TIDMSONG

RNS Number : 3842S

Hipgnosis Songs Fund Limited

16 March 2021

16 March 2021

Hipgnosis Songs Fund Limited ("Hipgnosis" or the "Company")

Additional Performance Disclosures

The Board of Hipgnosis Songs Fund Limited, the first UK listed

investment company offering investors a pure-play exposure to songs

and associated intellectual property rights, and its Investment

Adviser, The Family (Music) Limited, are pleased to announce

additional performance disclosures. These will provide an

additional lens to analyse the Company's performance and financial

prospects, complementing its annual and interim accounts prepared

under IFRS.

New Alternative Performance Measure - Pro-Forma Annual Revenue

(PFAR)

Due to the process of royalty collection, Hipgnosis is required

under IFRS to accrue for a proportion of its revenue where revenue

has been earned but where cash has not yet been received. These

accruals are highly accurate due to the reliable and predictable

nature of song income.

To support investors' understanding of the underlying annual

revenues of its current portfolio of songs, without the impact of

timing of the addition of newly acquired portfolios, estimated IFRS

revenue accruals and non-recurring contractual 'Rights To Income'

(RTI) in relation to periods prior to acquisition, the Company will

provide a Pro-Forma Annual Revenue (PFAR) which comprises revenue

as per royalty statements received.

Definition

Pro-forma Annual Revenue (PFAR) is the royalty revenue earned in

a calendar year by the portfolio of songs held by the Company at a

specific date, based on royalty statements received, irrespective

of whether the songs were owned by the Company over the period

analysed. PFAR disclosures will therefore comprise a revenue year

and a portfolio date in order to facilitate comparisons. PFAR does

not include IFRS revenue accruals or RTI and uses constant FX rates

to remove the impact of currency exchange movements. The PFAR is

presented in US Dollars as 84% of the Company's revenue is received

in US Dollars [1] .

For the purpose of this initial statement of PFAR, for the

portfolio of songs held by the Company on 31 December 2020, the

Company has used royalty statements received in relation to the

2019 calendar year earnings. Royalty statements for the second half

of the 2020 calendar year are expected to be received on or around

31 March 2021. Accordingly the Company will update the PFAR further

around the time of its full year results.

Pro-Forma Annual Revenue - PFAR

The PFAR of the portfolio owned as at 31(st) December 2020 for

the 2019 calendar year was USD 111.7m equal to 11.04 cents per

ordinary share in issue as at that date [2] .

New Key Performance Indicator - Variance Against Forecast

(VAF)

As part of its due diligence prior to acquiring every catalogue,

the Investment Adviser constructs a financial model which analyses

the past performance of a catalogue, removes revenues that it deems

to be non-recurring to establish its baseline earnings, and

forecasts its future earnings. The key assumptions in the financial

model are (1) expected market growth or decay from peak earnings

(in the case of catalogues with a weighted average vintage of less

than 10 years); (2) expected uplifts in revenue from bringing

efficiencies to the collection of royalty payments; and (3) uplifts

from active Song Management.

Whilst administration efficiencies and Song Management are

analysed individually for each catalogue based on its individual

characteristics, the market growth and decay assumptions used in

the Investment Adviser's financial models are as follows:

A. For catalogues with a weighted average vintage greater than

10 years, the Investment Adviser applies steady state market growth

assumptions as follows:

Year 2021E 2022E 2023E 2024E 2025E

---------------- ------ ------ ------ ------ ------

YoY Change

Mechanical (17%) (17%) (17%) (15%) (15%)

Performance 6% 6% 6% 6% 6%

Downloads (20%) (20%) (20%) (20%) (20%)

Streaming 21% 18% 17% 16% 12%

Synchronisation 5% 5% 5% 3% 3%

Other 6% 6% 5% 5% 5%

---------------- ------ ------ ------ ------ ------

Source: The Investment Adviser, Goldman Sachs (2019 )

B. For catalogues with a weighted average younger than 10 years,

the Investment Adviser applies a decay matrix to estimate a songs

steady state earnings, as shown below:

Year of Release

("R") 1 R+1 R+2 R+3 R+4 R+5 R+6 R+7 R+8 R+9

---------------- --- ------ ------ ------ ------ ------ ------ ------ ------ ------

YoY change

Mechanical 25% (51%) (51%) (44%) (18%) (22%) (14%) (17%) (10%)

Performance (28%) (51%) (47%) (18%) (14%) (8%) (9%) 0% 0%

Downloads (64%) (57%) (44%) (20%) (8%) (9%) (10%) (11%) 0%

Streaming (19%) (19%) (5%) (2%) 5% 3% 5% 6% 6%

Synchronisation 19% (28%) (23%) (17%) (15%) (9%) (7%) (5%) (3%)

Other 19% (28%) (23%) (17%) (15%) (9%) (7%) (5%) (3%)

--------------------- ------ ------ ------ ------ ------ ------ ------ ------ ------

Source: Work specifically developed for Hipgnosis' portfolio by

one of its large, global independent music valuation advisers

The Board and the Investment Adviser analyse the actual royalty

statement performance of all catalogues against these forecasts on

an ongoing basis. This analysis is measured on a like-for-like

basis in line with the PFAR described above (i.e. excluding RTI,

IFRS revenue accruals, and FX movements).

Definition

Variance Against Forecast (VAF) is the difference between the

total of the royalty statements received from each catalogue since

acquisition, and the acquisition model forecast over the same

period.

The VAF is expressed as a percentage point deviation from zero,

where a positive number means that the actual performance of the

portfolio is tracking ahead of the cumulative forecast. A negative

number indicates that the portfolio is falling behind forecast.

Variance Against Forecast (VAF)

VAF is relevant once the Company has owned the catalogue for at

least one royalty statement period. The VAF therefore currently

analyses all catalogues owned by the Company as at 30(th) September

2020.

The VAF for all catalogues owned as at the 30(th) September 2020

was +0.4%, meaning that royalty statement revenue is, in aggregate,

higher than forecast at the time of acquisition.

Merck Mercuriadis the Founder of Hipgnosis Songs Fund Limited

and The Family (Music) Limited said :

"As we approach our third annual report since launch in 2018, we

are committed to providing additional disclosure to our

shareholders which seeks to look through our rapid growth, and give

a consistent basis to evaluate our performance and prospects.

Whilst we are working on providing new detailed analysis of our

portfolio of songs and their performance, the additional

performance disclosures announced today will offer rich analysis as

we present like-for-like data points over time.

This work, led by our Chief Financial Officer, Chris Helm, Chief

Operating Officer, Björn Lindvall and Commercial Finance Director,

Samantha Garcia, represents an important step in our commitment to

improving and delivering best in class market disclosures. This

will be enhanced further in the future with the contribution of our

new Executive Vice President Richard Rowe."

For further information, please contact:

The Family (Music) Limited Tel: +44 (0)1481 742742

Merck Mercuriadis

N+1 Singer - Joint Corporate Broker Tel: +44 (0)20 7496

James Maxwell / James Moat / Amanda 3000

Gray (Corporate Finance)

Alan Geeves / James Waterlow / Sam Greatrex

(Sales)

J.P. Morgan Cazenove - Joint Corporate Tel: +44 (0)20 7742

Broker 4000

William Simmonds / Jérémie

Birnbaum (Corporate Finance)

James Bouverat (Sales)

RBC Capital Markets - Joint Corporate Tel: +44 (0)20 7635

Broker 4000

Will Smith / Elliot Thomas / Lauren

Davies (Corporate Finance)

Lisa Tugwell (Sales)

Ocorian - Company Secretary & Administrator Tel: +44 (0) 1481

Julian Carey 742742

The Outside Organisation Tel: +44 (0)7711 081

Alan Edwards / Nick Caley 843

FTI Consulting Tel: +44 (0)7771 978220;

Neil Doyle/ Paul Harris/ Laura Ewart +44 (0)7809 411882;

+44 (0)7761 332646

All US music publicity enquiries Tel: +1 917 767 5255

Fran Defeo

NOTES TO EDITORS

About Hipgnosis Songs Fund Limited

( www.hipgnosissongs.com )

Hipgnosis, which was founded by Merck Mercuriadis, is a Guernsey

registered investment company established to offer investors a

pure-play exposure to songs and associated musical intellectual

property rights. The Company has raised a total of over GBP1.1

billion (gross equity capital) through its Initial Public Offering

on 11 July 2018, and subsequent issues in April 2019, August 2019,

October 2019, July 2020, September 2020 and February 2021. In

September 2019, Hipgnosis transferred its entire issued share

capital to the premium listing segment of the Official List of the

FCA and to the London Stock Exchange's premium segment of the Main

Market, and in March 2020 became a constituent of the FTSE 250

Index.

About The Family (Music) Limited

The Company's Investment Adviser is The Family (Music) Limited,

which was founded by Merck Mercuriadis, manager or former manager

of globally successful recording artists, such as Nile Rodgers,

Elton John, Guns N' Roses, Morrissey, Iron Maiden and Beyoncé, and

hit songwriters such as Diane Warren, Justin Tranter and The-Dream,

and former CEO of The Sanctuary Group plc. The Investment Adviser

has assembled an Advisory Board of highly successful music industry

experts which include award winning members of the artist,

songwriter, publishing, legal, financial, recorded music and music

management communities, all with in-depth knowledge of music

publishing. Members of The Family (Music) Limited Advisory Board

include Nile Rodgers, The-Dream, Giorgio Tuinfort, Starrah, Nick

Jarjour, David A. Stewart, Bill Leibowitz, Ian Montone, Rodney

Jerkins, Björn Lindvall and Chris Helm.

[1] For the year ending 31 March 2020

[2] 1,011,456,797 ordinary shares were in issue as at 31

December 2020

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFERVDIRLIL

(END) Dow Jones Newswires

March 16, 2021 03:06 ET (07:06 GMT)

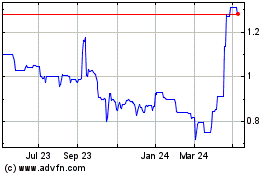

Hipgnosis Songs (LSE:SOND)

Historical Stock Chart

From Mar 2024 to Apr 2024

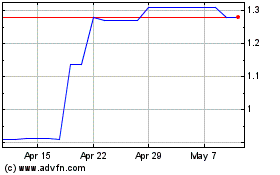

Hipgnosis Songs (LSE:SOND)

Historical Stock Chart

From Apr 2023 to Apr 2024