TIDMSOU

RNS Number : 8359G

Sound Energy PLC

29 July 2021

29 July 2021

Sound Energy plc

("Sound Energy" or the "Company")

Phase 1 Development LNG Sale & Purchase Agreement and Equity

Subscription

Sound Energy, the Moroccan focused upstream gas company, is

delighted to provide the following update in relation to the

Company's micro liquified natural gas ("mLNG") phase 1 development

plan for the TE-5 Horst development (the "Phase 1 Development") at

the Tendrara Production Concession (the "Concession").

Highlights

-- Ten (10) year take or pay LNG sale and purchase agreement entered into with Afriquia Gaz

-- GBP2 million equity placing with Afriquia Gaz cementing the

strategic alignment with Sound Energy PLC

-- Improved envisaged Afriquia Gaz loan note financing terms

Graham Lyon, Sound Energy's Executive Chairman, commented:

"We are delighted to announce the signature of a binding ten

year LNG sales agreement for the Phase 1 development covering the

sale of not less than 100 million cubic metres of gas in a

liquified form per year. In addition, the execution of the

previously announced equity subscription agreement and the GBP2

million equity placing cements the strategic alignment between

Sound Energy and Afriquia Gaz. This is a key milestone in moving

forward towards the final investment decision and notice to proceed

for the Tendrara Phase 1 Development.

In recognition of the alignment between Sound Energy and

Afriquia Gaz, I am also pleased that we announce today that the

parties are working towards improved terms in relation to the

Afriquia Gaz loan note upon which the LNG sale and purchase

agreement is, inter alia, conditional. We plan to conclude this

loan note ahead of finalising the contract to construct the

plant.

By establishing clear paths both to market for our gas and to

our financing of Phase 1 Development, today's announcement together

with the recently announced Schlumberger Silk Route Service

acquisition not only mark critical milestones for the Company but

underscore our commitment to Sound Energy Shareholders to deliver

upon our objectives and to create value through innovative

commercial arrangements."

Execution of LNG Sale and Purchase Agreement

The Company is pleased to announce that Sound Energy Morocco

East Limited ("SEMEL"), its wholly owned subsidiary, has entered

into a binding and fully termed conditional LNG sale and purchase

agreement with Afriquia Gaz S.A. ("Afriquia"), pursuant to which

SEMEL will sell not less than 171,000 cubic metres of LNG per year

(approximately 100 million cubic metres a year of gas to be

produced and liquefied from the Phase 1 Development) on behalf of

the Concession joint venture (the "LNG SPA").

Under the LNG SPA, SEMEL will commit, for 360 days of each year

over a period of 10 years from first gas, to provide to Afriquia a

daily quantity of between 475 and 546 cubic metres of LNG, and

Afriquia will commit to an annual minimum "Take or Pay" quantity of

475 cubic metres per day of LNG.

Pricing under the LNG SPA will be within a range, the floor

price being US $6 per mmBTU and the ceiling price commencing at $8

per mmBTU and increasing during the course of the LNG SPA to $8.346

per mmBTU and will be determined using an indexed formula which

applies a combination of the European Title Transfer Facility and

United States Henry Hub benchmark indices. The point of sale to

Afriquia will be at the Tendrara (TE-5) field location following

processing and liquefaction, with Afriquia having responsibility

for transportation and delivery to its downstream customers.

The LNG SPA is conditional upon fulfilment of certain conditions

precedent including:

-- The approval of the LNG SPA by the Concession joint venture;

-- The execution of a loan note agreement between the Company

(as borrower) and Afriquia (as lender) setting out the terms of an

US$ 18 million secured loan with a 6% annual coupon and a 12 year

term;

-- The execution of a project contract with Italfluid Geoenergy

S.r.l ( Italfluid) for the provision of a gas processing and

liquefaction facility relating to the Phase 1 Development;

-- Receipt by Afriquia of regulatory approvals for the

transportation of LNG by tankers and the sale of LNG; and

-- Afriquia having secured in principle agreement from

downstream buyers to purchase not less than 60% of the Annual Take

or Pay Quantity under the LNG SPA

such conditions to be satisfied by 29 October 2021.

Execution of Equity Subscription Agreement

In addition, the Company is pleased to also announce, subsequent

to its announcement on 29 June 2020, that it has entered in an

equity subscription agreement with Afriquia pursuant to which

Afriquia has made a GBP2.0m subscription to the Company in

consideration for which the Company has today issued for

159,731,651 new ordinary shares in Sound Energy at a price of

1.2521 pence per new ordinary share to Afriquia.

Application will be made for the 159,731,651 new ordinary

shares, which will rank pari passu with the Company's existing

ordinary shares, to be admitted to trading on AIM ("Admission').

Dealings in the new ordinary shares

are expected to commence on or around 8:00a.m. on 4 August 2021.

Total Voting Rights

On Admission the Company will have 1,628,282,948 ordinary shares

in issue. No ordinary shares are held in treasury. The figure of

1,628,282,948 may be used by the Company's shareholders as the

denominator in the calculations by which they will determine if

they are required to notify their interest in, or change to their

interest in, the Company under the Financial Conduct Authority's

Disclosure Guidance and Transparency Rules.

For further information please contact:

Vigo Communications - PR Adviser Tel: 44 (0)20 7390 0230

Patrick d'Ancona

Chris McMahon

Sound Energy chairman@soundenergyplc.com

Graham Lyon, Executive Chairman

Tel: 44 (0)20 7397 8900

Cenkos Securities - Nominated Adviser

Ben Jeynes

Russell Cook

SP Angel Corporate Finance LLP - Broker

Richard Hail, Sam Wahab Tel: +44 (0)20 3470 0470

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulation (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

mmBTU means million British thermal units

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDLVLLLFDLLBBQ

(END) Dow Jones Newswires

July 29, 2021 02:00 ET (06:00 GMT)

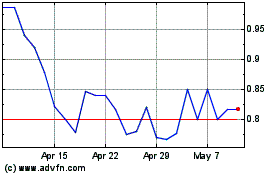

Sound Energy (LSE:SOU)

Historical Stock Chart

From Mar 2024 to Apr 2024

Sound Energy (LSE:SOU)

Historical Stock Chart

From Apr 2023 to Apr 2024