TIDMSOS

RNS Number : 2145V

Sosandar PLC

13 April 2021

Date: 13 April 2021

On behalf of: Sosandar plc ('Sosandar' or 'the Company')

Embargoed until: 0701hrs

Sosandar plc

Trading Update

A year of strong revenue growth accelerating in Q4 with

substantial EBITDA improvement year on year

Sosandar, the online women's fashion brand, is pleased to

provide the following trading update for its financial year ended

31 March 2021.

The Company delivered another strong performance in its fourth

quarter (January - March 2021) with revenue of GBP3.94m, up 63%

year on year. Customer activity stepped up each month during the

quarter with record revenue delivered in the month of March, up 66%

compared to January and 163% up on the lockdown impacted previous

year. This performance reflects an increasing level of consumer

optimism as lockdown restrictions start to lift. Gross margin has

also shown continual improvement throughout the fourth quarter with

March at 54.0%.

Highlights for the financial year ended 31 March 2021:

* The Company expects to report revenue of GBP12.2m, up

35% year on year, with the EBITDA loss reduced by

over 60%

* Continued engagement with loyal customer base:

o Number of orders increased 29% to 276k

o Repeat orders increased 40% to 190k

o Conversion rate increased to 3.1% from 2.7%

* Gross margin 48.1% (48.5% in the prior year)

reflecting promotional activity during the period of

lockdowns

* Continued improvement in returns rate, which reduced

to 43% (from 50% in the prior year), reflecting a

diversification of product mix

* Strong sales with John Lewis and Next, with March

being a new record month and a significant step up on

the previous best, and the product range continuing

to develop and expand

* Successfully launched with Marks & Spencer as a

third-party online retailer at the end of March with

excellent initial sales

* Net cash of GBP3.93m as at 31 March 2021, being

slightly improved compared with 31 December 2020,

reflecting the strong trading performance, continued

careful cost management and focus on return on

investment from the marketing spend

The Company is pleased to have delivered increased sales, better

cost efficiency, ever increasing engagement with customers and an

expanded product range in spite of a very challenging and volatile

market backdrop, demonstrating management's ability to successfully

navigate changing circumstances.

This strong growth has also been achieved despite a significant

overall reduction in marketing spend over the period. Utilising

learnings from the previous financial year, the Company has been

able to maximise its return on investment from marketing

throughout. The Company has engaged in successful customer

acquisition at key periods with more new customers acquired

compared to the prior year on less than half the marketing spend.

Following success in February and March, the Company plans to

continue with carefully controlled customer acquisition in April

and May and continue using these learnings to maintain higher

returns on investment longer-term.

Throughout the year the Company has continued to invest and

expand the product range, a key factor in its strong trading

performance. As an agile business it has been able to fast track

developments in its product range to meet consumer demand

reflecting the changing circumstances. Loungewear, knitwear, denim

and outerwear have all performed particularly well. In January 2021

the Company launched active and leisure wear, with strong sales

results and the category already being established as a key part of

the product mix.

The Company successfully launched with both John Lewis and Next

on their website platforms in August and has continued to release

regular new drops of stock to the retailers since. Trading to date

with both retail partners has been very successful, with March 2021

delivering record monthly revenues. The Company has just launched

with Marks & Spencer, where the initial product range has been

incredibly well received by the M&S customer with many styles

selling out and being quickly replenished in the first week of

trading. These partnerships allow Sosandar to further increase

brand awareness across its target market, whilst driving

incremental sales and accelerating improvement in EBITDA.

Market positioning and outlook

Moving into Spring and with the loosening of restrictions laid

out, Sosandar has seen early signs that customers are preparing

their wardrobes for a busy summer. This includes an increase in the

sales across all key categories, in particular colourful dresses,

tops and denim.

Looking to the year ahead, against a backdrop of improving

visibility, Sosandar is very well positioned to accelerate its

growth trajectory and further improve EBITDA. The acceleration in

the adoption of online shopping has expanded the long-term market

opportunity, and as a pureplay ecommerce brand, the Company is set

up to successfully cater to customers through this channel. The

team has demonstrated its skilful management throughout 2020,

maintaining a strong cash position whilst developing the

infrastructure and capability for future growth. The Sosandar brand

has also shown its desirability in having been chosen to appear on

the platforms of three major British retailers. The Company sees

many opportunities for growth both on its own site and with its

retail partners in the coming months and beyond.

Conference call

Sosandar is hosting a Q&A call for analysts and investors

today at 08:30am to discuss the Trading Update. If you

would like to register for the call please follow this link: http://bit.ly/SOS_FY_Trading_Update

Ali Hall and Julie Lavington, Co-CEOs commented:

" In what has been a year that no one could have possibly

predicted, we are delighted to have shown resilience and our

entrepreneurial spirit, overcoming challenges to deliver a

significant improvement in revenue and reduction in EBITDA losses,

together with the further diversification of our product range.

The progress we are making reflects the scale of our opportunity

and growing demand for our unique offering in the market. The

recent purchasing trends that we have seen from our customers point

to a period of increased activity and we believe that our extensive

product range can cater to their needs.

We would like to take this opportunity to extend our sincere

thanks to all our colleagues, partners, and suppliers for their

hard work and commitment throughout what has been a difficult time

for everyone.

Inevitably, some uncertainty remains, however, we are seeing a

gradual return to more normalised trading conditions and now have

much greater visibility over forward trading. We are confident in

what the future holds, and believe that Sosandar is well positioned

to take advantage of the opportunities ahead of us."

Enquiries

Sosandar plc www.sosandar.com

Julie Lavington / Ali Hall, Joint CEOs c/o Alma PR

N+1 Singer (Nominated Adviser & Broker)

Peter Steel / Kailey Aliyar / Hannah Woodley +44 (0) 20 7496 3000

Alma PR Limited (Financial PR) +44 (0) 20 3405 0205

Susie Hudson / Sam Modlin / Molly Gretton sosandar@almapr.co.uk

This announcement contains information which, prior to its

disclosure, was inside information as stipulated under Regulation

11 of the Market Abuse (Amendment) (EU Exit) Regulations 2019/310

(as amended).

About Sosandar PLC

Sosandar is an online womenswear brand, specifically targeted at

a generation of women who have graduated from throwaway fashion and

are looking for quality, affordable clothing with a premium,

trend-led aesthetic. This is a section of the market that is

currently being underserved.

Sosandar was launched in September 2016. The Sosandar business

model is built around using trend-led, exclusive designs produced

in-house and then manufactured using a variety of global suppliers.

Sosandar caters for a growing market of fashion-conscious women,

while utilising an outsourced logistics provider that can support

its planned growth over the coming years.

Sosandar's founders are Ali Hall and Julie Lavington, who

previously launched and ran high street fashion magazine Look, as

editor and publishing director respectively. They have a combined

experience of over 35 years in the fashion industry.

More information is available at www.sosandar-ir.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBIGDSXSBDGBD

(END) Dow Jones Newswires

April 13, 2021 02:01 ET (06:01 GMT)

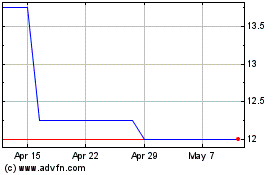

Sosandar (LSE:SOS)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sosandar (LSE:SOS)

Historical Stock Chart

From Apr 2023 to Apr 2024