historical Stock Chart

From Apr 2023 to Apr 2024