TIDMSFR

RNS Number : 2069W

Severfield PLC

22 April 2021

22 April 2021

Severfield plc

('the Company' or 'the Group')

Pre-close trading update

FY21 upgrade: improved expectations for the full year

Severfield plc, the market leading structural steel group, today

issues the following trading update for the year ended 31 March

2021, ahead of the announcement of its annual financial results on

Wednesday 16 June.

FY21 expectations and outlook

The Group is currently performing well and based on the good

progress made in the second half of the 2021 financial year, we now

expect to deliver a full year result which is comfortably above

management's previous expectations.

Whilst we continue to be mindful of the COVID-19 backdrop, we

remain optimistic about the future. We continue to regularly win

high-quality work resulting a strong order book of GBP315m, which

supports trading throughout the 2022 financial year and beyond. We

have an encouraging pipeline of opportunities in the UK, Europe and

India, a strong balance sheet position, expertise in managing

complex projects and good long-standing client relationships. This

leaves us well-placed to win work in the diverse range of market

sectors and geographies in which we operate and across a wide

client base, providing us with extra resilience and the ability to

increase our market share in the future.

Operational and trading update

UK and Europe

The Group has, to date, been well-prepared for and coped well

with the challenges presented by the COVID-19 pandemic, including

the most recent national lockdown in January. The Group's factories

and sites are fully operational, and we have been trading at normal

(pre-pandemic) levels, in line with government and industry

guidelines, since the beginning of Q2 of the 2021 financial

year.

In the second half of the year, we have continued to secure a

significant value of new work, resulting in a UK and Europe order

book of GBP315m as at 1 April 2021 (1 November 2020: GBP287m),

including GBP17m for the recently acquired DAM Structures, of which

GBP252m is for delivery over the next 12 months. This leaves the

Group well-positioned with a strong future workload for the 2022

financial year and beyond. In terms of geographical spread, 80 per

cent of this order book represents projects in the UK, with the

remaining 20 per cent representing projects for delivery in Europe

and the Republic of Ireland.

We remain very encouraged by the current level of tendering and

pipeline activity across the Group. We continue to see a good

number of opportunities, albeit at more competitive prices given

the current market conditions, in our key market sectors, including

in the industrial and distribution, transport infrastructure,

stadia and leisure, nuclear and data centre sectors.

India

The Indian joint venture ('JSSL') has continued its recovery

from the disruptive effects of COVID-19. After a difficult first

half, the company has maintained a largely break-even profit

position in H2, reflecting an Indian market which is starting to

show signs of recovery. JSSL's order book as at 1 April 2021 was

GBP104m (1 November 2020: GBP98m) and this includes several recent

commercial awards (a large data centre in Chennai and commercial

offices in Bangalore and Hyderabad) and some further industrial

work for JSW. In terms of mix, 90 per cent of the order book

represents higher margin commercial work, with the remaining 10 per

cent representing industrial projects, mainly for JSW.

JSSL's pipeline of potential orders continues to include several

commercial projects for key developers and clients with whom it has

established strong relationships. JSSL is also developing formal

strategic alliances with certain key clients, mainly for

commercial, data centre and healthcare projects. This leaves the

business well placed to win more work in the future, albeit we

remain mindful of the evolving COVID-19 backdrop in India.

Strong balance sheet and financial position

Cash generation in H2 was good and our financial position

remains strong, allowing us to support continued investment in

efficiency and growth, both organically and by acquisition,

including the recent purchase of DAM Structures, which is

integrating well into the Group's operations. Year-end net funds

(on a pre-IFRS 16 basis) were c.GBP4m, representing cash of

c.GBP25m offset by the outstanding acquisition loans for Harry

Peers of GBP9m and DAM Structures of GBP12m. The Group has

continued to operate in a net funds position throughout the

pandemic maintaining significant amounts of cash headroom (c.GBP50m

as at 31 March 2021) in banking facilities, which expire in October

2023.

The Group has made no claims for support under any

employee-related government schemes (including the Coronavirus Job

Retention Scheme) and all PAYE, VAT and other COVID-related tax

deferrals have now been repaid in full.

SteelZero - building a sustainable future

The Group has strengthened its commitment to reducing carbon

emissions by signing up to SteelZero, a global initiative to speed

up the transition to a net zero steel industry. SteelZero is led by

the international non-profit organisations, the Climate Group and

Responsible Steel. This customer-led initiative, which aims to

drive a major shift in the global market for the responsible

sourcing and production of steel, is being signed up to by an

increasing number of steel buyers, both in the UK and

internationally.

Targeting net zero steel from the demand-side of the supply

chain makes this the first initiative of its kind, with the

potential for it to have significant impact on investment, policy,

manufacturing, and production in the construction sector. By

signing up, we are making a public commitment to transition to

procuring, specifying, or stocking 100 per cent net zero steel by

2050, with certain interim targets to be achieved by 2030.

Jenny Chu, Head of Energy Productivity Initiatives at the

Climate Group, said: 'We are delighted that Severfield, one of the

UK's leading structural steel construction companies, has become

the latest member to join SteelZero. The initiative gives

forward-looking companies a springboard from which they can use

their collective purchasing power and influence to demonstrate

there is strong demand for clean and sustainable steel.'

For further information, please contact:

Severfield Alan Dunsmore 01845 577 896

Chief Executive Officer

Adam Semple 01845 577 896

Group Finance Director

Jefferies International Simon Hardy 020 7029 8000

Will Soutar 020 7029 8000

Camarco Ginny Pulbrook 020 3757 4980

Tom Huddart 020 3757 4980

Notes to editors:

Severfield is the UK's market leader in the design, fabrication

and construction of structural steel, with a total capacity of

c.165,000 tonnes of steel per annum. The Group has six sites,

c.1,500 employees and expertise in large, complex projects across a

broad range of sectors. The Group also has an established presence

in the expanding Indian market through its joint venture

partnership with JSW Steel (India's largest steel producer).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEALLFAEDFEFA

(END) Dow Jones Newswires

April 22, 2021 02:00 ET (06:00 GMT)

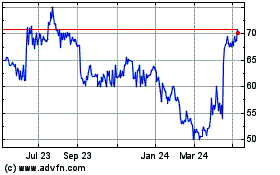

Severfield (LSE:SFR)

Historical Stock Chart

From Mar 2024 to Apr 2024

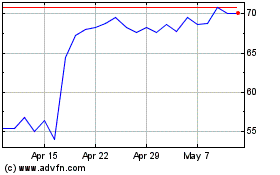

Severfield (LSE:SFR)

Historical Stock Chart

From Apr 2023 to Apr 2024