TIDMSIXH

RNS Number : 7414F

600 Group PLC

20 July 2021

This announcement contains inside information for the purposes

of Article 7 of EU Regulation 596/2014 (as amended), which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018. Upon publication of this announcement via a Regulatory

Information Service, this inside information is now considered to

be in the public domain.

20 July 2021

The 600 Group PLC

Trading Update and Notice of Results

The 600 Group PLC (the "Group"), the diversified industrial

engineering company (AIM: SIXH), is pleased to provide an update in

respect of current trading following the period ended 31 March 2021

("FY21").

In doing so the Group re-confirms its expectations of FY21

performance announced by the Group on 15 April 2021 and announces

that it now expects to report its audited FY21 results by 30

September 2021 as a result of COVID-19 related restrictions and

delays.

Summary of Unaudited FY21 Results

-- Revenue of $53.5 million (2020: $67.2 million), down by just

over 20% due to the impact of COVID-19 on trading.

-- Underlying EBIT of $2.5 million.

-- Underlying profit before taxation (excluding adjusted items)

in line with previous year at $1.1 million (2020: $1.1 million),

due to management's swift response to the COVID-19 pandemic.

-- Group net debt as at 31 March 2021 (excluding IFRS16 lease

liabilities) was $12.8m, reduced from $14.2m as at 28 March

2020.

-- $2.2m of 31 March 2021 Group net debt will be eligible for

forgiveness from September 2021 as a US Paycheck Protection Program

("PPP") loan dependent on employment numbers, payroll expenditure

and certain facility costs, with any amount not forgiven repayable

over a two-year term with an all-in interest rate of 1.0%.

-- Strong pipeline of opportunities across all operating

divisions, in particular in Industrial Laser Systems where the

integration of the sales operations and back-office functions of

TYKMA and Control Micro Systems ("CMS") has progressed well.

-- Group order book of $14.1m as at 31 March 2021 which has

since increased to $22.5m as at 15 July 2021.

-- Stable leadership and retention of key senior management teams.

Current Trading and Outlook

Trading in the first quarter of the current financial year has

been strong, with orderbooks seeing a marked improvement since 31

March 2021 and increased levels of activity across the Group.

In particular, the pipeline in the Group's higher margin, growth

market Industrial Laser Division is very encouraging - with CMS

taking a number of large new orders in the current year, including

a $4.3m order earlier this month - the largest in its history.

As at 15 July 2021 the Group's order book stood at $22.5m (31

March 2021: $14.1m). In addition to being a material increase over

the Group's order book as at 31 March 2021, it is pleasing to note

that $12.9m (57%) of the current order book relates to the Group's

higher margin Industrial Laser Division.

The Group's management teams continue to respond exceptionally

well in difficult conditions and, having successfully restructured

the Groups' loan notes to provide financial flexibility, the Group

is now positioned as a leaner and more efficient organisation which

can take advantage of the operational gearing in our activities as

volumes continue to increase.

Whilst there still remains some uncertainty created by the

COVID-19 pandemic, the Board continues to believe in the long-term

fundamentals of the Group, in brand promotion, investment in new,

higher end product capabilities and diversification into new

markets and selective acquisitions. The Board is excited about the

possibilities that lie ahead.

Enquiries:

The 600 Group PLC Tel: +1-407-818-1123 / 01924

Paul Dupee, Executive Chairman 415000

Neil Carrick, Company Secretary

Instinctif Partners Tel: 0207 457 2020

Tim McCall

Rosie Driscoll

Cenkos Securities plc (Nominated Tel: 020 7397 8900

Adviser and Broker)

Ben Jeynes / Max Gould (Corporate

Finance)

Alex Pollen (Sales)

About The 600 Group PLC

The 600 Group PLC is a distributor, designer and manufacturer of

industrial products with three principal areas of activities:

Industrial Laser Systems

Industrial laser systems cover laser marking and processing

including cutting, drilling, ablation and a host of other niche

applications in the marking and micro machining sectors. They

require no consumables and can operate on a continuous high speed

basis and can be integrated into customers' production lines. The

businesses have their own technology and proprietary software.

Customer applications are diverse and range from aerospace to

medical and pharmaceuticals. The requirement for increased product

and component traceability is one of the market drivers.

Machine Tools

The business has a strong reputation in the market for metal

turning machines. Products range from small conventional machines

for education markets, CNC workshop machines and CNC production

machines. Selected outsourcing partners support the manufacturing

of these machines and they are marketed through the Group's wholly

owned international sales organisation and a global distribution

network.

Precision Engineered Components

Machine spares are distributed to customers globally to help

maintain the installed base of group machines which number in

excess of 100,000. Additionally, work holding products are sold via

specialist distributors to OEMs, including other machine

builders.

More information on the Group can be viewed at:

www.600group.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAPXNFASFEFA

(END) Dow Jones Newswires

July 20, 2021 02:00 ET (06:00 GMT)

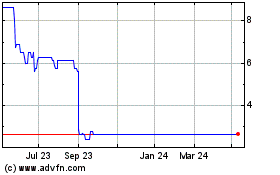

600 (LSE:SIXH)

Historical Stock Chart

From Mar 2024 to Apr 2024

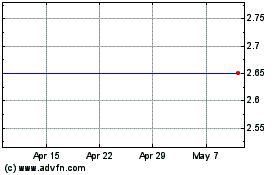

600 (LSE:SIXH)

Historical Stock Chart

From Apr 2023 to Apr 2024