TIDMSML

RNS Number : 3486V

Strategic Minerals PLC

14 April 2021

Market Abuse Regulation (MAR) Disclosure

Certain information contained in this announcement would have

been deemed inside information for the purposes of Article 7 of

Regulation (EU) No 596/2014 until the release of this

announcement.

14 April 2021

Strategic Minerals plc

("Strategic Minerals" or the "Company")

March Quarter 2021 Magnetite Sales and Cash Balances

Strong Cobre Sales Continue

Strategic Minerals plc (AIM: SML; USOTC: SMCDY), a profitable

producing mineral company , is pleased to provide the following

update on the Company's cash position and ore sales at the Cobre

magnetite operation in New Mexico, USA ("Cobre") for the quarter

ended 31 March 2021.

Highlights

-- Annual Cobre sales continue to exceed US$3m

-- Revenue growth of over 12% year on year at Cobre

-- Group cash balance of US$0.686m as at 31 March 2021

Sales update: Cobre magnetite tailings operations

The 2021 March quarter saw sales at Cobre continue to grow, with

revenues rising by over 12% year on year. Sales remained robust and

the positive annual growth highlights both the strong underlying

demand and the Southern Minerals Group ("SMG") team's ability to

maintain "contactless" operations, therein protecting both our

personnel and clients.

Sales comparisons on quarterly and annual periods to 31 March

2021, along with associated volume details, are shown in the table

below:

Tonnage Sales (US$'000)

---------------------------- -----------------------------

Year 3 months to 12 months to 3 months to 12 months to

March March March March

2021 13,002 51,567 771 3,032

2020 12,953 45,998* 764 2,698*

2019 9,471 42,401 553 2,480

* For comparison purposes, the US$0.75m of deposits forfeited by

CV Investments LLC ("CV") has been excluded.

The Company's wholly owned subsidiary, SMG, continues to remain

in contact with the Receiver appointed by the US Securities

Exchange Commission in relation to the previously notified US$21.9m

arbitration claim against CV Investments LLC. The Receiver is

currently in the process of identifying and validating assets

applicable to this claim. The Company will update the market with

details as and when they are provided by the Receiver.

Financials and Operations

At 31 March 2021, the Group's non-restricted cash balance was

US$0.686m (31 December 2021: US$0.833m).

Generally, cash flows have been consistent with budgets and the

Company continues discussions relating to the funding of both Leigh

Creek Copper Mine ("Leigh Creek") and the Redmoor Tin and Tungsten

project ("Redmoor"). Interest in Leigh Creek has risen, in line

with increased copper prices. Subject to funding, finalisation of

arrangements to recommence production are anticipated in

conjunction with the issuance of the approval of the Paltridge

North Programme for Environmental Protection and Rehabilitation

("PEPR").

Cornwall Resources Limited ("CRL"), the holder of the Redmoor

Tin and Tungsten project, continues to work with NRG Capital and

those parties that have expressed an interest in being involved

with Redmoor. To date, the Company considers that the proposals it

has received do not adequately reflect the project's value;

particularly given project enhancements and the supportive

commodity price environment. While the Company will continue

dialogue with interested parties, its 2021 focus is now on the

works associated with both the Redmoor West exploration program and

the Deep Digital programme (as detailed in the Company's

announcement of 15 February 2021) in Cornwall for which CRL is to

receive significant grant funding for its role.

Commenting, John Peters, Managing Director of Strategic

Minerals, said:

"The Company has been fortunate that its Cobre operation has

been able to continue "contactless" during the pandemic, which has

maintained this important income stream for the Company.

"The Board considers that the current copper price, of circa US

$4/lb, is likely to endure and is also encouraged by feedback from

the Company's recent meeting with the South Australian Minister for

Energy and Mining on the Leigh Creek Copper Mine project.

Accordingly, the Company is confident that 2021 will begin to

unlock the substantial value inherent in the Leigh Creek Copper

Mine project and provide a valuable, significant second income

stream before the end of the year."

For further information, please contact:

+61 (0) 414 727

Strategic Minerals plc 965

John Peters

Managing Director

Website: www.strategicminerals.net

Email: info@strategicminerals.net

Follow Strategic Minerals on:

Vox Markets: https://www.voxmarkets.co.uk/company/SML/

Twitter: @SML_Minerals

LinkedIn: https://www.linkedin.com/company/strategic-minerals-plc

+44 (0) 20 3470

SP Angel Corporate Finance LLP 0470

Nominated Adviser and Broker

Matthew Johnson

Ewan Leggat

Charlie Bouverat

Notes to Editors

Strategic Minerals plc is an AIM-quoted, profitable operating

minerals company actively developing projects tailored to materials

expected to benefit from strong demand in the future. It has an

operation in the United States of America along with development

projects in the UK and Australia. The Company is focused on

utilising its operating cash flows, along with capital raisings, to

develop high quality projects aimed at supplying the metals and

minerals likely to be highly demanded in the future.

In September 2011, Strategic Minerals acquired the distribution

rights to the Cobre magnetite tailings dam project in New Mexico,

USA, a cash-generating asset, which it brought into production in

2012 and which continues to provide a revenue stream for the

Company. This operating revenue stream is utilised to cover company

overheads and invest in development projects orientated to

supplying the burgeoning electric vehicle/battery market.

In May 2016, the Company entered into an agreement with New Age

Exploration Limited and, in February 2017, acquired 50% of the

Redmoor Tin/Tungsten project in Cornwall, UK. The bulk of the funds

from the Company's investment were utilised to complete a drilling

programme that year. The drilling programme resulted in a

significant upgrade of the resource. This was followed in 2018 with

a 12-hole 2018 drilling programme has now been completed and the

resource update that resulted was announced in February 2019. In

March 2019, the Company entered into arrangements to acquire the

balance of the Redmoor Tin/Tungsten project which was settled on 24

July 2019 by way of a vendor loan which was fully repaid on 26 June

2020.

In March 2018, the Company completed the acquisition of the

Leigh Creek Copper Mine situated in the copper rich belt of South

Austra lia and brought the project temporarily into production in

April 2019. The project currently awaits clearance from the South

Australian Government of its lodged Program for Environmental

Protection and Rehabilitation (PEPR).

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBUGDSSBBDGBX

(END) Dow Jones Newswires

April 14, 2021 02:00 ET (06:00 GMT)

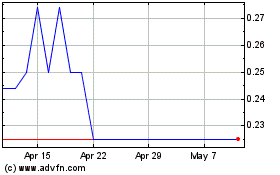

Strategic Minerals (LSE:SML)

Historical Stock Chart

From Mar 2024 to Apr 2024

Strategic Minerals (LSE:SML)

Historical Stock Chart

From Apr 2023 to Apr 2024